Is My Traditional Ira Contribution Deductible On My Federal Income Tax Return

It is generally deductible, within certain limits, if neither you nor your spouse is an active participant in an employer-sponsored retirement plan for the year. If either you or your spouse is an active participant, your ability to make deductible contributions to a Traditional IRA phases out completely if your modified adjusted gross income is at least 70,000 , 50,000 or $10,000 . In general, if your spouse is an active participant, but you are not, and you file a joint tax return, your ability to make deductible contributions phases out completely at modified adjusted gross income of $160,000. Report deductible contributions to a Traditional IRA on Form 1040, Line 24, or on Form 1040A, line 17.

Tax Preparation Checklist: What Do I Need To File My Taxes

A checklist for all the information you need can make the tax preparation process easier. Often, your income and tax figures are provided to you on special forms, but sometimes you have to rely on your own records for your source of income. Although most people have their taxable income reported to them and the IRS on official tax forms, you are required to report all of your taxable income, even if you dont receive a form.

For example, a company only has to prepare a W-2 for you if you earned more than $600. However, if you earned $500, youre still required to report that income on your tax return even though you likely wont receive a W-2.

Heres a tax-filing checklist of all the information you need to file your tax return:

How To Complete Form 5498

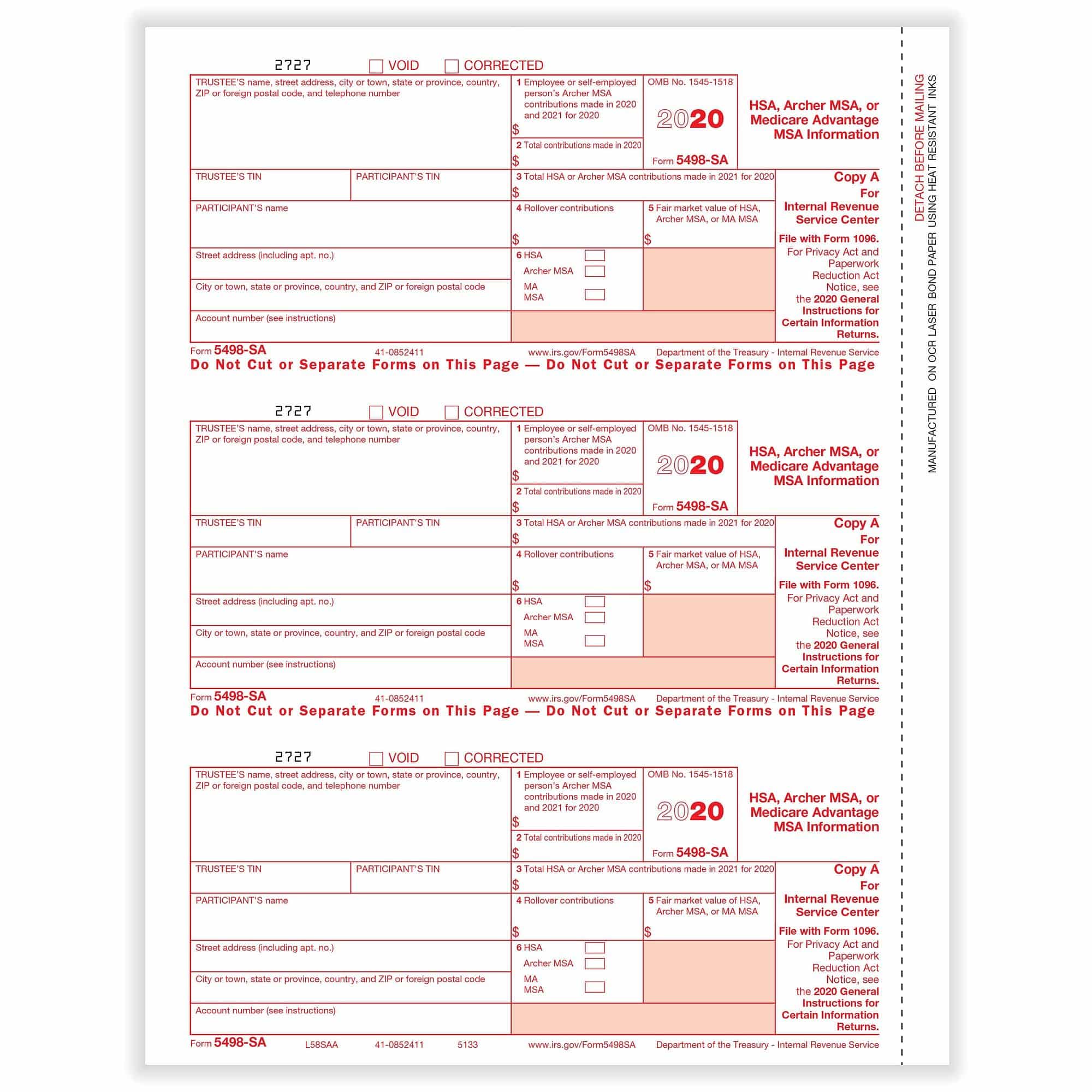

Trustees who are responsible for filing Form 5498-SA generally follow these instructions from the IRS:

*Note that trustees may list total contributions made by government agencies to an MA MSA in box 2, but are not required to do so.

You May Like: Phone Number For Irs Taxes

Reporting Deadline And Form 5498 Filing

As mentioned earlier, the 2021 Form 5498 filing deadline is May 31, 2022. It is by this date Form 5498 must be sent to the IRS and to an IRA owner or beneficiary. Most financial organizations will submit these forms to the IRS electronically, either through their data service provider, or through a third-party vendor such as Wolters Kluwers Account Recordkeeping Services. The information in this article is based on the IRS instructions for paper reporting. The electronic reporting requirements may vary slightly. For specific instructions regarding electronic reporting to the IRS, see Publication 1220, Specifications for Electronic Filing of Forms 1097, 1098, 1099, 3921, 3922, 5498, and W2-G.

Form 5498 identifies an individual by name, address on record with the IRA custodian/trustee, and taxpayer identification number , including Social Security number or individual taxpayer identification number . Treasury Regulation 301.6109-4 allows filers of Form 5498 to truncate an individuals TIN on paper or electronic payee statements. A TIN is sensitive information and there is a risk that this information could be misappropriated from an IRA statement and misused in various ways, including facilitation of identity theft. A TIN is truncated by replacing the first five digits of the nine-digit number with asterisks or Xs.

What Do You Need To File Taxes A List Of All The Documents To Have

Tax filing can feel like a never-ending stack of paperwork especially if you find yourself digging for documents as you try to work through your return. Having a checklist and preparing your information ahead of time will help ensure youre ready to file your tax return. Read on and find out which documents you need to file taxes.

Advice: 5 Things You Must Do When Your Savings Reach $50,000

Don’t Miss: Small Business Income Tax Calculator

Who Receives Form 5498

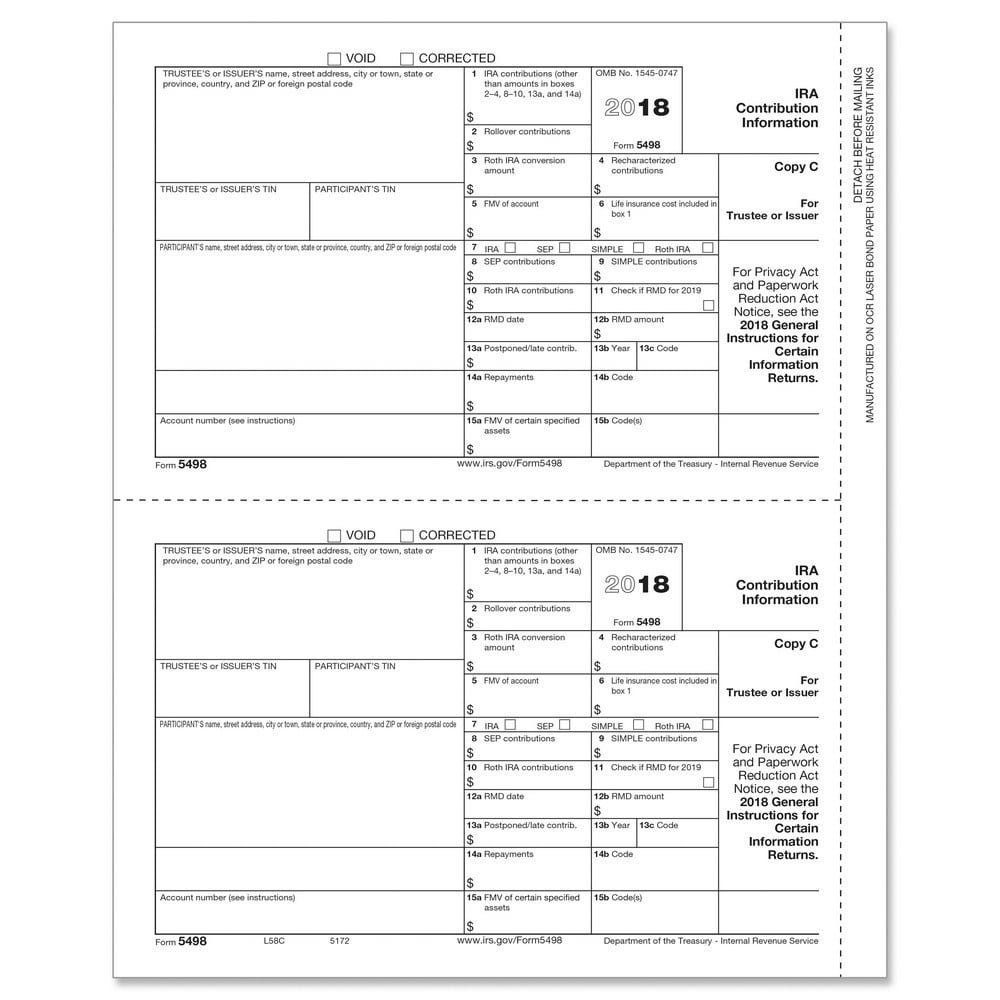

There are three copies of each Form 5498 that is issued. They contain identical information and they each go to different parties:

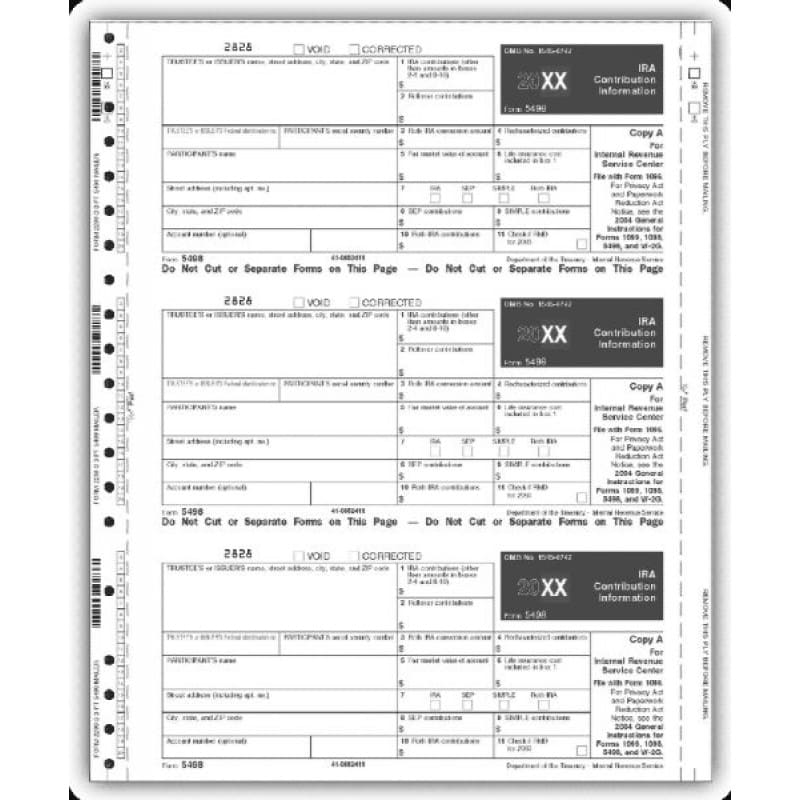

Copy A: Copy A goes to the Internal Revenue Service.

Copy B: Copy B goes to the taxpayer. This is the copy you should expect to receive from your IRA trustee or IRA custodian.

Copy C: Copy C is retained by the IRA custodian.

Roth Ira Conversions And Recharacterizations

Box 3 reports conversions to Roth IRAs. The amount converted to this type of IRA does not limit the amount that can be contributed annually to an IRA, including a Roth IRA.

As of Jan. 1, 2018, you can no longer recharacterize conversions to a Roth IRA. However, you can recharacterize contributions made to one type of IRA as having been made to the other type of IRA. To do this, simply instruct the trustee of the institution holding your IRA to transfer your contribution amount plus earnings to a different type of IRA, either with the same trustee or a different trustee. Recharacterized contributions are entered in Box 4 of Form 5498

Read Also: What’s The Deadline For Filing Taxes

What Is Irs Form : Ira Contributions Information

OVERVIEW

Form 5498: IRA Contributions Information reports your IRA contributions to the IRS. Your IRA trustee or issuer – not you – is required to file this form with the IRS by May 31.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Taxpayers Prefer Community Tax

Its our mission to create a new standard in the tax preparation industry in which the clients best interests come first. We dont charge frivolous upfront fees and hidden costs. Our corporate philosophy states that no client should pay full price for a service until they know what their options are and what we can provide for them.

Community Tax has successfully helped over 44,000 clients solve their tax problems with over $250 million in tax debt resolved. We are a Department of Consumer Affairs accredited business with an A+ rating by the Better Business Bureau. The IRS has also deemed us an Approved Continuing Education Provider, along with recognition from the National Association of Tax Resolution Companies.

Whether you need to file back taxes or lift a wage garnishment, our tax advocates can help you out of any tax situation.

Read Also: How To File Extension On Taxes

When Is Form 5498

Form 5498-SA is typically due by May 31 of each year. This is the deadline for the HSA trustee or custodian to provide the form to the taxpayer, as well as the deadline for the taxpayer to file the form with their tax return.

If a taxpayer is unable to file their Form 5498-SA by the May 31 deadline, they may be able to request an extension.

The IRS typically grants extensions on a case-by-case basis, allowing taxpayers to file their tax returns and any required forms later.

However, it is important to note that an extension of time to file is not an extension of time to pay any taxes owed.

Therefore, taxpayers who expect to owe taxes should still pay by the original deadline to avoid penalties and interest.

What Is Irs Form : Ira Contribution Information

If you have an Individual Retirement Account , the issuer or trustee of your IRA must provide you and the IRS with Form 5498: IRA Contribution Information, which reports contributions, required minimum distributions , Roth IRA conversions, rollovers, and the fair market value of the IRA account.

Form 5498 is posted in May since contributions to an IRA are allowed for the previous year through mid-April, before tax filing. The document is for informational purposes only and you are not required to file it with your tax return.

Recommended Reading: California State Capital Gains Tax

What Should Be Done With Irs Form 5498

As previously mentioned, trustees must file Form 5498-SA with the IRS on time and provide a copy to plan participants, who may want to save it with their other tax records. If participants need help deciphering the form, they should contact the account trustee or a licensed tax attorney for additional support.

Does The Money Used Or Received From An Hsa Need To Be Reported

Trustees are also required to report distributions from an HSA, Archer MSA or MA MSA. Reporting is done using Form 1099-SA, a copy of which is provided to the account participant.

The participants must then file either Form 8853 or Form 8889, regardless of whether the distributions were subject to taxes. Distributions may be considered taxable income and will have to be reported on an individual income tax return if one of the following occurs:

- Distributed funds were used to pay for unqualified medical expenses

- The HSA or Archer MSA account balance was not rolled over from the prior year

- An estate or non-spouse beneficiary inherited the fair market value of the account

Don’t Miss: How Late Can I File My Taxes

Will I Receive Form 5498

Only taxpapers who hold one of the IRA contract types listed above and have made at least one applicable transaction will receive an IRS Form 5498.

If you meet only one of these conditions but not the other, then you will not receive the form. For instance, if you hold a Traditional IRA but did not make any contributions, rollovers, conversions, or recharacterizations to it in the previous tax year, then you should not expect to receive one.

However, the IRS will still receive information on the fair market value of your contract, even if Form 5498 isnt generated. Note that if you are expecting to receive a copy of this form but it hasnt arrived, then there could be other issues at work.

For instance, there may be a shipping delay or an error with your mailing information. Contact your trustee to make sure they have your correct mailing information on file. You may also be able to log into your online account and check the status there.

What Do You Do If You Received Form 5498

You are not required to file Form 5498 with your tax return. It’s an information statement that should match up with what you state on your tax return when it comes to your IRA contributions for the tax year. If you receive Form 5498, you can save it in case you ever need to verify what you reported on your tax return.

Read Also: Sales Tax Rate In Nyc

You Should File Form 5498 For Each Ira Holder

You should file Form 5498 for each person who has an IRA in your custody. You dont need a separate form for each asset in their IRA for instance, if someone has three certificates of deposit in their IRA, you still should only file one Form 5498. You only need to file multiple forms if a single person has multiple IRA accounts.

What Are The Parts Of The Form

- Identifying information: On the left-hand side of the form, the trustee provides their address and tax identification number. The form also lists the account holders name, tax identification number, address and account number in this area. On the form, the account holder is referred to as the participant.

- Box 1: The total amount of contributions made by the account holder to an Archer MSA account are entered here. If the account in question is an HSA, the trustee leaves this box blank.

- Box 2: The total amount of contributions made to an Archer MSA or HSA during the tax year are entered here.

- Box 3: Contributions made to an Archer MSA or HSA between the end of the tax year and the tax filing deadline are reported here.

- Box 4: The total amount of any rollovers made to the HSA or Archer MSA go here.

- Box 5: Trustees enter the fair market value in this box. The FMV is the total value of the account at the time the form was completed.

- Box 6: The trustee checks a box here to report whether the account is an HSA, Archer MSA or Medicare Advantage MSA.

Dont Miss: How Long To Get Tax Return

You May Like: Credit Karma Tax Return 2020

Irs Tax Form : What Do I Do With Paperwork From My Ira Provider

Tax form 5498 you know it, you probably dont love it, but do you understand it? The Internal Revenue Service seems to use it, but its an unclear form full of codes and terms the average investor doesnt know. Want to know more about this form, what you need to do with it, and how its used? Let us ease all your concerns and answer your questions, below.

The Irs Allows Individuals To Bank Some Substantial Tax Deductions If They Contribute To An Individual Retirement Account To Bolster Their Pension

Some tax filers choose to utilise an individual retirement account , which allows them to save for their retirement with more favourable tax conditions. This can take the form of a traditional IRA, a roth IRA or a rollover IRA, each of which has different benefits.

However in order to keep the IRS updated about any IRA contributions that you have made you will need to complete Form 5498, which also covers any applicable recharacterisations, conversions, and year-end fair market values.

Even though roth IRAs do not qualify for a tax deduction, you still need to make sure that any contributions are reported to the IRS in the same way. Heres everything you need to know about filing tax form 5498.

Don’t Miss: How To Get Extension On Taxes 2021

Ira Withdrawals And Distributions

Form 5498 tells you the fair market value of all the investments in your IRA account. If your IRA is not a Roth IRA, the IRS requires you to begin withdrawing money from the account starting with the calendar year you turn 72 . When the custodian of your account prepares your Form 5498, it must report the amount of your required withdrawals or distributions.

If you are subject to required minimum distributions and fail to withdraw a sufficient amount of funds from your IRA, the IRS can penalize you 50% of the amount that should have been distributed. The percentage of all funds in the account that you are obligated to withdraw increases as you get older.

Why Dont My Fair Market Values Match Up

As you review your completed Form 5498, you may notice a discrepancy in the fair market value totals. Usually, the amount listed on the IRS form will be higher than the amount that you see listed on the year-end statement from your trustee.

If this is the case, then dont panic. Theres a good explanation behind the inconsistency. Most of the time, this happens because one of two factors held true for your IRA contract in the previous tax year:

- It experienced a Roth conversion

- You paid required minimum distributions

In this case, the value reflected on Form 5498 will include your Actuarial Present Value, or APV. This number represents the value of any future benefits associated with your annuity product from a given date onward . If youre using this product to help fund your retirement account, then the APV must either be included in the conversion amount or used to calculate your RMD payments.

Note that RMD payments were waived for 2020, in keeping with Section 2203 of the Coronavirus Aid, Relief, and Economic Security Act. However, they were mandated again in 2021. If you were at least 70.5 years old in the previous tax year, then federal law requires that you begin taking minimum distributions from your IRA account in the following calendar year.

Recommended Reading: Morgan Stanley Tax Documents 2021

What Is The Difference Between A 5498 And 1099

Form 1099-R is issued by the IRS and is part of a series of forms called information returns. The form is used to report distributions from annuities, retirement plans, profit-sharing plans, IRAs, insurance contracts, and/or pensions. IRS Form 5498 is used by those who have an individual retirement account .

You Must Report Recharacterizations

A recharacterization is when an account holder transfers a contribution from one IRA to another type of IRA. The custodian of the first IRA must file Form 5498 to report the original contribution, and then they can use a 1099-R to report the distribution. The custodian of the second IRA, in turn, should report the recharacterized amount as a contribution on the Form 5498 that they generate.

Don’t Miss: Short Term Capital Gains Taxes 2021

Who Reports Ira Contribution Information On Form 5498

Form 5498 lists contributions made to IRAs for the tax year of the form . Reporting applies for traditional IRAs, Roth IRAs, , SIMPLE IRAs, and deemed IRAs. Deemed IRAs are employee contribution plans set up as traditional or Roth IRAs that are tacked on to an employers qualified retirement plan.

An IRA trustee or custodian sends Form 5498 to the IRS and taxpayers. It is required to be sent by June 1 following the year to which the contributions relate. Taxpayers don’t have to include a copy of the form when they file taxes but should keep it with their tax records.

All copies of Form 5498 are available on the IRS website.

Where Do I Put My 1099

Youll most likely report amounts from Form 1099-R as ordinary income on line 4b and 5b of the Form 1040. The 1099-R form is an informational return, which means youll use it to report income on your federal tax return. If the form shows federal income tax withheld in Box 4, attach a copy Copy Bto your tax return.

Read Also: Look Up State Tax Id Number

You May Like: How Much To Set Aside For Taxes 1099