Why You Should Consider Filing Anyway

Even if you are not required to file your taxes during this tax year, it may be beneficial to file and potentially earn a refund in the upcoming year. If you do not file taxes, you are unable to earn any refund that may be owed to you. Some examples of refunds you may qualify for include the First Time Homebuyers credit, the Health Coverage Tax Credit, the American Opportunity Credit, and the Child Tax Credit. There are many other qualifiers that could ultimately provide you a tax refund in the coming year, and it is worth exploring the options and filing your taxes even if you are not required.

Is It Better To Claim 1 Or 0

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. If your income exceeds $1000 you could end up paying taxes at the end of the tax year.

Dont Miss: Oklahoma Tag Title And Tax Calculator

What Is Your Childs Income Tax Rate

The first $1,150 of unearned income is covered by the kiddie tax standard deduction, so it isnât taxed. The next $1,150 in unearned income is taxed at the childâs tax rate, which is ordinarily lower than the parentâs. Income over $2,300 is taxed at the parentâs maximum income tax rate.

Figuring the kiddie tax can be complex. For example, if a parent has more than one child subject to the kiddie tax, the net unearned income of all the children has to be combined, and a single kiddie tax calculated.

For federal income tax purposes, the income a child receives for personal services is the childâs, even if, under state law, the parent is entitled to and receives that income. So, dependent children pay income tax on their earned income at their own individual tax rates.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

Read Also: Tax Filing Deadline 2021 Extension

What Happens If You Dont Declare Income From Other Sources

Not declaring this income amounts to tax evasion and could fetch a notice from the tax department, says Sudhir Kaushik, Co-founder and CFO, Taxspanner.com. Things become more serious if the undeclared income is substantial and tax has not been paid on it. The taxpayer could be slapped with a late payment penalty.

How Can I Get An Earned Income Tax Credit

The Earned Income Tax Credit is a refundable credit that reduces your tax bill dollar-for-dollar, unlike a tax deduction which reduces the amount of taxable income you have. This credit was created to help supplement salaries for low-income individuals and can be claimed whether or not you have children.

But similar to determining your minimum income requirement to file taxes, it can be complicated to determine your eligibility for the Earned Income Tax Credit . To learn more about IRS Notice 797 and the Earned Income Tax Credit, visit the IRS website.

Read Also: How To Report Tax Fraud To The Irs

The Tax Code Has Specific Rules About Who Needs To File A Federal Income Tax Return If You Didnt Earn A Lot Of Money You May Be Below The Minimum Income To File Taxes

While youre generally not required to file a federal income tax return if you earn less than the filing threshold, it could still be in your benefit to file. For example, if your employer withheld federal income tax from your wages, filing a return is the only way to get that money back. And you may be eligible for refundable tax credits like the earned income tax credit but you have to file a return to claim them.

Lets look at some things to consider before you decide to skip the filing process.

How Has The Earned Income Tax Credit Changed In 2022

For those without children, the Earned Income Tax Credit has changed significantly this year. Only taxpayers who have no children and are between the ages of 25 and 65 are eligible for a maximum EITC of $560. This means seniors are no longer eligible for the EITCunless they have dependents.

| Family size |

Recommended Reading: What State Has Highest Taxes

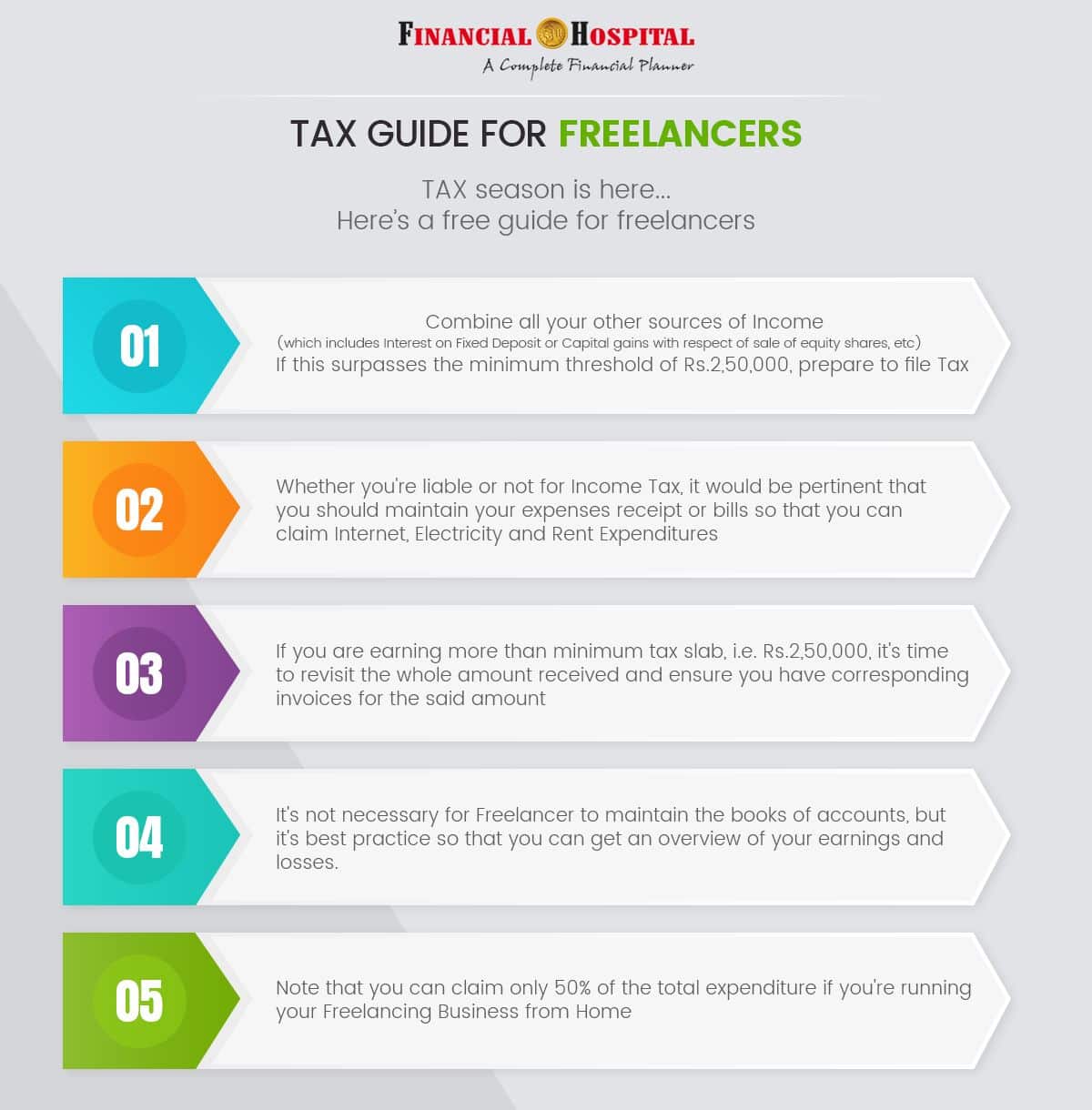

How Can I Avoid Paying Taxes On Side Jobs

Here are some ways you can keep your side hustle from messing up your taxes:

What If I Only Receive Social Security Benefits

In most cases, if you only receive Social Security benefits you wouldn’t have any taxable income and wouldn’t need to file a tax return.

One catch with Social Security benefits is if you are married but file a separate tax return from your spouse who you lived with during the year. Then you will always have to include at least some of your Social Security benefits in your taxable income to see if it is greater than your standard deduction. If your taxable income is greater than you standard deduction, you would need to file a return.

You May Like: Long Term Capital Gain Tax Calculation

Do I Need To Do Anything Different When Filing My Taxes

No, if you are making a lower income, you do not need to do anything differently when filing your federal income taxes. If you fall below the $12,200 minimum income requirement, technically you do not need to file at all.

Again, we still do not advise doing this, as its better to have it on the record that you attempted to pay your taxes, for that particular tax year. Lower end earners may also qualify for a tax credit that higher income earners do not qualify for, as well.

Does Irs Check Your Bank Account

The Short Answer: Yes. The IRS probably already knows about many of your financial accounts, and the IRS can get information on how much is there. But, in reality,the IRS rarely digs deeper into your bank and financial accounts unless youre being audited or the IRS is collecting back taxes from you.

Also Check: What Percentage Is Self Employment Tax

Do Students Have To File Taxes

Students who are claimed as single dependents do not need to file a tax return if they have earned less than $12,200, the same as the dependent tax information outlined above.

Going to school and juggling classes is already stressful, so its important to know whether you need to add doing taxes into the mix as well. If you can be claimed as a dependent, youll need to file taxes if:

- Your earned income is more than $12,200

- Your unearned income is more than $1,100

- Your business or self-employment net income is at least $400

- Your gross income exceeds the total 2019 threshold

How Much Do You Have To Make If You’re A Dependent

You may still have to file a tax return even if you’re being claimed as a dependent, depending on a number of factors. There’s the earned income you make, the unearned income you make , and your gross income, and the minimums for all of these will be determined by either your age or whether or not you are blind.

You May Like: Where.is.my Tax Refund

Can I File A Tax Return Using A Tax Return Form

Yes, that is possible if you cannot or do not want to file a tax return online.

In the following situations you can only file a tax return using a paper tax return form:

- In the tax return year, you lived in more than 2 countries.

- You are filing a tax return on behalf of a deceased person.

- You made a profit from a business in the tax return year.

- You have a partner who lived in the Netherlands and in the tax return year, you did not make a choice for being considered a resident taxpayer.

Read below which tax return form you use.

You May Like: When Is The Income Tax Due

Do I Have To Report Income Under $600

Yes, unless the income is considered a gift, you need to report all income that is subject to US taxation on your tax return. The $600 limit is just the IRS requirement for Form 1099-MISC to be considered necessary to file by the payer. You will report this income as other miscellaneous income on line 21 of your 1040.

Don’t Miss: What Will My Tax Return Be

Who Should File A Tax Return

Most U.S. citizens and permanent residents who work in the United States need to file a tax return if they make more than a certain amount for the year.

You may want to file even if you make less than that amount, because you may get money back if you file. This could apply to you if you:

- Have had federal income tax withheld from your pay

- Made estimated tax payments

- Qualify to claim tax credits such as the Earned Income Tax Credit and Child Tax Credit

How Evolution Tax And Legal Can Help With Your Expat Tax Return

Our team of dually-certified accountants and lawyers has the expertise needed to help you file your expat returns, and optimize your tax filing as much as possible to save you money. We are a team of seasoned international tax experts, who understand the intricacies and will use our expertise to find the tax solutions that will suit you. Contact the team to get started filing your expat tax return today.

Read Also: New Mexico State Tax Refund

Uncommon Income Tax Filing Situations

There are even more situations where you will still have to file income taxes with the IRS, even if you dont meet the minimum income. For example, if you owe any special taxes.

These could come from an IRA , in which case IRS Form 5329 would be utilized. There are also things like the Alternative Minimum Tax, as well as the Medicare tax, and even Social Security.

These could be utilized for tips you received but did not report to your employer or if an employer did not withold these taxes from any paychecks they gave you. Another unique situation is self-employment where you must report any earnings of at least $400 and any money over $108.28 earned from a tax exempt organization .

Penalty For Failure To Pay Or Underpayment Of Estimated Tax

Revised Statute 47:118authorizes a penalty for failure to pay or underpayment of estimated income tax. The penalty is 12 percent annually of the underpayment amount for the period of the underpayment.

Determination of the Underpayment Amount

Determination of the Underpayment PeriodThe underpayment period is from the date the installment was required to be paid to whichever of the following dates is earlier:

Notification of Underpayment of Estimated Tax Penalty

Don’t Miss: Free Tax Filing H& r Block

Age And Status Requirements For Dependents

Being claimed as a dependent on someone elses taxes changes the rules a bit, and it does not rule out the possibility that you will still be required to file. If you are an adult, working dependent, you will likely be required to file your own return.

| Under 65 | $12,400 earned |

| 65 or older OR blind | $14,050 earned |

| 65 or older AND blind | $15,700 earned |

| Under 65 | $12,400 earned OR Your gross income was at least $5 and yourspouse files a separate return and itemizes deductions. |

| 65 or older OR blind | $13,700 earned income OR Your gross income was at least $5 and yourspouse files a separate return and itemizes deductions |

| 65 or older AND blind | $15,000 earned OR Your gross income was at least $5 andyour spouse files a separate return and itemizes deductions |

Minimum Income Requirements Under Age 65 With Married Dependent

If you can be claimed as a dependent on someone elses return and are married, you will need to file a tax return if your income meets any of the following thresholds.

- If you file a married filing separate return and your spouse itemizes on their return.

- Your unearned income was more than

Also Check: How Do I Get My Tax Transcripts

What Is The Minimum Income Required To File A Tax Return I Cannot Find Anything On The Irsgov Website For My Children Who Had Summer Jobs With W2s

Even if youâre a dependent, youâll generally need to file your own 2021 tax return if:

- Your unearned income exceeds $1,100

- Your business or self-employment net income is at least $400

- Your gross income exceeds the larger of $1,100 or your earned income plus $350

But even if your income falls below these filing requirements, youâll want to file your own tax return to get a refund of any federal or state taxes withheld from your paychecks.

Donât Miss: What Is The Tax Percentage Taken Out Of My Paycheck

The Rules For Adults And Dependent Children

The rules change when someone can claim you on their tax return. In this scenario, you may have to file a federal tax return even if your income is lower than shown in the chart above. The thresholds look different because the IRS separates your gross income into two categories earned income and unearned income.

Earned income is the money you make by working for someone else or running your own business. Your unearned income includes investment income like interest, dividends or capital gains. It may also include canceled debt, taxable Social Security benefits, pensions and more.

The rules for when a dependent must file can be confusing, so be sure to read the threshold rules carefully. Theyre generally included in the instructions for each years Form 1040. You can also learn more in IRS Publication 501.

Recommended Reading: How Long Do Taxes Take To Process

Corporate Estimated And Alternative Minimum Taxes In California

The State of California imposes a flat corporate tax of 8.84% for most businesses. This rate applies to C Corporations and LLCs elected as corporations.

S Corporations must pay a corporate tax of 1.5% in California. Other businesses pay the alternative minimum tax at 6.65% wherever applicable.

Businesses must make estimated quarterly income tax payments to their respective state departments as well as to the IRS when applicable.

When Can You Start Filing Taxes For 2021

Starting next Monday, Jan. 1, the Internal Revenue Service will begin accepting and processing 2021 tax returns. Due to an early start date of the current tax season, this is 17 days earlier than the late start date for the previous one. In case you still need it, you might need to have certain items together.

You May Like: Do You Pay Tax On Life Insurance

You May Like: Live In One State Work In Another Taxes

What Income Does Not Need To Be Reported

Asked By : Connie Schrenk

The minimum income amount depends on your filing status and age. In 2021, for example, the minimum for single filing status if under age 65 is $12,550. If your income is below that threshold, you generally do not need to file a federal tax return. Review the full list below for other filing statuses and ages.

Qualifying Rules If You Can Be Claimed As A Dependent

You must file a tax return for 2021 under any of the following circumstances if you’re single, someone else can claim you as a dependent, and you’re not age 65 or older, or blind:

- Your unearned income was more than $1,100.

- Your earned income was more than $12,550.

- Your gross income was more than $1,100 or $350 plus your earned income up to $12,550, whichever is greater.

Dependents who are students must include taxable scholarships and fellowship grants in their incomes.

Recommended Reading: Tax Preparation Services Springfield Il