Finding The Most Fuel Efficient Vehicle

Car buyers can explore all their vehicle options with RelayCars. The site lets buyers explore different models via 3D models and augmented reality.

RelayCars includes thousands of models, including luxury brands like Ferrari and Lamborghini. RelayCars lets users research their vehicle choices from the comfort of home. With a tablet or a smartphone or even just a PC, car shoppers can explore their favorite models in 3D.

Using a fingertip or the mouse, buyers can turn the vehicle image around to view the car from all angles. RelayCars also lets buyers explore the interior of the car, too. Each model includes numerous images and interactive features.

The users environment also can be transformed into an augmented reality car showroom. RelayCars provides an augmented reality experience for car models in its inventory. This feature is initiated using the camera feature of a tablet or smartphone.

The user captures their environmentthis could be a driveway, backyard or even the living roomto be used as the showroom space for the vehicle. Once the user captures their space, they can drop in an augmented reality image of the vehicle.

RelayCars augmented reality experience is guided by the camera car shoppers can walk around the digital image of the vehicle just as they would at the dealership. Augmented reality can better aid buyers in understanding the design of the vehicle.

Do I Have To Pay Gas Guzzler Tax

Since 1991, consumers have paid the Gas Guzzler Tax on every new car purchased or leased with an unadjusted combined EPA fuel economy rating less than 22.5 miles per gallon . This only applies to cars, not pickups, vans, or SUVs. The maximum tax for cars with fuel economy ratings less than 12.5 mpg is $7,700.

Should I Trade In My Gas Guzzler

While choosing a more fuel-efficient model is certainly sound advice if you’re already in the market for a new car or have one that’s just coming off lease, it’s not financially advantageous to trade-in a vehicle particularly one that’s already paid for and otherwise meets your needs solely for the sake of …

Recommended Reading: Sales And Use Tax Exemption Certificate

Trucks Suvs And Cuvs Inclusion In The Gas Guzzler Tax Is 20 Years Overdue

Did you know that trucks, vans, SUVs and crossovers are not subject to the gas guzzler tax in the US?

Many organizations, including the Union of Concerned Scientists in Fuel Economy Fraud way back in 2005, have called for trucks and SUVs to be included in the gas guzzler tax. The automotive market has changed significantly since the gas guzzler tax was established by Congress as part of the Energy Tax Act of 1978 and it is time for this now embarrassing oversight to be corrected.

Are V8 Cars Good On Gas

Whether you enjoy the power of a V-8 engine in your muscle car or need to haul heavy work gear in your truck, a V-8 is never going to be as good on gas as smaller engines, such as a four-cylinder. However, there are several ways to improve your gas mileage to help your vehicle become as fuel efficient as possible.

Don’t Miss: Do You Get State Or Federal Taxes Back First

The Future Of The Tax

Energy experts and select grassroots organizations continue to push for an expansion of the Gas Guzzler Act to cover trucks, SUVs and vans. This would level the playing field within the automotive market and provide tremendous financial incentives to automakers to improve their products fuel efficiency, say FOE advocates. An alternative idea backed by the FOE other groups is providing tax credits to manufacturers and importers. The objective of this tax credit initiative is to create an incentive for manufacturers to produce fuel-efficient cars rather than the gas guzzlers that inspired this tax.

References

What Is Luxury Tax Used For

Luxury tax is a tax placed on goods considered expensive, unnecessary and non-essential. Such goods include expensive cars, private jets, yachts, jewellery, etc. Luxury tax is an indirect tax that increases the price of a good or service and is only incurred by those who purchase or use the product.

Also Check: Harris County Tax Assessor Office

Are Minivans Gas Guzzlers

The Gas Guzzler Tax is assessed on new cars that do not meet required fuel economy levels. These taxes apply only to passenger cars. Trucks, minivans, and sport utility vehicles are not covered because these vehicle types were not widely available in 1978 and were rarely used for non-commercial purposes.

How Much Mpg Does A Hellcat Get

The 2021 Challenger SRT Hellcat doesn’t power-slam gas like a competitive drinkerat least, not more than its competition. The EPA estimates it’ll earn 13 mpg in the city and up to 22 mpg on the highway. The Camaro ZL1 and Shelby GT500 top out at 14/21 mpg city/highway and 12/18 mpg city/highway, respectively.

Read Also: Federal Tax Return By Mail

Can I Finance Two Cars In My Name

The answer is yes! You can have two car loans at one time, but you must be mindful that it may be more difficult to qualify for a second loan. Lenders will only approve you if your income and debt can handle the added monthly expense. In addition, you will need good to excellent credit to receive a low APR.

What Vehicles Are The Most Energy Efficient

Back in the late 70s, buyers only had the option to purchase vehicles with fuel injected engines. Cars were powered by fuel, and electric vehicles or hybrid models werent introduced for decades.

Today, though, buyers dont have to be tied to the pump. Now car buyers can opt for hybrid vehicles and electric models. These vehicles are the most energy-efficient on the market.

Hybrid vehicles typically boast about 50 MPGe, while electric vehicles are measured by their range . The longest-range electric model is produced by Lucid and has a range of 520 miles.

One of the most fuel efficient vehicles on the marketthat is neither hybrid nor electricis the Mitsubishi Mirage. The Mirage offers an estimated 43 MPG on the highway and up to 36 MPG in the city. The vehicle also is one of the most economically priced models on the market with a base price less than $15,000.

While the Mirage is fuel efficient and budget-friendly, it doesnt score well with sites like Car and Driver, which rated the Mirage 2.5 out of 10. The model was noted as having poky acceleration and less than impressive interior features.

Some buyers might not have the budget to purchase an electric or hybrid model. Other fuel-efficient standard vehicles include:

- Chevrolet Spark

Also Check: How To Apply For An Extension On Taxes

Fotw #1183 April : New Cars Purchased With Low Fuel Economy Ratings Continue To Be Assessed A Gas Guzzler Tax

Since 1991, consumers have paid the Gas Guzzler Tax on every new car purchased or leased with an unadjusted combined EPA fuel economy rating less than 22.5 miles per gallon . This only applies to cars, not pickups, vans, or SUVs. The maximum tax for cars with fuel economy ratings less than 12.5 mpg is $7,700. Most of the models that are assessed the tax are sports cars or luxury models.

Note: Unadjusted fuel economy is based on only city and highway driving cycles, while the fuel economy on the window sticker is based on city, highway, three additional driving cycles, and an on-road adjustment factor.

Internal Revenue Service, Form 6197, , “Gas Guzzler Tax.”

How Does It Work

- The levyLevyA levy is a lawful process where the debtor’s property is seized when the debtor cannot pay the outstanding debts. It is different from liens, as a lien is only a claim against a property, whereas a levy is an actual property takeover to fulfill the obligation.read more of gas guzzler tax is determined based on two values calculated by the Environmental Protection Agency . It is computed as the cars fuel economy based on 55% city driving estimate combined with the 45% highway driving cycles.

- The vehicles that get 22.5 miles per gallon or more, of the combined highway to city mileage, do not have to pay such tax at all. It means if your vehicle runs a smaller number of miles for a given quantity of fuel, it consumes more fuel. More consumption means more pollutants evacuated into the environment. Hence, the term gas guzzler is used.

Read Also: How Long Do Taxes Take To Process

Gas Guzzler Tax Refund

Buyers arent assessed a gas guzzler tax and arent responsible for paying this tax. Again, the manufacturer or importer will be taxed. However, the tax is noted on the vehicles sticker and might mean a higher price for consumers.

Car owners might wonder if there is a gas guzzler tax refund. The only refund mentioned that is related to the gas guzzler tax is discussed in Ford forums for a 2020 model perhaps of the Mustang. It appears that the gas guzzler tax was computed incorrectly and a refund was issued.

Explaining The Gas Guzzler Tax

Q:Last year I purchased a 2007 Mercedes-Benz E550 that required a $1,300 gas guzzler payment. In the 15 months since, this vehicle has averaged 23.0 miles per gallon overall, and between 27 to 30 mpg on the highway depending on how fast I drive. I see advertising touting the great fuel efficiency of vehicles getting less mileage with no gas guzzler tax. How is this tax calculated, and why was I required to pay this penalty? — David A Burya, Fort Myers, Fla.

A:The gas-guzzler tax is based on your vehicle’s overall fuel economy, based on Environmental Protection Agency estimates. The estimate for your car is 21.3 miles per gallon and $1,300 is the penalty for cars like yours that score at least 20.5 mpg but less than 21.5 mpg. Cars need a rating of at least 22.5 mpg to avoid the tax.

I’d call the gas-guzzler tax a joke if there was a shred of humor in it. The rule, which dates to the late 1970s, was meant to discourage people from buying cars that aren’t fuel efficient. But since few people used pickups and SUVs for family transport back then, the rule doesn’t apply to light trucks. So there’s no such tax on your neighbor’s 10-mile-per-gallon Hummer.

More details about the tax are available at: www.epa.gov/fueleconomy/guzzler

Q:Even with the easing of gas prices, my next car will be a Prius. Is there soon to be released a new version, and if so, when. I really don’t want to buy the last model year of the “old” version. — Steven E. Rubin, Great Neck, N.Y.

Read Also: Where’s My Tax Refund Pa

What Is Gas Guzzler Tax

The gas guzzler tax is a surcharge added to the sales or lease price of cars in the U.S. that have poor fuel economy ratings. The tax, which is paid by the manufacturer or importer of the vehicle, varies depending on the miles-per-gallonmiles-per-gallonFuel economy is the distance travelled per unit volume of fuel used for example, kilometres per litre or miles per gallon , where 1 MPG 0.354006 km/L. In this case, the higher the value, the more economic a vehicle is . https://en.wikipedia.org wiki Fuel_efficiency

What cars are affected by the gas guzzler tax?

- The Gas Guzzler Tax is assessed on new cars that do not meet required fuel economy levels. These taxes apply only to passenger cars. Trucks, minivans, and sport utility vehicles are not covered because these vehicle types were not widely available in 1978 and were rarely used for non-commercial purposes.

Are Suvs Gas Guzzlers

Without adjusting the figures to account for occupancy, Dr. Sivak found that passenger cars burned 33.1 gallons of gas over 1,000 miles, while SUVs swallowed 42.9 gallons. But the gas guzzling SUVs carried an average of 1.83 passengers, compared with cars, which carried an average of 1.54 passengers.

Don’t Miss: Does Texas Have State Income Taxes

The Big Guy Gets His Cut

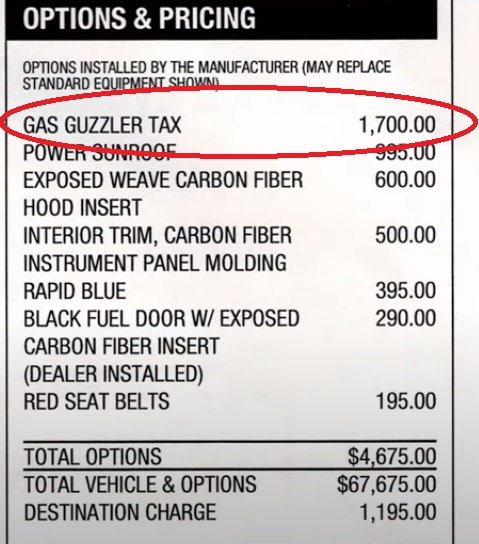

The Gas Guzzler Tax is one of those things just about every enthusiast loves to hate. After all, paying even more money to The Man just for the privilege of having a car capable to dumping more fuel into the cylinders for go-fast power can be insulting. Unsurprisingly, evidence has emerged that the 2023 Chevy Corvette Z06 will come with the Gas Guzzler Tax, meaning buyers will have to pony up even more cash up front to get theirs.

Find out why activists are deflating tires on gas guzzlers here.

Likely, most people who are buying a six-figure sports car will be able to float the $2,600 to $3,000 in taxes. That lower amount supposedly will be for C8 Z06 cars lacking the Carbon Aero package, while those who opt for Carbon Aero will have to pay the higher tax.

This is all according to a post from MidEngineCorvetteForum.com. One of the founders posted a photo taken of a screen showing the pricing breakdown for the C8Z, and it looks pretty legit. Still, the Gas Guzzler Tax hasnt been officially announced by Chevrolet, so dont start thinking this is official.

If anything, the Gas Guzzler Tax make performance cars like the new Z06 Corvette even bigger status symbols in certain circles. We seriously doubt GM will have trouble selling any.

Source and image: MidEngineCorvetteForum.com

Lead image via GM

Sign up for the Motorious Newsletter. For the latest news, follow us on , , and .

Calculation Of Gas Guzzler Tax

The information is required to be submitted in Part I of the form number 6197 of the IRS. This form 6197 is attached to form 720. Part II of the form requires the manufacturer to submit details regarding the identification of the models which are subject to the said tax. Like in our example, the manufacturer should specify the exact model name, make, and model year of the 8 cars sold underline number 5 having a rate of tax $ 2100. The exact format is as below:

| Line Number from above | Make, Model name & Model Year |

|---|

Also Check: How To Check If Your Taxes Were Filed

Which Cars Are Not Gas Guzzlers

The Gas Guzzler Tax is assessed on new cars that do not meet required fuel economy levels. These taxes apply only to passenger cars. Trucks, minivans, and sport utility vehicles are not covered because these vehicle types were not widely available in 1978 and were rarely used for non-commercial purposes.

Which Cars Are Subject To Gas Guzzler Tax

The EPA published a list of new car models that were subject to the gas guzzler tax up until 2016. It has not published one since, but the 2016 list of gas guzzlers gives a sense of the kind of cars that are subject to the tax.

The majority are high-end luxury and sports cars, including models from Aston Martin, BMW, Ferrari, and Rolls-Royce. A few American muscle cars were on the list, too, including the Chevrolet Corvette and one iteration of the Ford Mustang.

Also Check: What Is Form 5498 For Taxes

Will Gas Engines Go Away

Though governmental organizations have begun enforcing increasingly strict emissions standards, the change from gas to electric may still prove slow. The average age of the combustion engine vehicles out on the road is over 10 years. That means it could take up to 25 years for all the cars bought in 2020 to die.

What Is A Gas Guzzler Tax

The gas guzzler tax is a surcharge added to the sales or lease price of cars in the U.S. that have poor fuel economy ratings. The tax, which is paid by the manufacturer or importer of the vehicle, varies depending on the miles-per-gallon efficiency of the vehicle and ranges from $1,000 to $7,700.

What cars are affected by the gas guzzler tax?

- The Gas Guzzler Tax is assessed on new cars that do not meet required fuel economy levels. These taxes apply only to passenger cars. Trucks, minivans, and sport utility vehicles are not covered because these vehicle types were not widely available in 1978 and were rarely used for non-commercial purposes.

Recommended Reading: How Can Tax Identity Theft Occur

Vehicles That Are Exempt From The Gas

In 1984, Jeep introduced the Cherokee XJ, which is widely credited as the first sport utility vehicle . The SUV didn’t exist when the gas guzzler tax was passed, but over the next 30 years, it became the most popular type of vehicle sold in the U.S.

In 2019, American consumers continued to favor trucks and SUVs over cars. Nonseasonally adjusted passenger car sales in the U.S. for 2019 declined 10.9% to 4.7 million units, versus 5.3 million units in 2018. Sales of trucks, minivans and SUVs for the year totaled 12.2 million units, up 2.8% from the 2018 figure of 11.9 million units, according to an S& P Global Market Intelligence analysis.

Auto manufacturers were keen to take advantage of a loophole in the gas guzzler tax and its interpretation through regulatory agencies like the EPA that exempted “light-duty trucks” from the law. Consequently, the amount of gas guzzler tax collected by the U.S. in the fiscal year 2019 was under $43 million.

Which Vehicles Are Not Included In The Gas Guzzler Tax

trucks, minivans, and SUVsJeep Cherokee XJ in 1984popular models that arenât subject

Key Takeaway Americaâs most popular vehicles like SUVs, trucks, and minivans are typically exempt from the gas guzzler taxâwhile high-end, luxury models are notoriously subject to it.

MORE

You May Like: How Do I Report Crypto On Taxes