Unemployment Insurance Tax Base

The UI base subindex scores states on how they determine which businesses should pay the UI tax and how much, as well as other UI-related taxes for which businesses may also be liable.

The states that receive the best scores on this subindex are Oklahoma, Delaware, Vermont, New Mexico, and Ohio. In general, these states have relatively simple experience formulas, they exclude more factors from the charging method, and they enforce fewer surtaxes.

States that receive the worst scores are Virginia, Nevada, Idaho, Maine, and Georgia. In general, they have more complicated experience formulas, exclude fewer factors from the charging method, and have complicated their systems with add-ons and surtaxes. The three factors considered in this subindex are experience rating formulas , charging methods , and a host of smaller factors aggregated into one variable .

Experience Rating Formula. A businesss experience rating formula determines the rate the firm must paywhether it will lean toward the minimum rate or maximum rate of the particular rate schedule in effect in the state at that time.

Charging Methods and Benefits Excluded from Charging. A businesss experience rating will vary depending on which charging method the state government uses. When a former employee applies for unemployment benefits, the benefits paid to the employee must be charged to a previous employer. There are three basic charging methods:

Also Check: Can I Still Do My Taxes

A Patchwork Of Retirement Income

Pensions pay out a defined amount each month until an employee dies, which is why they are called defined benefit plans. Your payout typically depends on your salary over time, and how long you worked with the company. Pensions are becoming increasingly rare among private employers, however: Only 14 percent of Fortune 500 companies offered a pension plan to new hires in 2019, down from 59 percent in 1998.

Increasingly, Americans have had to rely on defined contribution plans, such as 401 plans, for retirement income. The payout from these plans depends on how much you contribute, as well as the investment returns in the plan. In most defined contribution plans, distributions are taxed as ordinary income by the federal government, but taxation varies from state to state. Of the 14 states that won’t tax your pension, two states Alabama and Hawaii will tax your income from defined contribution plans such as 401s.

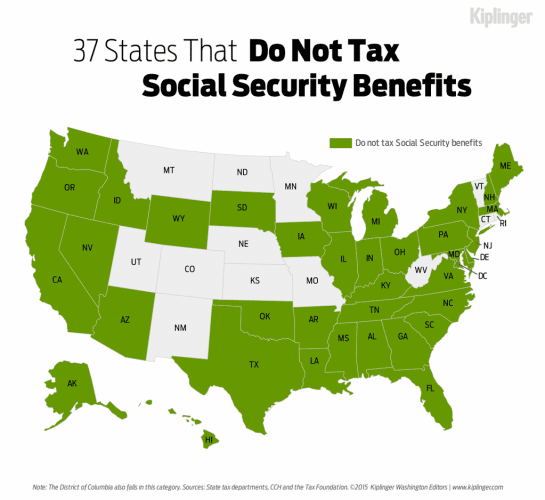

Finally, there’s Social Security income. The federal government can tax some Social Security benefits, depending on your income. You’ll be taxed on:

- up to 50 percent of your benefits if your income is $25,000 to $34,000 for an individual or $32,000 to $44,000 for a married couple filing jointly.

- up to 85 percent of your benefits if your income is more than $34,000 or $44,000 .

Why Do States Charge A State Tax

Following the adoption of the U.S. Constitution, the federal government was granted the authority to impose taxes on its citizens. Each state also retained the right to impose what kind of tax it wanted, excluding any that are forbidden by the U.S. Constitution as well as its own state constitution. These states fund their governments through tax collection, fees, and licenses.

Don’t Miss: When Are Tax Returns Sent Out

Total Tax Burden: 823%

Nevada relies heavily on revenue from high sales taxes on everything from groceries to clothes, sin taxes on alcohol and gambling, and taxes on casinos and hotels. This results in a state-imposed total tax burden of 8.23% of personal income for Nevadans, the second-highest on this list. However, it still ranks a very respectable 22 out of 50 when compared with all states.

That said, the high costs of living and housing put Nevada near the bottom when it comes to affordability. The state ranks 37th on the U.S. News & World Report Best States to Live In list.

Nevadas spending on education in 2019 was $9,344 per pupil, the fourth-lowest in the western region of the U.S. One year earlier, in 2018, the ASCE gave Nevada a grade of C for its infrastructure.

In addition to receiving an F grade from the Education Law Center in 2015, Nevada was also the worst state overall in terms of the fairness of its state school funding distribution. Nevadas healthcare spending in 2014 was $6,714 per capita, the lowest on this list and the fourth-lowest nationally.

All The States That Dont Tax Retirement Income

States vary widely in the way they tax retirement income so location is an important consideration in financially planning for retirement. Some states dont levy income states on any sort of retirement income, while others tax IRA and 401 distributions, pension payouts and even social security payments like ordinary income. Income taxes are just part of the story, however, as some states with low or no income taxes have high property, sales and other taxes. Consider working with a financial advisor when you are planning for retirement to make sure you avoid any unnecessary taxes.

Retirement Income Tax Basics

Most retirement income can be subject to federal income taxes. That includes Social Security benefits, pension payments and distributions from IRA and 401 plans. Exceptions include distributions from Roth IRA and Roth 401 plans. Federal income taxes on Roth contributions are paid before the contributions are made. These contributions as well as any investment gains can be withdrawn free of federal income taxes after five years if you have reached age 59 1/2.

The situation is more complex when it comes to how states will tax your income. Many states have no income tax at all, so all retirement income, as well as other income, is state tax-free. Most states specifically exclude Social Security benefits from taxation. Some others also exempt retirement account distributions and pensions. Most have a mix of approaches to taxing retirement income.

Bottom Line

Also Check: Where Is My California Tax Refund

State And Local Property Taxes

State and local property taxes are another important factor to consider. The biggest property tax paid by most retirees is the annual tax paid on the value of their home. However, some states and local jurisdictions offer property tax exemptions, credits and abatements to retirees, such as an exemption from paying the school tax portion of their property taxes.

Taxes On Iras And 401s

Once you start taking out income from a traditional IRA, you owe tax on the earnings portion of those withdrawals at your regular income tax rate. If you deducted any portion of your contributions, you’ll owe tax at the same rate on the full amount of each withdrawal. You can find instructions for calculating what you owe in IRS Publication 590, Individual Retirement Arrangements.

If you have a Roth IRA, you’ll pay no tax at all on your earnings as they accumulate or when you withdraw following the rules. But you must have the account for at least five years before you qualify for tax-free provisions on earnings and interest.

When you receive income from your traditional 401, 403 or 457 salary reduction plans, you’ll owe income tax on those amounts. This income, which is produced by the combination of your contributions, any employer contributions and earnings on the contributions, is taxed at your regular ordinary rate. Keep in mind that withdrawals of contributions and earnings from Roth 401 accounts are not taxed provided the withdrawal meets IRS requirements.

Don’t Miss: Federal Tax Married Filing Jointly

Which States Dont Tax Retirement Distributions

Twelve states do not tax retirement distributions. Illinois, Mississippi, and Pennsylvania dont tax distributions from 401 plans, individual retirement accounts , and pensions. The remaining nine states that dont levy a state tax at all are Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming. Alabama and Hawaii also dont tax pensions but they do tax distributions from 401 plans and IRAs.

How Property Tax Rates Are Determined

The property tax rates of local jurisdictions arent uniform, but they do use similar formulas to calculate the rates. Each state has a number of tax districts that establish property tax rates based on their financial needs for the year, which generally include the necessary funding to support school districts and local government offices. From this amount, local governments subtract the funds they expect to receive from other sources to arrive at the budget deficiencywhich is the amount it needs to raise through property taxes. This budget deficiency is divided by the total assessed values for all homes within the jurisdiction to determine the appropriate rate of property tax to charge homeowners.

Read Also: When To Expect My Tax Refund 2021

Read Also: Is Auto Insurance Tax Deductible

States With The Lowest Tax Rates For Retirees

Once you retire, and youre living on a fixed income, things like taxes can make a big difference where your financial situation is concerned. Hopefully youve saved up enough money that, if living on a fixed income is a bit dicey, you have savings to fall back on. Regardless, nobody wants to pay too much in taxes.

States that dont tax pension income or Social Security offer a favorable situation for retirees. But there can be some downfalls involved, as well . Lets explore some of the states with the lowest tax rates for retirees.

Is North Carolina A Tax Friendly State For Retirees

North Carolina exempts all Social Security retirement benefits from income taxes. Other forms of retirement income are taxed at the North Carolina flat income tax rate of 5.499%. Other taxes seniors and retirees in North Carolina may have to pay include the states sales and property taxes, both of which are moderate.

Read Also: California Sales Tax By Zip Code

Taxes On Retirement Benefits Vary From State To State

Nine states currently have no tax on regular or retirement income: Mississippi, Nevada, New Hampshire, Pennsylvania, South Dakota, Tennessee, Texas, Washington or Wyoming. Other states can treat retirement income taxes very differently.

For example, Tennessee will stop taxing all forms of retirement income entirely in 2021. The Hall tax on bond and note interest and stock dividends will be wholly repealed at that time. Oregon taxes most retirement income at the top rate while allowing a credit of up to $6,250 for retirement distributions.

Some states exempt all pension income and most exempt Social Security benefits. Other states provide only partial exemption or credits, and some tax all retirement income.

Fourteen states currently exempt pension income entirely for qualified individuals. If this is important to you and youre looking for a warmer climate, consider retiring in Alabama, Florida, Hawaii, Mississippi, Nevada, Tennessee or Texas. Other states with no tax on pension are New Hampshire, Pennsylvania, Alaska, South Dakota, Illinois, Washington and Wyoming.

You will learn about how each state taxes or exempts retirement income from our research.

Get important retirement news and special offers delivered to your inbox.

Cutting Taxes For All Iowans

On March 1, 2022, Governor Reynolds signed into law Iowas most significant tax reform bill in state history, establishing a 3.9% flat income tax rate, eliminating state tax on retirement income, reforming corporate income tax and more.

When Governor Reynolds took office, Iowa had the sixth highest individual income tax rate in the nation. Now that the Governor’s plan proposed this year has passed with bipartisan support, Iowa’s income tax rate will be fourth lowest among all states that charge income tax, ranking among the most tax-friendly states in America.

Thanks to the administrations strong, conservative budgeting practices and fiscal responsibility, Iowa is in a formidable economic position. Last fiscal year, Iowa closed its books with a general fund balance of $1.24 billion and nearly $1 billion in cash reserves.

There’s never been a better time in Iowa for bold, sustainable tax reform that meets the priorities of the state, allows Iowans to keep more of what they earn, and creates a highly competitive tax system.

-

3.9% individual income tax rate.

-

Elimination of retirement income tax.

-

Exemption of net capital gains on sale of employee-awarded capital stock.

-

Reduction of corporate income tax rate.

Recommended Reading: Is Hazard Insurance Tax Deductible

Total Tax Burden: 737%

Like many states with no income tax, South Dakota rakes in revenue through other forms of taxation, including taxes on cigarettes and alcohol. The home of the Lakota Sioux and the Black Hills has one of the highest sales tax rates in the country and above-average property tax rates. South Dakotas position as home to several major companies in the credit card industry, in addition to higher property and sales tax rates, helps to keep the states residents free from income tax, according to reporting by The Atlantic.

South Dakotans pay just 7.37% of their personal income in taxes, according to WalletHub, ranking the state eighth in terms of the total tax burden. The state ranks 14th in affordability and 15th on the U.S. News& World Report Best States lists.

South Dakota spent $8,933 per capita on healthcare in 2014, the 14th highest in the nation. Although it spent more money on education, at $10,139 per pupil in 2019, it spent less than any other neighboring Midwestern state. Additionally, it received a grade of F for its school funding distribution.

South Dakota hasnt received an official letter grade from the ASCE, though much of its infrastructure is notably deteriorated, with 17% of bridges rated structurally deficient and 90 dams considered to have high hazard potential.

Should You Move To A State With No Income Tax

If youre trying to determine whether moving to a state with no income tax is financially worth it, start by taking a look at your most recent tax return. Calculate how much you paid in state income taxes and determine your individual income tax rate. Then, compare that total with what you would be paying in the state where you wish to move.

But those calculations should be the tip of the iceberg, according to Steber. Compare the property tax and sales tax rates of both locations, along with cost-of-living considerations, such as housing and food.

Familial and educational considerations might matter as well, which might not be immediately on your radar. Steber, for instance, ended up having to pay out-of-state tuition to his childrens colleges back in Alabama after the family moved across state lines to Florida.

I would tell you, if I had stayed in Alabama, I wouldnt pay out-of-state tuition, which wouldve offset the income tax that I wouldve had, he says.

Recommended Reading: How To Buy Property For Back Taxes

Read Also: How To File An Extension Taxes

States With No Income Tax: Should You Move To One

While everyone in the US pays a federal income tax, not everyone pays a state income tax. There are seven states in the US with no income tax whatsoever, plus two more that dont tax wages.

While people who live in these states dont pay income tax, they may pay higher taxes in other ways, like when they go shopping or stop at the gas station. This guide will explore whether or not people in income tax-free states save money overall, along with the pros and cons of moving to one of these states.

First, lets look at the nine states with few or no taxes on income.

Who Should Move To An Income Tax

As you read above, income tax-free states tend to have higher sales, gas, and property taxes and a reduced budget for public programs, like education. If any of the following are true for you, then you might benefit from living in one of these states. If the opposite is true, then you probably shouldnt move to one.

Recommended Reading: How To Report Tax Fraud To The Irs

States That Reduce Social Security Taxation Based On Age Or Income

Retirees from ages 55 to 64 are able to deduct up to $20,000 in retirement income, including Social Security benefits, and those 65 or older can deduct up to $24,000. As of this year, Colorado residents can deduct all federally taxable Social Security benefits.

Retirees whose adjusted gross income is than $75,000 for a single filer and $100,000 for joint filers can deduct most or all of their benefit income, according to Investopedia. For people who make more than these thresholds, they can still deduct 75% of Social Security benefit payments.

In Kansas, if your adjusted gross income is $75,000 or less, you dont have to pay state taxes on your benefits, no matter your filing status.

Although Social Security is taxable in Missouri, many seniors will not have to, specifically those who have an adjusted gross income of less than $85,000 or $100,000 , according to SmartAsset.

For many retirees in Montana, Social Security is taxable. However, taxpayers who make less than $25,000 and $32,000 can deduct all of their Social Security retirement income, according to SmartAsset.

Currently, Social Security benefits are still taxable in Nebraska, though on a sliding scale based on adjusted gross income, according to SmartAsset. However, thanks to recent legislation, the state will phase out the state income tax on benefits by 2025, according to AARP.

Penalties And Interest Rates

Q. What are the applicable interest and penalty rates for underpayments of Delaware Income Tax?

A. The interest and penalty rates for underpayment of Delaware Income Tax are as follows:

You May Like: When Is The Last Day To Turn In Taxes