What Phones Can You Use On T

As one of the big three carriers in the US, T-Mobile supports a wide variety of 4G LTE and 5G devices. Here is a short list of some of your best options:

As you can see, T-Mobile users arent starved for choice. If you want to look through all of the best options, feel free to head over to our list of the best T-Mobile phones to spend your money on.

You can also bring your own phone to T-Mobile if you recently upgraded or youre just not ready for a new device. However, T-Mobile is a GSM carrier, so youll have to first make sure that your phone is GSM compatible. Verizon is the leading CDMA carrier, and AT& T is a GSM option, so youll have the easiest time bringing an AT& T device to the network.

See also: The best Android phones | The best cheap Android phones

Right now, T-Mobile is offering even more of an incentive to bring your phone. The carrier offers a whopping $1,000 back for simply paying off your device and porting it over. All you have to do is upload an image of your bill, and T-Mobile will hook you up with a rebate card up to the full amount. Learn more and get started right here.

The most important factor in bringing your phone to T-Mobile is band support. Check out the table below for all of the bands T-Mobile uses across the 3G, 4G LTE, and 5G networks:

| Frequency |

|---|

Got Questions About 3rd Line Free Offer

Yes, new Business customers and current Business customers who have only one paid voice line are eligible to receive this promotion, as long as the account remains 5 lines or less after adding lines for the promotion. New customers must activate at least 3 voice lines on an eligible plan and existing single-line customers must activate at least two additional voice lines on an eligible plan to receive one of the lines free. Eligible T-Mobile for Business plans are Business Unlimited Select , Business Unlimited Advanced , or Business Unlimited Ultimate .

Starting January 13, 2022, for a limited time, new and existing single-line customers activating on an eligible Essentials, Magenta, Magenta MAX, Business Unlimited Select , Business Unlimited Advanced , or Business Unlimited Ultimate plan can get a free voice line when you have 2 paid voice lines.

To qualify for a free voice line, you must:

Youâre never required to use Autopay, but youâll get a monthly discount on select voice plans if you do.

If your account is past due but active, your free line credit will remain. If you are past due and suspended, your offer credit is also suspended and will resume once the account is back in active status.

Yes, your free line must be a voice line. Other line types are not eligible for this promotion.

No, this offer only allows one additional free voice line per account.

Yes, this promotion can be combined with Carrier Freedom. Learn more here.

Is Your Payment Missing

If you have more than one T-Mobile account, check all your accounts to see if the payment has posted to the wrong account. If not, check with your bank or credit card provider. If they processed your payment, but it’s not reflecting on your T-Mobile account, please collect as many details as you can before contacting us:

- How, when, and where you made the payment

- Specific payment method including the last four digits of the payment method, if applicable

- Exact payment amount

Once you have reviewed this information, submit your missing payment findings so we can open a missing payment request.

If a text message link from T-Mobile brought you here, you’ll need to provide additional payment documentation. Use these details to determine what is needed.

Important: Don’t include sensitive information . We only need your full name, the last four digits of your SSN, and your mobile number to verify your identity. Omit any sensitive information.

Also Check: Federal Tax Return By Mail

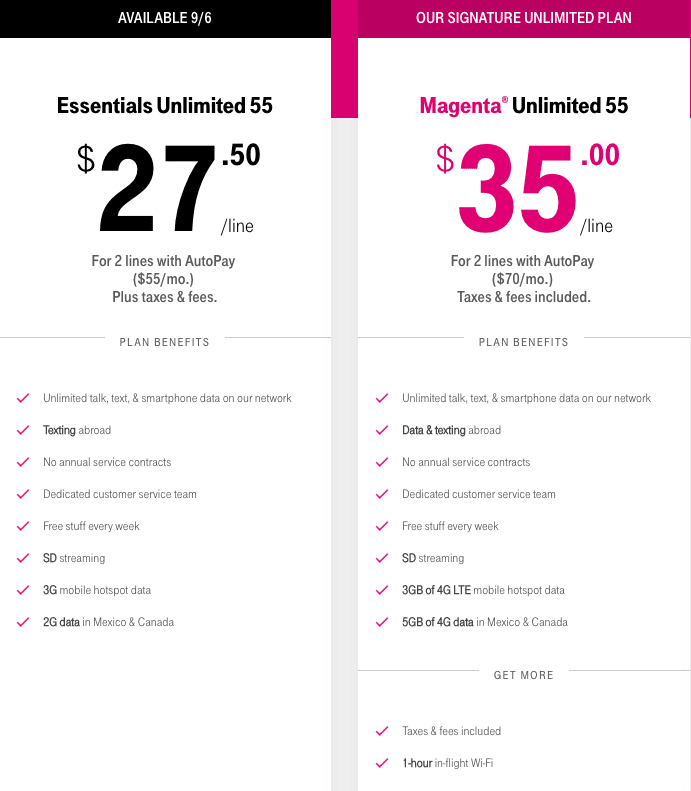

How Much Are The Taxes And Fees On The Essentials 55+ Plan

Magenta 55+ at $70/mo, taxes and fees included, for 2 lines on autopay and the

Essentials 55+ at $55/mo plus taxes & fees. for 2 lines on autopay

Wondered if anyone on the Essentials 55+ plan could help out on what the taxes and fees you are paying per month are?

Thanks!

Taxes and fees vary by State and taxes can vary even down to the city level.

AH, good point, thanks for your reply Syaoran.

Anyone from California care to share, just so I have a rough idea?

Taxes are probably going to be about the same from carrier to carrier, itsfees that contain the surprises!

Thanks gramps28, I didnt have much luck with googling before posting here, sites info either didnt have a date or were old.

Anyway, I think I can figure out taxes. But its T-Mobiles fees that remain a mystery. Companies can charge what they like for those.

Anyone here in CA willing to share their monthly total for the the Essentials 55+ plan?

Thanks again!

You may want to ask a Tmobile support using messenger on one of tmobile’s social media platforms to see if they can help you they also are a higher tier of support.

The terms and conditions states that there are surcharges but doesn’t list them.

Just changed from Magenta 55+ to Essential 55+ and my difference is $8.63 here in SO. CAL.

Don’t know if it helps

Thanks Williamblanco.a.

The plan differences are listed here:

https://www.t-mobile.com/cell-phone-plans/unlimited-55-senior-discount-plans

At the moment that’s my experience!

What Other Details Do I Need To Consider When Looking For Hidden Fees In My T

Most T-Mobile accounts are billed for services starting at the beginning of the cycle and then that bill is due within the same billing cycle. If you change your due date you might end up having to pay two payments within a short amount of time and in some cases you might have a significantly larger bill the following months than you expected because it has one full month of charges and prorated charges from a previous billing cycle.

If you have an older account you might also be billed for services after your billing cycle is closed.

Read Also: How Long Do Taxes Take To Process

Carry A Portable Wifi Hotspot Always With You

Don’t get upset if your device is locked or doesnt support the eSIM technology. Keepgo provides portable travel WiFi hotspots on Lifetime and GoFi plans. Whichever option you choose, you will be able to connect up to 15 WiFi-enabled devices to it simultaneously. Such devices are the best choice for families and big groups of people leaving for a vacation or looking for a reliable backup data solution.

Fast And Furious Toys

T-Mobile Pros Cheap unlimited data: With unlimited talk, text, and data plans starting at $27.50 per month per line, T-Mobile is easily the most affordable unlimited plan from a major provider, not to mention they’re one of the few with 5G access. They run off of T-Mobile. However if you are looking for unlimited 4G hotspot them they also have such a plan for $65 a month +3 dollars taxes and fees. However if you are looking for < b> unlimited< /b> 4G < b> hotspot< /b> them they also have such a plan for $65 a month +3 dollars taxes and fees. Other Charges -. Taxes& Surcharges 8.38. Total Charges: 83.35. my plan is 1500 min 39.99, internet 29.99 and test messaging 4.99. my wife has the same as me except she. The items allowable under premium are found in 225.001 of the Texas Insurance Code. The tax estimator can be used for individual policies or groups of policies that fall into the same. The plan will cost $60 for one line, $30 for the second line, and $15 for each of the next lines . That means for a family of four the T-Mobile Essentials plan will only cost.

Don’t Miss: How To Find 2020 Tax Return

Additional Details To Consider

Most accounts are billed for services at the beginning of the cycle and the bill is due within the same bill cycle.

- As you are billed after the bill cycle begins, you will have 2 payments due in a short period of time if you change your due date.

- The next bill will be larger because it includes a full month of charges for the new bill cycle, and prorated charges for the current bill cycle.

Older accounts may be billed for services after the bill cycle is closed and will include plan and service charges through the end of the current bill cycle.

- Your next bill will be for your old billing cycle.

- The following bill will be a prorated bill that covers a partial month from the end of the previous cycle to the beginning of the new one and it will reflect your new due date.

- This means that to move to a new due date, you will have 2 bill payments due in a short amount of time.

If after reviewing, you still want to make the change, let us know so we can help you get started.

Government Taxes Fees & Charges And T

Many T-Mobile plans, such as Magenta and Magenta MAX, include recurring monthly taxes and fees in the service plan price. For plans that have taxes and fees excluded, taxes, fees, and other charges apply. Additionally, beginning 2/19/2022, for upgraded or optional add-on services, including but not limited to Stateside International Talk and Text, Global Plus, and Family Mode, taxes and fees apply separately, even for customers with service plans with taxes and fees included. Find more information on your bill or receipt or visit your state government website to learn more.

Also Check: Are Municipal Bonds Tax Free

Cell Phone Taxes And Fees By State

Does it seem like your wireless bill keeps creeping up each year?

You know how it goes: you think you’re getting the deal you saw on TV – “Get four lines for just $120 a month!” Then the bill comes and it’s closer to $140 than $120. A couple years go by and suddenly you’re paying almost $150 per month…that great deal doesn’t seem quite so sweet now.

You’re not imagining things. According to the consumer tax and spending think tank Tax Foundation, average cell phone service fees and taxes have reached 18.6%.

This means that wireless customers are paying an average of $225 per year above and beyond the actual price of their mobile service. This number also represents a 4.5% increase in these extra fees over the past decade.

Your first question is probably something like this: what, exactly, am I paying for, if I’m not just paying for my cellular service? It’s a good question – and I’ve got the answers.

In this guide, I’ll explain what each hidden wireless fee and tax signifies, how to understand the terminology on your cell phone bill, plus tell you how to save money on your monthly cell phone expenses.

And there’s more: I’ll also show you which states have the highest mobile fees and taxes and which carrier offers the fairest pricing model.

The Federal Universal Service Fund

The Federal Universal Service Fund is administered by the FCC under open-ended authority from Congress. The program subsidizes telecommunications services for schools, libraries, hospitals, low-income people, and rural telephone companies operating in high-cost areas. The FCC has also recently decided to use funds to subsidize broadband deployment.

The FCC has authority to set spending for these programs outside of the normal congressional appropriations process. After deciding what to spend on the various programs, the FCC sets the quarterly contribution factor or surcharge rate that telecommunications providers must remit to the FUSF to generate sufficient revenues to fund the expenditure commitments. Providers may elect to surcharge these contributions on their customer bills.

FUSF surcharges apply only to revenues from interstate telecommunications services. They currently do not apply to internet access service, information services, and intrastate telecommunications services.

Alternatively, carriers may use a single uniform national safe harbor percentage to its fixed monthly plans. The FCC currently sets this safe harbor at 37.1 percent of the fixed monthly charge. For example, when determining the FUSF, a $50 monthly wireless voice calling plan is deemed to include $18.55 in interstate calls and $31.45 in intrastate calls. If a carrier elects to use the safe harbor, the FUSF rate would be applied to $18.55 of the bill each month.

You May Like: How To Report Tax Fraud To The Irs

Government Taxes & Fees

T-Mobile is required to collect these taxes and fees. These taxes and fees are remitted to the jurisdiction assessing the tax, fee or charge. There may be other taxes and charges not listed that we are required to collect and remit to the required jurisdiction.

- State and Local Required 911 Surcharges: Some states and localities require wireless carriers to collect a fee for 911 funds. These fees vary by state and locality.

- State and Local Taxes: States, counties, cities, and special taxing districts may assess various taxes on wireless communication services, sales and rentals of wireless phones, and other services T-Mobile provides. These fees vary by state and locality.

The Impact Of Excessive Wireless Taxes

The popularity of wireless service, and the explosive growth in the number of wireless subscribers, has led some to question whether wireless taxes matter to wireless consumers and the wireless industry. However, there are two compelling reasons why policymakers should be cautious about expanding wireless taxes, fees, and surcharges. First, as discussed above, wireless taxes and fees are regressive and have a disproportionate impact on low-income citizens. Excessive taxes and fees increase the cost of access to wireless service for low-income consumers at a time when citizens are relying on wireless service for education and remote work during the coronavirus pandemic. Second, discriminatory taxes may slow investment in wireless infrastructure. Ample evidence exists that investments in wireless networks provide economic benefits to the broader economy because so many sectorstransportation, health care, energy, education, even governmentuse wireless networks to boost productivity and efficiency. These economic benefits are especially important during the current pandemic because they help employees work remotely and allow students to continue their studies remotely.

Don’t Miss: What Is The Tax Rate On 401k Withdrawals

Install Keepgo Sim In Your Dual

If your smartphone or tablet is not eSIM-compatible but it lets you use two physical SIM cards simultaneously, you can install Keepgo Lifetime World SIM card or GoFi SIM card in the second slot of your device. Depending on where and how you want to use your second line, you can choose between our Lifetime World and Lifetime Europe SIM cards with data valid forever without any obligatory monthly refills, or you can use our GoFi SIM cards with a minimum monthly payment of $8 for 1GB and unlimited data after $64.

If its a Lifetime or a GoFi SIM card that you install in the second slot of your dual-SIM device, you will always get the best coverage where you use Keepgo services. All our products operate on two or more wireless networks in every country that we cover. For example, whenever you plan a trip to Germany, you can use Keepgo Lifetime Europe SIM card and use O2, T-Mobile and Vodafone with the same line. Switch between the carriers to get the best coverage in your stay location. If Germany is not the only European country you want to visit, your Keepgo Lifetime Europe SIM card will also come in handy to you in 30+ European countries. Data refill prices are the same in all countries covered by the Lifetime Europe SIM card.

State Universal Service Funds

Some states have their own universal service funds that provide subsidies for many of the same purposes as the FUSF. State USF surcharges are imposed on intrastate revenues, while the FUSF is imposed on interstate revenues. In states like Arkansas, Alaska, Kansas, Nebraska, and California, high state USF surcharge rates add significantly to the overall burden on wireless consumers. For example, the USF rate in Arkansas is 11.25 percent of all intrastate charges. Table B1 in Appendix B lists the rates in the 20 states that impose a state USF charge.

In 2020, state USF rates were increased in Arkansas, Kansas, Michigan, and South Carolina and were reduced in Nevada, New Mexico, and Wyoming.

You May Like: Short-term Rental Tax Loophole

How Can You Benefit From Combining T

We commonly use our cellular lines for texting and calling in everyday life. Most of our cell phone plans also include wireless internet data. How often did you use all gigabytes from your data plan? We mostly use wireless data when we are out of home or when WiFi doesn’t work. So the question is why should you pay for the services you don’t need?

Suppose you use your T-Mobile line for texting and calling mainly, rather than using an unlimited data plan or prepaid Unlimited Plus plan , you can opt for cheaper plans for texting and calling on T-Mobile.

Besides paying the monthly bill for T-Mobile services based on the chosen plan, you should be informed that not all T-Mobile plans include taxes and fees. Some surcharges vary based on where you live because different states charge T-Mobile different amounts for various taxes, which gets put on your bill.

For example, T-Mobile is legally required to collect a 911 surcharge on behalf of your state. In some places, there are regulatory program fees or recovery fees that have to do with third-party services and government programs. These fees are charged to T-Mobile and T-Mobile recovers those costs by charging its customers.

Extra charges vary based on the stage where you live. These might include the following:

If you need to keep your phone number for texting and calling, you can use the cheapest T-Mobile plan for cellular services and get more data on demand whenever you need it using Keepgo prepaid services.

How Can You Lower Your T

One of the first steps you need to take is to switch to a more cost-effective T-Mobile data plan. There are three prepaid data plans available. If you use Unlimited Plus for $60 per line, your total bill for three lines will be $180/mo + taxes and fees.

If you do not use more than 10GB of data per month, it would be a more cost-effective solution to switch to the $40/mo data plan per line, which is $120/mo for 3 lines + taxes and fees. If we do not calculate extra charges that differ in different locations, switching to the cheaper plan will result in the $60 savings per month for a family of three.

If you still feel like using T-Mobile unlimited plan is the best option for you and your family, you may consider switching to the following options.

Such plans already include extra fees so that you wont face any unexpected charges. All of them include:

- Unlimited 5G & 4G LTE data

- Unlimited talk & text

Recommended Reading: Irs Address To Mail Tax Returns