Tax Policy In West Virginia

This article does not contain the most recently published data on this subject. If you would like to help our coverage grow, consider donating to Ballotpedia.

| Tax policy in West Virginia |

| Tax rates in 2017 |

| Total state expenditures State debt West Virginia state budget and finances |

West Virginia generates the bulk of its tax revenue by levying a personal income tax, a general sales tax and select sales taxes . The state derives its constitutional authority to tax from Article X of the state constitution.

Tax policy can vary from state to state. States levy taxes to help fund the variety of services provided by state governments. Tax collections comprise approximately 40 percent of the states’ total revenues. The rest comes from non-tax sources, such as intergovernmental aid , lottery revenues and fees. The primary types of taxes levied by state governments include personal income tax, general sales tax, excise taxes and corporate income tax.

HIGHLIGHTS

Wva Governor Pitches 10% Income Tax Cut

CHARLESTON, W.Va. – West Virginias governor is proposing a permanent, 10% cut of the states personal income tax.

Gov. Jim Justice announced the proposal during his end-of-the-year revenue report. If passed, it would be the first change in the states personal income tax rate since 1987 and could save taxpayers an estimated $200 to $300 each year.

The governor said the proposal is possible thanks to the states record budget surplus, more than $1.3 billion. That is millions more than the states $1 billion rainy day fund.

The Governors Office estimates the proposal would cost nearly $254 million annually, but Justice and state Revenue Secretary Dave Hardy said the state can afford that without raising taxes elsewhere.

This is absolutely a pure tax cut, with no bells and whistles attached to it to have to raise anything, Justice said in response to a question from WSAZs Curtis Johnson.

In answer to the question, Curtis, we would not recommend this to the Governor if we thought this would result in raising other taxes or this was non sustainable in the future, Hardy added. We always look to the future. Were always thinking two or three years out.

The proposed tax cut would be retroactive to the beginning of the 2022 calendar year.

The House of Delegates overwhelmingly passed a similar proposal in February. That proposal died in the state Senate, where senators hoped for a much bigger tax cut in future years.

Copyright 2022 WSAZ. All rights reserved.

Most Read

Can I File A Different Filing Status Than My Federal Return

Yes, however West Virginia instructions state:

- If you filed a you can choose to file a state return. If you choose to file as married filing separate, use Rate Schedule II when figuring your tax. Refer to the Instructions for further information on filing separate state returns when a joint federal return was filed.

- If you file a the filing status on your federal tax return must be Married Filing Joint also. However you can elect to file Married Filing Separate and use the state’s Rate Schedule II to determine your state tax.

- If you filed your federal tax return as , you must file the West Virginia return as Married Filing Separate also.

You May Like: How Much In Inheritance Tax

Other West Virginia Tax Facts

West Virginia taxpayers who are age 65 or older during any part of the taxable year or who are permanently and totally disabled may deduct from their federal adjusted gross income up to $8,000 income, regardless of source, to arrive at the amount that is taxable by West Virginia. When a married couple files a joint return, if each spouse qualifies, then up to $16,000 of income is excludable from West Virginia taxes.

West Virginia taxpayers can use the MyTaxes page to file their returns as well as go online to check the status of their state income tax refunds.

For more information, contact the West Virginia State Tax Department, General Assistance, at 982-8297, or visit its website.

To download tax forms on this site, you will need to install a free copy of Adobe Acrobat Reader. Click here for instructions.

Related Links:

Note On Multistate Businesses And Nexus

Our primary focus here is on businesses operating solely in West Virginia. However, if you’re doing business in several states, you should be aware that your business may be considered to have nexus with those states, and therefore may be obligated to pay taxes in those states. Also, if your business was formed or is located in another state, but generates income in West Virginia, it may be subject to West Virginia taxes. The rules for taxation of multistate businesses, including what constitutes nexus with a state for the purpose of various taxes, are complicated if you run such a business, you should consult with a tax professional.

You May Like: How Old Do You Have To Be To File Taxes

West Virginia Alcohol Tax

In West Virginia, the state government controls the sale of alcohol, which adds up to significant revenue for the state. All alcohol sold is subject to markups and an excise tax that varies depending on the type of alcohol.

For beer, the excise tax is low, at just 18 cents per gallon. However, the total tax on wine is $1 per gallon. Keep in mind that the general sales tax rates of 6% to 7% still applies on top of those excise taxes.

Total Estimated 2021 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

Also Check: Do I Need Letter 6475 To File Taxes

West Virginia Estate Tax

There is no estate tax in West Virginia. Up until 2005, there was an estate tax based on the federal estate tax. It has since been phased out. Estates and inheritances are no longer taxed at the state level in West Virginia. You may still need to pay the federal estate tax, though.

- West Virginia gained statehood during the Civil War, when it seceded from Virginia to join the Union.

- Coal is West Virginias largest export. The state is the leading producer of coal in the U.S.

- The state motto of West Virginia is montani semper liberi, which means mountaineers are always free.

How Long Can You Expect To Wait For Your West Virginia Refund

The West Virginia Tax Division continues to respond to an increased risk of fraudulent filings and is implementing enhanced security measures for taxpayers protection. As a result, expect a significant delay of your tax refund. You should only call the Tax Division if it has been more than 10 weeks since filing your state tax return.

The typical refund timeframes for correctly filed returns are:

- For an e-filed return: Seven to 8 weeks after the acknowledgement is received from the state.

- For a paper return: Ten to 11 weeks after the return is received by the West Virginia Tax Division.

Also Check: 1 Year Tax Return Mortgage

West Virginia Real Property Taxes

In West Virginia, the median property tax rate is $584 per $100,000 of assessed home value.

West Virginia Property Tax Breaks for Retirees

People who are 65 years of age or older are entitled to an exemption from property taxes on the first $20,000 of assessed value on their owner-occupied residence .

If you still owe local property taxes after the application of the exemption, you may also be eligible for a senior citizen income tax credit. To qualify for the credit, you must participate in the homestead exemption program , pay your property tax, and have an income less than 150% of federal poverty amount . The county determines the credit amount.

If your property taxes are more than 4% of your annual gross income, you could also qualify for a homestead excess property tax credit, which is equal to the amount of property tax that exceeds 4%. The credit cannot exceed $1,000. If you also qualify for the senior citizens tax credit, you must deduct that credit amount from property taxes paid when determining eligibility.

West Virginia Median Household Income

| Year | |

|---|---|

| 2010 | $38,218 |

West Virginia has a progressive state income tax with rates from 3% to 6.50%, depending on taxpayers income level and filing status. Within the five-bracket system, single filers, joint filers and heads of household earning up to $10,000 in taxable income pay 3% in state taxes. The top tax rate of 6.50% applies to taxable income over $60,000 for these filers. The rates are the same for married people filing separately, but the income levels are halved. Compared with other states’ income tax rates, West Virginia falls near the middle of the pack.

While no cities in West Virginia have a local income tax, several of them apply local City Service User Fees, which are deducted from the paychecks of people who work in those cities. Employers deduct these fees from your wages whether youre a resident of the city or not and regardless of the number of hours you work. Self-employed workers are responsible for paying this fee themselves.

Charleston, Huntington, Parkersburg and Weirton impose these fees on people working within their city limits. Weirton charges the lowest fee at $2 per pay period. Workers in Parkersburg pay $5 per pay period, Charleston have a fee of $6 per pay period, and Huntington charges a fee of $10 per pay period. It’s noteworthy that these fees do not appear on workers’ tax forms in the way that local income taxes do.

Read Also: Tax Software For Tax Preparer

Registration In Other States

If you will be doing business in states other than West Virginia, you may need to register your LLC in some or all of those states. Whether you’re required to register will depend on the specific states involved: each state has its own rules for what constitutes doing business and whether registration is necessary. Often activities such as having a physical presence in a state, hiring employees in a state, or soliciting business in a state will be considered doing business for registration purposes. Registration usually involves obtaining a certificate of authority or similar document.

For more information on the requirements for forming and operating an LLC in West Virginia, see Nolo’s article, 50-State Guide to Forming an LLC, and other articles on LLCs in the LLC section of the Nolo website.

Cutting Income Tax: Whats Happened In Other States

The proposed tax cut will be retroactive to Jan. 1, 2022, and the governors office says that it will put $254 million back into West Virginians pockets.

Ive been the biggest proponent of completely eliminating our state personal income tax. It will drive job growth, population growth, and prosperity in West Virginia. But the most important thing to do is get started right away. In the past year, gas prices have gotten out of control and inflation is through the roof. West Virginians need help right now.

Once we get the ball rolling, we can keep coming back and chipping away at our personal income tax until its completely eliminated. When you look at states like Florida, Texas, and Tennessee, they have no personal income tax and their state economies are growing like crazy. There is a direct correlation. People are moving to no-income-tax states because they can keep more of their hard-earned paycheck, which spurs ever greater economic activity. Its a cycle of goodness producing goodness. Thats what I want in West Virginia, and I hope that the Legislature will agree with me and pass this bill.

West Virginia Gov. Jim Justice

Below is a chart detailing tax cuts by income level under the proposed plan:

| Amount Made by Individual |

|---|

Don’t Miss: 401k Roth Vs Pre Tax

Wv Gov Justice Will Again Propose Ending State Income Tax

West Virginia Gov. Jim Justice

West Virginia officials are again working on drafting a bill to phase out West Virginias income tax, which will be introduced to the legislature, Secretary of Revenue Dave Hardy announced late Tuesday afternoon.

We are starting the process right now, in 2022, of proposing to the West Virginia legislature that we start phasing out West Virginias state income tax, Hardy said during a news conference with Gov. Jim Justice. …Thats our goal and thats where were going. The goal of this governor and this administration is to eliminate the state income tax in West Virginia as soon as we possibly and fiscally responsibly can do that.

Hardy said the bill would first cut the state income tax by 10%, which would immediately save taxpayers $271 million. He did not announce other specifics on the bill or say when the governor would send the plan to lawmakers.

The governor introduced legislation to end the state income tax last year. Although House and Senate leadership both supported a plan to end the tax, lawmakers could not reach an agreement on how the state should do it. He introduced another bill during this years regular session that would immediately reduce the income tax, which passed the House and did not receive a vote in the Senate. He then called a special session to introduce similar legislation, which also passed the House and did not receive a vote in the Senate.

West Virginia State Tax Guide

State tax rates and rules for income, sales, property, fuel, cigarette, and other taxes that impact West Virginia residents.

Retirees: Mixed Tax Picture

Taxes in West Virginia are up and down, depending on the type of tax. For instance, depending on your financial situation, income taxes in the Mountain State can take a big bite out of your earnings. There’s help for retirees, though. Starting in 2022, Social Security benefits taxed by the federal government are completely excluded from West Virginia’s income tax for single taxpayers with federal adjusted gross income of $50,000 or less and joint filers with a federal AGI of $100,000 or less.

Don’t Miss: When Do Taxes Need To Be Filed 2022

Is West Virginia Good For Retirees

If you are considering spending your retirement years in the Mountain State, youre in luck, West Virginia is ideal for retirees. The overall cost of living in the state is lower than the national average.Those places aside, there are plenty of areas in the state where you can enjoy your retirement years.

How High Are Property Taxes In West Virginia

West Virginia has some of the lowest property taxes of any U.S. state. The median property tax paid by homeowners in West Virginia is just $711 per year.

Part of the reason that property taxes due are so low is that tax rates and home values are generally quite low. The states average effective rate is 0.57%, and the median home value is less than $125,000. Those low costs can be a major help for seniors looking to move from another part of the country.

Read Also: Are Municipal Bonds Tax Free

What Is The West Virginia Homestead Exemption

The West Virginia homestead exemption program helps to lower the property tax burden on seniors. It is available to anyone age 65 or older who owns and occupies their home and has paid taxes on that home for at least two consecutive years prior to applying for the exemption. Qualifying homeowners receive an exemption of $20,000 on the assessed value of the property.

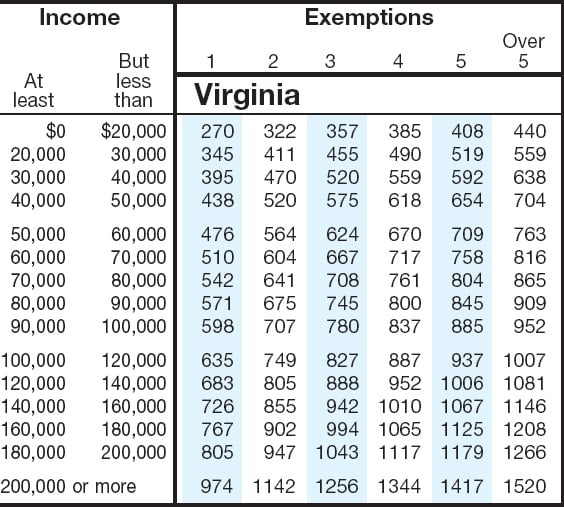

What If I Work In A Reciprocal State Of West Virginia

West Virginia has reciprocal agreements with Kentucky, Maryland, Ohio, Pennsylvania and Virginia. If you are a West Virginia resident working in one of these states, and your employer withheld the other states income tax, you must file for a refund from that state. You cannot claim a refund for taxes withheld to a reciprocal state on the resident return.

Read Also: Can I Pay Estimated Taxes All At Once

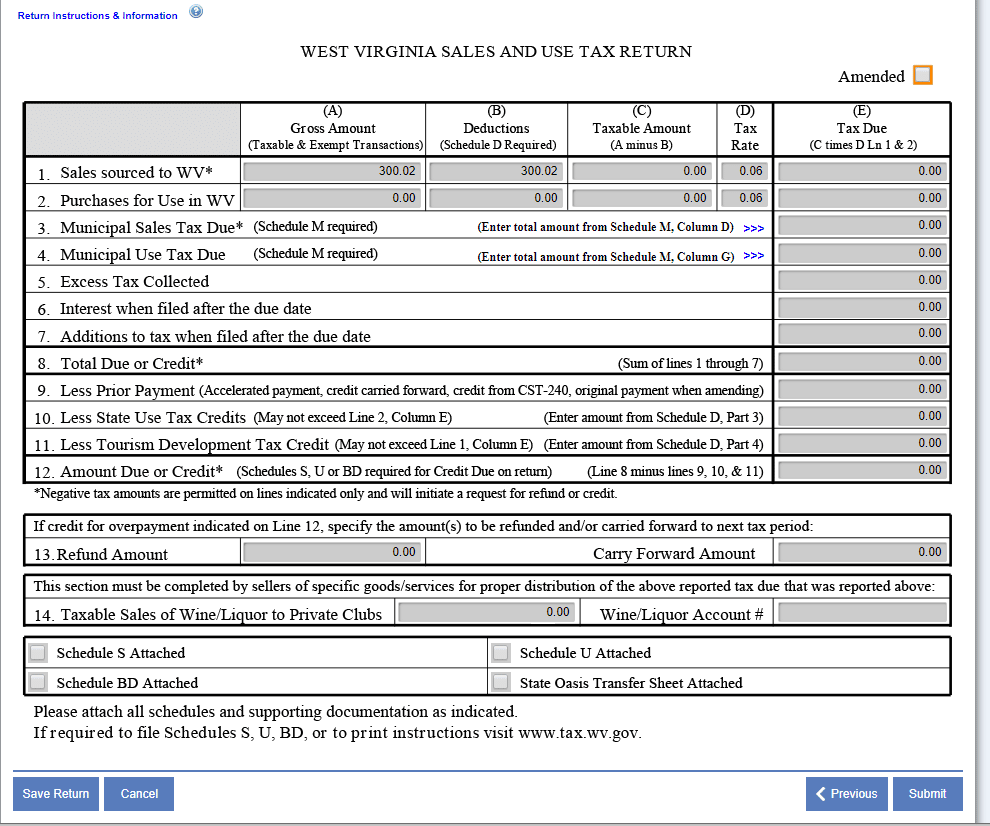

West Virginia State Tax Payments

West Virginia has many income tax payment options. Find the option that works best for you below.

Pay with an Electronic Funds Transfer

You can use this payment option when you e-file with us.

Pay with a Credit Card

Visit mytaxes.wvtax.gov

Pay by Mail

If you mail your West Virginia tax return, include a check or money order with your return.

If you e-file your West Virginia tax return, include a check or money order with your Form IT-140V

ACH Debits:

You can also pay directly from your bank account with an ACH debit. Click the Pay Personal Income Tax link on the MyTaxes website.

The due date for tax payments is April 18, 2023 regardless of which payment method you choose. If your payment is late, West Virginia charges 5% of the tax due for each month, or part of a month, on any overdue amounts.

West Virginia Income Tax Rate 2022

West Virginia state income tax rate table for the 2022 – 2023 filing season has five income tax brackets with WVtax rates of 3%, 4%, 4.5%, 6% and 6.5% for Single, Married Filing Jointly, Married Filing Separately, and Head of Household statuses.

The West Virginia tax rate and tax brackets are unchanged from last year.

West Virginia income tax rate and tax brackets shown in the table below are based on income earned between January 1, 2022 through December 31, 2022. Outlook for the 2023 West Virginia income tax rate is to remain unchanged.

Please reference the West Virginia tax forms and instructions booklet published by the West Virginia State Tax Department to determine if you owe state income tax or are due a state income tax refund. West Virginia income tax forms are generally published at the end of each calendar year, which will include any last minute 2022 – 2023 legislative changes to the WV tax rate or tax brackets. The West Virginia income tax rate tables and tax brackets shown on this web page are for illustration purposes only.

You May Like: When Are Taxes Due By