Refunds Audits And Other Considerations

Both TurboTax and TaxAct let you receive a federal refund via direct deposit to a bank account thats the fastest option. Other options both offer include getting an old-fashioned paper check, applying the refund to next years taxes or directing the IRS to buy U.S. Savings Bonds with your refund.

Both providers offer an option to have your refund loaded onto a prepaid card. And both let you use your refund to pay for your tax-prep fees .

» MORE:See how to track the status of your tax refund

If you are audited, its important to know what kind of support youre getting from your tax software. First, be sure you know the difference between support and defense. With most providers, audit support typically means guidance about what to expect and how to prepare thats it. Audit defense, on the other hand, gets you full representation before the IRS from a tax professional.

TurboTax gives everyone free audit support from a tax pro to help you understand whats going on if you get that dreaded letter about your 2021, 2020 or 2019 tax return if TurboTax cant connect you with a pro, youll get a refund. If you want someone to represent you in front of the IRS, youll need TurboTaxs audit defense product, called MAX. It runs an extra $49 and includes features such as identity theft monitoring, loss insurance and restoration help.

Taxact Vs Turbotax 2022

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Competition is fierce among the biggest tax-prep software providers. TurboTax may be more widely recognized, but TaxAct is a fierce competitor with its free tax help.

One note on prices: Providers frequently change them. You can verify the latest price by clicking through to each provider’s site.

Why Don’t We Show The Price

Adding this item won’t require you to purchase the product. You can easily remove it from your cart if you decide not to buy it.

| Price: |

Note:

You May Like: How To Read Tax Return

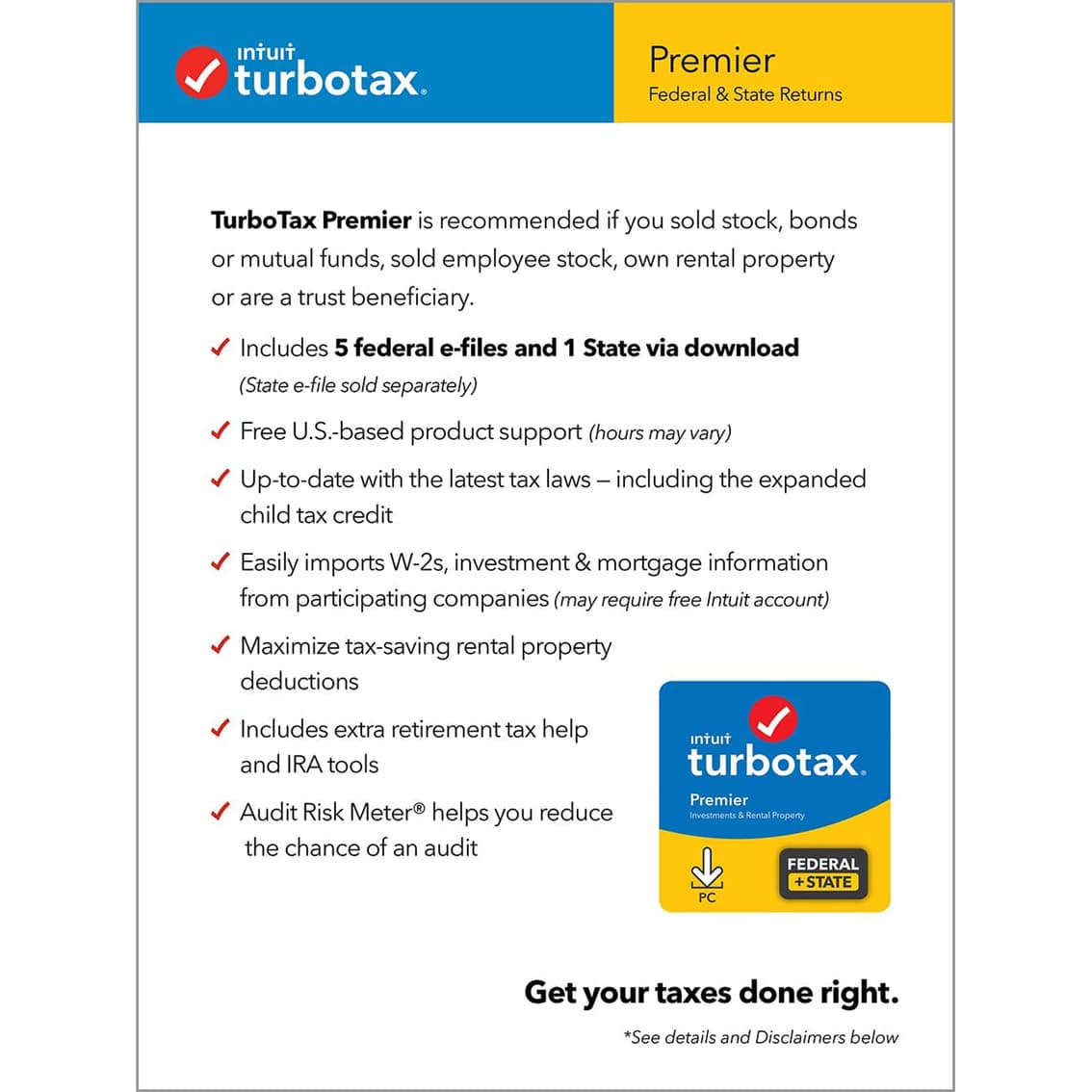

Turbotax Premier Is Recommended If Any Of The Following Apply:

- Need to file both Federal & State Tax Returns

- Sold stock, bonds or mutual funds

- Sold employee stock

Get your taxes done right with TurboTax 2021

TurboTax is tailored to your unique situationit will search for the deductions and credits you deserve, so youre confident youll get your maximum refund.

- Keep more of your investment and rental income

- Includes 5 free federal e-files and one download of a TurboTax state product. State e-file sold separately.

- Extra help for investment sales such as stocks, bonds, mutual funds, and employee stock plans

- Automatically imports W-2s, investment & mortgage information from participating companies

- Your information is safeguarded – TurboTax uses encryption technology, so your tax data is protected while it’s e-filed to IRS and state agencies.

Searches over350 tax deductions

- TurboTax finds every tax deduction and credit you qualify for to get you the biggest tax refund, guaranteed.

Double-checks your return

- TurboTax runs through thousands of error checks and double-checks your tax returns as you go to help make sure there are no mistakes.

100% accurate calculations

- TurboTax calculations are 100% accurate so your taxes will be done right, guaranteed, or we’ll pay you any IRS penalties.

WINDOWS SYSTEM REQUIREMENTS

MAC SYSTEM REQUIREMENTS

| Commonly Filed Tax Forms and Schedules |

|---|

| 1040 |

How To Upload Your 1099 To Turbotax

Were excited to support Intuit TurboTax this tax season. You can use TurboTax Premier or TurboTax Premier Live to automatically import your trade history directly into their software. Remember to use this link so you can claim a discount of up to $15. This offer is available for customers with investments in securities and/or cryptocurrencies who file using TurboTax Premier and/or TurboTax Premier Live services.*

Read Also: Standard Tax Deduction Vs Itemized

Get Your Taxes Done Right With Turbotax 2020

TurboTax is tailored to your unique situationâit will search for the deductions and credits you deserve, so youâre confident youâll get your maximum refund.

- Keep more of your investment and rental income

- Includes 5 free federal e-files and one download of a TurboTax state product. State e-file sold separately.

- Free product support via phone

- Extra help for investment sales such as stocks, bonds, mutual funds, and employee stock plans

- Automatically imports W-2s, investment & mortgage information from participating companies

Free Trial of Quicken Starter Edition 2021

- Get your complete financial picture at a glance–view balances, budgets, accounts and transactions, see spending trends and search transaction history, all in one place

- To redeem your Quicken offer and get more information about Quicken, install your TurboTax software and click âClaim this offerâ

TurboTax Premier is recommended if any of the following apply:

- Need to file both Federal & State Tax Returns

- Sold stock, bonds or mutual funds

- Sold employee stock

Turbotax Vs Taxact: Which One Is Right For You

TurboTax may reign supreme when it comes to tools and integrations, but that doesnt mean the providers overall offerings are the perfect fit for every user.

TaxActs paid packages cost less, and this year, they come with the providers human help support option Xpert Assist free of charge across all tiers until April 7. This makes TaxAct a great one-stop shop for both seasoned and beginner filers who might feel at ease knowing that help is available should they need it.

TurboTax, on the other hand, has a long-standing reputation for its ease of use, including a well-reviewed mobile app and plenty of its own human support options at a cost. This may make the provider a better choice for those who are willing to pay a little bit extra for the bells and whistles of white-glove tax prep.

Read Also: Sales Tax And Use Texas

Troubleshooting: Why Wont My File Upload

Here are some common reasons for why your file may not be uploading:

Features And Ease Of Use

Only one entity determines how the math works on a tax return, and thats the IRS. So unless theres a programming error, you should get the same numerical answer no matter which tax software you use. But you still have to feed the software all of your information, and there are a million ways to do that. Which is why we look at features and ease of use we want to know which offerings are least likely to make you want to pull your hair out.

Recommended Reading: What Does It Mean To Write Off Taxes

Turbotax Cd/download Product Guide

Here’s our 2021 TurboTax CD/Download software lineup for Windows and Mac:

- Basic Best for simple returns where you don’t need to file a state return.

- Deluxe Recommended for homeowners and others who want to maximize your deductions.

- Premier Everything in Deluxe, plus extra guidance for your investments, rentals, retirement accounts, and employee stock plans. Includes an IRA tool!

- Home & Business Handles your personal return along with maximizing your self-employment, consultant, or small business expenses on Schedule C. Also includes everything in Premier.

- Business For corporation, S corporation, partnership, multi-member LLC, estate & trust, and homeowner association returns.

Although Basic through Home & Business all include the same tax forms and schedules, the step-by-step guidance differs. For example, Premier and Home & Business have extra guidance, help files, and interview screens for investment and self-employment topics, respectively.

How Do Turbotax And Taxact Compare With Other Providers

Promotion: NerdWallet users get 25% off federal and state filing costs. |

|

Promotion: NerdWallet users can save up to $15 on TurboTax. |

Don’t Miss: Where To Find Tax Id Number

Get Your Taxes Done Right With Turbotax

TurboTax is tailored to your unique situation it will search for the deductions and credits you deserve, so youre confident youll get your maximum refund

- Get your personal and self-employed taxes done right

- Extra guidance for self-employment & business deductions

- Boost your bottom line with industry-specific tax deductions.

- Help along the way get answers to your product questions, so you wont get stuck.

- Includes 5 free federal e-files and one download of a TurboTax state product. State e-file sold separately.

- Your information is safeguarded TurboTax uses encryption technology, so your tax data is protected while its e-filed to IRS and state agencies.

Ability To Save Documentation:

If you need your tax information during the year, TurboTax allows you to quickly locate stored records anytime. Searching by keyword is much easier than searching through a stack of papers.

Tax preparation software is secure and easy to use. Purchase your copy from London Drugs today and enjoy having more time in your day

Read Also: Sales Tax Vs Use Tax

What Do You Get With Turbotax

TurboTax keeps your information secure with data encryption. It also requires multi-factor authentication every time you log in to verify your identity.

One of the biggest complaints about TurboTax is the ease with which it attempts to upgrade users to the next-tier product. A 2019 investigation by ProPublica found that Intuit, TurboTax’s parent company, was deliberately hiding its free filing services from Google and other search engines. As of this writing, TurboTax’s free file options are clearly advertised.

TurboTax is a leader in tax preparation services for a reason. Millions of people come back to TurboTax year after year because they can easily and successfully file their tax return. If you follow the directions provided and enter the numbers on your income forms correctly, you should end up with accurate taxes just as if you went to a more expensive professional tax preparer.

Some of TurboTax’s product support and customer service lines that are included in the cost of prep for the lower-tier products are not as helpful as they could be. The best way to get specialized help is usually to upgrade to a more expensive TurboTax Live package.

Overall, TurboTax is the most expensive way to prepare your tax return online, unless you qualify for the free option. While the platform’s features justify the cost for some people, it’s not the best choice if saving money on tax prep is your priority.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: I Claimed 0 And Still Owe Taxes 2021

Turbotax Premier + State 2021 Tax Software

Once you’ve completed your federal tax return, Turbotax will automatically transfer your information and give you the option of completing your state taxes using TurboTax.

One state INCLUDED with TurboTax Deluxe,Premier, and Home & Business

Prepare and print unlimited returns for one state at no extra cost.Only $40 per additional state. E-file additional*

How To Install

If youre trying to figure out how to activate TurboTax or youre wondering how to install TurboTax with a code, we can help. To activate and install your TurboTax CD/Download software, youll need the license code, a 16-character combination of letters and numbers that can be found:

- On the CD box insert, envelope, or packing slip OR

- In the Download confirmation email and/or order history

To download TurboTax with the license code, enter your activation number in the License code box on the activation screen and select Continue to complete installation.

Youre free to use the same license code to install the software on up to five computers youll need to purchase another license if you need more.

If you need help installing, select your operating system for more info:

Recommended Reading: Home Office Tax Deduction 2022