What Happens If I Cant File My Return On Time And/or Pay My Taxes

It is possible to request an extension to avoid paying penalties for filing a late return.

Extensions provide more time to file, but not to pay taxes due.

You can request a free extension through Free File, when making a payment, or through extension forms.

Now, if you dont pay the taxes you owe on time, the balance is subject to interest and a monthly penalty for late payment.

Thats why the IRS encourages taxpayers to file their return on time, even when they cant pay the balance due in full.

For those who cannot pay the taxes due in full, the IRS offers alternatives.

A short-term payment plan may be an option and can be requested for up to 120 days, reads the IRS site.

Check if you qualify to request a payment plan and how much each payment plan costs depending on its duration.

In the event that the IRS determines that the taxpayer is unable to pay any portion of their debt, the agency may temporarily delay the collection process.

However, the amount you owe will increase due to accrual of penalties and interest until full payment is made.

To request a temporary delay or to inquire about your payment options, the IRS asks taxpayers to call 800-829-1040 or the phone number on the bill or notice you received.

IRS tax return

Dont Miss: Cook County Appeal Property Tax

Time Is Running Out To Claim Your Stimulus And Child Tax Credit Payments

Last month, the IRS reported that millions of eligible people have yet to properly claim their COVID relief payments. The IRS uses tax returns to determine eligibility for both pandemic stimulus checks and child tax credits, and unfortunately, those who need the relief mostsuch as people with lower incomes, limited internet access, or who are experiencing homelessnessare often the least likely to have filed their taxes. Heres what you can do to take action before this weeks deadline for claiming your stimulus and/or child tax credit payments.

How Do You Get A Tax Deadline Extension

Taxpayers who know they will be unable to make the April 18, 2022, deadline for filing their income tax can request a six-month tax deadline extension by filing Form 4868 before the deadline. Once the IRS receives your extension request, the deadline for filing your taxes is pushed back to Oct. 17, 2022.

Military extensions may extend beyond Oct. 17. While most U.S. taxpayers are required to file by the Oct. 17 deadline, some military members may be eligible for an automatic extension if they were deployed to a tax-free combat zone for part of the previous or current tax year. This extension has several rules, so visit the IRS website for specific information.

Note: According to the IRS, this extension may also apply to individuals serving in the combat zone in support of the U.S. Armed Forces, such as merchant marines serving aboard vessels under the operational control of the Department of Defense, Red Cross personnel, accredited correspondents, and civilian personnel acting under the direction of the U.S. Armed Forces in support of those forces.

Also Check: Us Individual Income Tax Return

Alignment With State And District Of Columbia Holidays And Changes In Date

Tax Day occasionally falls on Patriots’ Day, a civic holiday in the Commonwealth of Massachusetts and state of Maine, or the preceding weekend. When this occurred for some time, the federal tax deadline was extended by a day for the residents of Maine, , Massachusetts, New Hampshire, New York, Vermont, and the District of Columbia, because the IRS processing center for these areas was located in Andover, Massachusetts and the unionized IRS employees got the day off. In 2011 and 2015, Tax Day fell on Patriots’ Day. However, federal filings were directed to Hartford, Connecticut, Charlotte, North Carolina and Kansas City, Missouri, and there was no further extension for Maine, Massachusetts or other surrounding states’ residents. In 2019 and 2021, when Patriots Day was again observed on the tax filing deadline, residents of Maine and Massachusetts were given extra time to file as post offices in those states would be closed on normal deadline.

Emancipation Day is celebrated in Washington, D.C. on the weekday nearest April 16, and under a federal statute enacted decades ago, holidays observed in the District of Columbia have an impact nationwide. If April 15 falls on a Friday, then Emancipation Day is celebrated on the same day and tax returns are instead due the following Monday, April 18. When April 15 falls on a Saturday or Sunday then Emancipation Day is celebrated on the following Monday and tax returns are instead due on Tuesday.

Tax Deadlines: July To September

- :Deadline for employees who earned more than $20 in tip income in June to report this income to their employers.

- : Deadline for employees who earned more than $20 in tip income in July to report this income to their employers.

- Deadline for employees who earned more than $20 in tip income in August to report this income to their employers.

- : Deadline forthird-quarter estimated tax payments for the 2021 tax year.

- : Final deadline to file partnership and S-corporation tax returns for tax year 2021, if an extension was requested .

Recommended Reading: How Are Social Security Taxes Calculated

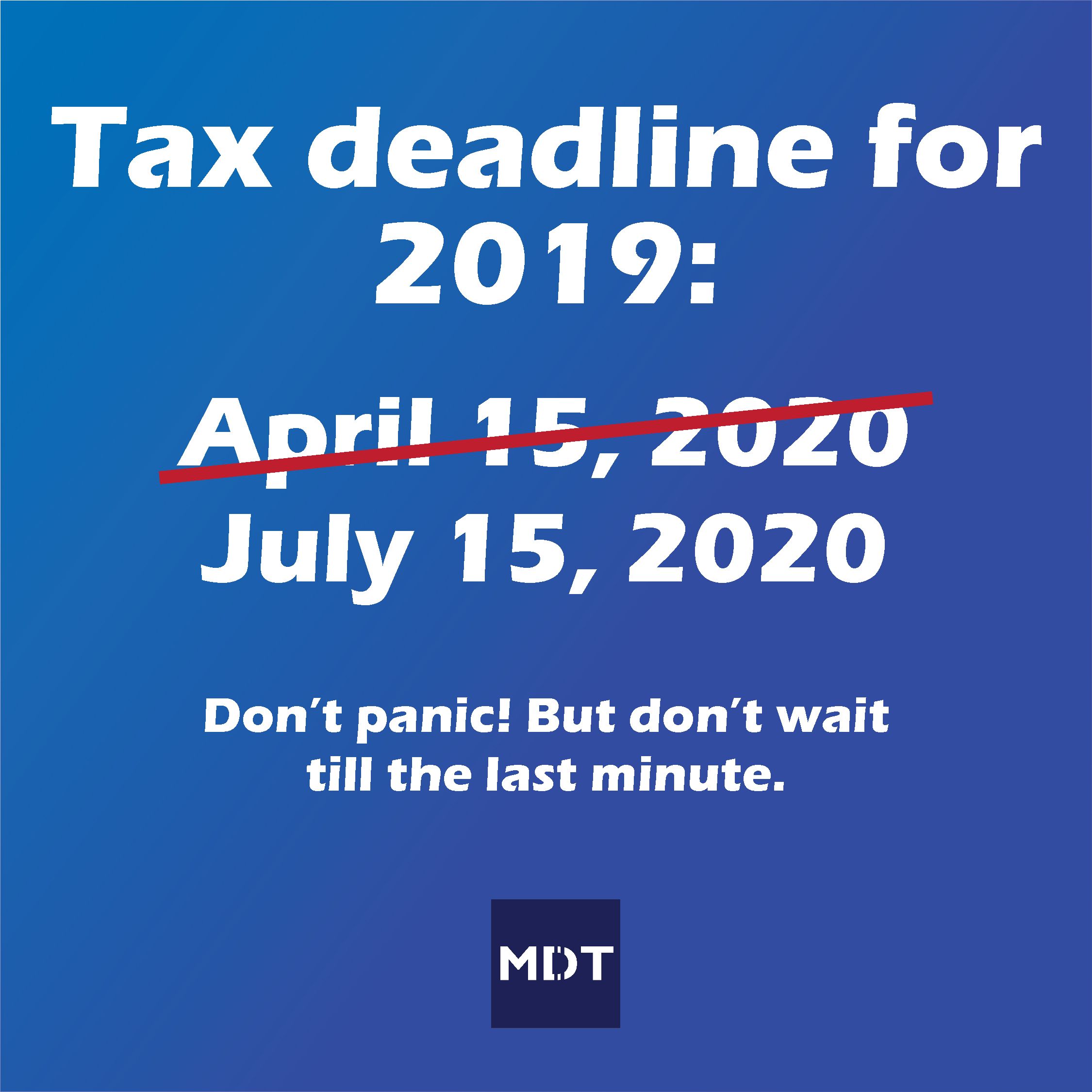

What Is The Last Day To Contribute To My Retirement Account For 2019

As with other elements of the extension, individuals can wait to make 2019 contributions to their retirement accounts normally due April 15, 2020 until July 15, 2020. Consider using this extra time to set aside more money in your retirement accounts if you’re able. You can contribute a maximum of $6,000 to an IRA for 2019, plus an extra $1,000 if you’re 50 or older.

You don’t need to wait to file your tax return to make this contribution, however. If you know how much you’ll contribute by the tax deadline, you can put this on your tax return and make the actual contribution by the new deadline.

When Is The Filing Deadline For Earned Income Tax Credit

The IRS recently announced that individuals would be able to use their Free File system until November 17, 2022.

“Inevitably some people will learn of the opportunity too late,” IRS spokesman Eric Smith stated.

“For them, as has been true, by law, for many years, we remind them that they have a three-year statute of limitations for filing a return and claiming a refund.

“For a 2021 return, that means that, in most cases, the window closes on April 15, 2025.”

Recommended Reading: Home Depot Tax Exempt Registration

Federal Income Tax Deadline In 2022

After the COVID-19 pandemic pushed back the filing deadline for federal income taxes two years in a row, taxes for the 2021 tax year will once again be due in April.

Circle April 18, 2022, on your calendar because thats the one general date by which most filers need to get returns into the IRS. While taxes are typically due on April 15, this years Tax Day falls on Emancipation Day, a legal holiday observed in Washington, D.C. As a result, most filers will have until the next business day, April 18, to submit their tax returns.

However, you may have a different deadline if you filed for an extension or if you are a corporation. Heres a rundown of all the deadlines you need to keep track of.

Given fluid tax filing rules its important to ensure your investments are protected. A financial advisor can help you make sure your tax filings dont unnecessarily hurt your assets.

Tax Rules Changed By Covid Relief

Pandemic-related relief changed many rules for 2021 tax returns. On 2021 returns, theres no longer an age cap or ceiling set at 64 or younger for workers to qualify for the earned income tax credit. Its a one-time-only deal, but the AARP is pushing to extend the tax break for older workers beyond 2021 tax returns.

The earned income credit has been expanded so that the credit can apply on 2021 federal returns to workers who are 65 or older, even if they do not have dependent children, thanks to the American Rescue Plan passed last year.

It now also applies to childless workers from age 19 to 24 who are not half-time or full-time students and are claimed as dependents on their parents tax return.

Don’t Miss: How Much Will I Get Paid After Taxes

Individual Income Tax Filing Due Dates

- Typically, most people must file their tax return by May 1.

- Fiscal year filers: Returns are due the 15th day of the 4th month after the close of your fiscal year.

If the due date falls on a Saturday, Sunday, or holiday, you have until the next business day to file with no penalty.

Filing Extensions

Can’t file by the deadline? Virginia allows an automatic 6-month extension to file your return . No application is required. You still need to pay any taxes owed on time to avoid additional penalties and interest. Make an extension payment.

Tax Filing Season Begins Jan 24 Irs Outlines Refund Timing And What To Expect In Advance Of April 18 Tax Deadline

IR-2022-08, January 10, 2022

WASHINGTON The Internal Revenue Service announced that the nation’s tax season will start on Monday, January 24, 2022, when the tax agency will begin accepting and processing 2021 tax year returns.

The January 24 start date for individual tax return filers allows the IRS time to perform programming and testing that is critical to ensuring IRS systems run smoothly. Updated programming helps ensure that eligible people can claim the proper amount of the Child Tax Credit after comparing their 2021 advance credits and claim any remaining stimulus money as a Recovery Rebate Credit when they file their 2021 tax return.

“Planning for the nation’s filing season process is a massive undertaking, and IRS teams have been working non-stop these past several months to prepare,” said IRS Commissioner Chuck Rettig. “The pandemic continues to create challenges, but the IRS reminds people there are important steps they can take to help ensure their tax return and refund don’t face processing delays. Filing electronically with direct deposit and avoiding a paper tax return is more important than ever this year. And we urge extra attention to those who received an Economic Impact Payment or an advance Child Tax Credit last year. People should make sure they report the correct amount on their tax return to avoid delays.”

Recommended Reading: Do You Get State Or Federal Taxes Back First

Contribute To Or Open An Ira By Tax Day

Contributions to a traditional IRA can be tax-deductible. You have until the April 18, 2022, tax deadline to contribute to an IRA, either Roth or traditional, for the 2021 tax year. The maximum contribution amount for either type of IRA is $6,000 or $7,000 if you’re age 50 or older. See all the rules here.

» MORE: Learn how IRAs work and where to get one

What’s The Fastest Way To File My Tax Return

The fastest way to file your tax return is to file electronically.

E-filing your tax return to the IRS is more secure than paper filing. Because the tax return is electronically transmitted to the IRS, you don’t have to worry about it getting lost in the mail or arriving late. You’ll also get confirmation right away that the IRS has received your return and has started processing it.

If you’re waiting for a tax refund, the fastest way to get your money is to have it electronically deposited into your bank account. The IRS typically issues 90% of refunds in less than 21 days when taxpayers combine direct deposit with electronic filing.

Don’t Miss: Do You Have To Pay Taxes On Life Insurance

What This Means For You

We understand that each taxpayers situation is unique, and in order to help you during these difficult days, our recommendation is to continue working toward the tax deadline as if it was still April 15. This will enable us to more quickly evaluate your tax position in order to determine what is most beneficial for you. For those who will receive a refund, we can file your return so you receive the payment as soon as possible. For those who will owe tax, you can proactively determine the amount and then plan to delay the payment until closer to the deadline.

Undoubtedly, circumstances may make it difficult to proceed as you once intended, but we remain committed to working with you even more so during these difficult times. If you have any questions, please contact your KSM advisor.

Irs: Dont Miss This Important Oct 17 Tax Extension Deadline

IR-2022-175, October 7, 2022

WASHINGTON The Internal Revenue Service today reminds taxpayers who requested an extension to file their 2021 tax return to do so by Monday, October 17.

While October 17 is the last day for most people to file a Form 1040 to avoid the late filing penalty, those who still need to file should do so as soon as possible. If they have their information ready, there’s no need to wait.

However, some taxpayers may have additional time. They include:

- Members of the military and others serving in a combat zone. They typically have 180 days after they leave the combat zone to file returns and pay any taxes due.

- The IRS calls special attention to people hit by recent national disasters, including Hurricane Ian. Taxpayers with an IRS address of record in areas covered by Federal Emergency Management Agency disaster declarations in Missouri, Kentucky, the island of St. Croix in the U.S. Virgin Islands and members of the Tribal Nation of the Salt River Pima Maricopa Indian Community have until November 15, 2022, to file various individual and business tax returns. Taxpayers in Florida, Puerto Rico, North Carolina, South Carolina, parts of Alaska and Hinds County, Mississippi, have until February 15, 2023. This list continues to be updated regularly potentially affected taxpayers by recent storms should visit the disaster relief page on IRS.gov for the latest information.

Also Check: Minimum Income To File Taxes

Perfect For Independent Contractors And Small Businesses

TurboTax Self-Employed searches over 500 tax deductions to get you every dollar you deserve.

Uncover industry-specific deductions, get unlimited tax advice, & an expert final review with TurboTax Live Self-Employed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Irs Extends Tax Filing Deadline To July 15

Update: The IRS has provided additional information on filing and payment here.

On March 20, the IRS extended the federal income tax filing deadline to July 15, in order to provide tax relief to those affected by the COVID-19 pandemic. This means that individuals, trusts, estates, corporations, and other non-corporate tax filers, including those who pay self-employment tax, will now have until July 15 to both file their tax returns and make tax payments.

The July 15 extension is automatic and does not require filing additional forms. It applies not only to 2019 federal income tax returns and payments due but also to 2020 federal estimated tax payments originally due on April 15.

In a previous notice, the IRS had limited the amount of payment that could be delayed, but IRS Notice 2020-18 states that there is no limit on the amount of the payment that may be postponed. Additionally, no penalties or interest will accrue until after the July 15 deadline. It is important to note that no extension is provided in this notice for the payment or deposit of any other type of federal tax or for the filing of any federal information return. This relief is available solely with respect to federal income tax filings and payments, including payments of tax on self-employment income.

Don’t Miss: Does Nc Have State Income Tax

Llc Tax Filing Deadline

LLCs are company structures that provide various financial and legal benefits for their owners.

If you choose to treat your LLC as a corporation, your tax dates are:

-

overall tax due date if you follow the calendar year for your fiscal year

-

15th day of the fourth month after your fiscal year ends: overall tax due date if you have a different fiscal year

If you choose to run your LLC as a sole proprietorship:

The IRS taxes you like an individual. Your income and expenses are therefore reported on your personal tax return.

Without an extension, the personal tax return is due on April 18. File Form 1040, and youll be good to go.

Expect A New Tax Form Related To Venmo Paypal Income

For tax year 2022, many business owners may be receiving a form they haven’t in the past. That form is a 1099-K and owners who receive payment of $600 or more through a third party processor such as Venmo or PayPal should be receiving it. In past years, the form was only sent out if the payments amounted to more than $20,000 and if there were more than 200 individual transactions.

The obligation for owners to report their income hasn’t changed. However, owners who may have been lax in the past now have more incentive to report that income since there will be a record on file with the government, Bronnenkant said.

He also suggests owners check to ensure that all of the payments on the 1099-K form are actually for goods and services, as opposed to a gift from a friend that was mischaracterized. “You shouldn’t have to pay taxes on it just because someone issued you a 1099-K with erroneous information,” Bronnenkant said.

You May Like: Tax On Food In Virginia