Need More Tax Guidance

Whether you make an appointment with one of our knowledgeable tax pros or choose one of our online tax filing products, you can count on H& R Block to help you get the support you need when it comes to filing taxes.

Need to check the status of your federal refund? You can visit our Wheres My Refund page to find out how soon youll receive your federal refund.

Related Topics

Donating household goods to your favorite charity? Learn the ins and outs of deducting noncash charitable contributions on your taxes with the experts at H& R Block.

Wheres My Refund Virginia

Are you wondering where your Virginia state refund may be? Check the status of your Virginia state refund online at: .

You can also call for Virginias automated refund system.

To check the status of your refund:

- Enter your Social Security number

- Enter the tax year of the return filed

- Enter the expected refund amount

Both options are available 24 hours a day, seven days a week, and have the same information as customer service representatives, without the wait of the phone queue. You can check the status of your refund 72 hours after you file electronically or four weeks after you file a paper return.

E-filed tax returns take up to four weeks to receive your refund. Paper-filed returns can take up to eight weeks sent by certified mail allow an additional three weeks.

Virginia Refund Status Wheres My Va Tax Refund

Virginia Refund Status Wheres My VA Tax Refund? Virginia Department of Taxation is responsible for handling all Virginia State Tax Refund Payments. Wheres My Virginia State Refund? Wheres My Virginia State Refund? Find my VA Refund. E-File Department of Taxation. Track my VA State Tax Refund. Virginia Tax Resources list here. Virginia Refund Calculator Wheres My Virginia Refund? Check the Status of your Refund Phone Lookup Call 367-2486 to check the status of your refund 24 hours a day, 7 days a week. You will need to enter your SSN and the amount of the refund you are expecting. How Long does it Take If you e-Filed your tax return your refund will be processed in about 1 week. If you filed your tax return on paper your refund could take up to 7 weeks to process. Please note, if you mailed your tax return using Certified Mail it could take from 1-3 weeks before we receive it from the…

Follow:

Also Check: Where Is My California Tax Refund

Federal Refund Reduced Because Of A Virginia Tax Debt

If you have delinquent debt with us, we can submit a claim to the U.S. Treasury Offset Program to withhold or reduce any of your federal income tax refund by the amount of your tax debt. The claim may also be applied to eligible federal vendor payments for businesses with outstanding debt.

If you receive a letter from us regarding a debt submitted to the TOP, and you think youve already paid the amount due or dont owe it for other reasons, please contact us.

Wheres My State Tax Refund Nebraska

Its possible to check your tax refund status by visiting the revenue departments Refund Information page. On that page, you can learn more about the states tax refunds and you can check the status of your refund. Make sure to have your SSN, filing status and the exact amount of your refund handy to check your refund.

You May Like: Amended Tax Return Deadline 2020

Wheres My State Tax Refund Illinois

The State of Illinois has a web page called Wheres My Refund, where you can see if the state has already processed your tax return and initiated your refund. The only information you need to enter is your SSN, first name and last name. If the state has not processed your return yet, you can set up an email or text notification to let you know when it does.

Wheres My State Tax Refund New York

You can use this link to check the status of your New York tax refund. You will need to enter the exact amount of your refund in whole dollars in order to log in. This amount can be found on the state tax return that you filed.

Dont forget that if you paid any local income taxes for living in New York City or Yonkers, those taxes are included in your state return.

Recommended Reading: Do You Have To Pay Taxes On Inheritance

Wheres My State Tax Refund Colorado

Taxpayers can check the status of their tax refund by visiting the Colorado Department of Revenues Revenue Online page. You do not need to log in. Click on Wheres My Refund/Rebate? from the Quick Links section. Then you will need to enter your SSN and the amount of your refund.

Colorado has increased its fraud prevention measures in recent years and and warns that it may need take up to 60 days to process returns. Returns will take longest as the April filing deadline approaches. This is when the state receives the largest volume of returns. The state also recommends filing electronically to improve processing time.

Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But, you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS you should also submit a Change of Address to the USPS.

Recommended Reading: California Sales Tax By Zip Code

Wheres My State Tax Refund New Mexico

The Tax & Revenue department of New Mexico provides information on their website about tax returns and refunds. To check the status of your return, go to the Taxpayer Access Point page and click on Wheres My Refund? on the right of the page.

Taxpayers who filed electronically can expect a refund to take six to eight weeks to process. The state asks that you wait at least eight weeks before calling with inquiries about your return. Paper returns will likely take eight to 12 weeks to process. The state advises waiting 12 weeks before calling with refund status questions.

Wheres My State Tax Refund Louisiana

The status of your Louisiana tax refund is available by visiting the Louisiana Taxpayer Access Point page and clicking on Wheres My Refund? at the bottom. You will need to enter your SSN and your filing status.

Refund processing time for e-filed returns is up to 60 days. Those who filed paper returns can expect to wait 12 to 14 weeks. As with many other states, these time frames are longer than in years past. Louisiana is implementing measures to prevent fraudulent returns and this has increased processing times.

Read Also: States With No Tax On Retirement Income

Wheres My State Tax Refund Tennessee

Tennessee residents do not pay income tax on their income and wages. The tax only applied to interest and dividend income, and only if it exceeded $1,250 . Taxpayers who made under $37,000 annually were also exempt from paying income tax on investment earnings. The state levied a flat 4% tax rate for 2017 and was phased entirely by January 1, 2021. A refund is unlikely for this income tax.

Why Did You Receive This Letter

We often send letters requesting additional documentation to verify information claimed on returns. If you receive a letter from us, it doesn’t mean you did anything wrong, or that there is anything wrong with your return. It’s just an extra step we’re taking to verify the returns we process and make sure refunds go to the right person.

Our goal is to stop fraudulent returns before they go out the door, not to slow down your refund. If you receive a letter, respond with the requested information as soon as you can to help us take the appropriate action.

Don’t Miss: Are Medical Insurance Premiums Tax Deductible

Virginians Are Getting Tax Rebates Of Up To $250 Per Person Heres How It Works

By: Graham Moomaw– August 11, 2022 12:03 am

If you owed income taxes to the state of Virginia for 2021, some of that money might be coming back this fall.

As part of a bipartisan tax rebate plan approved this year, the state government is preparing to send out payments of up to $250 per tax filer .

The payments wont be quite as big as what Gov. Glenn Youngkin suggested in the tax-cutting plan he campaigned on last year, but the governor has touted the roughly $1 billion rebate initiative as the largest tax rebate in the history of Virginia.

The rebate plan didnt get as much attention as more politically contentious tax proposals, like suspending the gas tax, partly because it had broad support and little drama. Before handing power over to Youngkin, former Gov. Ralph Northam included a plan for one-time rebates, funded with surplus revenues, in his final budget proposal.

From there, lawmakers mostly just had to work out how big the checks would be based on what the state could afford. Once that was done, the rebate plan was overwhelmingly approved as part of the state budget passed in June.

Heres how the payments will work:

Whos eligible?

Groups that dont owe much in state income taxes such as low-income people whose tax burdens are already minimized through a variety of other credits and elderly or disabled filers who live off Social Security, which Virginia doesnt count as taxable income are unlikely to qualify for the rebate money.

How will people get it?

Some Taxpayers Will Receive The Rebate By Direct Deposit And Some Will Receive A Paper Check

If you received a refund by direct deposit this year, youll likely receive your rebate by direct deposit in the same bank account, with the description VA DEPT TAXATION VATXREBATE. All other eligible taxpayers will receive their rebate by paper check in the mail.

- If you’ve moved in the last year and have a current forwarding order with the USPS, then your check will be forwarded to your new address.

- Were not able to update your bank account information. If the bank account where you received your Virginia refund by direct deposit is closed, call us at , and we can mark it as an invalid account. Youll receive your rebate by paper check in the mail.

Read Also: File Income Tax Return India

Wheres My State Tax Refund Michigan

Checking your refund status is possible through the Michigan Department of Treasury. Just visit the Wheres My Refund? page. Michigan requires you to enter slightly different information than most other states. You will need to enter your SSN, the tax year, your filing status and your adjusted gross income.

Michigan says to allow four weeks after your return is accepted to check for information. This assumes you filed electronically. If you filed a paper return, allow six to eight weeks before checking.

How Does The Refund Offset Process Work

Certain government agencies can submit eligible delinquent debts for inclusion in state and federal offset programs.

Claims eligible for offset include eligible debt owed to:

- The Department of Social Services

- Other Virginia state agencies and courts

- Local Virginia governments cities, towns, or counties

- Some federal government agencies

Before we issue a refund, our systems check against these claims. If there is a pending claim, or multiple claims, we will withhold or reduce your refund by the amount of the debt owed. We will send you the details of the debt, including the agency making the claim, how much of your refund was applied or withheld, and a phone number to call in case you have questions.

Individual and business tax refunds are subject to offset for debts from most agencies, however claims for federal non-tax debts can only be applied to individual income tax refunds.

If you have a remaining refund after your debts are paid, we will send you a check for the leftover amount.

Read Also: How Much Is Tax At Walmart

Wheres My State Tax Refund Oklahoma

In order to check the status of your state tax refund, visit Oklahoma Tax Commission page and click on the Check on a Refund link. From there you can get to the Oklahoma Taxpayer Access Point. You will need to log in with the last seven digits of your SSN or ITIN, the amount of your refund and your zip code.

If you e-filed, you can generally start to see a status four days after the Oklahoma Tax Commission receives your return. Paper filings will take longer and you should wait about three weeks before you start checking the status of a refund. Once a refund has been processed, allow five business days for your bank to receive the refund. If you elect to get a debit card refund, allow five to seven business days for delivery.

Virginia Estimated Income Tax

At least 90% of your tax liability for the year must be paid throughout the year by withholding and/or installments of estimated tax. Declarations are provided for paying current state income tax in excess of the amount withheld from wages and other sources of income. This is required of individuals, estates, and trusts whose tax liability exceeds $150 with an exception for Farmers and Fisherman. If you filed an estimated tax form last year, a new one will be sent to you automatically. If you need to file for the first time, contact our office and request Form 760ES or download at Virginia Tax .

Don’t Miss: Is Hazard Insurance Tax Deductible

Wheres My State Tax Refund West Virginia

Check on your state tax return by visiting the West Virginia State Tax Departments website. On the right side of the page, you will see a link called Wheres My Refund? This link will take you to the refund status page. Enter your SSN, the tax year and the amount of your refund in order to check your status.

Why Is It Taking So Long To Get My Virginia Tax Refund

A number of things could cause a delay in receiving your Virginia refund, including the following: If the state needs to verify information reported on your return or request additional information. If there are math errors in your return or other adjustments. If you used more than one form type to complete your return.

Don’t Miss: Local County Tax Assessor Collector Office

Have Questions About An Offset Or Dont Think You Owe The Debt In Question

- If your refund was reduced to satisfy a Virginia Tax debt, and you have any questions or disagree with the bill, please contact Collections at .

- If the offset is for a debt owed to another agency, please contact the agency collecting the debt . We do not have any information about debts with other agencies. If you have already paid your debt in full, or you don’t owe the debt for other reasons, the agency collecting the debt is responsible for returning any part of your payment that should not have been reduced.

- If the offset was for a federal non-tax debt, and you need help contacting the agency, please call the TOP call center at or .

Wheres My State Tax Refund Alabama

You can expect your Alabama refund in eight to 12 weeks from when it is received. In order to check the status of your tax return, visit My Alabama Taxes and select Wheres My Refund? To maintain security, the site requires you to enter your SSN, the tax year and your expected refund amount.

Another thing to note with Alabama is that even if you filed for direct deposit of your refund, the state may send your refund as a physical check. This is an attempt to prevent fraud by sending a paper check to the correct person instead of sending an electronic payment to the wrong persons account.

Also Check: Nys Dtf Pit Tax Paymnt

Tips For Managing Your Taxes

- Working with a financial advisor could help you invest your tax refund and optimize a tax strategy for your financial needs and goals. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free toolmatches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

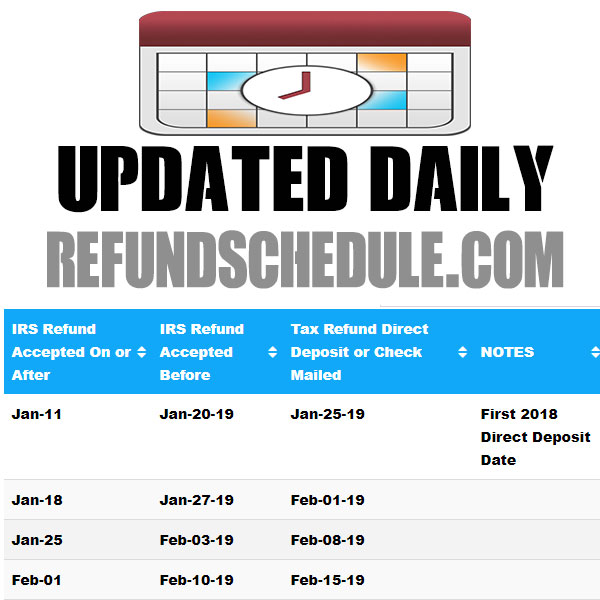

- Each state will process tax returns at a different pace. On the other hand, the IRS generally processes federal returns at the same pace, no matter where you live. Heres a federal refund schedule to give you an idea of when to expect your refund.