California Sales Tax Filing Due Dates

It’s important to know the due dates associated with the filing frequency assigned to your business by the California Department of Tax and Fee Administration. This way you’ll be prepared and can plan accordingly. Failure to file by the assigned date can lead to late fines and interest charges.

The CDTFA requires all sales tax filing to be completed by the last day of the month following the assigned filing period. Below, we’ve grouped California sales tax filing due dates by filing frequency for your convenience. Due dates falling on a weekend or holiday are adjusted to the following business day.

NOTE: If the due date falls on a weekend or state holiday, the due date is extended to the next business day.

| Reporting period |

|---|

Register For A Permit License Or Account

You can register online for a permit, license, or account for Sales and Use Tax and most of the Special Tax and Fee programs. See below for additional information.

You will answer questions regarding your business activities and the registration system will identify the permits and licenses required.

The registration process will automatically save the information at each step, allow you to quit at any time and continue at a later time.

Note:Partially completed applications will be deleted after 30 days.

You can also use the registration system to:

- Add a new business location to an existing account

- Serial Number of a mobile/manufactured home or aircraft

- Make of a mobile/manufactured home, vehicle, vessel, or aircraft

- Year of a mobile/manufactured home, vehicle, vessel, or aircraft

- Purchase date of the mobile/manufactured home, vehicle, vessel, or aircraft

- Vehicle Identification Number of vehicle

- License plate number of vehicle or undocumented vessel

- Location address of mobile/manufactured home, vehicle, vessel, or aircraft

- Documentation number of US Coast Guard registered vessel

- Hull identification number of the vessel

- Tail number of the aircraft

- Model of the aircraft

If you have any questions, you may contact our Customer Service Center at 1-800-400-7115 , Monday through Friday, 7:30 a.m. 5:00 p.m., Pacific time, excluding state holidays.

File online by logging in to our secure site using your username and password

Sales And Use Tax Review

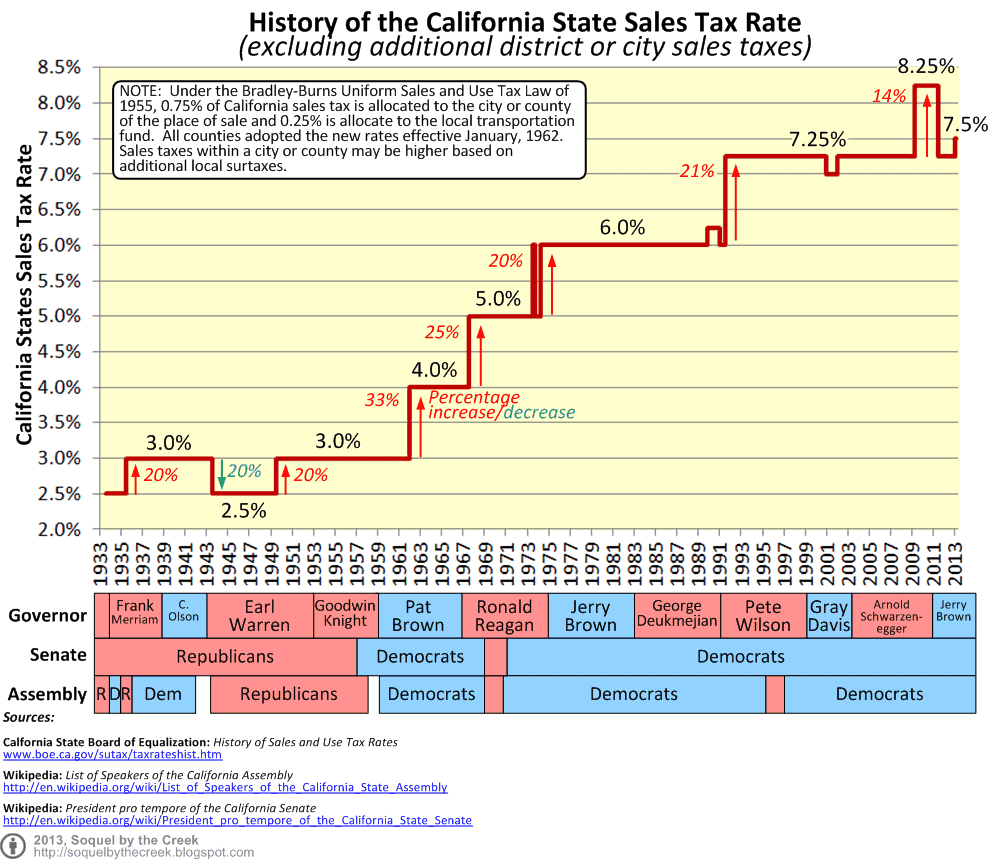

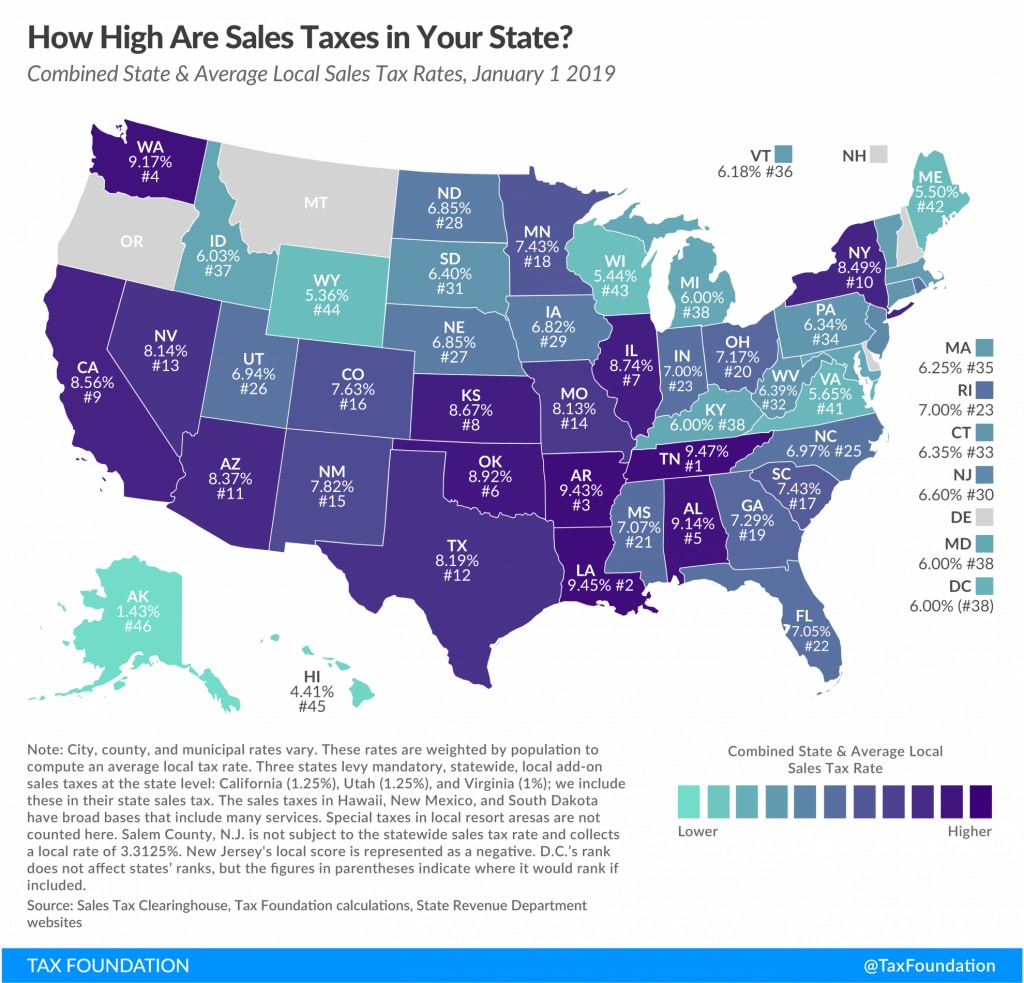

Currently, the base tax rate for the state sales tax is 7.5 percent. Local jurisdictions may add onto that. This tax is imposed on all California retailers and applies to all retail sales of merchandise within the state. All retailers must have a sellers permit and pay sales tax to the California California Department of Tax and Fee Administration.

Retailers are allowed to collect the sales tax from customers but are not required to do so. Most retailers do. In all cases, they are liable for sales tax on anything they sell, whether the tax is collected from customers or not.

Use tax is levied on consumers of merchandise used, consumed or stored in the State of California. It does not matter where it was purchased. If you buy something from an online source that is not registered to collect California sales tax or else does not collect it, you are on the hook for paying the tax, which is the same rate as the sales tax.

Use tax is also imposed on leased merchandise such as cars, boats and planes. If you make a purchase in a foreign country and hand-carry it through U.S. customs into California, you must pay the use tax.

Sales and use taxes are mutually exclusive. You cannot be required to pay both sales tax and use tax for the same merchandise.

Read Also: When Is The Last Day To Turn In Taxes

Exemptions And Exclusions From Sales And Use Taxes

There are a number of exemptions to the obligation to remit sales and use taxes. Some of these exemptions exist in an attempt to promote certain types of industry or consumer choices. An example is the current such exemption on fresh, but not prepared, foodstuffs.

Other exemptions exist to avoid burdening certain organizations with the obligation to collect sales tax, and so many nonprofit or veterans organizations are wholly exempt. Other exemptions are in place so that the same item does not give rise to two sales tax charges. Thus, items purchased for resale, or to various out-of-state entities or which are in transit to an overseas destination, are exempt.

Other examples of exempt sales include sales of certain food plants and seeds, sales to the U.S. Government and sales of prescription medicine. The list of exemptions is long and detailed, so if you are not sure if your business falls under those headings, you may wish to clarify with the DOE. A comprehensive list is available as Publication 61.

In general, businesses which provide a service that does not result in a tangible good are exempt from sales tax, as it only applies to goods. For example a freelance writer or a tradesperson is not required to remit sales tax, although a carpenter making custom furniture is so required.

If you are a reseller, you may also apply for a California Resale Certificate, which allows you to buy goods within California for resale without paying sales tax on those goods.

What Tax Rate Do I Use

If your business is located in an unincorporated area of the county, you should generally collect the county sales and use tax rate. Generally, you must collect, report, and pay the rate for the district on the sale of taxable items if you are engaged in business:

- At a business location within the district

- With representatives in the district who make sales or deliveries into the district

- Leasing merchandise in the district or

- Selling or leasing vehicles, undocumented vessels, or aircraft that will be registered in the district.

It is not always possible to determine the correct tax rate based solely on a mailing address or zip code. We offer these tools to help retailers identify the correct rate:

- Some cities offer an online database of addresses within their jurisdiction. Links to those databases are available on this webpage.

You May Like: Roth Vs Pre Tax 401k

Cigarette Tax Stamp Program

Licensed cigarette distributors can order and check on the status of their orders online. You must be a registered stamp purchaser and have a valid email account, username, and password to use the system. For more information, please see publication 63, Cigarette Distributor Licensing and Tax Stamp Guide.

If you are already a registered stamp purchaser and have a username and password, you may log in to order cigarette stamps.

Sales And Use Tax In California

There are two key tax types businesses selling goods and services in California should be well-versed in: sales tax and use tax. Businesses should be well versed in both to be sure to stay compliant with California state and local tax laws. This guide aims to assist by summarizing key tax topics in an easy to read format.

Don’t Miss: Can I Still File My 2017 Taxes Electronically In 2021

California Sales Tax Software

To accurately calculate and collect California sales tax on your website or other application, use our TaxTools product. It scrubs California addresses and finds the right sales tax rate for all orders shipping within the state of California, regardless of destination or product class. Configuring sales tax on your ecommerce store has never been easier. Contact us for more information or register for a free trial of the TaxTools software.

You can also use our free sales tax calculator to look up the rate for any California address.

AccurateTax believes that sales tax automation should be affordable for all businesses. The laws don’t make compliance easy, but our software helps. See how much time you can save by using AccurateTax.

Solutions

Determining California Sales Tax Nexus

Any business with a physical location in California has nexus, and is therefore required to register to collect sales tax, and to file sales tax returns and pay sales tax to the state.

Other activities that create nexus include someone working for you who lives in the state, having California affiliates who advertise your products in exchange for commission when a sale is made from their affiliate link/marketing activities, or attending a tradeshow and making one or more sales at that show.

Retailers who sell on Amazon and use their Fulfillment by Amazon program, will have a physical presence in California if any of their products are stored within a California FBA warehouse.

Don’t Miss: Free Irs Approved Tax Preparation Courses

Are Drop Shipments Subject To Sales Tax In California

“Drop shipping” refers to the common business practice in which a vendor, often in a different state, makes a sale of a product which is shipped to the end-user by a third party supplier hired by the initial vendor.In California, drop shipments are generally exempt from sales taxes.The state of California does not usually allow any seller who legally has tax nexus to accept any sort of resale exemption from a customer who does not have tax nexus, in a situation where the seller drop ships a property to any in-state customer. If an out-of-state retailer, otherwise known as a true retailer, holds a permit, and it issues the drop shipper any resale certificate for the sale, the drop shipper is is not responsible for reporting or paying the tax

How Do I Claim A Refund While Making Payments

If you are making payments towards a Notice of Determination and believe you do not owe the amount due or believe you have been overcharged, you may now file a claim for refund using the CDTFA’s page. To submit your claim for refund, login with your username and password and click on the account for which you want to request a refund. Then under the I Want To section click the More link. Then select the Submit a Claim for Refund link and follow the prompts. You may file one single timely claim for refund to cover any prior payments within the applicable statute of limitations , any current payments, and any subsequent payments applied to that billing. If you are disputing more than one billing, you must file a timely claim for refund for each separate billing.

Also Check: What Percent Of Your Check Goes To Taxes

To Verify The Tax Rate For A Location:

- Find a list of the latest sales and use tax rates at the following link: California City & County Sales & Use Tax Rates.

- You can look up a tax rate by address

- Visit or call our Offices

- Call our Customer Service Center at 1-800-400-7115 . We are available to help you 7:30 a.m. to 5:00 p.m., Monday through Friday, except State holidays.

I Should Have Collected California Sales Tax But I Didnt

Unlike many of our competitors who offer a one size fits all solution and blindly suggest filing a Voluntary Disclosure Agreement in each state, our sales tax professionals will work with you to determine the best and most cost-effective solution for your business.

If you determine your business has nexus but you have not collected California sales tax, the primary options are to:

Here is what you need to know about each option to make the best decision for your business:

Option 1: Register to Pay Back Taxes, Penalties, and Interest

Sometimes the best solution for a business is simply to register with California and pay back taxes, penalties, and interest. A VDA is not cost-effective if the past liabilities and penalties are minimal. Be wary of the tax professionals that recommend doing a VDA in these cases, they are looking to make a buck rather than looking out for your best interests. If youre unsure what your past liabilities are,contact us and one of our state tax professionals will work with you to conduct an analysis and help you make the right choice for your business.

When to consider registration and payment:

- If you established nexus less than 3 or 4 years ago.

- The sales tax penalty is LESS than the professional fees charged for the VDA.

- Your business does NOT have a sales tax collected issue.

Beware: registering does not generally eliminate past liabilities

Don’t Miss: Can You Write Off Property Tax

Is The California Sales Tax Destination

California is a origin-based sales tax state, which meanssales tax rates are determined by the location of the vendor, not by the location of the buyer. The origin-based method of determining sales tax is less complicated for vendors than destination-based sales tax, because all in-state buyers are charged the same sales tax rate regardless of their location.

California Sales Tax Nexus

Businesses with nexus in California are required to register with the California State Board of Equalization and to charge, collect and remit the appropriate tax.Generally, a business has nexus in California when it has a physical presence there, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives. However, out-of-state sellers can also establish nexus in the ways described below.California nexus for out-of-state sellersAffiliate nexusIf your business has ties to businesses in California, including affiliates, it may have nexus under the states affiliate nexus provisions.An out-of-state business is engaged in business in California if it is member of a commonly controlled group and combined reporting group in which a member of the commonly controlled performs services in California to help the out-of-state business establish or maintain a California market for sales of products. This includes, but is not limited to, the design and development of tangible personal property sold by the remote retailer, or solicitation of sales of tangible personal property on behalf of the retailer.Click-through nexusReferrals, including online referrals, from in-state entities may also trigger nexus for an out-of-state business. An out-of state seller has nexus in California if all the following conditions are met:

Trade show nexus

- MondayFriday 4:30 a.m.4:30 p.m. PT

Read Also: Where’s My Tax Credit

How To File A Sales Tax Return In California

Online Only: California requires that you file a sales tax return using the Taxpayer Online Services Portal.

We will be adding an instructional video here at a later date.

Registration Fee: Free, but there may be a security deposit if your taxable sales are high enough.

Renewal Required?: No, California does not require you to renew your sales tax permit.

Using A Third Party To File Returns

To save time and avoid costly errors, many businesses outsource their sales and use tax filing to an accountant, bookkeeper, or sales tax automation company like Avalara. This is a normal business practice that can save business owners time and help them steer clear of costly mistakes due to inexperience and a lack of deep knowledge about California sales tax code.

Avalara Returns for Small Business is an affordable third-party solution that helps business owners simplify the sales tax returns process and stay focused on growing their business. Learn how automating the sales tax returns process could help your business. See our offer to try Returns for Small Business free for up to 60 days. Terms and conditions apply.

Recommended Reading: How Do I Report Crypto On Taxes

Certain Kinds Of Food Taxation

As you may have guessed, the top necessity of life is food. However, the exemptions can appear complicated because the CDTFA looks at a variety of items that may not seem to be food but are related in a way that allows tax exemption.

For example, most food products for human consumption are easily recognized but where and how they are sold impacts the exemption. Food that falls under the following conditions is considered taxable:

- Sold in a heated condition

- Served as meals

- Consumed on or at a sellers facilities

- Is ordinarily sold for consumption on or near the sellers parking facility, or

- Is sold for consumption where there is an admission charge

However, there is an exception. Hot bakery items or hot beverages such as coffee sold for a separate price are still tax exempt.

The justification for the tax exemption on food products sold through a vending machine is just as convoluted. The vending machine operator is considered the consumer of any food products retailing for 15 cents or less and food products sold through bulk vending machines for 25 cents or less.

Wait, there is more: for sales of cold food products, hot coffee, hot tea and hot chocolate through a vending machine for more than 15 cents, 67 percent of the receipts are tax exempt. The rest is fully taxed.

Other necessities of life include health-related products, services, and meals as well as some utilities like gas, water and electricity.

When Are Services Subject To California Sales Tax

California law restricts the application of sales or use tax to transfers or consumption of tangible personal property or physical property other than real estate. Unlike many other states, California does not tax services unless they are an integral part of a taxable transfer of property. The law does not specifically name most services as exempt, but such activities are automatically excluded from the tax base because they are outside the definition of tangible personal property.

Two types of service activities still may be swept into the tax base, however. The first is any service that is so tied to the sale of property that it is considered a part of that sale and, thus, inseparable from the measure of the tax. Example: a taxable sale of machinery that the seller must calibrate as a condition of the sale. The calibration fee will be taxable even if the seller separates the charge.

The second taxable service is fabrication. Fabrication is the labor involved in creating tangible personal property that is different in form or function from its component parts. This type of labor includes something as simple as drilling holes in a metal strap and bending the strap to make a bracket. The charge for drilling and bending would be taxable unless some other exemption applied.

Sales and use tax law is often assumed to be relatively simple and straightforward.

As you can see, that assumption may be hazardous to your financial health.

Don’t Miss: Are Funeral Expenses Tax Deductable