How To Determine Gross Pay

For salaried employees, start with the person’s annual amount divided by the number of pay periods. For hourly employees, it’s the number of hours worked times the rate .

If you are not sure how to pay employees, read this article on the difference between salaried and hourly employees.

Here are examples of how gross pay for one payroll period is calculated for both salaried and hourly employees if no overtime is included for that pay period:

A salaried employee is paid an annual salary. Let’s say the annual salary is $30,000. That annual salary is divided by the number of pay periods in the year to get the gross pay for one pay period. If you pay salaried employees twice a month, there are 24 pay periods in the year, and the gross pay for one pay period is $1,250 .

An hourly employeeis paid at an hourly rate for the pay period. If an employee’s hourly rate is $12 and they worked 38 hours in the pay period, the employee’s gross pay for that paycheck is $456.00 .

Then include any overtime pay. Next, you will need to calculate overtime for hourly workers and some salaried workers. Overtime pay must be added to regular pay to get gross pay.

How To Get Into A Lower Tax Bracket

You can lower your income into another tax bracket by using tax deductions, such as the write-offs for charitable donations, property taxes and the mortgage interest. Deductions help cut your taxes by reducing your taxable income.

Tax credits, such as the earned income tax credit, or child tax credit, can also put you into a lower tax bracket. They allow for a dollar-for-dollar reduction in the amount of taxes you owe.

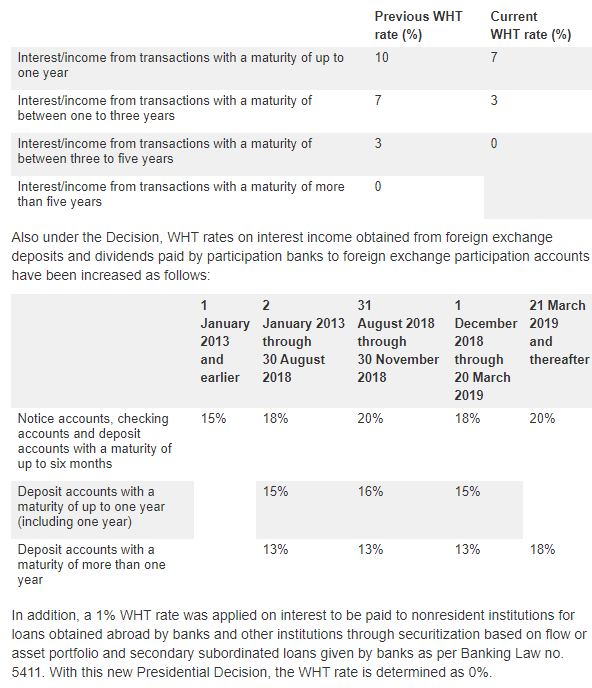

Federal Withholding Tax Table

When it comes to running a business, you need to be aware of many payroll factors. Setting up payroll can be a difficult process. You need to obtain an Employer Identification Number , collect important paperwork, establish a pay period, and choose a payroll system . But in addition to setting up payroll for your employees, you also have to understand federal withholding tax tables. Withholding tables are important for business owners to understand because they need to calculate how much tax to withhold from employee paychecks.

Not calculating federal withholding tax correctly can result in many issues for your business. An employer has legal responsibility to withhold payroll taxes and pay those taxes to the Internal Revenue Service . Not doing so will impact both the employer and the employee and can even lead to more serious consequences, like having to pay a heavy fine. So it is crucial you stay on top of these taxes.

Understanding what a federal withholding tax table is will take some time, so lets break it down into key components. Read the post in full or navigate using the links below to jump ahead:

Read Also: Irs Track My Tax Return

How Is Tax Calculated

Tax is charged as a percentage of your income. The percentage that you pay depends on the amount of your income. The first part of your income, up to a certain amount, is taxed at 20%. This is known as the standard rate of tax and the amount that it applies to is known as the standard rate tax band.

Why Is My Social Security Tax Withheld So High

For tax year 2021, you’ll have excess Social Security withholdings if the sum of multiple employers’ withholdings exceeds $8,853.60 per taxpayer. You don’t need to take any action. We’ll automatically add the excess to your federal refund or subtract it from federal taxes you owe, whichever applies.

Recommended Reading: Tax On Pension Lump Sum

What Are Withholding Allowances

Withholding allowances were exemptions that employees used to use to claim from federal income tax, using Form W-4. Withholding allowances were used to determine an employees withholding tax amount on their paychecks. The more allowances an employee chooses to claim, the less federal tax their employer deducted from their pay.

Estimate Your Tax Liability

Now that you know your projected withholding, the next step is to estimate how much youll owe in taxes for this year.

The IRS provides worksheets to walk you through the process, which is basically like completing a pretend tax return.

If youre married and filing jointly, for example, and your taxable income is around $107,000 for the 2021 tax year, that puts you in the 22% tax bracket. But you actually wont pay 22% on your entire income because the United States has a progressive tax system. After deductions, your tax liability, or what you owe in taxes, will be about $9,600.

Remember, federal taxes arent automatically deducted from self-employment income. If you have a side business or do freelance work, its especially important to factor that income into your tax equation to make sure you dont end up with a big tax bill at the end of the year.

Read Also: Nys Dtf Pit Tax Paymnt

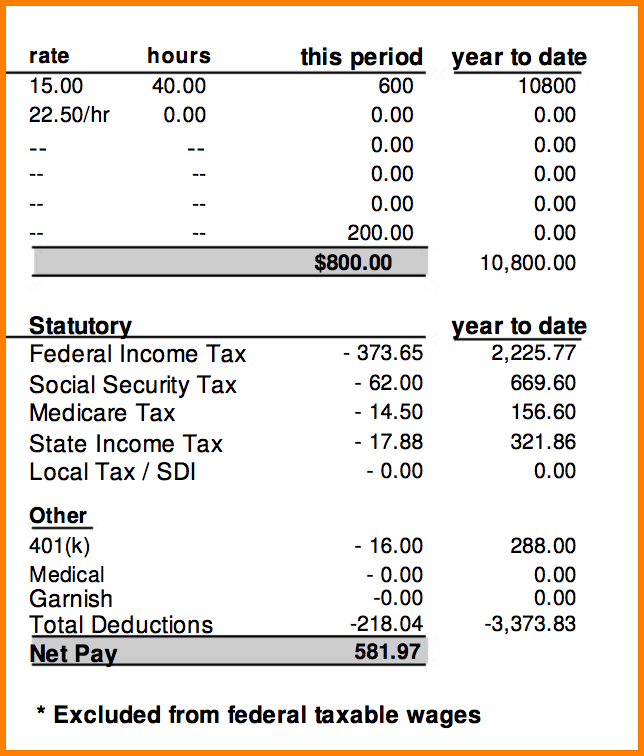

Total Up Your Tax Withholding

Lets start by adding up your expected tax withholding for the year. You can find the amount of federal income tax withheld on your paycheck stub. Ugh, we know. Its been years since youve looked at your paystub, and you dont even remember how to log in to your payroll system. But this will be worth it!

Lets say you have $150 withheld each pay period and get paid twice a month. That would be $3,600 in taxes withheld each year.

If youre single, this is pretty easy. If youre and both of you work, calculate your spouses tax withholding too. In this example, well assume your spouse has $400 withheld each pay period and receives a monthly paycheck.

Then add the two together to get your total household tax withholding.

Adjust Gross Pay For Social Security Wages

Now that you have gross wages, we can take a closer look. Before you calculate FICA withholding and income tax withholding, you must remove some types of payments to employees.

The types of payments not included from Social Security wages may be different from the types of pay excluded from federal income tax.

For example, if you hire your child to work in your business, you must take out the amount of their pay when you calculate Social Security withholding but don’t take it out when calculating federal income tax withholding.

Here’s another example: Your contributions to a tax-deferred retirement plan plan should not be included in calculations for both federal income tax or Social Security tax.

Also Check: Do Retirees Need To File Taxes

What Is The Percentage Of Federal Income Tax Withheld

As an employer, you withhold income tax on behalf of your employees and then remit those taxes quarterly to federal, state, and local tax authorities.

To calculate how much of your employeeâs federal income tax to withhold, youâll need a copy of their Form W-4, as well as your employeeâs gross pay.

Your next step is to determine the method you want to use to calculate withholding. Most employers have two options: the Wage Bracket Method or the Percentage Method. While not exactly simple, the wage bracket method is the more straightforward approach to calculating payroll tax.

The Taxes Owed Depend On Your Age The Type Of Account And More

How much you will pay in taxes when you withdraw money from an individual retirement account depends on the type of IRA, your age, and even the purpose of the withdrawal. Sometimes the answer is zeroyou owe no taxes. In other cases, you owe income tax on the money you withdraw. You can even owe an additional penalty if you withdraw funds before age 59½. On the other hand, after a certain age, you may be required to withdraw some money every year and pay taxes on it.

There are multiple IRA options and many places to open these accounts, but the Roth IRA and the traditional IRA are by far the most widely held types. The withdrawal rules for other types of IRAs are similar to the traditional IRA, with some minor unique differences. These other types include the , SIMPLE IRA, and SARSEP IRA. Each has different rules about who can open one. But before getting into the details, you should know that the Internal Revenue Service refers to a withdrawal from an IRA as a distribution.

You May Like: Free Tax Filing H& r Block

Withholding Taxes On Wages

If you’re an employer, you need to withhold Massachusetts income tax from your employees’ wages. This guide explains your responsibilities as an employer, including collecting your employee’s tax reporting information, calculating withholding, and filing and paying withholding taxes.This guide is not designed to address all questions that may arise nor does it address complex issues in detail. Nothing contained herein supersedes, alters or otherwise changes any provision of the Massachusetts General Laws, Massachusetts Department of Revenue Regulations, Department rulings, public written statements or any other sources of law or published guidance.Updated: September 15, 2022

Tax Withholding: How To Get It Right

Note: August 2019 this Fact Sheet has been updated to reflect changes to the Withholding Tool.

FS-2019-4, March 2019

The federal income tax is a pay-as-you-go tax. Taxpayers pay the tax as they earn or receive income during the year. Taxpayers can avoid a surprise at tax time by checking their withholding amount. The IRS urges everyone to do a Paycheck Checkup in 2019, even if they did one in 2018. This includes anyone who receives a pension or annuity. Heres what to know about withholding and why checking it is important.

Read Also: Bexar County Tax Assessor Collector San Antonio Tx

How Much Tax Should I Withhold

What if too much tax is being withheld?

- If too much tax is being withheld from your paycheck, you end up getting a refund. While everybody likes suddenly getting a pile of money, this is actually a bad thing. It means youve been giving Uncle Sam an interest-free loan, rather than getting that extra money in every paycheck where it could help on a day-to-day basis.

The Basics Of Withholding

Withholding refers to an employers responsibility to pay each employees estimated income tax, by directing a percentage of gross taxable wages to the government tax office rather than paying it directly to the employee. For state income taxes, Arizona offers seven withholding percentage options:

Calculating the exact amount is the employers responsibility.

First right to choose state withholding percentage belongs to the employee, who by accepting a job assumes responsibility to request a specific withholding amount. This is done by completing an Arizona Withholding Percentage Election form , preferably within the first five days of employment. Employees also may fill out a separate form to request that their withholding rate be reduced and the difference contributed to nonprofit or educational organizations. If a new employee fails to complete an A-4 within the first week of employment, the employer is required to withhold at the median rate of 2.7% until the employee officially requests a change.

Its best to head off possible misunderstandings by briefing each new employee on the rules of A-4 and other withholding, and by double-checking that the employee has access to the proper forms and knows how to fill them out.

Read Also: Can I Amend My 2021 Tax Return

Do I Have To Pay Arizona State Income Tax

Please note: An Arizona full-year resident is subject to tax on all income, including earnings from another state. Arizona will also tax retirement from another state. Part-year residents should exclude income Arizona law does not tax. Nonresidents are subject to Arizona tax on any income earned from Arizona sources.

Do You Pay Taxes On Social Security After Age 65

Are Social Security benefits taxable regardless of age? Yes. The rules for taxing benefits do not change as a person gets older. Whether or not your Social Security payments are taxed is determined by your income level specifically, what the Internal Revenue Service calls your provisional income.

Also Check: Still Haven’t Received My Tax Refund 2022

Should You Have Taxes Withheld From Social Security Check

It isn’t obligatory for you to have taxes withheld from your Social Security benefits. However, many people voluntarily choose to withhold taxes to cover any taxes that may come due. You don’t need to get taxes withheld if this is your only income. However, if you expect a tax bill, according to the above IRS calculation, it’s better to have a part withheld.

The U.S. taxation system is pay-as-you-go, which means that people are required to pay income taxes as they receive their income during the year. If you have underpaid your taxes at the end of the year, you might face a penalty.

#SocialSecurity encourages you not to carry your Social Security card with you every day. Learn how to #GuardYourCard at

Review The Employees W

Next, make sure you have the correct form. Youll need to refer to the employees Form W-4 to find the following information relevant to the withholding tax calculations, including their filing status, number of dependents, additional income information, and any additional amounts that the employee requests to be withheld.

You May Like: When Are Tax Returns Sent Out

How We Make Money

Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products.

Bankrate, LLC NMLS ID# 1427381 |NMLS Consumer AccessBR Tech Services, Inc. NMLS ID #1743443 |NMLS Consumer Access

A Mistake Can Get You In Trouble With The Irs Here’s What You Need To Know

Over the years, a diminishing number of employers have offered pensions to their workers. Between the early 1990s and the early 2010s, pension plan availability fell roughly by half, from about one in three workers having access to a pension 25 years ago, to only one in six more recently. If you’re fortunate enough to work for an employer that gives you a chance to get pension payments when you retire, it’s important to know what you need to do in order to make the most of them. That way, when you decide to end your career, you’ll know you’ll be getting every penny available to you to last you the rest of your life.

Although pension income is a valuable retirement benefit that can supplement your Social Security benefits and make your retirement a lot more financially secure, it also comes with some extra responsibilities. Your monthly pension payment almost always counts as taxable income, and you’ll need to make sure that you have enough taxes withheld from your pension payments to satisfy the Internal Revenue Service.

Image source: Getty Images.

Read Also: Free Irs Approved Tax Preparation Courses

Withholding Income Tax From Your Social Security Benefits

You can ask us to withhold federal taxes from your Social Security benefit payment when you first apply.

If you are already receiving benefits or if you want to change or stop your withholding, you’ll need a Form W-4V from the Internal Revenue Service .

You can or call the IRS toll-free at 1-800-829-3676 and ask for Form W-4V, Voluntary Withholding Request.

When you complete the form, you will need to select the percentage of your monthly benefit amount you want withheld. You can have 7, 10, 12 or 22 percent of your monthly benefit withheld for taxes.

Only these percentages can be withheld. Flat dollar amounts are not accepted.

Sign the form and return it to your local Social Security office by mail or in person.

Why Do You Need To Adjust Your Tax Withholding

If you adjust your withholding so you break even at tax time, you end up with more cash in your pocket throughout the year. In other words, you dont send the IRS a big check, and you dont get a huge refund back either.

IRS data shows that the average tax refund for the 2021 tax season was $2,856.2 So, lets say you got paid twice a month and received the average refund. That means you shouldve had an extra $119 in every paycheck last year! Think of what you could do with $238 or more each month!

And if you went through a major life change over the past year that might impact how much you owe in taxesyou got married, bought a house, or welcomed a baby into the worldits a good idea to take a fresh look at your tax withholding and make any adjustments.

Recommended Reading: What Is Real Estate Tax

Remittance To Tax Authorities

Most withholding tax systems require withheld taxes to be remitted to tax authorities within specified time limits, which time limits may vary with the withheld amount. Remittance by electronic funds transfer may be required or preferred.

Penalties for delay or failure to remit withheld taxes to tax authorities can be severe. The sums withheld by a business is regarded as a debt to the tax authority, so that on bankruptcy of the business the tax authority stands as an unsecured creditor however, sometimes the tax authority has legislative priority over other creditors.

What Are Tax Brackets

Tax brackets were created by the IRS to determine how much money you need to pay the tax agency each year.

The amount you pay in taxes depends on your income. If your taxable income increases, the taxes you pay will increase.

But figuring out your tax obligation isnt as easy as comparing your salary to the brackets shown above.

Read Also: How To Report Tax Fraud To The Irs