How To Have The Easiest Tax Year Ever

Helping entrepreneurs manage their numbers into profitability | Small Business Financial Educator | Profitability Strategist

Heres another oldie, but goodie to get your business ready for the new year. Well, its not really old , but it deserves an additional spotlight as we quickly move towards a new tax season.

Imagine if tax season was a smooth and easy process you finished early every year – and with barely a second thought.

What if you already had a plan in place to pay the minimum in taxes and were on track to achieve that plan?

What if you knew your records were so clean that the IRS agents would be high-fiving and smiling because you had your stuff together – lets just say your chances of getting extra scrutiny from the IRS are minimized.

This doesnt have to be only in your imagination. Its all very possible and within reach.

As Im writing this blog, its almost tax season again. Anxiety is rising among many small business owners because they fear:

- How much they will owe, OR

- Whether they paid enough estimated taxes, OR

- Whether they did things incorrectly , OR

- The process of trying to find all the documents and remember those other items purchased on their personal credit card .

Owning a small business can give us entrepreneurs great freedom to be our own bosses, make the big decisions, not have to answer to anyone else, and decide our own destiny. But every year around March and April, we have to answer to a higher power, the IRS.

Coronavirus Unemployment Benefits And Economic Impact Payments

You may have received unemployment benefits or an EIP in 2021 due to the COVID-19 pandemic.

Unemployment compensation is considered taxable income. You must report unemployment benefits on your tax return if you are required to file.

If you received the EIP, you do not need to report it as income whether youre required to file a tax return or not. If you did not receive some or all of your stimulus payments, you may claim missing stimulus money that you are owed by filing for a Recovery Rebate Credit on your 2021 return.

Tax Planning Using Private Corporations

Canada has enacted legislation to combat tax advantages for high income individuals, gained through the use of private corporations. Income sprinkling using private corporations has been restricted. The legislation provides some clarity on whether a family member is to be considered significantly involved in a business, and thus potentially exempted from being taxed automatically at the highest marginal tax rate on non-salary income or gains derived from that business. However, the legislation is also extremely complex when applied to typical business structures. This creates uncertainty for many business owners, without any grandfathering for current income splitting arrangements. The CRA has issued some guidance on the potential application of the rules through a number of example scenarios.

Retaining business income in a CCPC to earn income on passive investments is discouraged by:

- reducing the annual CAD 500,000 small business deduction limit, for a CCPC that earned more than CAD 50,000 of passive investment income in the preceding year, by CAD 5 for every CAD 1 of investment income over CAD 50,000 , and

- entitling a CCPC to a refund of taxes paid on certain investment income only by paying non-eligible taxable dividends, which are subject to a higher effective tax rate when received by a shareholder that is an individual.

Recommended Reading: Is Ein And Tax Id The Same

What Are Tax Brackets

Tax brackets were created by the IRS to implement Americas progressive tax system, which taxes higher levels of income at the progressively higher rates we mentioned earlier. The brackets help determine how much money you need to pay the IRS annually.

The amount you pay in taxes is dependent on your income. If your taxable income increases, the taxes you pay will increase.

But figuring out your tax obligation isnt as easy as comparing your salary to the brackets shown above. For example, if youre single and your 2022 taxable income is $50,000, not all of that will be taxed at 22%, the top bracket for a single person making $50,000. Some of that will be taxed in lower brackets.

Calculating Your Tax Refund

Whether or not you get a tax refund depends on the amount of taxes you paid during the year. This is because they were withheld from your paycheck. However, it also depends on your tax liability and whether or not you received any refundable tax credits.

When you file your tax return, if the amount of taxes you owe is less than the amount that was withheld from your paycheck during the course of the year, you will receive a refund for the difference. This is the most common reason people receive a tax refund.

If you paid no taxes during the year and owe no taxes, but are eligible for one or more refundable tax credits, you will also receive a refund equal to the refundable amount of the credits.

Read Also: Do I Have To Do Taxes

Federal Income Tax: 1099 Employees

Independent contractors, unlike W-2 employees, will not have any federal tax deducted from their pay. This means that because they are not considered employees, they are responsible for their own federal payroll taxes .

Both 1099 workers and W-2 employees must pay FICA taxes for Social Security and Medicare. But, whereas W-2 employees split the combined FICA tax rate of 15.3% with their employers, 1099 workers are responsible for the entire amount.

The IRS mandates employers to send 1099 forms to workers who are paid more than $600 during a tax year.

A financial advisor can help you understand how taxes fit into your overall financial goals. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

Choosing The Best Tax Software

You can buy tax software that you install on your computer or online programs that you can access through an internet browser. In either case, different providers offer several versions to fit a wide range of individual tax needs, and both online and desktop tax software come with some advantages and disadvantages.

One company’s “basic” version doesn’t necessarily offer the same features as another company’s “basic” product. “Premium” versions might share the same base features, but some have additional perks that you won’t find in another software package.

You May Like: How Much Is Property Tax In California

Tax Brackets & The Tax Cuts And Jobs Act Of 2017

The Tax Cuts and Jobs Act of 2017 guides current tax policy. Among its notable achievements:

- Number of brackets remained steady at seven.

- Four of the lowest five marginal rates dropped between one and four points the top rate sank 2.6 points, to 37%.

- Modified bracket widths.

- Eliminated the personal exemption, but nearly doubled the standard deduction.

- Indexed brackets and other provisions to the Chained Consumer Price Index measure of inflation .

- Retains the charitable contribution deduction.

- Caps the mortgage interest deduction to the first $750,000 in principal value.

- Deduction for state and local income, sales, and property taxes limited to a combined $10,000.

While taxpayers still may use itemizing if their total deductions work to their advantage , boosting the standard deduction was designed to simplify calculations for the vast majority of filers and it worked. For the 2018 tax year, 90% of households opted for the standard deduction, up from 70% in recent previous years .

Examples Of Fiscal Years For Corporations

Investors might ask, “What fiscal year is it?” and it can vary from company to company. Below are 10-K reports from popular companies with fiscal years that don’t follow the calendar. A 10-K is an annual report of financial performance that is filed with the Securities and Exchange Commission .

Apple Inc. ends its fiscal year on the last Saturday of September in 2020, this fell on the 26th.

Microsoft Corporation ends its fiscal year on the last day of June every year.

Macy’s Inc. ends its fiscal year on the fifth Saturday of the new calendar year in 2021, this date fell on Jan. 30. Many retailers generate a large chunk of their earnings around the holidays, which could explain why Macy’s chooses this end date.

Recommended Reading: When Do People Get Tax Returns

If Youre Looking To Get The Biggest Tax Refund Possible Keep This In Mind

Although the IRS mentioned that some taxpayers might receive a smaller refund in 2023, there are a few things you can do that may help get you a larger refund. These include:

- Claim child tax credits and credits for child-related expenses .

- Collect your renewable energy credits.

- Itemize if it will yield a higher deduction.

- Claim the American Opportunity Tax Credit if you have a child that is in college. The credit can be applied towards expenses paid for a student during their first four years of college. The maximum amount you can receive annually is $2,500 per student. If the credit brings your tax due to $0, youre entitled to have 40 percent of any remaining amount refunded to you.

State And Local Income Taxes

Many states, as well as some cities and counties, have their own income taxes. These are collected in addition to the federal income tax. States that have a state income tax require that you file a separate state tax return, as they have their own rules. If you’re curious about a particular states tax system and rules, visit one of our state tax pages.

Don’t Miss: When Do You Have File Taxes

Tax Withholding Estimator: Calculating Taxable Income Using Exemptions And Deductions

Federal tax rates apply only to taxable income. This is different than your total income, otherwise known as gross income. Taxable income is always lower than gross income since the U.S. allows taxpayers to deduct certain income from their gross income to determine taxable income.

To calculate taxable income, you begin by making certain adjustments from gross income to arrive at adjusted gross income . Once you have calculated adjusted gross income, you can subtract any deductions for which you qualify to arrive at taxable income.

Note that there are no longer personal exemptions at the federal level. Prior to 2018, taxpayers could claim a personal exemption, which lowered taxable income. The tax plan signed in late 2017 eliminated the personal exemption, though.

Deductions are somewhat more complicated. Many taxpayers claim the standard deduction, which varies depending on filing status, as shown in the table below.

What If Im Self

As a small business owner, you may be required to file additional returns, such as those for payroll and GST/HST remittances and withholdings. Failure to meet the CRAs payroll obligations results in penalties and interest there are several types of penalties for payroll accounts. Failure to deduct can result in a penalty of 10% for the first failure, and will go up to 20% with any additional failures. Late filing or non-payment penalties start at 3% and will go up to 20%.

Don’t Miss: Irs Self Employment Tax Calculator

Putting It All Together: Calculating Your Tax Bill

But, wait. Theres more!

Effective tax rates dont factor in any deductions. To get closer to what percentage of your salary goes to Uncle Sam, try using your adjusted gross income. Assuming the single filer with $80,000 in taxable income opted for the standard deduction, the amount of AGI that went to the IRS was more like 10% less than half of 22%.

Heres how that works out:

Subtract the standard deduction to determine taxable income .

Break the taxable income into tax brackets the next chunk, up to $41,775 x .12 and the remaining $15,000 x .22 to produce taxes per bracket of $1,025 + $3,780 + $3,300 = total tax bill of $8,105.

For a final figure, take your gross income before adjustments. Add back in your allowable above the line deductions for example, retirement and health savings account contributions certain business-related expenses alimony paid charitable deductions and divide your tax bill by that number. The overall rate for our single filer with $80,000 in adjusted gross income could be in the high single digits.

Due Date For 2021 Tax Returns & Payments Is May 2 2022

Personal income tax returns, except for those ofindividuals with self-employment income, are normally due by April 30th, as is any amount owing. Penalties and interest may be charged for late returns or late payments.

New:See below re interest relief for some 2020 recipients of COVID-19 relief benefits, and Quebec’s extension of the tax return/payment due date.

Don’t Miss: Loudoun County Personal Property Taxes

How To Determine Your Tax Bracket

As mentioned above, determining your tax bracket hinges on two things: filing status and taxable income. Here are some useful details:

The IRS recognizes five different filing statuses:

- Single Filing Unmarried, legally separated and divorced individuals all qualify all single.

- A married couple agrees to combine income and deduct the allowable expenses.

- A married couple files separate tax returns to keep an individual income lower. This is beneficial in certain situations like repaying student loans under an income-driven repayment plan.

- Head of Household Unmarried individuals who paid more than half the cost of keeping up a home for the year and have a qualifying person living with them in their home for more than half the year.

- Qualifying Widow A widow can file jointly in the year of their spouses death. A qualifying widow has a dependent child and can use the joint tax rates and the highest deduction amount for the next two years after their spouses death.

A Constantly Changing Tax Code Makes It Hard For Families To Plan Their Financial Lives One Expert Says

The majority of Americans receive an income-tax refund, and for many its one of the years most significant financial events.

In 2022, Julie Groces larger-than-usual income-tax refund arrived just in time.

The teacher, who lives in Grand Blanc, Mich., had a daycare provider for her 4-year-old son that fit her familys needs regarding quality, proximity and cost. But that cost had just increased by $100 a month, so part of her 2021 federal refund of approximately $6,500 went straight toward covering that increased monthly bill.

This year, Groce isnt expecting a repeat performance from her tax refund. Shes hoping for something in the $3,000 to $4,000 range, which is a more typical amount for her and her husband. But the familys expenses have continued to increase, including another $100 per month for the childcare bill.

Groce, 38, said any refund is welcome. Every year I get money , I feel like Im doing good, she said. But this year, I feel like it will have less of an impact, she said.

The majority of Americans receive a refund, and for many its one of the years most significant financial events. As the 2023 tax season approaches with high inflation still in place and recession worries looming, its an especially bad time for refunds to shrink but thats what is likely to happen for many people, according to tax experts and the IRS.

Here are some things U.S. taxpayers can expect this year.

Child- and dependent-care credit

Child tax credit

Read Also: What Is Real Estate Tax

Tax Filing Deadline For Individual Tax Returns

The tax filing deadline for your 2022 tax return is May 1, 2023. .

The Canada Revenue Agency usually expects individual taxpayers to submit their income tax returns by April 30 of every year. If April 30 falls on a weekend, the CRA extends the deadline to the following business day.

If you want to file early, the CRA will open its NETFILE service in February 2023 to electronically receive submitted returns .

Mailed responses must be received or postmarked by the due date, and electronically submitted returns must be submitted by midnight local time of the date they are due.

When The Deadline Is Different

Submit your online return by 30 December if you want HMRC to automatically collect tax you owe from your wages and pension. Find out if you are eligible to pay this way.

HMRC must receive a paper tax return by 31 January if youre a trustee of a registered pension scheme or a non-resident company. You cannot send a return online.

HMRC might also email or write to you giving you a different deadline.

Also Check: Filing For An Extension On Taxes 2022

How Can I Determine What My Exempt Organization’s Tax Year Is

A tax year is usually 12 consecutive months. There are two kinds of tax years:

- Calendar Tax Year: This is a period of 12 consecutive months beginning January 1 and ending December 31 or

- Fiscal Tax Year: This is a period of 12 consecutive months ending on the last day of any month except December.

Generally, your tax year can be found in the following documents:

- Your organization’s by-laws.

- Your application for federal tax-exempt status or the determination letter you received approving your tax-exempt status.

- The application, Form SS-4, your organization filed to obtain its employer identification number .

- A copy of a prior year return, Form 990 or 990-EZ, that you filed with the IRS.

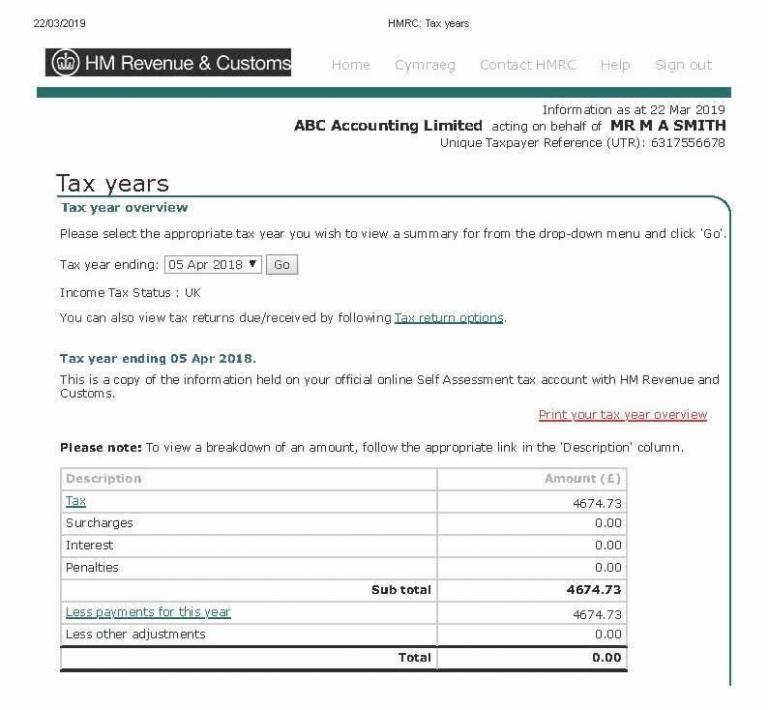

If You Do Not Have A Personal Tax Account

You need a Government Gateway user ID and password to set up a personal tax account. If you do not already have a user ID you can create one when you sign in for the first time.

Youll need your National Insurance number and 2 of the following:

- a valid UK passport

- a UK driving licence issued by the DVLA

- a payslip from the last 3 months or a P60 from your employer for the last tax year

- details of your tax credit claim

- details from your Self Assessment tax return

- information held on your credit record if you have one

Also Check: What Happens If I Dont File My Taxes