Total Tax Burden: 697%

This popular snowbird state features warm temperatures and a large population of retirees. Sales and excise taxes in Florida are above the national average, but the total tax burden is just 6.97%the sixth-lowest in the country.

Florida ranks 31st in affordability due to its higher-than-average housing costs. Still, Florida came in at 10 on the U.S. News & World Report Best States to Live In list.

In 2019, Florida was one of the lowest states in terms of school system spending, at $9,645 per pupil. In 2021 the ASCE gave Florida a C grade for its infrastructure. Six years earlier, Florida received the same grade from the Education Law Center for the fairness of its state school funding distribution. In 2014, its healthcare spending per capita was $8,076, $31 more than the national average.

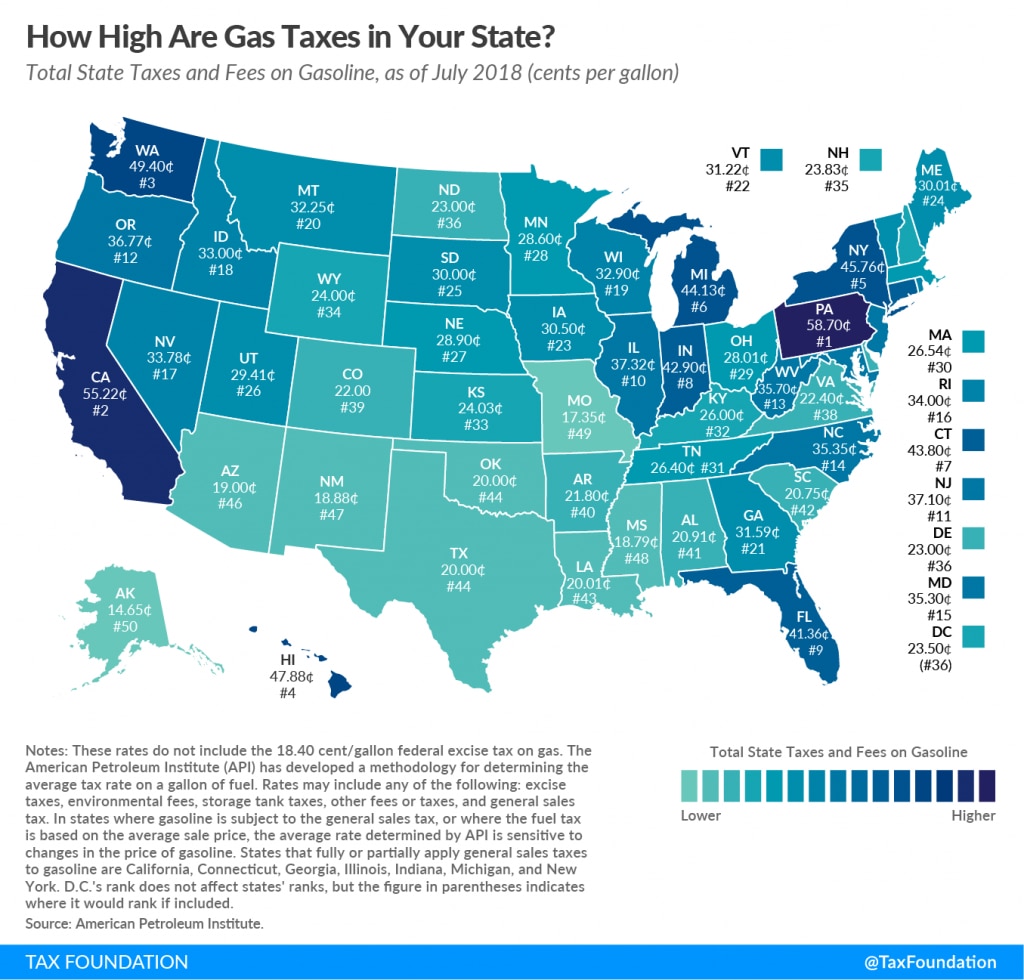

The Average Price Dropped 12 Cents Last Week And Some Locations Are Seeing Gas Below $3 A Gallon

Gas prices across Florida have dipped to their lowest levels since Gov. Ron DeSantis instituted a gas tax break for the month of October, with some locations seeing prices below $3 a gallon.

According to a release from AAA, gas prices dropped 12 cents a gallon last week, to $3.27 a gallon, as of Monday.

That’s the lowest price per gallon since Oct. 31, the final day of a 25-cent monthlong gas tax break.

“Florida gas prices have plunged 30 cents in the past three weeks, due to low oil prices and strong gasoline supplies,” Mark Jenkins, AAA spokesman, said in a news release. “The downward momentum should continue this week. Unless fundamentals change, the state average could drift below $3.20 per gallon by next weekend.”

According to the release, crude oil prices increased slightly last week but remain 15% below the price from three weeks ago

COVID-19 lockdowns in China have also kept oil prices down and could reduce the worldwide demand for fuel, according to AAA.

Motorists across the greater Tampa Bay region are paying an average of $3.26 a gallon.

What Is Exempt From The Sales Tax

Thankfully, the sales tax doesnt apply to all purchases. Most groceries, prescription drugs and medical itemslike over-the-counter medicinesare exempt from sales tax.3 Which is great because these items are essential for, you know, living. Thats right, your Publix trip is most likely tax-free!

But heres something to keep in mind: Even though most groceries arent taxed, prepared foodlike when you dine out at your favorite restaurantis still taxed at 6%.4 This includes take-out or to-go prepared food items as well.

If youre bummed your burrito bowls getting taxed, this might cheer you up: Governor Ron DeSantis signed a few temporary exemptions into law this year. Well get to those in a minute.

You May Like: What State Has The Lowest Property Taxes

How Much Florida Homeowners Pay In Property Taxes Each Year

- Samuel Stebbins, 24/7 Wall St. via The Center Square

Property taxes are the lifeblood of local governments and municipalities across the United States, accounting for over 70% of all local tax revenue. Property taxes such as taxes levied on homeowners and landowners go to fund schools, parks, roads, and other public works and services.

While states typically impose a minimum property tax, property taxes are mostly determined at the local level and are often a percentage of a property or homes overall value. Depending on where you choose to buy a home, property taxes can range from negligible amounts to nearly matching a mortgage payment.

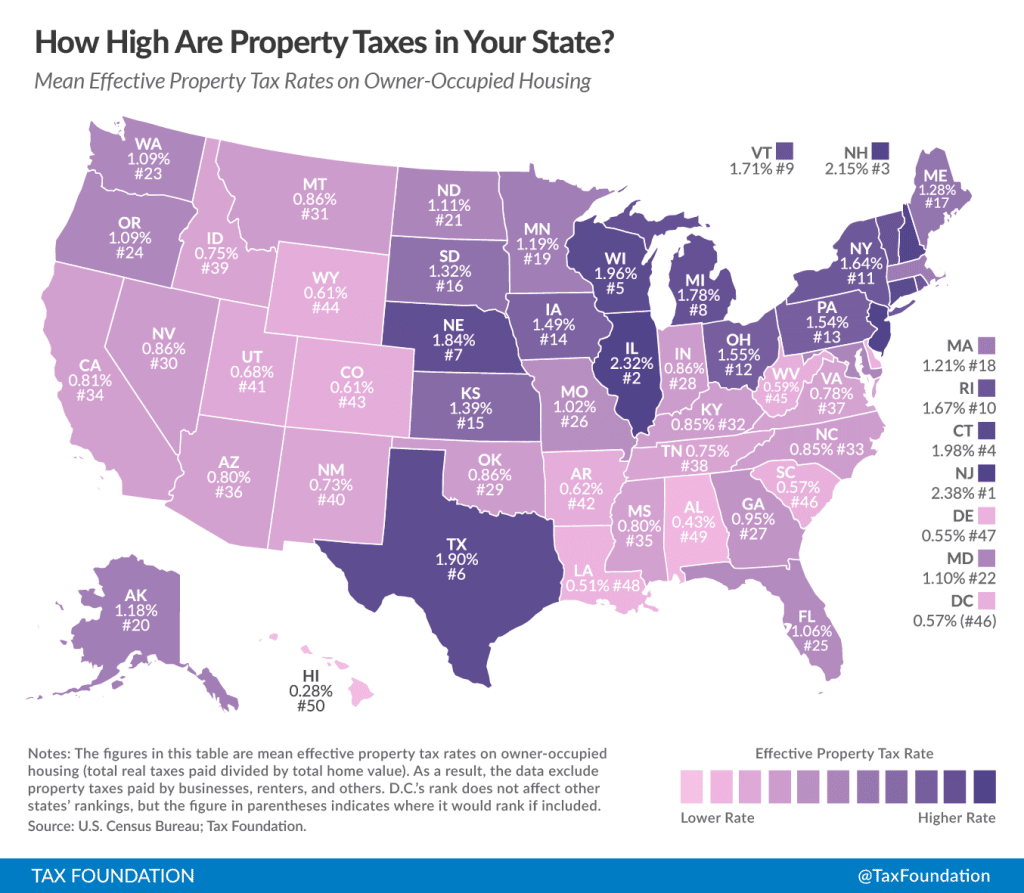

Across Florida, the effective annual property tax rate stands at 0.86%, the 25th lowest among states. For context, homeowners in the U.S. pay an average of 1.03% of their housing value in property taxes a year.

The effective property tax rate is calculated by taking the total amount of taxes paid on owner-occupied homes in a given area as a share of the total value of those homes. While an effective property tax rate is useful for comparing taxes at the state level, it is important to note that property tax rates can still vary considerably within a given state.

All data in this story is from the Tax Foundation, a tax policy research organization, and the U.S. Census Bureaus 2019 American Community Survey.

You May Like: Can I Still File My 2017 Taxes Electronically In 2021

The Florida Property Tax

The Florida constitution reserves all revenue from property taxes for local governmentsthe state itself doesn’t use any of this money. Property taxes are based on the “just value” or market value of properties as they’re assessed by a local appraiser as of Jan. 1 of each year.

Increases in value are limited to 3% of the previous year’s assessment or the Consumer Price Index , whichever is less. This limitation is known as the “Save Our Homes” cap.

Taxes are based on millage rates set by local governments, with 10 mills being equal to 1%. The millage rate is multiplied by the value of the property to determine the dollar amount of the tax. County, city, and school districts are permitted to levy taxes at up to 10 mills each.

Recommended Reading: States With No Tax On Retirement Income

Florida Sales Tax Rates By City

The state sales tax rate in Florida is 6.000%. With local taxes, the total sales tax rate is between 6.000% and 7.500%.

Florida has recent rate changes .

Select the Florida city from the list of popular cities below to see its current sales tax rate.

Sales tax data for Florida was collected from here. Sale-Tax.com strives to have the most accurate tax percentages available but tax rates are subject to change at any time. Always consult your local government tax offices for the latest official city, county, and state tax rates. Help us make this site better by reporting errors.

Florida Communication Services Tax

In addition to the above taxes, Florida also collects a special communication services tax on all phone, internet and television services. The total tax rate is 7.44%, but service providers are only allowed to directly bill consumers for 5.07% of that. For the remaining 2.37%, consumers must report and pay the tax independently.

For satellite-based services like DirecTV, the rate is even higher at 11.44%. So if you are a big spender on high-speed internet, multiple phone lines and the top-of-the-line cable TV packages, expect a slightly higher price-tag when it comes time to pay up.

You May Like: How To Pay Taxes On Stocks

Overview Of Florida Taxes

Florida is known for having low taxes. Delving into the numbers, the state mostly lives up to the reputation. Despite having no income tax, though, there are some taxes that Florida residents still have to pay.

| Household Income |

| Number of State Personal ExemptionsDismiss |

* These are the taxes owed for the 2021 – 2022 filing season.

Can You Deduct Transfer Taxes

Usually, you cant deduct transfer taxes when it comes time to file your tax return. However, there are two potential situations in which you can still capture some tax savings.

Firstly, if youre using the property in question as a rental home or investment property, you can sometimes write it off as a business expense. If thatsnot possible, you can wrap those taxes into the cost basis of the property.

The cost basis of the property is basically what you had to pay in order to acquire the property, and is used to arrive at the amount of capital gains taxes youll owe. Your capital gains are arrived by deducting the cost basis of your property from the total price, so including the cost of the Doc Stamps can be helpful in lowering these taxes.

Recommended Reading: When Is Tax Returns Due

Also Check: What Is Mass Sales Tax

How You Can Affect Your Florida Paycheck

If you want a bigger Florida paycheck you can ask your employer about overtime, bonuses, commissions, stock options and other forms of supplemental wage pay. Just like regular income, supplemental wages are not taxed at the state level in Florida. However, your employer will withhold federal income taxes from your supplemental wage payments.

If you want to shelter more of your Florida earnings from a federal tax bite, you can max out your 401 so that more of your paycheck is going to tax-advantaged retirement savings. You can also contribute to a tax-free FSA or HSA to use for medical expenses. If you opt to contribute to an FSA account, remember that the money is use-it-or-lose-it and doesnt roll over from year to year.

But dont stop there. Ask your employer or HR department about other tax-advantaged places for your money, such as commuter benefits that let you pay for parking or public transit with pre-tax dollars.

Determine Your Florida Businesss Employment Taxes

Florida employers pay a reemployment tax. Many states call this an unemployment tax.The initial Florida business tax rate for reemployment is 2.7%. After the employer has reported taxes for 10 quarters, the state does some math. The new rate is calculated by dividing the total benefits charges to the account by the taxable payroll reported for the first seven of the last nine quarters immediately preceding the quarter in which the rate becomes effective.

There is an exception for businesses that transfer ownership. The new owner may choose to accept the tax rate of the previous employer. They will also be responsible for paying any outstanding taxes.

Reemployment taxes are due every quarter by the following dates:

Recommended Reading: How To Calculate The Sales Tax

How Your Florida Paycheck Works

Living in Florida or one of the other states without an income tax means your employer will withhold less money from each of your paychecks to pass on to tax authorities. But theres no escaping federal tax withholding, as that includes both FICA and federal income taxes. FICA taxes combine to go toward Social Security and Medicare. The FICA tax withholding from each of your paychecks is your way of paying into the Social Security and Medicare systems that youll benefit from in your retirement years.

Every pay period, your employer will withhold 6.2% of your earnings for Social Security taxes and 1.45% of your earnings for Medicare taxes. Your employer will match that by contributing the same amount. Note that if youre self-employed, youll need to pay the self-employment tax, which is the equivalent of twice the FICA taxes – 12.4% and 2.9% of your earnings. Half of those are tax-deductible, though. Earnings over $200,000 will be subject to an additional Medicare tax of 0.9%, not matched by your employer.

Your employer will also withhold money from every paycheck for your federal income taxes. This lets you pay your taxes gradually throughout the year rather than owing one giant tax payment in April. The rate at which your employer will apply federal income taxes will depend on your earnings on your filing status and on taxable income and/or tax credits you indicate W-4 form.

Total Estimated 2021 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

Recommended Reading: Do I Have To Do Taxes

Does Florida Have Sales Tax Holidays

Florida hosts a bunch of sales tax holidays throughout the year.7 Basically, this is a stretch of time when certain items are exempt from sales tax, saving you a few bucks at checkout. Pretty sweet deal, right?

Here are the sale tax holidays happening right now:

- ENERGY STAR appliances: You can snag a new ENERGY STAR appliance without paying sales tax until June 30, 2023. This includes washing machines, clothes dryers and water heaters selling for $1,500 or less and refrigerators selling at $3,000 or less.8

- Childrens diapers and clothing: Have a newborn or toddler at home? Well, youre in luck! You can stock up on diapers and childrens clothing for your little ones without getting hit with sales tax until June 30, 2023.9

- Home hardening: Its no secret that Florida gets some crazy weather. All the way through June 30, 2024, impact-resistant doors, windows and garage doors are all exempt from sales tax. So you can save some cash prepping your home for harsh conditions.10

And these are just a few of the tax holidays this year. Past holidays have included tax exemptions on childrens books, tools, outdoor activities, back-to-school supplies and motor fuel.11 So be sure to keep an ear to the ground so you can take advantage of new or returning holidays as theyre announced.

Who Pays Florida Income Tax

Florida taxes all wages and income earned by residents who meet taxation requirements. That includes wages, interest income, capital gains, rental property income, and self-employment income . Regardless of where you live or work in Florida , you must pay tax on your entire taxable income.

Starting with your first paycheck in Florida, youll have to deal with a small income tax withholding and payments. Youll also have to figure out how to file your taxes each year by April 15th of the following year, and if youre self-employed, you may have to deal with estimated quarterly payments during certain times of the year.

There are more than 6 million taxpayers in Florida. But not all of them pay income tax. The reason for that is simple: There are multiple types of taxes in Florida, and most people dont have to pay all of them. If youre a resident or part-year resident, you owe state income tax if your taxable income meets or exceeds certain limits that apply based on your filing status and other factors.

Read Also: Iowa State Tax Refund Status

Also Check: New Jersey Tax Refund Status

Taxes In Florida Explained

For decades, Florida has had one of the lowest tax burdens in the country, according to the independent research organization Tax Foundation. For 2013, Florida will place the fifth-lowest tax burden on its residents and businesses. But not all taxes are created equal, and the state collects in a variety of ways that residents need to be aware of.

Florida Llc Taxes: Everything You Need To Know

Youll need to pay Florida LLC taxes if you own and operate a LLC in the state of Florida and then take additional steps in order to maintain your business.3 min read

Youll need to pay Florida LLC taxes if you own and operate a Limited Liability Company in the state of Florida. After forming your LLC, youll need to take additional steps in order to maintain your business.

Also Check: Best Place To Do Your Taxes

How Income Taxes Are Calculated

When Do We Update? – We regularly check for any updates to the latest tax rates and regulations.

Customer Service – If you would like to leave any feedback, feel free to email

…read more

Taxes can really put a dent in your paycheck. But with a Savings or CD account, you can let your money work for you. Check out these deals below:

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

Federal Income Tax In Florida

Floridians low tax burden is due to the absence of an income tax, making Florida one of seven states without an income tax. Even though Floridians pay federal income taxes, the Florida constitution prohibits this tax.

Depending on your filing status, you pay federal income tax at a rate of 22% on your taxable income.

You can deduct the most common personal deductions to lower your taxable income. The total value of these deductions cannot exceed $6,100 for single filers and $12,200 for married filing jointly.

Dont Miss: Out Of State Sales Tax

Read Also: How Long Receive Tax Refund

How 2022 Sales Taxes Are Calculated In Florida

The state general sales tax rate of Florida is 6%. Florida cities and/or municipalities dont have a city sales tax.Every 2022 combined rates mentioned above are the results of Florida state rate , the county rate . There is no city sale tax for the Florida cities. There is no special rate for Florida.The Floridas tax rate may change depending of the type of purchase. Some of the Florida tax type are: Consumers use, rental tax, sales tax, sellers use, lodgings tax and more.Please refer to the Florida website for more sales taxes information.

Capital Gains Tax Calculator

A Florida capital gains tax calculator will help you estimate and pay taxes based on your situation. You can use a capital gains tax rate table to manually calculate them, as shown above.

For example, if a person earns $50,000 per year and earns a capital gain of $1,000, they will have to pay $150 in capital gains taxes to the IRS.

Read Also: How Much Do You Need To Make To File Taxes

You May Like: Federal Tax Extension Deadline 2022