What Is A Simple Return

Simple tax returns covered my MyFreeTaxes include: W-2 Income, Limited Income interest, dividend income, student education expenses, unemployment income, student education credits, student loan interest, claiming the standard deduction, Earned Income Tax Credits, Child Tax Credit, and Child and dependent care expenses. A full list of forms included can be found here: MyFreeTaxes.com/Support

What Are The Limitations To Services

Many returns that are typically in-scope and free at our in-person tax sites, are not all included in the free software, for example, Self-Employment income , Mortgage Interest, Real Estate Taxes, other Itemized Deductions, Third-Party Payments , HSA, and many others. If you have these tax forms, you will have to purchase an upgrade to file with this system. However, you will receive a discount if using MyFreeTaxes.com. A full list of what is included in the free software can be found at MyFreeTaxes.com/Support

What Are Other Free Resources That Are Available For Me

You can explore a few different options:

- Free Virtual Tax Prep with our Tax Experts: Have your taxes prepared virtually by our Free Tax Preparation expert team. Scroll down this page to see more information on the org option.

- Online filing: you can find additional free filing tools via IRS Free File programs. Visit gov/FreeFile for more information and details.

Don’t Miss: Unexpected Tax Refund Check 2021

Volunteer Income Tax Assistance

Save the Fee. File for Free.

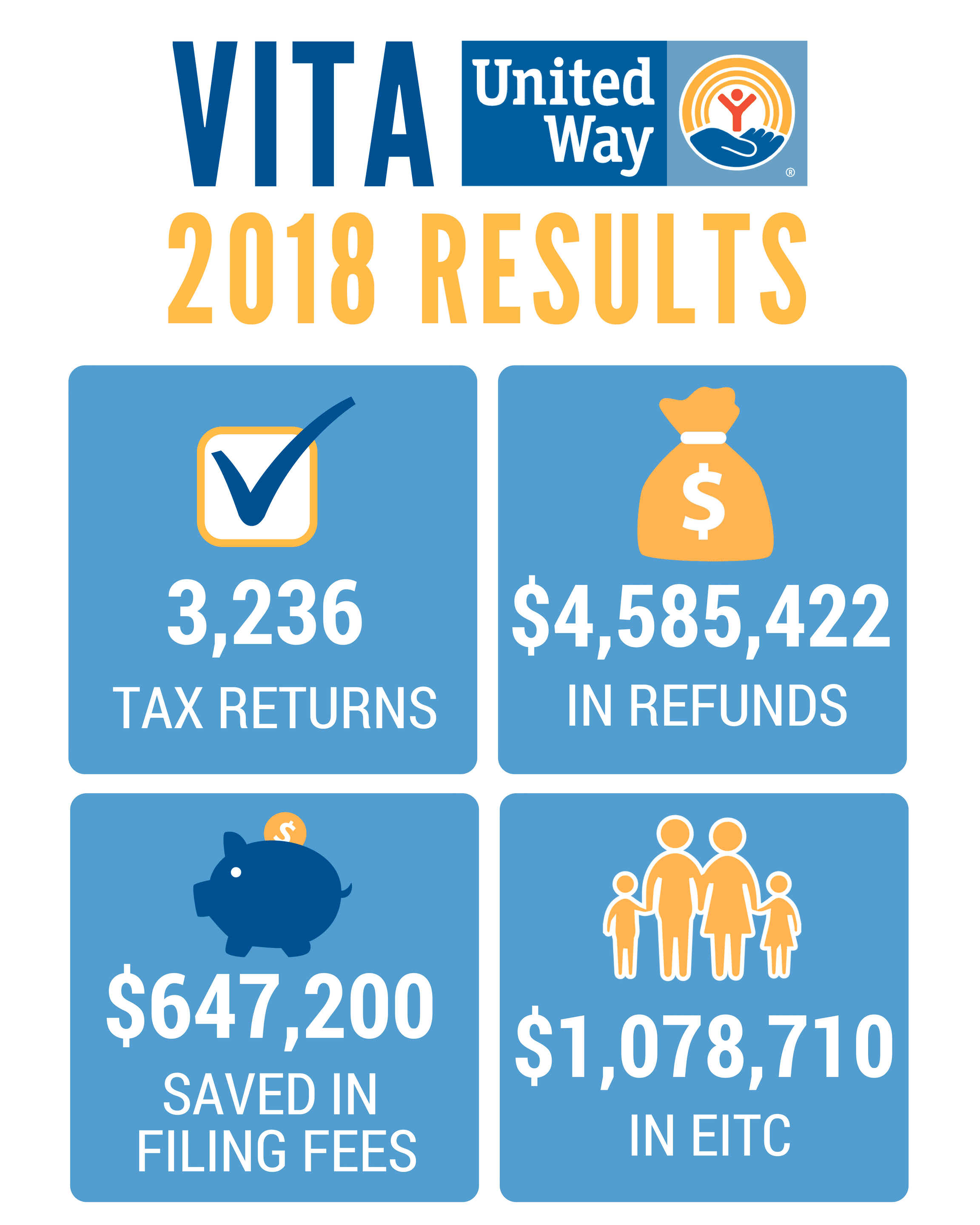

For more than a decade, the Volunteer Income Tax Assistance program has been one of United Way of Greenville Countys most impactful financial stability initiatives.

Sponsored by the Internal Revenue Service , VITA provides free income tax preparation assistance to individuals and families with a household income of $60,000 a year or less.

VITA helps taxpayers obtain all eligible tax credits and deductions, especially the Earned Income Tax Credit, Child Tax Credit, Education Tax Credits and Child Care tax deductions. By offering this service for free in Greenville County, we can help more individuals and families maximize their returns while achieving greater financial stability.

VITA now offers three easy ways to file for free. See which one is right for you.

How Does Free Tax Prep Help File My Taxes

United Way offers several services to prepare your taxes for free instead of paying someone. On average, American families spend more than $300 each year on tax preparation and filing fees. When companies offer advanced loans to complete your taxes, you still are not getting the refund you are owed. Paying for tax preparation services can mean the difference between paying down a credit card, having money in an emergency savings account or getting a car repaired.

Before you spend several hundred dollars on a fee-based service, connect with one of United Way’s Free Tax Prep sites to access the service that meets your needs.

Recommended Reading: How Long Does Taxes Take To Process

Vita Offers Free Person

Our VITA program offers free tax help to individuals, families, persons with disabilities, the elderly and limited English speaking taxpayers who need assistance in preparing their own tax returns. IRS-certified volunteers provide free basic income tax return preparation with electronic filing to qualified individuals.

United Ways Free Tax Prep Opens And Goes Virtual

United Ways Free Tax Prep initiative is now booking appointments for the tax season offering free tax help to residents living in Oneida and Herkimer Counties whose households make approximately up to $66,000 annually.

To keep clients, volunteers, and staff safe and healthy, the program is offering virtual appointments to replace its usual in-person appointment option. IRS-certified volunteers are ready to provide free basic and advanced income tax return preparation with electronic filing available.

Clients can sign-up for virtual appointments with United Ways Free Tax Prep volunteers through an easy-to-use, HIPPA approved secure teleconnection platform, Klara. This platform allows for one-on-one assistance with the client and the tax preparer, the ability to easily upload tax documents, signing and filing documents, all digitally!

United Way of the Mohawk Valley is consistently identifying innovative solutions to our communitys problems, said Betty-Joan Beaudry, United Way MVs Director of Community Impact and 211. Our team used technology to transform a service that usually requires in-person into a safe, no contact option. This allows United Way to still offer one-on-one, personal assistance between client and tax preparer while keeping our staff, volunteer, and clients safe.

Don’t Miss: Texas Franchise Tax Instructions 2021

Free Income Tax Preparation At United Way

United Way of Indian River County is once again coordinating the IRS Volunteer Income Tax Assistance program offering free help to people who make $57,000 or less and need assistance filing their taxes.

The United Way Center, located at 1836 14th Avenue in Vero Beach, is the only site offering VITA services in Indian River County for the 20/21 tax season. VITA will be restricted to a drop-off valet model, during which there will be no close contact between a client and volunteer tax preparer. A tax preparer will contact the client by phone or text if there are any questions about the clients tax return. UWIRCs VITA protocol will follow guidance published by the IRS and health experts.

Families with low to moderate-income may miss out on substantial tax credits if they dont have assistance filing their tax returns. All United Way VITA volunteers are IRS-trained and certified every year and provide free tax return preparation with electronic filing to qualified individuals in Indian River County. They ensure that taxpayers receive credits due to them such as Earned Income Tax Credit, Child Tax Credit, and Credit for the Elderly or Disabled.

About United Way of Indian River County

Myfreetaxes: Helping Families With Free Tax Assistance

United Way is glad to offer MyFreeTaxes, an online service to help households earning less than $66,000 with free state and federal tax preparation and filing services.

MyFreeTaxes is the only online initiative allowing free tax assistance in all fifty states . Through MyFreeTaxes, families can:

- electronically file their taxes through our tax partner

- connect tax filers to local in-person tax preparation and filing assistance through Volunteer Income Tax Assistance and AARP Tax Counseling for elderly populations. To find a free help center near you, please call 800.906.9887 or search by a location by .

- help people with disabilities connect with the National Disability Institute which has created systems to increase accessibility of free tax filing

Households earning more than $66,000 can also file their income taxes via MyFreeTaxes

To receive tax preparation and filing services, and connect with a local United Way in California about health, education and financial stability resources, please visit .

You May Like: Status Of Federal Tax Return

Community Volunteer Income Tax

The Community Volunteer Income Tax program provides free tax preparation for low income earners.

Eligible clients must have all necessary tax documents with them when dropping off at United Way. United Way Staff and Volunteers are not able to access documents from CRA “My Accounts” on behalf of the client. Once the taxes are filed, clients are responsible for picking up all originaldocuments. If not picked up within 60 days of being notified that they are complete, we are authorized to shred these documents.

Income cut-off:

Vita Free Tax Prep Service

United Way’s Volunteer Income Tax Assistance service is focused on putting more money into the pockets of working families. IRS-trained volunteers offer FREE Tax Prep for families and individuals who earned less than$60,000 in 2022! Our goal is to make sure you get your FULL refund, claim all your eligible credits, and learn to use taxes to grow your assets! You can count on VITA to provide the highest quality tax service to families, individuals, and self-employed taxpayers.

Take a look at theTax Prep Checklistto help you stay on top of your taxes and know what to prepare so you are ready to file and maximize your refund.

You May Like: Which State Has Low Property Taxes

What Do I Need To Bring To Receive Free Tax Help

Required:

- Both spouses, if filing jointly

- Picture ID for taxpayer

- Social Security card for each person listed on the return

- Proof of income, like W2s and 1099s

- Documentation of expenses

- If anyone in the household is insured through the Marketplace, Form 1095-A and dependents proof of income

Recommended:

- Account and routing numbers for direct deposit of refunds

- Prior year tax return

Acceptable Alternatives for Social Security Card:

- Social Security Benefit Statement

- Military ID with Social Security number

- Any document issued by the Social Security Administration with Social Security number last four digits must be visible

- A printout from mySocialSecurity with the last four digits of your Social Security number visible

- Please note: Per IRS regulations, a return cannot be prepared without the required documents. Prior year tax returns do NOT satisfy document requirements.

Free Tax Help Bay Area Is A Coalition Of Organizations That Provide Free Tax Help Throughout The Bay Area Led By United Way Bay Area In Partnership With The Irs Our Services Are Free Secure And High

We ensure taxpayers maximize their refunds by claiming cash-back tax credits like the Federal and California Earned Income Tax Credit, and the Federal and California Child Tax Credit. California residents who made less than $30,000 in 2022 may be eligible for up to $8,000 in state and federal tax credits, depending on income and family size.

Free Filing Options

In-Person Tax Preparation and Drop-Off

Use the map below to find your closest tax site. You can also filter by special requirements and services. Please be sure to contact sites directly to verify days and hours of operation as they may change without notice

Use the map below to find your closest tax site. You can also filter by special requirements and services. Please be sure to contact sites directly to verify days and hours of operation as they may change without notice.

Don’t Miss: T Mobile Taxes And Fees

About Free Tax Prep Services

Free Tax Prep, an initiative of United Way of Greater Cincinnati, provides free income tax preparation and filing services. Funded by the IRS and powered by volunteers.

We offer services including preparing and filing your taxes on your behalf or supporting you in preparing and filing your taxes on your own.You can connect with Free Tax Prep online or in person. All in-person services have been modified to limit contact and ensure safe distancing during the COVID-19 pandemic.

To determine the best Free Tax Prep Service for you, whether it’s in-person or virtual, call United Way of Greater Cincinnati’s or .

What Is Volunteer Income Tax Assistance Vita

VITA is an IRS program that utilizes certified volunteers to help provide free and accurate tax preparation services to low- to moderate-income taxpayers. These services are provided at a variety of public locations such as libraries, schools, and neighborhood centers in certain high-need areas. VITA has been instrumental in helping ALICE households receive thousands of dollars in additional refunds.

Read Also: California Sales Tax By Zip Code

When You Give Locally You Help People Like Dixia

Dixia is living at a local womens shelter for victims of domestic violence. She is working hard to stabilize and get her life back on track.

Im going through a very difficult separation. I find myself with limited means. Coming in here I felt a tremendous sense of relief that I was helped out. The staff was very kind and the volunteers were very nice. I felt like I was actually stuck at this point but having the United Way help me out and provide the service means everything to me.

Dixia Baltodano,

What Are The Limitations To The Service

United Way is an equal opportunity provider and anyone in Washington State can access United Ways Free Tax Preparation services. However, some returns are too complex for our volunteers. For example, we cannot prepare returns for income earned in other states.

We have partnered with Express Credit Union to process returns with ITINs and will offer free ITIN applications and renewals through Express Credit Union.

Here are services we do NOT provide:

- State returns .

- If you have a 1099-B .

- If you sold your home or if it went into foreclosure.

- If you received rental income.

- If you are self-employed and had expenses above $25,000, had a net loss, or want to deduct the use of your home as a business expense.

- If you are a registered domestic partnership.

You May Like: File Taxes With Credit Karma

I Dont Know My 2021 Agi What Should I Do

You can find it on line 7 of your 2019 return if you still have a copy of your return. If you filed your taxes at a United Way of King County Free Tax Prep location last year, email and include your phone number so we can provide you with a copy of last years return. If you did not file with us last year, IRS.gov/get-transcript can help you retrieve a copy of last years tax return.

What Will The Campaign Do To Address Health And Safety Concerns Regarding Covid

The Campaign will constantly monitor health protocol recommendations made by King County Public Health and the CDC and adjust our protocols accordingly. Additionally, we will provide the following:

- A limited number of sites will have more stringent health protocols in place .

- Hand sanitizer will be provided at all tax preparation and intake stations.

- We have discussed air filtration with all the organizations we partner with. For sites without modern HVAC, we will provide standing air filtration.

- We will continue having reduced room capacity at all sites where we are able to enforce this.

- We will have spit guards and masks available for all volunteers and staff who would prefer to use them.

Read Also: 6 Months And Still No Tax Refund 2021

What Should I Bring With Me

-

Social Security Card or ITIN for each person to be claimed

-

W2, 1099 form, 1098 form, and/or social security income statements for all income

-

End of the year retirement plan statements

-

Child care provider name, address and tax ID number

-

Record of expenses

-

For direct deposit, a blank check with an account and routing number

-

Homeowners: Hazard Insurance Declaration page for LA Citizens Credit

-

Last year’s tax return, if you have it

-

Receipts for charitable donations, business expenses, etc.

-

1095a Health Insurance Marketplace Statements if you have them

Will Masking Be Required For In

Not all sites will have mask requirements. However, due to safety concerns expressed by some volunteers, we will have some sites with more stringent health protocols, to include required masking by all clients and volunteers. Please view the site details to see which sites will have these protocols.

Recommended Reading: Tax Preparer Santa Ana Ca

How Is Free Tax Help Different From A Paid Preparer

There are many ways that Free Tax Help differs from a paid preparer. We invite you to come in person and see the difference for yourself!

- We save the average taxpayer an average of $250

- All our volunteers are IRS certified

- Every completed tax return undergoes an extensive review process to ensure quality and accuracy

- We will never offer predatory lending option such as rapid refunds

Im A New Volunteer And I Cant Attend Any Of The In

This is possible on a case-by-case basis. Someone from our team will have to contact you to assess your situation, then put you in contact with the site manager of the site youd like to volunteer at and determine if they have the capacity to train you onsite. Please be aware that this may not be possible to accommodate and we recommend that you sign up for an intake volunteer role, which does not require extensive training.

Recommended Reading: Why Is My Tax Refund So Low 2021

Options For Tax Preparation

United Way of Central Alabama is providing tax services again this year. In response to the COVID-19 pandemic, however, we have established new processes to assist you with your taxes in a safe and secure manner.

Preparing Your Own Return

If you are interested in preparing your own return, MyFreeTaxes.com now offers FREE online software for your state and federal returns. There are no income limits for this service. Telephone support is available for prompt answers to any questions you may have.

If there are additional questions about getting taxes prepared for free, please call 2-1-1 or 1-888-421-1266.

Tax Preparation by United Way Volunteers

United Way of Central Alabama offers free volunteer tax preparation for households with annual income of $54,000 or less.

In order to safely serve you, United Way is offering a contact-free, online intake for volunteer tax preparation this year. For an appointment, or to request accommodations, please call 2-1-1 or 1-888-421-1266.

Who Qualifies for Free Tax Preparation?

- If you earn $54,000 or less per year, you qualify for free tax assistance provided by United Way. Call 2-1-1 or 1-888-421-1266 for appointment information.

- If you are interested in preparing your own returns, you can file online for free. There is NO income limit to file state and federal taxes at MyFreeTaxes.com.

What Information Do Tax Filers Need to Gather to be Ready for Tax Preparation?