Check Eligibility For Property Tax Exemption

There are certain property tax exemptions available at the state and local level, depending on where you live. Thy are typically reserved for seniors, veterans, active-duty service members, and individuals with disabilities. If any of these apply to you, you can apply for an exemption with your county. Note that for some of these categories, there may be additional income requirements as well. In some situations, homeowners may be eligible for a complete exemption from property taxes.

What Do States Do With Tax Revenue

State governments are largely responsible for funding health care and education. On average, these account for 17% and 41% of state budgets, respectively.

But according to the Center on Budget and Policy Priorities, âstates also fund a wide variety of other services, including transportation, corrections, pension and health benefits for public employees, care for persons with mental illness and developmental disabilities, assistance to low-income families, economic development, environmental projects, state police, parks and recreation, housing and aid to local governments.â

To pay for all this, states primarily rely on tax revenueâincluding income taxesâand federal funds.

Is It Cheaper To Live In States With No Income Tax

Regardless of whether thereâs an income tax where you live, states still need resources to pay for things. If your state doesnât collect income taxes, you might pay more in sales tax, property tax or vehicle registration. The cost of living can also be a consideration.

Florida, for example, doesnât have an income tax. But its other state and local taxes rank 27th highest in the nation.

Alaska also has low taxes, but its remote location makes it an expensive place to live.

Don’t Miss: When Do I Have To File Taxes 2021

States With The Lowest Property Taxes In 2022

Oceanfront home on Oahu Hawaii at sunset. Though Hawaii has high home values, its effective property … tax rate is the lowest in the country.

getty

Property taxes are tricky. Property tax rates can vary by county, municipality, township, and school district. Another interesting aspect of property taxes is the terminology and the way they are often calculated. In many states, counties use whats called a millage rate, in which the tax rate of one mill represents a tax liability of $1 per $1,000 of assessed value of the property one one-thousandth, hence the term mill.

Thus, when it comes to figuring out the states with the lowest property taxes, there is no statewide property tax rate which states can be ranked against. Instead, the best approach to identifying the states with the lowest property taxesis to determine the effective property tax rate: The real dollar amount paid in real estate taxes as a percentage of the median home value for a state.

In a recent study, analyzed all 50 U.S. states in order to determine which states had the lowest taxes. The study took into account personal income tax rates, state sales tax rates, and effective property tax rates, calculating the latter based on the median amount of real estate taxes paid and the median home value reported in the Census Bureaus 2020 American Community Survey Five-Year Estimates, the latest data available.

Read on to find out the states with the lowest property taxes in 2022.

States With Highest Property Taxes

Among All 50 States, the Following States have the Highest Property Taxes:

- New York 1.68%

- Pennsylvania 1.89%

While the average effective property tax rate in the United States is 1.08%, there are several states that have much higher rates. In fact, the top 10 states with the highest effective property tax rates are all above 2%.

New Jersey has the highest effective property tax rate in the country at 2.47%. This is followed by Illinois , Connecticut , New Hampshire , and Wisconsin .

While property taxes are generally higher in states with higher home values, this is not always the case. For example, while Texas has a relatively high median home value of $174,600, its effective property tax rate is just 1.93%.

On the other hand, some states with lower median home values have much higher property tax rates. For example, Pennsylvania has a median home value of just $153,900 but an effective property tax rate of 1.89%.

Just because a state has a high property tax rate does not mean that its residents pay more in taxes overall. This is because states with higher property taxes often have lower income taxes. For example, New Jersey has the highest effective property tax rate in the country but also has the third-lowest effective income tax rate.

While some people may view high property taxes as a burden, they can also be seen as a sign of strong public service. States with high property taxes often have good schools, low crime rates, and well-maintained infrastructure.

Don’t Miss: Last Date For Filing Taxes

What Constitutes Lower Property Taxes For Senior Citizens

Property taxes vary from state to state, but the calculation process is more or less the same. A county assessor will assess your property value based on the current market rate in your area. Applying your areas property tax rate to the assessed property value results in your property tax amount.

Seniors struggle with property taxes because they tend to grow over time, while seniors income stays the same.

Senior citizens can typically apply for some property tax relief, depending on the state they live in. Available tax breaks for seniors in the U.S. include:

- Deferralsit refers to the possibility of postponing tax payments

- Tax creditssome states offer senior citizens credit for the portion of the real estate taxes or a yearly rent

- Exemptionsproperty tax exemptions typically reduce the value of your home that is subject to taxation

- Rate freezesthey prevent property tax increases for eligible taxpayers

When Property Taxes Are Lower Other Taxes Are Higher

Nationwide, local governments rely on property taxes for over 70% of their revenue, and use these funds to pay for public schools, government services, construction projects, and more. If a county or city has low property taxes, theyre likely to raise taxes in other areas in order to compensate.

For example, Louisianas median property tax rate is only 0.53%, but local sales tax rates are just below 10%. Similarly, in Nevada, the average local sales tax is 6.85%. These sales tax rates are quite significantly higher than the national average local sales tax of 1.45%.

You May Like: Last Day To Do 2021 Taxes

Property Tax System Basics

Translation:

Property taxes provide the largest source of money that local governments use to pay for schools, streets, roads, police, fire protection and many other services. Texas law establishes the process followed by local officials in determining the property’s value, ensuring that values are equal and uniform, setting tax rates and collecting taxes.

Texas has no state property tax. The Texas Constitution and statutory law authorizes local governments to collect the tax. The state does not set tax rates, collect taxes or settle disputes between you and your local governments.

The property tax system consists of officials who administer the process, property tax agencies, and the laws or regulations that govern what they do.

Officials in the property tax system consist of the governing bodies who oversee the operations of local property agencies also known as a taxing unit. There are several types of local taxing units, cities, county, school districts, junior colleges, and special districts who set tax rates, collect, and levy property tax to fund annual public services. Cities, county, and junior colleges have access to other revenue sources, a local sales tax. School districts rely on local property tax, state, and federal funding.

The property owner, whether residential or business, is responsible for paying taxes and has a reasonable expectation that the taxing process will be fairly administered. The property owner is also referred to as the taxpayer.

Property Taxes By State

The table below shows average property taxes by state, in alphabetical order. It indicates both the annual property tax on a median-value home in the state and, for comparison, what the property tax would be on the U.S. national median home sales price of $440,300, as of the second quarter of 2022.

| State |

|---|

| $2,686 |

You May Like: How Do Trusts Avoid Taxes

Understanding Property Tax Rates

While one of the most misunderstood factors associated with homeownership, its absolutely imperative for prospective buyers to understand local property tax rates. In order to truly understand property taxes, however, buyers must first understand why they are paying them in the first place.

For better or for worse, property taxes serve as a primary source of state funding. Most states rely on the money they bring in from property taxes to fund their infrastructure. Local municipalities use the money they receive from property taxes to fund a number of projects: education, roads, parks and recreational activities, public transportation, and payroll for municipal employees. Most cities rely on the money brought in from property taxes to pay police, firefighters, and their local public works department. That is an important distinction to make: While most people may not be too fond of the idea of paying property taxes, the money is going to good use. A lot of the money is returned to the community from which it came, which begs the question: How do local municipalities decide how much to charge in property taxes?

Limits Have Forced Cuts In Local Services

Constrained by the limits on their ability to raise revenues, local governments and schools have little choice when hitting property tax limits but to cut spending, often with serious consequences for residents.

Michigans two constitutional property tax limits, for example, made it extremely difficult for localities to recover from the Great Recession. Thats largely because one of the limits allows taxable values to fall during recessions but then limits their growth during an economic recovery. This ratchet effect makes it nearly impossible for local revenues to recover even as the economy improves, putting serious strain on local budgets.

Localities responded to these serious challenges in large part by cutting spending for services. One study of spending by Michigan cities other than Detroit found that total spending fell by more than 17 percent between 2008 and 2014, after adjustment for inflation. Every category of services saw declines. For example, the police and sheriff category fell by 13 percent, fire by 14 percent, parks and recreation by 27 percent, and health and human services by nearly 8 percent.

| TABLE 1 | |

|---|---|

| $2,756 | -17% |

Note: Expenditure values have been rounded to the nearest million. Percent change calculations may not match due to rounding.

Source: Great Lakes Economic Consulting, Michigans Great Disinvestment: How State Policies Have Forced Our Communities into Fiscal Crisis, April 2016. Inflation adjustment by CBPP.

Recommended Reading: Taxes As An Independent Contractor

Sales Tax Takers And Leavers

If you’re a consumer, you’ll want to consider that all but four states Oregon, New Hampshire, Montana and Delaware rely on sales tax for revenue.

Of these, Alaska also has no income tax, thanks to the severance tax it levies on oil and natural gas production. 37 states, including Alaska and Montana, allow local municipalities to impose a sales tax, which can add up. Lake Providence, Louisiana has the dubious distinction of most expensive sales tax city in the country in 2021, with a combined state and city rate of 11.45%.

Factoring the combination of state and average local sales tax, the top five highest total sales tax states as ranked by the Tax Foundation for 2021 are:

- Tennessee 9.55%

Residents of these states pay the least in sales taxes overall:

- New Hampshire 0%

States With The Highest Property Tax Rates

Some of the highest property taxes can generally be found in the northeast, with the highest rate being 2.47% in New Jersey. The average homeowner in New Jersey paid $8,104 per home in property taxes. One reason for the property tax rate being consistently high in New Jersey is that county, and municipal governments cannot impose local income or sales tax in New Jersey as they can in other states. Property taxes pay for most of everything in New Jersey.

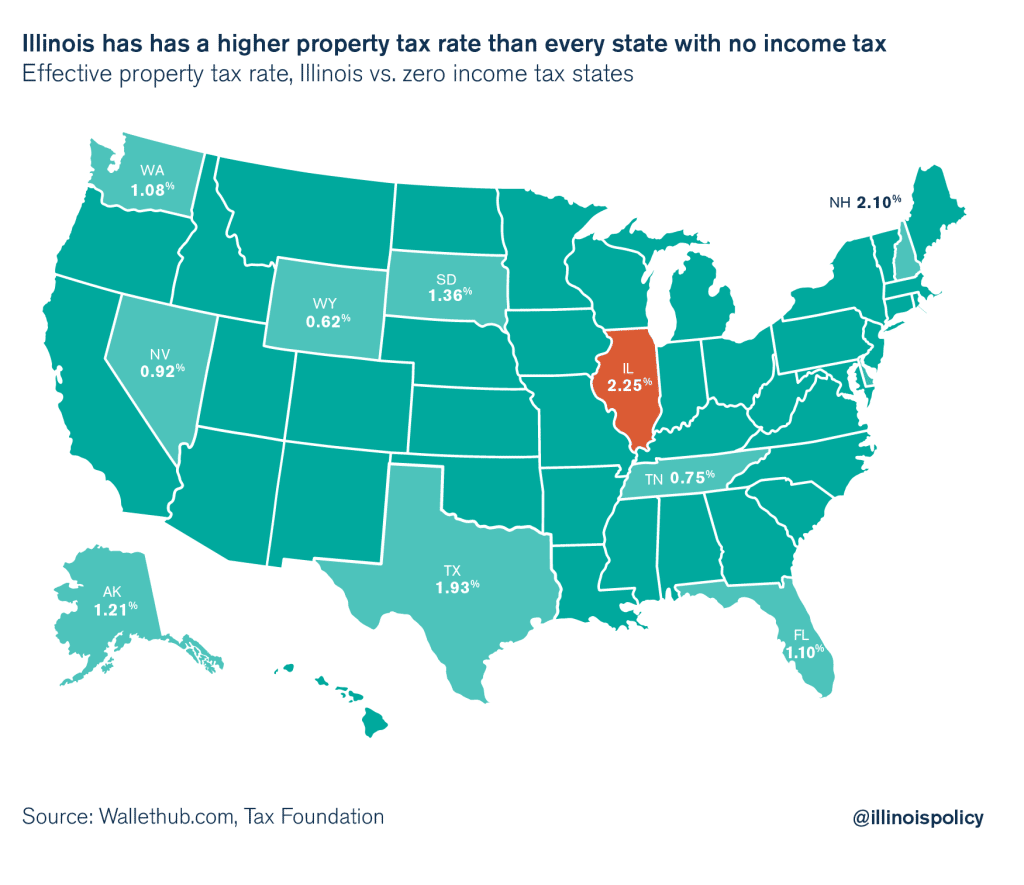

The second-highest property tax rate is in Illinois. The property tax rate is 2.30% in Illinois. In 1996, Illinois property tax bills were around the national average and then saw an 80% increase in the following 20 years. Home value appreciation has been lagging despite property taxes increasing quickly.

New Hampshire has the third-highest property tax rate in the U.S. of 2.20%. New Hampshire residents pay a higher percentage of income in property taxes than any other state. The high property tax rate has made it hard for younger people to purchase homes because the property tax bill is often larger than their mortgages. However, New Hampshire does not impose an income tax on earned salaries or wages and does not have a sales tax.

Wisconsin has the fifth-highest property tax rate in the United States of 1.91%, which finally dips just below 2%. Per capita property taxes in Wisconsin are about $1,615.71, above the national average. The median home value in Wisconsin is $178,900, and the median household income is $59,305.

Recommended Reading: How To Find Tax Rate

Expert Insights: Moving And Taxes

Making the move to a different state is a big step, and from a tax perspective, it can get complicated. MoneyGeek interviewed several experts to elaborate on the unique tax issues that moving presents and what you may need to take into account if you’re thinking about making a move across state lines. The views expressed are the opinions and insights of the individual contributors.

States Can Relieve Pressure On Property Taxes

States can couple eliminating or reforming property tax limits with actions to avoid unwarranted increases in property taxes, or in some cases to reduce those taxes States can increase income taxes, especially for high-income residents who have gained the most from rising inequality. Other options include adopting or expanding state inheritance and estate taxes, which typically are paid by the very wealthy closing loopholes that allow profitable corporations to avoid taxes and other steps that ask the wealthy to contribute at least as much of their income in state and local taxes as middle- and low-income families. The additional state revenue could be used to restore cuts in state aid to localities and for future increases in state support for education and other local services.

As noted, federal aid to localities has dropped precipitously since the late 1970s, and the Trump Administration and Republican congressional leaders have proposed additional cuts in areas including education, policing, environmental efforts, and infrastructure. The federal government could relieve pressure on property taxes by increasing, rather than cutting, aid to localities for these types of services and investments.

Don’t Miss: What Is The Oasdi Tax

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity,this post may contain references to products from our partners. Here’s an explanation for how we make money

Reforming The Property Tax In The Twentieth Century

Efforts to reform the property tax varied from state to state, but usually included centralized assessment of railroad and utility property and exemption or classification of some forms of property. Typically intangibles such as mortgages were taxed at lower rates, but in several states tangible personal property and real estate were also classified. In 1910 Montana divided property into six classes. Assessment rates ranged from 100 percent of the net proceeds of mines to seven percent for money and credits. Minnesotas 1913 law divided tangible property into four classes, each assessed at a different rate. Some states replaced the town or township assessors with county assessors, and many created state agencies to supervise and train local assessors. The National Association of Assessing Officers was organized in 1934 to develop better assessment methods and to train and certify assessors.

The depression years after 1929 resulted in widespread property tax delinquency and in several states taxpayers forcibly resisted the sale of tax delinquent property. State governments placed additional limits on property tax rates and several states exempted owner-occupied residence from taxation. These homestead exemptions were later criticized because they provided large amounts of relief to wealthy homeowners and disproportionally reduced the revenue of local governments whose property tax base was made up largely of residential property.

Californias Tax Revolt

Also Check: Where Can Senior Citizens Get Their Taxes Done Free

Which Us City Has The Highest Property Taxes

- New York. Median property taxes paid all homes: $8,602. Median property taxes paid homes with a mortgage: $8,819. …

- San Jose, Calif. Median property taxes paid all homes: $7,471. Median property taxes paid homes with a mortgage: $8,559. …