The Last Date For Filing Income Tax Returns By Companies Who Are Required To Get Their Accounts Audited Was October 31

CBDT said the ITR filing due date is extended.

New Delhi:

The Finance Ministry today extended the deadline for filing income tax returns for the assessment year 2022-23 by businesses till November 7.

The last date for filing income tax returns by companies who are required to get their accounts audited was October 31.

The Central Board of Direct Taxes , the decision-making body in matters of income and corporate tax, in a notification said since it had last month extended the deadline for filing audit reports, hence the ITR filing due date too is extended.

“CBDT… extends the due date of furnishing of Return of Income under sub-section of section 139 of the Act for the Assessment Year 2022-23, which is October 31, 2022… to November 7, 2022,” the CBDT notification said.

Domestic companies are required to file their income tax returns by October 31, 2022, for the Financial Year 2021-2022. The due date to file ITR will be November 30, 2022, for companies which are subject to transfer pricing norms.

AMRG & Associates Director Om Rajpurohit said the extension would provide much-needed relief during the festival season vis-a-vis to prevent any future anomalies with tax provisions .

Federal Income Tax Returns Were Due April 18 For Most Of Us But Some People Have Some Extra Time To File Are You One Of Them

Getty Images

Most Americans had to file their federal tax return for the 2021 tax year by April 18, 2022. Note that we said “most Americans.” Taxpayers in two states had until April 19 to submit their 1040s to the IRS. Victims of certain natural disaster also get more time to file, with varying dates depending on when the disaster hit.

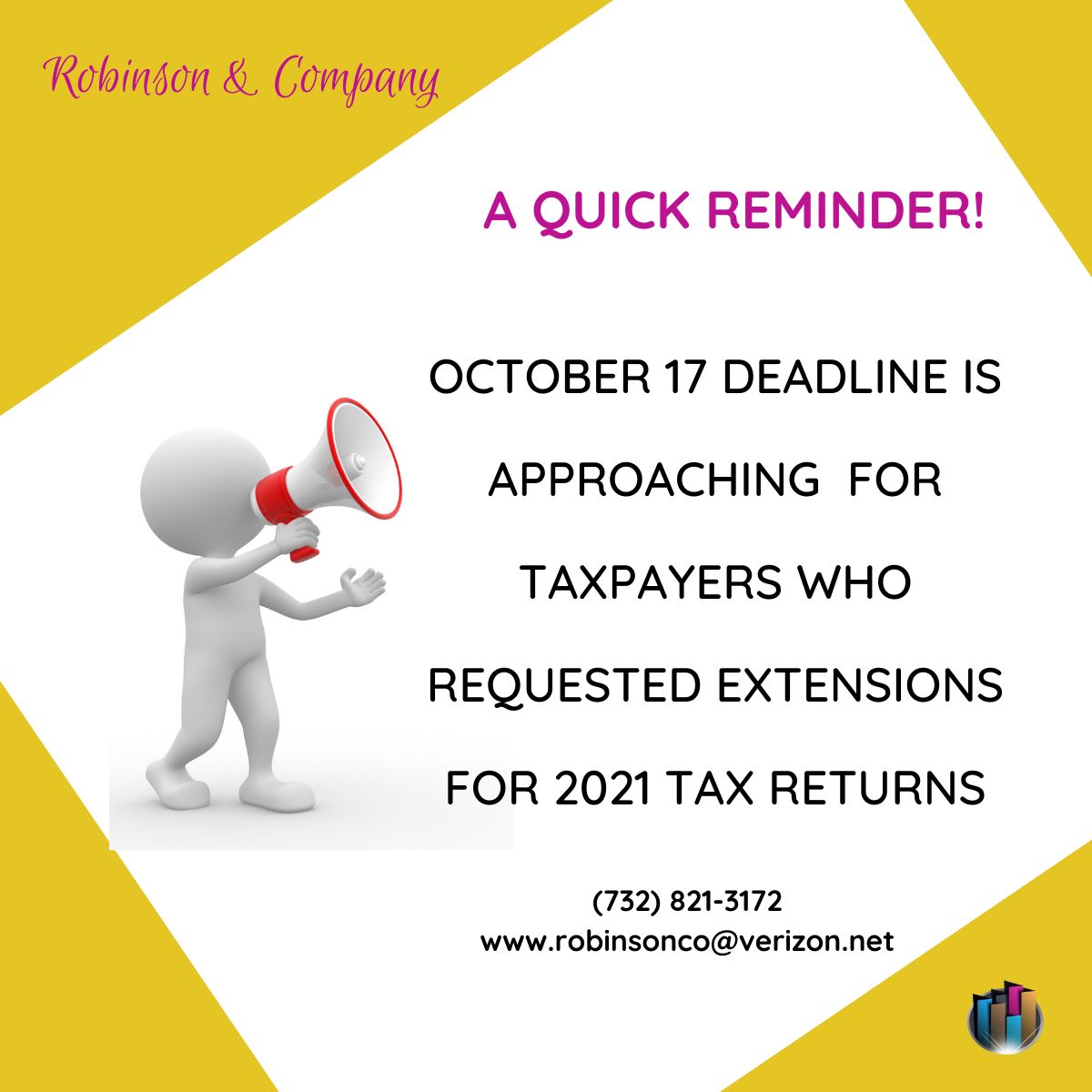

If for some reason you weren’t able to file your federal tax return on time, hopefully you requested an automatic six-month tax extension to October 17, 2022, by filing Form 4868 or making an electronic tax payment. To get the extension, you had to act by the original due date for your return, whether that was April 18, April 19, or some other date. Keep in mind, however, that an extension to file doesn’t extend the time to pay your tax. If you didn’t pay up by your original due date, you’ll owe interest on the unpaid tax and could be hit with additional penalties for filing and paying late.

Also note that special tax extension rules apply for Americans living abroad and people serving in a combat zone or contingency operation. As a result, they might have more time beyond April 18 to file their 2021 tax return and pay whatever tax they are expected to owe, and they could receive an extension past October 17.

What Customers Are Saying:

I really was impressed with the prompt response. Your expert was not only a tax expert, but a people expert!!! Her genuine and caring attitude came across in her response…

T.G.WMatteson, IL

I WON!!! I just wanted you to know that your original answer gave me the courage and confidence to go into yesterday’s audit ready to fight.

BonnieChesnee, SC

Great service. Answered my complex tax question in detail and provided a lot of additional useful information for my specific situation.

JohnMinneapolis, MN

Excellent information, very quick reply. The experts really take the time to address your questions, it is well worth the fee, for the peace of mind they can provide you with.

OrvilleHesperia, California

Wonderful service, prompt, efficient, and accurate. Couldn’t have asked for more. I cannot thank you enough for your help.

Mary C.Freshfield, Liverpool, UK

This expert is wonderful. They truly know what they are talking about, and they actually care about you. They really helped put my nerves at ease. Thank you so much!!!!

AlexLos Angeles, CA

Thank you for all your help. It is nice to know that this service is here for people like myself, who need answers fast and are not sure who to consult.

GPHesperia, CA

Don’t Miss: Amend My 2020 Tax Return

Tax Day For Individuals Extended To May 1: Treasury Irs Extend Filing And Payment Deadline

IR-2021-59, March 17, 2021

WASHINGTON The Treasury Department and Internal Revenue Service announced today that the federal income tax filing due date for individuals for the 2020 tax year will be automatically extended from April 15, 2021, to May 17, 2021. The IRS will be providing formal guidance in the coming days.

“This continues to be a tough time for many people, and the IRS wants to continue to do everything possible to help taxpayers navigate the unusual circumstances related to the pandemic, while also working on important tax administration responsibilities,” said IRS Commissioner Chuck Rettig. “Even with the new deadline, we urge taxpayers to consider filing as soon as possible, especially those who are owed refunds. Filing electronically with direct deposit is the quickest way to get refunds, and it can help some taxpayers more quickly receive any remaining stimulus payments they may be entitled to.”

Individual taxpayers can also postpone federal income tax payments for the 2020 tax year due on April 15, 2021, to May 17, 2021, without penalties and interest, regardless of the amount owed. This postponement applies to individual taxpayers, including individuals who pay self-employment tax. Penalties, interest and additions to tax will begin to accrue on any remaining unpaid balances as of May 17, 2021. Individual taxpayers will automatically avoid interest and penalties on the taxes paid by May 17.

How Are Individuals Affected By The Tax Deadline Extension

The tax extension deadline generally applies to all calendar year tax-paying entities, including individuals, self-employed persons, and trusts and estates. The Treasury and IRS announced the deferment of filing your federal tax return as well as specific federal tax payments. This delay in payment comes interest- and penalty-free, for 90 days, until July 15, regardless of the amount owed.

Furthermore, anyone who needs to make quarterly estimated tax payments also has until July 15 to submit these payments. This means your 2020 tax year first and second quarter estimated tax payments, previously due on April 15 and June 15, are now both deferred until July 15.

Also Check: How Long To Get Tax Refund 2022

Returns Filing Due Dates On Extension

- Corporate excise taxpayers receive an automatic extension of time to file their tax returns as long they have paid the greater of 50% of the total amount of tax ultimately due or the minimum corporate excise by the original due date for filing the return.

- If requesting time to file a return please ensure to deposit what you estimate you owe in tax as your extension payment. There are no zero extensions, a payment must be made in order to file an extension.

- Filing an extension with the IRS does not count as filing an extension for Massachusetts.

- An extension is an extension of time to file not to pay, any amount due will incur interest even if a valid extension is on file.

Apply For An Extension Of Time To File An Income Tax Return

If you cannot file on time, you can request an automatic extension of time to file the following forms:

- Form IT-201, Resident Income Tax Return

- Form IT-203, Nonresident and Part-Year Resident Income Tax Return

- Form IT-203-GR, Group Return for Nonresident Partners Note: Group agents must enter the special identification number assigned to the partnership in the Full Social Security number field.

- Form IT-204, Partnership Return

- Form IT-205, Fiduciary Income Tax Return

Recommended Reading: Do Retirees Need To File Taxes

What Is The Last Day To File Taxes

The last day to file taxes for individual federal income tax returns is April 15, or as late as April 18 in the event Tax Day falls on a Saturday, Sunday or official holiday. Some state-level holidays can extend the tax deadline by one day further. You can request a six-month filing extension through filing Form 4868, making your last day to file individual income taxes October 17, 2022.

If you also file taxes for your small business as a partnership, LLC or S Corp, the last day to file taxes is March 15 unless it falls on a weekend or official holiday. If your business runs on a non-calendar tax year, your federal tax return is generally due by the 15th day of the third month following the end of the tax year.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

Here Are A Few Resources On Irsgov To Help Last

- IRS Free File Available through October 17, IRS e-file is easy, safe and the most accurate way to file taxes. There are eight Free File products available in English and two in Spanish. Filing electronically can also help taxpayers determine their earned income tax credit, child and dependent care credit, and recovery rebate credit.

- Online Payments Taxpayers can pay online using IRS Direct Pay at no cost or use a debit card, credit card or Digital Wallet, which may be subject to a payment processing fee.

If they’re filing through tax software or a tax preparer, taxpayers can schedule a payment when filing.

Read Also: Free Irs Approved Tax Preparation Courses

Get An Extension To File Your Federal Return

You do not need to request an extension to file your Georgia return if you receive a Federal extension. The due date for filing your Georgia return will be automatically extended with an approved Federal extension. Attach a copy of Federal Form 4868 or the IRS confirmation letter to the Georgia return when filed. Contact the IRS at 1-800-829-1040 or visit their website at www.irs.gov to obtain Form 4868 and additional extension information.

Service In A Combat Zone

The April 18 due date for filing your tax return is automatically extended if you serve in a combat zone. There’s a two-step process for figuring the length of a combat zone extension. First, your deadline is extended for 180 days after the last day you’re in a combat zone or the last day the area qualifies as a combat zone, or the last day of any continuous hospitalization for an injury from service in the combat zone. Use whichever of these two dates is the latest.

Second, your tax extension deadline is pushed back beyond the first 180 days by the number of days you had left to take action with the IRS when you entered the combat zone. For example, you had 3½ months to file your tax return this year. Any days left in this period when you entered the combat zone are added to the 180 days.

The combat zone extension isn’t just for military personnel, either. It can be claimed by merchant marines on ships under the Department of Defense’s control, Red Cross personnel, war correspondents and civilians supporting the military.

You May Like: Penalty For Not Paying Taxes Quarterly

More Time To File And Pay

If you wont be able to file by the original May 1 deadline, dont worry. Everyone has an automatic 6-month filing extension in Virginia, which moves the filing deadline from May 1 to November 1 for most taxpayers .

In addition, as part of the state’s COVID-19 tax relief actions, if you owe taxes, you have until June 1, 2020 to pay without any penalties or interest.

This also applies to individual extension payments for Taxable Year 2019 as well as the first estimated income tax payments for Taxable Year 2020.

No Form 8606 To Verify Nondeductible Ira Contributions

Another common oversight is skipping Form 8606 for nondeductible IRA contributions, said Marianela Collado, a CFP and certified public accountant at Tobias Financial Advisors in Plantation, Florida.

That’s an issue because you may need this paperwork to verify contributions for so-called Roth conversions, a move that bypasses the income limits for Roth IRA deposits, allowing future tax-free growth. Without proof of the original deposits, you may get taxed on the same income twice.

You May Like: Do You Get State Or Federal Taxes Back First

Prepayment Requirements For Filing Extension

You must prepay by the original due date:

- 90 percent of your 2021 tax due

- 100 percent of your 2020 tax liability or

- 90 percent of your 2021 tax due if you did not have a Utah tax liability in 2020 or if this is your first year filing.

You may prepay through withholding , payments applied from previous year refunds, credits and credit carryovers, or payments made by the tax due date using form TC-546, Individual Income Tax Prepayment Coupon, or at tap.utah.gov. Interest is assessed on unpaid tax from the original filing due date until the tax is paid in full. Penalties may also apply.

How Do I File A Tax Extension

You can get a tax extension electronically or via mail. You should request an extension on or before the to avoid a late-filing penalty from the IRS.

If you dont plan to use tax software or havent decided which software to use, consider IRS Free File. The IRS partners with a nonprofit organization called the Free File Alliance to provide people who make less than $73,000 of adjusted gross income access to free, name-brand tax-prep software. Anybody even people above the income threshold can go there to file an extension online.

If you’re planning to use tax software, make sure your provider supports Form 4868 for tax extensions. Most do. You can simply follow the programs instructions and see how to file a tax extension electronically that way. The IRS will send you an electronic acknowledgment when you submit the form.

Promotion: NerdWallet users get 25% off federal and state filing costs. |

Promotion: NerdWallet users can save up to $15 on TurboTax. |

|

Also Check: Short-term Rental Tax Loophole

When To File And Pay

You must file your return and pay any tax due:

Note: The due date may change if the IRS changes the due date of the federal return.

You must pay all Utah income taxes for the tax year by the due date. You may be subject to penalties and interest if you do not file your return on time or do not pay all income tax due by the due date. See

Utah does not require quarterly estimated tax payments. You can prepay at any time at tap.utah.gov, or by mailing your payment with form TC-546, Individual Income Tax Prepayment Coupon.

What Are Tax Ratios

Tax ratios define the relative tax burden across the property classes, and affect the rates for each class. Tax ratios must be set within flexibility ranges determined by Provincial regulations for each region. The York Regional Council sets tax ratios and are applied region-wide.

|

Property Class |

|

|---|---|

|

0.2500 |

0.2500 |

As a result, for equal assessment value, the total commercial property class, including its subclasses will pay 1.3321 times more tax than equal assessed value in the residential property class. These ratios are then used to calculate the actual tax rates for each property class, based on the budgeted tax levy requirements.

You May Like: Do I Need Letter 6475 To File Taxes

Can I Appeal My Taxes

You can appeal your property assessment and in very few cases, you can appeal your taxes.

Tax appeals may be filed for reasons set out in Section 357 and 358 of the Municipal Act, for the following reasons: property assessment class changes, and demolition and razed by fire. To initiate a tax appeal, complete the Tax Adjustment Application. The last day to file a tax appeal for any taxation year is February 28 of the subsequent year. Mail or email your request to:

Richmond Hill225 East Beaver Creek Road Richmond Hill, ON L4B 3P4

Extension Of Time To File

- Filers will receive an automatic 6-month extension to file an estate tax return if you paid at least 80% of the tax finally determined to be due within nine months after the date of death of the decedent. See TlR 16-10.

- The 6-month extension begins from the due date of the original return.

- Failure to meet the 80% payment requirements will result in the imposition of interest and penalties calculated from the original due date of the return.

Don’t Miss: Roth Vs Pre Tax 401k

Paid Family And Medical Leave Contributions

Employers, other business entities and self-employed individuals electing PFML coverage are required to file Quarterly Returns through MassTaxConnect.

The first required quarterly return will cover the period from October 1, 2019 to December 31, 2019 and must be filed on or before January 31, 2020. All subsequent return filings will be due on or before the last day of the month following a calendar quarters close.

For more PFML information visit: