Business Vehicle Tax Deduction

Maybe you use your car a lot for business to meet with clients or even to perform your primary business services. Or, you might just use your car to pick up supplies and attend an occasional meeting with a client. In either case, you’ll want to claim your self-employed mileage deduction.

The standard mileage deduction is $.585 per mile for the first six months of 2022 and $.625 for the final six months of 2022. But in order to use this deduction, you’ll need to keep track of your mileage for business purposes. One of the best ways to do this is by using Driversnote. the app makes tracking your mileage for your self-employed mileage deduction easy. Here’s how.

- The app allows you to automatically record your trips by using its motion detector.

- You can record trips without the need to open the app. This makes it far more likely that you’ll record all of your trips.

- The app allows you to save frequently visited places, thus making tracking your trips easier.

- You can download a tax-compliant mileage report any time you want in either Excel or PDF format.

- If you use more than one vehicle for business purposes, the app will record a separate log for each vehicle.

- The app will also track mileage and keep separate logs for multiple workplaces.

Find out more about mileage deductions in our guide on self-employed mileage deduction rules.

Internet And Telephone Tax Deduction

If you use your cell phone for business, you can deduct a percentage of your cell phone bill from your taxes. Or, if you have a dedicated line for your business, you can deduct the total amount of the bill. The same is true of your internet bill. You can deduct all or part of your bill, depending on whether or not you have a dedicated line for your business. So, be sure to claim these tax write-offs for the self-employed.

Here’s What You Need To Know:

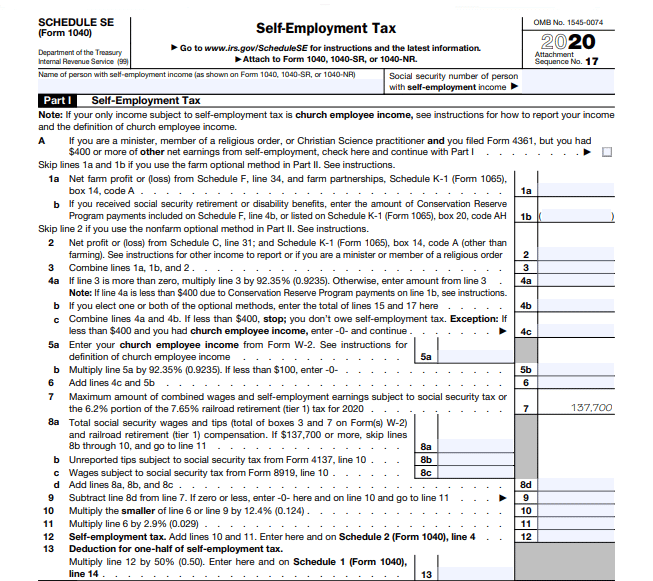

- For 2020, the self-employment tax rate is 15.3% on the first $137,700 worth of net income, lus 2.9% on net income over $137,700

- The rate consists of 2 parts: 12.4% for Social Security and 2.9% for Medicare

- You must pay self-employment tax if your net earnings are over $400, or you had a church income of $108.28 or more

Year after year, filing your business taxes and paying your self-employment tax is one of those constant headaches that never seem to get any easier . Not only is it a challenge to calculate, but the self-employment tax rate changes every year. Wondering what youll pay in self-employment tax 2020? Lets take a closer look.

Read Also: How To File Free Taxes

Health Insurance Premiums Deduction

If you are self-employed, pay for your health insurance premiums, and are not eligible to participate in a plan through your spouses employer, then you can deduct all of your health, dental, and qualified long-term care insurance premiums.

You can also deduct premiums that you paid to provide coverage for your spouse, your dependents, and your children who were younger than 27 at years end, even if they arent dependents on your taxes. Calculate the deduction using the Self-Employed Health Insurance Deduction Worksheet in IRS Publication 535.

What Percentage Is Self Employment Tax Uk

Previous Years Self-employed Key Details 2022 Every year this web site is updated because the tax rates and private allowance changes. Fundamental essentials details and figures for 2020 / 2021.

For individuals operating at greater profit levels, the required taxes due as self-employed could be greater than should you operate your company like a limited company. So its useful regularly reviewing your company structure, your contact with limitless liability, your profit and also the forecasted quantity of tax that youll pay.

- Taxes paid by the self employed

- Benefits of being a sole trader

- Register as Self employed

Video advice: Capital Allowances for the self employed

Read Also: Bexar County Tax Assessor Collector San Antonio Tx

When Are Estimated Taxes Due

Estimated payments break down your annual tax bill into four installments. You’ll make payments in April, June, and September of the same year and in January of the following year.

Here are the dates to mark in your calendar:

As you may have noticed, the IRS does not follow typical business quarters regarding estimated taxes. Note also that you don’t have to make your January 15 payment if you file your annual tax return by January 31and pay your full balance due along with it.

California & Federal Self

Residents of California who are ready to send in their payments have a few options. To pay your California Self Employment Tax, visit the FTB website. Use the link to the free Calfile portal or print out the forms and mail them in. The IRS offers several ways to pay your taxes. View all methods on their payments page.

Also Check: Pay My Car Tax Online

Know Where You Can Save Money And Grow Your Profits

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

Over the years, legislators have written numerous lines into the tax code to soften the blow of the extra costs that self-employed taxpayers must shoulder as they do business. The Tax Cuts and Jobs Act , effective as of the 2018 tax year, made several changes to self-employed tax deductions. Many of these changes are temporary and set to expire in 2025, but others are permanent.

The law affects small businesses in many ways, particularly via a qualified business income deduction for pass-through businessesthose that pay taxes as an individual taxpayer rather than through a corporation.

For owners of sole proprietorships, partnerships, S corporations, and certain trusts, estates, and limited liability companies , this deduction provides a great benefit. Eligible taxpayers can deduct up to 20% of their QBI. A pass-throughs QBI is the net amount of qualified items of income, gain, deduction, and loss from a qualified trade or business.

Social Security And Medicare Taxes

It is important to note that the self-employment tax refers to Social Security and Medicare taxes, similar to Federal Insurance Contributions Act tax paid by an employer. When a taxpayer takes a deduction of one-half of the self-employment tax, it is only a deduction for the calculation of that taxpayers income tax. It does not reduce the net earnings from self-employment or reduce the self-employment tax itself.

Remember, youre paying the first 7.65% whether you are self-employed or work for someone else. And when you work for someone else, youre indirectly paying the employer portion because thats money that your employer cant afford to add to your salary.

Self-employed individuals determine their net income from self-employment and deductions based on their method of accounting. Most self-employed individuals use the cash method of accounting and will therefore include all income actually or constructively received during the period and all deductions actually paid during the period when determining their net income from self-employment.

Don’t Miss: Are Funeral Expenses Tax Deductable

Penalties For Late Filing & Non

It is never an ideal situation to fall behind on tax payments. In the unfortunate event that it does happen, the penalties can stack up. Penalties can also begin for self-employed taxpayers who fail to make their quarterly payments. Worse case situations can end up with the issuance of a tax lien.

Penalties begin at 5% of the total tax due on a specific date. For each month or partial month thereafter, the IRS charges an additional .5%. The maximum penalty can rise to 25%, though the IRS cannot charge for over 40 months. Interest also accrues daily on all past due accounts.

Find A Payment Schedule That Works For You

Many people are surprised to learn this, but just because your estimated taxes are due quarterly doesnât mean they have to be paid on the due date. You can make estimated payments as often as you need to to say on top of things. Some people prefer making monthly or biweekly payments, so that they donât have to sit on their tax money for too long. A more regular payment schedule also helps keep the process fresh âyou wonât have to relearn it every four months.

Also Check: Capital Gains Tax Calculator New York

The Home Office Deduction

If you work from your home or use part of it in your business, then self-employment tax deductions like this one could get you a break on the cost of keeping the lights on.

What you can deduct: A portion of your mortgage or rent property taxes the cost of utilities, repairs and maintenance and similar expenses. Generally, this deduction is only available to the self-employed employees typically cannot take the home office deduction.

How it works: Calculate the percentage of your home’s square footage that you use, in the IRS words, exclusively and regularly for business-related activities. That percentage of your mortgage or rent, for example, becomes deductible. So if your home office takes up 10% of your house’s square footage, 10% of those housing expenses for the year may be deductible. IRS Publication 587 outlines a lot of scenarios, but note that only expenses directly related to the part of your home you use for business say, fixing a busted window in your home office are usually fully deductible.

What else you can do: Choose the simplified option, which lets you deduct $5 per square foot of home used for business, up to 300 square feet thats about a 17-by-17-foot space. You wont have to keep as many records, but you might end up with a lower deduction, so consider calculating it both ways before filing.

» MORE: Home office tax deductions for small-business owners

How To Calculate Your Self

The self-employment tax rate for 2019 is 15.3%, which encompasses the 12.4% Social Security tax and the 2.9% Medicare tax. Self-employment tax applies to your net earnings. For 2019, only the first $132,900 of your earnings is subject to Social Security tax , but a 0.9% additional Medicare tax may also apply to your self-employment earnings if they exceed $200,000 if youre a single filer, or $250,000 if youre filing jointly.

As mentioned earlier, to accurately calculate your self-employment tax, you need to calculate your net self-employment earnings for the year which is your self-employment gross income minus your business expenses. Typically, 92.35% of your self-employment net earnings is subject to self-employment tax. Once you have your total net earnings from self-employment that are subject to tax, apply the 15.3% tax rate to determine your total self-employment tax.

If youve had a loss or just a little bit of income from self-employment for the year, there are two optional methods to calculate net earnings in the IRS Schedule SE.

Recommended Reading: H& r Block Tax Identity Shield

Self Employment In The Uk 2022

As of October 2021, there are just under 4.3 million self-employed workers in the United Kingdom.

Self-employment support scheme Between 1992 and 2021, there has consistently been more males self-employed than females, with the recent figures showing that over 2. 8 million men, and 1. 5 million women were self-employed. During the same time period, the most numerous self-employed age group was those aged between 45 and 54 years old, reaching just over 1. 3 million individuals, indicating that middle aged people have the highest self-employment rates. As of the third quarter of 2020, around 821 thousand self-employed workers in the UK were based in the London region, with a further 707 thousand based in South East England.

UK Tax Rates, Thresholds and Allowances for Self-Employed People and Employers in 2022/23 and 2021/22 Read our guide to UK tax for sole traders, limited companies, partners and partnerships, employers and other businesses. The UK tax system

As well as making NI contributions on the wages that they pay their staff, employers must also make Class 1A and 1B National Insurance contributions on the equivalent financial value of any work benefits which they provide to employees. The rate of Class 1A and 1B National Insurance is the same as Class 1 NI.

Why Do I Have To Pay Self

Like income and sales taxes, taxes are just a way of life. But, unfortunately, while business owners and other independent workers have the flexibility to work for themselves, they also have a more substantial tax liability since they must pay the same amount in taxes as everyone else.

Look at it this way, the purpose of the self-employment tax is to fund Social Security and Medicare for your benefit. Therefore, even if you never save for your retirement, you’re able to receive Social Security retirement benefits, which can provide financial support in your golden years. Also, your additional Medicare tax contribution will help you pay for your medical and health care expenses in the future.

So, while it may seem like a pain now, you’ll be grateful when you’re about to retire, and you have an extra income stream.

You May Like: Which States Have No Income Tax

Credit Card And Loan Interest

Check your credit card statements for potential self-employment tax deductions.

What you can deduct: Interest accrued on purchases that were business expenses.

How it works: You cant deduct credit card interest accrued from business expenses if the purchase was made on someone elses credit card, for instance.

What else you can do: You dont necessarily need to have a business credit card to deduct qualifying interest charges. If you use a personal card exclusively for business expenses, for example, you can generally still deduct the interest charges.

Tax Deductions And Tax Credits

When youre looking for ways to save on your taxes, you might automatically jump to tax deductions and tax credits. But do you know the difference between the two? According to H& R Block, tax credits directly decrease the amount of taxes you owe, while tax deductions lower the overall amount of your taxable income.

Since deductions lower your taxable income, they also lower the amount of taxes you owe by decreasing your tax bracket, not by lowering your actual taxes. There are standard deductions and itemized deductions:

- Almost everyone qualifies for the standard tax deduction the deduction amount varies based on your filing status , but everyone with the same filing status receives the same standard deduction amount.

- There are many possible itemized deductions, and the deduction amounts vary by individual. These are some of the most common itemized deductions:

- Certain medical and dental expenses above 7.5% of your adjusted gross income

- State income taxes

- State sales and local tax

- Mortgage interest

- Student loan interest

There is a catch when it comes to itemized deductions, however. Each taxpayer is only permitted to take either their standard or itemized deductions, whichever is higher, but not both.

When it comes to tax credits, there are two types refundable or non-refundable:

Which is better? If you had to choose, youd probably prefer to receive a tax credit. Here is a list of possible tax credits:

- Earned income credit

Read Also: Oklahoma Tag Title And Tax Calculator

Phone And Internet Costs

Anyone from real estate agents and journalists to day care providers and jewelry makers could deduct part or all of their annual cell phone or internet bill.

What you can deduct: You can deduct your entire bill if you have a dedicated business cell phone or internet connection.

How it works: You must use your smartphone or internet service for business, and your employer if you have one must not reimburse you.

What else you can do: If you don’t have a dedicated line, you can deduct the percentage used for business.

What Impact Does Business Type Have On Your Self

You’re deemed self-employed if you’re a lone proprietor, a member of an LLC, or a partner in a partnership, and your percentage of net income from your firm is liable to self-employment tax.

For each of these business categories, the calculation of net income is done in essentially the same way.

If you’re a partner in a partnership or a member of an LLC, you’ll get a portion of the business’s net profits based on the rules of your partnership. Even if the money stays in the firm, you’ll have to pay self-employment tax on it.

Recommended Reading: New York State Tax Refund Number

When Do I Have To Pay The Self

Under most circumstances, the self-employment tax must be paid during the year by filing quarterly estimated tax payments. If you wait to pay the tax until the following April when your annual tax return is due, the IRS may add a penalty charge.

You can make quarterly payments online using the Electronic Federal Tax Payment System, or you can submit vouchers found in IRS Form 1040-ES.

Consult a qualified tax advisor to make sure you do everything right when calculating and paying the self-employment tax.

Everything You Need To Know About Self

With the gig economy booming, and COVID-19 forcing more and more people to take side hustles and weekend jobs to earn extra money some are even opting to make the leap into full-time self-employment. But, when you start working for yourself, you might have to pay different taxes, including the federal self-employment tax.

The IRS considers you self-employed when youre in business for yourself, such as an independent contractor or if you have a sole proprietorship, or are a partner in a partnership, including an LLC that is taxed as a partnership. Read on to learn how to calculate self-employment taxes, no matter which state you live in.

Exclusive: Americans Savings Drop to Lowest Point in Years

Recommended Reading: Tax On Pension Lump Sum