Do I Have To Pay Income Tax In Ohio

Youâre required to file an Ohio tax return if you receive income from an Ohio source, and you fall into one of the following categories:

- Resident: Your abode is in Ohio. Youâre considered a resident even if you take temporary absences from your home in Ohio, no matter how long the absences are.

- Part-year resident: You lived in Ohio for part of the tax year. Part-year residents are entitled to the nonresident credit for any income earned while they were a resident of another state. Theyâre also eligible for the resident credit on any non-Ohio income earned while living in Ohio, as long as they paid tax on it in another state.

- Nonresident: Youâre a resident of another state for the entire tax year. If you earned Ohio-sourced income, you will have to file an Ohio state tax return, but youâll be eligible to claim the nonresident credit to all income earned outside of Ohio to avoid being taxed twice. If you live in Indiana, Kentucky, Michigan, Pennsylvania or West Virginia, you donât need to file an Ohio state tax return if your only Ohio-sourced income is wages.

Ohio Property Taxes By County

You can choose any county from our list of Ohio counties for detailed information on that county’s property tax, and the contact information for the county tax assessor’s office. Alternatively, you can find your county on the Ohio property tax map found at the top of this page. Hint: Press Ctrl+F to search for your county’s name

Median Property Taxes In Ohio By County

Rose Bowl: No 11 Penn State 35 No 8 Utah 21

No. 11 Penn State used a strong second half and took advantage of a key Utah injury to power past the eighth-ranked Utes 35-21 to win just the second Rose Bowl in program history and first since 1995. That push was led by Nittany Lions quarterback Sean Clifford, who capped off a lengthy and successful career with one of his best games. The senior went 16 of 22 for 279 yards passing and a pair of touchdowns while firing off accurate throws all evening.

While Clifford was the highlight of the evening, Utah’s quarterback situation also marked a key storyline in the game. Utes quarterback Cameron Rising exited in the third quarter with a left knee injury with his team trailing 21-14. Backup quarterback Bryson Barnes struggled in relief, throwing an interception on his first drive and failing to get Utah on the scoreboard until garbage time. Running backs Ja’Quinden Jackson and Micah Bernard combined for 140 yards and a touchdown, but it was not enough.

After Rising went out, Penn State scored a pair of touchdowns to put the game away, including an 88-yard touchdown pass from Clifford to KeAndre Lambert-Smith. The Penn State ground game was effective, too. Running back Nicholas Singleton broke the game open with an 87-yard touchdown scamper, one of two on the day, as he cleared the 100-yard rushing plateau for the fourth time this season.

87 YARDS TO. THE. HOUSEThe third-longest TD run in Rose Bowl history

Don’t Miss: 2021 Federal Tax Rates Married Filing Jointly

Lump Sum Retirement Credit

If you claim this credit, you canât claim the retirement income credit on this yearâs return or any future return. If you received a total, lump sum distribution on account of retirement, and your modified adjusted gross income, less exemption, is less than $100,000 you can claim this credit. The lump sum retirement credit can only be claimed once per lifetime.

Overview Of Ohio Taxes

Ohio has a progressive income tax system with six tax brackets. Rates range from 0% to 3.99%. For all filers, the lowest bracket applies to income up to $25,000 and the highest bracket only applies to income above $110,650. There are more than 600 Ohio cities and villages that add a local income tax in addition to the state income tax.

Work InfoDismiss

You can’t withhold more than your earnings. Please adjust your .

| Gross Paycheck | |

| FICA and State Insurance Taxes | –% |

| State Family Leave Insurance Tax | –% |

| State Workers Compensation Insurance Tax | –% |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

| Unfortunately, we are currently unable to find savings account that fit your criteria. Please change your search criteria and try again. Searching for accounts… |

Recommended Reading: How To Check Amended Tax Return Status

School District Income Tax Rates

Districts Serving Residents of Fairfield County 2301Amanda Clearcreek LSD* / Fairfield County 2302Berne Union LSD* / Fairfield County 2303 2502Canal Winchester LSD / Franklin County 2304Fairfield Union LSD / Fairfield County 2305 2306Liberty Union-Thurston LSD / Fairfield County 2307 2309 4510Southwest Licking LSD / Licking County 6503Teays Valley LSD* / Pickaway County 2308Walnut Twp. Local Schools* / Fairfield County

Ohio Inheritance And Estate Taxes

Ohio no longer has an estate tax on estates of people who passed away on or after Jan. 1, 2013. If someone died before that, and the gross value of their estate exceeded $338,333, the estate may be subject to Ohios estate tax. Gross estate value may include a home, vehicles, bank accounts, business interests, life insurance proceeds, stock and other types of assets.

Recommended Reading: When Is The Last Day To Turn In Taxes

Total Estimated 2021 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

Cincinnati Ohio Sales Tax Rate

cincinnati Tax jurisdiction breakdown for 2023

What does this sales tax rate breakdown mean?

Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more.

Need the exact sales tax rate for your address?

What is the sales tax rate in Cincinnati, Ohio?

The minimum combined 2023 sales tax rate for Cincinnati, Ohio is . This is the total of state, county and city sales tax rates. The Ohio sales tax rate is currently %. The County sales tax rate is %. The Cincinnati sales tax rate is %.

Did South Dakota v. Wayfair, Inc affect Ohio?

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in Ohio, visit our state-by-state guide.

Did COVID-19 impact sales tax filing due dates in Cincinnati?

The outbreak of COVID-19 may have impacted sales tax filing due dates in Cincinnati. Please consult your local tax authority for specific details. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance.

Automating sales tax compliance can help your business keep compliant with changing sales tax laws in Ohio and beyond. AvaTax delivers real-time sales tax rates and uses advanced technology to map rates to exact address locations, based on the latest jurisdiction requirements.

Recommended Reading: Penalty For Filing Late Taxes

Toledo Ohio Sales Tax Rate

toledo Tax jurisdiction breakdown for 2023

What does this sales tax rate breakdown mean?

Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more.

Need the exact sales tax rate for your address?

What is the sales tax rate in Toledo, Ohio?

The minimum combined 2023 sales tax rate for Toledo, Ohio is . This is the total of state, county and city sales tax rates. The Ohio sales tax rate is currently %. The County sales tax rate is %. The Toledo sales tax rate is %.

Did South Dakota v. Wayfair, Inc affect Ohio?

The 2018 United States Supreme Court decision in South Dakota v. Wayfair, Inc. has impacted many state nexus laws and sales tax collection requirements. To review the rules in Ohio, visit our state-by-state guide.

Did COVID-19 impact sales tax filing due dates in Toledo?

The outbreak of COVID-19 may have impacted sales tax filing due dates in Toledo. Please consult your local tax authority for specific details. For more information, visit our ongoing coverage of the virus and its impact on sales tax compliance.

Automating sales tax compliance can help your business keep compliant with changing sales tax laws in Ohio and beyond. AvaTax delivers real-time sales tax rates and uses advanced technology to map rates to exact address locations, based on the latest jurisdiction requirements.

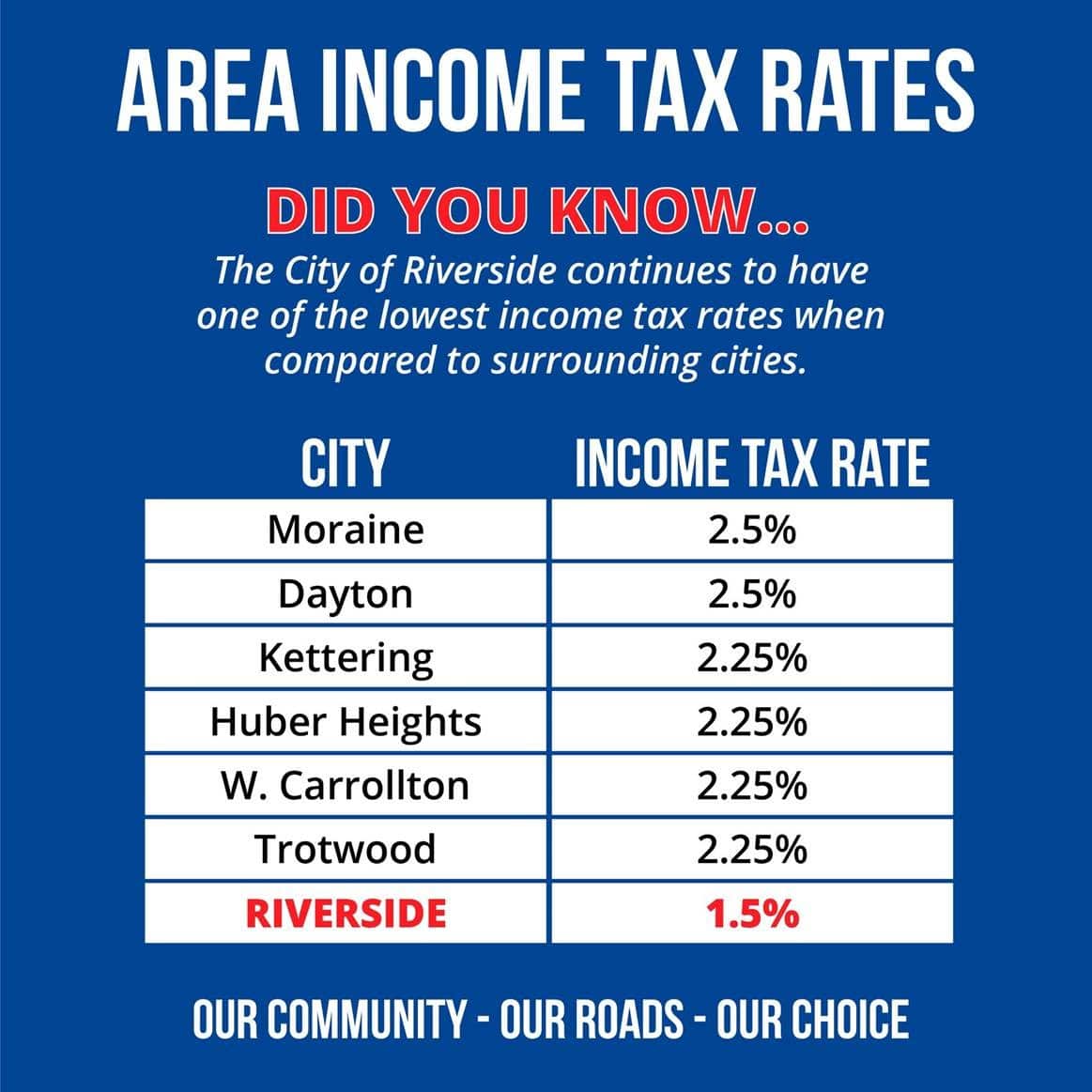

Ohio Local Income Taxes

Depending on where you live in Ohio, you may have to pay municipal income taxes. Your municipality determines your local income tax rate. These rates may range from 0.5% to 3%, with Ohios three largest municipalities Cincinnati, Cleveland and Columbus charging more than 2%. Municipalities cant charge more than 1% without voter approval.

The Ohio Department of Taxation keeps a list of cities and villages with income taxes here. It suggests contacting your local municipality directly with questions about your local income tax rate.

Don’t Miss: Why Am I Paying Medicare Tax

How Do I Pay The Ohio Use Tax

In many states, an optional field for remitting use tax is included in the state income tax return. A use tax return form may also be available on the Ohio Department of Revenue website for calculating and paying use tax.

Above: Example use tax field on a state income tax return

Use tax is a self-assessed tax with a very low public awareness rate, and as a result states have a very hard time enforcing use tax compliance. Only about 1.6% of taxpayers pay use tax each year, remitting an average of $69 in use taxes on total purchases averaging $929.

Government studies have shown that a large percentage of use tax payments are made as the result of an audit or under the threat of an audit. If unpaid use tax is discovered by a Ohio tax audit, significant underpayment fees and interest may apply.

Lump Sum Distribution Credit

If youâre 65 and older with a modified adjusted gross income, less exemptions, under $100,000, and you received a total, lump sum distribution from a qualified pension, retirement or profit-sharing plan, youâre eligible to claim this credit. You can only claim this credit once per lifetime. If you claim the lump sum distribution credit, you canât claim the above senior citizen credit on this return or any future return.

Also Check: What Percent Of Your Check Goes To Taxes

Ohio Median Household Income

| 2010 | $45,090 |

When you look at your Ohio paycheck, youll see the federal withholding as described above, plus any additional withholdings that you may have set up, such as for your 401 contributions or health insurance premiums. But youll also see a withholding for state taxes. Because Ohio collects a state income tax, your employer will withhold money from your paycheck for that tax as well.

As mentioned above, Ohio state income tax rates range from 0% to 3.99% across six brackets. The same brackets apply to all taxpayers, regardless of filing status. The first bracket covers income up to $25,000, while the highest bracket covers income higher than $110,650.

Ohio State And Local Tax Update: Budget Bill 2021

On Thursday, July 1, 2021, Governor Mike DeWine signed House Bill 110 into law after vetoing 14 different provisions in the bill.

Summary of Ohio Tax Changes

- Provides municipal income tax withholding guidance to employers and remote workers and addresses 2020 and 2021 municipal income tax refunds from principal place of work municipalities

- Reduces the top personal income tax rate from 4.797% to 3.99% for tax years beginning on or after January 1, 2021

- Eliminates the sales tax on employment labor services and employment placement services

- Allowed Commercial Activity Tax exclusions of BWC Dividend Refunds to become permanent

- Streamlined many tax incentive programs and extended or created several new tax incentive programs for taxpayers retaining or creating jobs in Ohio

Local Municipal Income Tax Withholding

As most Ohio taxpayers are aware, Ohios emergency order ended June 18, 2021 and with that the withholding changes under H.B. 197, which required employers to continue to withhold local municipal income taxes based on an employees principal place of work, expired 30 days after on July 18, 2021. However, in order to assist employers as they evaluate their post-COVID return to work policies and procedures, H.B. 110 allows, but does not require, employers to extend the H.B. 197 withholding procedures through December 31, 2021. Effective January 1, 2022, employers will be required to return to the pre-COVID 20-day rule.

Individual Income Tax Reductions

Recommended Reading: Business Tax Return Due Date 2022

How You Can Affect Your Ohio Paycheck

If you want a bigger Ohio paycheck, there are several steps you can take. For starters, you can fill out a new W-4 form so that you can adjust your withholdings. This can decrease the amount your employer withholds and thus make each paycheck bigger. Just remember that you might have a bill during tax season if you dont withhold enough throughout that year. Another option to increase the size of your Ohio paycheck is to seek supplemental wages, such as commissions, overtime, bonus pay, etc. The tax withholding rate on supplemental wages is a flat 3.5%.

On the other hand, you may want to shrink the size of each paycheck for tax reasons. If youre getting a big tax bill every year, you might want to fill out a new W-4 form and request additional withholding. You can also specify a dollar amount to withhold from each paycheck in addition to what your employer is already withholding. There is a line on the W-4 where you can write in any additional withholding you want. If youre unsure how much to write in, use the paycheck calculator to get an idea of what your tax liability is. The end result of requesting an additional withholding is receiving smaller paychecks, but you may have a smaller tax bill or even a refund come tax season.

Tangible Personal Property Tax

Since 2009, Ohio no longer assesses taxes on most tangible personal property. Tangible personal property is defined as the physical property used in general operations of manufacturing and service-based businesses and included machinery, equipment, furniture, fixtures, and inventory.

This revamping of the way Ohio taxes businesses was initiated in 2005, effectively eliminating the State Tangible Personal Property Tax. This tax was viewed as a disincentive to capital investment, and as a result, was considered a barrier to increases in personal and business productivity, income growth, and job creation in Ohio.

Don’t Miss: When’s The Last Day To Do Your Taxes

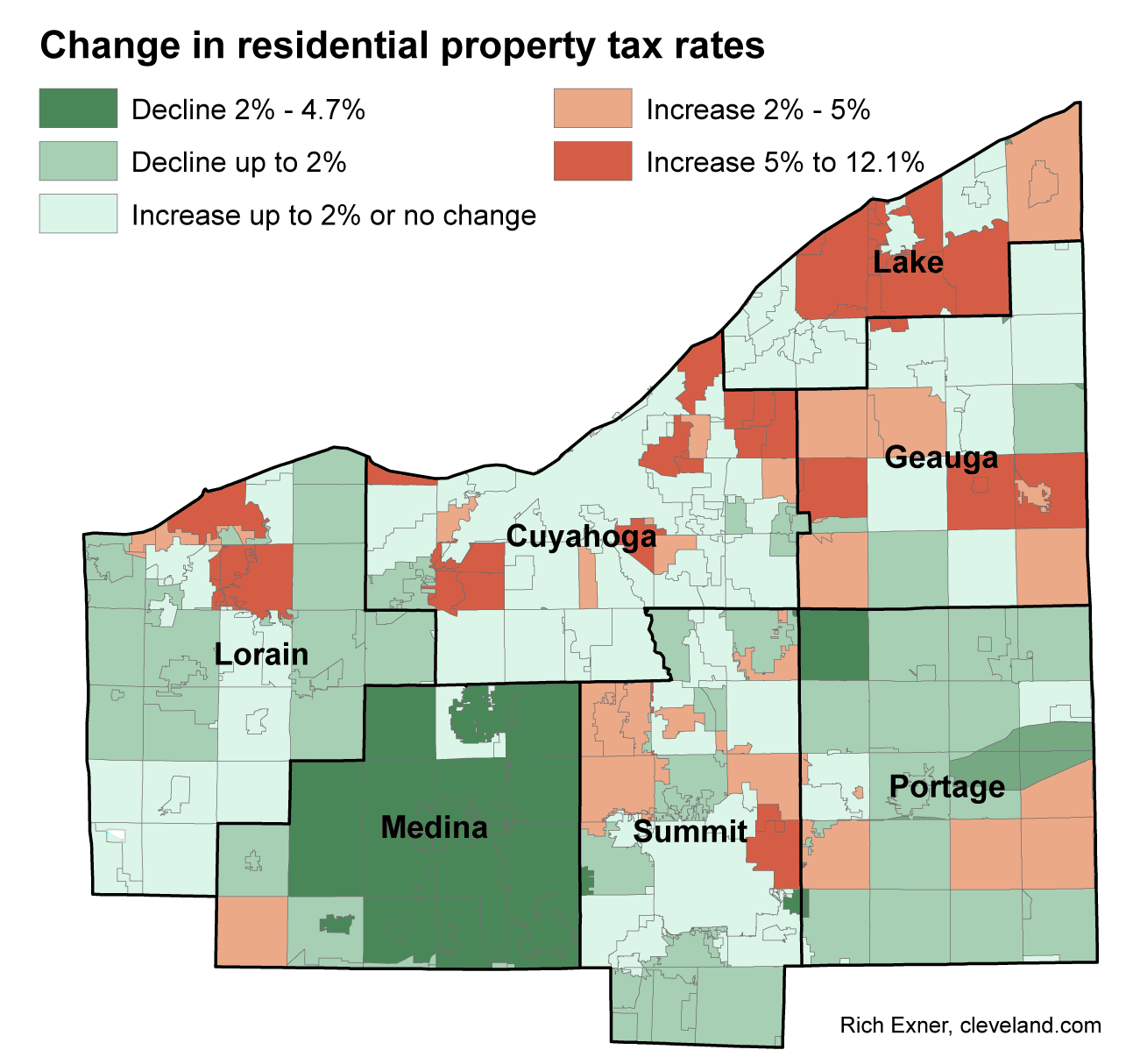

Ohio Property Tax Rates

Property taxes are collected on a county level, and each county in Ohio has its own method of assessing and collecting taxes. As a result, it’s not possible to provide a single property tax rate that applies uniformly to all properties in Ohio.

Instead, Tax-Rates.org provides property tax statistics based on the taxes owed on millions of properties across Ohio. These statistics allow you to easily compare relative property taxes across different areas, and see how your property taxes compare to taxes on similar houses in Ohio.

The statistics provided here are state-wide. For more localized statistics, you can find your county in the Ohio property tax map or county list found on this page.

While the exact property tax rate you will pay will vary by county and is set by the local property tax assessor, you can use the free Ohio Property Tax Estimator Tool to calculate your approximate yearly property tax based on median property tax rates across Ohio.

If you would like to get a more accurate property tax estimation, choose the county your property is located in from the list on the left. Property tax averages from this county will then be used to determine your estimated property tax.

Keep in mind that assessments are done on a property-by-property basis, and our calculators cannot take into account any specific features of your property that could result in property taxes that deviate from the average in your area.

How Do Ohio Tax Brackets Work

Technically, you don’t have just one “tax bracket” – you pay all of the Ohio marginal tax rates from the lowest tax bracket to the tax bracket in which you earned your last dollar. For comparison purposes, however, your Ohio tax bracket is the tax bracket in which your last earned dollar in any given tax period falls.

You can think of the bracketed income tax as a flat amount for all of the money you earned up to your highest tax bracket, plus a marginal percentage of any amount you earned over that. The chart below breaks down the Ohio tax brackets using this model:

| For earnings between $21,750.00 and $43,450.00, you’ll pay 2.85% |

| For earnings between $43,450.00 and $86,900.00, you’ll pay 3.33%plus $618.45 |

| For earnings between $86,900.00 and $108,700.00, you’ll pay 3.8%plus $2,063.60 |

| For earnings between $108,700.00 and $217,400.00, you’ll pay 4.41%plus $2,892.43 |

| For earnings over $217,400.00, you’ll pay 4.8% plus $7,689.36 |

| For earnings between $21,750.00 and $43,450.00, you’ll pay 2.85% |

| For earnings between $43,450.00 and $86,900.00, you’ll pay 3.33%plus $618.45 |

| For earnings between $86,900.00 and $108,700.00, you’ll pay 3.8%plus $2,063.60 |

| For earnings between $108,700.00 and $217,400.00, you’ll pay 4.41%plus $2,892.43 |

| For earnings over $217,400.00, you’ll pay 4.8% plus $7,689.36 |

Don’t Miss: What Do I Need For My Taxes