Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

- Federal taxes were withheld from your pay

and/or

- You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

Individual Income Taxes Are A Primary Source Of Government Revenue

Compared to the OECD average, the United States relies significantly more on individual income taxes than other developed countries. While OECD countries on average raised 23.9 percent of total tax revenue from individual income taxes in 2018, in the U.S., individual income taxes were the primary source of tax revenue at 40.72 percent, a difference of almost 17 percentage points.

State and localities rely heavily on the individual income tax, which comprised 23.5 percent of total U.S. state and local tax collections in fiscal year 2016, the latest year of data available. The level of reliance on income taxes varies significantly by state.

Protect Yourself From Tax

Tax ID theft occurs when someone steals your personal information to file a tax return using your personal data. Usually, the fraudulent tax filer will use your Social Security number to file your return in order to collect a refund. To protect yourself from tax ID theft, you can obtain a six-digit Identity Protection PIN from the IRS. IP PINs are known only to you and the IRS so the IRS is able to confirm your identity when you file your return. Learn more about how the IP PIN works and how to apply.

Recommended Reading: File State And Federal Taxes For Free

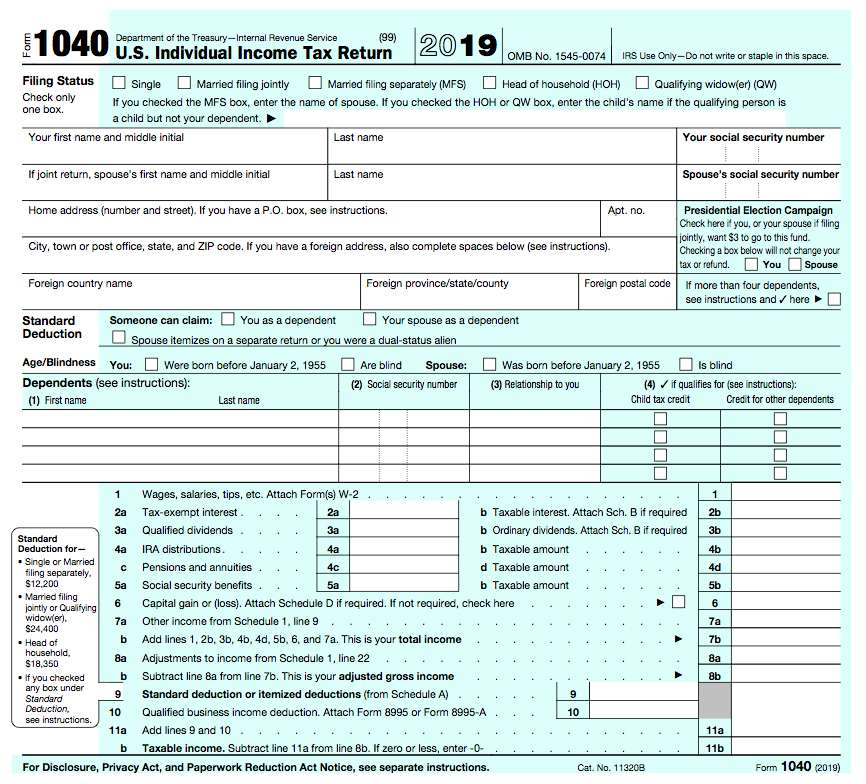

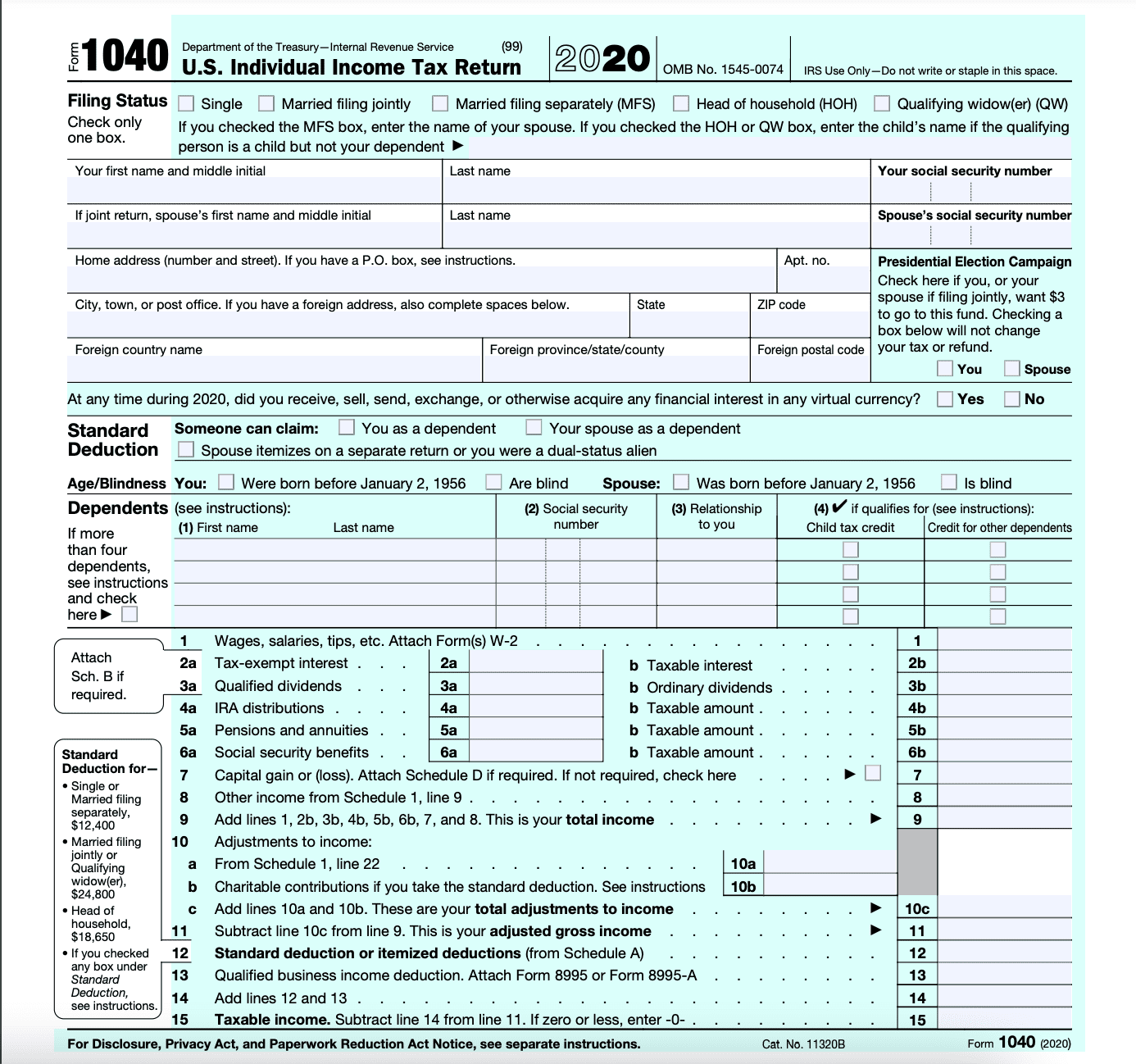

What Is A 1040 Form

The Form 1040 is used for tax filing purposes. The form is known as a U.S. Individual Income Tax Return and it will be used by people who need to file their yearly income tax return. The form will be received and recorded by the United States Internal Revenue Service. The Form 1040 is one of the simplest forms available to accurately and completely file income taxes.

A Form 1040 will require a lot of personal information. Information to prove your identity will be needed, including full name, social security number, and address. Financial information is also required. This is how the IRS will ensure you are paying the appropriate amount of income tax. You will need to include your total earnings for the year from your job. Certain expenses and deductions can also be included in order to reduce the amount of taxes you owe.

The income tax return will determine whether you owe more taxes to the IRS or if you are owed a refund. If you have complicated finances, a tax professional can be helpful.

Create a free Form 1040 in minutes with our professional document builder.

Penalty For Failure To Pay Or Underpayment Of Estimated Tax

Revised Statute 47:118authorizes a penalty for failure to pay or underpayment of estimated income tax. The penalty is 12 percent annually of the underpayment amount for the period of the underpayment.

Determination of the Underpayment Amount

Determination of the Underpayment PeriodThe underpayment period is from the date the installment was required to be paid to whichever of the following dates is earlier:

Notification of Underpayment of Estimated Tax Penalty

You May Like: Sales Tax Exempt Form Ny

How To Fill Out A Form 1040

If you’re filing your return using tax software, you’ll be asked to provide information that is translated into entries on your Form 1040. The tax program should then autopopulate Form 1040 with your responses and e-file it with the IRS. You can print or download a copy for your records.

If you prefer to fill out your return yourself, you can download Form 1040 from the IRS website. The form can look complex, but it essentially does the following four things:

Asks who you are. The top of Form 1040 gathers basic information about who you are, what tax-filing status you’re going to use and how many tax dependents you have.

Calculates taxable income. Next, Form 1040 gets busy tallying all of your income for the year and all the deductions you’d like to claim. The objective is to calculate your taxable income, which is the amount of your income that’s subject to income tax. You consult the federal tax brackets to do that math.

Calculates your tax liability. Near the bottom of Form 1040, you’ll write down how much income tax you’re responsible for. At that point, you get to subtract any tax credits that you might qualify for, as well as any taxes you’ve already paid via withholding taxes on your paychecks during the year.

Get A Transcript Of A Tax Return

A transcript is a computer printout of your return information. Sometimes a transcript is an acceptable substitute for an exact copy of your tax return. You may need a transcript when preparing your taxes. They are often used to verify income and tax filing status when applying for loans and government benefits.

Contact the IRS to get a free transcript . There are two ways you can get your transcript:

-

Online – To read, print, or download your transcript online, you’ll need to register at IRS.gov. To sign-up, create an account with a username and a password.

Don’t Miss: How Does Tax Write Off Work

How The Treasury Offset Program Works

Here’s how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then TOP will send the entire amount to the other government agency. If you owe less, TOP will send the agency the amount you owed, and then send you the remaining balance.

Here’s an example: you were going to receive a $1,500 federal tax refund. But you are delinquent on a student loan and have $1,000 outstanding. TOP will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

The Internal Revenue Service can help you understand more about tax refund offsets.

Relationship With State Tax Returns

Each state has separate tax codes in addition to federal taxes. Form 1040 is only used for federal taxes, and state taxes should be filed separately based on the individual state’s form. Some states do not have any income tax. Although state taxes are filed separately, many state tax returns will reference items from Form 1040. For example, California’s 540 Resident Income Tax form makes a reference to Form 1040’s line 37 in line 13.

Certain tax filing software, such as TurboTax, will simultaneously file state tax returns using information filled in on the 1040 form.

The Federal government allows individuals to deduct their state income tax or their state sales tax from their federal tax through Schedule A of Form 1040, but not both. In addition to deducting either income tax or sales tax, an individual can further deduct any state real estate taxes or private property taxes.

Don’t Miss: Amended Tax Return Deadline 2020

Paying The Federal Income Tax

While everyone is subject to the federal income tax, the Supreme Court has carved out possible exceptions. One example of note comes from Cheek v. United States, 498 U.S. 192, . In Cheek, the petitioner was charged with failing to file a federal income tax return, violating §7203 of the Internal Revenue Code, as well as willfully attempting to evade his income taxes, violating § 7201. Cheek admitted that he did not file his returns, but testified that he had not acted willfully because he sincerely believed, based on his indoctrination by a group believing that the federal tax system is unconstitutional and his own study, that the tax laws were being unconstitutionally enforced and that his actions were lawful. The Supreme Court held that if a jury accepts Cheek’s assertion that he truly believed that the Code did not treat wages as income, then the Government would not have proved that Cheek willfully violated the tax code, however unreasonable the belief might appear to a court.

What Is The Purpose Of A 1040 Form

Taxpayers use the federal 1040 form to calculate their taxable income and tax on that income. One of the first steps is to calculate Adjusted Gross Income by first reporting your total income and then claiming any allowable adjustments, also known as above-the-line deductions. Your AGI is an important number since many credits and deduction limitations are affected by it.

On line 11 of the tax year 2021 Form 1040, you will report your AGI. You can reduce it further with either the standard deduction or the total of your itemized deductions reported on Schedule A. Itemized deductions include expenses such as:

If the total of your itemized deductions does not exceed the standard deduction for your filing status, then your taxable income will usually be lower if you claim the standard deduction. Beginning in 2018, exemption deductions are replaced with higher child tax credits and a new other-dependent tax credit.

TurboTax will do this calculation for you and recommend whether choosing the standard deduction or itemizing will give you the best results.

Read Also: Sales Tax In North Dakota

If A Particular Business Or A Salaried Individual Makes A Turnover Or A Income Above The Stipulated Limits A Tax Audit Is Required According To Section 44ab Of The Income Tax Act

New Delhi: The Central Board of Direct Taxes , under the Department of Revenue, Ministry of Finance, has extended the deadline for filing income tax returns for Assessment Year 2022-23 till November 7, 2022, in cases where an audit is required. This is the third extension granted by the tax authority. The September 30 deadline was extended to October 7 and then, October 31 earlier.Also Read – ITR Filing Last Date Today No Deadline Extension, Over 5 Crore Income Tax Returns Filed So Far

Who Needs To File Form 1040

Broadly speaking, if a United States citizen wants to or needs to file a Federal income tax return, they need to file Form 1040 or a variation of Form 1040 mentioned above. There are three general conditions to consider regarding whether an individual needs to file.

First, the IRS requires individuals with gross income of certain levels to file taxes. This gross income threshold varies based on the individual’s filing status and age. The table below lists the income limits for individuals under 65 years old older tax payers will have higher thresholds, and the threshold changes if neither, one, or both individuals in a marriage are 65 or older.

| 2021 Gross Income Thresholds | |

|---|---|

| Qualifying Widow | $25,100 |

Second, children and dependents may not be required to file if they can be claimed as a dependent. If the dependent’s unearned income greater than $1,100, earned income was greater than $12,550, or gross income meets certain thresholds, the dependent must file their own Form 1040. These rules are slightly different for single dependents as opposed to dependents who are married.

Last, there are some specific situations that require an individual to file Form 1040. Regardless of their income or dependency status, some of those situations include but are not limited to:

Also Check: California Tax On Capital Gains

How To Complete A 1040 Form

To complete a Form 1040, you will need to provide the following information:

- Personal Information

- Spouses social security number

Changes To Complexity And Tax Rates

The complexity and compliance burden of the form and its associated instructions have increased considerably since 1913. The National Taxpayers Union has documented the steady increase in complexity from a 34-line form in 1935 to a 79-line form in 2014, decreasing to 23 lines in 2018. Quartz created an animated GIF showing the gradual changes to the structure and complexity of the form. The NTU table is below with data through 2014:

| 1 | 2 |

In addition to an increase in the complexity of the form, the tax rates have also increased, though the increase in tax rates has not been steady in contrast with the steady increase in tax complexity.

Don’t Miss: What Percent Of Your Check Goes To Taxes

Virginia Taxpayers Must File By The Deadline To Be Eligible For One

Lauren Helkowski, Digital Content Producer

Virginia Tax is reminding taxpayers that the individual income tax filing extension deadline is days away on Nov. 1.

To be eligible for Virginias one-time income tax rebates, taxpayers must file by the deadline. Income tax rebates include up to $250 for single filers and $500 for married couples filing jointly.

Like last year, we encourage taxpayers to file electronically and to request a refund, if you have one coming, via direct deposit, said Tax Commissioner Craig Burns. Wed also like to remind taxpayers that to be eligible for the one-time income tax rebates, theyll need to file by Nov. 1. Generally, it takes up to two weeks to process an electronically-filed return and up to eight weeks to process a paper return.

Virginia Tax is also reminding taxpayers of the following:

- If your income was $73,000 or less in 2021, youre eligible to file your taxes for free

- If you do need to make a payment, you have several easy-to-use options available including online, directly from your bank account check or money order and credit or debit card, both of which incur an additional fee

- For secure, online self-service you can create and log onto an online individual account which allows you to track your return or refund

- You can also check the status of your refund by calling 804-367-2486, or using the Wheres My Refund application on the Virginia Tax website

About the Author:

Watch For Your Income Documents To Arrive

You should receive forms about how much income youve earned from your employers and other income sources in January or February. If you are a full-time employee, you will receive a Form W-2 detailing your earnings, as well as which taxes were withheld. If you work freelance or on a contract, you may receive a Form 1099-NEC detailing what you earned. You may also receive documents showing dividends or interest earned on investments , or student loan interest youve paid . If youre a college student , youll receive a Form 1098-T that shows how much you paid in tuition, as well as any amounts you received from grants or fellowships, to help you figure out deductions and credits related to education expenses.

You May Like: Property Taxes In Austin Texas

Proof Of Timely Filing