Determining California Sales Tax Nexus

Any business with a physical location in California has nexus, and is therefore required to register to collect sales tax, and to file sales tax returns and pay sales tax to the state.

Other activities that create nexus include someone working for you who lives in the state, having California affiliates who advertise your products in exchange for commission when a sale is made from their affiliate link/marketing activities, or attending a tradeshow and making one or more sales at that show.

Retailers who sell on Amazon and use their Fulfillment by Amazon program, will have a physical presence in California if any of their products are stored within a California FBA warehouse.

How Much Is The Sales Tax In California

The statewide California sales tax rate is 7.25 %. However, you should not calculate California sales and use tax by considering this number only. To determine whats the sales tax in California that should be applied to you, you should look at the district where your customers are located and also the district of your business. This model is called a hybrid-origin collection. If you are located outside of California, you should add only the district California tax sales of your buyer. Local jurisdictions in California usually have district taxes that range from 0.1% to 3.25% and need to be added to the sales tax. To identify the sales tax rate California districts have, you can either consult with 1StopVATs team or use our Sales Tax Calculator. Keep in mind that some areas can have more than one district rate added to theCalifornia state sales tax rate.

To Verify The Tax Rate For A Location:

- Find a list of the latest sales and use tax rates at the following link: California City & County Sales & Use Tax Rates.

- You can look up a tax rate by address

- Visit or call our Offices

- Call our Customer Service Center at 1-800-400-7115 . We are available to help you 7:30 a.m. to 5:00 p.m., Monday through Friday, except State holidays.

You May Like: State Of Ct Income Tax

Keep In Mind For 2022 And Beyond

The definition of a retailer engaged in business in a tax district means that you:

- Ship or deliver the merchandise into the district using your own vehicle

- Maintain, occupy, or use any type of office, sales room, warehouse, or other space within the district, even if it is a temporary space, you are doing business indirectly or through an agent

- Have a representative of any kind making sales or deliveries, installing or assembling personal property, or taking orders within the district

- Receive revenue from the rental or lease of tangible personal property located in the district

- Sell or lease vehicles or undocumented vessels, which will be registered within the district

As long as you are engaged in business within the district, you are responsible for reporting and paying district taxes as well as state taxes. The requirement also applies to multiple business locations you are liable for the sales tax amount in force in the district where you have a retail presence and conduct principal negotiations for sales within that district.

For use tax, there is a single exception to payment or collection: if you ship or deliver merchandise outside of a district to a purchaser’s principal residence address or business address unless the merchandise is a vehicle, vessel, or aircraft. The caveat is that you must accept, in good faith, a properly executed declaration under the penalty of perjury to be relieved of this obligation.

Some things are not taxable:

What Is Eligible For California Sales Tax

Sales tax applies to most goods purchased by consumers. Unprepared food is not taxable, nor are some medical devices, prescription medications, or sales to the US Government. California does not have any clothing tax exemptions or sales tax holidays.

Other taxable points to consider include:

- Services Most services are not taxable by the state of California. Two exceptions are if the service is inseparable from the property being purchased , or services related to the fabrication or manufacture of tangible personal property.

- Shipping charges on orders shipped via common carrier are not taxable provided that they are stated separately on the invoice and that the amount charged to the customer is the same amount as charged by the carrier. If you charge the customer more than the actual cost charged by the carrier, the difference is taxable.

- Drop-shipping Items that are drop-shipped from a California company on behalf of an out-of-state retailer who is not required to hold a California sellers permit, should be taxed by the drop-shipper.

- Vehicles purchased outside the state are subject to the 12-month test. If the vehicle, vessel, or aircraft was purchased outside of California, first used outside the state, and then brought into California within 12 months of purchase, it is taxable .

Read Also: Walmart Tax Refund Advance 2022

As A Retailer Am I Subject To District Tax In A District Where I Solicit And Accept A Sale When The Property Is Never Physically In The District

The transactions tax does not apply to property sold within a district but is shipped or delivered, as agreed to in the contract of sale, to a point outside the district.

You are generally required to pay the district use tax in your customer’s district, if you are “engaged in business” in the district in which you deliver the merchandise .

What You Need To Know About California Sales Tax

Governments, at all levels, may charge sales tax for goods and services. Retailers collect sales tax on their goods at the point of sale and then send their collections to the government. Currently, 45 states charge sales tax with some counties and cities charging their own taxes. No state has quite perfected the art of sales tax like California.

The California Department of Tax and Fee Administration , which administers tax and fee collection, shows that California cities charge a myriad of different sales tax rates. So what can you expect to pay and where does all that money go?

Need help creating a financial plan or managing your investments? A financial advisor can help. Find a trusted advisor today.

Recommended Reading: Pto Cash Out Tax Calculator

How Do I Amend My California Sales And Use Tax Return

There is no electronic method currently available to amend an online return. You must print the return and write the correct figures on the Confirm Filing page of the return filed online, then write Amended Return across the top. Submit via mail with any additional payment due or file a claim for refund or credit if you have overpaid. Mail documents to:

California Department of Tax and Fee AdministrationSpecial Taxes and FeesAppeals and Data Analysis Branch PO Box 942879Sacramento, CA 94279-0033

If I Am Located In A District Am I Subject To My District’s Tax If I Make A Sale To A Person Located Outside The District

You are generally not required to pay for your district’s tax if the customer does not take possession of the property in your district.

However, if your customer is located in another district, you are generally required to pay that district’s use tax if:

- You are “engaged in business” in that district and you ship or deliver the property, as agreed to in the contract of sale, into the district .

- You are a licensed dealer selling a vehicle, undocumented vessel, or aircraft that the buyer registers at an address located in the district.

Don’t Miss: California Used Car Sales Tax

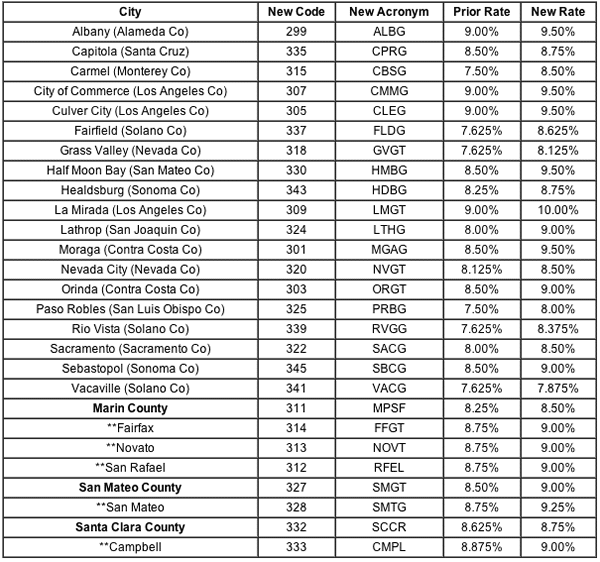

Tax Rates For California Cities And Counties

Many of California’s cities, counties, towns, and communities have special taxing jurisdictions , that impose a transaction sales and use tax, referred to as district taxes, in addition to the standard statewide tax rate of 7.25%.

- District taxes increase the tax rate in a particular area by adding the district tax to the basic statewide tax rate of 7.25% .

- Rates for these districts may range from 0.10% to 1.00% per district.

- In some areas, there is more than one district tax in effect.

- In others, there is no district tax in effect.

- As a seller or a consumer, you are required to report and pay the applicable district taxes for your taxable sales and purchases in thatdistrict.

To find the sales and use tax rate for a specific location, you may use the Find a Sales and Use Tax Rate webpage to look up a tax rate by address.

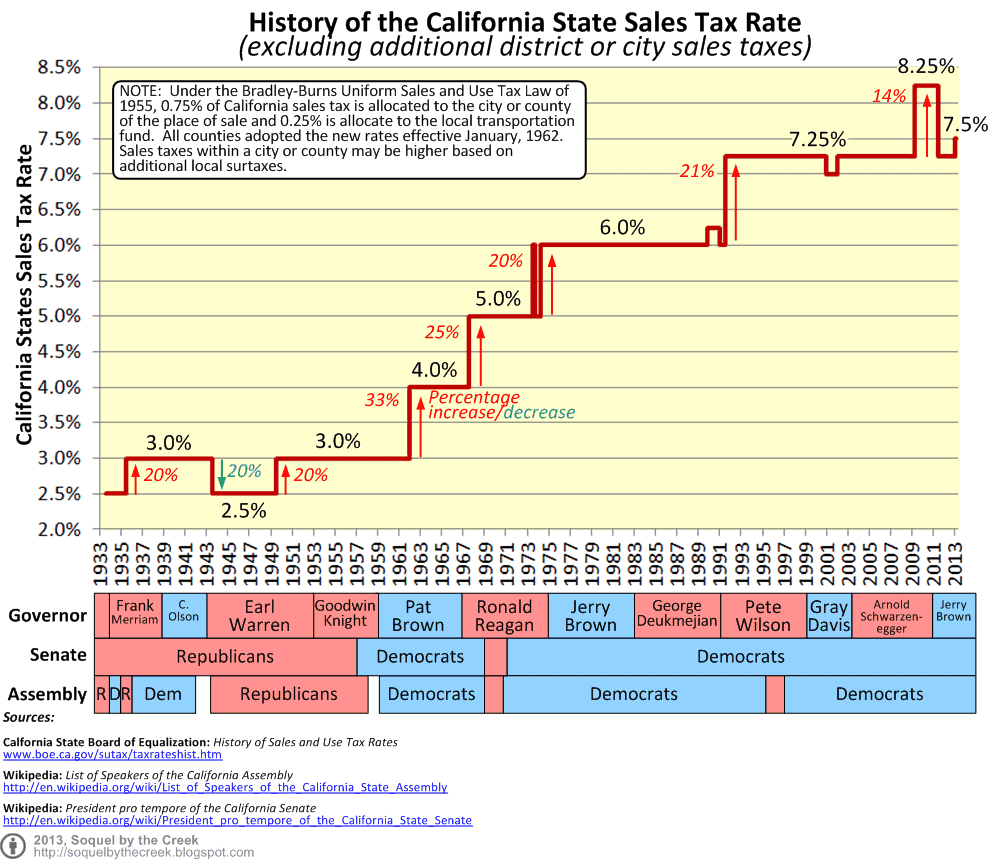

Recent Statewide Sales Tax Increases

Recent temporary statewide sales tax increases include:

- From April 1, 2009 until June 30, 2011, the state sales and use tax increased by 1% from 7.25% to 8.25% as a result of the 2008-2009 California budget crisis.

- Effective January 1, 2013, the state sales and use tax increased by 0.25% from 7.25% to 7.50% as a result of Proposition 30 passed by California voters in the November 6, 2012 election. The change was a four-year temporary tax increase that expired on December 31, 2016.

Read Also: Sales Tax In Nj Calculator

Determining California Sales Tax Nexus For Out Of State Sellers

Out of state sellers who do not have a physical presence in California may be required to collect and remit sales tax if they meet any of the following criteria:

- Affiliate Nexus California requires businesses with ties to businesses or affiliates in the state to collect and remit sales tax. This could include developing or designing TPP that is distributed by a remote seller.

- Those who direct traffic to a website for the purpose and intention of generating a sale establish Nexus for that business. Total referrals on sales of more than $10,000 within a year and total sales of $1,000,000 or more are required to establish click-through nexus.

- Economic Nexus Californias economic nexus law requires businesses that sell $500,000 or more of TPP into the state directly or via a marketplace to register to collect sales tax. This also impacts in-state businesses based on the municipalities in which they operate.

What Tax Rate Do I Use

If your business is located in an unincorporated area of the county, you should generally collect the county sales and use tax rate. Generally, you must collect, report, and pay the rate for the district on the sale of taxable items if you are engaged in business:

- At a business location within the district

- With representatives in the district who make sales or deliveries into the district

- Leasing merchandise in the district or

- Selling or leasing vehicles, undocumented vessels, or aircraft that will be registered in the district.

It is not always possible to determine the correct tax rate based solely on a mailing address or zip code. We offer these tools to help retailers identify the correct rate:

- Some cities offer an online database of addresses within their jurisdiction. Links to those databases are available on this webpage.

You May Like: Irs Status Of Tax Return

Software Electronically Transmitted To Customers

According to Regulation 1502, the sale of noncustom software to customers who download the software from a server is generally not subject to sales tax because the transaction does not involve tangible personal property. However, if the customer is provided a copy of the software on a physical storage medium such as a CD-ROM or a DVD, the entire transaction is generally subject to sales tax. Thus, a customer can generally avoid sales tax liability by purchasing a downloadable version of software instead of a physical version.

Local Sales Tax Reduction Or Repeal Using Proposition 218

Proposition 218 was a 1996 initiative constitutional amendment approved by California voters. Proposition 218 includes a provision constitutionally reserving to local voters the right to use the initiative power to reduce or repeal any local tax, assessment, fee or charge, including provision for a significantly reduced petition signature requirement to qualify a measure on the ballot. A local sales tax, including a sales tax previously approved by local voters, is generally subject to reduction or repeal using the local initiative power under Proposition 218.

Examples where the reduction or repeal of a local sales tax may be appropriate include where there has been significant waste or mismanagement of sales tax proceeds by a local government, when there has been controversial or questionable spending of sales tax proceeds by a local government , when the quality of the programs and services being financed from sales tax proceeds is not at a high level expected by voters, when the local sales tax rate is excessive or unreasonably high , or when promises previously made by local politicians about the spending of local sales tax proceeds are broken after voter approval of the sales tax #General_Tax_Abuses_By_Local_Governments” rel=”nofollow”> legally nonbinding promises concerning the spending of general sales tax proceeds that are not legally restricted for specific purposes).

Also Check: Mortgage Calculator Taxes And Insurance

Where To Send Your California Tax Return

| Income Tax Returns Franchise Tax Board |

You can save time and money by electronically filing your California income tax directly with the . Benefits of e-Filing your California tax return include instant submission, error checking, and faster refund response times. Most tax preparers can electronically file your return for you, or you can do it yourself using free or paid income tax software, like the examples listed below.

California’s free eFile program allows all California taxpayers to instantly file their income tax return over the internet. California provides several free resources for eFile users, including ReadyReturn , and CalFile, a free software program offered by the Franchise Tax Board. In addition, California supports e-filing your return through a variety of third-party software packages.

The benefits of e-filing your California tax return include speedy refund delivery , scheduling tax payments, and instant filing confirmation. If you have questions about the eFile program, contact the California Franchise Tax Board toll-free at 1-800-852-5711.

To e-file your California and Federal income tax returns, you need a piece of tax software that is certified for eFile by the IRS. While most in-depth tax software charges a fee, there are several free options available through the states, and simple versions are also offered free of charge by most tax software companies.

Tax Rate Faq For Sales And Use Tax

- California sales tax is imposed on all California retailers.

- It applies to all retail sales of merchandise in the state.

- Retailers are required to obtain a seller’s permit and to report and pay sales tax to the California Department of Tax and Fee Administration .

- Retailers have the option of collecting sales tax from their customers. Most retailers choose this option.

- Whether or not a retailer collects sales tax, the retailer must report and pay the tax due.

Recommended Reading: When Do I Have To File Taxes 2021

Collecting And Filing The Sales Tax

Once you have found out the applicable California sales tax rates, you might want to learn the right way of collecting and filing these taxes.

Upon the sales tax permit registration, you will be assigned a frequency of returning the sales tax. It can be monthly , quarterly, twice a year, or annually. Sales tax reports are due on the last day of the month that follows the end of the period.

To file the sales tax, you will have to calculate how much sales tax you owe, file the sales tax return and pay the CDTFA. You can calculate how much sales tax you owe by multiplying the cost of the items sold by the sales tax rate in California.

If you are still wondering how much sales tax in California you would have to pay, you should consult with the 1StopVAT team, who will help you file your sales tax seamlessly and in no time.

Things To Know About California State Tax

California’s standard deduction for state income taxes is $4,803 and $9,606 .

Californias tax-filing deadline generally follows the federal tax deadline.

Tax software will do your state taxes .

Wondering “Where is my California state tax refund?” Good news: You can check the status of your state tax refund online.

If you cant pay your California state tax bill on time, you can request a one-time, 30-day delay.

If you cant afford your tax bill and owe less than $25,000, California offers payment plans. Typically, you get three to five years to pay your bill. Theres a fee to set up an agreement.

You can also apply for the states offer in compromise program, which might allow you to pay less than you owe.

Also Check: Highest Sales Tax By State

State Sales Tax Rates

The following chart lists the standard state level sales and use tax rates

Sales and use tax rates change on a monthly basis. This chart is for informational purposes only. Specific questions should be addressed to your tax advisor. Rate information is gathered from various State Department of Revenue materials and various rate providers including Thomson Reuters and Vertex, Inc.

How to Use This ChartSpecific details can be seen by placing your mouse over this icon: More Information. Range of Local Rates Column: included as a quick reference to determine the combined state and local tax rate maximums and minimums. However, for accurate tax calculation, the specific jurisdiction tax rate should be used. Local Rates Apply to Use Tax Column: local use tax rates can be used to determine whether the use tax also applies to local taxes . Note: Non-standard rates are not represented in this chart . |

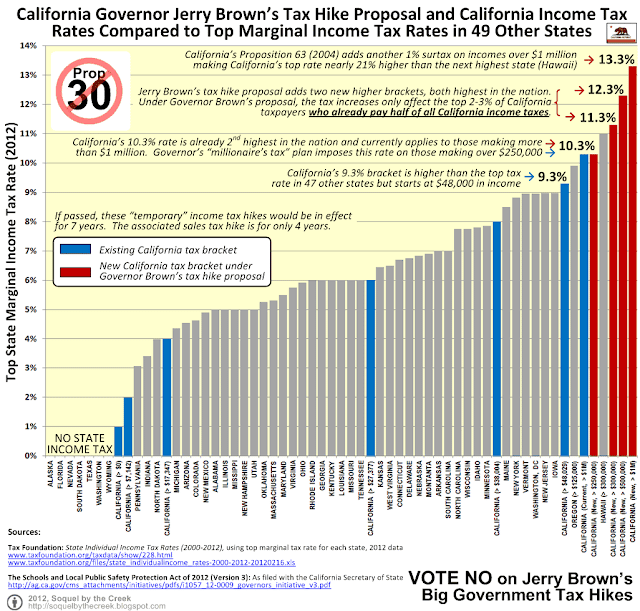

Sales Tax By State 2022

Most states have a sales tax ranging between 4% and 7%. The average sales tax for a state is 5.09%. 32 states fall above this average, and 18 states fall below this average, suggesting that the few states with a sales tax of 0% bring down the average.

There is only one state with a sales tax over 7%, which is California, and is also the state with the largest population. There are six states with sales tax under 4%. Colorado has a sales tax of 2.9%. The other five, Oregon, New Hampshire, Montana, Delaware, Alaska, have state sales taxes of 0%.

The average local sales taxes range from -.03% to 5.14%. The average average local sales tax is 1.45%. There are 18 states whose average local tax is above this average and 32 states that are below it. This is the inverse of how the state sales tax is distributed.

There is only one state with an average local sales tax above 5%–Alabamawhich also has a state sales tax of 4%. New Jersey is the only state with a negative average local sales tax . 12 other states have an average local sales tax of 0%. These states are Delaware, Montana, New Hampshire, Oregon, Maine, Kentucky, , Michigan, Massachusetts, Connecticut, Rhode Island, Indiana. There seems to be no correlation between state tax and average local tax.

There are five states that have an average local tax higher than their state tax– Alaska,New York, Colorado, Louisiana, Alabama.

Here are the 10 states with the highest sales tax rates:

Recommended Reading: How To File Free Taxes