Ira Contribution Limits For Tax Years 2022 And 2023

For the 2022 tax year, the maximum contribution you can make to a traditional or Roth IRA is $6,000. That increases to $6,500 in 2023. This cap only applies if youre under the age of 50, as those 50 and older can contribute up to $7,000, or $7,500 in 2023.

Prior to 2020, you could no longer make regular contributions to a traditional IRA beginning the year you were set to turn 70.5. However, the SECURE Act of 2019 eliminated the age limit. As a result, regular contributions to traditional and Roth IRAs can continue after age 70.5. However, your traditional IRA is still subject to required minimum distributions after you turn 72.

Remember that you can still contribute to your IRA for the most recent tax year until Tax Day of the following calendar year. In other words, IRA contributions can begin on the first day of the year and can continue to be made until tax day for that tax year. So for 2022, you could start making contributions on January 1, 2022 and could continue to do so until mid-April of 2023 when the tax deadline occurs.

What Is The Maximum Ira Contribution For 2021

The maximum depends on the IRA. For Roth IRA and Traditional IRA the maximum is $6,000. If you are over 50 years of age you can contribute $1,000 more . For a SEP IRA, the contribution limit is up to 25% of compensation, with a maximum of $58,000. And for a SIMPLE IRA, employee contribution limit is $13,500 if you are under 50 years if you are over 50 the maximum is $16,500. Excess amounts are taxed at 6% per year for each year the excess amount remains in the IRA.

Dont Miss: Low Income Housing Baltimore City

The Deduction May Not Be Worth It

The main thing that separates a traditional IRA from a Roth IRA is when you receive your tax break. With the traditional IRA, the tax break is on the front end with the potential tax deduction. With a Roth IRA, you can’t deduct your contributions, but you can take tax-free withdrawals in retirement . Even if you’re eligible for the traditional IRA tax deduction, you may find you’re better off going with a Roth IRA and taking the tax-free withdrawals on the back end.

If you’re relatively early in your career and your tax bracket is likely to be higher when you retire, it makes sense to pay taxes now instead of later when it’ll cost you more. This is especially true when you consider how much investments can compound over time. If you make a one-time $6,000 investment in a Roth IRA and earn 10% annually, on average, for 25 years, you would have accumulated over $65,000. Since it’s in a Roth IRA, that entire amount could be withdrawn tax-free in retirement, easily saving you thousands in taxes. In a traditional IRA, there’s a chance the taxes you’d owe on that amount would offset the benefits you received from the tax deduction.

The Motley Fool has a disclosure policy.

Don’t Miss: G Wagon Tax Write Off

Can High Income Earners Contribute To A Traditional Ira

If a high-income earner decides to make an IRA contribution, the contribution cannot be made to a Roth IRA. Instead it must be made to a Traditional IRA. … If no IRA contribution is made, the cash could be invested in a taxable investment, such as shares of individual stocks, mutual funds, bonds or cash funds.

Health Savings Plan Contributions

Contributions limits may vary year over year. The IRS releases new contributions limits every year. Check out the current HSA contributions limits here.

Anyone covered under an eligible high deductible health plan may contribute to an HSA.

You cannot be enrolled in Medicare or any other health coverage that is not permitted by the IRS. See publication 969.

You can keep your HSA account at any age, but you can no longer make new contributions to the account after you have signed up for Medicare Part A or Medicare Part B.

For most individuals, this means you will no longer be eligible when you turn 65. You lose eligibility as of the first day of the month you turn 65.

You may make full years contribution into the HSA, even if you are eligible for only part of the year. If you make a contribution for the full year when you only had partial year HSA-eligibility, you must remain HSA-eligible through the last month of the following calendar year to avoid tax and penalty.

If you are changing the amount contributed via payroll on a pre-tax basis, check with your employer. You can change the amount you contribute to your HSA at any time during the plan year.

Contributions to HSAs can be made by you, your employer, or both. All contributions are aggregated to determine whether you have contributed the maximum allowed. Additionally, family members may make contributions on behalf of other family members as long as the other family member is an eligible individual.

Don’t Miss: Federal Tax Rate On Capital Gains

Tax Deductions For Traditional Roth Iras

Whether you have access to a workplace retirement account or not, everyone with earned income can contribute to their own IRA. However, depending on your income, work situation and the type of IRA chosen, your contributions may or may not be tax-deductible. There are several types of IRAs available and its important to know whether IRA contributions are tax-deductible. A financial advisor may also be able to help with some of these questions. Consider using SmartAssets free advisor matching tool today to find advisors who serve your area.

If You Are Married Filing Jointly

This is where things get complicated. For those , the maximum tax-deductible contribution differs significantly if one person is contributing to a 401, and it can be limited for higher-income couples.

- If the spouse making the IRA contribution is covered by a workplace retirement plan, the deduction begins phasing out at $109,000 in adjusted gross income and disappears at $129,000 for 2022.

- If the IRA contributor does not have a workplace plan and their spouse does, the 2022 limit starts at $204,000, and no tax deduction is allowed once the contributors income reaches $214,000 .

Read Also: Take Home Pay After Tax

Roth Ira Income Limits In 2023

Unlike Traditional IRAs, Roth IRAs dont save you money on your taxes in the current year. However, your investments grow and can be withdrawn tax free in retirement if you meet certain criteria. The amount you can contribute to a Roth IRA depends on your filing status and income. These amounts were increased for tax year 2023. See the table below to determine if you are eligible to contribute to a Roth IRA.

If your income is above the limit, you may still be able to add funds to a Roth IRA using a strategy called back-door Roth contributions. There are important caveats to using this method, so discuss your options with an experienced financial advisor.

Other Tax Breaks For Retirement Savings

Although some investors won’t qualify for IRA contribution deductions, there are other options to consider.

Nondeductible IRA contributions are a popular choice because some investors convert the after-tax deposit to a Roth IRA, known as a Roth conversion, which bypasses the income limits.

Other options may include maxing out a workplace retirement plan, including catch-up contributions for those who are age 50 and older, Pressman suggests.

After that, you may consider investing in low-turnover index mutual funds in a regular brokerage account.

“This account will not be subject to retirement rules, limiting your access to the funds, and when you take distributions your growth will be taxed at more favorable capital gains tax rates rather than higher ordinary income rates of IRAs,” he added.

“While you will need to pay taxes on capital gains and dividends each year, using index funds with low turnover should keep these taxes to a minimum,” Pressman said.

Recommended Reading: What Happens If You File Taxes Twice

The #1 Traditional Ira Tax Break Mistake

But there is a big mistake that trips up many people when trying to claim the deduction.

This mistake can be summarized by not understanding the IRA deduction limits.

A lot of people do not know this but your deduction can be limited if you meet certain criteria.

The first criteria is if you are covered by a retirement plan at work.

The IRS specifically says that your deduction may be limited if you are covered by a retirement plan at work, and your income exceeds certain levels.

Well discuss those income levels in a second, but basically, if you or your spouse is employed by a company that offers a retirement plan, your deduction may be limited.

If you or your spouses employer contributes to a profit-sharing, 401k, stock bonuses, or any IRA-based plan, then you are considered covered.

This means that your deduction may be limited if your income surpasses a certain amount.

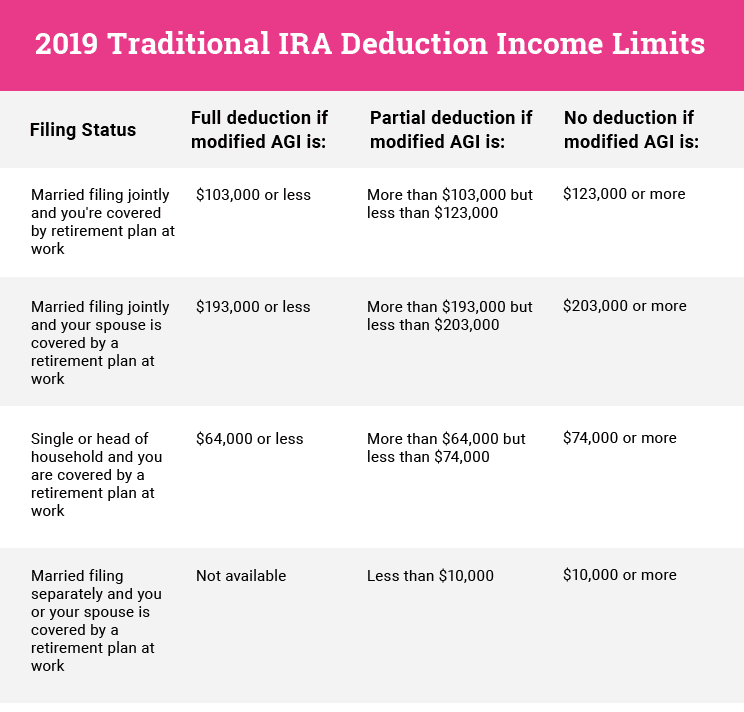

So lets take a look at those income limits.

Here are the 2021 income limits.

As you can see, your deduction is phased-out once you start earning over a certain amount of money.

Remember, these phase-outs only apply if you or your spouse is covered by a retirement plan at work.

So lets say youre single and your employer contributes to your 401k.

If your income is less than $66,000, then you can enjoy the tax benefits of your 401K and your Traditional IRA.

But if your income exceeds $66,000, but is less than $76,000, then you will only receive a partial deduction for your IRA contribution.

Get With A Smartvestor Pro

Remember, we want you to invest 15% of your annual gross income for retirement. Youll want to start with your employer-sponsored plan, if you have one, and contribute up to the company matchbut after that, pile up your money in a Roth IRA ). So, these limits are important!

To understand the big picture of your financial situation and how to get to that 15%, get with a SmartVestor Pro. Theyre RamseyTrusted and know what options you have based on your timeline to retirement, tax obligations and anything else relevant to your situation.

Recommended Reading: What Date Do You Have To File Your Taxes By

What Would Cause A Taxpayer’s Contribution To A Traditional Ira To Be Non

Non-Deductible IRAs Unlike a traditional IRA, which is tax-deductible, non-deductible IRA contributions are made with after-tax dollars and provide no immediate tax benefit. In a given tax year, as long as you or your spouse have enough earned or self-employment income, you can each contribute to an IRA.

How Do You Report An Excess Ira Contribution

You don’t have to report it to the government if you accidentally exceed your IRA contribution limit, and you catch your error before you file your tax return for that tax year. You can simply contact the financial institution that holds your IRA and ask them to withdraw the excess amount. But you’ll have to claim the income on your 1099 if your contributions were invested and gained value while in your IRA. This could come with a 10% penalty tax if you’re younger than age 59 1/2.

Read Also: Department Of Tax Debt And Financial Settlement Services

Change Jobs Without Losing Any Retirement Benefits

IRAs can also come in handy when you’re about to leave jobs and need to move your retirement plan assets. If your former employer permits you to withdraw your retirement money, you can move these funds to an IRA account and postpone the payment or move them from your former employer’s qualified retirement plan into a rollover IRA and avoid owing current income tax on the distribution.

If you choose to physically receive part or all of your money and do not replace the entire amount within 60 days, you may be subject to an early withdrawal penalty tax and income taxes on the amount you don’t rollover to an IRA or other plan. Some exceptions may apply.

What Is The Difference Between An Ira And A 401

An IRA is a self-managed retirement amount where you select your own broker, have a broader range of retirement investment options, and can have automatic withdrawals taken out of your bank account. A 401 is managed by your employer, though you do get to select your contribution amount and investments. Each type of retirement account has different contribution limits, income thresholds to contribute, and rules around distributions.

Don’t Miss: Capital Gains Tax On Cryptocurrency

Ira Tax Deduction Rules

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

Broadly speaking, qualified retirement accounts offer some sort of tax benefit either during the year that contributions are made or when distributions take place after retiring. But, not all retirement accounts are taxed the same.

With a traditional IRA, its possible for certain individuals to both invest for their future and reduce their present tax liability. For tax year 2022, the maximum IRA deduction is $6,000 for individuals younger than 50, and $7,000 for those 50 and older. For tax year 2023, the maximum IRA deduction is $6,500 for people younger than 50, and $7,500 for those 50 and older.

To maximize deductions in a given year, the first step is understanding how IRA tax deductions work. Practically speaking, a good place to start is the differences between common retirement accounts and their taxation. Since each individual financial situation is different, speaking with a tax professional to share specific tax questions is a good idea.

Get Your Investment Taxes Done Right

For stocks, crypto, ESPPs, rental property income and more, TurboTax Premier has you covered.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Read Also: Wisconsin Sales And Use Tax

Roth Ira Income Limits For Contributions

Lets talk about Roth IRAs firsttheyre our favorite because your money is allowed to grow tax-free. Remember, the contribution limit for any IRARoth or traditionalin 2022 is $6,000 . But with Roth IRAs, there are actually a few more limitations on your contributions based on your tax filing status and income.4 If youre not sure exactly where you land, youll want to get with your investment pro to figure it out.

2022 Roth IRA Contribution Limits

|

If your filing status is |

And your modified AGI is |

Then you can contribute |

Simple Ira Contribution Limits In 2023

If your employer offers a SIMPLE IRA, you can contribute up to $15,500 in 2023 a $1,500 increase from the 2022 limit. If you are 50 or older, you can also make catch-up contributions. These are limited to $3,500 for tax year 2023 a $500 increase from the previous year. With a SIMPLE IRA, your employer can either match contributions up to 3% of your salary or offer a 2% nonelective contribution. If your company uses the nonelective contribution method, they will add 2% of your compensation up to the salary cap of $330,000. This limit was increased from $305,000 in 2022.

Don’t Miss: Nj Employer Payroll Taxes 2021

Are Ira Contributions Tax

There are three main types of IRAs to choose from, traditional IRA, Roth IRA and nondeductible IRA. Each one has specific benefits and features that make them ideal for different types of investors. Your choice and eligibility to contribute depend on your income, tax-filing status and the availability of a workplace retirement account. The income limits in the charts below are indexed for inflation. It is wise to compare the limits each year versus your income and tax-filing status. The results will determine whether or not you are eligible to contribute and deduct your contributions.

Can I Deduct My Ira Contribution If I Have A 401k

Yes, you can have both accounts and many people do. The traditional individual retirement account and 401 provide the benefit of tax-deferred savings for retirement. Depending on your tax situation, you may also be able to receive a tax deduction for the amount you contribute to a 401 and IRA each tax year.

Read Also: California Sales Tax By Zip Code

Find Out If You Can Contribute And If You Make Too Much Money For A Tax Deduction In 2021 And 2022

Traditional IRAs are tax-advantaged retirement savings accounts. Money invested in a traditional IRA can grow tax-free until you begin making withdrawals as a retiree. Withdrawals are taxed at your ordinary income tax rate.

Many, but not all, Americans can invest in a traditional IRA with pre-tax funds, claiming a deduction for their contribution in the year it is made. However, if either you or your spouse is covered by a workplace retirement plan, there are income limits for making tax-deductible contributions to traditional IRAs. If you exceed the income limits, you will not be eligible to contribute to your account with pre-tax funds, but you can still make nondeductible contributions and benefit from tax-free growth. On a related note, there are limits to your IRA contribution as well.

Here’s what you need to know about traditional IRA income limits in 2021 and 2022.