Sales Tax Settlement And Reporting

Sales tax must be reported and paid to tax authorities at regulated intervals . You can settle tax accounts for the interval and offset the balances to the tax settlement account, as specified in the ledger posting groups. You can access this functionality on the Settle and post sales tax page. You must specify the sales tax settlement period that sales tax should be settled for.

After the sales tax has been paid, the balance on the sales tax settlement account should be balanced against the bank account. If the sales tax authority that is specified on the sales tax settlement period is related to a vendor account, the sales tax balance is posted as an open vendor invoice and can be included in the regular payment proposal.

Paying Tax To Another State

If possession of tangible personal property or a specified digital product is taken in another state and sales tax has already been paid to the other state, no additional tax is due if the tax paid is the same or more than Iowa’s state rate. If the tax is less, the purchaser owes Iowa the difference. It is the purchasers responsibility to show where delivery took place and that the appropriate sales tax has been paid.

Personal Liability For Paying Taxes

If a corporation, association, or partnership fails to pay sales and use taxes, the officers or partners are personally liable for the tax, interest, and penalty due.

A person selling a business must file final tax returns and pay all taxes due. However, the new owner should withhold a sufficient amount of the purchase price to pay any unpaid tax, interest, and penalty in case the seller fails to pay the final tax due. If the new owner intentionally fails to do this, the new owner is personally liable for the tax.

Recommended Reading: Do You Have To Pay Taxes On Life Insurance

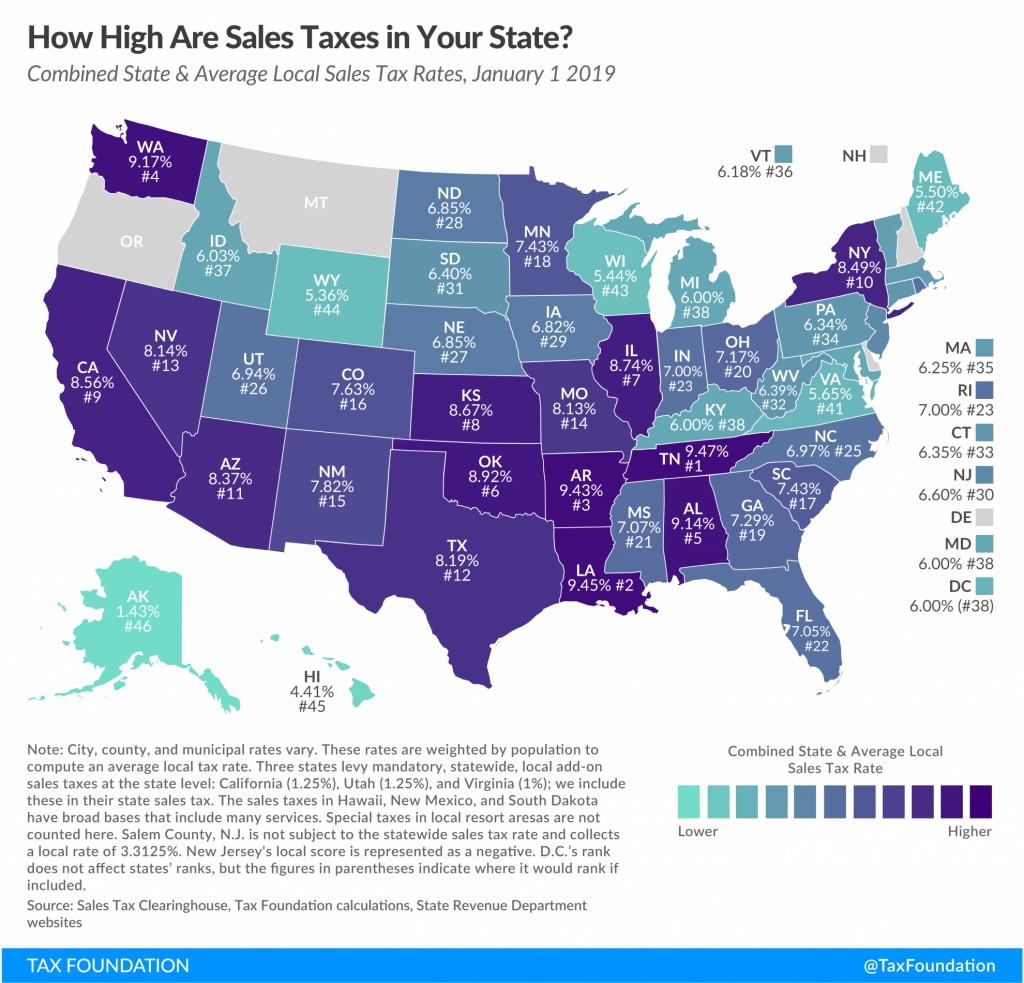

Sales Tax Bases: The Other Half Of The Equation

Sales tax rates arent the only factor that matters. The tax basewhat is and isnt taxablecan have a significant impact on the competitiveness of different sales tax regimes and the efficiency with which they raise revenue.

U.S. state sales tax bases can vary greatly. For instance, most states exempt groceries from the sales tax base, others tax groceries at a limited rate, and still others tax groceries at the same rate as all other products.

Tax experts generally recommend that sales taxes apply to all final retail sales of goods and services but not intermediate business-to-business transactions in the production chain.

Taxing business-to-business transactions results in whats called tax pyramiding, an economically harmful phenomenon where the tax burden stacks up throughout the production chain, as in the case of gross receipts taxes.

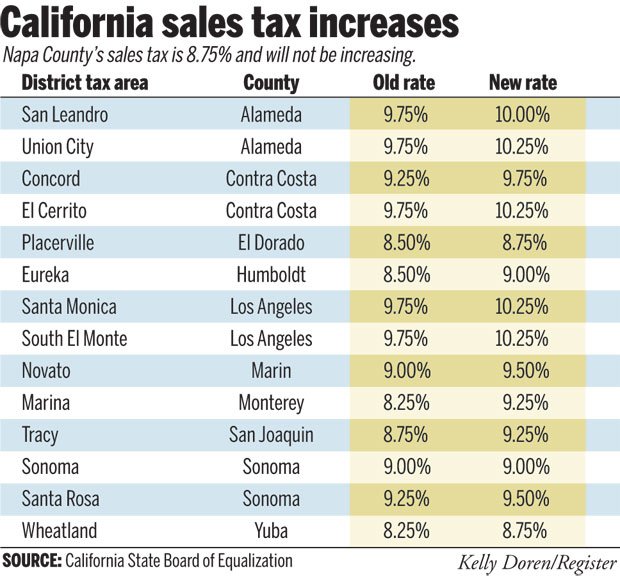

Sales Tax Rate Changes

Access the latest sales and use tax rate changes for cities and counties. Local sales taxes are effective on the first day of the second calendar quarter after the Department of Revenue receives notification of the rate change . Local taxes can also have an expiration date, lowering the sales or use tax rate for that particular city or county. Expirations also take place on the first day of a calendar quarter .

You May Like: Do You Have To Pay Taxes On Inheritance

Sales Tax On Transactions

On every transaction , you must enter a sales tax group and an item sales tax group to calculate sales tax. Default groups are specified in master data , but you can manually change the groups on a transaction if you must. Both groups contain a list of sales tax codes, and the intersection of the two lists of sales tax codes determines the list of applicable sales tax codes for the transaction.

On every transaction, you can look up the calculated sales tax by opening the Sales tax transaction page. You can look up the sales tax for a document line or for the whole document. For certain documents , you can adjust the calculated sales tax if the original document shows deviant amounts.

Key Actions For Introduction

9 a.m.4 p.m., Monday through Friday

A vendor is anyone who:

- Sells, rents or leases tangible personal property or telecommunications services in Massachusetts generally

- Buys tangible personal property or telecommunications services for resale in Massachusetts

- Gets parts to manufacture goods for sale or resale in Massachusetts

- Has a business location in Massachusetts

- Has representatives soliciting orders for tangible personal property or telecommunications services within Massachusetts

- Sells to Massachusetts residents or businesses and delivers, repairs or installs goods or telecommunications services within Massachusetts

- Makes remote sales to Massachusetts customers that exceed $100,000 in a calendar year, or

- Operates a marketplace that facilitates the sale of tangible personal property by marketplace sellers, and whose direct and facilitated Massachusetts sales exceed $100,000 in a calendar year.

Tax-exempt organizations that sell tangible personal property or telecommunications services in the regular course of business are also considered vendors and required to collect sales/use tax.

More information for vendors with more than $100,000 in sales during a calendar year can be found on DORs website.

More information about marketplaces can be found on the Remote Seller and Marketplace Facilitator FAQs webpage.

Vendor responsibilities

Vendors are responsible for:

Registering to collect sales/use tax

Keeping sales/use tax records as a vendor

- Memorandum accounts

Bad debts

Also Check: How To File An Extension Taxes

Richmond Hill Georgia Sales Tax Rate

richmond hill Tax jurisdiction breakdown for 2022

What does this sales tax rate breakdown mean?

Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more.

Need the exact sales tax rate for your address?

What is the sales tax rate in Richmond Hill, Georgia?

The minimum combined 2022 sales tax rate for Richmond Hill, Georgia is . This is the total of state, county and city sales tax rates. The Georgia sales tax rate is currently %. The County sales tax rate is %. The Richmond Hill sales tax rate is %.

Did South Dakota v. Wayfair, Inc affect Georgia?

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in Georgia, visit our state-by-state guide.

Did COVID-19 impact sales tax filing due dates in Richmond Hill?

The outbreak of COVID-19 may have impacted sales tax filing due dates in Richmond Hill. Please consult your local tax authority for specific details. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance.

Effect Of Electronic Commerce

Electronic commerce business can also be affected by consumption taxes. It can be separated into four categories: retail. intermediaries, business-to-business and media . These categories were affected varying degrees. The intermediaries was affected by the retail sales tax since it provide platforms for transitions between different parties . Business-to-Business transactions will be placed in different circumstances by whether the case will be taxed in the US. Electronic commerce goods are usually not taxed the same especially across the stats in the US. Different states has their own sales tax regulation, for example, some states use their standard sales taxes law for the digital goods, and some of the states have specific laws for them. It is difficult to enforce the taxes on electronic commerce especially for digital goods that trade across different countries.

The effect that a sales tax has on consumer and producer behavior is rather large. The price elasticity of demand for online products is high, meaning that consumers are price sensitive and their demand will significantly change with small changes in price. This means that the tax burden lies primarily with the producer. To avoid altering demand, the producer will either avoid the tax if possible by relocating their fulfillment centers to areas without a high sales tax or they will internalize the cost of the sales tax by charging consumers the same price but paying for the tax from their profits.

Read Also: When Is The Last Day To Turn In Taxes

Do You Need To Register To Collect Sales Tax

If you sell, lease, distribute, or rent tangible personal property to customers in Virginia, or otherwise meet the definition of a dealer, and have sufficient activity in Virginia, you have nexus as defined in Va. Code § 58.1-612, and must register to collect and pay sales tax in Virginia.

- In-state dealers: generally individuals and businesses making sales with, or at, one or more physical locations in Virginia must register to collect sales tax as an in-state dealer.

- Out-of-state dealers: generally individuals and businesses located outside of Virginia, but with sufficient physical or economic presence to establish nexus in Virginia, must register to collect sales tax as an out-of-state dealer. Starting July 1, 2019, this includes remote sellers or online retailers that make more than $100,000 in annual Virginia gross sales or 200 or more transactions to Virginia customers. Learn more about economic nexus requirements for remote sellers.

- that have economic nexus in Virginia must register to collect and pay sales tax starting July 1, 2019. Generally, businesses without a physical location in Virginia that meet the economic nexus threshold should register as an out-of-state dealer, and businesses with a physical location should register as an in-state dealer. Marketplace facilitators must indicate that they are a marketplace facilitator when registering. Learn more.

How to register

You can register online or by mail. Use our checklist to make sure you have what you need.

How To Deduct Sales Tax In The Us

When filing federal income tax, taxpayers need to choose to either take the standard deduction or itemize deductions. This decision will be different for everyone, but most Americans choose the standard deduction. Sales tax can be deducted from federal income tax only if deductions are itemized. In general, taxpayers with sales tax as their only deductible expense may find that itemizing deductions is not worth the time. Itemizing deductions also involves meticulous record-keeping and can be tedious work because the IRS requires the submission of sales tax records, such as a year’s worth of purchase receipts. Anyone who plans to itemize should be keeping detailed records, as it will be very helpful in determining the amount of sales tax paid.

For more information about or to do calculations involving income tax, please visit the Income Tax Calculator.

Recommended Reading: What Is Social Security Tax

What Rate Should I Be Charged

If you buy an item from a business located in an unincorporated county area, you will generally be charged the county sales tax rate on your taxable items. If the same item is purchased in a city with an additional district tax, you will be charged that city’s tax rate. If you purchase an item from outside of California for use in the city and/or county where you live, you owe use tax on that purchase. If you have not saved your receipts from such purchases, the Use Tax Lookup Table calculates how much you owe, and you can enter it as a line item when you file your income tax returns.

Use The Sales Tax Deduction Calculator

The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A .

Your total deduction for state and local income, sales and property taxes is limited to a combined, total deduction of $10,000 .

Enter your information for the tax year:

- Sales tax paid on specified large purchases

W-2, 1099 or other income statements

Receipts for specified large purchases

ZIP code of your address and dates lived

You May Like: What Do You Need To Do Your Taxes

When Do I Begin Charging The New Rate

When the sales and use tax rate changes in your city or county, your business must collect, report, and pay the new rate beginning on and after the effective date. Generally, district tax rates become effective on the first day of the next calendar quarter, at least 110 days after the adoption of the district tax.

Enforcement Of Tax On Remote Sales

In the United States, every state with a sales tax law has a use tax component in that law applying to purchases from out-of-state mail order, catalog and e-commerce vendors, a category also known as “remote sales”. As e-commerce sales have grown in recent years, noncompliance with use tax has had a growing impact on state revenues. The Congressional Budget Office estimated that uncollected use taxes on remote sales in 2003 could be as high as $20.4 billion. Uncollected use tax on remote sales was projected to run as high as $54.8 billion for 2011.

Enforcement of the tax on remote sales, however, is difficult. Unless the vendor has a physical location, or nexus, within a state, the vendor cannot be required to collect tax for that state. This limitation was defined as part of the Dormant Commerce Clause by the Supreme Court in the 1967 decision on National Bellas Hess v. Illinois. An attempt to require a Delaware e-commerce vendor to collect North Dakota tax was overturned by the court in the 1992 decision on Quill Corp. v. North Dakota. A number of observers and commentators have argued, so far unsuccessfully, for a Congressional adoption of this physical presence nexus test.

Read Also: Is Hazard Insurance Tax Deductible

Sponsor For This Episode

Sales Tax & More assists companies and their trusted advisors like CPAs with sales tax needs. They offer consulting and research, registrations, returns, and so much more. Over the years they have assisted thousands of sellers both foreign and domestic with their tax issues in the United States and in Canada.

The Nebraska State Sales And Use Tax Rate Is 55%

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1, 2023

Effective , the village of will start a local sales and use tax rate of 1%.

Effective , the village of Sutherland will start a local sales and use tax rate of 1.5%.

Effective , the city of Seward will increase its local sales and use tax rate from 1.5% to 2%.

Effective , Gage County will terminate its 0.5% local sales and use tax rate.

With the termination of Gage Countys local sales and use tax, there will only be local sales tax in the other cities and villages within Gage County that impose a local sales and use tax. These cities and villages are Beatrice , Clatonia , Cortland , Odell , and Wymore .

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective October 1, 2022

Effective , the village of Bruning and the city of Humboldt will start a local sales and use tax rate of 1.5%.

Also effective , the following cities: Falls City, Gering, and West Point, will each increase their local sales tax and use tax from 1.5% to 2%.

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective July 1, 2022

There are no changes to local sales and use tax rates that are effective

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective April 1, 2022

Don’t Miss: How To Check If Your Taxes Were Filed

To Verify The Tax Rate For A Location:

- Find a list of the latest sales and use tax rates at the following link: California City & County Sales & Use Tax Rates.

- You can look up a tax rate by address

- Visit or call our Offices

- Call our Customer Service Center at 1-800-400-7115 . We are available to help you 7:30 a.m. to 5:00 p.m., Monday through Friday, except State holidays.

Us History Of Sales Tax

When the U.S. was still a British colony in the 18th century, the English King imposed a sales tax on various items on the American colonists, even though they had no representation in the British government. This taxation without representation, among other things, resulted in the Boston Tea Party. This, together with other events, led to the American Revolution. Therefore, the birth of the U.S. had partly to do with the controversy over a sales tax! Since then, sales tax has had a rocky history in the U.S. and this is perhaps why there has never been a federal sales tax. Some of the earlier attempts at sales tax raised a lot of problems. Sales tax didn’t take off until the Great Depression, when state governments were having difficulty finding ways to raise revenue successfully. Of the many different methods tested, sales tax prevailed because economic policy in the 1930s centered around selling goods. Mississippi was the first in 1930, and it quickly was adopted across the nation. Today, sales tax is imposed in most states as a necessary and generally effective means to raise revenue for state and local governments.

Read Also: Property Taxes In Austin Texas

Sales Tax Exemptions And Exceptions

Exemption Certificates

In many cases, in order to sell, lease, or rent tangible personal property without charging sales tax, a seller must obtain a certificate of exemption from the buyer. The sales-for-resale exemption prevents tax from being charged multiple times on the same item. The sales tax should be applied on the final retail sale to the consumer. The exemption prevents the tax being applied on goods as they are distributed before being sold at retail.

A dealer who makes a sale without charging applicable sales tax must retain a copy of the exemption certificate on file to substantiate the sale was tax exempt under the law.

- To apply for a cigarette resale exemption certificate or to learn more about the process, go to Cigarette Resale Exemption Certificates.

Virginia Sales and Use Tax Dealer Lookup

If your business is registered as a retail sales tax dealer with us, you can use the Virginia Sales and Use Tax Dealer Lookup through your online business account to verify that a business providing you with a sales tax exemption certificate is currently registered as a retail sales tax dealer in Virginia. If you dont have an account, youll need to create oneto use the tool. You can also call Customer Services at to check.