Which Evs Qualify For The New Electric Vehicle Tax Credit Its Complicated

Electric vehicles are on a roll, lately. New EV tax credits should increase popularity this year and next, and California is set to approve a new rule Thursday phasing out sales of new gas-powered vehicles, starting in 2026.

Interest in electric vehicles is predicted to surge next year due to expanded tax credits through the federal Inflation Reduction Act. EV popularity also should see a boost as California, the largest domestic car market, is expected to ban sales of new gas-powered passenger vehicles by 2035, essentially requiring them to be electric.

The new zero-emissions standard, called Advanced Clean Cars II, will scale down emissions permitted from new cars, SUVs and passenger trucks, starting in 2026. The plan relies on advanced vehicle technologies, including battery-electric, hydrogen fuel-cell electric, and plug-in hybrid electric vehicles, to meet air quality and climate change emissions goals. The California Air Resources Board is expected to approve the new rule on Thursday.

The two major public policy developmentsfrom Washington, D.C., and Sacramentoshould together be a boon for EVs, which have languished for years in the low single-digit percent range of annual new car sales.

As part of a broad new Inflation Reduction Actdesigned to address climate change, healthcare, and taxesthere is a new tax credit of up to $4,000 on used electric cars and revised tax credits of up to $7,500 on certain new EVs.

The Federal Tax Credit For Electric Vehicle Chargers Is Back

President Biden signed the Inflation Reduction Act into law on August 16. The massive climate, energy, tax, and healthcare package contains numerous clean energy incentives including tax credits for the purchase of new and used electric vehicles. But you may not have heard that the new law also revives the tax credit for electric vehicle charging stations and equipment that had expired in 2021. There are some changes to the prior charging station tax credit that you will want to be aware of, so that you can potentially use the tax break for your own EV charger.

How Does The New Ev Tax Credit Differ From The Current One

The existing federal EV tax credit offers consumers $2,500 to $7,500 in credit for vehicles with a battery capacity of at least 5 kilowatt-hours, but starts to phase out after the manufacturers first 200,000 qualifying electric vehicles have been purchased.

The new law allows consumers to get up to $7,500 no matter how many cars have been sold, said Howard Gleckman, a senior fellow at the Urban-Brookings Tax Policy Center at the Urban Institute.

Whereas the original credit only applied to the purchase of new vehicles, the new credit also expands eligibility to used vehicles, said Nick Nigro, founder of Atlas Public Policy and an expert on alternative fuel vehicle financing, policy and technology. Nigro said that this is significant because used vehicles account for the vast majority of vehicle purchases in the country.

Eligible used vehicles qualify for a credit of up to $4,000 under the Inflation Reduction Act.

Also, the new credit is not a traditional delayed tax credit, said Gil Tal, director of the Plug-in Hybrid and Electric Vehicle Research Center at UC Davis. Instead, its what is known as cash on the hood, or a rebate that is applied at the point of sale.

This means that buyers wont need to finance the full price of the car before getting the money back when they file their taxes. Instead, if the purchase is eligible for the tax credit, the actual price of the car at the dealership will immediately be up to $7,500 lower.

You May Like: Mortgage Calculator Taxes And Insurance

How Does The Electric Vehicle Tax Credit Work In 2022

For the most part, the IRA changes to the tax credit wont go into effect until January 2023. So, if youre thinking about leaving the dealership with an EV this year, most of the old rules still apply. Heres a recap of how the credit currently works:

-

The credit is worth $2,500 to $7,500, depending on the cars battery capacity.

-

You must own the car. Used or leased cars dont qualify.

-

The car must weigh less than 14,000 pounds.

-

The credit is nonrefundable it can lower your tax bill to zero, but it wont result in a refund.

How Can I Claim The Electric Vehicle Tax Credit

You can claim the tax credit when you file your Federal tax return. The amount of tax credit you can claim depends on how much you owe in taxes as this is a non-refundable tax credit. You cannot claim a tax refund through the electric vehicle tax credit.

For example, if you can claim a $7,500 tax credit but the amount you owe is only $5,000, you will only be able to use $5,000 of the available tax credit.

You will need to file Form 8936 to claim the credit. If you are using the vehicle for personal use, you will report the tax credit amount on Form 1040.

Recommended Reading: Where Is My California Tax Refund

What Happens If Youre Buying An Ev Now

If you took delivery of a new EV before Aug. 16, nothing in the new law applies.

If you signed a written binding contract to purchase a new EV before Aug. 16, but do not take possession until Aug. 16 or later, you also can claim the credit under all the old rules, the IRS said in its transition rules.

If you purchase and take possession of an EV between Aug. 16 and Dec. 31, the current rules not the 2023 rules apply. That means the car must be assembled in North America and cant be subject to the manufacturing cap to be eligible for the tax credit. But the price and income limits and sourcing requirements dont apply.

The IRS didnt say what happens if you sign a binding contract after Aug. 15 but cant take delivery until next year. But Michael Henaghan, a tax expert with Wolters Kluwer, said in that case, all the rules in effect for 2023 would apply.

Buyers caught in this transition period have tough decisions to make.

Joshua Mendoza, a Sacramento-area software executive, put a deposit on a Tesla Model Y after the law passed. It was scheduled for delivery in the spring, when a credit might be available. But on Sept. 11, he got a call saying a Model Y was available immediately.

I saw interest rates going up. And it wasnt clear to me if the Model Y would fully qualify for the credit, he said. Even if it did, I wasnt confident the tax credit would offset higher interest rates long term. So he took delivery the next day.

Does California Offer Incentives

California offers residents a rebate for the purchase of fuel-cell vehicles and electric vehicles, including plug-in hybrids. Income and price limits apply. For information on the Clean Vehicle Rebate Project, see .

On Tuesday, California voters defeated Proposition 30, which would have raised taxes on high-income households, in part to pay for rebates and other incentives for zero-emission vehicle purchases.

Also Check: Sales And Use Tax Exemption Certificate

Where The Battery Materials Come From Matters

Just like battery components, the law tackles the problematic issue of where the raw materials used in the battery come from.

After 2024, any vehicle with critical minerals that were extracted, processed, or recycled in a foreign entity of concern, will not qualify for the other half of the $7,500 EV tax credit .

That same year, the law has a percentage requirement for where these critical minerals come from. In short, a certain percentage of critical minerals must be extracted or processed in countries with which the U.S. has a free trade agreement.

The percentage requirement can also be met if they have been recycled in North America. That recycling part is going to become even more important as these percentages increase, meaning big business for startups like Redwood Materials.

The percentage requirements:

- 40% of critical minerals through end of 2023

So what is a critical mineral, anyway?

One Thing To Look Out For

One important exception is the final assembly requirement ushered in by the IRA. Clean vehicles that were purchased Aug. 16, 2022, or later must have had their final assembly in North America to meet the eligibility criteria.

To see a list of cars that likely qualify through the end of 2022 and into early 2023, you can reference this list of electric vehicles compiled by the U.S. Department of Energy.

And, importantly, if you already entered into what the IRS calls a binding written contract to purchase an EV before Aug. 16 and expect the car to be delivered at a later date, youre likely able to claim the credit without meeting this new final assembly requirement. Still, its a good idea to check with the dealership and a tax pro to make sure.

You May Like: How To Find 2020 Tax Return

People Who Qualify For The Ev Tax Credit

Not everybody can claim the EV Tax Credit. The Inflation Reduction Act limited the tax credit to income-qualified people.

- If you are single, you can claim the credit if you have a Modified Adjusted Gross Income below $150,000.

- can earn up to $300,000.

- If you file as a head of household you can claim the credit if you earn up to $225,000.

Those who exceed these limits cant claim the credit anymore. While the income limits are fairly high, some people no longer qualify to claim this credit.

Revived Ev Federal Tax Credits Were Officially Signed By Potus

In late July 2022 the US Senate shared it was moving forward to vote on EV tax credit reform after Senator Joe Manchin took a break from huffing coal to finally agree to include investments to curb climate change.

One of the most prominent parts of the bill includes the long-awaited and fought over electric vehicle tax credit reform. In this iteration of the bill, access to the tax credit will be returned to those who have already exhausted the threshold, including Tesla and GM vehicles.

On August 7, 2022 it was approved by the Senate and a week later signed into law by President Biden.

The biggest issue we all are having with the Inflation Reduction act, is how cloudy and confusing its EV requirements are. Bear with us as we sort through it all, to once again provide you with the most up to date details of this ever evolving tale.

We have learned that the reform bill will also apply to EVs delivered after December 31, 2022. Heres a breakdown of the terms of the new Inflation Reduction Act.

You May Like: How Much Is Property Tax In California

What Are The Requirements Regarding North American Supply And Production

- The final assembly of the new vehicle must occur in North America . This went into effect on August 16, 2022, and will affect vehicles purchased through 2032.

- The maximum credit available for new vehicles is still $7,500, but the size of the battery no longer dictates how much of the credit you get. Starting in 2023, the full $7,500 credit will be split into halves with separate criteria:

- Critical battery minerals: To qualify for this$3,750 credit in 2023, at least 40% of the critical minerals in the battery must have been either recycled in the U.S. or extracted or processed there . After that, the required percentage increases to 50% in 2024, 60% in 2025, 70% in 2026 and 80% in 2027.

- Battery components: To qualify for the remaining $3,750 credit in 2023, at least 50% of the EV’s battery components must be manufactured or assembled in the U.S. . After that, the percentage increases to 60% in 2024-2025, 70% in 2026, 80% in 2027, 90% in 2028 and 100% in 2029.

- Blacklisted countries ultimately cannot be involved with battery components or minerals. From January 1, 2024, a vehicle will be ineligible if any of the battery’s components were sourced from a “foreign entity of concern,” which includes China and Russia as of this writing, as well as Iran and North Korea. As of January 1, 2025, this exclusion will extend to cover critical battery minerals too. That’s a big deal given China’s outsized role in the minerals supply chain to date.

How Much Is The Electric Vehicle Tax Credit Worth In 2021

The electric vehicle tax credit hasnt changed for the past three years. The credit ranges from $2,500 to $7,500 depending on the size of your vehicles battery.

Use this chart to find your credit amount:

Electric vehicle tax credit limits 2021

| If my battery is this many kilowatt-hours | then my electric vehicle tax credit is.. |

|---|---|

| 4 |

Limits

The electric vehicle tax credit has quite a few limitations you should be aware of:

- The credit isnt refundable. If this credit reduces your tax bill to $0, you wont receive a refund if any amount is left over.

- Used vehicles dont count. You must purchase the electric vehicle brand new to qualify for the credit.

- You wont receive the credit if you lease. The car dealership receives the credit for leased vehicles because it holds the vehicles title, not the customer.

- Could have state and local incentives. Electric vehicle incentives vary by city and state, so research your area to see if you qualify for additional credits.

- The credit phases out. Once a manufacturer has sold 200,000 electric vehicles in the US, the electric vehicle tax credit is reduced to 50% for two quarters, then by 25% for the third and fourth quarters. After that, its gone forever.

You May Like: Sc State Tax Refund Status

How Commercial Consumer E

One key difference between the commercial and consumer tax credits for new clean vehicles is the absence of manufacturing and other requirements for the commercial credit.

To be eligible for a “new clean vehicles” credit , final assembly of the car must now occur in North America. The Energy Department has a list of vehicles that meet this standard.

Some additional rules take effect in 2023.

First, there are income caps. A tax credit isn’t available to single individuals with modified adjusted gross income of $150,000 and above. The cap is higher for others $225,000 for heads of household and $300,000 for married couples who file a joint tax return.

And certain cars may not qualify based on price. Sedans with a retail price of more than $55,000 aren’t eligible, nor are vans, SUVs or trucks over $80,000.

Two other rules apply to manufacturing: One carries requirements for sourcing of the car battery’s critical minerals the second requires a share of battery components be manufactured and assembled in North America. Consumers lose half the tax credit’s value up to $3,750 if one of those requirements isn’t met they’d lose the full $7,500 for failing to meet both.

The five requirements were added by the Inflation Reduction Act, and none of them apply to the commercial clean vehicle credit, Schmoll said.

Do Vehicle Price And Household Income Determine The New Federal Ev Tax Credits

Both vehicle price and household income are considered when determining qualifications for the federal EV tax credit under the new Inflation Reduction Act.

The price limits for new EVs are:

- SUVs, vans, and pickup trucks less than $80,000

- Other EVs less than $55,000

The income limits for qualifying buyers are:

- Joint filers not to exceed $300,000

- Head of household not to exceed $225,000

- Individual or another filing status not to exceed $150,000

Don’t Miss: Haven T Received Tax Return

Vehicles Purchased And Delivered Between August 16 And December 31 2022

Following the official signing of the Inflation Reduction Act, the IRS has included the following transition rule for those who already had an EV on the way but are wondering if they still qualify before the new credit terms kick in. In certain circumstances, the answer is yes. Per the IRS page:

If you purchase and take possession of a qualifying electric vehicle after August 16, 2022 and before January 1, 2023, aside from the final assembly requirement, the rules in effect before the enactment of the Inflation Reduction Act for the EV credit apply .

Electric Vehicle Tax Credit Faq

How does the EV tax credit work?

At the federal level, the tax credits for EVs operates as money back at the end of the fiscal year you purchased or leased your vehicles based on a number of factors.

The awarded credit is up to $7,500 per vehicle, but how much you may get back will depend on the your annual income, whether you are filing with someone else like a spouse, and what electric vehicle you purchased.

For example, if you purchased a Ford Mustang Mach-E and owed $3,500 in income tax this year, then that is the federal tax credit you would receive. If you owed $10,000 in federal income tax, then you could qualify for the full $7,500 credit.

Its important to note that any unused portion of the $7,500 is not available as a refund, nor as a credit for next years taxes.

You may also be able to receive money back right away as a point of sale credit, but those terms probably wont kick in until 2024 at the earliest.

What electric vehicles qualify for tax credits?

As things currently stand, there is a lot up in the air right now. The second list above details all of the electric vehicles that previously qualified before the signing of the Inflation Reduction Act this past August outlining new qualifying terms for automakers.

Some of the electric vehicles still qualify for tax credits if they are purchased and delivered before the end of 2022. .

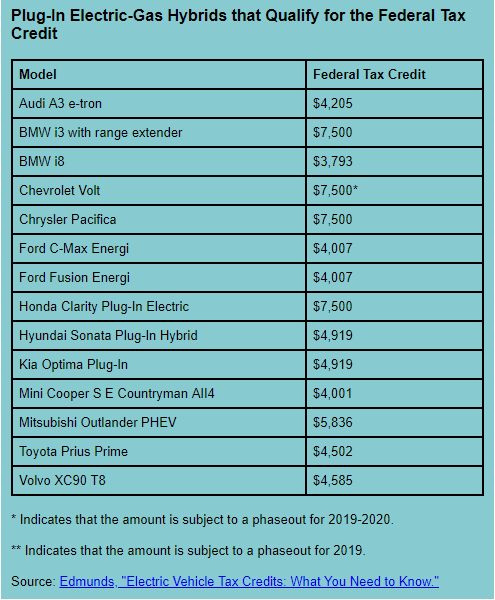

What electric vehicles qualify for the new tax credits starting in 2023?Do hybrids qualify for tax credits?

Don’t Miss: How To Find Tax Rate