Pension Payout Distribution Options

Retirees have multiple distribution options when receiving a pension. These are four common choices that retirees make:

- Single-life. Monthly payments are based on the life of the person receiving the payout.

- Joint and survivor. Payments continue until both spouses pass away. The surviving spouse may receive the full distribution or a fraction of it, depending on the pension plan.

- Life with period certain. The retiree receives lifetime income, but payments are also guaranteed for a minimum period of time in case the retiree dies quickly.

- Lump sum payout. Instead of receiving a monthly income, the retiree receives a lump sum that he or she can invest in a separate account.

Additional Information For Both Pfrs And Ers Members

If you file for both a service retirement and a disability retirement at the same time, you can choose a PLS payment, however, the PLS payment will not be made until it is determined whether you are approved for the disability retirement benefit. If you are approved for the disability benefit and choose to take the disability benefit, you will not be eligible to receive a PLS. If you choose to continue with the service retirement benefit , the PLS will then be paid.

If your retirement benefit will be impacted by the provisions of a Domestic Relations Order , we must review the court order before a PLS payment can be made. If you have any questions, you or your legal representative should email our Matrimonial Bureau.

The Pension Vs Lump Sum Debate

Getty

A frequently asked question regarding retirement for people fortunate enough to have a defined-benefit pension isshould you take the lifetime monthly pension or lump sum option?

As companies look to shrink increasing pension costs and liability, they will frequently offer a pension lump sum buyout. This significant amount is usually the largest lump-sum payment any employee would be granted in their lifetimes, and is one of the most important decisions they will make when it comes to meeting their retirement goals.

In general, employees are given a date or time period that they must decide whether to exchange a monthly benefit payment stream in the future for a one-time lump-sum payment. If you select the lump-sum option, you will receive an amount that can be put into an eligible tax-qualified plan such as an IRA or rollover IRA account. The companys monthly pension obligation will then end. If you do not opt for the lump-sum, you will lose the lump-sum option, and you will begin to receive your pre-determined monthly pension income.

Recommended Reading: What Do You Need To Do Your Taxes

How Can You Take Your Pension Tax

Okay, so weâve now covered how much of your pension you can get tax-free, and how you get taxed on the rest of it. BUT there are a few different ways that you can take money from your pension, and this might affect how you want to get that tax-free lump sum.

These are:

Not got a clue what any of those are? Donât worry, weâll break them each down for you in a second. But before we do, it might help to know that you donât necessarily need to choose just one way of taking your pension income. Instead, you may be able to mix and match, or use a combination of a couple. Hereâs the lowdownâ¦

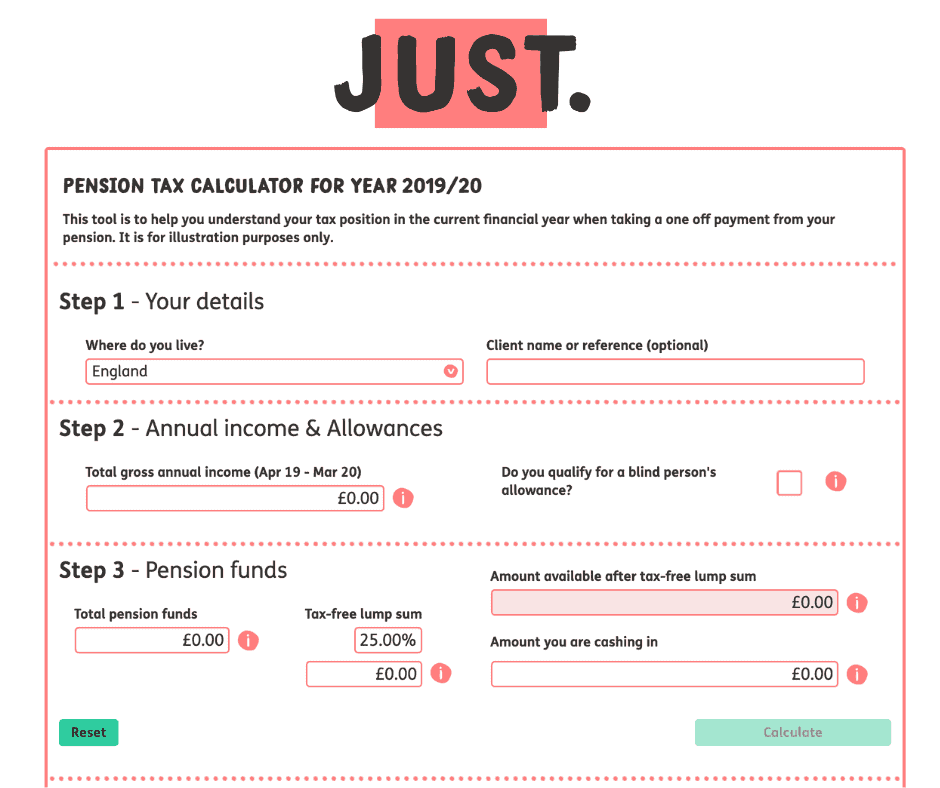

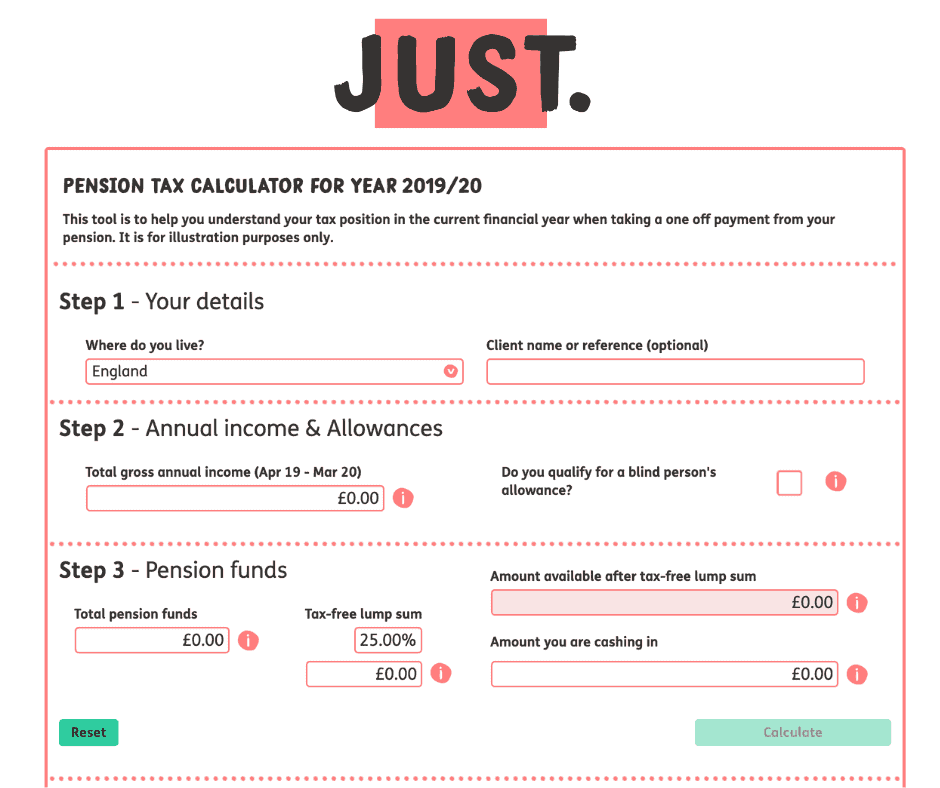

Calculate How Much Tax You’ll Pay When You Withdraw A Lump Sum From Your Pension In The 2020

When youre 55 or older you can withdraw some or all of your pension pot, even if youre not yet ready to retire.

The first 25% of the withdrawal is tax-free the remainder is taxed as extra income. To find out how this works in detail, you can read our guide ‘Should I take a lump sum from my pension?‘

This calculator will help you figure out how much income tax you’ll pay on a lump sum this tax year.

This calculator has been updated for the and 2022-23, 2021-22 and 2020-21 tax years. Use the ‘Tax year’ dropdown to select the one you want.

Which? Limited is registered in England and Wales to 2 Marylebone Road, London NW1 4DF, company number 00677665 and is an Introducer Appointed Representative of the following:

Inspop.com Ltd for the introduction of non-investment motor, home, travel and pet insurance products . Inspop.com Ltd is authorised and regulated by the Financial Conduct Authority to provide advice and arrange non-investment motor, home, travel and pet insurance products and is registered in England and Wales to Greyfriars House, Greyfriars Road, Cardiff, South Wales, CF10 3AL, company number 03857130. Confused.com is a trading name of Inspop.com Ltd.

Also Check: Selling House Capital Gain Tax

Can I Withdraw My Tax

In normal circumstances, no you cant withdraw any of your pension before the age of 55 without paying a huge tax penalty.

Any pension savings withdrawn before the age of 55 are subject to a huge 55% tax.

Watch out for companies promising early pension access.

Most of these schemes are scams, which come with fees as high as 30%, and the remainder of your fund is often invested in high risk or dubious schemes. Avoid doing this at all costs.

There are some circumstances when you may be able to take a lump sum, or indeed cash in your entire pension, earlier than 55.

If youre in poor health, or you work in an occupation that traditionally has early retirement ages, such as athletes, you could access your money earlier.

But for most pension schemes, the earliest you can access your pension is at age 55.

Taxation Of Social Security Benefits

Many older Americans are surprised to learn they might have to pay tax on part of the Social Security income they receive. Whether you have to pay such taxes will depend on how much overall retirement income you and your spouse receive, and whether you file joint or separate tax returns.

Check the base income amounts in IRS Publication 915, Social Security and Equivalent Railroad Retirement Benefits. Generally, the higher that total income amount, the greater the taxable part of your benefits. This can range from 50 to 85 percent depending on your income. There is no tax break at all if you’re married and file separate returns.

The IRS also provides worksheets you can use to figure out what’s taxable and how much you might owe in taxes on your retirement income. You can find these worksheets in IRS Publication 554, Tax Guide for Seniors.

Recommended Reading: Does Texas Have State Income Taxes

Tips For Creating Retirement Income

- Pensions and annuities provide regular income that retirees can depend on. Other investments supplement these payments and grow your portfolio to offset the effects of inflation. SmartAssets retirement income calculator can help you determine how much you need to save for retirement.

- Investors work with financial advisors to create financial plans for their investment needs and goals. These customized plans factor in your current nest egg, savings rate, risk tolerance and more. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

How Retirees Can Avoid Taxes On Lump Sum Pension Payouts

When your pension matures, there are multiple distribution options that you can choose from. Unfortunately, many of these distribution methods result in a tax liability that reduces your payout. However, you can avoid taxes on a lump sum by rolling it over into an individual retirement account or another eligible retirement plan. Heres how to make it happen.

A financial advisor can help you lower your taxes by optimizing your investments with a tax plan.

Pension Payout Distribution Options

Retirees have multiple distribution options when receiving a pension. These are four common choices that retirees make:

-

Single-life. Monthly payments are based on the life of the person receiving the payout.

-

Joint and survivor. Payments continue until both spouses pass away. The surviving spouse may receive the full distribution or a fraction of it, depending on the pension plan.

-

Life with period certain. The retiree receives lifetime income, but payments are also guaranteed for a minimum period of time in case the retiree dies quickly.

-

Lump sum payout. Instead of receiving a monthly income, the retiree receives a lump sum that he or she can invest in a separate account.

Tax Treatment of Pension Distributions

The Internal Revenue Service classifies pension distributions as ordinary income. This means that they are taxed at the highest income tax rates.

Because pension distribution taxes can be so high, investors wisely seek out ways to reduce taxes on this income.

Bottom Line

You May Like: File State And Federal Taxes For Free

Receiving Your Pls Payment

You can have the PLS payment made to you or you can have all or any portion paid in a direct rollover to a Traditional or Roth Individual Retirement Account or other eligible plan that accepts rollovers.

If you choose to have a PLS payment made directly to you:

- For most members, you will receive your PLS along with your first pension payment, at the end of the month following your retirement month.

- The payment will be subject to federal income tax in the year the payment is made and NYSLRS will issue you a 1099-R tax form the following January.

- We will withhold 20 percent of the taxable amount for federal income taxes.

- If you are less than 50 years old at the end of the calendar year in which payment is made, the payment may be subject to an additional tax of 10 percent for early distribution from a qualified retirement plan.

- You can roll over the payment to a Traditional or Roth IRA if the rollover is completed within 60 days of receiving payment.

If you choose a direct rollover to a Traditional IRA or other eligible plan:

- The payment will not be subject to federal income tax in the year the payment is made, and NYSLRS will issue you a 1099-R tax form the following January showing that this distribution is not taxable.

- Taxes will be deferred until you withdraw the funds from the IRA or other eligible plan.

- No federal income tax will be withheld from the payment.

If you choose a direct rollover to a Roth IRA:

Income Tax And National Insurance Contributions

After youve retired, you still have to pay Income Tax on any income over your Personal Allowance .

This applies to all your pension income, including the State Pension.

Many people assume that their pension income especially the State Pension will be tax-free, but thats not the case.

Some income, including your State Pension, is paid without any tax being taken off. But it doesnt mean that tax isnt due.

If you have to pay tax on your State Pension, this will usually be collected through any personal or workplace pension you might have.

National Insurance contributions are payable from the age of 16 to State Pension age. So if you continue working beyond the State Pension age, you no longer pay National Insurance contributions on your earnings.

You dont pay National Insurance on any income from a pension.

You May Like: State Of California Sales Tax

Tax Implications Of Lump

No income tax will be deducted from any payment to a registered retirement savings plan , locked-in retirement account , life income fund , the registered pension plan of a new employer or a life insurance company to purchase a deferred lifetime annuity.

Any payment not transferred to an RRSP, LIRA, LIF or RPP will have income tax deducted. Tax is deducted at the following rates for Canadian residents, where applicable:

- 10 per cent for payments of $5,000 or less

- 20 per cent for payments of $5,000.01 to $15,000

- 30 per cent for payments of $15,000.01 or more

If you are not a Canadian resident at the time of the lump-sum payment, the amount of tax withheld is based on the country of residency .

The above flat rates are set by the Canada Revenue Agency. These rates do not represent the actual tax that you may owe, which is calculated based on your personal tax rate when you file your tax return for the year in which you receive the lump-sum payment.

Where Can I Retire On 4000 A Month

Below, we round up the top five places to retire for $4,000 a month or less.

- If You Want Your Money to Go a Long Way: El Paso, Texas. …

- If You Enjoy an Outdoorsy Lifestyle: Albuquerque, New Mexico. …

- If You Want to Be Near the Beach: Sarasota, Florida. …

- If You Crave Quality Arts and Culture: Colorado Springs, Colorado.

You May Like: How To Check If Your Taxes Were Filed

Additional Options And Considerations

If you take a lump-sum distribution, even using Form 4972, the retirement plan administrator typically withholds 20% of your withdrawal and sends it to the IRS on your behalf.

- If your ultimate tax liability is lower than 20%, you can claim that part back when you file your taxes.

- If you change your mind and decide to roll over your distribution into another tax-advantaged account within 60 days, then you will likely receive a tax refund of most of the money.

- However, if you do not rollover the entire distribution, including the 20% sent to the IRS on your behalf, the amount that doesnt get rolled over will be taxable income.

One way to minimize the tax burden of a retirement plan withdrawal is to take smaller periodic distributions rather than one large lump sum. Smaller distributions can help you avoid large tax-bracket jumps and hopefully allow more of your money to continue growing tax-deferred in your account.

Whether you have stock, bonds, ETFs, cryptocurrency, rental property income or other investments, TurboTax Premier has you covered. Filers can easily import up to 10,000 stock transactions from hundreds of Financial Institutions and up to 4,000 crypto transactions from the top crypto exchanges. Increase your tax knowledge and understanding all while doing your taxes.

Backdated State Pension Claims

Important note: The special tax rules on this page do not apply to any payments you might receive when you backdate a claim to the state pension . They apply only to lump sums accrued when deferring pre-6 April 2016 state pensions.

You can backdate a claim to the state pension by up to 12 months. So if, for example, you reach state pension age on 1 October 2022 but do not claim it at that time, up to 30 September 2023 you can still backdate your claim as if you had originally made it at 1 October 2022.

In such cases, the state pension will be taxed in the year it would have been paid, had the claim been made at the appropriate time. Therefore, using 1 October as in the above example, any state pension that would have been due to be paid to you between 1 October 2022 and 5 April 2023 will be taxable in the 2022/23 tax year. Any amount due from 6 April 2023 will then be taxable in 2023/24.

This is effectively just a catch-up payment of the state pension you would have been due to receive if you had claimed it earlier, so there is no special tax treatment in this situation.

Don’t Miss: California Used Car Sales Tax

Consider The Rest Of Your Finances

If you have considerable financial resourcesbrokerage, 401, IRA, business assetsand other sources of reliable monthly income you may have less of a need for another source of lifetime income. Taking a lump sum could help you pay off debts. On the other hand, if you’re concerned about covering your essential monthly expenses and like the idea of having a source of guaranteed monthly income, that could favor the annuity over a lump sum.

How Much Can I Earn Before Paying Tax On My Pension

The standard personal income allowance in the UK is £12,570 you can earn this amount before having to pay tax. Income from a pension is classed as personal income, so only withdrawing up to your personal allowance in a tax year, means you wont be liable to pay income tax. Income from a pension is classed as personal income, so only withdrawing up to your personal allowance in a tax year, means you wont be liable to pay income tax.

Its worth considering that earnings from property, interest on savings over your savings allowance, or money taken from a pension pot are all classed as personal income and therefore will be subject to income tax based on the rates below.

This does not include Scotland where the tax bands are slightly different.

Don’t Miss: How Is Property Tax Paid

How Much Will I Receive

A PLS payment is a percentage of the value of your retirement benefit at the time you retire.

The chart below outlines PLS payment percentages available to you based on the number of years you have been eligible to retire.

| 5, 10, 15, 20 or 25% |

To estimate how much you would be eligible to receive:

- , and under My Account Summary, click Estimate my Pension Benefit. After you enter your basic retirement selections and click Create Estimate, eligible members will have access to a drop-down menu to see the amount you would receive under each of the PLS percentages that you are eligible for.

- Most eligible members can use the Quick Calculator on our website to create an estimate based on the information you enter. After you enter your tentative retirement information and click Estimate Single Life Allowance, youll be able to click a link at the bottom of the page if you are interested in the PLS option. Note: The Quick Calculator is not available to sheriffs and correction officers.

- Contact us to request an estimate.