What Is Consumer Use Tax

Consumer Use Tax Definition

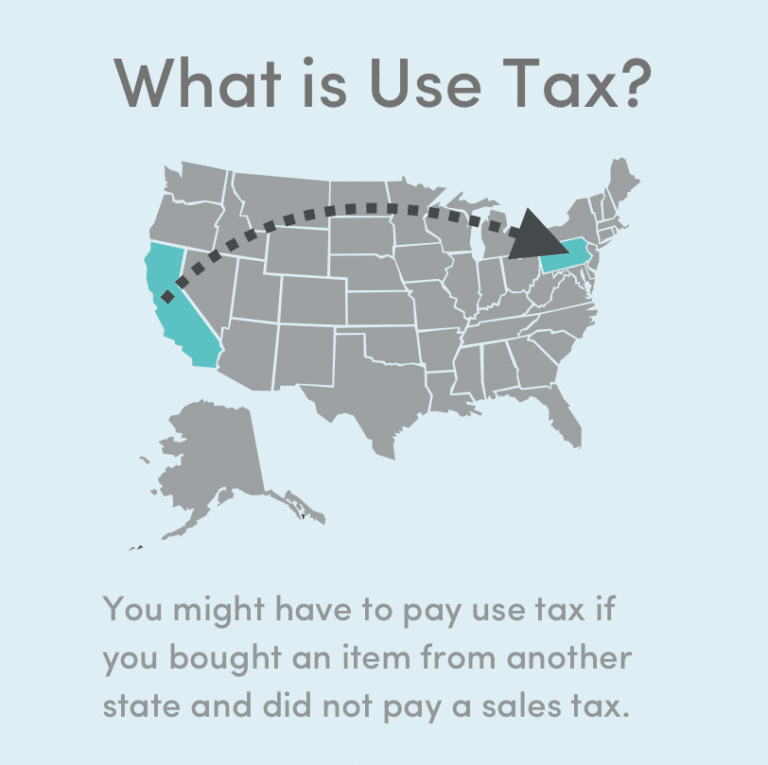

Consumer use tax is complementary to the sales tax. It is a type of excise tax imposed by state and local governments, calculated as a percentage of the sales price of goods and certain services but paid as a use tax. Typically, consumer use tax is imposed on transactions that are subject to sales tax, but tax was not charged. Usually, this occurs when items are purchased out-of-state, ordered through the mail, over the Internet, or by phone from another state. It is imposed on the use, storage, or consumption of tangible personal property in the state. The use tax often applies when a company makes a purchase from an out-of-state seller that is not required to collect sales tax in the purchasers state.

Retailers are not usually required to collect sales tax on taxable purchases from consumers in states where the retailer does not have some connection to the state . This connection is created by retailers if they have a physical presence, make regular deliveries with their own vehicles into the state, have sales representatives located in the state, economic nexus, affiliate nexus, click-through nexus or marketplace nexus. The use tax burden falls on the consumer to calculate and remit the tax to his or her state government. Therefore, if the seller does not collect the tax from the purchaser and the transaction is taxable, the purchaser is responsible for remitting the use tax to the state.

Calculating Missouri Car Sales Tax

If youre planning an investment in a vehicle, its helpful to have an estimation of the cost. The sales tax is one of the most critical parts of the payment on top of the official price of the car you want.

There are simple ways to calculate this tax. Once you have the number, add it to the existing price point.

If you want to calculate your estimated sales tax for a car in Missouri, you should:

- Locate the official cost of the vehicle

- Multiply the number by .04225

- Jot down the final answer

This number is the estimation for your Missouri car sales tax.

There are also many online calculators to complete the process if you dont want to do the math yourself. Once you understand what to anticipate, you can feel more confident in your large investment choice.

With any fee or tax, there are exemptions to consider. Are there any available for those who own vehicles in Missouri? Lets talk about it.

Who Should Register For Sales And Use Tax

Every business, person, or facilitator engaged in business in North Carolina of one or more of the following must register online or with the Department to obtain a Certificate of Registration:

- Selling tangible personal property at retail.

- Selling and providing taxable services.

- Renting or leasing taxable tangible personal property in this State.

Every business that buys taxable tangible personal property, services, or certain digital property for storage, use, or consumption in this State where the correct amount of sales tax has not been paid is required to file and remit the use tax due. A business must register to file and remit use tax unless:

All remote sellers having gross sales in excess of one hundred thousand dollars sourced to North Carolina or two hundred or more separate transactions sourced to North Carolina in the previous or current calendar year must register to collect and remit sales and use tax to North Carolina effective November 1, 2018. Review our Remote Sales web page for guidance and resources for persons required to collect sales tax on remote sales.

Are individuals who don’t operate a business required to register and file for sales and use tax if they make purchases without paying sales tax?

Read Also: Sales Tax On Gold And Silver By State

How To Pay Use Tax

If you have a California seller’s permit, you must pay the use tax due on business related purchases with your sales and use tax return in the period when you first used, stored, or consumed the item in California. Report the amount of your purchase under Purchases subject to use tax, on the return.

If you are a qualified purchaser, you must pay your use tax due by filing your return for the previous calendar year by April 15.

If you are not required to have a seller’s permit or a use tax account you must pay use tax in one of the following ways.

- The easiest way to report and pay the use tax is on yourCalifornia state income tax return. Follow the instructions included with your income tax return. Complete the worksheet included in those instructions to determine the amount of your use tax liability. As part of reporting use tax on the State Income Tax Return, you may also choose to use a Use Tax Lookup Table. OR

- Pay Use Tax directly to the California Department of Tax and Fee Administration by using the CDTFA’s electronic registration system

“Qualified purchasers” under Revenue and Taxation Code section 6225 are business operations that must register with CDTFA to report and pay use tax owed. A “qualified purchaser” means a person that meets all of the following conditions:

State County And Local Sales Taxes

In the United States, businesses need to think about sales taxes at multiple levels different governmental bodies regulate the imposition and collection of sales taxes. For example, 45 states collect a statewide sales tax rates vary, but each of these areas requires businesses with economic nexus in the state to charge and remit state-level sales taxes.

In addition, 38 states allow for local sales taxes to be charged and collected . In some cases, the local tax rate can exceed the state sales tax rate.

As a business owner, youll need to consider both state and local sales tax rates. If youre in the planning process, you should understand that high tax rates can push consumers to cross borders to buy goods. No matter what, youll need to ensure your sales tax compliance at the state, county, and local level.

Combined State and Local Sales Tax Rates in 2021

State and Local Sale Tax Rate data from Tax Foundations, State and Local Sales Tax Rates, 2021:

Read Also: Are Hsa Contributions Pre Tax

Sales & Use Tax In California

Retailers engaged in business in California must register with the California Department of Tax and Fee Administration and pay the state’s sales tax, which applies to all retail sales of goods and merchandise except those salesspecifically exempted by law. The use tax generally applies to the storage, use, or other consumption in Californiaof goods purchased from retailers in transactions not subject to the sales tax. Use tax may also apply to purchasesshipped to a California consumer from another state, including purchases made by mail order, telephone, or Internet.

The sales and use tax rate in a specific California location has three parts: the state tax rate, the local tax rate,and any district tax rate that may be in effect.

State sales and use taxes provide revenue to the state’s General Fund, to cities and counties through specific statefund allocations, and to other local jurisdictions.

Additional Sales And Use Tax Information

For additional information about the specifics of certain types of sales rates, fees and exemptions, visit the following two sections in the sales and use tax section for businesses:

- 1 cent on each sale where the taxable price is 20 cents.

- 2 cents if the taxable price is at least 21 cents but less than 34 cents.

- 3 cents if the taxable price is at least 34 cents but less than 51 cents.

- 4 cents if the taxable price is at least 51 cents but less that 67 cents.

- 5 cents if the taxable price is at least 67 cents but less than 84 cents.

- 6 cents if the taxable price is at least 84 cents.

- 1 cent if the excess over an exact dollar is at least 1 cent but less than 17 cents.

- 2 cents if the excess over an exact dollar is at least 17 cents but less than 34 cents.

- 3 cents if the excess over an exact dollar is at least 34 cents but less than 51 cents.

- 4 cents if the excess over an exact dollar is at least 51 cents but less than 67 cents.

- 5 cents if the excess over an exact dollar is at least 67 cents but less than 84 cents.

- 6 cents if the excess over an exact dollar is at least 84 cents.

Download our sales and use tax rate chart.

Read Also: Call Irs About Tax Return

What Is The Missouri Car Sales Tax Rate

Vehicle purchases are some of the most common investments across the country and in Missouri. The sales size means there could be a significant tax placed on purchases like vehicles, making it critical to understand the sales tax rate before making a final decision.

According to bobeuckmanford.com, the Missouri car sales tax rate is 4.225%. When considering the sales tax rate of every other state, this fee is very low – almost 2% lower than in states like Tennessee and Texas. However, there are lower states. Alabama and Colorado are about 2% lower than the sales tax.

Its also critical to consider the states local tax, which can add up to 4.5% alongside the Missouri car sales tax. There are also fees, insurance rates, and other registration costs when investing in a vehicle.

Lets say you want to trade in a car rather than purchase one outright. There are different taxes to consider if you decide to go this route instead of the traditional method.

NOT JUST FOR CAR SHOPPING

The CoPilot app isnt just for buying a car – our new CoPilot for Owning tool will help you keep track of recalls and gives you advice on which scheduled maintenance tasks are most important.

Other Fees To Consider

The sales tax isnt the only item to consider when investing in a new vehicle in Missouri. Although its the biggest one, the smaller fees will add up and take you by surprise if you are not careful. Lets discuss the other potential costs.

According to greenlightautocredit.com, here are additional fees to consider for your Missouri vehicle:

- Registration fees

- Processing fees

These go on top of the added sales tax and the original price of the vehicle.

Its critical to consider as many potential fees as possible to determine an accurate estimate for your car. Its always better to overestimate rather than underestimate. If you pay less, it will feel good. If you pay more, it will be discouraging. Consider additional fees on top of sales tax for your Missouri vehicle.

Don’t Miss: How To File An Extension Taxes

Sd State Senator Elected To Serve As The President Of The Streamlined Sales Tax Governing Board For 2023

01-13-2023 minute read

Congratulations to South Dakota State Senator Tim Reed, who has been elected to serve as the President of the Streamlined Sales Tax Governing Board for 2023.

Senator Reed was appointed to the Governing Board in 2017. Reed indicated I am truly humbled that our membership has chosen me to serve as their President for 2023. I look forward to leading Streamlined as we continue to work with the business community to simplify and modernize the sales tax systems throughout the country, especially in this post-Wayfair world.

According to Senator Reed, Now that a state can require out-of-state sellers to collect and remit sales taxes on remote sales even if they do not have a physical presence in that state, it is critical the business community is given the clarity and certainty they need to meet their sales tax collection obligations. Our organizations goals are to reduce the burdens of tax collection so the business owner will have resources to focus on growing their business.

The 24 member states that make up the Streamlined Sales Tax Governing Board have been partnering with the business community for over 20 years to create simpler, more uniform sales and use tax systems. SST administers the Streamlined Sales and Use Tax Agreement that contains the simplification and uniformity requirements states must meet to join.

To learn more about SST, please visit streamlinedsalestax.org.

What Is Sales Tax

Sales tax is a type of pass-through tax. This means that the tax passes through the business and onto the customer. Forty-five states and Washington D.C. have some form of sales tax . Alaska, Delaware, Montana, New Hampshire, and Oregon do not have any state sales tax laws.

Businesses collect sales tax at the point of sale when a customer is making a purchase. Customers are responsible for paying the sales tax on applicable purchases. However, the business owner is responsible for collecting and remitting the sales tax to the proper agency.

In some cases, customers may be exempt from paying sales tax on certain products . And, some states even have sales tax holidays that exempt certain items, like clothing and shoes, from sales tax for a day , week, or weekend. However, sales tax rules and holidays vary by state and locality.

The amount of sales tax you collect depends on what state, county, or city your business has physical presence in, otherwise known as sales tax nexus. Sales tax nexus determines if your business has enough presence in a location to collect sales tax. For example, states look at factors like office location, employees, and amount of sales to determine if you have nexus.

Businesses located in a state with sales tax and that have sales tax nexus must collect the tax from customers on taxable purchases. Generally, sales tax is a percentage of the customers total bill . Again, the seller is responsible for collecting and remitting the sales tax.

Also Check: What Is The Current Tax Year

Discounts Penalties Interest And Refunds

- Permitted sales taxpayers can claim a discount of 0.5 percent of the amount of tax timely reported and paid.

- Sales taxpayers who prepay can claim 0.5 percent for timely filing and paying, plus 1.25 percent for prepaying. See .

- A $50 penalty is assessed on each report filed after the due date.

- If tax is paid 1-30 days after the due date, a 5 percent penalty is assessed.

- If tax is paid over 30 days after the due date, a 10 percent penalty is assessed.

What’s The Difference Between The Use Tax And The Sales Tax

A sales and use tax are ultimately the same thing. They are both applied to goods and services. The difference lies in how they’re calculated and who pays them. While a sales tax is applied at the time a purchase is made and is collected and remitted to the government by the seller, a use tax is calculated and paid by the consumer or end user. The rate, however, is generally the same as the local/state sales tax.

Read Also: Best States For Income Tax

What Is The Difference Between Sales And Use Tax

Sales tax applies to taxable goods purchased within a state from a merchant with economic nexus. Use tax applies to taxable goods purchased outside a state from a merchant without economic nexus. Sales tax is collected by the seller, while the buyer is responsible for use tax. Youll never pay both sales tax and use tax on an item, since use tax is intended to make up for unpaid sales tax.

Consumer’s Use Tax For Businesses

The consumer’s use tax applies to tangible items used, consumed, or stored in Virginia when the Virginia sales or use tax was not paid at the time of purchase. The use tax is computed on the cost price of the property, which is the total amount for which the property was purchased, including any services that are a part of the purchase, valued in money or otherwise, and includes any amount for which credit is given the purchaser or lessee by the seller.

Returns are due on the 20th day of the month after the filing period. You dont have to file for any periods that you dont owe tax. File by including the taxable items on your regular sales tax return, or you can file using the eForm ST-7.

Also Check: How Much Taxes Deducted From Paycheck Tn

Filing & Paying Sales/use Tax

Schedule

A provision in the FY21 Budget changed the due date for sales and use tax and room occupancy excise returns. For more information visit New Due Date for Sales and Use Tax Returns.

| Due annually on or before the 30th day following the year represented by the return completed withMassTaxConnect or Form ST-9 | |||||

| From $101 up to $1,200 | Due quarterly on or before the 30th day following the quarter represented by the return completed with MassTaxConnect or Form ST-9 Form STS | ||||

|

Due monthly on or before the 30th day following the month represented by the return completed with MassTaxConnect or Form ST-9 Form STS New! Advance payment requirements for: Sales and use, Sales tax on services, Meals tax, Meals tax, Room occupancy excise, Marijuana retail taxes Beginning April 2021, a provision in the FY21 budget requires that taxpayers with over $150,000 in cumulative tax liability in the prior year will be required to make advance payments. To learn more, visit New Advance Payment Requirement for Vendors and Operators in G.L. c. 62C, § 16B. |

With return |

Businesses and individuals incurring use tax liabilities who are not registered vendors may file a Business Use Tax Return or Individual Use Tax Return . Both returns are due annually by April 15.

Electronic Filing Requirements

Some taxpayers are required to file returns electronically. See if electronic filing and payment requirements apply to you.

You must file returns and make payments electronically if you are a business with: