Calculating Income Tax Rate

The United States has a progressive income tax system. This means there are higher tax rates for higher income levels. These are called marginal tax rates,” meaning they do not apply to total income, but only to the income within a specific range. These ranges are referred to as brackets.

Income falling within a specific bracket is taxed at the rate for that bracket. The table below shows the tax brackets for the federal income tax, and it reflects the rates for the 2021 tax year, which are the taxes due in early 2022.

How Tax Brackets Work

As mentioned earlier, the United States follows a progressive income tax system. In that scheme, not all income is treated equally.

Which, as long as we lack an appetite for a flat tax plan, makes a certain amount of sense as we shall attempt to demonstrate.

When someone talks about being in the 24% bracket, then, that doesnt mean all of their taxable income endures the same 24% bite, but instead only their taxable income above a certain amount .

This is the headache-inducing beauty of the American system of marginal rates.

Earning A Million Dollars A Year

While not common in medicine, public records do show that a number of our states highest-paid employees are employed by our public universities. The football and basketball coaches usually top the list, but the neurosurgeons and cardiothoracic surgeons often populate a few of the top 10 positions. Theres also an ophthalmologist in Oregon earning $913,335 per year in retirement as his pension, for an outlandish example.

Yes, thats insane to me, and no, Ive never earned anywhere near a million dollars a year, but there are docs like this out there. Ive featured a urologist earning seven figures and another physician earning upwards of $1.8 Million a year as a practice owner. Youll find more examples of such high earners in our interview series.

In this example, the couple will earn a cool one million dollars in one year. To keep the FICA taxation consistent with the other examples, well assume this was one income-earner, but its more likely to see this kind of total income from a dual-physician couple, probably in high-paying specialties and perhaps practicing some geoarbitrage.

After accounting for the same $64,100 in deductions for the tax-deferred retirement contributions and standard deduction, they owe income tax on 93.6% of their $1,000,000 income.

The TaxCaster calculationshows $282,806 owed in total federal income tax. Note that the Additional Taxes of $6,398 represent the additional Medicare Tax owed on income above $250,000.

Don’t Miss: California Used Car Sales Tax

How To Live Off Interest

The first thing to understand is how you live off interest. When we talk about living off of interest payments, were referring to whats called passive income. This means that your various assets generate enough money on their own to provide your monthly income. You dont have supplemental income or other work that adds to either your portfolio or your monthly budget.

Ideally, you also dont draw down on the core principal. You can do so, of course. For example, someone who took $75,000 per year out of a $2 million account could coast for more than 25 years before the account ran dry. But when we talk about living on the interest, were trying to decide if you can live indefinitely. This means that you dont touch the principal, only the interest and returns.

Case Study : $2 Million Portfolio With $3000 After

The first scenario provides Mary and Joe $3,000 per month of income from their $2 million portfolio. This is income they will need above and beyond any other sources such as social security or pensions. The money must last until they each reach age 95.

Here are some additional assumptions for case study 1:

-

Starting portfolio value: $2 million dollars

-

After-tax portfolio income per month: $3,000

-

Retirement age: 60

-

Retirement start date: January 1, 2022

-

Retirement time horizon: 35 years

-

Portfolio mix: 60% stocks 40% bonds

Using Monte Carlo Simulation, the probability that their money will last 35 years is 96%.

With such a low withdrawal rate, their money has a very high probability of lasting throughout retirement as outlined in figure 1 below.

Figure 1

Also Check: Corporate Tax Rate In India

Disabled Person Home Purchase Or Retrofit Credit

A permanently disabled person that buys a single-family home with accessibility features can claim a credit up to $500. If a permanently disabled person retrofits an existing single-family home with accessibility features, they can claim a credit up to $125. This credit can be carried forward for three years.

Can I Retire At 40 With $2 Million

Yes, you can retire at 40 with 2 million dollars. At age 40, an immediate annuity will provide a guaranteed income of $91,404 annually for a life-only payout, $99,648 annually for life with ten years certain payout, and $98,976 annually for life with 20 years certain payout. Payouts change frequently and vary by state.

You May Like: Tax Short Term Capital Gains

Federal Income Tax Calculator

for a 2022 Federal Tax Refund Estimator.Taxes are unavoidable and without planning, the annual tax liability can be very uncertain. Use the following calculator to help determine your estimated tax liability along with your average and marginal tax rates.

Use this federal income tax calculator to estimate your federal tax bill and look further at the changes in 2021 to the federal income tax brackets and rates.

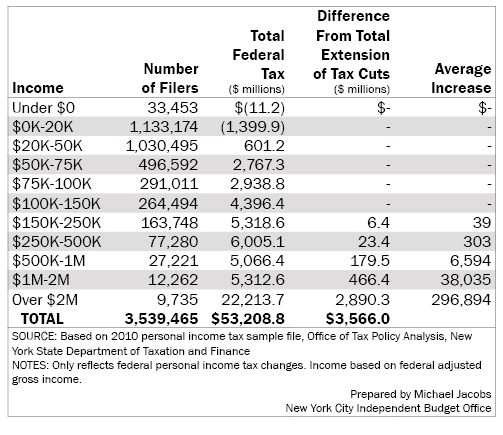

The Millionaires Who Pay The Highest Tax Rate

Warren Buffett and Mitt Romney have managed to create one of the enduring myths of our tax debate: that the rich pay a lower rate than the rest of America.

This may be individually true. Buffett pays a lower rate than his secretary and Romney pays a lower rate than most of us who make our living from salaries.

But nationally, the tax code is still broadly progressive. The more your make, the more taxes you pay as a percentage of your income.

According to new data from the IRS, people who make $1 million or more had an average tax rate of 20.4 percent in 2010. Tax filers who earned $30,000 to $50,000 paid an average rate of 4.8 percent, while those who made between $50,000 and $100,000 paid 7.7 percent. Those making under $30,000 had a negative effective rate, meaning they paid no federal income taxes after deductions and credits.

Put another way, millionaires pay a rate that’s more than four times that of the middle class.

One caveat: Rates go up as income goes up but only to a point. Once you hit a certain magic number among super-high earners, your tax rates start to fall slightly.

According to the IRS, average tax rates increase as income increases until you get to around $1.5 million in annual income. Once you make $2 million, average tax rates start to decrease. The average tax rate peaks at 25.1 percent for those making between $1.5 million and $2 million.

After that it starts to go down, and falls to 20.7 percent for those making $10 million or more.

Don’t Miss: Penalty For Filing Taxes Late If I Owe Nothing

Reported Income And Taxes Paid Increased In Tax Year 2019

Taxpayers reported nearly $11.9 trillion in adjusted gross income on 148.3 million tax returns in 2019. The number of returns filed rose by 3.9 million and reported AGI rose by $319 million above 2018 levels. Total income taxes paid rose by $42 billion to $1.58 trillion, a 2.7 percent increase above 2018. The average individual income tax rate was nearly unchanged: 13.29 percent in 2019, compared to 13.28 percent in 2018.

| $653 | $10,649 |

|

Note: Table does not include dependent filers. Income split point is the minimum AGI for tax returns to fall into each percentile. Income taxes paid is the sum of income tax after credits limited to zero plus net investment income tax from Form 8960 and the tax from Form 4970, Tax on Accumulation Distribution of Trusts. It does not include any refundable portions of these credits. Source: IRS, Statistics of Income, Individual Income Rates and Tax Shares. |

State Taxes On Capital Gains

Some states also levy taxes on capital gains. Most states tax capital gains according to the same tax rates they use for regular income. So, if you’re lucky enough to live somewhere with no state income tax, you won’t have to worry about capital gains taxes at the state level.

New Hampshire doesn’t tax income, but does tax dividends and interest. The usual high-income tax suspects have high taxes on capital gains, too. A good capital gains calculator, like ours, takes both federal and state taxation into account.

Recommended Reading: Bexar County Tax Assessor Collector San Antonio Tx

Why You Probably Can Live Off $2 Million

Some particularly budget-conscious households might be able to live off the return of Treasury debt at $34,000 per year. Though this is a small amount of money relative to your likely future needs. And even if you can pay your bills, it will almost certainly leave no room for error.

An index fund, however, could offer you an alternative to do this. The good news about an index fund is the simple numbers involved. At $200,000 per year in average returns, this is more than enough for all but the highest spenders to live comfortably. You can collect your returns, pay your capital gains taxes and have plenty left over for a comfortable lifestyle.

The bad news about an index fund is the variability. Over time major indices like the S& P 500 return to their averages. In any given year, though, returns will vary. For example, between 2012 and 2022 alone the S& P 500 posted annual returns of 29.6% , -6.24% and 26.89% . In between returns of nearly triple the average, the market also spent a year losing almost an entire years average gains.

Conveyances To Or From A Limited Liability Company

When a limited liability company is the seller or buyer in a deed transfer of a building containing up to four family dwelling units, Form TP-584 or Form TP-584-NYC cannot be accepted for filing unless accompanied by documentation that identifies the names and addresses of all members, managers and other of the LLC. If any member of the LLC is itself an LLC or other business entity, other than a publicly traded company, a REIT, a UPREIT, or a mutual fund, the names and addresses of the shareholders, directors, officers, members, managers and/or partners of that LLC or other business entity must also be provided until ultimate ownership by natural persons is disclosed.

The term means a person, whether or not a member, who is authorized by the operating agreement, or otherwise, to act on behalf of an LLC or foreign LLC.

The term natural person means a human being, as opposed to an artificial person, who is the beneficial owner of the real property. A natural person does not include a corporation or partnership, natural person operating a business under a d/b/a , an estate , or a trust.

Example: On September 16, 2019, RRP, LLC, a single-member LLC, is the seller in a deed transfer of a two-family house to an individual. RRP, LLCs single-member is ABC Partnership. ABC Partnership has four individual partners and one partner, RRP2, LLC, that is a multiple-member LLC. RRP2, LLC has three individual members. Provide documentation for:

Read Also: How To File An Extension Taxes

Who Pays The Tax

The base tax and additional base tax are paid by the grantor , and such tax shall not be paid directly or indirectly by the grantee except as provided in a contract between seller and buyer. However, if the seller doesn’t pay the tax, or is exempt from the tax, the buyer must pay the tax.

In the case of the conveyance of residential real property, if the transfer tax is paid by the buyer pursuant to a contract between the buyer and seller, the amount of tax shall be excluded from the calculation subject to tax.

Where the buyer has the duty to pay the transfer tax because the seller has failed to pay, the tax becomes the joint and several liability of the seller and the buyer provided that in the event of such failure, the buyer shall have a cause of action against the seller for recovery of payment of such tax by the buyer.

The mansion tax and supplemental tax are paid by the buyer. If the buyer doesnt pay the tax or is exempt, the seller must pay the tax.

In the case where the seller has the duty to pay the tax because the buyer has failed to pay, the tax becomes the joint and several liability of the seller and buyer.

Can I Retire At 50 With $2 Million

Yes, you can retire at 50 with 2 million dollars. At age 50, an annuity will provide a guaranteed income of $98,750 annually, starting immediately for the rest of the insureds lifetime. The income will stay the same and never decrease.If the annuitant selected the increasing income option, they would receive $72,000 annually initially, with the income amount increasing over time to keep up with inflation.Either lifetime income option will continue to pay the annuitant even after the annuity has run out of money. At the time of the annuitants death, the designated beneficiary will inherit the remainder of the annuity.

Don’t Miss: Are Medical Insurance Premiums Tax Deductible

Former Stockbroker Sentenced To 6 And A Half Years In Prison For 32 Million Dollar Investment Fraud Cheating On Taxes And Grandparent Scam

Contact:

A former licensed stockbroker was sentenced today to 78 months in federal prison for committing several felonies, including running a securities fraud scheme in which he targeted low-income Hispanic victims to obtain more than $3.2 million via false promises of high returns from construction loans.

Robert Louis Cirillo, of Chino Hills, was sentenced by United States District Judge David O. Carter, who also ordered him to pay $3,948,835 in restitution.

Cirillo pleaded guilty on June 28 to one count of securities fraud, one count of filing a false tax return, and one count of conspiracy to commit wire fraud.

From 2014 to 2021, Cirillo deceived more than 100 victims by lying to them that he would be investing their funds in short-term construction loans that would pay large return rates that ranged from 15% to 30% for a period of up to 90 days. As part of the scheme, Cirillo showed actual and prospective victim-investors fabricated bank statements that purported to show the investments’ growth.

In fact, Cirillo never invested the victims’ money and instead used it for his own personal expenses, including credit card payments, a trip to Las Vegas, and two automobiles a Jeep and an Alfa Romeo.

Cirillo targeted members of the Hispanic community, many of whom were of limited means, for his fraudulent scheme. One victim invested her life savings of $20,000 in Cirillo’s scheme.

IRS Criminal Investigation and the FBI investigated this matter.

Capital Gains: The Basics

Let’s say you buy some stock for a low price and after a certain period of time the value of that stock has risen substantially. You decide you want to sell your stock and capitalize on the increase in value.

The profit you make when you sell your stock is equal to your capital gain on the sale. The IRS taxes capital gains at the federal level and some states also tax capital gains at the state level. The tax rate you pay on your capital gains depends in part on how long you hold the asset before selling.

There are short-term capital gains and long-term capital gains and each is taxed at different rates. Short-term capital gains are gains you make from selling assets that you hold for one year or less. They’re taxed like regular income. That means you pay the same tax rates you pay on federal income tax. Long-term capital gains are gains on assets you hold for more than one year. They’re taxed at lower rates than short-term capital gains.

Depending on your regular income tax bracket, your tax rate for long-term capital gains could be as low as 0%. Even taxpayers in the top income tax bracket pay long-term capital gains rates that are nearly half of their income tax rates. That’s why some very rich Americans don’t pay as much in taxes as you might expect.

To recap: The amount you pay in federal capital gains taxes is based on the size of your gains, your federal income tax bracket and how long you have held on to the asset in question.

Also Check: How Do I Get My Tax Transcripts

Tallying Up The Taxes Of Lottery Winnings

OVERVIEW

If you find yourself holding a lottery ticket that doesnt bear the winning numbers of an epic Powerball drawing, take heart. Although the odds of winning a Powerball grand prize are only 1 in 292 million, they improve to 1 in less than 12 million for the smaller $1 million prize. Here’s an idea of what youll owe the IRS in taxes if you should win.

Tips To Help You Save For Retirement

- According to the Federal Reserve, 60% of those with self-directed retirement accounts are not confident about their investment decisions. If youre one of them, why not hire a financial advisor? SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Counting on Social Security benefits alone likely wont provide full support for your current lifestyle. But, benefits can definitely help with your living expenses in retirement. SmartAssets Social Security calculator will help you estimate how much of a benefit you can expect.

- And, if you want to figure out whether you are saving enough for retirement, SmartAssets free retirement calculator can help you determine how much you will need.

Read Also: Are Municipal Bonds Tax Free