Small Business Tax Rate: Your 2022 Guide

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

Small business taxes can be complicated, as there isnt a single tax form or even a single tax rate that applies to all businesses. How you file your taxes and the rate youll pay on business profits will depend on your business entity structure.

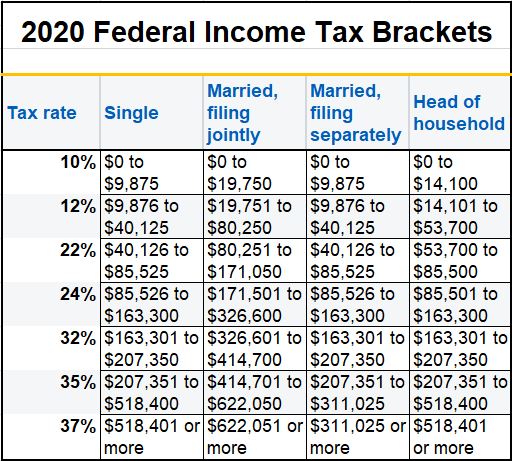

Businesses organized as corporations pay the corporate tax rate, which is 21%. Other business structures including sole proprietorships, partnerships and S corporations are considered pass-through entities their incomes are taxed at the owners personal tax rate, which is between 10% to 37%. Limited liability companies may either pay taxes as a corporation or as a pass-through entity.

Business Income Tax Rate For Corporations

C corporations have paid federal income taxes at a flat rate of 21% since 2018, as a result of the Tax Cuts and Jobs Act . Prior to 2018, C-corps paid taxes on a tiered structure, with rates ranging from 15% to 35%. Only about 5% of businesses in the U.S. are C corporations.

Taxes on corporate dividends

Corporations pay their shareholders dividends, and shareholders then have to pay taxes on those dividends on their individual tax returns. This is referred to as double taxation, because the income is taxed twice once at the corporate level, and again when paid out as dividends.

The tax rate shareholders pay on those dividends depend on whether the dividends are ordinary or qualified. Ordinary dividends are taxed at the same rate as the shareholders other income, and rates range from 10% to 37%. Qualified dividends are taxed at lower capital gains tax rates, ranging from 0% to 20%.

Although corporations face double taxation, the flat corporate tax rate is lower than the personal income tax rate in several tax brackets.

Tax Rules Are Based On Your Business Structure

Because tax rules differ based on business structure, its important that small businesses consult with an attorney and accountant to determine how their businesses should be classified.

Your business will likely fall into one of four structures:

- Sole proprietorship: A sole proprietor is someone who owns an unincorporated business by him or herself.

- Partnership: In a partnership, individuals are taxed on their share of business net income.

- Limited liability corporation: LLCs are taxed on their share of business net income. Multiple-member LLC’s are taxed as partnerships.

- Corporation: Corporations are the only entities that pay federal taxes on their own based on net earnings. They are currently taxed at a flat 21% rate.

Don’t Miss: States That Are Tax Free

Company Tax Cuts From 2016

The 2016 Budget contained proposals for reducing company tax rates.

Initial amendments brought to parliament were to have extended rate reductions progressively to all companies. Through negotiation in order to secure passage of the legislation, the government agreed to limit the tax rate reductions to base rate companies, progressively extending from small business entities to entities with aggregated turnover of less than $50 million.

The consequence of this limitation was that the corporate tax rate for entities with an aggregated turnover of $50 million or more remained at 30%.

The Treasury Laws Amendment Bill 2016 was passed by the parliament, and operates from 1 July 2016.

In addition to the modified 2016-17 budget reductions, government policy was to further reduce the corporate tax rate for all companies to reach 25%, initally by 2026-27. However following defeat of the Treasury Laws Amendment Bill 2017 in parliament the Bill was abandoned.

The final iteration: In the Government announced that the then scheduled introduction of the 25% rate would be brought forward to land in the 2021-22 year. This latest tax reduction schedule is now law and reflected in the final column of tax rates shown above.

* Historical company tax rates, and for other entity types, can be reviewed here.

Determining Your Small Business Tax Rate

At the end of the day, understanding and meeting your tax requirements are some of the most complicated parts of running a business. There are a number of reasons why business taxes are so complexâthere are a variety of taxes to consider, your small business tax rate will differ based on your entity type, and there are deductions and credits to incorporate as well.

Therefore, the best thing you can do for your business is to work with a qualified tax professional, like a CPA, enrolled agent, or tax attorney. Their expertise can help you understand the types of taxes your business is responsible for and make sure you are paying the correct small business tax rate.

Article Sources:

You May Like: Irs Tax Exempt Organization Search

Long Term Capital Gains Tax

Any capital asset held by a taxpayer for more than 36 months or 3 years immediately preceding the date of its transfer is treated as a long-term capital asset.

However, in respect of certain assets like shares , units of equity-oriented mutual funds, listed securities like debentures and government securities and Zero Coupon Bonds, the period of holding is 12 months. In case of unlisted shares of a company and immovable property, being land or building or both, the period of holding is 24 months.

When To Pay Small Business Taxes

Just as important as the types of taxes you pay is when you have to pay them. Most individuals pay taxes one time before a specific deadline set by the IRS. However, most business owners have to pay estimated income taxes and self-employment taxes on an ongoing basis.

Estimated taxes are taxes that you pay throughout the year, based on what you think your taxable income at the end of the year is going to be. Any business owner who expects to owe more than $1,000 in taxes for the year must pay estimated taxes on a quarterly basis. The estimated tax payments you make throughout the year are deducted from your total liability when you file your tax return. Federal income tax is a pay-as-you-go tax and you can incur penalties and interest if you fail to make the required estimated tax payments when they are due.

Don’t Miss: What Is Federal Excise Tax

Provincial Or Territorial Rates

Generally, provinces and territories have two rates of income tax a lower rate and a higher rate.

Lower rate

The lower rate applies to the income eligible for the federal small business deduction. One component of the small business deduction is the business limit. Some provinces or territories choose to use the federal business limit. Others establish their own business limit.

Higher rate

The higher rate applies to all other income.

Provincial and territorial tax rates

The following table shows the income tax rates and business limits for provinces and territories . These rates are in effect , and may change during the year.

Provincial and territorial lower and higher tax rates, and business limits, not including Quebec and Alberta

| Province or territory |

|---|

Small Business Tax Resources

Here are some additional resources for learning about taxes:

- The Small Business Administration maintains a guide on navigating the tax code and staying up to date on your tax responsibilities as a business owner.

- The IRS website has information about how the Affordable Care Act affects small business owners taxes, although the policies are subject to change.

- If you can choose which state your business will operate in, then you may want to consider the small business tax rates by state. Additional information and recommendations are available at the Tax Foundation.

- The SBA has a helpful guide on choosing the right business structure if youre just starting your business this year.

- The IRS website has additional details on the Small Business Health Care Tax Credit, which provides a tax credit to small businesses that offer healthcare coverage to their employees. You can learn if youre eligible and how to calculate and claim your credit.

- The IRS maintains an information center on self-employed and small business taxes.

Recommended Reading: Annual Income After Taxes Calculator

How Much Can A Small Business Make Before Paying Taxes

All businesses must submit an annual income tax return, according to the IRS. The exception is partnerships, which have to submit an information return instead. And if you have employees, employment taxes are mandatory.

Business owners who earn less than $400 can skip paying the self-employment tax. But thats the only tax you can avoid.

Thankfully, the IRS probably wont be interested in auditing your small business until you turn a profit. But its important to still file your taxes even if youre sustaining losses in order to take advantage of deductions and avoid legal issues down the line.

Short Term Capital Gains Tax

Any capital asset held by a taxpayer for not more than 36 months immediately preceding the date of its transfer is treated as short-term capital asset.

However, in respect of certain assets like shares which are listed on stock exchanges, units of equity-oriented mutual funds, listed securities like debentures and government securities, Zero Coupon Bonds, the period of holding is 12 months. In case of unlisted shares of a company and immovable property, being land or building or both, the period of holding is 24 months.

You May Like: How To Calculate Taxes For Payroll

Should I Lease Or Buy Equipment

Many small business owners focus a lot on the tax aspects of how they chose to get vital equipment. Leasing requires less upfront money, but the tax incentives for purchasing equipment outright recently have made it possible to get accelerated deductions in a way that can make buying more tax efficient. In the end, non-tax factors play a major role in answering this question.

Rates And Allowances For Corporation Tax

This publication is licensed under the terms of the Open Government Licence v3.0 except where otherwise stated. To view this licence, visit nationalarchives.gov.uk/doc/open-government-licence/version/3 or write to the Information Policy Team, The National Archives, Kew, London TW9 4DU, or email: .

Where we have identified any third party copyright information you will need to obtain permission from the copyright holders concerned.

This publication is available at https://www.gov.uk/government/publications/rates-and-allowances-corporation-tax/rates-and-allowances-corporation-tax

You May Like: When Are Tax Returns Sent Out

How Much Tax Does A Small Business Pay

dowell / Getty Images

How much small businesses pay in taxes depends on a few factors like income, deductions, expenses, business structure, and more. From corporate and business taxes to tax rates and tax forms, here’s how to figure out how much small businesses really pay in taxes.

The Small Business Tax Rates In 2021 Explained

Between keeping track of expenses and estimating your future income managing your taxes as a small business owner was already tough enough.

Unfortunately, small business tax rates in 2021 arent likely to make your job any easier. Federal laws are changing and theres a lot of uncertainty for small business owners.

Use this guide to understand how small business tax rates in 2021 will affect your bottom line and the best ways to stay prepared.

Read Also: Are Hsa Contributions Pre Tax

What Is Capital Gains Tax Types And Exemptions

Capital Gains Tax: Movable personal assets such as cars, apparel and furniture are excluded from the Capital Gains tax bracket.

Capital Gains Tax: Capital gain means any profit that is earned from the sale of a capital asset. The profit generated from the sale is taxed and this is called Capital Gains Tax. Capital Gains Tax are classified under two categories — Short Term Capital Gains and Long Term Capital Gains.

Small Business Tax Rates Vary By State

Not all state tax laws are created equal. In fact, some states dont have income tax at all. Wyoming, South Dakota, Alaska, Florida, Montana, New Hampshire, Nevada and Indiana have no or very low taxes on individuals. Plus, neither Wyoming nor South Dakota have corporate income tax or a gross receipts tax. On the flip side, states with higher sales, property, individual income tax and other tax laws include: Louisiana, Iowa, Maryland, Vermont, Minnesota, California and New York.

Read Also: Irs Tax Return Amendment Status

Will The Irs Extend The Tax Deadline In 2022

Taxpayers who dont qualify for any of these three special situations can still get more time to file by submitting a request for an automatic extension. This will extend their filing deadline until Oct.17, 2022. But because this is only a tax-filing extension, their 2021 tax payments are still due by April 18.

How To Pay Taxes As A Small Business Owner

How you pay taxes as a small business owner depends on your business structure:

- C-corps and LLCs taxed like C-corps report business income and expenses on Form 1120.

- S-corps and LLCs that elect to be taxed like S-corps report business income and expenses on Form 1120-S, then issue a Schedule K-1 to each shareholder reporting their share of profits or losses.

- Partnerships and LLCs with more than one member report business income and expenses on Form 1065. The completed Form 1065 includes a Schedule K-1 for each shareholder, which theyll need to report their share of profits or losses on their individual tax return.

- Sole proprietorships and LLCs with only one member report business income and expenses on Schedule C, a schedule that gets filed along with the owners individual tax return, Form 1040.

Recommended Reading: Rv Sales Tax By State

Worst States For Llc Taxes

Theres generally two kinds of state-level taxes that your LLC profits may be paying: income and business taxes. The following are states that frequently find higher taxes for 1099s or a single member LLC:

| State |

|---|

| 2 5.75% |

Please be aware that states with more progressive income rates , can make them poor choices for high business income earners. This table is designed for small business owners with ~$80,000/year in income.

Understanding 2021 Federal Tax Rates

No matter how 2018 has gone for your company, the best way to start preparing for the upcoming tax season other than tallying up those totals for your records is to acquaint yourself with the 2018 federal tax rates. Business tax rates are affected by a wide variety of factors, and as such are subject to fluctuation. Here well give you a bit of insight into what small business tax rate youll be facing next tax season.

In light of the Tax Cuts and Jobs Act of 2017, its no surprise that businesses are facing some changes when it comes to their tax filing this season. Signed into law in December 2017, the most impactful changes are some steep drops in the tax rate. Under this law, the nations federal corporate income tax rate was reduced from 35 percent to 21 percent. While this may seem like a respite for small businesses like yours, U.S.-based corporations must contend with another issue altogether.

Forty-four states also levy their own corporate income taxes, ranging from 3 percent in North Carolina to 12 percent in Iowa. When you take this into account, the nations overall statutory corporate income tax rate including average state corporate income taxes is back up to 25.7 percent. And the tax rate your business will face largely depends on which state you operate in.

Recommended Reading: State With No Property Tax

Personal Income Tax Rates

Indexing the personal income tax system

Albertas government is indexing the personal income tax system for inflation, beginning for the 2022 tax year. Tax bracket thresholds and credit amounts will increase by 2.3% over their 2021 value.

Many Albertans will first see the benefit of indexation through lower tax withholdings on their first paycheques of 2023. In addition, since indexation will resume for 2022, Albertans will receive larger refunds or owe less tax when they file their 2022 tax returns in spring 2023.

How Can A Small Business Reduce Taxable Income

Small businesses can reduce taxable income by taking advantage of tax deductions. Businesses can deduct ordinary and necessary costs of running the business, such as advertising, salaries and wages, interest expense and insurance. You can find more information on deductible business expenses in IRS Publication 535.

Read Also: Can I Pay Estimated Taxes All At Once

Small Business Tax Tips

If youve purchased a business this year or are new to small business tax structures, there are a few things to keep in mind. Here are five key tips:

- Think about taxes all year long. Small business owners should not treat income taxes as an annual event. Rather, tax planning should be a year-round activity. Waiting until the last minute makes tax preparation more complicated and limits your money-saving options.

- Be aware of changes to tax laws. Even with the help of a skilled professional, a small business owner must keep up with changes. This ensures your tax professional is doing the best possible job and keeps you informed as a business owner.

- Dont make assumptions. Never make business decisions assuming particular tax breaks will pass or that certain policies will be enacted.

- Choose the right state to incorporate in. You dont need to incorporate your business in the same state in which you run your company. If youre just starting out, here are some of the best states for small business taxes.

- You dont actually want a tax refund. Its possible to get a tax refund as a small business, but in most cases, it isnt to your benefit. Typically, a refund means you overestimated the amount of taxes you paid, which could have been reinvested into your business.