Five Us Filing Statuses:

- Single: For those who are not married, divorced or legally separated.

- Head of Household : The IRS cautions not to choose the by mistake and special rules apply to qualify for this filing status. Generally, this status applies if you are not married and must have paid more than half the cost of keeping up a home for yourself and a qualifying person.

- Qualifying Widow with Dependent Child: This status is similar to married filing jointly. It is applicable for only two years and conditions apply.

For more information check the Dependents, Standard Deduction, and Filing Information in Publication 501.

To help taxpayers determine which filing status applies to them the IRS has an online tool What Is My Filing Status?

How Can I Check My State Refund Status

You can check your refund status by visiting the website for your states department of revenue. Most states have a Wheres My Refund tool similar to the IRS.

If you filed online, it usually takes anywhere from 24 hours to a week for your tax return to show as received.

If you filed by mail, you may not see a refund status for 2-4 weeks or even longer. When you file by mail, your tax return has to go through the postal system first. Then it could spend a few days or weeks in your tax departments mailroom or warehouse before a worker updates it in the system as accepted.

If youre worried about making sure your paper tax return arrived, you may want to use a mailing option with tracking.

Read Also: Can I Pay My Pa State Taxes Online

How To File A Refund Re

Only the pre-validated bank account will be refunded. After receiving communication from CPC, taxpayers can file a service request in the e-Filing portal if their refund is denied. Here are steps to follow to file the request-

- Select New Request as the Request Type and Refund Reissue as the Request Category. Click the Submit button.

- PAN, Return Type, Assessment Year , Acknowledgement No, Communication Reference Number, Reason for Refund Failure, and Response are among the details displayed.

- Choose the bank account to which the tax refund will be credited and press the Continue button. Bank Account Number, IFSC, Bank Name, and Account Type are displayed for the taxpayer to cross-check.

- If the details are correct, click Ok in the popup, and the e-Verification options appear in the dialogue box. Select the appropriate e-Verification mode, To proceed with the request submission, generate and enter an Electronic Verification Code /Aadhaar OTP.

- A success message will be displayed, confirming the submission of the Refund Re-issue request.

Recommended Reading: When Can You File Your Taxes 2021

Also Check: G Wagon Tax Write Off

How To File Income Tax Returns

If you have filed your income tax return and are expecting a refund, you can check the status of your refund by following these steps:

If you have not received your refund after a reasonable amount of time, you can contact the Income Tax Departments customer care center for assistance.

Its important to note that the Income Tax Department may take some time to process your refund, especially if you have made any errors in your ITR or if there are any discrepancies in your tax records. Its a good idea to keep track of your refund status so that you know when to expect your refund.

What You Can Expect

Look on the following list for the action you took whether that’s sending us your individual or business tax return or answering a letter from us. Then, open the action to see how long you may have to wait and what to do next.

Filed a Tax Return

We are opening mail within normal time frames, and weve processed all paper and electronic individual returns in the order received if they were received prior to April 2022 and the return had no errors or did not require further review.

As of November 25, 2022, we had 3.2 million unprocessed individual returns received this year. These include tax year 2021 returns and late filed prior year returns. Of these, 1.7 million returns require error correction or other special handling, and 1.5 million are paper returns waiting to be reviewed and processed. This work does not typically require us to correspond with taxpayers, but it does require special handling by an IRS employee so, in these instances, it is taking the IRS more than 21 days to issue any related refund.

How long you may have to wait: We continue to process tax returns that need to be manually reviewed due to errors. For returns received in the current year, we process individual tax returns for which refunds are due first. Tax returns reflecting tax owed are processed last, but if a payment is mailed with the tax return, the payment is separated upon receipt and deposited to ensure the taxpayer account is credited for the payment.

Answered a Letter or Notice

Don’t Miss: What Form Do You Need To File Taxes

What Is The Standard Deduction

The standard deduction allows you to reduce your taxable income by a set dollar amount, depending on your tax filing status. If you file as a single person, you’ll get a smaller deduction than a person filing as head of household or a married couple filing jointly.

“There are special cases where the standard deduction can be higher for certain taxpayers,” says Armine Alajian, a certified public accountant and founder of the Alajian Group in Los Angeles. “If you are over 65 or blind, you can get an additional amount added to your standard deduction.”

Here’s a simple example of how the standard deduction looks in action: If you have gross income of $80,000 and file your return as a single person, are under 65, and are not blind, you would be eligible for a standard deduction of $12,950 on your 2022 tax return. This would mean you’d only be taxed on $67,050 of income, assuming there are no other above-the-line deductions.

Important: The standard deduction is just one of many tax deductions for which you may be eligible. For example, you may choose to itemize your deductions, which would allow you to write off expenses like mortgage interest, high medical expenses, charitable and property taxes.

I Claimed The Earned Income Tax Credit Or The Additional Child Tax Credit On My Tax Return When Can I Expect My Refund

According to the Protecting Americans from Tax Hikes Act, the IRS cannot issue EITC and ACTC refunds before mid-February. The IRS expects most EITC/Additional CTC related refunds to be available in taxpayer bank accounts or on debit cards by March 1, if they chose direct deposit and there are no other issues with their tax return. However, some taxpayers may see their refunds a few days earlier. Check Wheres My Refund for your personalized refund date.

Wheres My Refund? on IRS.gov and the IRS2Go mobile app remains the best way to check the status of a refund. WMR on IRS.gov and the IRS2Go app will be updated with projected deposit dates for most early EITC/ACTC refund filers by February 19.

Read Also: Income Tax Return Filing Due Date

Also Check: What Is The Small Business Tax Rate For 2021

My Spouse Has Passed Away And My Tax Refund Check Was Issued In Both Names How Can I Get This Corrected

Since a joint return was filed, the refund check must be issued jointly. When presenting the check for payment, you may want to include a copy of the death certificate to show you as surviving spouse. You may return the check to the Department and we will include “Surviving Spouse” and “Deceased” next to the respective names on the check. Should you need to return the check, please mail to: NC Department of Revenue, Attn: Customer Service, P O Box 1168, Raleigh NC 27602-1168.

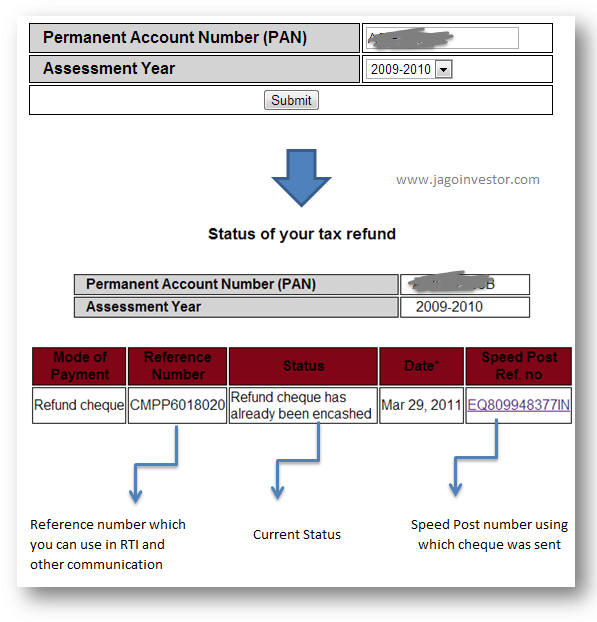

Check Income Tax Refund Status Online

Income Tax Department says :Checking the online refund status is always good. Its free and it tells you whats going on?

Please Note: Refund Status of income tax return that have been filed this year, must be updated in the Income Tax Department systems. You can check the latest status of tax refund by using this utility. Use the tool & check refund status now!

If you think your friends/network would find this useful, please share it with them Wed really appreciate it.

Don’t Miss: How To Check My Amended Tax Return

What Is Happening When Wheres My Refund Shows My Refunds Status As Approved

Weve approved your refund. We are preparing to send your refund to your bank or directly to you in the mail. This status will tell you when we will send the refund to your bank . Please wait 5 days after weve sent the refund to check with your bank about your refund, since banks vary in how and when they credit funds.

Protecting Your Tax Refund

Although we try to process your refund within the timeframes stated above, it may take longer due to our rigorous fraud detection procedures. Each year, the Department detects new schemes to commit tax refund fraud, and our staff works hard to stop criminals from stealing your refund.

The Department employs many review and fraud prevention measures to safeguard taxpayer funds. These measures may result in refund wait times of more than of 10 weeks. We apologize for this inconvenience and are actively working to release these refunds.

Read Also: What Are Bonuses Taxed At

What Can Slow Down Your Refund

- Your return was selected for additional review. As refund fraud resulting from identify theft has become more widespread, were taking extra steps to review all individual income tax returns we receive to be sure refunds go to the rightful owners. Additional safeguards can mean that it takes us longer to process your refund. However, our goal is to stop fraudulent refunds before theyre issued, not to slow down your refund. Learn more about our refund review process and what were doing to protect taxpayers.

- Missing information or documents. If we send you a letter requesting more information, please respond quickly so we can continue processing your return.

- Errors on your return. We found a math error in your return or have to make another adjustment. If the adjustment causes a different refund amount than you were expecting, we will send you a letter to explain the adjustment.

- Problems with direct deposit. If you requested direct deposit, but the account number was entered incorrectly, your bank wont be able to process the deposit. When this happens, your bank notifies us, and we will manually re-issue your refund as a check. This process could take up to 2 weeks between the time we receive notification from the bank and when you receive the check.

Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

at 1-800-829-1040

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

Recommended Reading: Corporate Tax Rate In India

How Do I Check The Refund Status From An Amended Return

Amended returns can take longer to process as they go through the mail vs. e-filing. Check out your options for tracking your amended return and how we can help.

Trump Claimed No Charitable Deductions In 2020

During his presidency, Trump pledged he would donate the entirety of his $400,000 salary to charity each year. He frequently boasted about donating parts of his quarterly paycheck to various government agencies.

While the press doesnt like writing about it, nor do I need them to, I donate my yearly Presidential salary of $400,000.00 to different agencies throughout the year, Trump tweeted in March 2019.

If he donated his 2020 salary, he didnt claim it on his taxes. Among the six years of tax returns the House Ways and Means Committee released, 2020 was the sole year in which Trump listed no donations to charity.

Trumps finances took a sizable hit in 2020, probably as a result of the pandemic and the lack of demand for vacations and lodging in his hotels. Trump reported large donations to charity in 2018 and 2019, helping reduce the amount he owed on millions of dollars in income he reported in those years.

But Trump posted a massive $4.8 million adjusted loss in 2020, a year, which alone wiped out his federal income tax obligation. Trump paid $0 in federal income taxes in 2020.

Recommended Reading: What State Has The Highest Property Tax

Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS you should also submit a Change of Address to the USPS.

Your Filing Status Could Save You Extra Money

There are five categories of filers and conditions apply to the one you should use to file your taxes. The main determiner is your marital status on 31 December of the year for which you are reporting taxes, that will be the one you use for the entire year. Its possible that more than one filing status applies to you, so the IRS recommends that you use the filing status that will reduce your tax liability the most.

Read Also: Taxes On Self Employment Calculator

Know Your Itr Status User Manual

1. Overview

The ITR Status service is available to the following registered users:

- All taxpayers for ITRs filed against their PAN

This service allows the above users to view the details of ITRs filed:

- View and download the ITR-V Acknowledgement, uploaded JSON , complete ITR form in PDF, and intimation order

- View the return pending for verification

2. Prerequisites for availing this service

Pre-Login:

- At least one ITR filed on the e-Filing portal with valid acknowledgement number

- Valid mobile number for OTP

Post-Login:

- Registered user on the e-Filing portal with valid user ID and password

- At least one ITR filed on the e-Filing portal

3. Process/Step-by-Step Guide

Step 1: Go to the e-Filing portal homepage.

Step 2: Click Income Tax Return Status.

Step 3: On the Income Tax Return Status page, enter your acknowledgement number and a valid mobile number and click Continue.

Step 4: Enter the 6-digit OTP received on your mobile number entered in Step 3 and click Submit.

Note:

- OTP will be valid for 15 minutes only.

- You have 3 attempts to enter the correct OTP.

- The OTP expiry countdown timer on screen tells you when the OTP will expire.

- On clicking Resend OTP, a new OTP will be generated and sent.

On successful validation, you will be able to view the ITR status.

Step 1: Log in to the e-Filing portal using your valid user ID and password.

Step 2: Click e-File> Income Tax Returns> View Filed Returns.

Note:

Get Ready By Gathering Tax Records

When filers have all their tax documentation gathered and organized, theyre in the best position to file an accurate return and avoid processing or refund delays or receiving IRS letters. Nows a good time for taxpayers to consider financial transactions that occurred in 2022, if theyre taxable and how they should be reported.

The IRS encourages taxpayers to develop an electronic or paper recordkeeping system to store tax-related information in one place for easy access. Taxpayers should keep copies of filed tax returns and their supporting documents for at least three years.

Before January, taxpayers should confirm that their employer, bank and other payers have their current mailing address and email address to ensure they receive their year-end financial statements. Typically, year-end forms start arriving by mail or are available online in mid-to-late January. Taxpayers should carefully review each income statement for accuracy and contact the issuer to correct information that needs to be updated.

Also Check: Pay Georgia Income Tax Online

Also Check: Irs Mail Address Tax Return