How Do You Calculate Social Security Tax

To calculate the Social Security tax, multiply the employees gross taxable wage by the Social Security tax rate. Pay frequency does not matter. You always calculate the tax the same way.

Say you pay an employee $1,000 in gross wages. Multiply the $1,000 by 6.2% to determine how much to withhold from the employees wages. Because you contribute the same amount, use the calculated amount to determine how much you contribute.

Social Security tax = $1,000 X 0.062 = $62

Withhold $62 from the employees wages and contribute $62 for the employer portion of the tax.

Once the employee earns $142,800 in 2021 , stop withholding and contributing Social Security tax on their wage. If the employees wages never reach the annual wage base, do not stop withholding and contributing the tax.

What Changes Could Be Included

Democrats have proposed reapplying the Social Security payroll tax starting at $400,000 in wages. Earnings up to $147,000 would still be taxed. Then there would be a donut hole or gap where the taxes were no longer applied until wages reached $400,000 and the tax was assessed again.

There are other ways lawmakers could include more wages in the Social Security payroll tax, according to Kathleen Romig, director of Social Security and disability policy at the Center on Budget and Policy Priorities.

That could include simply applying the tax on all wages above $147,000.

Additionally, they could create a surtax specifically for higher earners, and possibly reducing the benefits they receive.

Just keeping up with the growing wage inequality in this country … would close a substantial portion of the financing gap.Kathleen Romigdirector of Social Security and disability policy at the Center on Budget and Policy Priorities

Lawmakers could also choose to apply Social Security payroll taxes to programs that were non-existent when Congress last addressed this issue, such as transit subsidies or flexible spending accounts.

Since the cap was first set, wages at the top have grown dramatically faster.

Social Security payroll taxes initially covered about 90% of wages. To cover that level of wages, the cap would be need to be around $270,000, according to a 2016 estimate.

Social Security Retirement Benefits

As a worker earns income during their working years, they earn up to four Social Security credits per year. Forty credits are typically required to receive retirement benefits. So, in general, if someone has worked and paid into Social Security for at least 10 years, they will be eligible for Social Security retirement benefits.

The amount of retirement benefits a retiree receives depends on their inflation-adjusted lifetime earnings as well as how old they are when they choose to begin receiving benefits.

Although individuals may be able to begin receiving Social Security retirement benefits at age 62, they will receive lower payments than if they wait until their full retirement age. A workerâs full retirement age depends on when they were born.

| Year of Birth | |

|---|---|

| 66 and 10 months old | |

| 1960 or later | 67 |

On the other hand, if a worker chooses to delay receiving retirement benefits until after they reach full retirement age, their future retirement benefits will increase with each month of delay until they turn 70 years old.

You can estimate your future Social Security benefits on the Social Security Administrationâs website.

Read Also: Amended Tax Return Deadline 2020

Claim That It Is A Ponzi Scheme

Critics have drawn parallels between Social Security and Ponzi schemes, arguing that the sustenance of Social Security is due to continuous contributions over time. One criticism of the analogy is that while Ponzi schemes and Social Security have similar structures , they have different transparencies. In the case of a Ponzi scheme, the fact that there is no return-generating mechanism other than contributions from new entrants is obscured whereas Social Security payouts have always been openly underwritten by incoming tax revenue and the interest on the Treasury bonds held by or for the Social Security system. The sudden loss of confidence resulting in a collapse of a conventional Ponzi scheme when the scheme’s true nature is revealed is unlikely to occur in the case of the Social Security system. Private sector Ponzi schemes are also vulnerable to collapse because they cannot compel new entrants, whereas participation in the Social Security program is a condition for joining the U.S. labor force. In connection with these and other issues, Robert E. Wright calls Social Security a “quasi” pyramid scheme in his book, Fubarnomics.

Is Social Security Income Taxable

According to the IRS, the best way to see if youll owe taxes on your Social Security income is to take one half of your Social Security benefits and add that amount to all your other income, including tax-exempt interest. This number is known as your combined income, and this is how its calculated:

Combined Income = Adjusted Gross Income + Nontaxable Interest + 1/2 of Social Security benefits

If your combined income is above a certain limit , you will need to pay at least some tax. The limit for 2022 is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child. The 2022 limit for joint filers is $32,000. However, if youre married and file separately, youll likely have to pay taxes on your Social Security income.

Recommended Reading: Out Of State Sales Tax

Definition And Example Of Social Security

Social Security is a federal benefits program that pays benefits to retirees and workers who are disabled, as well as their family members and survivors.

- Alternate name: Old-Age, Survivors, and Disability Insurance Program

- Acronym: OASDI

For example, workers who have paid into Social Security for at least 10 years are generally eligible to receive Social Security reduced retirement benefits when they turn 62 years old and full benefits if they elect to wait until the reach full retirement age .

How Do Social Security Claimants Know If They Have To Pay Tax

The SSA mails the statement every January and it summarizes how much you received in benefits the previous year.

If you have not received this form, or if you’ve misplaced it, you can request a new one using your online social security account.

Select the “replacement documents” tab and follow the instructions to order your new form.

If it turns out you do owe taxes on your benefits, you can opt to make quarterly estimated payments to the IRS, or you can choose to have federal taxes withheld when you initially apply for benefits.

You can choose to have either 7%, 10%, 12% or 22% of your monthly benefit withheld for taxes.

We also explain why the COLA increase is bad news for retirees and future claimants.

You May Like: Tax Short Term Capital Gains

Claim That Politicians Exempted Themselves From The Tax

Critics of Social Security have said that the politicians who created Social Security exempted themselves from having to pay the Social Security tax. When the federal government created Social Security, all federal employees, including the president and members of Congress, were exempt from having to pay the Social Security tax, and they received no Social Security benefits. This law was changed by the Social Security Amendments of 1983, which brought within the Social Security system all members of Congress, the president and the vice president, federal judges, and certain executive-level political appointees, as well as all federal employees hired in any capacity on or after January 1, 1984. Many state and local government workers, however, are exempt from Social Security taxes because they contribute instead to alternative retirement systems set up by their employers.

Social Security Benefits For Survivors

Upon a Social Security beneficiaryâs death, their surviving family may be eligible for benefits. These are called survivors benefits.

Generally, survivors receive 75% to 100% of the beneficiaryâs basic Social Security benefit with total family limits ranging from 150% to 180%.

Surviving spouses or minor children may be eligible for a one-time payment of $255 survivorâs benefit upon the death of the beneficiary.

A survivorâs eligibility for benefits depends on their relationship to the deceased beneficiary and possibly other factors such as their age, disability status, , dependency status, student status, benefits status, and childcare responsibilities.

| Type of Survivor |

| Eligible if they were your dependent for at least half their support |

Read Also: Tax On Food In Virginia

Office Of Hearings Operations

On August 8, 2017, Acting Commissioner Nancy A. Berryhill informed employees that the Office of Disability Adjudication and Review would be renamed to Office of Hearings Operations . The hearing offices had been known as “ODAR” since 2006, and the Office of Hearings and Appeals before that. OHO administers the ALJ hearings for the Social Security Administration. Administrative Law Judges conduct hearings and issue decisions. After an ALJ decision, the Appeals Council considers requests for review of ALJ decisions, and acts as the final level of administrative review for the Social Security Administration .

Example Of Social Security Taxes

The Social Security tax is a regressive tax, meaning that a larger portion of lower-income earners’ total income is withheld, compared with that of higher-income earners. Consider two employees, Izzy and Jacob. Izzy earns $85,000 for the tax year 2020 and has a 6.2% Social Security tax withheld from his pay. The federal government, in effect, collects 6.2% x $85,000 = $5,270 from Izzy to help pay for retirement and disability benefits.

Jacob, on the other hand, earns $175,000 for the tax year 2020. The Social Security tax rate will only be applied up to the limit of $137,700 . Therefore, Jacob will pay 6.2% x $137,700 = $8,537.40 as his contribution to the countrys Social Security account for older people and people with disabilities, but his effective Social Security tax rate is $8,537.40 ÷ $175,000 = 4.87%. Izzy, with a lower income per annum, is effectively taxed at 6.2% .

Even households that earn a level of income to which little to no federal income tax will be applied may still have Social Security tax taken from their pay. A single taxpayer who earns $10,000 gross income in a given year, for example, will have zero income tax liability, but 6.2% may still be taken for Social Security.

You May Like: How To Find 2020 Tax Return

Who Is Exempt From Paying Social Security Tax

Certain individuals may claim an exemption and not be required to pay Social Security taxes. Some religious groups that openly oppose Social Security benefits may claim a religious exemption. Non-resident aliens may be exempt depending on their type of visa. Students working at their university may be exempt. Last, workers for a foreign government may be exempt under certain circumstances. If you believe you may fall into one of these groups, consult your tax advisor.

Demographic And Revenue Projections

| This section’s factual accuracy may be compromised due to out-of-date information. The reason given is: Several of these projected dates have passed, and some language referring to data as ‘current’, ‘latest’, ‘most recent’, etc. is as old as 2005, or undated. Please help update this article to reflect recent events or newly available information. |

In 2005, this exhaustion of the OASDI Trust Fund was projected to occur in 2041 by the Social Security Administration or by 2052 by the Congressional Budget Office, CBO. Thereafter, however, the projection for the exhaustion date of this event was moved up slightly after the recession worsened the U.S. economy’s financial picture. The 2011 OASDI Trustees Report stated:

Annual cost exceeded non-interest income in 2010 and is projected to continue to be larger throughout the remainder of the 75-year valuation period. Nevertheless, from 2010 through 2022, total trust fund income, including interest income, is more than is necessary to cover costs, so trust fund assets will continue to grow during that time. Beginning in 2023, trust fund assets will diminish until they become exhausted in 2036. Non-interest income is projected to be sufficient to support expenditures at a level of 77 percent of scheduled benefits after trust fund exhaustion in 2036, and then to decline to 74 percent of scheduled benefits in 2085.

Ways to eliminate the projected shortfall

Also Check: How Long Does Your Tax Return Take

Retirement Earnings Test Exempt Amounts

Workers who receive benefits before they reach full retirement age are subject to the retirement earnings test. If your income exceeds certain thresholds, then Social Security will withhold benefits until you reach FRA. Like the Social Security tax limit, these thresholds typically increase annually with the national wage index.

There are two annual earnings test exempt amounts: one that applies to individuals younger than retirement age and one that applies to individuals who reach FRA during that year. For younger recipients, Social Security withholds $1 for every $2 in excess of their exempt amount. Individuals who reach retirement age will have $1 withheld for every $3 in excess of their exempt amount.

In 2022, the earnings test exemption amounts will increase to:

- $19,560 for individuals younger than the FRA

- $51,960 for those who reach their FRA

In other words, an individual who earns $19,560 or less in 2022 may be eligible to receive full Social Security benefits. This is up from $18,960 in 2021.

What Is Social Security Tax

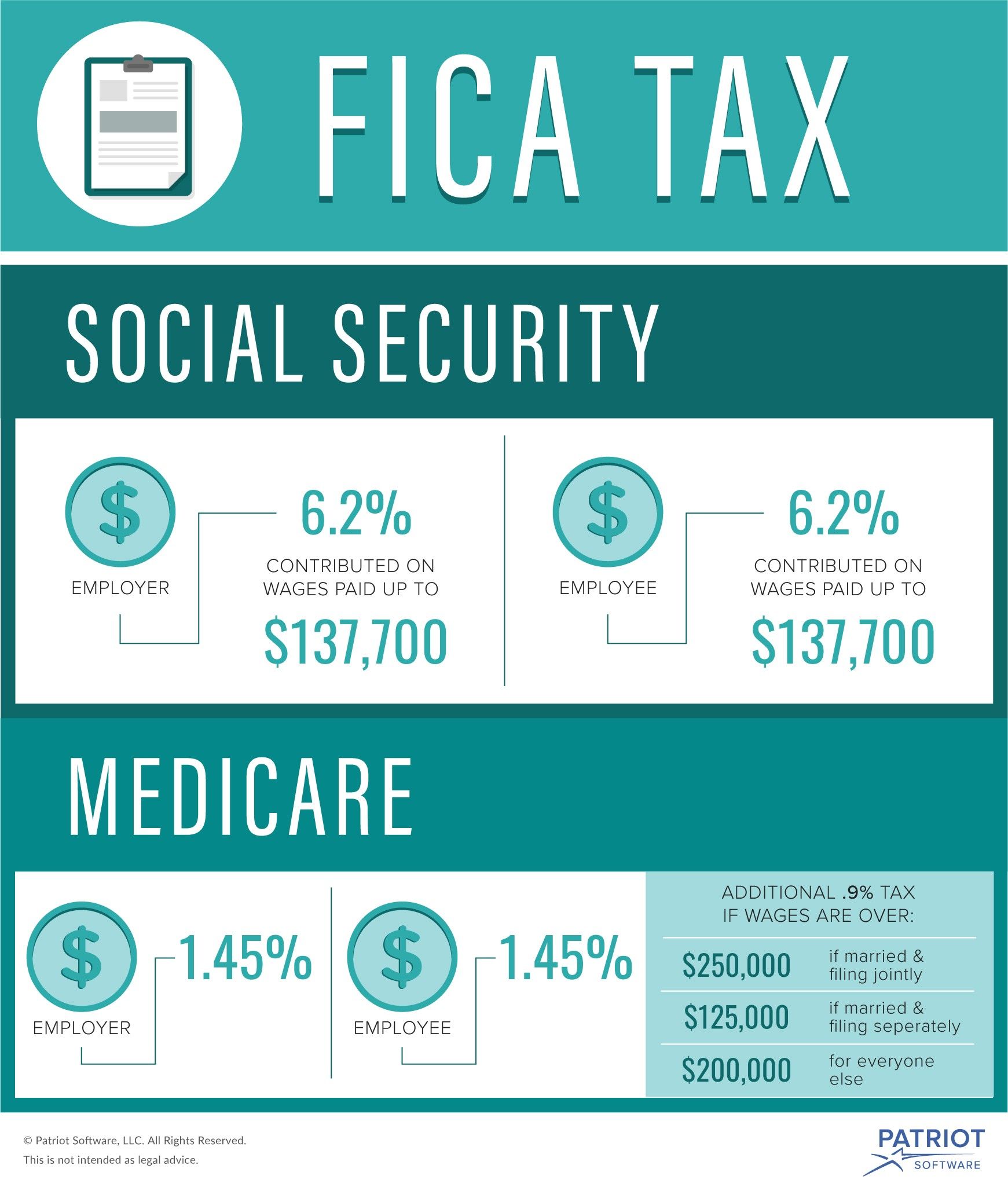

The FICA tax is a payroll tax, which means that employers withhold it directly from their employees paychecks. It pays for the major federal insurance programs, Social Security, and Medicare. The FICA tax has two components:

- Social Security 12.4%

- Medicare 2.9%

There is a third component for individuals who make more than $200,000 as a single filer or $250,000 as joint filers. For these households, the government also includes a 0.9% additional Medicare tax.

The Social Security tax is then broken into two components: employee and employer contributions. Each employer is required to pay half of an employees FICA taxes and to withhold the other half from the employees paycheck. This means that as an employee, you pay the following:

- Social Security 6.2%

- Medicare 1.45%

Don’t Miss: Corporate Tax Rate In India

How Fica Tax Or Withholding Tax Are Calculated

The amount of tax your employer withholds from your check largely depends on what you put on your Form W-4, which you probably filled out when you started your job. Here are some things to know:

-

Form W-4 asks about your marital status, dependents and other factors to help you calculate how much to withhold. The less you withhold, the less tax comes out of your paycheck.

-

What you put on your W-4 then gets funneled through something called withholding tables, which your employer’s payroll department uses to calculate exactly how much federal and state income tax to withhold.

-

You can change your W-4 at any time. Just , fill it out and give it to your human resources or payroll team.

How The Math Works

The math works like this:

- If your wages were less than $137,700 in 2020, multiply your earnings by 6.2% to arrive at the amount you and your employer must each pay for a total of 12.4%. If you were self-employed, multiply your earnings up to this limit by 12.4% to calculate the Social Security portion of your self-employment tax.

- If your wages were more than $137,700 in 2020, multiply $137,700 by 6.2% to arrive at the amount you and your employer must each pay. Anything you earned over this threshold is exempt from Social Security tax. You would do the same but multiply by 12.4% if you’re self-employed.

For taxes due in 2021, refer to the Social Security income maximum of $137,700 as you’re filing for the 2020 tax year.

Also Check: Do You Have To Pay Taxes On Life Insurance

The Social Security Tax Limit For 2022 And How It Works Explained

- 8:37 ET, Mar 2 2022

MILLIONS of senior citizens and disabled Americans claim Social Security benefits.

About nine out of 10 individuals aged 65 and older receive monthly Social Security benefits, which account for nearly 33% of income for the elderly.

To qualify, seniors must have worked for a certain number of years and paid into the Social Security system for a certain amount of time.

The amount received depends upon when you were born, your earnings history, and when you begin to claim benefits.

Some households are also subject to pay taxes on their Social Security benefits, usually if there are additional significant earnings including wages, self-employed earnings, dividends, or other taxable income.

It’s important to note that Supplemental Security Income differs from monthly Social Security benefits. SSI payments are not taxable.

Will You Owe Taxes On Your Social Security Benefits

As with most questions about taxes, the answer is “it depends.”

About 40% of people who get benefits pay income taxes on them, according to the Social Security Administration . That’s because their income in retirement exceeds limits set by tax rules and regulations.

Generally, if Social Security is your only retirement income, you won’t have to pay taxes on it. But if you have at least moderate income, you’ll most likely owe the government some money.

The good news is that while up to 85% of your benefits may be taxed at ordinary income rates, it’s never 100%. That’s considered tax-efficient compared with other retirement plans whose distributions may be fully taxable. In addition to the federal tax bite, 13 states also tax Social Security benefits using either the federal provisional income formula or their own.

You May Like: How Much Will I Get Paid After Taxes

What Reforms Have Been Proposed For The Social Security Tax

Reform proposals for the Social Security tax have been numerous and varied over the years. Some have proposed raising the tax rate, while others have suggested reducing or eliminating it. Some have proposed changing the way the tax is calculated, while others have suggested doing away with it altogether.