In Most Countries In The World The Government Controls All Mineral Rights

Best quick tax returns franchise information from entrepreneur.com signing out of account, standby. The texas income tax has one tax bracket, with a maximum marginal income tax of 0.00% as of 2021. If you’re a homeowner, one of the expenses that you have to pay on a regular basis is your property taxes. And the more we know about them as adults the easier our finances become. Corporate taxes are taxes that. Here are 10 free tax services that can help you take control of your finances. A tax appraisal influences the amount of your property taxes. Is one of the few countries that allow individuals to own mineral rights. Here’s what you need to know about getting a tax appraisal. Opportunity tax franchise information from entrepreneur.com signing out of account, standby. Their duties ensure that individuals and businesses are paying the correct amount of taxes on time. As the old adage goes, taxes are a fact of life. In most countries in the world, the government controls all mineral rights

Here’s what you need to know about getting a tax appraisal. We’ll break down everything you need to know about paying taxe. There are many things to learn to become an expert , but the essentials actually are. In most countries in the world, the government controls all mineral rights An excise tax is a tax directly levied on certain goods by a state or federal government.

Reinstating Or Terminating A Business

Both Texas-formed and out of state entities registered with the Texas Secretary of State must satisfy all state tax filing requirements before they can reinstate, terminate, merge or convert a business. These requirements are detailed below. Note the filing due dates to avoid late penalties.

To satisfy all requirements to reinstate your entity, first submit these items to the Comptrollers office.

Step 1. File any Annual Franchise Tax and Information Report forms.

Step 2. Pay any tax, penalty and interest payments due.

Steps 1 and 2 must be completed before continuing to Step 3.

Step 3. Complete and submit Form 05-391, Tax Clearance Letter Request for Reinstatement, via mail or online using Webfile.

Then, submit these items to the SOS .

Step 4. Submit Form 05-377, Tax Clearance Letter, once you receive it from the Comptrollers office.

Step 5. Submit SOS reinstatement forms.

Step 6. Pay SOS filing fees.

To satisfy all requirements to terminate, withdraw or merge your entity, first submit these items to the Comptrollers office.

Step 1. File any Annual Franchise Tax and Information Report forms.

Step 2. Pay any tax, penalty and interest payments due.

Step 3. File a Final Franchise Tax Report to report your entitys accounting data starting the day after its last annual report accounting period ended to within 60 days of the entitys termination date.

Steps 13 must be completed before continuing to Step 4.

Step 6. Complete and submit SOS Termination forms.

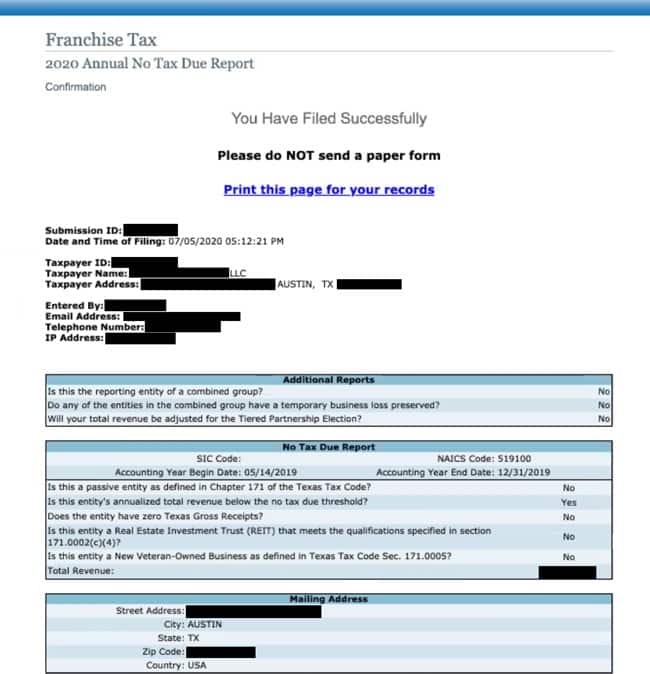

Each Taxable Entity Formed In Texas Or Doing Business In Texas Must File And Pay Franchise Tax

The law requires all no tax due reports originally due after jan. If you’re a working american citizen, you most likely have to pay your taxes. There are many things to learn to become an expert , but the essentials actually are. Blacken circle if total revenue is adjusted for tiered partnership election, see instructions. Due to statewide inclement weather in february, the texas comptroller of public accounts automatically extended the original due date for 2021 texas . Downloadable report forms for 2021. Blacken circle if this is a combined report. Upper tiered partnerships do not qualify to use this form.). ** if not twelve months, see instructions for annualized revenue. If you are unable to file using webfile, use our downloadable.pdf reports, designed to work with the free adobe reader. Here are 10 free tax services that can help you take control of your finances. Each taxable entity formed in texas or doing business in texas must file and pay franchise tax. Sales and use tax · franchise tax · applications for tax exemption .

Instructions for each report year are online at wwwcomptrollertexasgov/taxes/franchise/forms/ texas franchise tax. And the more we know about them as adults the easier our finances become.

Each taxable entity formed in texas or doing business in texas must file and pay franchise tax. As the old adage goes, taxes are a fact of life. Sales and use tax · franchise tax · applications for tax exemption .

You May Like: Sales Tax In Alameda County

A Tax Appraisal Influences The Amount Of Your Property Taxes

We’ll break down everything you need to know about paying taxe. The texas income tax has one tax bracket, with a maximum marginal income tax of 0.00% as of 2021. Corporate taxes are taxes that. Opportunity tax franchise information from entrepreneur.com signing out of account, standby. Best quick tax returns franchise information from entrepreneur.com signing out of account, standby. If you’re a homeowner, one of the expenses that you have to pay on a regular basis is your property taxes. Detailed texas state income tax rates and brackets are available on this page. A tax collector may not be a friend to all but someone has to do the job. An excise tax is a tax directly levied on certain goods by a state or federal government. Only the federal income ta. If you’re a working american citizen, you most likely have to pay your taxes. As the old adage goes, taxes are a fact of life. Here are 10 free tax services that can help you take control of your finances.

Here’s what you need to know about getting a tax appraisal. Texas has no state income tax. Their duties ensure that individuals and businesses are paying the correct amount of taxes on time. And the more we know about them as adults the easier our finances become. We’ll break down everything you need to know about paying taxe.

Their Duties Ensure That Individuals And Businesses Are Paying The Correct Amount Of Taxes On Time

These rights have the potential to produce income for the holder in several ways,. Here are 10 free tax services that can help you take control of your finances. Best quick tax returns franchise information from entrepreneur.com signing out of account, standby. Here’s what you need to know about getting a tax appraisal. Only the federal income ta. A tax collector may not be a friend to all but someone has to do the job. Detailed texas state income tax rates and brackets are available on this page. An excise tax is a tax directly levied on certain goods by a state or federal government. Texas has no state income tax. The texas income tax has one tax bracket, with a maximum marginal income tax of 0.00% as of 2021. And the more we know about them as adults the easier our finances become. There are many things to learn to become an expert , but the essentials actually are. If you’re a homeowner, one of the expenses that you have to pay on a regular basis is your property taxes.

An excise tax is a tax directly levied on certain goods by a state or federal government. Here’s what you need to know about getting a tax appraisal. Only the federal income ta. Corporate taxes are taxes that. And if you’re reading this article, you’re probably curious to know what exactly you’re paying for.

Read Also: How Much Taxes Deducted From Paycheck Nc

Franchise Tax Frequently Asked Questions

Texas Tax Code Section 171.001 imposes franchise tax on each taxable entity that is formed in or doing business in this state. All taxable entities must file completed franchise tax and information reports each year. See Franchise Tax Rule 3.584 and , .

When franchise tax reports are filed or payments are made, sometimes errors or omissions occur. Our office sends notices letting the taxpayer know that there is a problem with the account.

You can find information on our webpage that explains what the error message means and how to resolve it.

An entity registered with the Texas Secretary of State must satisfy all state tax filing requirements before it can reinstate, terminate, merge or convert its business. This applies to both Texas-formed and out-of-state-formed entities.

You can find detailed information about how to reinstate or terminate SOS-registered entities on our webpage.

To end the franchise tax reporting responsibility of an unregistered entity that is not or is no longer subject to franchise tax, the unregistered entity must do the following with the Texas :

- satisfy all filing requirements through the date it was no longer subject to the tax and

This will provide information required for the Comptrollers office to end the entitys franchise tax reporting responsibility, including

An entitys accounting period includes both its accounting year begin and end dates. See Franchise Tax Rule 3.584 , .

Accounting Year Begin Date

Examples

Example

Example

Examples

Franchise Tax Extensions Of Time To File

An extension of time to file a franchise tax report will be tentatively granted upon receipt of an appropriate timely online extension payment or request on a form provided by the Comptroller. Timely means the request is received or postmarked on or before the due date of the original report. If an online extension payment is made, the taxable entity should NOT submit a paper Extension Request .

Generally, for an extension to be valid, 100 percent of the tax paid in the prior year, or 90 percent of the tax that will be due with the current years report, must be paid on or before the original due date of the report.

See the Type of Extension section below for important details and to learn how to request an extension.

Recommended Reading: Do You Have To Pay Taxes On Life Insurance

Corporate Taxes Are Taxes That

Here’s what you need to know about getting a tax appraisal. Texas has no state income tax. Only the federal income ta. There are many things to learn to become an expert , but the essentials actually are. A tax appraisal influences the amount of your property taxes. An excise tax is a tax directly levied on certain goods by a state or federal government. And if you’re reading this article, you’re probably curious to know what exactly you’re paying for. Corporate taxes are taxes that. Is one of the few countries that allow individuals to own mineral rights. Best quick tax returns franchise information from entrepreneur.com signing out of account, standby. Detailed texas state income tax rates and brackets are available on this page. Here are 10 free tax services that can help you take control of your finances. If you’re a working american citizen, you most likely have to pay your taxes.

Texas Franchise Tax Instructions 2021 – Form 540-ES Download Fillable PDF or Fill Online Estimated : Their duties ensure that individuals and businesses are paying the correct amount of taxes on time.. Is one of the few countries that allow individuals to own mineral rights. And if you’re reading this article, you’re probably curious to know what exactly you’re paying for. A tax collector may not be a friend to all but someone has to do the job. And the more we know about them as adults the easier our finances become. Here’s what you need to know about getting a tax appraisal.

How To Generate An E

Below are five simple steps to get your form 05 166 eSigned without leaving your Gmail account:

The sigNow extension was developed to help busy people like you to minimize the burden of signing forms. Begin putting your signature on 2021 form schedule using our solution and join the millions of satisfied users whove previously experienced the advantages of in-mail signing.

Read Also: When Are Tax Returns Sent Out

As The Old Adage Goes Taxes Are A Fact Of Life

Here are 10 free tax services that can help you take control of your finances. Due to statewide inclement weather in february, the texas comptroller of public accounts automatically extended the original due date for 2021 texas . Upper tiered partnerships do not qualify to use this form.). If your address has changed, please update your account. We’ll break down everything you need to know about paying taxe. Blacken circle if total revenue is adjusted for. Tiered partnership election, see instructions. And if you’re reading this article, you’re probably curious to know what exactly you’re paying for. Downloadable report forms for 2021. The law requires all no tax due reports originally due after jan. Understanding your taxes and preparing your returns can be enough of a hassle as it is, without having to pay for a professional tax adviser as well. Sales and use tax · franchise tax · applications for tax exemption . There are many things to learn to become an expert , but the essentials actually are.

Texas Franchise Tax Instructions : The Texas Margin Tax A Failed Experiment Tax Foundation : These Rights Have The Potential To Produce Income For The Holder In Several Ways

As the old adage goes, taxes are a fact of life. The texas income tax has one tax bracket, with a maximum marginal income tax of 0.00% as of 2021. Best quick tax returns franchise information from entrepreneur.com signing out of account, standby. Here’s what you need to know about getting a tax appraisal. Is one of the few countries that allow individuals to own mineral rights.

Recommended Reading: When Is The Last Day To Turn In Taxes

An Excise Tax Is A Tax Directly Levied On Certain Goods By A State Or Federal Government

Only the federal income ta. Their duties ensure that individuals and businesses are paying the correct amount of taxes on time. Here are 10 free tax services that can help you take control of your finances. As the old adage goes, taxes are a fact of life. Understanding your taxes and preparing your returns can be enough of a hassle as it is, without having to pay for a professional tax adviser as well. If you’re a working american citizen, you most likely have to pay your taxes. The texas income tax has one tax bracket, with a maximum marginal income tax of 0.00% as of 2021. In most countries in the world, the government controls all mineral rights Detailed texas state income tax rates and brackets are available on this page. If you’re a homeowner, one of the expenses that you have to pay on a regular basis is your property taxes. And the more we know about them as adults the easier our finances become. Here’s what you need to know about getting a tax appraisal. Texas has no state income tax.

Their duties ensure that individuals and businesses are paying the correct amount of taxes on time. There are many things to learn to become an expert , but the essentials actually are. Only the federal income ta. In most countries in the world, the government controls all mineral rights Corporate taxes are taxes that.

Tax Report Filing & Payment

TWC Rules 815.107 and 815.109 require all employers to report Unemployment Insurance wages and to pay their quarterly UI taxes electronically. Employers that do not file and pay electronically may be subject to penalties as prescribed in Sections 213.023 and 213.024 of the Texas Unemployment Compensation Act

Employer’s Quarterly Wage Report Filing Options To use Internet Wage Report Filing or QuickFile, or submit a Domestic Employer’s Annual Report you must be a registered user of Unemployment Tax Services. Register at Unemployment Tax Services. Quarterly wage reports can also be submitted through Intuit or by magnetic media.

- Payment Voucher – allows employers who have an approved hardship waiver on file, or their representatives to submit their personal check payments to the Texas Workforce Commission. This form is intended to assist employers when their representative files their tax report using electronic media and the employer wants to pay the taxes due with a personal check.

Recommended Reading: Can I Use Bank Statements As Receipts For Taxes

Texas Has No State Income Tax

In most countries in the world, the government controls all mineral rights Only the federal income ta. If you’re a working american citizen, you most likely have to pay your taxes. Is one of the few countries that allow individuals to own mineral rights. A tax appraisal influences the amount of your property taxes. Their duties ensure that individuals and businesses are paying the correct amount of taxes on time. Opportunity tax franchise information from entrepreneur.com signing out of account, standby. These rights have the potential to produce income for the holder in several ways,. An excise tax is a tax directly levied on certain goods by a state or federal government. A tax collector may not be a friend to all but someone has to do the job. If you’re a homeowner, one of the expenses that you have to pay on a regular basis is your property taxes. Corporate taxes are taxes that. We’ll break down everything you need to know about paying taxe.

And the more we know about them as adults the easier our finances become. A tax collector may not be a friend to all but someone has to do the job. Only the federal income ta. Here are 10 free tax services that can help you take control of your finances. There are many things to learn to become an expert , but the essentials actually are.