What Are Property Taxes Based On

While your homes assessed value for property taxes may match its actual value, that wont always be the case. That gap can affect your tax amount. What youll pay in property taxes ranges depending on the state and county you live in as well as the overall value of your home. That includes both the land itself and the structures on it. So, vacant land will likely have lower real estate taxes due to a lower assessed value.

Assessment is based on a unit called a mill, equal to one-thousandth of a dollar. Assessors find annual property tax liability by multiplying three values:

- the state tax rate,

- the assessment ratio ,

- and the property value.

Some of these values fluctuate according to the market and state.

States do their property assessments at different frequencies, some annually and others every couple of years.

Take the first step toward buying a house.

Get approved to see what you qualify for.

Failure Of The General Property Tax

By the beginning of the twentieth century, criticism of the uniform, universal property tax was widespread. A leading student of taxation called the tax, as administered, one of the worst taxes ever used by a civilized nation .

There are several reasons for the failure of the general property tax. Advocates of uniformity failed to deal with the problems resulting from differences between property as a legal term and wealth as an economic concept. In a simple rural economy wealth consists largely of real property and tangible personal property land, buildings, machinery and livestock. In such an economy, wealth and property are the same things and the ownership of property is closely correlated with income or ability to pay taxes.

In a modern commercial economy ownership and control of wealth is conferred by an ownership of rights that may be evidenced by a variety of financial and legal instruments such as stocks, bonds, notes, and mortgages. These rights may confer far less than fee simple ownership and may be owned by millions of individuals residing all over the world. Local property tax administrators lack the legal authority, skills, and resources needed to assess and collect taxes on such complex systems of property ownership.

Overlapping governments caused little problem for real estate taxation. Each parcel of property was coded by taxing districts and the applicable taxes applied.

States Constrain Local Property Taxes

The property tax is primarily a local government tax and can be a flexible revenue source to support schools and locally provided public services. In its purest form, it is based on an assessment of the market values of all properties in a jurisdiction. Once these values are established, the jurisdiction applies a tax rate to yield the amount of revenue needed to support the desired level of services. Property tax limits interrupt this calculation. Some constrain the percentage by which assessed values can grow each year, others limit the property tax rate, and still others the most severe limit the percentage growth in property tax revenue each year. These last are known as levy limits.

Although property taxes are primarily a local revenue source, states largely control the conditions under which they are administered. Property tax limits generally are enacted by states and cover an entire state. Some states have statutory limits enacted by legislatures others have constitutional limits, which generally required approval by voters.

Property tax limits date far back to the 19th century, but the late 1970s was by far the most significant period for states adopting limits. The number of state-imposed limits nearly doubled in the 1970s and 1980s, as levy and assessment limits first became widespread. Today, 44 states and the District of Columbia impose at least one kind of limit, and many use a combination of limits.

Four State Examples of Property Tax Limits

Don’t Miss: Is Ein And Tax Id The Same

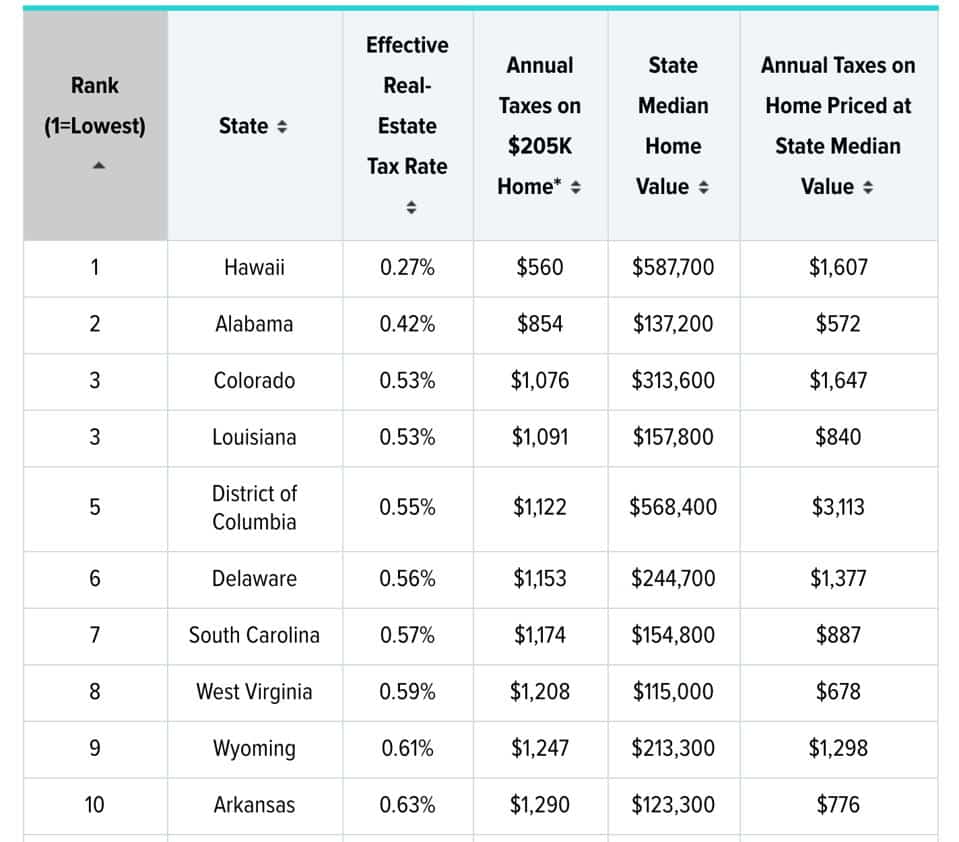

States With The Lowest Property Tax In 2020

Once again, states with no property tax donât really exist in the US housing market 2020. The good news is that some states are better than others when it comes to the rate of property tax assessed and collected. For example, New Jersey, Illinois, and New Hampshire are the top 3 US states with the highest property tax rates. Property tax rates for these states are 2.47%, 2.30%, and 2.20% respectively according to WalletHubâs Property Taxes by State 2020 ranking. However, there are 28 states that have property taxes below 1% and are essentially next to nothing. Plus, these are some of the best states to invest in real estate.

Hereâs a list of the 10 lowest property tax states in 2020 along with the annual property taxes paid at the state median value according to WalletHub. For the complete ranking of WalletHubâs property taxes by state, click here.

1) Hawaii Real Estate Market

- Effective Property Tax Rate: 0.27%

- Median Home Value: $587,700

- Annual Taxes on State Median Home Value: $1,607

Hawaii has the lowest real estate property tax rate in the US this 2020! However, before investing in the Hawaii housing market, keep in mind that the median house cost is very high here. Hence, the annual property taxes youâll have to pay are pretty high . Hawaii also has the second-highest income tax. Buying an investment property here can generate $2,161 in monthly rental income according to Mashvisorâs real estate data and analytics.

2) Alabama Real Estate Market

Median Property Taxes Paid By County 2020

Note: Missing values are due to small sample sizes in low-population counties. This interactive map is more accessible when viewed on larger screens.

Below is a shareable version of the interactive map shown above.

Property tax payments also vary within states. In Georgia, for example, where the median property tax bill is relatively low, median taxes range from $413 in Quitman County to $3,185 in Fulton County . This is typical among states higher median payments tend to be concentrated in urban areas. This is partially explained by the prevalence of above-average home prices in urban cities. Because property taxes are assessed as a percentage of home values, it follows that higher property taxes are paid in places with higher housing prices. However, because millagesthe amount of tax per thousand dollars of valuecan be adjusted to generate the necessary revenue from a given property tax base, the higher payments also reflect an overall higher cost of governmentand commensurately higher taxesin these areas.

While no taxpayers in high-tax jurisdictions will be celebrating their yearly payments, its worth noting that property taxes are largely rooted in the benefit principle of government finance: the people paying the property tax bills are most often the ones benefiting from the services.

How does your state compare?

You May Like: Are Gofundme Donations Tax Deductable

Understanding Property Tax Rates

While one of the most misunderstood factors associated with homeownership, its absolutely imperative for prospective buyers to understand local property tax rates. In order to truly understand property taxes, however, buyers must first understand why they are paying them in the first place.

For better or for worse, property taxes serve as a primary source of state funding. Most states rely on the money they bring in from property taxes to fund their infrastructure. Local municipalities use the money they receive from property taxes to fund a number of projects: education, roads, parks and recreational activities, public transportation, and payroll for municipal employees. Most cities rely on the money brought in from property taxes to pay police, firefighters, and their local public works department. That is an important distinction to make: While most people may not be too fond of the idea of paying property taxes, the money is going to good use. A lot of the money is returned to the community from which it came, which begs the question: How do local municipalities decide how much to charge in property taxes?

States With Highest Property Taxes

Among All 50 States, the Following States have the Highest Property Taxes:

Median Annual Property Tax: $7,840Property Tax Rate: 2.44%

Median Annual Property Tax: $4,157Property Tax Rate: 2.31%

Median Annual Property Tax: $5,388Property Tax Rate: 2.20%

Median Annual Property Tax: $5,582Property Tax Rate: 2.07%

Median Annual Property Tax: $3,286Property Tax Rate: 1.94%

Median Annual Property Tax: $4,040Property Tax Rate: 1.83%

Median Annual Property Tax: $2,775Property Tax Rate: 1.83%

Median Annual Property Tax: $2,565Property Tax Rate: 1.80%

Median Annual Property Tax: $4,915Property Tax Rate: 1.68%

Median Annual Property Tax: $4,013Property Tax Rate: 1.66%

Median Annual Property Tax: $2,241Property Tax Rate: 1.64%

You May Like: Aarp Foundation Tax-aide Site Locator

States With The Highest And Lowest Property Taxes

Property tax falls under local, not state, jurisdiction. Median household property tax payments from analysis performed by the Tax Foundation as a percentage of median household income from the Census Bureau’s 2018 American Community Survey cites these as the counties with the most expensive property tax:

- Essex County, New Jersey 16.86%

- Passaic County, New Jersey 14.62%

- Union County, New Jersey 12.70%

These Louisiana parishes hold the least expensive spots for property tax as a percent of income:

- Assumption Parish 0%

- Vernon Parish 0.45%

- Grant Parish 0.68%

Louisiana carries some of the lowest property tax rates as a percentage of earned income because it offers a homestead exemption. This law allows the first $7,500 of assessed property values to forego having property taxes levied against them.

For reference, assessed home values represent 1/10 of the home’s actual value. For example, a $100,000 home would have a $10,000 assessed value. Therefore, Louisiana’s homestead exemption allows the first $75,000 of home value not to count toward calculating your property tax bill, which goes a long way toward lowering the percentage of income that goes toward these taxes.

Property Tax And Other Write

Although most of us dont like to pay tax, the good news for real estate investors is that property tax paid on rental property is a fully deductible expense used to reduce net taxable income.

Normal deductible expenses

Tax write-offs that real estate investor use include:

- Mortgage interest

- Business credit card interest paid when making purchases for the property

- Hazard and business insurance

- Professional fees such as property management or leasing fees

- Legal and tax preparation fees

Don’t Miss: When Do Taxes Need To Be Filed 2022

States And Federal Government Have Exacerbated Localities Problems

State property tax limits might have caused less harm to residents if either states or the federal government had made up for the lost local revenue. But that generally did not happen, sometimes even in states whose limits required the state to make up the lost local revenue. To the contrary, federal aid to localities fell from 8.4 percent of total local revenue in 1977 to 3.8 percent in 2015, while state aid to localities dropped from 30.7 percent of total local revenue to 28.4 percent.

In some states, income tax cuts have left inadequate revenue available to sustain previous levels of support for localities. For example, income tax cuts in Massachusetts led to a 44 percent reduction in unrestricted state aid to localities, after adjusting for inflation. After Maine enacted major income tax cuts, the state scaled back aid for localities, ultimately cutting the amount of aid from 5 percent of broad-based taxes to 2 percent. And income tax cuts in Kansas made it very difficult to restore recession-era cuts in aid to localities, which remains down 14 percent since 2009 after adjusting for inflation.

The failure of state aid to make up for the revenue lost to local property tax limits is evident in the focus states of this report.

How Do Property Taxes Affect Rental Income Flow

Some might wonder why they need to look for states that do not have property tax for investing in real estate. Well, you should understand that there are many expenses associated with owning a property. Rental fees may vary depending on factors such as the cost of renovations and/or repairs. There are also other expenses like mortgage payments and the real estate property tax for which a property owner is responsible. All these expenses can have a considerable impact on rental income flow.

Every investor wants to maximize their properties potential cash flows such that they generate rental income that covers all these expenses and leave something extra as profit. So, if you end up purchasing property in tax-burden states, you may ultimately be decreasing your cash flow potential. You can potentially save more money by investing in real estate located in tax-friendly states.

You May Like: How Long Does Taxes Take To Process

States With No Property Tax 2022

Residents of the United States are familiar with paying taxes. Individuals pay federal income taxes and additional state income taxes that vary depending on their state of residence. In addition to income taxes, property taxes may also be applicable.

Property tax is a real estate ad-valorem tax, considered a regressive tax, levied by the jurisdiction in which the property is located and paid for by the property owner. Taxes are determined by multiplying the property tax rate by the current market value and are recalculated annually. Property taxes are used to fund education, infrastructure, law enforcement, parks and recreation, public transportation, and water and sewer improvements.

Unfortunately, every state has property taxes however, some property taxes are very low, and others do not apply to vehicles. States with lower property taxes may have higher costs elsewhere, such as a high sales tax, to make up for the costs.

Total Tax Burden: 510%

Alaska has no state income or sales tax. The total state and local tax burden on Alaskans, including income, property, sales, and excise taxes, is just 5.10% of personal income, the lowest of all 50 states.

All residents of Alaska receive an annual payment from the Alaska Permanent Fund Corp. made up of revenue and investment earnings from mineral lease rentals and royalties. The per citizen dividend payment for 2021 was $1,114.

The cost of living in Alaska is high, though, mostly due to the states remote location. Alaska also levies the second-highest beer tax of any state in the union at $1.07 per gallon, bested only by Tennessee. The state ranks 47 out of 50 in affordability and 45 out of 50 on the U.S. News & World Report list of Best States to Live In.

Alaska has one of the highest and fastest-rising healthcare costs of any state in the U.S. That said, at $11,064 per capita in 2014the most recent year the Centers for Medicare and Medicaid Services Office of the Actuary reported statisticsit also spent the most on healthcare, excluding the District of Columbia.

At $18,394 per pupil, it also spent the most on education of any state in the Western U.S. in 2019. In 2017, Alaskas infrastructure received a grade of C- from the American Society of Civil Engineers .

You May Like: How Is Property Tax Paid

How To Qualify For A Senior Property Tax Reduction

There are some general qualifying criteria for senior property tax relief. Eligibility rules include:

The age standard differs from state to state, but it usually ranges from 6165 years. In some states, having a high income can disqualify you from getting property tax relief or reduce the amount of your property tax exemption.

Total Tax Burden: 614%

With an estimated six people per square mile, Wyoming is the second least densely populated state, bested only by Alaska, which has roughly one human being for every square mile. Citizens pay no personal or corporate state income taxes, no retirement income taxes, and enjoy low sales tax rates. The total tax burdenincluding property, income, sales, and excise taxes as a percentage of personal incomeis 6.14%, ranking the state third lowest.

Like Alaska, Wyoming taxes natural resources, primarily oil, to make up for the lack of a personal income tax, according to reporting in the Cowboy State Daily. The state ranks an average 33rd in affordability and 35th on the U.S. News & World Report list of Best States to Live In.

In 2019, at $16,304 per pupil, Wyoming was one of the highest spenders on education in the western U.S., second only to Alaska. It also earned a grade of A for its school funding distribution in 2015, the best on this list.

Wyomings healthcare spending in 2014 was more moderate by comparison, at $8,320 per capita. Although Wyoming hasnt received an official letter grade for its infrastructure yet, the ASCE found that 6.9% of its bridges are structurally deficient and 99 of its dams have a high hazard potential.

You May Like: Us Individual Income Tax Return

States With No Income Tax Might Put More Pressure On Lower

Income taxes are usually progressive in nature, meaning that they tax higher earners at a greater rate than lower earners. Other taxes typically dont have that Robin Hood-like characteristic.

Sales taxes, for example, are considered regressive. They dont change depending on the income level of the consumer. They treat everyone the same. So do levies on food, gasoline and other key consumable items.

These taxes place a bigger burden on the poor, according to ITEP research. The reason is the lowest earners in the state devote the lions share of their take-home pay to buying things that are subject to sales taxes. The wealthy, who can save a chunk of their income in their 401s and other investments, have a much smaller proportional exposure to the sales tax.

How Property Taxes Are Calculated

Property taxes are calculated differently depending on the municipality where the property is located, but they usually follow some basic calculation rules:

Property assessment

Once a year, or sometimes every few years, depending on the state and local law, the tax assessor will estimate the assessed value of the property. Assessors usually use one of three methods to determine a propertys assessed value:

- Sales comparison to compare similar properties that have recently sold in the same area, making adjustments for variables that would make one property more or less valuable than another.

- Cost method uses the replacement cost of a property if it were to be rebuilt from the ground up, factoring depreciation and value of the land or lot the house is one.

- Income method is used for commercial and business properties based on the net income an owner would receive if the property were rented and considers market factors such as operating expenses and current market rent rates.

Once the tax assessor determines the market value of the property for tax purposes, property owners are sent a notice of assessed value, followed by the property tax bill.

Property tax calculation

Once the assessed value of a property is determined, the assessor multiplies the assessed value by the local tax rate or mill rate to calculate the actual property tax.

- $100,000 assessed value / $1,000 = 100 x 35 = $3,500 property tax or –

- $100,000 assessed value x 3.5% = $3,500 property tax

Also Check: Taxes On 2 Million Dollars Income