Analysis Shows Population Growth In Lower Tax States

For many, the pandemic has altered their perceptions about where they want to live and where they can live. Millions of city-weary residents aching for more space have moved since the start of the pandemic.

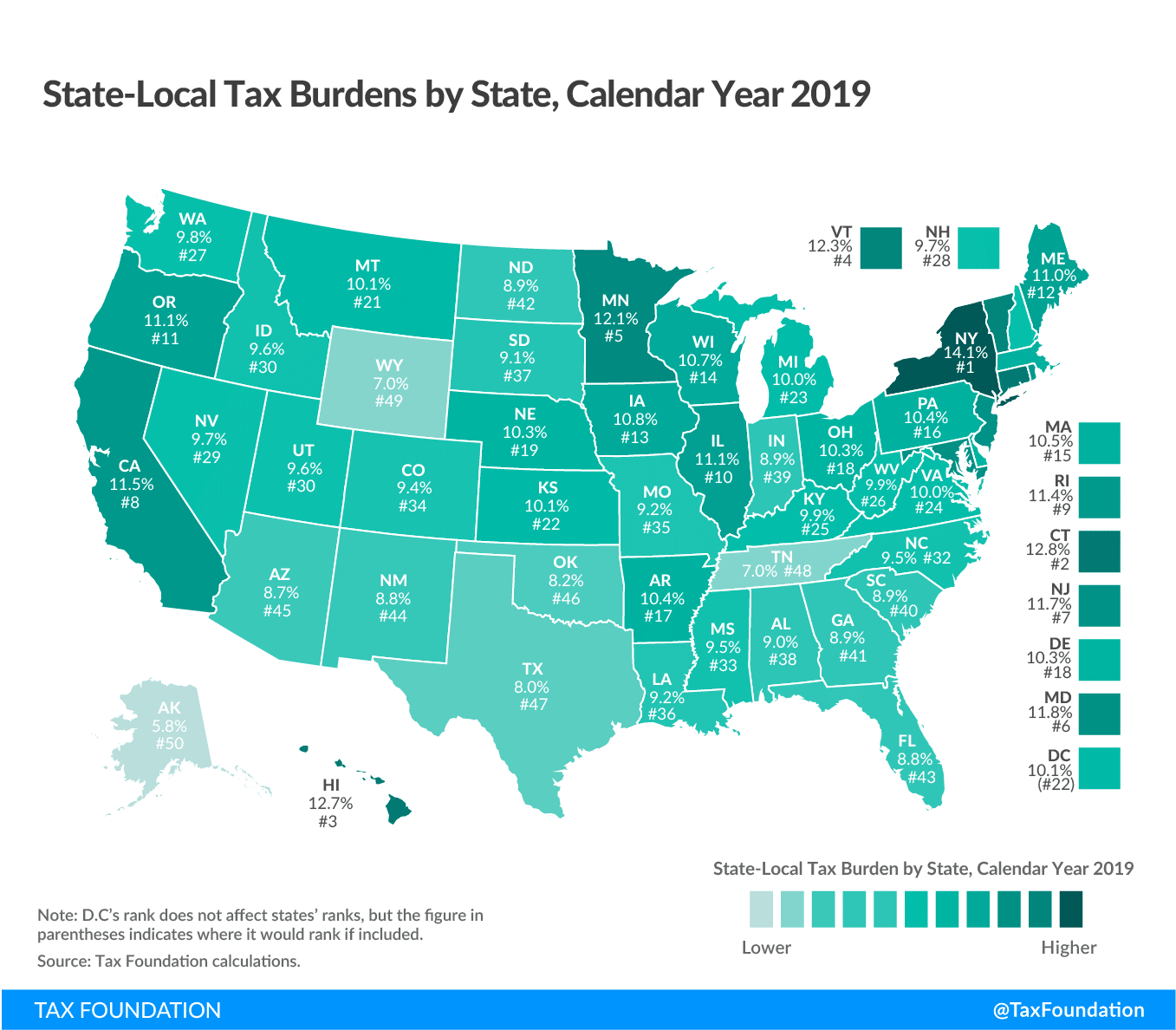

Analysis of state tax burden rates and the change in population from 2020 to 2021, as estimated by the U.S. Census Bureau shows a negative correlation. The lower the state and local tax burden, the higher the population growth in 2021.

Four of the five states with an A grade in tax friendliness had population growth at or above the national average.

Of the states with an E grade, two out of three had population declines in 2021. Of the nine states with a D grade, only two New Hampshire and Vermont had population growth higher than the national average.

The included expert insights section on this page has advice on how to manage moving and taxes.

These States Have The Highest And Lowest Tax Burdens

- You may have a wildly different tax bill depending on where you live.

- That’s because your tax burden individual income, property, sales and excise taxes as a share of total personal income varies by state.

- You can expect to spend the most in New York, Hawaii, Maine, Vermont and Minnesota, according to a WalletHub report.

As this year’s tax deadline approaches, you may have a wildly different bill depending on where you live, according to a WalletHub report ranking how much residents pay by state.

The report compares total tax burdens individual income, property, sales and excise taxes as a share of total personal income.

“Tax burden is a simpler ratio and helps cut through a lot of the confusion, especially when you’re looking to relocate,” WalletHub analyst Jill Gonzalez said.

Local Sales Tax Rates

The five states with the highest average local sales tax rates are Alabama , Louisiana , Colorado , New York , and Oklahoma .

In an unusually quiet year on the sales tax front, no states saw ranking shifts due to local rate changes since January. West Virginias towns of Alderson and Ansted adopted local option sales taxes of 1 percent beginning on July 1, but this was not enough to change the states ranking. Robust receipts and ample federal pandemic relief funds have likely reduced pressure on localities to generate additional tax revenue.

It must be noted that some cities in New Jersey are in Urban Enterprise Zones, where qualifying sellers may collect and remit at half the 6.625 percent statewide sales tax rate , a policy designed to help local retailers compete with neighboring Delaware, which forgoes a sales tax. We represent this anomaly as a negative 0.03 percent statewide average local rate , and the combined rate reflects this subtraction. Despite the slightly favorable impact on the overall rate, this lower rate represents an implicit acknowledgment by New Jersey officials that their 6.625 percent statewide rate is uncompetitive with neighboring Delaware, which has no sales tax.

You May Like: How Much To Set Aside For Taxes 1099

Ology How We Determined The States With The Most Tax Burden

To find the states that tax their residents the most and least aggressively, we ranked the 50 states on three criteria:

-

Individual Income Tax

-

Total Sales Tax

Each of the above criteria was ranked based on the percent of income. Property tax and individual income were weighted together and makeup 70% of each states score. To put a dollar amount to income, we pulled from the median state income. To put a dollar amount to home value, each states percent of property tax was applied to the states median home price. The two numbers were added together and the total was applied to the median income to get a combined tax burden for property and income tax. Sales tax makes up the remaining 30% of the ranking.o local taxes or excise taxes were used in our rankings. However, these can vary dramatically from city to city.

We collected the above data from a combination of the Tax Foundation and scouring state tax documents. The median state income and home prices came from the Census most recent American Community Survey.

The full ranked list of states from the greatest to least tax burden is located at the bottom of the article.

States With The Lowest Personal Income Tax Rates In 2022

Eight states had no income tax at all in 2022:

| 20% | $50,001+ |

You pay 10% on the first $10,000 you make. Then 15% on any earnings you make between $10,001 and $50,000, and 20% on anything beyond that.

So how much do you actually pay in taxes in a marginal tax system? Heres how you estimate it:

First, break out how much money you make in each category and then multiply the amount by the tax rate in decimal form. So in our above example, the taxes owed on a marginal basis would look like this:

+ + = $9,000

If your entire income were to be solely taxed at the highest rate, then someone making $60,000 in Imagination would owe $12,000 in taxes $3,000 more than they would using the marginal system.

Because of the marginal tax rates, its important to know the tax brackets along with the income tax rates. Although California has the highest possible income tax rate, Oregons top tax rate kicks in at a much lower income level compared to Californias. That means a person could potentially end up paying less state income tax in California.

For example, single filers in California making between $61,214 and $312,686 cap out at an income tax rate of 9.3%. Meanwhile in Oregon, single filers making above $9,200 have an income tax rate of 9.9%.

One thing to note: Income can be taxed at both the federal and state level. Even if a state doesnt have a personal income tax, an individual may still owe money on their income to the federal government.

Recommended Reading: States With No Tax On Retirement Income

Low Taxes Or Just Regressive Taxes

This report identifies the most regressive state and local tax systems and the policy choices that drive that unfairness. Many of the most upside-down tax systems have another trait in common: they are frequently hailed as low-tax states, often with an emphasis on their lack of an income tax. But this raises the question: low tax for whom?

No-income-tax states like Washington, Texas, and Florida do, in fact, have average to low taxes overall. However, they are far from low-tax for poor families. In fact, these states disproportionate reliance on sales and excise taxes make their taxes among the highest in the entire nation on low-income families.

FIGURE 10

Figure 10 shows the 10 states that tax poor families the most. Washington State, which does not have an income tax, is the highest-tax state in the country for poor people. In fact, when all state and local taxes are tallied, Washingtons poor families pay 17.8 percent of their income in state and local taxes. Compare that to neighboring Idaho and Oregon, where the poor pay 9.2 percent and 10.1 percent, respectively, of their incomes in state and local taxes far less than in Washington.

Summary On States With The Highest Tax Burdens

Tax is a complicated issue, with different tax breaks and brackets based on income and household size. However, some states quite simply tax more than others. Between property taxes, sales tax, and personal income there are a variety of ways for states to get revenue and often a low tax in one area means a higher rate in another.

When contemplating an interstate job move, savvy job hunters know that the salary is just one component to investigate, as higher taxes can take a deep chunk of that anticipated pay raise. Which states offer job seekers the least tax obligations?

States With The Lowest Tax Burdens

Don’t Miss: Look Up State Tax Id Number

Income Tax Calculator: Estimate Your Taxes

Ranking New York as the state with the highest tax burden should not be surprising. It has high property values, which lead to high property taxes. New York also has high incomes paired with high tax rates, leading to a high proportion of income needed to cover state income taxes. Lastly, the Empire State also brings in revenue via its sales taxes.

- Total tax burden: 12.75%

- Property tax burden: 4.43%

- Individual income tax burden: 4.90%

- Total sales & excise tax burden: 3.42%

Hawaii may be a tourists paradise, but Hawaii has the second highest state tax burden in the USA.

AFP via Getty Images

2. Second Highest State Tax Burden: Hawaii

Hawaii may be paradise, with many gorgeous beaches and tropical forests. However, the tax burden in Hawaii is not far behind New York.

- Total tax burden: 12.70%

- Property tax burden: 2.55%

- Individual income tax burden: 3.18%

- Total sales & excise tax burden: 6.97%

Maine has the third highest state tax burden in the USA.

Portland Press Herald via Getty Images

3. State with the Third Highest Tax Burden: Maine

- Total tax burden: 11.42%

While California is known for our amazing weather and and high taxes, our state only ranks as the … state with the 9th worst tax burden.

Getty Images

The States With The Highest Income Tax Rates

A state’s income tax, which comes from the income of its residents, is similar to federal income tax, but goes toward state budgets instead of to the federal government. States take three approaches to income taxation: not taxing at all, imposing a flat tax , or imposing a progressive tax. The latter means a higher tax bracket for those with higher incomein 2021, there were seven brackets: 10, 12, 22, 24, 32, 35, and 37 percent.

Eight states dont have income tax: Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming. The states with the highest income taxes are the following:

Also Check: Travis County Tax Office – Main

Which State Has The Highest Sales Tax

Sales tax is a tax payable to the local government for services and goods sold. The sellers usually collect sales tax during purchase time under prescribed laws. The sales tax is divided into different types which are retail or conventional tax , manufacturers sales tax , and wholesale sales tax . Others include gross receipts, excise taxes, use tax, securities turnover excise, and value added tax.

The States With The Highest Sales Tax

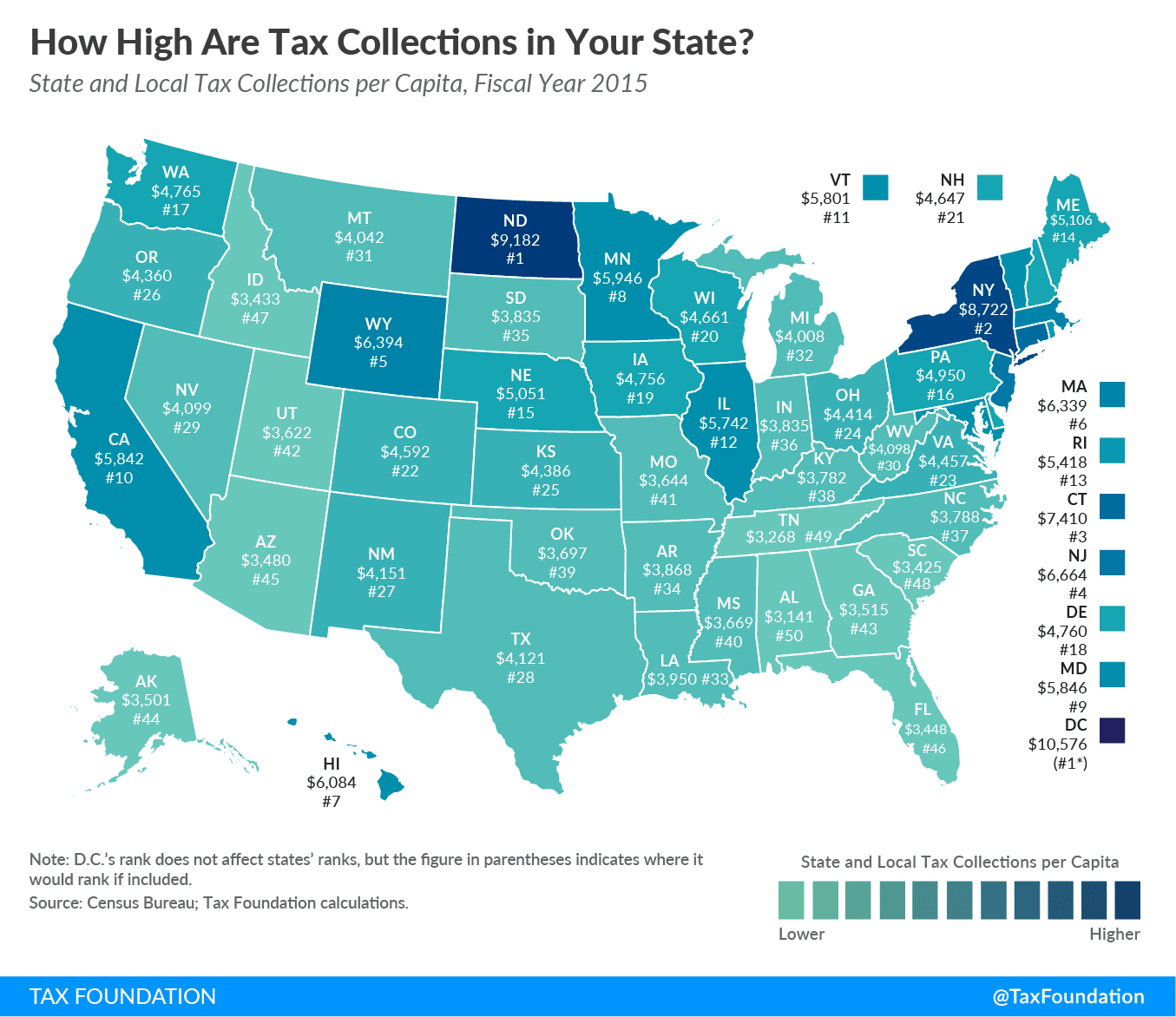

Sales tax, paid for goods and services, is generally split into two categories: state and local. Most states have a sales tax of between 4 and 7 percent. The average state sales tax rate is 5.09 percent, with 32 states above this average and 18 states below. According to The Tax Foundation, only four states don’t have state-wide sales tax: Delaware, Montana, New Hampshire, and Oregon.

The states with the highest sales taxes in 2022 are as follows:

Read Also: Tax Loopholes For Small Business

States Where The Tax Burden Has Changed Dramatically Over Time

Among states with declining tax burdens, Alaska is the extreme example. Before the Trans-Alaska Pipeline system was finished in 1977, taxpayers in Alaska paid 11.7 percent of their share of net national product in state and local taxes. By 1980, with oil tax revenue pouring in, Alaska repealed its personal income tax and started sending out checks to residents instead. The tax burden plummeted, and now Alaskans are the least taxed with a burden of only 4.6 percent of income.

Similarly, North Dakotas burden has fallen from 13.0 percent in 1977 to 8.8 percent of net state product in 2022.

Although the majority of states have seen a decrease in tax burdens over time, 16 have experienced increases since 1977, many of these likely to be temporary upticks due to the pandemic. Connecticut taxpayers have seen the largest increase, of 3.3 percentage points, followed by Hawaii at 2.5 percent.

Total Tax Burden: 510%

Alaska has no state income or sales tax. The total state and local tax burden on Alaskans, including income, property, sales, and excise taxes, is just 5.10% of personal income, the lowest of all 50 states.

All residents of Alaska receive an annual payment from the Alaska Permanent Fund Corp. made up of revenue and investment earnings from mineral lease rentals and royalties. The per citizen dividend payment for 2021 was $1,114.

The cost of living in Alaska is high, though, mostly due to the states remote location. Alaska also levies the second-highest beer tax of any state in the union at $1.07 per gallon, bested only by Tennessee. The state ranks 47 out of 50 in affordability and 45 out of 50 on the U.S. News & World Report list of Best States to Live In.

Alaska has one of the highest and fastest-rising healthcare costs of any state in the U.S. That said, at $11,064 per capita in 2014the most recent year the Centers for Medicare and Medicaid Services Office of the Actuary reported statisticsit also spent the most on healthcare, excluding the District of Columbia.

At $18,394 per pupil, it also spent the most on education of any state in the Western U.S. in 2019. In 2017, Alaskas infrastructure received a grade of C- from the American Society of Civil Engineers .

Also Check: Do You Pay Tax On Life Insurance

States With The Lowest Personal Income Tax Rates

Only eight states have no personal income tax:

In addition, New Hampshire limits its tax to interest and dividend income, not income from wages.

Among the states that tax income, Pennsylvania’s 3.07% flat tax ranks the Keystone State as the 10th lowest in the nation for 2021.

Low personal income tax rates can be misleading a lack of available tax deductions, for example, can raise the effective rate you pay. The Retirement Living Information Center states that figuring your total tax burden, including sales and property taxes, can give you a more accurate reading on affordability, especially if you’re on a fixed income. However, these states with the lowest taxes on income can be a good place to start looking for a more affordable location.

Gas Tax And Price Of Leading States Based On Highest Effective Gasoline Tax In The United States As Of March 2022

| Characteristic |

|---|

You need a Statista Account for unlimited access.

- Full access to 1m statistics

- Incl. source references

- Available to download in PNG, PDF, XLS format

You can only download this statistic as a Premium user.

You can only download this statistic as a Premium user.

You can only download this statistic as a Premium user.

As a Premium user you get access to the detailed source references and background information about this statistic.

As a Premium user you get access to background information and details about the release of this statistic.

As soon as this statistic is updated, you will immediately be notified via e-mail.

…and make my research life easier.

You need at least a Starter Account to use this feature.

Also Check: How Late Can I File My Taxes

States With The Lowest Taxes And The Highest Taxes

OVERVIEW

Where you live can help or hinder your ability to make ends meet. A myriad of taxesproperty, license, state and local sales, property, inheritance, estate and excise taxes on gasolineeat away at your disposable income. Weighing the tax landscape against your financial picture lets you stretch your dollars. Here’s a roundup of the highest and lowest taxes by state.

“Location, location, location” is a focus that applies to more than just housing. Where you live can help or hinder your ability to make ends meet.

A myriad of taxes such as property, license, state and local sales, inheritance, estate, and excise taxes can eat away at your income. Often, the biggest tax ticket citizens face after paying the Internal Revenue Service is the one their state presents. As a result, identifying the states with the lowest taxes might be a smart financial move to make.

Currently, 41 states and the District of Columbia levy a personal income tax. Weighing the tax landscape against your financial picture could help you stretch your dollars further.

How State Income Tax Rates Work

In general, states take one of three approaches to taxing residents and/or workers:

No tax income at all.

Flat tax. That means they tax all income, or dividends and interest only in some cases, at the same rate.

Progressive tax. That means people with higher taxable incomes pay higher state income tax rates.

If, like most people, you live and work in the same state, you probably need to file only one state return each year. But if you moved to another state during the year, lived in one state but worked in another or have, say, income-producing rental properties in multiple states, you might need to file more than one. And because the price of most tax software packages includes preparation and filing for only one state. Filing multiple state income tax returns often means paying extra.

Recommended Reading: When’s The Last Day To Do Your Taxes

What Are Property Taxes

Property taxes, or real estate taxes, are paid by a real estate owner to county or local tax authorities. The amount is based on the assessed value of your home and vary depending on your states property tax rate. Most U.S. homeowners have to pay these fees, usually on a monthly basis, in combination with their mortgage payments. If you pay off your loan, you receive a bill for the tax from local government occasionally during the year.

The money used for the property tax goes toward the community. It supports infrastructure improvements, public services and local public schooling.