How Does The New Ev Tax Credit Differ From The Current One

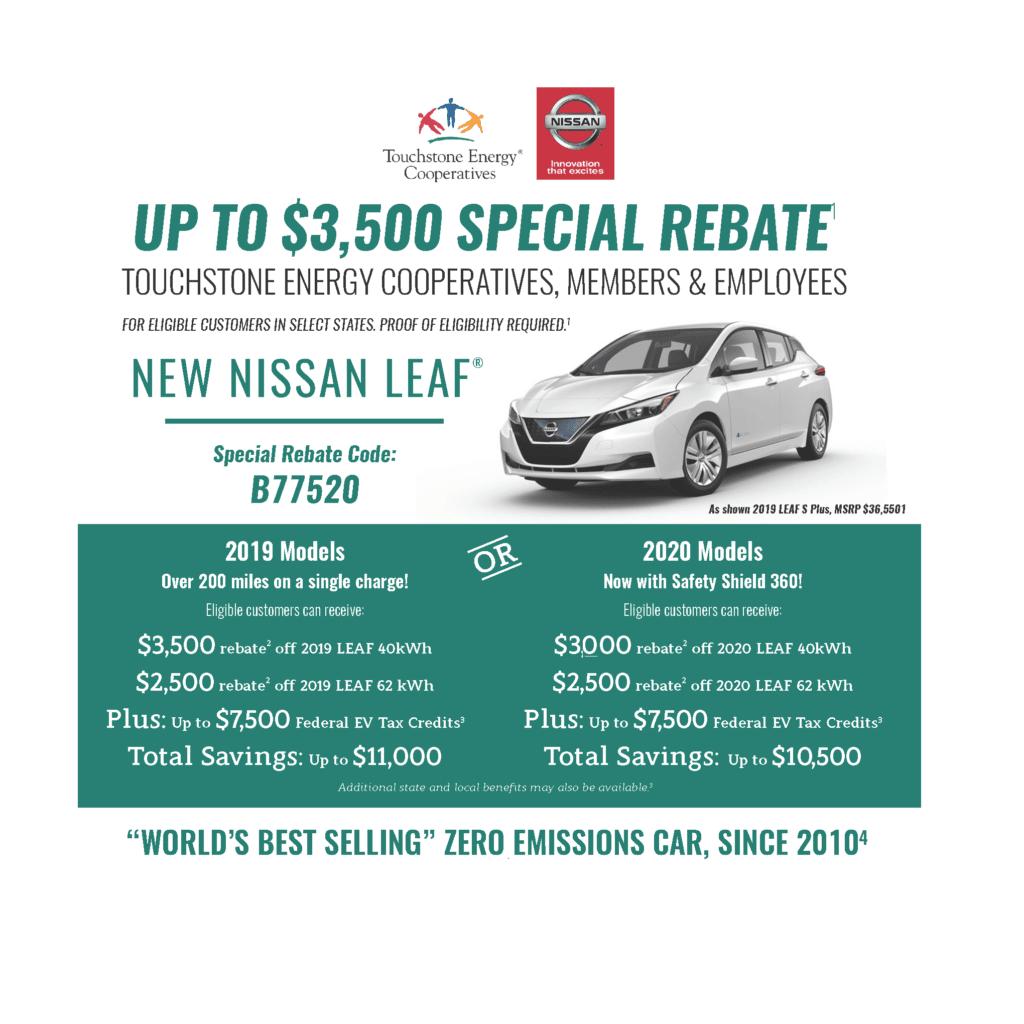

The existing federal EV tax credit offers consumers $2,500 to $7,500 in credit for vehicles with a battery capacity of at least 5 kilowatt-hours, but starts to phase out after the manufacturers first 200,000 qualifying electric vehicles have been purchased.

The new law allows consumers to get up to $7,500 no matter how many cars have been sold, said Howard Gleckman, a senior fellow at the Urban-Brookings Tax Policy Center at the Urban Institute.

Whereas the original credit only applied to the purchase of new vehicles, the new credit also expands eligibility to used vehicles, said Nick Nigro, founder of Atlas Public Policy and an expert on alternative fuel vehicle financing, policy and technology. Nigro said that this is significant because used vehicles account for the vast majority of vehicle purchases in the country.

Eligible used vehicles qualify for a credit of up to $4,000 under the Inflation Reduction Act.

Also, the new credit is not a traditional delayed tax credit, said Gil Tal, director of the Plug-in Hybrid and Electric Vehicle Research Center at UC Davis. Instead, its what is known as cash on the hood, or a rebate that is applied at the point of sale.

This means that buyers wont need to finance the full price of the car before getting the money back when they file their taxes. Instead, if the purchase is eligible for the tax credit, the actual price of the car at the dealership will immediately be up to $7,500 lower.

Ev Charging Station Credit

The EV charger credit, formally known as the alternative fuel refueling station credit, has been extended through 2032. The credit is available for both individual and commercial uses to help cover the cost of charging stations.

- For individual/residential uses, the tax credit covers 30% of the cost of the equipment

- For commercial uses, the tax credit covers 6% of the cost of the equipment

- Bidirectional charging equipment is eligible

- 2- and 3-wheeled vehicle equipment is eligible

- Starting after 2022, equipment must be placed in a low-income community or non-urban area

Visit the Alternative Fuels Data Center for more information on the credit.

Federal Vs State Electric Vehicle Tax Credits

There are important distinctions between both federal and state electric vehicle tax credits. Most obvious, federal credits apply to the entire United States as a whole while state credits and rebates vary by each territory and can be far more abundant or not. It all depends on where you live.

For example, while the federal electric vehicle tax credit is quite complicated under its revised terms in the Inflation Reduction Act, the concept of the credit itself remains quite cut and dry. US consumers may qualify for up to $7,500 in federal tax credit for an electric vehicle.

Now there are a bunch of other factors that are and will be in play starting January 1, 2023 when the new terms kick in, but weve already delved deep into that for you. If youd like to learn more about electric vehicle tax credits at the federal level, check out those details here.

Electric vehicle tax credits, rebates, and exemptions vary much more at the state level and can even get more granular down to specific counties or energy companies, depending whether its a state-level or private utility perk available to you.

If thats confusing, stick with us. Weve laid it all out piece by piece for you below. Just find your state in the table of contents above, give it a tap or click and see what sort of options are available. There should be plenty for most states, at least.

Lets start with the tax credits available for the purchase or lease of a new or used electric vehicle.

Also Check: Irs.gov File Taxes For Free

Missouri Electric Vehicle Charging Tax Rebates

- All-Electric Vehicle and EV Charging Station Rebate SPPD

- Southern Public Power District offers residential customers a $500 rebate for the installation of an eligible Level 2 EV charging station. SPPD also offers residential customers an additional rebate of up to $400 for the pre-wiring necessary for EV charging station installation. Eligible residential customers include single- and multi-family residences.

- SPPD offers commercial customers a 50% reimbursement for the installation of a public Level 2 or direct current fast charging station and a 100% reimbursement, of up to $1,000, for the construction of conduit necessary to support EV charging station installations. Rebates are available on a first-come, first-served basis. For more information, including eligible EV charging stations and how to apply, see the SPPD Incentive Programs website.

Does California Offer Incentives

California offers residents a rebate for the purchase of fuel-cell vehicles and electric vehicles, including plug-in hybrids. Income and price limits apply. For information on the Clean Vehicle Rebate Project, see .

On Tuesday, California voters defeated Proposition 30, which would have raised taxes on high-income households, in part to pay for rebates and other incentives for zero-emission vehicle purchases.

Read Also: When Is The Last Day To Turn In Taxes

What About Used Evs

The tax credit for used EVs will be calculated at either 30% of the vehicle’s value or $4,000, whichever is less. The rules for used EVs also take effect on January 1, 2023, and are as follows:

- Price limit for used vehiclesThere is a hard eligibility ceiling at a sale price of $25,000 for all used EVs regardless of type.

- Income limitsfor used vehiclesBy filing status, the limits are:

- Joint tax returns or a surviving spouse: MAGI must not exceed $150,000.

- Head of household: MAGI must not exceed $112,500.

- Individual or any other filing status: MAGI must not exceed $75,000.

- Other eligibility requirements for used EVs

- The vehicle must be at least two model years older than the calendar year in which it is purchased.

- The used EV tax credit will only apply once in the vehicle’s lifetime. Subsequent owners will not be eligible.

- Once a buyer has taken the federal used EV credit, they are not eligible for another credit for three years.

- The vehicle must be for personal use and “not for resale.”

- The vehicle must be purchased through a dealer.

- Only an individual may claim the used EV tax credit. Businesses are excluded.

Utah Offers Big Electric Vehicle Tax Credits But Only For Heavy

Read Also: Irs Tax Return Amendment Status

Many Electric Vehicles May Not Qualify For The Credit

However, it could be difficult for cars to qualify, he said, depending on where they source their materials and where they complete the manufacturing process. The Alliance for Automotive Innovation has warned that many electric vehicles will be ineligible for the credit right off the bat.

Additionally, another change in the legislation would allow a car buyer who qualifies for the tax credit to transfer it to the dealership, which could then lower the price of the car.

Meanwhile, another modification included in the bill is good news for some electric vehicle manufacturers.

Basically, the existing $7,500 credit was authorized in 2008 and 2009 legislation with the intention of spurring adoption of electric cars. Part of that included a phase-out of the tax credit once a manufacturer reached 200,000 of the vehicles sold.

Tesla hit that threshold in 2018, which means their electric cars currently do not qualify for the tax credit. General Motors is in the same position. Toyota also has now crossed that threshold, and its electric cars are scheduled to be ineligible for the tax credit after a phaseout of it ends in September 2023.

The congressional measure would eliminate that 200,000 sales cap, making their electric cars again eligible for the credit at least based on that sales-threshold removal.

Tax Incentives On Electric Vehicles Are Worth The Research

Hopefully this post has helped to incentivize you to use the resources above to your advantage.

Whether its calculating potential savings or rebates before making a new EV purchase or determining what tax credits might already be available to you for your current electric vehicle, there is much to discover.

Ditching fossil fuels for greener roadways should already feel rewarding, but right now the government is willing to reward you further for your environmental efforts.

Use it to your full capability while you can, because as more and more people start going electric, the less the government will need to reward drivers.

Also Check: Tax Short Term Capital Gains

How Do Tax Credits For Electric Cars Work

The Inflation Reduction Act expands eligibility for federal tax credits for electric vehicle owners.

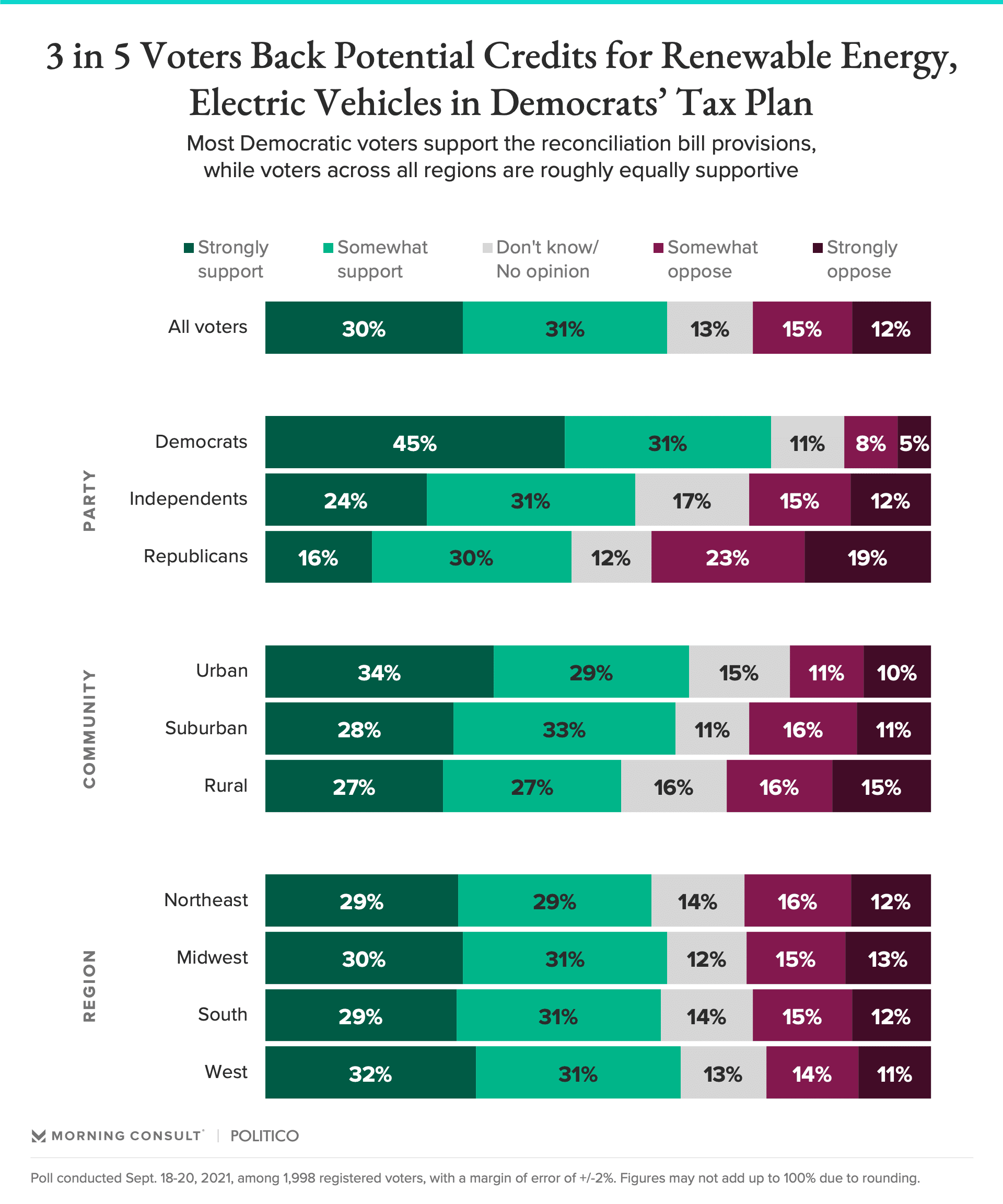

The Inflation Reduction Act, which passed the Senate this weekend, expands federal tax credits for electric vehicles. The bill removes a cap that prevents owners of popular electric vehicle manufacturers, such as Tesla and General Motors, from receiving the credit. It also expands the credit to used electric vehicles.

More than 7 million fully-electric or hybrid vehicles were registered in the US in 2021, according to data from the Department of Energy. Electric cars make up less than 4% of total passenger cars in the US. The federal government and some states provide tax incentives to individuals who purchase electric vehicles. These tax credits can add up to more than $10,000 in some states.

The Department of Energy defines electric-drive vehicles as those that use electricity as their primary power source or to improve the efficiency of conventional vehicle designs. From this definition, there are three major categories of electric vehicles: all-electric, plug-in hybrid, and hybrid. Hybrid vehicles are the most popular, making up about 70% of all electric vehicle registrations in 2021.

Ira Webinar: What Is The Ira And How Does It Affect Federal Ev Tax Credits

Plug In America recently hosted a webinar that explains the upcoming changes to the federal EV tax credit. This webinar is geared toward those interested in learning about the changes to EV tax credits as a result of the IRA. It was hosted by Plug In Americas Policy Manager, Alexia Melendez Martineau, and Senior Policy Advisor, Jay Friedland.

Disclaimer: Plug In America offers this information as our best interpretation of the IRA and does not guarantee its accuracy or that what we have shared will ensure a consumer will be eligible for any tax benefit. We recommend that you consult a tax advisor or legal counsel.

Also Check: How Are Taxes Calculated On Paycheck

Which Vehicles Qualify For The Electric Car Tax Rebate

The U.S. Department of Energy has a handy chart that shows all the vehicles that are eligible for the tax credit, and whether or not that vehicle is being phased out.

What exactly does that phase-out mean for you? When a manufacturer sells 200,000 eligible plug-in vehicles, the federal government will begin to slowly reduce the tax credit until no credit is available. While you can still get the full tax credit up to a few months after the manufacturer reaches that 200,000 mark, the credit will drop to 50% for the next 6 months, then to 25% for an additional 6 months and finally to zero.3

Washington Ev Tax Rebate

Also Check: Irs Extension To File Taxes

How To Tinker With Your Tax Bill

Consumers who want to buy an electric vehicle and think their tax bills will be too small to get the full $7,500 can take steps to boost their tax liability and therefore maximize the credit’s value.

For example, investors can consider converting a pretax retirement account to a Roth, a type of after-tax account they’d owe income tax on that conversion. Investors can also consider selling winning stocks or other assets, thereby incurring capital gains tax.

“If you can harvest some gains or have additional income you can pull into 2022, maybe you consider that,” Herron said.

Workers can also adjust the tax withholding on their paychecks, opting to withhold less and thereby increasing the taxes they owe at tax time. While doing so won’t affect your overall tax liability, it can help you keep more money in your paycheck during the year, with the aim of using the vehicle tax credit to offset the bigger tax-time bill.

However, Herron doesn’t recommend this route due to potential unknowns. For example, an unexpected bonus during the year might mean a larger-than-expected tax bill, depending on the withholding adjustment.

Are Electric Vehicle Rebates Taxable

Some states, such as New York, Vermont, and Connecticut, may classify rebates as taxable income. Others, like California, do not. Consult a tax professional if you have any questions about how to correctly file your tax return forms. Everyones situation is different, and its always a good idea to check your local state regulations. Once again, consider consulting an accountant when you need professional tax advice.

Also Check: Which States Have No Income Tax

The Best Electric Cars

Thinking of going electric? Its the perfect time to make the switch. Weve rounded up some of the best electric vehicles qualifying for tax credits and rebates when purchased new. If youre just starting your EV adventure, there are more cars also available as electric vehicles than you might think.

Today, electric vehicles go further than ever as technology continues to improve. Automakers are also hard at work developing all-new electric vehicles and paving the way for EV SUVs and trucks. From the flagship Ford Mustang Mach-E to the Hummer EV, its safe to say that your options are quickly expanding every year.

For a deeper dive into the world of electric vehicles, be sure to check out our EV buying guide. When youre ready to buy, you can use TrueCar to shop and get an upfront, personalized offer from a certified dealer. Until then, keep an eye out for the latest electric vehicle news and updates from the TrueCar blog.

What Happens To The Tax Credit That Existed Before The Inflation Reduction Act

The Internal Revenue Service has provided some preliminary guidelines regarding the EV tax credit and its immediate future.

The previous $7,500 tax credit, which did not have limitations on income, price or battery component sourcing, will still be in effect until December 31, 2022. However, now that the Inflation Reduction Act has been signed into law, the North American “final assembly” requirement will immediately apply. This will greatly reduce the pool of vehicles to choose from until automakers start to locate more of their supply chains and factories within North America, which could take a few years.

You May Like: When Is Tax Returns Due

Cars That Qualify For The Used Vehicle Ev Tax Credit

Starting Jan. 1, 2023, income qualified individuals can start to claim the EV Tax Credit on used cars. The credit is limited to $2,500-$4,000 , but you can claim the credit if the car is more than two years old. The maximum credit is 30% of the purchase price of a vehicle. If you pay more than $25,000 for a used vehicle, you cant claim the credit.

Most importantly, you can only claim the tax credit on the first transfer of a vehicle, and the tax credit can only be claimed once every three years per vehicle. A car with two previous owners wont qualify for the EV Tax Credit. If the prior owner claimed an EV Tax Credit within the last two years, you wont be able to get the credit.

Used cars also have to meet the final assembly in North America requirements. You can check whether the car meets the requirement by checking the United States Department of Transportations VIN decoder.

The law also created a battery manufacturing requirement. Starting next year, a certain percentage of the vehicles battery must be assembled or manufactured within North America. The thresholds are set as follows:

- 2029 through 2032: 100%

No website has been released to track battery manufacturing and assembly, but this is expected to be released prior to January 2023.

Washington Electric Vehicle Charging Tax Rebates

- Anyone who purchases an electric vehicle battery or fuel cell, or installs an electric vehicle battery, fuel cell charging station, or hydrogen fueling stations on purchases on or after Aug. 1, 2019 until July 1, 2025.

- Qualifying activity:

- Sale or use of batteries and fuel cells for EVs, including those sold as a component of an electric bus.

- Sale of or charge made for labor and services rendered in respect to installing, repairing, altering, or improving electric vehicle batteries and fuel cells.

- Sale of or charge made for labor and services rendered in respect to installing, constructing, repairing, or improving battery or fuel cell EV infrastructure, including hydrogen fueling stations.

- Sale or use of tangible personal property that will become a component of battery or fuel cell electric vehicle infrastructure during the course of installing, constructing, repairing, or improving battery or fuel cell electric vehicle infrastructure.

You May Like: Taxes On Lottery Winnings Calculator