Im Counting On My Refund For Something Important Can I Expect To Receive It In 21 Days

Many different factors can affect the timing of your refund after we receive your return. Even though we issue most refunds in less than 21 days, its possible your refund may take longer. Also, remember to take into consideration the time it takes for your financial institution to post the refund to your account or for you to receive it by mail.

Im A Nonresident Alien I Dont Have To Pay Us Federal Income Tax How Do I Claim A Refund For Federal Taxes Withheld On Income From A Us Source When Can I Expect To Receive My Refund

To claim a refund of federal taxes withheld on income from a U.S. source, a nonresident alien must report the appropriate income and withholding amounts on Form 1040-NR, U.S. Nonresident Alien Income Tax ReturnPDF. You must include the documents substantiating any income and withholding amounts when you file your Form 1040NR. We need more than 21 days to process a 1040NR return. Please allow up to 6 months from the date you filed the 1040NR for your refund.

I Claimed The Earned Income Tax Credit Or The Additional Child Tax Credit On My Tax Return When Can I Expect My Refund

According to the Protecting Americans from Tax Hikes Act, the IRS cannot issue EITC and ACTC refunds before mid-February. The IRS expects most EITC/Additional CTC related refunds to be available in taxpayer bank accounts or on debit cards by March 1, if they chose direct deposit and there are no other issues with their tax return. However, some taxpayers may see their refunds a few days earlier. Check Wheres My Refund for your personalized refund date.

Wheres My Refund? on IRS.gov and the IRS2Go mobile app remains the best way to check the status of a refund. WMR on IRS.gov and the IRS2Go app will be updated with projected deposit dates for most early EITC/ACTC refund filers by February 19.

Don’t Miss: How Do The Rich Avoid Taxes

What Is Happening When Wheres My Refund Shows My Refunds Status As Approved

Weve approved your refund. We are preparing to send your refund to your bank or directly to you in the mail. This status will tell you when we will send the refund to your bank . Please wait 5 days after weve sent the refund to check with your bank about your refund, since banks vary in how and when they credit funds.

Wheres My State Tax Refund Tennessee

Tennessee residents do not pay income tax on their income and wages. The tax only applied to interest and dividend income, and only if it exceeded $1,250 . Taxpayers who made under $37,000 annually were also exempt from paying income tax on investment earnings. The state levied a flat 4% tax rate for 2017 and was phased entirely by January 1, 2021. A refund is unlikely for this income tax.

Also Check: Arizona Charitable Tax Credit List 2021

Why Do I See Irs Treas 310 In My Bank Statement

If you receive your tax refund by direct deposit, you may see IRS TREAS 310 listed in the transaction. The 310 code simply identifies the transaction as a refund from a filed tax return in the form of electronic payment. You may also see TAX REF in the description field for a refund.

If you see a 449 instead of 310, it means your refund has been offset for delinquent debt.

Who Is Eligible For A Tax Rebate

To be eligible for a refund, the administration said individuals must have filed a 2021 state tax return on or before Oct. 17, 2022. An individual’s credit may be reduced due to refund intercepts, including for unpaid taxes, unpaid child support and certain other debts.

Please note that:

- Both resident and non-resident filers are eligible

- Non-residents on whose behalf a partnership files on a composite basis are eligible

- Fiduciary filers are eligible

You May Like: What If I Already Paid Taxes On Unemployment

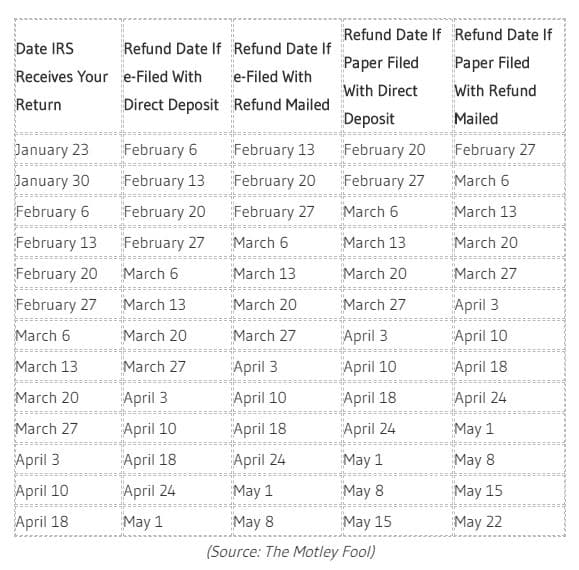

Irs Tax Refund Dates: When To Expect Your Refund

The estimated refund date chart is below if you just want to scroll down. Most Americans who are expecting an income tax refund receive it by direct deposit in as little as 2 weeks after filing electronically.

Will the 2022 tax filing season be normal? According to tax attorney Ken Berry, its not likely that when Spring 2022 comes around that everything will be like it was in 2019 or before. Covid-19 will still be a concern, several stimulus tax laws will still be challenging for some filers, and new tax laws may very well be created between now and then that add more complexity.

But the income tax filing process will likely be closer to normal than either 2020 or 2021 were, which both had extended filing deadlines due to closures of IRS offices, the tax courts, and IRS and tax firm staff being new to remote working.

In other words be ready to have your taxes filed The good news is that the federal and state income tax returns filing process should be closer to normal, as well. Depending on when a taxpayer files, they can often receive their tax refund payments within only 2-3 weeks.

Although the last two tax filing seasons were significantly impacted by the Covid-19 pandemic, and the IRS extended both deadlines, the IRS is not expected to extend the tax filing deadline for 2022.

Several factors can determine when a taxpayer may receive their tax return, including:

| May 23 |

Be Safe Hire a Professional

Other Notes:

What If You Cant File Your Income Taxes By April 15?

How Quickly Will I Get My Refund

We issue most refunds in less than 21 calendar days. However, if you filed on paper and are expecting a refund, it could take six months or more to process your return. Wheres My Refund? has the most up to date information available about your refund.

It is also taking the IRS more than 21 days to issue refunds for some tax returns that require review including incorrect Recovery Rebate Credit amounts, or that used 2019 income to figure the Earned Income Tax Credit and Additional Child Tax Credit .

Read Also: Calculate Capital Gains Tax On Real Estate

Claiming Earned Income Tax Credit Or Additional Child Tax Credit

A 2015 tax law called the Protecting Americans from Tax Hikes Act created built-in certain rules to help protect against tax fraud and identity theft. Part of this law includes a section that requires the IRS to withhold tax refunds for taxpayers who file a tax return claiming either the Earned Income Tax Credit and Additional Child Tax Credit .

Keep in mind it can take another week or so to receive the funds after being released by the IRS. Returns claiming the EITC or ACTC filed after this date may not be delayed.

Will The Refunds Be Treated As Taxable Income

The refunds are not taxable as income at the state level.

All tax refunds, including the 62F refunds, are taxable at the federal level only to the extent that an individual claimed itemized deductions on their fedreal return for tax year 2021. Refund recipients who itemized on their federal returns for 2021 will receive a Form 1099-G from the Department of Revenue by Jan. 31, 2023 to use when completing their 2022 federal return.

The administration plans to distribute the refunds on a rolling basis through Dec. 15. The administration had previously estimated refunds of about 13% of income tax liabilities.

Taxpayers who owed state personal income tax last year and already filed their 2021 return are eligible and do not need to take any additional steps to receive their refunds.

Information from State House News Service and Mass.gov was included in this report.

Don’t Miss: Irs Estimated Tax Payment Dates

Why Was My Refund Mailed Instead Of Being Deposited In My Bank Account

There are a couple of reasons that your refund would be mailed to you. Your money can only be electronically deposited into a bank account with your name, your spouse’s name or a joint account. If your bank rejected the deposit for some reason, it may be the next best way to get your refund.

In addition, the IRS can only direct deposit up to three refunds to one account, so if you are getting multiple refund checks they will have to be mailed. If you’re receiving a refund check in the mail, learn how to track it from the IRS to your mailbox.

It’s important to note that direct deposit isn’t always automatic for refunds. To be certain, sign in to your IRS account to check that the agency has your correct banking information.

Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But, you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS you should also submit a Change of Address to the USPS.

Don’t Miss: How Does The Electric Car Tax Credit Work

How The Treasury Offset Program Works

Here’s how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then TOP will send the entire amount to the other government agency. If you owe less, TOP will send the agency the amount you owed, and then send you the remaining balance.

Here’s an example: you were going to receive a $1,500 federal tax refund. But you are delinquent on a student loan and have $1,000 outstanding. TOP will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

The Internal Revenue Service can help you understand more about tax refund offsets.

Wheres My State Tax Refund Kansas

If youre waiting for a tax refund from Kansas, simply visit the Income and Homestead Refund Status page. There you can check the status of income and homestead tax refunds. You can also check your refund status using an automated phone service.

Taxpayers who filed electronically can expect their refund to arrive in 10 to 14 business days. This is from the date when the state accepted your return. If you filed a paper return, you will receive your refund as a paper check. The state advises people that a paper refund could take 16 to 20 weeks to arrive.

Recommended Reading: How To Avoid Paying Taxes On Crypto

Looking For Information About Your Tax Refund

E-file and sign up for Direct Deposit to receive your refund faster, safer, and easier! You can check the status of your refund using IRS Wheres My Refund?

Not using e-file? You can still get all the benefits of Direct Deposit by getting your tax refund deposited into your account. Simply provide your banking information to the IRS at the time you are submitting your taxes.

Convenience, reliability and security. No more special trips to your institution to deposit your check a nice feature if you are busy, ill, away from home, located far from a branch or in a place where parking is hard to find. You no longer need to wait for your check to arrive in the mail. Your money will always be in your account on time. If you move without changing financial institutions, you will not have to wait for your check to catch up with you. You do not have to worry about lost, stolen or misplaced checks.

We issue most refunds in less than 21 calendar days.

Use the IRS2Go mobile app or the Wheres My Refund? tool. You can start checking on the status of your tax return within 24 hours after we have received your e-filed return or 4 weeks after you mail a paper return.

The Treasury Bureau of the Fiscal Service’s Kansas City Regional Financial Center will be disbursing all tax refund direct deposits on behalf of the IRS. Information in the ACH Batch Header Record can be used to identify an IRS tax refund, as follows:

Direct Deposit

Wheres My State Tax Refund Virginia

If you want to check the status of your Virginia tax refund, head to the Wheres My Refund? page. Click on the link to check your refund status and then enter your SSN, the tax year and your refund in whole dollars. You will also need to identify how your filed . It is also possible to check your status using an automated phone service.

Taxpayers who file electronically can start checking the status of their returns after 72 hours. You can check the status of paper returns about four weeks after filing.

In terms of refunds, you can expect to wait up to four weeks to get a refund if you e-filed. If you filed a paper return, you can expect to wait up to eight weeks. Allow an additional three weeks if you sent a paper return sent via certified mail.

Read Also: What Is The Tax Rate On 401k Withdrawals

What If I’m Looking For Return Info From A Previous Year

The Where’s My Refund tool lists the federal refund information the IRS has from the past two years. If you’re looking for return details from previous years, you’ll need to check your IRS online account.

From there, you’ll be able to see the total amount you owe, your payment history, key information about your most recent tax return, notices you’ve received from the IRS and your address on file.

Your P800 Tax Rebate Calculation

Is a form showing you what tax you have overpaid and is based on all the information HMRC has about your income, work benefits and tax. It is absolutely crucial that you do not take HMRCs P800 calculation as always being correct, but do the maths yourself to double check.

They may have made a mistake or have incomplete or incorrect information about your circumstances. They are looking after millions of taxpayers you cant expect them to get everything right.

Don’t Miss: What Is Form 5498 For Taxes

You Might Be Due To Get A Tax Refund From Hmrc

If you overpaid your tax you might be in for a tax refund from HMRC. Situations might include:

- Self-assessment tax returns, particularly concerning your Payments on Account. If your actual takings are less than the predicted Payment on Account amount, and you paid it without any reduction, then you likely paid too much tax.

- You were on an emergency tax code when you started a new job.

- You have more than one job and you lose some of your personal allowance entitlement because the second job applies Basic Rate tax to your entire salary.

- Pay as you earn is connected to an incorrect tax code issued by HMRC, or your employer applies the wrong one.

- Work expenses tax reliefs and allowances.

- You are in the construction industry scheme .

There are other tax calculation circumstances that apply to individuals which may lead to an overpaid returnsuch as having more than one pension, leaving the country without using up your whole personal allowance, and redundancy payments to the UK gov. These are all reasons you might want to make a overpaid tax claim.

Advance Child Tax Credit Eligibility 2021

About Ryan Guina

Ryan Guina is The Military Wallet’s founder. He is a writer, small business owner, and entrepreneur. He served over six years on active duty in the USAF and is a current member of the Illinois Air National Guard.

Ryan started The Military Wallet in 2007 after separating from active duty military service and has been writing about financial, small business, and military benefits topics since then. He also writes about personal finance and investing at Cash Money Life.

Ryan uses Personal Capital to track and manage his finances. Personal Capital is a free software program that allows him to track his net worth, balance his investment portfolio, track his income and expenses, and much more. You can open a free Personal Capital account here.

Featured In: Ryan’s writing has been featured in the following publications: Forbes, Military.com, US News & World Report, Yahoo Finance, Reserve & National Guard Magazine , Military Influencer Magazine, Cash Money Life, The Military Guide, USAA, Go Banking Rates, and many other publications.

Read Also: How Long Does Taxes Take To Process

Wheres My State Tax Refund Oregon

You can check on your state income tax refund by visiting the Oregon Department of Revenue and clicking on the Wheres My Refund? button. This will take you to an online form that requires your ID number and the amount of your refund.

This online system only allows you to see current year refunds. You cannot search for previous years tax returns or amended returns.