Which State Has No Property Tax In Usa

Unfortunately, there are no states that do not have a property tax. The majority of the states revenue comes from property taxes. The proceeds of a tax are used to pay for the operation and maintenance of essential government services, such as law enforcement, infrastructure, education, transportation, parks, water, and sewer service improvements.

The 10 Best States To Retire In The Us

Furthermore, each of these states has a low combined state and local tax burden, low income tax rates, and generous tax breaks for retirement income. Furthermore, they have strong economies with low unemployment rates and high incomes, in addition to low unemployment rates. If youre looking for a state to retire in, youve come to the right place.

Texas Local Sales Taxes Part I Vital Services For Two Pennies More

Some of the best things in life arent free. Ask any local government. Many of the services we tend to take for granted police and fire protection, public libraries, weekly trash collection and bus service come at a price, and local sales taxes pay much of the tab.

According to the Advisory Commission on Intergovernmental Relations, the first local sales taxes were enacted in New York City in 1934. Today, 38 states allow these taxes.

Nine of the 10 most populous states have authorized local sales taxes . Among those with local taxes, only Floridas maximum local rate is lower than Texas. The highest local rates typically are levied in major metropolitan areas.

Cannabis Tax Elevates State Revenue

Nineteen states currently have cannabis tax legislation in place, helping to increase funding for state programs and reducing the number of black market sales. Despite the elevated state tax earnings from marijuana sales, cannabis legalization is slow-moving in over half of the United States. Because of a lack of federal regulation, it is up to each state to decide on a tax structure and how those taxes will be allocated, unlike alcohol and cigarettes.

Alcohol, cigarette, and gas taxes also contribute to state funds, but federal agencies regulate them. Due to a lack of regulation, different states enforce different marijuana taxes, and some leverage multiple taxes on medical or recreational products.

Currently, there are three different marijuana tax structures in use in the U.S. Some choose to tax based on a percentage of the price of the plant, while others tax based on weight or potency. Many states have that money allocated by state law for specific programs. Others simply add it to the rest of tax revenues to fund operations, public health programs, and other state initiatives.

Read Also: Do 16 Year Olds Have To File Taxes

Exhibit : State And Local Sales Tax Rates In The 10 Most Populous States

| State |

|---|

Note: The 10 most populous states comprise more than 50 percent of the U.S. population.

In Texas, local sales taxes are considered optional, in that they must be approved by voters in the area to be affected. Today, 1,544 jurisdictions across Texas levy the tax, including cities, counties, transit authorities and many special-purpose districts .

In 2015, these entities received slightly more than $8 billion from local sales taxes far less than the $40 billion raised by local property taxes, but still an important element of local government finance.

In Texas, the total local sales tax rate in any one particular location that is, the sum of the rates levied by all local taxing authorities can never exceed 2 percent.

In Texas, the total local sales tax rate in any one particular location that is, the sum of the rates levied by all local taxing authorities can never exceed 2 percent. For instance, if a city imposes a 1 percent sales tax and the county in which it resides levies a 0.5 percent sales tax, an emergency services district in that city could not establish a sales tax rate higher than 0.5 percent.

In many Texas metro areas, the combined local sales tax rate is at the full 2 percent allowed by law.

States With The Highest State Income Tax Burdens

While Broadway may bring joy into your life, the tax burden of living in New York could bust your … budget.

Getty Images

Depending on your income in 2021, you may be feeling the pain of paying your state and federal income taxes. Some of you reading this post may be feeling a bit more pain based on the state within which you live, how you earn your income, and whether or not you own a home. The overall tax burden can vary widely from state to state.

While seven states boast of not having an income tax, this doesn’t mean you get to live tax-free. They have to fund the state budgets somehow. If you were wondering, the seven states without an income tax are Nevada, Washington, South Dakota, Texas, Florida, Wyoming, and Alaska.

Income taxes are just one part of the overall tax burden of living in a state. Your personal tax burden at the state level can vary widely depending on your financial circumstances. Your tax burden is the proportion of your total personal income required to cover your state and local taxes. The most common types of state and local taxes are personal income taxes, sales taxes, capital gains taxes, and property taxes.

WalletHub compared all 50 states across the three most common types of taxation property taxes, income taxes, and sales taxes- as a share of your personal income to determine the five states with the highest state tax burdens.

Read Also: Federal Taxes On Capital Gains

Total Tax Burden: 823%

Nevada relies heavily on revenue from high sales taxes on everything from groceries to clothes, sin taxes on alcohol and gambling, and taxes on casinos and hotels. This results in a state-imposed total tax burden of 8.23% of personal income for Nevadans, the second-highest on this list. However, it still ranks a very respectable 22 out of 50 when compared with all states.

That said, the high costs of living and housing put Nevada near the bottom when it comes to affordability. The state ranks 37th on the U.S. News & World Report Best States to Live In list.

Nevadas spending on education in 2019 was $9,344 per pupil, the fourth-lowest in the western region of the U.S. One year earlier, in 2018, the ASCE gave Nevada a grade of C for its infrastructure.

In addition to receiving an F grade from the Education Law Center in 2015, Nevada was also the worst state overall in terms of the fairness of its state school funding distribution. Nevadas healthcare spending in 2014 was $6,714 per capita, the lowest on this list and the fourth-lowest nationally.

Read Also: 1 Year Tax Return Mortgage

Which States Have The Lowest Sales Tax

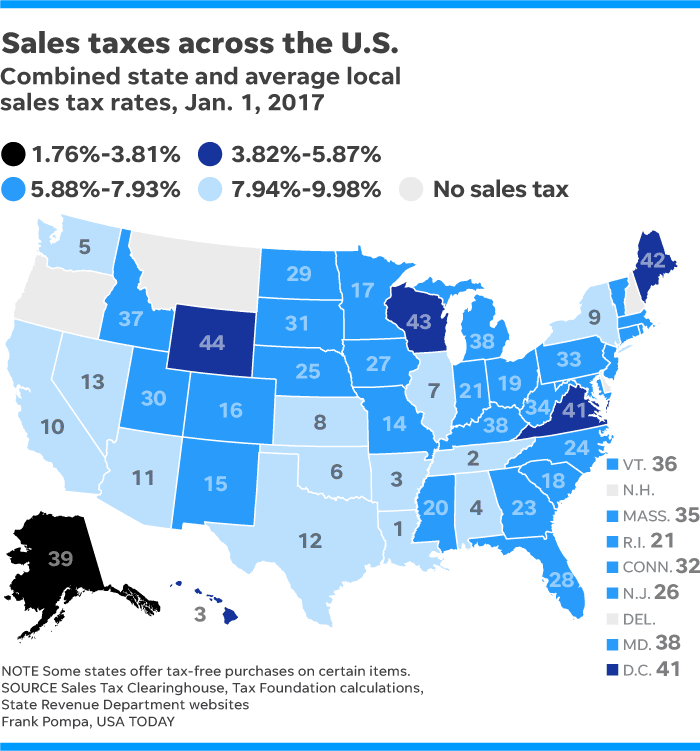

The sales tax laws within the United States are not subject to federal regulation and each state has control over its base sales tax. Sales taxes are imposed on retail transactions and certain services.

Whether or not a state imposes a state sales tax, local municipalities and counties may impose excise or surtaxes. For example, the sales tax in New York state is 4%, but New York City has additional taxes, increasing the rate to 8.875%.

As of 2022, five states impose a 0.000% sales tax including Alaska, Delaware, Montana, New Hampshire, and Oregon. Each of these states, however, may have individual municipalities that impose excise taxes, income taxes, and taxes imposed on tourist locations.

Also Check: Irs Tax Exempt Organization Search

Distinguishing Goods From Nontaxable Items

Since services and intangibles are typically not taxed, the distinction between a taxable sale of tangible property and a nontaxable service or intangible transfer is a major source of controversy. Many state tax administrators and courts look to the “true object” or “dominant purpose” of the transaction to determine if it is a taxable sale. Some courts have looked at the significance of the property in relation to the services provided. Where property is sold with an agreement to provide service , the service agreement is generally treated as a separate sale if it can be purchased separately. Michigan and Colorado courts have adopted a more holistic approach, looking at various factors for a particular transaction.

Highest Taxed States 2022

Only two things in life are certain: death and taxes, the old adage goes. Aside from federal taxes, every U.S. state determines its own tax rates for income taxes, property taxes, and sales taxes. Because of this, each state’s tax burden varies significantly. Across the board, California, Hawaii, and New Jersey have the highest taxes in the U.S.

You May Like: Live In One State Work In Another Taxes

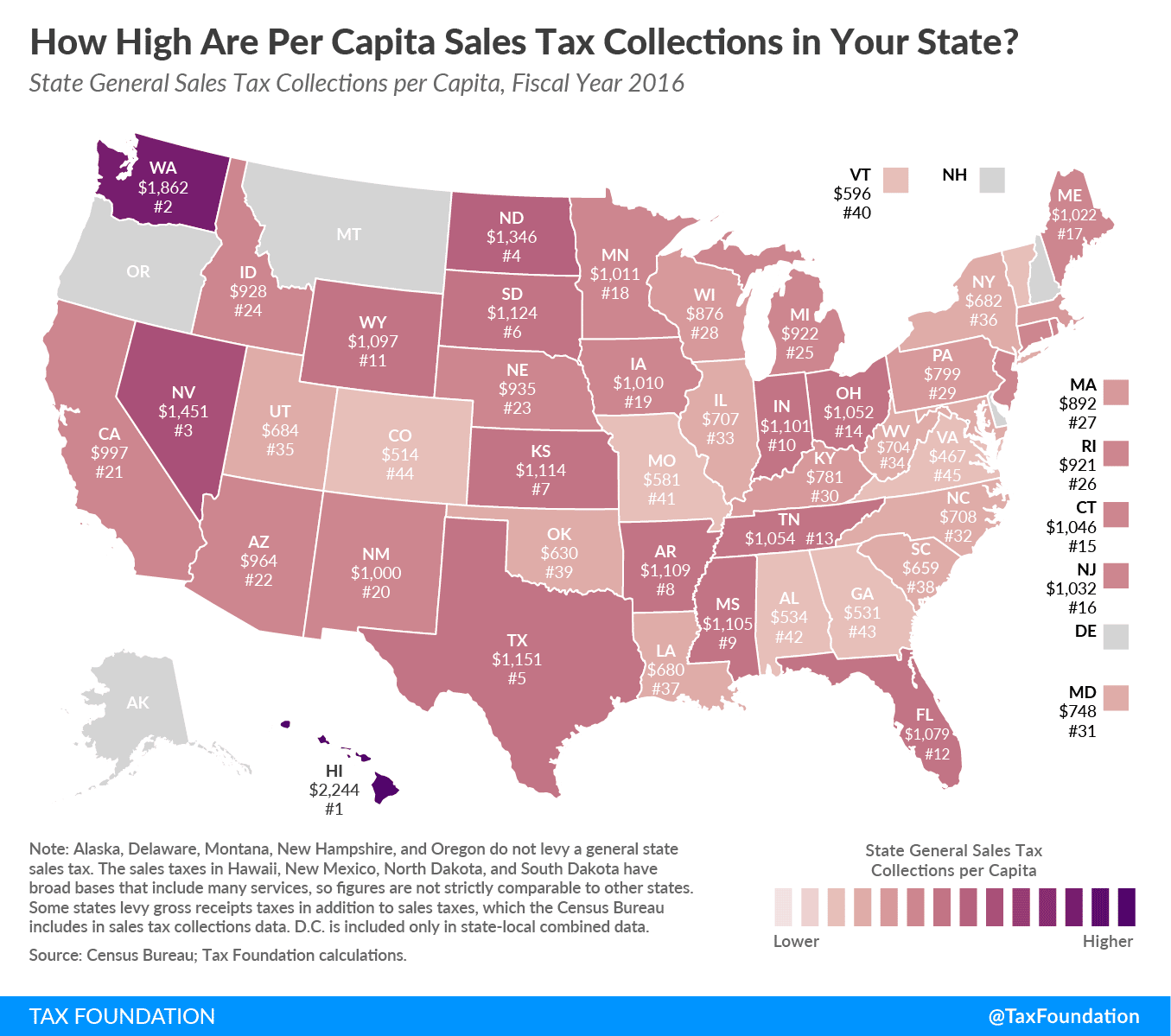

State Sales Tax Rates

California has the highest state-level sales tax rate, at 7.25 percent. Four states tie for the second-highest statewide rate, at 7 percent: Indiana, Mississippi, Rhode Island, and Tennessee. The lowest non-zero state-level sales tax is in Colorado, which has a rate of 2.9 percent. Five states follow with 4 percent rates: Alabama, Georgia, Hawaii, New York, and Wyoming.

No state rates have changed since April 2019, when Utahs state-collected rate increased from 5.95 percent to 6.1 percent.

States Without Sales Tax

These five states dont charge sales taxes:

Can I be charged a sales tax by both the city and the borough?

It is possible. State law allows both cities and boroughs to levy a sales tax. In many boroughs that levy a sales tax, it is not unusual for a city within that borough to also levy a tax. Please refer to Alaska Taxable, Table 2-Boroughs or Table 2-Cities as a reference guide on local sales tax levies. .

You May Like: Credit Karma Tax Return 2020

Sales Taxes In The United States

Sales taxes in the United States are taxes placed on the sale or lease of goods and services in the United States. Sales tax is governed at the state level and no national general sales tax exists. 45 states, the District of Columbia, the territories of Puerto Rico, and Guam impose general sales taxes that apply to the sale or lease of most goods and some services, and states also may levy selective sales taxes on the sale or lease of particular goods or services. States may grant local governments the authority to impose additional general or selective sales taxes.

As of 2017, 5 states do not levy a statewide sales tax.California has the highest base sales tax rate, 7.25%. Including county and city sales taxes, the highest total sales tax is in Arab, Alabama, 13.50%.

Sales tax is calculated by multiplying the purchase price by the applicable tax rate. The seller collects it at the time of the sale. Use tax is self-assessed by a buyer who has not paid sales tax on a taxable purchase. Unlike the value added tax, a sales tax is imposed only at the retail level. In cases where items are sold at retail more than once, such as used cars, the sales tax can be charged on the same item indefinitely.

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Recommended Reading: How To Find 2020 Tax Return

What Cities Have The Highest Sales Tax

While the highest state-level sales tax in the USA is 7%, thousands of municipal governments charge an additional local-option sales tax on top of the state rate. This means that some cities have tax rates that can be significantly higher than their states sales tax rate.

This table lists cities and towns with the highest sales tax rates in the United States. Arkansas accounts for the majority of the top-ten highest taxed cities in the USA, with many cities collecting combined state and local sales taxes of 11% or more. Other states with cities in the top-50 include Louisiana, Colorado, Arizona, and Oklahoma.

Sales Tax Rates Database:Need an updated list of local sales tax rates for your business? Download our sales tax database!

| Rank |

|---|

Which Cities And States Have The Highest Sales Tax Rates

Although sales tax rates vary by exact location , here are the cities with the highest combined state and local sales tax rate today:

- Gould, Arkansas: 11.5%

- Birmingham and Montgomery, Alabama: 10%

- Baton Rouge, Louisiana: 9.95%

- Nashville, Tennessee: 9.25%

- San Jose, California: 9.25%

What is a combined state and local sales tax rate? In addition to the state sales tax rate, counties and jurisdictions can enforce their own local sales tax rates. So when you look at a combined sales tax rate, youre looking at the state sales tax rate plus the local sales tax rates from the county and city.

A small group of states have kept sales tax simple. They only require sellers to charge a flat state tax rate. That means no worrying about adding any local rates. Which states are these? We have your list here.

You May Like: Tax Credits For Electric Vehicles

What Makes Up A Sales Tax Rate Anyway

A lot of factors go into the sales tax rates you charge customers. Firstly, there are state rates. With a few exceptions , each state with a sales tax has a flat statewide sales tax rate. These rates vary widely from 4-7%.

Next there are local/city/jurisdiction sales tax rates. There are taxes enforced by local areas like your county, city, or jurisdiction. Youve most likely voted on a local sales tax rate change on a ballot at some point, if there was a specific publicly-funded venture your local government was embarking on. For example, a new park, highway, county hospital. However, not every state has local sales tax rates and well get into that in a minute.

If your mind is whirling a bit by now, we understand. All of these taxes combined gives the U.S. more than 14,000 different sales tax districts.

Hebron Community Center 611 N Main St Hebron

Early voting hours at this location for Porter County voters: 8:30 a.m.-3:30 p.m. Mondays, Wednesdays and Fridays 11 a.m.-7 p.m. Tuesdays and Thursdays 8:30 a.m.-3:30 p.m. Oct. 29 and Nov. 5 8:30 a.m.-12 p.m. Nov. 7. A list of additional mobile early voting sites is available online: .

Also Check: How Do I Report Crypto On Taxes

Porter County Administration Building 155 Indiana Ave Valparaiso

Early voting hours at this location for Porter County voters: 8:30 a.m.-3:30 p.m. Mondays, Wednesdays and Fridays 11 a.m.-7 p.m. Tuesdays and Thursdays 8:30 a.m.-3:30 p.m. Oct. 29 and Nov. 5 8:30 a.m.-12 p.m. Nov. 7. A list of additional mobile early voting sites is available online: .

The Role Of Competition In Setting Sales Tax Rates

Avoidance of sales tax is most likely to occur in areas where there is a significant difference between jurisdictions rates. Research indicates that consumers can and do leave high-tax areas to make major purchases in low-tax areas, such as from cities to suburbs. For example, evidence suggests that Chicago-area consumers make major purchases in surrounding suburbs or online to avoid Chicagos 10.25 percent sales tax rate.

At the statewide level, businesses sometimes locate just outside the borders of high sales-tax areas to avoid being subjected to their rates. A stark example of this occurs in New England, where even though I-91 runs up the Vermont side of the Connecticut River, many more retail establishments choose to locate on the New Hampshire side to avoid sales taxes. One study shows that per capita sales in border counties in sales tax-free New Hampshire have tripled since the late 1950s, while per capita sales in border counties in Vermont have remained stagnant. At one time, Delaware actually used its highway welcome sign to remind motorists that Delaware is the Home of Tax-Free Shopping.

State and local governments should be cautious about raising rates too high relative to their neighbors because doing so will yield less revenue than expected or, in extreme cases, revenue losses despite the higher tax rate.

Recommended Reading: Tax On Food In Virginia

States With The Lowest Personal Income Tax Rates

Only eight states have no personal income tax:

In addition, New Hampshire limits its tax to interest and dividend income, not income from wages.

Among the states that tax income, Pennsylvania’s 3.07% flat tax ranks the Keystone State as the 10th lowest in the nation for 2021.

Low personal income tax rates can be misleading a lack of available tax deductions, for example, can raise the effective rate you pay. The Retirement Living Information Center states that figuring your total tax burden, including sales and property taxes, can give you a more accurate reading on affordability, especially if you’re on a fixed income. However, these states with the lowest taxes on income can be a good place to start looking for a more affordable location.

Total Tax Burden: 614%

With an estimated six people per square mile, Wyoming is the second least densely populated state, bested only by Alaska, which has roughly one human being for every square mile. Citizens pay no personal or corporate state income taxes, no retirement income taxes, and enjoy low sales tax rates. The total tax burdenincluding property, income, sales, and excise taxes as a percentage of personal incomeis 6.14%, ranking the state third lowest.

Like Alaska, Wyoming taxes natural resources, primarily oil, to make up for the lack of a personal income tax, according to reporting in the Cowboy State Daily. The state ranks an average 33rd in affordability and 35th on the U.S. News & World Report list of Best States to Live In.

In 2019, at $16,304 per pupil, Wyoming was one of the highest spenders on education in the western U.S., second only to Alaska. It also earned a grade of A for its school funding distribution in 2015, the best on this list.

Wyomings healthcare spending in 2014 was more moderate by comparison, at $8,320 per capita. Although Wyoming hasnt received an official letter grade for its infrastructure yet, the ASCE found that 6.9% of its bridges are structurally deficient and 99 of its dams have a high hazard potential.

Recommended Reading: How To File An Extension Taxes