Other Employer Payroll Tax Requirements

As the pay periods go by and tax money is withheld from employees paychecks , businesses may eventually have to file quarterly tax returns with federal, state and local governments. The deadline for filing IRS Form 941, Employer’s Quarterly Federal Tax Return is usually the last day of the month following the end of a quarter. So, if the first quarter of the year ends March 31, then the first Form 941 would be due April 30. Payments can be made via the Electronic Federal Tax Payment System® .

After the year is over, employers typically need to issue Forms W-2 to employees and Forms 1099-MISC to independent contractors. They might also have to file three additional forms:

- Form W-3 reports the total W-2 earnings from all employees to the Social Security Administration

- Form 1096 is a summary and transmittal form that accompanies other IRS forms

How Your Paycheck Works: Fica Withholding

In addition to income tax withholding, the other main federal component of your paycheck withholding is for FICA taxes. FICA stands for the Federal Insurance Contributions Act. Your FICA taxes are your contribution to the Social Security and Medicare programs that youll have access to when youre a senior. Its your way of paying into the system.

FICA contributions are shared between the employee and the employer. 6.2% of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6.2%. However, the 6.2% that you pay only applies to income up to the Social Security tax cap, which for 2022 is $147,000 . So for 2022, any income you earn above $147,000 doesnt have Social Security taxes withheld from it. It will still have Medicare taxes withheld, though.

There is no income limit on Medicare taxes. 1.45% of each of your paychecks is withheld for Medicare taxes and your employer contributes another 1.45%. If you make more than a certain amount, you’ll be on the hook for an extra 0.9% in Medicare taxes. Here’s a breakdown of these amounts:

- $200,000 for single filers, heads of household and qualifying widows with dependent children

- $250,000 for married taxpayers filing jointly

- $125,000 for married taxpayers filing separately

How Your Paycheck Works: Deductions

Federal income tax and FICA tax withholding are mandatory, so theres no way around them unless your earnings are very low. However, theyre not the only factors that count when calculating your paycheck. There are also deductions to consider.

For example, if you pay any amount toward your employer-sponsored health insurance coverage, that amount is deducted from your paycheck. When you enroll in your companys health plan, you can see the amount that is deducted from each paycheck. If you elect to contribute to a Health Savings Account or Flexible Spending Account to help with medical expenses, those contributions are deducted from your paychecks too.

Also deducted from your paychecks are any pre-tax retirement contributions you make. These are contributions that you make before any taxes are withheld from your paycheck. The most common pre-tax contributions are for retirement accounts such as a 401 or 403. So if you elect to save 10% of your income in your companys 401 plan, 10% of your pay will come out of each paycheck. If you increase your contributions, your paychecks will get smaller. However, making pre-tax contributions will also decrease the amount of your pay that is subject to income tax. The money also grows tax-free so that you only pay income tax when you withdraw it, at which point it has grown substantially.

Recommended Reading: G Wagon Tax Write Off

When Not To Withhold

If you do bring in an outside tax expertor any other independent contractorremember that you wont be withholding anything from their paychecks. State withholding requirements also do not apply to many part-time and nonresident workers, or to paid work done outside an employees official job. Clarity on who is actually an employee is very important for accurate filing of both state and federal taxes, so if you have any doubts on whether someone qualifies, get advice from a financial or legal expert. Better safe than sorry is always a best principle in the complicated world of taxes.

How To Check Your Withholding

Use the IRS Withholding Estimator to estimate your income tax and compare it with your current withholding. Youll need your most recent pay stubs and income tax return.

The results from the calculator can help you figure out if you need to fill out a new Form W-4 for your employer. Or, the results may point out that you need to make an estimated tax payment to the IRS before the end of the year.

If you adjusted your withholding part way through 2021, the IRS recommends that you check your withholding amounts again. Do so in early 2022, before filing your federal tax return, to ensure the right amount is being withheld.

You May Like: Self Employed Estimated Tax Calculator

How We Make Money

Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products.

Bankrate, LLC NMLS ID# 1427381 |NMLS Consumer AccessBR Tech Services, Inc. NMLS ID #1743443 |NMLS Consumer Access

How Withholding Is Determined

The amount withheld depends on:

- The amount of income earned and

- Three types of information an employee gives to their employer on Form W4, Employee’s Withholding Allowance Certificate:

- Filing status: Either the single rate or the lower married rate.

- Number of withholding allowances claimed: Each allowance claimed reduces the amount withheld.

- Additional withholding: An employee can request an additional amount to be withheld from each paycheck.

Note: Employees must specify a filing status and their number of withholding allowances on Form W4. They cannot specify only a dollar amount of withholding.

Recommended Reading: Does Nc Have State Income Tax

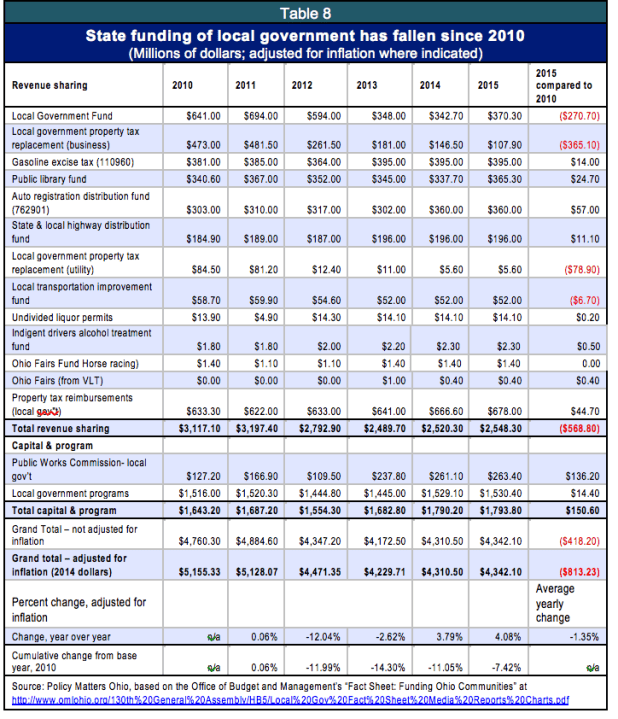

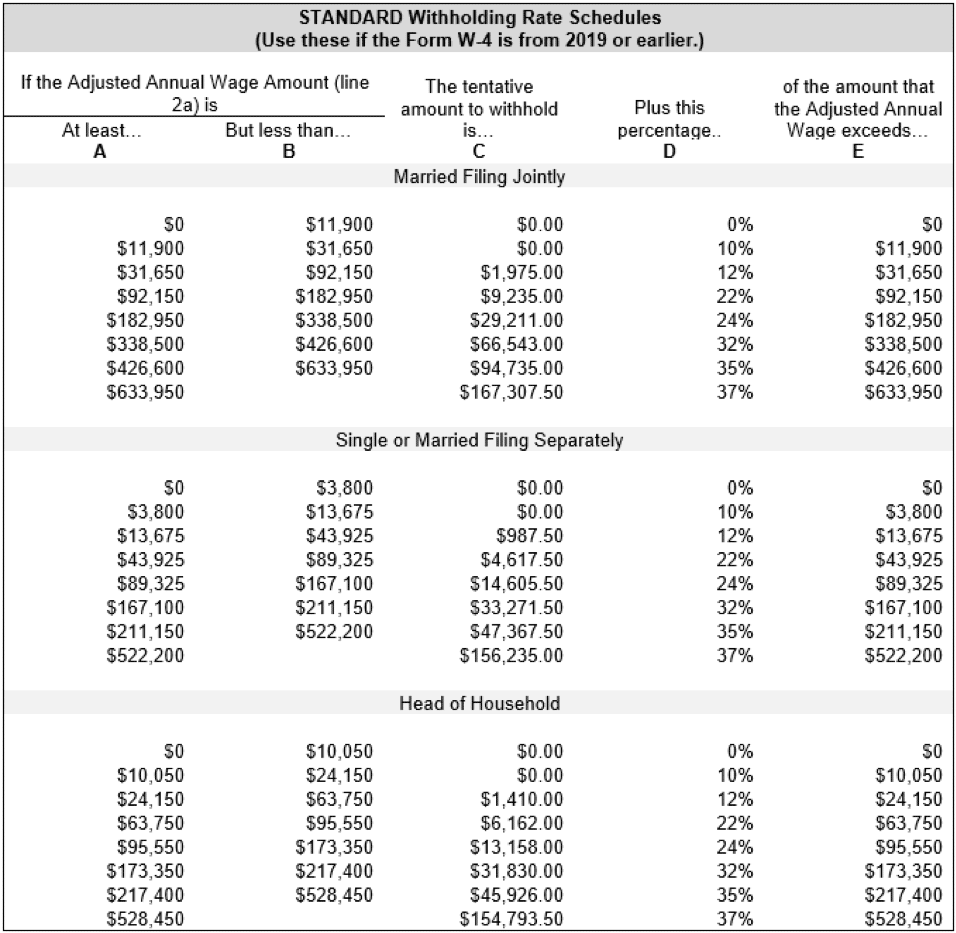

What Are Income Tax Withholding Tables

Federal withholding tables dictate how much money an employer should withhold from their employees wages. This includes federal income tax, Social Security and Medicare tax, and sometimes state income tax as well. A federal withholding tax table is usually in the form of a table or chart to simplify this process for employers. To determine the amount to withhold, you will need an employees W-4 information, filing status, and pay frequency. Every new employee at a business needs to fill out a W-4 for this purpose.

Form W-4, Employees Withholding Certificate, is a tax form issued by the IRS that all U.S. employees must complete. These are the components of 2020 or later Form W-4:

Us Resident Withholding Tax

The first and more commonly discussed withholding tax is the one on U.S. residents personal income, which every employer in the United States must collect. Under the current system, employers collect the withholding tax and remit it directly to the government, with employees paying the remainder when they file a tax return in April each year.

If too much tax is withheld, it results in a tax refund. However, if not enough tax has been held back, then the individual will owe money to the IRS.

Generally, you want about 90% of your estimated income taxes withheld and sent to the government. This ensures that you never fall behind on income taxes and that you are not overtaxed throughout the year.

Investors and independent contractors are exempt from withholding taxes but not from income taxthey are required to pay quarterly estimated tax. If these classes of taxpayers fall behind, they can become liable to backup withholding, which is a higher rate of tax withholding set at 24%.

You can easily perform a paycheck checkup using the IRSs tax withholding estimator. This tool helps identify the correct amount of tax withheld from each paycheck to make sure you dont owe more in April. To use the estimator, you’ll need your most recent pay stubs, your most recent income tax return, your estimated income during the current year, and other information.

Read Also: Unexpected Tax Refund Check 2021

How Do I Avoid Taxes On Ira Withdrawals

Heres how to minimize 401 and IRA withdrawal taxes in retirement:

How To Calculate Your Tax Withholding

8 Min Read | Aug 18, 2022

Think that hefty tax refund you got last year was basically a big bonus? Think again.

A big, fat refund just means youve been loaning the government too much of your hard-earned cash with each paycheck, and Uncle Sam is simply returning money that was yours to begin withthats why its called a refund!

Or maybe you have the opposite problem. Youre getting hit with massive tax bills, and youre sick and tired of sending the IRS a big check every April. If thats you, we feel your pain.

How much should you withhold for taxes? Should you withhold an additional amount from each paycheck? It all starts with taking a closer look at your tax withholding.

Don’t Miss: Can I Use Bank Statements As Receipts For Taxes

What Percentage Of My Paycheck Is Withheld For Federal Tax 2021

Asked by: Prof. Torrey Dickinson

The federal withholding tax has seven rates for 2021: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. The federal withholding tax rate an employee owes depends on their income level and filing status. This all depends on whether you’re filing as single, married jointly or married separately, or head of household.

What Happens If Too Much Social Security Tax Is Withheld

Unfortunately, you cannot stop the withholding. However, you will get a credit on your next tax return for any excess withheld. Each employer is obligated to withhold social security taxes from your wages. The total they both can withhold may exceed the maximum amount of tax that can be imposed for the year.

You May Like: H& r Block Tax Identity Shield

How Do You Calculate Tax Withholding On Ira

Take the total amount of nondeductible contributions and divide by the current value of your traditional IRA account this is the nondeductible portion of your account. Next, subtract this amount from the number 1 to arrive at the taxable portion of your traditional IRA.

Total Estimated 2021 Tax Burden

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 – 2021 filing season based on the Trump Tax Plan.

You May Like: How Can Tax Identity Theft Occur

What Is A Tax Bracket

A tax bracket is a range of taxable income that is subject to a specific tax percentage. The brackets used to calculate your income tax depend on your filing status. In 2021 there are seven tax brackets with each one having a different tax rate ranging from 10% to 37%. For example, the brackets below show the first tax bracket if you are filing as single is from $0 to $9,950 with a tax rate of 10%.

TurboTax Tip: Ordinary income is taxed at seven different rates: 10, 12, 22, 24, 32, 35 and 37 percent. These are marginal rates, meaning that each rate applies only to a specific slice of income, rather than to your total income.

Total Up Your Tax Withholding

Lets start by adding up your expected tax withholding for the year. You can find the amount of federal income tax withheld on your paycheck stub. Ugh, we know. Its been years since youve looked at your paystub, and you dont even remember how to log in to your payroll system. But this will be worth it!

Lets say you have $150 withheld each pay period and get paid twice a month. That would be $3,600 in taxes withheld each year.

If youre single, this is pretty easy. If youre and both of you work, calculate your spouses tax withholding too. In this example, well assume your spouse has $400 withheld each pay period and receives a monthly paycheck.

Then add the two together to get your total household tax withholding.

Read Also: 2021 Dependent Care Tax Credit

When To Check Withholding:

- If the tax law changes

- When life changes occur:

- Lifestyle Marriage, divorce, birth or adoption of a child, home purchase, retirement, filing chapter 11 bankruptcy

- Wage income The taxpayer or their spouse starts or stops working or starts or stops a second job

- Taxable income not subject to withholding Interest, dividends, capital gains, self-employment and gig economy income and IRA distributions

- Itemized deductions or tax credits – Medical expenses, taxes, interest expense, gifts to charity, dependent care expenses, education credit, Child Tax Credit, Earned Income Tax Credit

A Payroll Tax Withholding Example

Lets say a business has an employee named Bob who is married, has two children and a spouse who also works. How would his federal tax withholding each pay period be determined if he earns $1,000 per week?

First, see if Bobs wages need to be adjusted. Since he isnt claiming any additional income from investments, dividends or retirement and hes chosen the standard deduction, his wages remain $1000.

Second, look at the weekly pay period bracket table on 15-T. For married filing jointly with the Form W-4 Step 2 checkbox withholding option, the tentative withholding amount is $88.

Third, account for tax credits. Bob has two children, so he may get $4000 in tax credits. Divide this number by 52 since hes paid weekly and subtract the result from $88 . The result is $11.08.

Finally, if Bob requested an additional $1000 withheld from his taxes each year on his Form W-4, divide that number by 52. The result is $19.23, which when added to $11.08, equates to a final withholding amount of $30.31 per pay period.

Don’t Miss: File My State Taxes For Free

Understanding The New W

Remember the first day of your job? Dont worry. We dont either. A new job is a blur of new names and spaces. But at some point, you probably filled out a W-4 form to help your employer figure out how much taxes to withhold from each paycheck.

The official government title for a W-4 is Employees Withholding Certificate, which sounds kind of fancy. But its not. You wont hang this certificate in a place of honor next to the one you got for second place in a hot dog eating contest.

The W-4 is divided into five, fairly easy steps that will give your employer the info they need to calculate your withholding. Leave it to the government to label a five-step form with the number four!

- Step 1: Youll enter some basic personal information herename, address, Social Security number and filing status . Everyone has to fill out this step, but you only have to fill out steps 24 if they apply to you.

- Step 2: If you have more than one job, or youre married filing jointly and your spouse also works, fill out this step. You can use the IRStax withholding estimator or the worksheet on the form to calculate how much additional tax youll need to withhold from your paycheck.

The IRS introduced a new W-4 form in 2020. If youve been at your job for a while, you dont have to fill out a new W-4 form. But it could be a good idea to check it anyway because the new form should help you get your tax withholding closer to where it needs to be.

What Is A Marginal Tax Rate

Your marginal tax rate is the rate of the highest tax bracket that you’ll be taxed in. It is the tax you pay on each additional dollar of your income and the rate by which each dollar of deduction lowers your tax. You do not pay your marginal tax rate on all of your taxable income . Instead, you pay the lowest tax rate up to the limit of the lowest tax bracket, then the rate of the next lowest bracket up to its limit, and so on until reaching your total taxable income.

Also Check: New Mexico Tax Deadline 2022

Why Do I Get Taxed So Much On My Paycheck 2021

Common causes include a marriage, divorce, birth of a child, or home purchase during the year. If it looks like your 2021 tax withholding is going to be too high or too low because of one of these or some other reason, you can submit a new Form W-4 now to increase or decrease your withholding for the rest of the year.

What Are Tax Brackets

Tax brackets were created by the IRS to determine how much money you need to pay the tax agency each year.

The amount you pay in taxes depends on your income. If your taxable income increases, the taxes you pay will increase.

But figuring out your tax obligation isnt as easy as comparing your salary to the brackets shown above.

Recommended Reading: Do I Need To Report Cryptocurrency On My Taxes

Don’t Use This Tool If:

- You have a pension but not a job. Estimate your tax withholding with the new Form W-4P.

- You have nonresident alien status. Use Notice 1392, Supplemental Form W-4 Instructions for Nonresident Aliens.

- Your tax situation is complex. This includes alternative minimum tax, long-term capital gains or qualified dividends. See Publication 505, Tax Withholding and Estimated Tax.