States With The Lowest Sales Taxes

Only four states don’t have a sales tax as of 2021: Delaware, Montana, New Hampshire, and Oregon. Alaska comes close. It doesn’t impose a state sales tax. But it does allow cities and counties to levy sales taxes at an average rate of 1.76%.

After Alaska, the four states with the lowest combined state and local sales tax rates as of 2021 are:

- Wisconsin: 5.43%

The five states with the highest combined state and local sales tax rates as of 2021 are:

- Tennessee: 9.55%

Retirement Income Tax Basics

Most retirement income can be subject to federal income taxes. That includes Social Security benefits, pension payments and distributions from IRA and 401 plans. Exceptions include distributions from Roth IRA and Roth 401 plans. Federal income taxes on Roth contributions are paid before the contributions are made. These contributions as well as any investment gains can be withdrawn free of federal income taxes after five years if you have reached age 59 1/2.

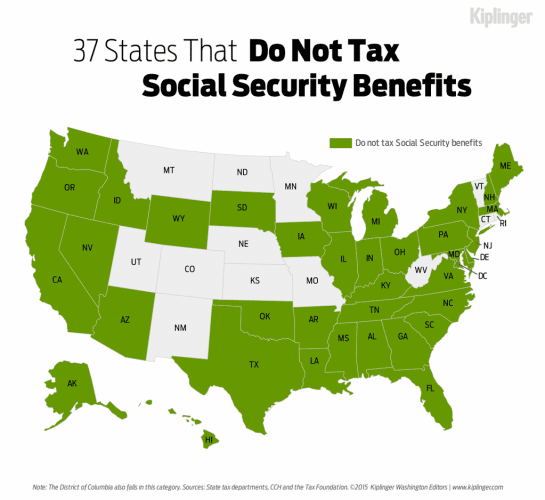

The situation is more complex when it comes to how states will tax your income. Many states have no income tax at all, so all retirement income, as well as other income, is state tax-free. Most states specifically exclude Social Security benefits from taxation. Some others also exempt retirement account distributions and pensions. Most have a mix of approaches to taxing retirement income.

Now that you have a good baseline knowledge of how retirement taxes work at the state level, lets dive into the states that wont tax you at all.

Delaware Resident Working Out Of State

Q. Im considering taking a job in Maryland. I know the states do not have a reciprocal agreement. How does the credit work for taxes paid to another state? Will I owe County taxes in MD?

A. If you are a resident of Delaware who works in Maryland, you may take credit on line 10 of the Delaware return for taxes imposed by other states. You must attach a signed copy of your Maryland return in order to take this credit.

Even though you may not be liable for Maryland County Taxes, Maryland imposes a Special Non-resident tax on their non-resident income tax return.

Read Also: Amended Tax Return Deadline 2020

Unemployment Insurance Tax Base

The UI base subindex scores states on how they determine which businesses should pay the UI tax and how much, as well as other UI-related taxes for which businesses may also be liable.

The states that receive the best scores on this subindex are Oklahoma, Delaware, Vermont, New Mexico, and Ohio. In general, these states have relatively simple experience formulas, they exclude more factors from the charging method, and they enforce fewer surtaxes.

States that receive the worst scores are Virginia, Nevada, Idaho, Maine, and Georgia. In general, they have more complicated experience formulas, exclude fewer factors from the charging method, and have complicated their systems with add-ons and surtaxes. The three factors considered in this subindex are experience rating formulas , charging methods , and a host of smaller factors aggregated into one variable .

Experience Rating Formula. A businesss experience rating formula determines the rate the firm must paywhether it will lean toward the minimum rate or maximum rate of the particular rate schedule in effect in the state at that time.

Charging Methods and Benefits Excluded from Charging. A businesss experience rating will vary depending on which charging method the state government uses. When a former employee applies for unemployment benefits, the benefits paid to the employee must be charged to a previous employer. There are three basic charging methods:

Also Check: Can I Still Do My Taxes

Tax Deadlines And What To Know About Online Tax Software

Tax season is well underway as the IRS started accepting and processing tax returns on Jan. 24 for the 2022 tax season.

Taxes are traditionally due on April 15, but because April 15 falls on a holiday for Washington D.C., tax day this year is April 18, 2022. While most state deadlines are the same day, a few states have bumped their deadline back a few extra weeks. You can check your state’s filing deadline here.

The federal tax deadline is not far away meaning it’s time to start collecting your 2021 tax documents. And rather than mail your taxes to the IRS, you may consider signing up for an online tax service like H& R Block or TurboTax to ensure your taxes are securely filed.

It’s important to select the right tax platform based on your tax needs as each of them are designed for specific tax returns ranging from simple tax returns to complex returns.

Here are our favorite tax platforms:

- Best overall tax software: TurboTax

Don’t Miss: Percent Of Taxes Taken Out Of Paycheck

How Property Tax Rates Are Determined

The property tax rates of local jurisdictions arent uniform, but they do use similar formulas to calculate the rates. Each state has a number of tax districts that establish property tax rates based on their financial needs for the year, which generally include the necessary funding to support school districts and local government offices. From this amount, local governments subtract the funds they expect to receive from other sources to arrive at the budget deficiencywhich is the amount it needs to raise through property taxes. This budget deficiency is divided by the total assessed values for all homes within the jurisdiction to determine the appropriate rate of property tax to charge homeowners.

Read Also: Is Auto Insurance Tax Deductible

Total Tax Burden: 834%

Washington hosts a young population, with only 15.9% of its residents over age 65, and many major employers, thanks to the lack of state-mandated corporate income tax . Residents do pay high sales and excise taxes, and gasoline is more expensive in Washington than in most other states. The state comes in at 26 out of 50, with a total tax burden of 8.34%.

Unusually higher-than-average living and housing costs hurt Washingtonians, putting the state at 44th in terms of affordability. For some residents that might not matter, however, because their state was ranked by U.S. News & World Report as the overall best state to live in once again for 2021.

Washington spent $7,913 per capita on healthcare in 2014, $132 below the national average. Conversely, at $14,223 per pupil, it spent more on education than most in 2019, though it received a C grade for its school funding distribution four years earlier. In 2019, Washington earned the same grade for its infrastructure from the ASCE.

Don’t Miss: Department Of Tax Debt And Financial Settlement Services

States That Dont Tax Retirement Income

Eight states have no state income tax. Those eight Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington and Wyoming dont tax wages, salaries, dividends, interest or any sort of income.

No state income tax means these states also dont tax Social Security retirement benefits, pension payments and distributions from retirement accounts. Even income from securities held in non-retirement brokerage accounts is free from any state income tax in these states. That means retired residents in these states have no worries about paying state income taxes on their income from any source.

Another state, New Hampshire, has no state income tax on wages, salaries, retirement account withdrawals or pension payments. But New Hampshire does currently tax dividends and interest, which are likely to be sources of income for some retirees with assets outside retirement accounts.

The rest of the states take a variety of approaches to taxing retirement income. Some tax all retirement income, including Social Security. Others exempt Social Security but tax sources such as pensions and retirement account income if retirees income exceeds a certain cap. But the following states levy no tax on retirement income of any sort.

States With Small Retirement Tax Requirements

What To Consider Before Moving To A No

While moving to a state with no income tax may sound appealing, it comes with trade offs. States with no income tax often make up for the loss of revenue to the state by charging residents a higher sales, property or excise tax .

For instance, Tennessee has the highest combined sales tax rate in the nation at 9.53%, according to the Tax Foundation, a D.C.-based think tank. Washington state has one of the highest tax rates on gasoline in the nation, at 49.4 cents per gallon. Of all states, New Hampshire and Alaska rely the most on property taxes, with tax collections accounting for 67.6% and 51.8%, respectively, of their revenue.

Taxes are also a big source of income that the state uses to finance public services such as infrastructure, healthcare and education. Lower taxpayer dollars likely translates into lower funding for these initiatives.

South Dakota, for example, spends the lowest on education of all states in the Midwest, at $10,073 per pupil per year. Nationwide, the average school spending per pupil is $12,612, and Florida, Nevada, Tennessee, Texas all spend less than the average.

To weigh another state’s affordability, consider these above factors as well as the overall cost of living and job opportunities in your field. Leaving a big city, for example, you may have to accept certain trade-offs, such as a lower paying job for more affordable real estate.

Also Check: How To Pay Taxes Quarterly

Total Tax Burden: 823%

Nevada relies heavily on revenue from high sales taxes on everything from groceries to clothes, sin taxes on alcohol and gambling, and taxes on casinos and hotels. This results in a state-imposed total tax burden of 8.23% of personal income for Nevadans, the second-highest on this list. However, it still ranks a very respectable 22 out of 50 when compared with all states.

That said, the high costs of living and housing put Nevada near the bottom when it comes to affordability. The state ranks 37th on the U.S. News & World Report Best States to Live In list.

Nevadas spending on education in 2019 was $9,344 per pupil, the fourth-lowest in the western region of the U.S. One year earlier, in 2018, the ASCE gave Nevada a grade of C for its infrastructure.

In addition to receiving an F grade from the Education Law Center in 2015, Nevada was also the worst state overall in terms of the fairness of its state school funding distribution. Nevadas healthcare spending in 2014 was $6,714 per capita, the lowest on this list and the fourth-lowest nationally.

Which States Dont Tax 401k

If you are on the lookout for tax-friendly states for retirees, here is a list of states that don’t tax 401 distributions, social security payments, and pension payments.

After years of soaking away retirement savings, you can choose to permanently leave the workforce and start collecting the retirement savings youâve worked so hard to accumulate. Before making the final decision to exit the workforce, you should decide the best state to stay after retirement. Each state has different tax rules for retirement income, and the state you reside in can make a big difference in the amount of taxes you pay.

Most states tax a small portion of the retirement income you earn, while some states may exempt retirement income from 401s and IRA. Some of the states that donât tax 401 include Alaska, Illinois, Nevada, New Hampshire, South Dakota, Pennsylvania, and Tennessee. You can save a lot of money if you live in these states since your retirement income will be exempt from taxation.

You May Like: Self Employment Tax Rates 2021

States That Exempt Retirement Income

The remaining 41 states in the U.S. do have income taxes. However, three of them exempt retirement income plans, IRAs, and pension plans) from being taxed:

There are a couple of things to know, though. Mississippi does tax pension income for early retirement before age 59 1/2. Pennsylvania taxes pension income for residents who retire before age 60.

Also, all three of these states will tax any income that you make outside of retirement accounts. For example, if you receive dividends or sell stocks that aren’t held in an IRA or 401 plan, be prepared to pay taxes.

Cutting Taxes For All Iowans

On March 1, 2022, Governor Reynolds signed into law Iowas most significant tax reform bill in state history, establishing a 3.9% flat income tax rate, eliminating state tax on retirement income, reforming corporate income tax and more.

When Governor Reynolds took office, Iowa had the sixth highest individual income tax rate in the nation. Now that the Governors plan proposed this year has passed with bipartisan support, Iowas income tax rate will be fourth lowest among all states that charge income tax, ranking among the most tax-friendly states in America.

Thanks to the administrations strong, conservative budgeting practices and fiscal responsibility, Iowa is in a formidable economic position. Last fiscal year, Iowa closed its books with a general fund balance of $1.24 billion and nearly $1 billion in cash reserves.

Theres never been a better time in Iowa for bold, sustainable tax reform that meets the priorities of the state, allows Iowans to keep more of what they earn, and creates a highly competitive tax system.

-

3.9% individual income tax rate.

-

Elimination of retirement income tax.

-

Exemption of net capital gains on sale of employee-awarded capital stock.

-

Reduction of corporate income tax rate.

Recommended Reading: Is Hazard Insurance Tax Deductible

Also Check: Taxes On Lottery Winnings Calculator

Why Do States Charge A State Tax

Following the adoption of the U.S. Constitution, the federal government was granted the authority to impose taxes on its citizens. Each state also retained the right to impose what kind of tax it wanted, excluding any that are forbidden by the U.S. Constitution as well as its own state constitution. These states fund their governments through tax collection, fees, and licenses.

A Patchwork Of Retirement Income

Pensions pay out a defined amount each month until an employee dies, which is why they are called defined benefit plans. Your payout typically depends on your salary over time, and how long you worked with the company. Pensions are becoming increasingly rare among private employers, however: Only 14 percent of Fortune 500 companies offered a pension plan to new hires in 2019, down from 59 percent in 1998.

Increasingly, Americans have had to rely on defined contribution plans, such as 401 plans, for retirement income. The payout from these plans depends on how much you contribute, as well as the investment returns in the plan. In most defined contribution plans, distributions are taxed as ordinary income by the federal government, but taxation varies from state to state. Of the 14 states that won’t tax your pension, two states Alabama and Hawaii will tax your income from defined contribution plans such as 401s.

Finally, there’s Social Security income. The federal government can tax some Social Security benefits, depending on your income. You’ll be taxed on:

- up to 50 percent of your benefits if your income is $25,000 to $34,000 for an individual or $32,000 to $44,000 for a married couple filing jointly.

- up to 85 percent of your benefits if your income is more than $34,000 or $44,000 .

You May Like: How Much Tax On Rental Income

No Income Tax States For Retirees

For people who want to retire, there are some things that must be considered. These include the places where you want to live and retire. Basically, you do not simply pick a place that you want and live there. There are some factors that you still need to consider before you choose a best place to retire for you.

Relocation is probably the biggest issue for retirees whether they have a fixed income or not. Usually, they are concern about how their retirement income will be taxed. They are also considering if the food is also taxed on a specific place. It is better if you will consider no income tax states.

If you will consider some of the no income tax states, Alaska is probably at the top of your list. Actually, this place even pays for the people who want to live there. There is no state income tax, no state sales tax and it only has 25 places that have a property tax. In 2009, the dividend given for people who resides in Alaska for at least one year is $1,305 for every man, woman and child in your family. This is probably the best place that you can live when you talk about taxes. However, if you are already too old and you cannot withstand too much cold, it is not advisable for you to live here since this is one of the coldest places on Earth. The no income tax can be good for a retiree but the place is not a good residential area for older people.

Wyoming and Texas round out the no income tax states.

How State Income Property And Sales Taxes Impact Retirement

In addition to state taxes on retirement benefits, consider others when evaluating tax-friendly states for retirees:

State Income Tax

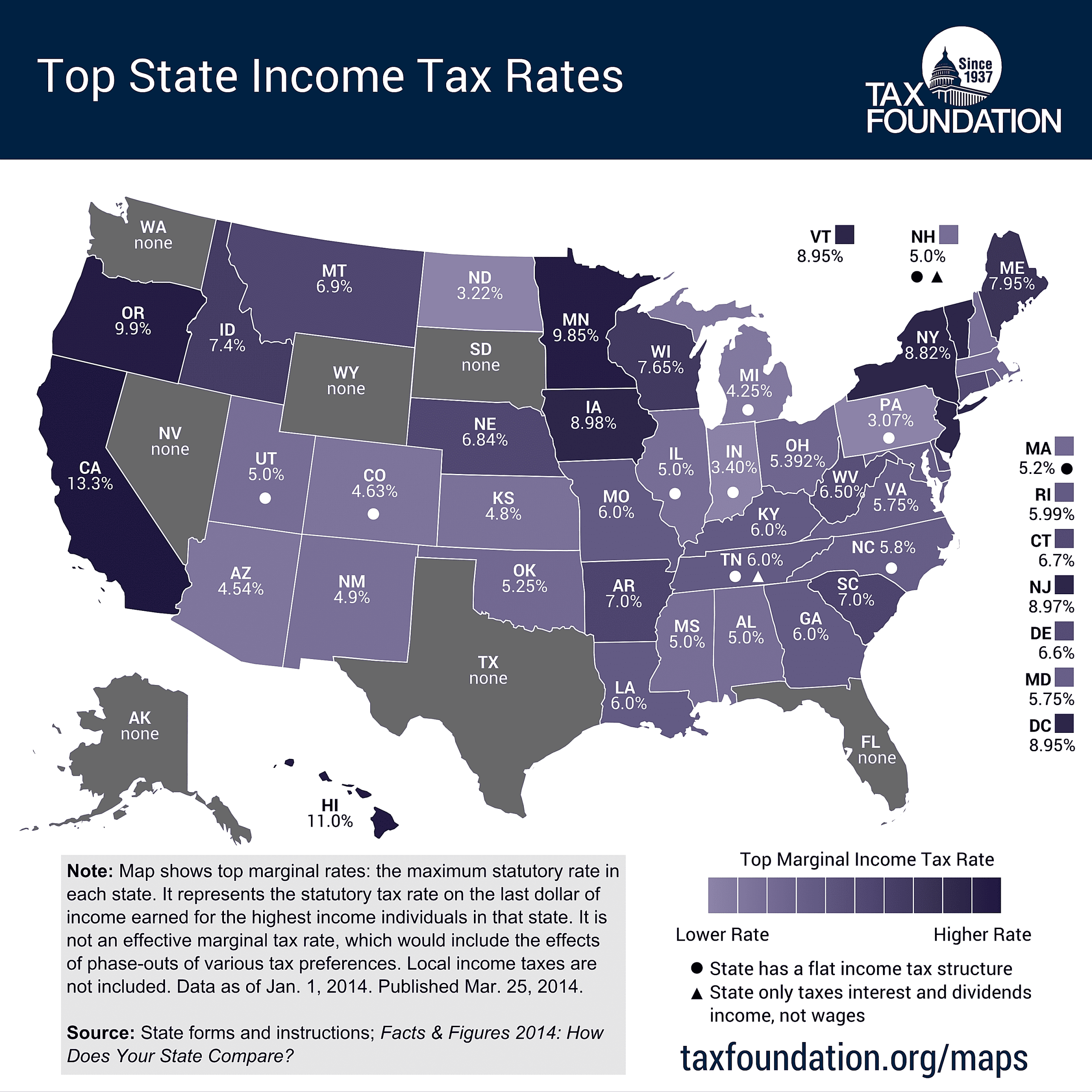

Seven states have no income tax and two only tax interest and dividends. Several other states have a relatively low tax rate across all income levels. Arizona, Colorado, Illinois, Indiana, Michigan, New Mexico, North Dakota, Ohio, Pennsylvania and Utah levy tax on income under 5%.

State and Local Sales Taxes

Forty-five states and the District of Columbia impose a state sales and use tax. Alaska, Delaware, Montana, New Hampshire and Oregon are free of sales tax, but some Alaska cities charge local sales tax. States with the highest sales tax rates are California, Indiana, Mississippi, Rhode Island and Tennessee. Local sales taxes can add significantly to the combined rate, and weve provided that information in our state profiles.

State and Local Property Taxes

Many states and some local jurisdictions offer senior homeowners some form of property tax relief. Exemptions, credits, abatements, tax deferrals and refunds are among these benefits. Renters also get tax breaks in some jurisdictions. Age and income are typical qualifiers for the programs.

State Estate Taxes

Estate tax laws have been in a state of flux in recent years and will probably continue to be so in the foreseeable future.

Charts and Tables to Compare States

Also Check: Home Office Tax Deduction 2022