Ira Rollover Bridge Loan

There is one final way to borrow from your 401k or IRA on a short-term basis. You can roll it over into a different IRA. You are allowed to do this once in a 12-month period.

When you roll an account over, the money is not due into the new retirement account for 60 days. During that period, you can do whatever you want with the cash.

However, if its not safely deposited in an IRA when time is up, the IRS will consider it an early distribution. You will be subject to penalties in the full amount.

This is a risky move and is not generally recommended. However, if you want an interest-free bridge loan and are sure you can pay it back, its an option.

Read More: 7 Essential Steps for Retirement Planning

The Hardship Withdrawal Option

A hardship withdrawal can be taken without a penalty. For example, taking out money to help with economic hardship, pay college tuition, or fund a down payment for a first home are all withdrawals that are not subject to penalties, though you still will have to pay income tax at your regular tax rate. You may also withdraw up to $5,000 without penalty to deal with a birth or adoption under the terms of the SECURE Act of 2019.

A hardship withdrawal from a participants elective deferral account can only be made if the distribution meets two conditions.

- Itâs due to an immediate and heavy financial need.

- Itâs limited to the amount necessary to satisfy that financial need.

In some cases, if you left your employer in or after the year in which you turned 55, you may not be subject to the 10% early withdrawal penalty.

Once you have determined your eligibility and the type of withdrawal, you will need to fill out the necessary paperwork and provide the requested documents. The paperwork and documents will vary depending on your employer and the reason for the withdrawal, but once all the paperwork has been submitted, you will receive a check for the requested fundsone hopes without having to pay the 10% penalty.

Taxes On Employer Contributions To Your 401

In addition to your contributions, an employer may also put money into your 401. Once that money is in your account, the IRS treats it the same as your contributions. You wont pay any taxes while the money is in your account, but you will pay income taxes when you withdraw it. Unlike your own contributions, you dont pay any payroll taxes when your employer contributes to your account. Its truly free money. It doesnt even count toward the $19,500 contribution limit for 2021. That limit rises to $20,500 in 2022, and if youre at least 50 years old the limit is $27,000.

Recommended Reading: Local County Tax Assessor Collector Office

Figuring Out Your Taxes On A Traditional 401

Distributions from a regular, or traditional, 401 are fairly simple in their tax treatment. Your contributions to the plan were paid with pre-tax dollars, meaning they were taken “off the top” of your gross salary, reducing your taxable earned income and, thus, the income taxes you paid at that time. Because of that deferral, taxes become due on the 401 funds once the distributions begin.

Usually, the distributions from such plans are taxed as ordinary income at the rate for your tax bracket in the year you make the withdrawal. There are, however, a few exceptions, including if you were born before 1936 and you take your distribution as a lump sum. In such a case, you may qualify for special tax treatment.

The situation is much the same for a traditional IRA, another tax-deferred retirement account that’s offered by some smaller employers or may also be opened by an individual. Contributions to traditional IRAs are also made with pre-tax dollars, and so taxes are due on them when the money’s withdrawn.

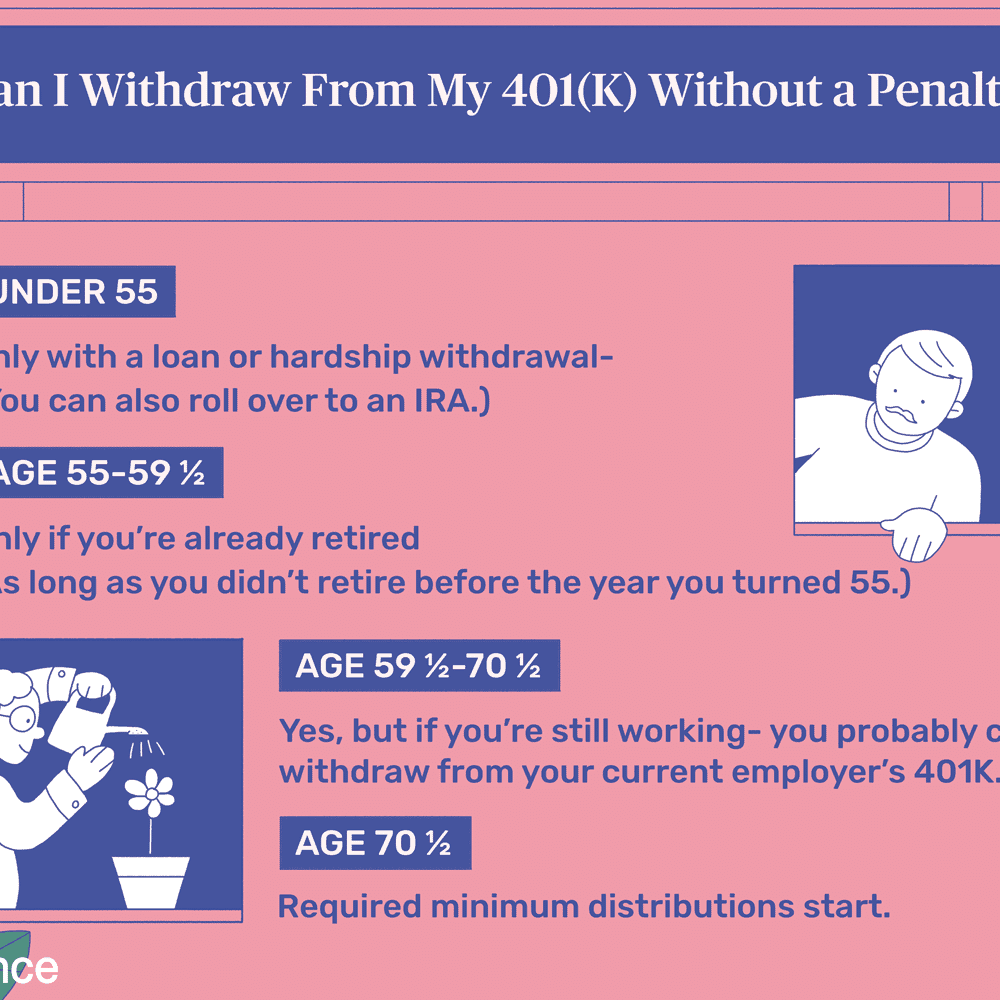

How To Avoid An Early Withdrawal Penalty

You can avoid the 401 early withdrawal penalty by waiting until you are 59 ½ to take distributions from your plan. The IRS also lists various situations which could exempt you from the 10% tax, such as taking an early distribution due to a qualifying disability or reducing excess contributions. Make sure to review the exemptions list to see if your situation qualifies.

Another way to avoid the 10% early withdrawal tax is to opt for a loan against your 401 account. Your loan amount wont be taxed as a distribution as long as:

- You borrow 50% or less of your vested balance up to $50,000.

- The loan is repaid within five years .

- Your payments are substantially level.

- Payments are made at least quarterly over the life of the loan.

While 401 loans can be a good alternative, not all plan providers offer them so youll have to check to see if its an option for you.

You May Like: How Long To Get Tax Refund 2022

How Federal Taxes Work For Single Filers

Your 2020 tax would be calculated like this if your taxable income is $72,000 and youâre single:

- The first $9,875 is taxed at 10%, so you pay $987.50 on that amount.

- The next $30,250 is taxed at 12%, so you pay $3,630 on that portion.

- And the last $31,875 is taxed at 22%, so you pay $7,012.50.

- You owe a total of $11,630 in taxes.

Your your highest tax bracketis 22%, but only $31,875 of your income is taxed at that rate. Your effective tax rate, which is your taxes paid divided by your taxable income, works out to about 16.2%.

Also Check: How To Withdraw My 401k From Fidelity

How Can You Withdraw From A 401 Without Penalty

You can withdraw from a 401 distribution without penalty if you are at least 59½. If you are under that age, the penalty is 10% of the total. There are exceptions for financial hardship, and for certain qualified reasons such as:

- Essential medical expenses for treatment and care

- Home-buying expenses for a principal residence

- Up to 12 months worth of educational tuition and fees

- Expenses to prevent being foreclosed on or evicted

- Burial or funeral expenses

- Certain expenses to repair casualty losses to a principal residence

Don’t Miss: How Much Is Inheritance Taxes

Build An Emergency Fund

This should be the foundation of your financial plan and experts recommend having about six months worth of expenses saved. You can park this money in a high-yield savings account to earn more interest than you would in a traditional checking account. An emergency fund should help you manage most of lifes curveballs.

The 401 Withdrawal Rules For People Older Than 59

Most 401s offer employer contributions. You can get extra money for your retirement, and you can keep this benefit after you change jobs as long as you meet any vesting requirements. Thats an important advantage that an IRA doesnt have. Stashing pre-tax cash in your 401 also allows it to grow tax-free until you take it out. Theres no limit for the number of withdrawals you can make. After you become 59 ½ years old, you can take your money out without needing to pay an early withdrawal penalty.

You can choose a traditional or a Roth 401 plan. Traditional 401s offer tax-deferred savings, but youll still have to pay taxes when you take the money out. For example, if you withdraw $15,000 from your 401 plan, youll have an additional $15,000 in taxable income that year. With a Roth 401, your contributions come from post-tax dollars. As long as youve had the account for five years, Roth 401 withdrawals are tax-free.

Read Also: Can 401k Be Transferred To Roth Ira

Don’t Miss: How To Find 2020 Tax Return

How Much Tax Do You Pay On 401 Distributions

A withdrawal you make from a 401 after you retire is officially known as a distribution. While youve deferred taxes until now, these distributions are now taxed as regular income. That means you will pay the regular income tax rates on your distributions. You pay taxes only on the money you withdraw. If you withdraw $10,000 from your 401 over the course of the year, you will only pay income taxes on that $10,000. Its possible to withdraw your entire account in one lump sum, though this could push you into a higher tax bracket for the year, so its smart to take distributions more gradually.

The good news is that you will only have to pay income tax. Those FICA taxes only apply during your working years. You will have already paid those when you contributed to a 401 so you dont have to pay them when you withdraw money later.

State and local governments may also tax 401 distributions. As with the federal government, your distributions are regular income. The tax you pay depends on the income tax rates in your state. If you live in one of the states with no income tax, then you wont need to pay any income tax on your distributions. So depending on where you live, you may never have to pay state income taxes on your 401 money.

Withdrawal Rules Frequently Asked Questions

If you participate in a 401 plan, you should understand the rules around separation of service, and the rules for withdrawing money from your account otherwise known as taking a withdrawal. 401 plans have restrictive withdrawal rules that are tied to your age and employment status. If you dont understand your plans rules, or misinterpret them, you can pay unnecessary taxes or miss withdrawal opportunities.

We get a lot of questions about withdrawals from 401 participants. Below is a FAQ with answers to the most common questions we receive. If you are a 401 participant, you can use our FAQ to understand when you can take a withdrawal from your account and how to avoid penalties.

Don’t Miss: Are Municipal Bonds Tax Free

Have Diverse Retirement Income Sources

To be truly efficient with your taxes in retirement, itâs best to have a diverse mix of assets to work with â which means saving for retirement using more than just a 401. This allows you to make strategic withdrawals in retirement that can help you lower your tax burden overall because different assets like Roth accounts, whole life insurance and even annuities have different attributes, including their tax treatment.

What Is A 401 Plan

Traditional 401 plans are employer-sponsored retirement accounts. They allow you to contribute pre-tax earnings through automatic payroll deductions. Employers can also contribute to your account by matching your contributions or making non-matching donations.

Your 401 account balance grows over time, not only from contributions but thanks to interest yields. However, the Internal Revenue Service restricts how much you can contribute each year and when you can take penalty-free distributions.

If you’re looking to explore retirement accounts besides the traditional 401 it may also be worth considering an IRA.

Also Check: Is Hazard Insurance Tax Deductible

What Determines Your Social Security Benefit

Your Social Security benefit amount is largely determined by how much you earned during your working years, your age when you retire, and your expected lifespan.

The first factor that influences your benefit amount is the average amount that you earned while working. Essentially, the more you earned, the higher your benefits will be. The SSA’s annual fact sheet shows workers retiring at full retirement age can receive a maximum benefit amount of $3,345 for 2022. The Social Security Administration calculates an average monthly benefit amount based on your average income and the number of years you are expected to live.

In addition to these factors, your age when you retire also plays a crucial role in determining your benefit amount. While you can begin receiving Social Security benefits as early as age 62, your benefit amount is reduced for each month that you begin collecting before your full retirement age. The full retirement age is 66 and 10 months for those who turn 62 in 2021. It increases by two months each year until it hits the current full retirement age cap of 67 for anyone born in 1960 or later.

To ensure benefits maintain their buying power, the Social Security administration adjusts them every year in accordance with changes in the cost of living. For example, as of January 2022, the COLA will cause Social Security and Supplemental Security Income benefits to increase by 5.9%.

Avoid Taxes On Your 401 Rollover

Rolling over a 401 to an IRA or a new employer-sponsored retirement account isnât considered a distribution as long as you do it properly. There are two ways you can go about it. The first is called a direct rollover. You provide your 401 provider with details about where youâd like your funds transferred, and they will automatically send the money to your new account. You may pay a one-time service fee for doing this. If youâre unsure how to get started, talk to your 401 plan administrator.

The other option is an indirect rollover. Here you withdraw all of the funds from your 401 yourself and then deposit them into your new account. As long as you deposit the funds into the new account within 60 days of the withdrawal, the government wonât consider it a distribution. But if you donât deposit the money in time, or you fail to deposit the full amount you withdrew from your 401, the government is going to come around asking for its cut.

Thatâs why the direct rollover method is usually considered safer. You donât touch the money at all, so you donât have to worry about owing taxes right now. It is possible to do an indirect rollover without paying taxes as well, but make sure you deposit the new funds right away to avoid any issues.

You May Like: How To File Taxes Without W2 Or Paystub

Taxable Iras Pensions And Annuities

Taxable income from IRA distributions, IRA withdrawals, pensions, and annuities all impact your tax bracket calculations.

Not all IRA distributions are taxable. For instance, Roth IRA distributions are usually tax-free.

Pensions and annuities may or may not be taxable depending on your situation and the particular pension or annuity.

Can An Account Owner Just Take A Rmd From One Account Instead Of Separately From Each Account

An IRA owner must calculate the RMD separately for each IRA that he or she owns, but can withdraw the total amount from one or more of the IRAs. Similarly, a 403 contract owner must calculate the RMD separately for each 403 contract that he or she owns, but can take the total amount from one or more of the 403 contracts.

However, RMDs required from other types of retirement plans, such as 401 and 457 plans have to be taken separately from each of those plan accounts.

Donât Miss: How To Transfer Roth 401k To Roth Ira

Also Check: Texas Franchise Tax Instructions 2021

Tax Benefits For Saving

Based on your income and filing status, your contributions to a qualified 401 may lower your tax bill even more through the Savers Credit, formally called the Retirement Savings Contributions Credit.

- The savers credit directly reduces your tax by a portion of the amount you put into your 401.

- Since its introduction in 2002, this credit for retirement savings has ranged from $1,000 to $2,000.

- Eligible taxpayers calculate their credit using form 8880 and enter the amount on their 1040 tax return.

Whether you have stock, bonds, ETFs, cryptocurrency, rental property income or other investments, TurboTax Premier has you covered. Filers can easily import up to 10,000 stock transactions from hundreds of Financial Institutions and up to 4,000 crypto transactions from the top crypto exchanges. Increase your tax knowledge and understanding all while doing your taxes.

Dont Miss: Where Do I Go To Pay My Property Taxes

When You Owe Income Tax On A Withdrawal

Once you reach age 59½, you can withdraw money without a 10% penalty from any type of IRA.

If it is a Roth IRA and you’ve had a Roth for five years or more, you won’t owe any income tax on the withdrawal. If it’s not, you will.

Money deposited in a traditional IRA is treated differently from money in a Roth.

If it’s a traditional IRA, SEP IRA, Simple IRA, or SARSEP IRA, you will owe taxes at your current tax rate on the amount you withdraw. For example, if you are in the 22% tax bracket, your withdrawal will be taxed at 22%.

You won’t owe any income tax as long as you leave your money in a traditional IRA until you reach another key age milestone. Once you reach age 72, you will be required to take a distribution from a traditional IRA. The age was set at 70½ until the passage of the Setting Every Community Up for Retirement Enhancement Act in December 2019.

The IRS has specific rules about how much you must withdraw each year, the required minimum distribution . If you fail to withdraw the required amount, you could be charged a hefty 50% tax on the amount not distributed as required.

There are no RMD requirements for your Roth IRA, but if money remains after your death, your beneficiaries may have to pay taxes. There are several different ways your beneficiaries can withdraw the funds, and they should seek advice from a financial advisor or the Roth trustee.

Don’t Miss: Free Irs Approved Tax Preparation Courses

Withdrawing From Your Own Rrsps

RRSPs are a type of retirement savings plan, which means the plan lets you withdraw the funds when you have retired it shouldnt be confused with Canada Pension Plan . However, there are ways to withdraw money from your RRSP before maturity. It is not suggested, but there are ways to go about it. When you retire, you can easily withdraw the funds. The contributions are tax-deferred but count as taxable income when withdrawn .

When withdrawing money from an RRSP, the most important rule is that you must report the money as income. The income is then subjected to income tax at the marginal tax rate and provincial tax rates. Even though it is possible to withdraw money from a traditional RRSP at any time, there are disadvantages to doing this. Some reasons why it is not suggested include: