Payments Not Accepted As Allowable Deductions

Not all payments to tax-exempt charities are deductible. The following are examples of payments not accepted as allowable donations:

- Payments for lottery or raffle tickets

- Payments for admission to film shows or charity shows

- Payments for grave spaces

- Payments made for services such as saying prayers or the reservation of a space for ancestral worship

- Purchase of goods in bazaars

- Payments made to a church, a tax-exempt charity, through dropping cash in the donation bag during Sunday masses except where donation receipts could be produced to prove the amount of donation made by the claimant.

Temporary Increase In Limits On Contributions Of Food Inventory

There is a special rule allowing enhanced deductions by businesses for contributions of food inventory for the care of the ill, needy or infants. The amount of charitable contributions of food inventory a business taxpayer can deduct under this rule is limited to a percentage of the taxpayers aggregate net income or taxable income. For contributions of food inventory in 2020, business taxpayers may deduct qualified contributions of up to 25 percent of their aggregate net income from all trades or businesses from which the contributions were made or up to 25 percent of their taxable income.

The Coronavirus Tax Relief and Economic Impact Payments page provides information about tax help for taxpayers, businesses, tax-exempt organizations and others including health plans affected by coronavirus .

This article generally explains the rules covering income tax deductions for charitable contributions by individuals. You can find a more comprehensive discussion of these rules in Publication 526, Charitable ContributionsPDF, and Publication 561, Determining the Value of Donated PropertyPDF. For information about the substantiation and disclosure requirements for charitable contributions, see Publication 1771PDF. You can obtain these publications free of charge by calling .

Cash Donations Less Than $250

You must prove the donation amount if you want to deduct it with one of these:

- Bank or credit union statements

- Canceled checks

- Donation amount

For donations you made by payroll deduction, you can prove your donations if you have both of these:

- Document showing the amount withheld, like a pay stub or W-2 from your employer

- Pledge card or other document from the organization. It must state that they dont provide goods or services for donations made by payroll deduction.

Read Also: Are Medical Insurance Premiums Tax Deductible

When You Give Money To A Charity Your Gift Is Often A Tax

Like many Australians, you might have a charity or cause thats close to your heart. Tax deductible donations are a great way to give your tax refund a boost, while contributing to a worthy cause you care about. It really is the definition of a win, win! Charities rely on the generosity of the people who donate money to support them, without the generosity of people like you, they wouldnt be able to do the great things they do to help good causes.

Every time you make a donation more than $2 to a registered charity, dont forget, your charitable donation is probably tax deductible.

Heres what you need to know to correctly claim tax deductible donations on your tax return.

What Is A Tax

A tax-deductible donation allows you to deduct cash or property you transfer to a qualified organization, such as clothing or household items. A qualified organization includes nonprofit religious, charity or educational groups.

You can check whether the organization is tax-exempt by searching the IRS Tax Exempt Organization Search Tool. Youll need the complete name of the entity or its employer identification number .

Generally, the amount you can deduct on your taxes is the fair market value of the property you donate, or the cash value. However, in some cases, the IRS may limit the amount you can claim on your taxes.

You can generally claim charitable contributions if theyre less than 60% of your adjusted gross income. You can find your AGI on line 11 of Form 1040. Depending on the type of property and the organization, the IRS may even reduce your contributions up to 50%, 30%, or 20%. If youre not sure about your contribution amount, you should consult a tax professional.

You May Like: Turbo Tax Customer Service Contact Number

Business Meals And Gifts

The 2017 tax reforms excluded entertainment expenses as deductible business expenses and limited meal deductions to 50%. But in 2021, business meals and beverages are now 100%, which includes takeout and delivery.

Gifts used for business purposes are deductible either in full or partially, depending on the business circumstances.

How Do Tax Write Offs Work The Basics

If your business runs from home there are things such as mortgage interest, state taxes or self employment costs, amongst others.

Therefore it is smart to itemize all of your expenses and costs.

In regards to this, tax preparation software, or a fantastic tax preparer, might help you navigate the labyrinth of tax breaks.

Nevertheless, it can help comprehend how do tax write offs work if you want to save on paying the high fees of a tax lawyer each year.

as you go throughout the year, ideally amassing invoices in route.

Read Also: Is Doordash Taxed

Don’t Miss: How Long Do Taxes Take To Process

Maximize Your Tax Deductions By Bunching Your Charitable Donations

If you want to make the most of your giving and usually make charitable donations over $10,000, consider the bunching strategy, which allows you to stack your gift-giving in a tax year.

Lets say youre single and you would like to give $10,000 annually to your favorite charity. But since you dont have any other itemized deductions, giving a gift of $10,000 wouldnt qualify you to claim the full donation as an itemized deduction .

In this case, you should consider the bunching strategy.

Heres how it works: You give $10,000 on Jan. 1 and another $10,000 on Dec. 31. This strategy allows you to claim the $20,000 gift as an itemized deduction on your tax return for the year in question instead of taking the standard deduction. The $20,000 deduction can reduce your taxes.

You Can Feel Good About It

Does doing something good make you feel good? For many people the answer is yes. A survey by the Charities Aid Foundation found the top motivating factors for charitable giving are all positive ones. Ninety-seven percent of donors say their personal values motivate them to give, 96% cite their sense of ethics, and 75% note their belief in a specific cause. And 42% agreed the positive feeling they got from donating was a key factor in their decisions to give.

Read Also: Do I Need Letter 6475 To File Taxes

How Do I Claim Charity Donations On My Tax Return

All you need to do to claim your donation on your tax return is ensure you:

- Donate to a charity endorsed by the ACNC as a DGR

- Contribute an amount greater than $2

- Keep your receipt as proof of your gift

You must keep the receipts for any donations that you wish to deduct from your taxable income. The ATO says you should keep records of donations to DGRs for five years after lodging a claim in your tax return, as they can request proof from you in that time frame.

The only exception to this is if you made donations of $2 or more to bucket collections conducted by an approved organisation for natural disaster victims. You can claim a tax deduction equal to your contribution without a receipt, provided the contribution does not exceed $10, said a spokesperson from the ATO.

What Is The Standard Deduction

To itemize your deductions and get proper credit for your donations the total of your deductions must exceed the standard deduction. For the 2021 tax year, the standard deduction is:

- $25,100 for married couples filing jointly, up $300 from 2020

- $12,550 for single taxpayers and married individuals filing separately, up $150 from 2020

- $18,800 for heads of households, up $150 from 2020

Taxpayers who are blind or at least 65 are eligible to claim an additional $1,350 standard deduction in 2021, or $1,700 if filing as single or head of household. The deduction is doubled for taxpayers who qualify as both.

For the 2022 tax year, the standard deduction will be

- $25,900 for married couples filing jointly, up $800 from 2021

- $12,950 for single taxpayers and married individuals filing separately, up $400 from 2021

- $19,400 for heads of households, up $600 from 2021

Also Check: 401k Roth Vs Pre Tax

What You Can Deduct

You or your business can deduct cash or non-cash gifts of property or equipment (called in-kind contributions.

If you personally have made non-cash contributions over $500 in any year, you must file Form 8283 with your tax return, providing information on the donated property. If your non-cash contribution is greater than $5,000 you must have at-the-time written acknowledgment, along with Form 8283.

You can also deduct mileage and other travel expenses incurred in working for a charitable organization, at the IRS-designated standard mileage rate for charitable work or actual expenses.

Quid Pro Quo Contributions

For certain donations, some calculation is required to determine the amount that can be deducted. These include quid pro quo donations for which the donor receives an economic benefite.g., goods or servicesin return for the gift.

For example, if a donor receives a T-shirt in return for making a donation, the deduction is limited to the amount of the contribution that exceeds the fair market value of the shirt. So, if the contribution is $40, and the fair market value of the T-shirt is $20, the deductible amount is $20 .

The same rule applies for contributions for events like charity dinners, for which the fair market value of the meal must be subtracted from the cost of the event to determine the amount of the deduction.

Recommended Reading: How Long Do Tax Returns Take

Charities Accepting Tax Deductible Donations

Even though your donation may be used for a good cause, that doesn’t necessarily mean that you can deduct it. Only contributions to certain charitable organizations are deductible. For example, you probably can’t deduct a donation given through a GoFundMe page to help a local business that’s struggling or a neighbor whose house burned down.

Fortunately, there’s an easy way to determine if donations you make to an organization are tax-deductible charitable contributions. The IRS’s online “Tax Exempt Organization Search ” tool will tell you if an organization is tax-exempt and eligible to receive tax-deductible charitable contributions.

Tax Planning Is Critical

To maximize the tax benefit of your charitable giving strategy, careful planning can be helpful. Consider working with your tax, legal and financial professionals to determine the most efficient assets, timing, amount, and forms of the gifts youd like to make.

Learn how U.S. Bank can help you and your family develop a charitable giving strategy.

Read Also: How Does Withholding Tax Work

You Must Itemize To Claim A Charitable Tax Deduction

People who took the standard deduction on their 2020 or 2021 tax return could also claim a tax deduction of up to $300 for cash donations to charity. That deduction wasn’t available to taxpayers who claimed itemized deductions on Schedule A .

However, the $300 deduction wasn’t extended past 2021. As a result, you can’t claim a charitable donation tax deduction on your 2022 tax return. For 2022 and beyond, the only way to write off gifts to charity is to itemize.

Here’s a tip if your standard deduction is a little bit higher than your itemized deductions: Consolidate expected charitable deductions from the next few years into the current tax year. With this strategy known as “bunching” you may be able to boost your itemize deductions for the current year so that they exceed your standard deduction amount. Also consider using a donor-advised fund if you’re bunching donations. With a donor-advised fund, you make one large contribution to the fund and deduct the entire amount as an itemized deduction in the year you make it. Money from the fund is then sent to the charities of your choice over the next few years when you’re claiming the standard deduction.

Books And Legal And Professional Fees

Business books, including those that help you do without legal and tax professionals, are fully deductible as a cost of doing business.

Fees you pay to lawyers, tax professionals, or consultants generally can be deducted in the year incurred. But if the work clearly relates to future years, they must be deducted over the life of the benefit you get from the lawyer or other professional.

You May Like: Do 16 Year Olds Have To File Taxes

Contributions Donations And Gifts

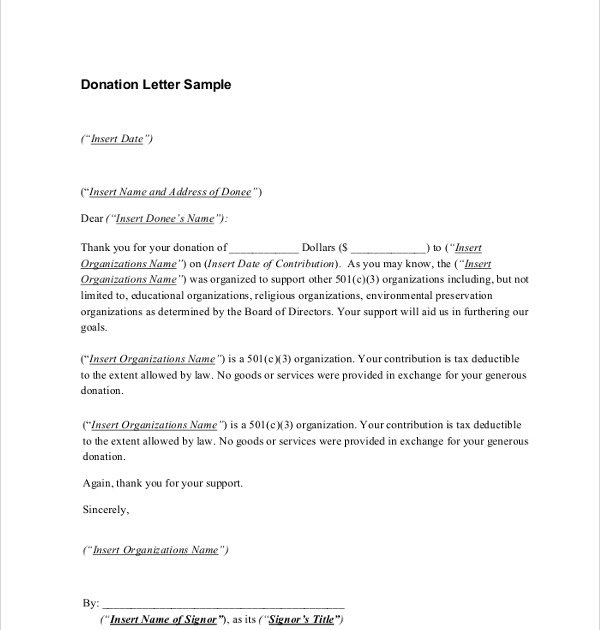

The words contribution,donation, or gift are typically used to refer to money or property received from a donor. These words mean essentially the same thing and are often used interchangeably. In the nonprofit world, however, people tend to use the word donation for small gifts say an item of clothing and reserve the word contribution for larger gifts real estate, for example.

Charitable deductions are claimed by donors on their individual tax returns . It is up to the donor and his or her tax adviser not the nonprofit that receives a donation to determine how much to deduct, and when and how to deduct it. The nonprofits role in the charitable tax deduction process is fairly limited. Subject to some important exceptions, a nonprofit is not required to report donations to the IRS or make any tax filings when it receives a donation. The nonprofits main responsibility is to make sure it complies with any substantiation and documentation requirements for the donations it receives.

How Do I Claim A Tax Deduction

Recommended Reading: How Much Tax Is Deducted From Paycheck In Florida

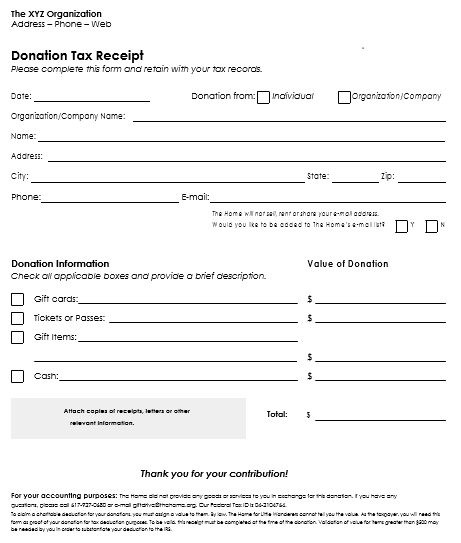

How Much Can You Write Off For Donations Without A Receipt

There is no specific charitable donations limit without a receipt, you always need some sort of proof of your donation or charitable contribution. For amounts up to $250, you can keep a receipt, cancelled check or statement. Donations of more than $250 require a written acknowledgement from the charity.

Qualifying Organizations For Charitable Tax Deductions

Donations are eligible for tax write-offs only if you make them to qualified organizations. An organization has to have received the 501 designation from the IRS for it to qualify as a charitable organization in terms of deduction donations for tax purposes, said accountant Eric Nisall, founder of AccountLancer, which provides accounting, tax and consulting services for freelancers.That means your neighbors kids Little League team selling raffle tickets isnt a tax write-off unless the team holds that certification.

Its a good idea to check first with the IRS Tax Exempt Organizations Search Tool, but generally, charitable gifts to the following types of tax-exempt organizations are tax-deductible donations:

- Churches, synagogues, temples, mosques, and other religious organizations

- Federal, state, and local governments, if your contribution is only for public purposes, such as a gift to reduce the public debt or maintain a public park

- Nonprofit schools and hospitals

- The Salvation Army, American National Red Cross, CARE, Goodwill Industries, United Way, Boy Scouts of America, Girl Scouts of America, Boys & Girls Clubs of America and others

- War veterans groups

- A nonprofit volunteer fire company

- Expenses you paid for a student living with you who is sponsored by a qualified organization

- Out-of-pocket expenses for serving as a volunteer for a qualified organization

Read Also: What Is The Easiest Online Tax Service To Use

Also Check: How Long Does My Tax Return Take

What Does It Mean To Write Off Taxes In Canada

Writing off something on your taxes simply means deducting an amount permitted by the Canada Revenue Agency to reduce your taxable income. You can write-off numerous items on your taxes, ranging from child support payments to employment expenses.

Some tax write-offs also come in the form of non-refundable credits, which reduce the amount of tax you owe. Tax write-offs are beneficial to you as a taxpayer because they can save you money on your tax bill.

You May Like: Pastyeartax.com Reviews

No Goods Or Service Provided

No payments made for goods or services can be deducted from a donors taxes even if the payment was made to a 501 organization.

For example, if a person is going to a dinner event for a charity, the fee for the dinner may not be used as a tax deduction. Although, if a separate cash donation is made at the dinner, that amount may be deducted.

You May Like: Deadline For Filing 2020 Taxes

Business Travel Expenses Deduction

If you regularly travel for work, you might be eligible to subtract ordinary and necessary expenses incurred while you travel for work. These expenses might include transportation, airfare, meals, and accommodation.

However, any extravagant costs are exempt from this deduction. As a business owner, you can claim these deductions on Schedule C, Form 1040.

How Do I Calculate My Charitable Tax Credits

To calculate your charitable tax credit, you first need to determine the eligible amount of your charitable donations. Go to Making a donation to determine which organizations can issue official donation receipts, and what types of gifts qualify. Once you have determined that your donations are eligible, you must then determine the total amount of donations you wish to claim. In any one year, you may claim:

- donations made by December 31 of the applicable tax year

- any unclaimed donations made in the previous five years and

- any unclaimed donations made by your spouse or common law partner in the year or in the previous five years.

You can claim eligible amounts of gifts to a limit of 75% of your net income. For gifts of certified cultural property or ecologically sensitive land, you may be able to claim up to 100% of your net income .

Once you have determined the amount, use the Charitable donation tax credit rates table to calculate your charitable tax credit. There are two charitable tax credit rates for both the federal government and the provinces and territories. Any eligible amount you give above $200 qualifies you for a higher rate. The following example shows how to use the rate table.

Danielle lives in the province of Saskatchewan and donated $400 in 2013 to registered charities:

Don’t Miss: When Does Tax Season End 2022