How Bench Can Help

Wondering what deductions you can claim? Could you save on taxes by switching to an S corporation status? Bench provides small businesses with year round tax advice from a team of experts inside our easy-to-use platform.

With Bench, you receive a dedicated bookkeeper to do your monthly bookkeeping and ensure your financials are organized and up-to date for tax filing. Youâll have an on-going, accurate view of the health of your business and the most stress-free tax season yet.

Additional California Payroll Tax Resources:

Our calculator is here to help, but of course, you can never learn enough, especially when it comes to payroll taxes. Here are some additional resources and contact information to help you run California payroll:

State of California Employment Development Department : 333-4606 | E-Services for Business | Register Online

Franchise Tax Board : 852-5711

Being a California employer isnt always easy. If you want to take some of the administrative burdens off your shoulders, there are a number of terrific payroll software companies that can do all the heavy lifting for you.

LET’S DO THIS

California Sales Tax Rates By City

The state sales tax rate in California is 7.250%. With local taxes, the total sales tax rate is between 7.250% and 10.750%.

California has recent rate changes .

Select the California city from the list of popular cities below to see its current sales tax rate.

Sales tax data for California was collected from here. Sale-Tax.com strives to have the most accurate tax percentages available but tax rates are subject to change at any time. Always consult your local government tax offices for the latest official city, county, and state tax rates. Help us make this site better by reporting errors.

Read Also: Due Date To File Taxes 2022

Supplementary Local Sales Taxes

Supplementary local sales taxes may be added by cities, counties, service authorities, and various special districts. Local county sales taxes for transportation purposes are especially popular in California. Additional local sales taxes levied by counties and municipalities are formally called “District Taxes.”

The effect from local sales taxes is that sales tax rates vary in California from 7.25% to 10.75% . For example, the city of Sacramento, the state capital, has a combined 8.75% sales tax rate, and Los Angeles, the largest city in California, has a combined 9.50% sales tax rate.

Local sales tax rate cap

The combined tax rate of all local sales taxes in any county is generally not allowed to exceed 2.00 percent. However, this is a statutory restriction and the California Legislature routinely allows some local governments, through the adoption of separate legislation, to exceed the 2.00 percent local tax rate cap. The 2.00 percent local tax rate cap is exceeded in any city with a combined sales tax rate in excess of 9.25% .

As of July 1, 2022, the following 140 California local jurisdictions have a combined sales tax rate in excess of the 2.00 percent local tax rate cap:

| CITY |

|---|

| SAN MATEO |

SB 566 and the rise in local sales tax increases

Local jurisdictions with at least 10.00% combined sales tax rates

As of July 1, 2022, the following 68 California local jurisdictions have a combined sales tax rate of at least 10.00%:

| CITY |

|---|

| SUTTER |

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity,this post may contain references to products from our partners. Here’s an explanation for how we make money

Also Check: Sales Tax Vs Use Tax

States With Flat Tax Rates

Among the states that do have income taxes, many residents get a break because the highest rates don’t kick in until upper-income levels. But this isn’t the case in the 10 states that have flat tax rates. The flat-tax states and their rates, from highest to lowest, can be seen in the table below.

| State |

|---|

California Property Tax Rates

Property taxes are collected on a county level, and each county in California has its own method of assessing and collecting taxes. As a result, it’s not possible to provide a single property tax rate that applies uniformly to all properties in California.

Instead, Tax-Rates.org provides property tax statistics based on the taxes owed on millions of properties across California. These statistics allow you to easily compare relative property taxes across different areas, and see how your property taxes compare to taxes on similar houses in California.

The statistics provided here are state-wide. For more localized statistics, you can find your county in the California property tax map or county list found on this page.

While the exact property tax rate you will pay will vary by county and is set by the local property tax assessor, you can use the free California Property Tax Estimator Tool to calculate your approximate yearly property tax based on median property tax rates across California.

If you would like to get a more accurate property tax estimation, choose the county your property is located in from the list on the left. Property tax averages from this county will then be used to determine your estimated property tax.

Keep in mind that assessments are done on a property-by-property basis, and our calculators cannot take into account any specific features of your property that could result in property taxes that deviate from the average in your area.

You May Like: Credit Karma Tax Return 2020

Recent Statewide Sales Tax Increases

Recent temporary statewide sales tax increases include:

- From April 1, 2009 until June 30, 2011, the state sales and use tax increased by 1% from 7.25% to 8.25% as a result of the 2008-2009 California budget crisis.

- Effective January 1, 2013, the state sales and use tax increased by 0.25% from 7.25% to 7.50% as a result of Proposition 30 passed by California voters in the November 6, 2012 election. The change was a four-year temporary tax increase that expired on December 31, 2016.

Now Write Those Paychecks

Feel that wave of relief? Youve checked payroll taxes off your to-do list so you can move onto the important things. Once each employees net pay is calculated , youre in the clear. All you have to worry about is getting your employees paid on time as well as setting aside whatever you owe in FICA and UI taxes. Those numbers can add up quickly!

You can pay federal taxes online to the IRS here. Plus, heres everything you need to know about federal tax filings.

You May Like: Tax Short Term Capital Gains

Things To Know About California State Tax

California’s standard deduction for state income taxes is $4,803 and $9,606 .

Californias tax-filing deadline generally follows the federal tax deadline.

Tax software will do your state taxes .

Wondering “Where is my California state tax refund?” Good news: You can check the status of your state tax refund online.

If you cant pay your California state tax bill on time, you can request a one-time, 30-day delay.

If you cant afford your tax bill and owe less than $25,000, California offers payment plans. Typically, you get three to five years to pay your bill. Theres a fee to set up an agreement.

You can also apply for the states offer in compromise program, which might allow you to pay less than you owe.

California Income Tax Calculator

| $114.00* | $353.00* |

* Note:

The standard deduction, which California has, is a deduction that is available by default to all taxpayers who do not instead choose to file an itemized deduction.

The Personal Exemption, which is supported by the California income tax, is an additional deduction you can take if you are primarily responsible for your own living expenses. Likewise, you can take an additional dependent exemption for each qualifying dependent , who you financially support.

The Federal income tax also has a standard deduction, personal exemptions, and dependant deductions, though they are different amounts than California’s and may have different rules.

Head over to the Federal income tax brackets page to learn about the Federal Income Tax, which applies in all states nationwide.

Also Check: How To Calculate Taxes On Tips

Capital Gains Tax Rate In California

The capital gains tax rate in California for 2022, unlike federal capital gains taxes, do not depend on whether it’s a short-term or long-term gain. This California capital gains tax rate is applied to the profit you make from selling certain assets, like stocks, bonds, mutual funds, and real estate. The capital gains tax rate is in line with normal California income tax laws .

These California capital gains tax rates can be lower than the federal capital gains tax rates, which are 0%, 15%, and 20% for long-term gains . The difference is that the federal capital gains tax rates only apply to taxable income above $425,800 or $481,601 .

Federal Income Tax Brackets For 2019

At the federal level, the Internal Revenue Service has adjusted the individual and joint income tax brackets for inflation for the 2019 tax year. The current federal income tax brackets are as follows:

- 10% for taxable income up to $9,700

- 12% for taxable income over $9,700

- 22% for taxable income over $39,475

- 24% for taxable income over $84,200

- 32% for taxable income over $160,725

- 35% for taxable income over $204,100

- 37% for taxable income over $510,300

Despite being published in this manner, the federal tax brackets are marginal, just as they are in California. In other words, if you and your spouse earn $150,00 in taxable income and file jointly, you would pay federal income tax as follows:

- 12% on $19,400 of your joint income

- 22% on your joint income between $19,401 and $78,950 and,

- 24% on your joint income between $78,951 and $150,000.

Also Check: Penalty For Not Paying Taxes Quarterly

Get To Know California Income Tax Brackets

In California, state income taxes are generally among the highest in the country, but the burden is spread among different segments of the population. The rate of California income tax is arranged on something of a sliding scale, separated by income tax brackets.

Low earners pay a smaller percentage of tax on their wages, while people who earn more pay higher rates. Understanding which bracket you fall into is the first step towards calculating how much income tax you owe the state.

Sales Tax Takers And Leavers

If you’re a consumer, you’ll want to consider that all but four states Oregon, New Hampshire, Montana and Delaware rely on sales tax for revenue.

Of these, Alaska also has no income tax, thanks to the severance tax it levies on oil and natural gas production. 37 states, including Alaska and Montana, allow local municipalities to impose a sales tax, which can add up. Lake Providence, Louisiana has the dubious distinction of most expensive sales tax city in the country in 2021, with a combined state and city rate of 11.45%.

Factoring the combination of state and average local sales tax, the top five highest total sales tax states as ranked by the Tax Foundation for 2021 are:

- Tennessee 9.55%

Residents of these states pay the least in sales taxes overall:

- New Hampshire 0%

Also Check: Car Registration Fee Tax Deductible

Where The Trouble Begins

The trouble for restaurant owners begins with a relatively uncomplicated-seeming statement in the California tax code: “Sales of food for human consumption are generally exempt from tax unless….”

The trouble begins at the phrase “generally exempt” and continues after “unless” with the provided list of exceptions along with the exceptions to the exceptions.

The exceptions to the exemption from the tax are:

- food sold in a heated condition

- food consumed at or near the seller’s facilities

- soft drinks and alcoholic beverages

- food sold for consumption where there’s an admission charge

This is already mildly confusing but wait, there’s more and it only gets worse.

States Without Income Tax

On the flip side, Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington state, and Wyoming dont impose an income tax at all. New Hampshire falls into a gray area. It doesn’t levy a tax on earned income, but it does tax interest and dividends at a flat 5%.

Since they don’t collect income tax, some states generate revenue in other ways. Tennessee has one of the highest combined state and local sales tax rates in the country. Your paycheck might be safe, but you’ll be dinged at the cash register. New Hampshire and Texas have high property taxes in relation to home values. And Pennsylvania charged the highest tax on gasoline in 2021.

Read Also: Filing For An Extension On Taxes 2022

The Alternative Tax Calculation

Fortunately, there is a way out of this mess, although you’re probably not going to like it much. California’s “Tax Guide for Restaurant Owners” explains that you don’t have to document these dual sales. Instead, you can just charge the applicable tax on 100 percent of all sales_._ That’s what a lot of food truck and cafe owners do.

References

Calculating The Ca Capital Gains Tax

The California capital gains tax is calculated by taking the sale price of the asset and subtracting the cost basis. The cost basis is what you paid for the asset plus any improvements you made to it. For example, if you bought a stock for $100 and it increased in value to $150, your capital gain would be $50. If you sold a piece of real estate for $500,000 and your cost basis was $400,000, your capital gain would be $100,000.

The capital gains tax rate that you pay on your capital gain depends on your taxable income. You should use your normal tax bracket rate to calculate how much of the gain you’ll be taxed on .

Also Check: Is Hazard Insurance Tax Deductible

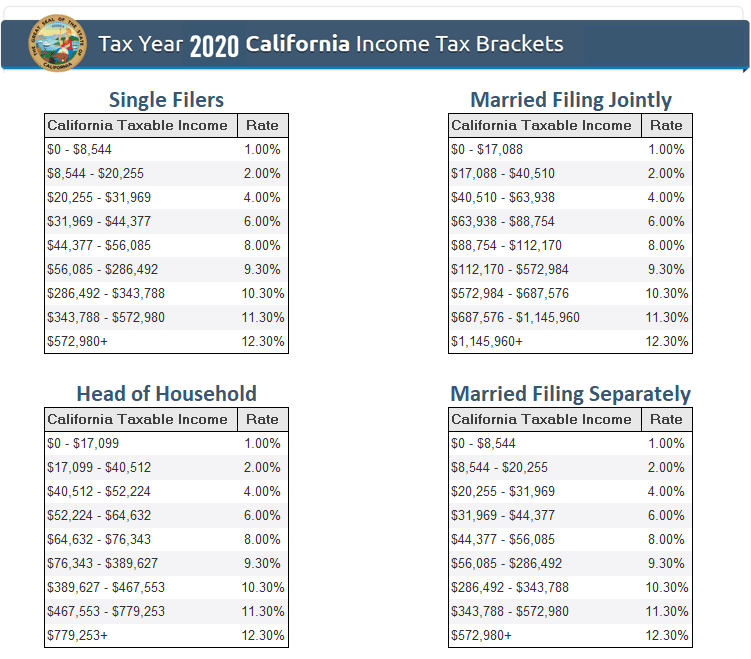

What Are The California State Income Tax Brackets

Knowing which tax bracket you fall under is important to know to anticipate how much you will owe in state income taxes. Tax rates typically change a little each year, so its important to stay up-to-date on the latest rates.

Weve put together this California state income tax bracket table to help you better understand your tax liability.

California Property Taxes By County

You can choose any county from our list of California counties for detailed information on that county’s property tax, and the contact information for the county tax assessor’s office. Alternatively, you can find your county on the California property tax map found at the top of this page. Hint: Press Ctrl+F to search for your county’s name

Median Property Taxes In California By County

Recommended Reading: Earned Income Tax Credit 2021 Release Date

California State Income Tax

Self-employed workers, independent contractors and unincorporated businesses in California might not have to pay state corporate or franchise taxes, but most still have to pay state income taxes. Same goes for people who earn income from pass-through entities like S Corporations and LLCs.

The California state income tax rate ranges from 1 to 12.3 percent. Your income tax rate is based on which of the nine California tax brackets you fall into, and also your filing status.

If your filing status is âSingleâ or âMarried Filing Separately,â youâll calculate your 2020 California income tax based on the following schedule:

| Over | Enter on Form 540, line 31 | |

|---|---|---|

| $0 | $0.00 + 1.00% of the amount over $0 | |

| $8,932 | $89.32 + 2.00% of the amount over $8,932 | |

| $21,175 | $334.18 + 4.00% of the amount over $21,175 | |

| $33,421 | $824.02 + 6.00% of the amount over $33,421 | |

| $46,394 | $1,602.40 + 8.00% of the amount over $46,394 | |

| $58,634 | $2,581.60 + 9.30% of the amount over $58,634 | |

| $299,508 | $24,982.88 + 10.30% of the amount over $299,508 | |

| $359,407 | $31,152.48 + 11.30% of the amount over $359,407 | |

| $599,012 | And over | $58,227.85 + 12.30% of the amount over $599,012 |

Consult the FTBâs schedules here if youâre filing your taxes jointly with a spouse, are a qualifying widow, or are using the âHead of Householdâ filing status.

Top Income Tax Rates By State

Below, you’ll find the top 10 states with the highest income tax rates.

| State | |

|---|---|

| Wisconsin | 7.65% |

California tops the list with the highest income tax rates in the countryits highest tax rate is 12.3%, but it also implements an additional tax on those with income of $1 million or more, which makes its highest actual tax rate 13.3%. New Jersey and New York also implement this type of “millionaire’s tax.” Other states have a top tax rate, but not all states have the same number of income brackets leading up to the top rate. For example, Hawaii has a top tax rate of 11% and 12 income brackets, while Iowa has a top tax rate of 8.53% and nine income brackets. And of course, Washington, D.C. is not a state, but it has its own income tax rate.

You May Like: When Will I Get My Tax Return