New Report Finds That New Jersey Again Ranked No 1 In 2020 While Hawaii Had The Lowest Rates

Newsletter Sign-up

Delivers the most important property news around the world to your inbox each weekday

Every week, Mansion Global poses a tax question to real estate tax attorneys. Here is this weeks question.

Q. What states have the highest and lowest property taxes?

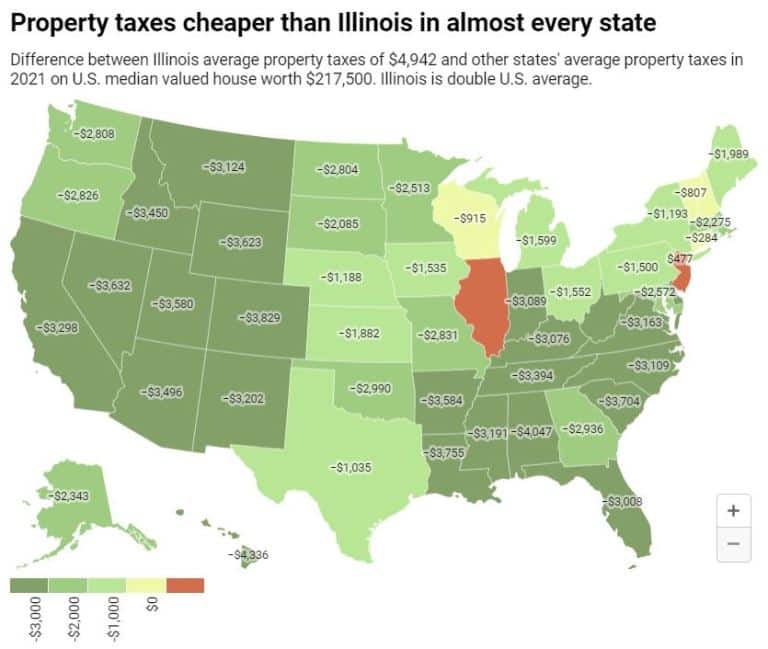

A. New Jersey had the highest property taxes in the U.S. again in 2020, according to a report this week from WalletHub.

The state has a 2.49% effective tax rate, and the median home value is $335,600, according to the report. That means homeowners there pay about $8,362 on a property valued at that amount.

Connecticut paid the second-highest amount, $5,898, and had a 2.14% effective tax rate, the report found. There, the median home value was $275,400. New Hampshire had the third-most expensive property taxes, with homeowners seeing a $5,701 bill on a property with a median price of $261,700. The effective tax rate there was 2.18%.

New York, Illinois and California are also in the top 10 states with the highest property taxes in 2020, with homeowners paying $5,407, $4,419 and $3,818, respectively.

Nationally, property taxes are fairly high overall, said WalletHub analyst Jill Gonzalez.

More: Whats the Latest on New Yorks Proposed Pied-a-Terre Tax?

The average American household spends $2,471 in property taxes, she said in an email. Even though no one is exempt from paying property taxes, location is very important in determining how big your burden will be.”

File 100% Free With Expert Help

Get live help from tax experts plus a final review with Live Assisted Basic.

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.For simple tax returns only

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Property Taxes By State 202: Ranked Lowest To Highest

Belong on Aug 11, 2022

You own a home.

Everyone pays property taxes. Yes, were talking to you too, renters! Though homeowners and investors are probably the first to investigate states with the lowest property taxes, landowners often pass property taxes onto their tenants. That means everyone should get curious about property taxes.

But a lower property tax rate isnt necessarily better. Property taxes help fund critical government programsthink schools and police departments, for starterswhich is why communities cant just do away with property taxes. How much a property owner will actually pay in property taxes also has as much to do with the property tax rate as it does with that propertys value.

Whether youre considering investing in a new rental or want to better understand the annual costs of your existing real estate, its important to know what property taxes are based on and the tax rate you might pay in your state .

You May Like: California State Capital Gains Tax

Property Taxes Vary Widely By State

There are several states without an income tax. But property taxes? Those are a part of life in every state across the country. Essentially, your local government determines a property tax rate based on each homeowner’s property value to pay for a variety of community tools and resources.

While property taxes may seem like a nuisance , this tax payment is pretty integral to townships and municipalities to fund community projects.

Which States Do Not Have Property Tax In 2022

Unfortunately, there are no states without a property tax. Property taxes remain a significant contributor to overall state income. Tax funds are used to operate and maintain essential government services like law enforcement, infrastructure, education, transportation, parks, water and sewer service improvements.

States without property tax refer to those states that have the lowest ratio rate of property tax. In other words, the tax is so small that its almost negligible and doesnt affect the investment return much.

The Top 10 States With the Lowest Property Tax Based on State Median Home Value Are:

1- Hawaii

Property Tax Rate: 0.27%

According to a study by the Tax Foundation, Hawaii has the lowest average effective property tax rate at 0.27%. This is significantly lower than the national average of 1.19%.

The state also has relatively low property values, with the median home value being $551,800 compared to the national median home value of $184,700.

This combination of low property taxes and values may make Hawaii an attractive option for prospective homeowners.

2- Alabama

Property Tax Rate: 0.40%

The state of Alabama has some of the lowest property taxes in the United States, with an average effective rate of 0.40%. Some counties in Alabama even have a property tax rate of 0%, meaning residents do not have to pay any property taxes at all.

3- Louisiana

Property Tax Rate: 0.55%

4- Wyoming

Property Tax Rate: 0.58%

5- West Virginia

Property Tax Rate: 0.55%

7- Colorado

Also Check: Tax Burden By State 2022

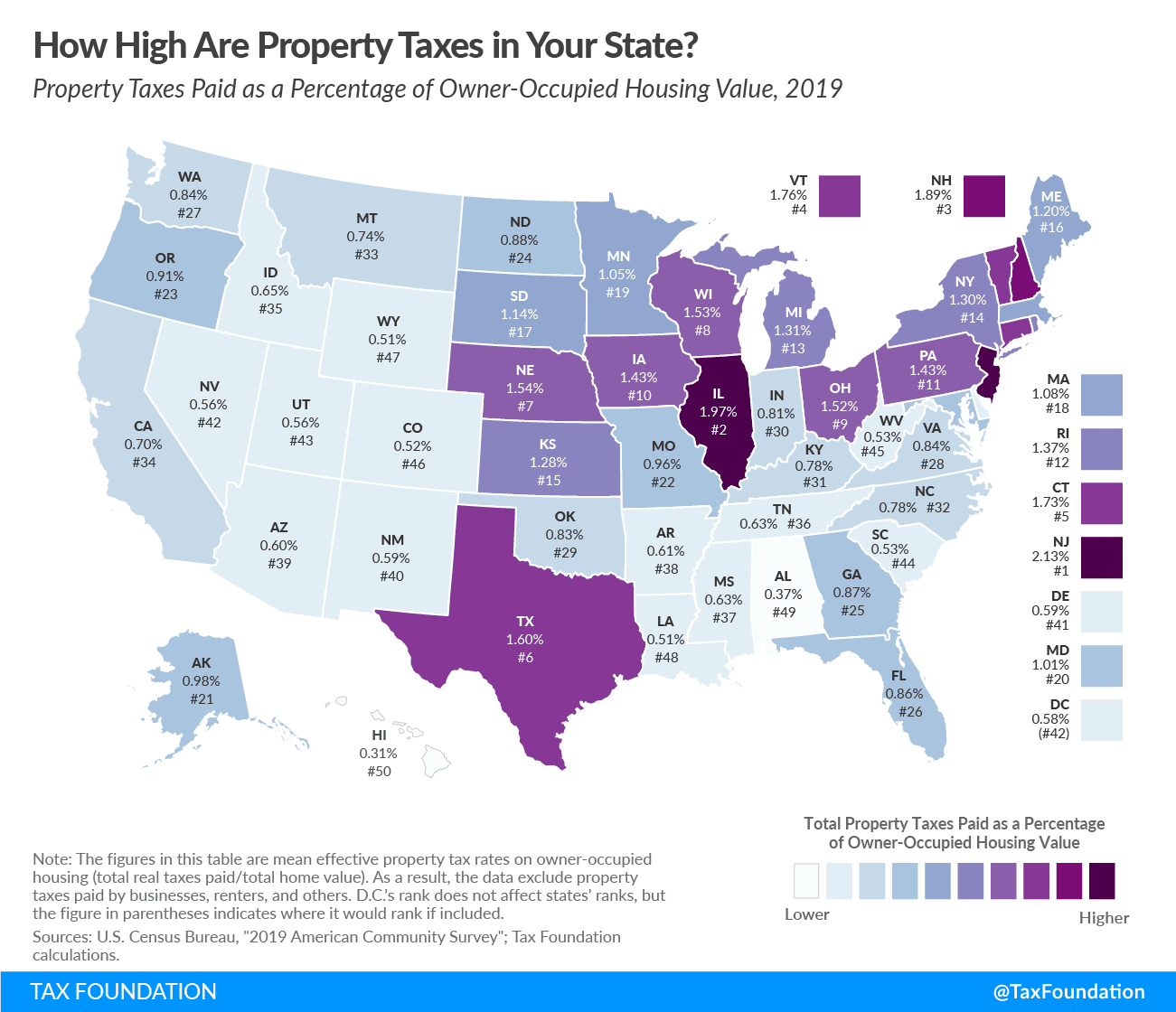

States With The Highest And Lowest Property Taxes

Property tax falls under local, not state, jurisdiction. Median household property tax payments from analysis performed by the Tax Foundation as a percentage of median household income from the Census Bureau’s 2018 American Community Survey cites these as the counties with the most expensive property tax:

- Essex County, New Jersey 16.86%

- Passaic County, New Jersey 14.62%

- Union County, New Jersey 12.70%

These Louisiana parishes hold the least expensive spots for property tax as a percent of income:

- Assumption Parish 0%

- Vernon Parish 0.45%

- Grant Parish 0.68%

Louisiana carries some of the lowest property tax rates as a percentage of earned income because it offers a homestead exemption. This law allows the first $7,500 of assessed property values to forego having property taxes levied against them.

For reference, assessed home values represent 1/10 of the home’s actual value. For example, a $100,000 home would have a $10,000 assessed value. Therefore, Louisiana’s homestead exemption allows the first $75,000 of home value not to count toward calculating your property tax bill, which goes a long way toward lowering the percentage of income that goes toward these taxes.

How To Calculate Property Tax

Property taxes aren’t cut and dry. The basic gist is this: Every year, you’re charged a certain percentage of your assessed home value. The exact rate depends on your jurisdiction — how much it needs for local schools, government operations, utilities, and more. You’re usually charged a rate for each one of these individual services, and they’re all added up, giving you what’s called your effective property tax rate, or mill rate.

These rates diverge significantly from city to city and state to state. One homeowner may pay $5,000 in property taxes on a $250,000 house while another pays the same amount on a $750,000 house. It all depends on where you live and the local services your municipality provides.

Recommended Reading: Personal Tax Return Due Date 2022

What Are Property Taxes Based On

While your homes assessed value for property taxes may match its actual value, that wont always be the case. That gap can affect your tax amount. What youll pay in property taxes ranges depending on the state and county you live in as well as the overall value of your home. That includes both the land itself and the structures on it. So, vacant land will likely have lower real estate taxes due to a lower assessed value.

Assessment is based on a unit called a mill, equal to one-thousandth of a dollar. Assessors find annual property tax liability by multiplying three values:

- the state tax rate,

- the assessment ratio ,

- and the property value.

Some of these values fluctuate according to the market and state.

States do their property assessments at different frequencies, some annually and others every couple of years.

Take the first step toward buying a house.

Get approved to see what you qualify for.

Best States For Property Taxes

If youre curious about how low property taxes can get, check the list of the 10 best states for property taxes below. Also listed are each states effective property tax rate, typical home value, annual taxes on a home priced at the state typical value, and median household incometo help put the tax rates in context.

Typical home valuescurrent as of January 2022are from real estate aggregator Zillows Home Value Index , a smoothed, seasonally adjusted measure of the estimated home value for single-family homes across the U.S. Data from the U.S. Census Bureaus American Community Survey was used to find median household incomes.

Read Also: New Mexico State Tax Refund

Lowest Property Tax Rate #: Colorado

Coloradans pay just 0.51 percent in property taxes, but the median housing price is high, at $343,300, which translates to $1,756 in annual property taxes. The Mile High State also rakes in revenue from taxes on legalized marijuana, which brought in $387 million in 2020. Colorado ranked #16 in U.S. News & World Reports 2021 list of best states to live in, earning high marks for education and economy, but scoring lower for opportunity and fiscal stability.

Property Tax As Source Of General Revenue

In our property taxes comparison by state, New Jersey, Connecticut, and New Hampshire have the highest median property taxes paid. So, it makes sense that property tax represents a significant share of the general income of these states. In this category, the positions are different as Coonecticut has the highest percentage of 61.76. New Hampshire comes in second with property tax representing 61.61% of its revenue. Finally, New Jersey and its 61.01% hold the third place. Arkansas property tax is only 11.8% of the states income, placing the jurisdiction at the bottom.

You May Like: Irs Tax Return Amendment Status

States With The Highest Personal Income Tax Rates

A comparison of 2020 tax rates compiled by the Tax Foundation ranks California as the top taxer with a 12.3% rate, unless you make more than $1 million. Then, you have to pay 13.3% as the top rate. The additional tax on income earned above $1 million is the state’s 1% mental health services tax.

The top 10 highest income tax states for 2021 are:

Each of these states has a personal income tax floor, deductions, exemptions, credits, and varying definitions of taxable income that determine what a citizen actually pays.

Which State Has No Property Tax In Usa

Unfortunately, there are no states without a property tax. Property taxes remain a significant contributor to overall state income. Tax funds are used to operate and maintain essential government services like law enforcement, infrastructure, education, transportation, parks, water and sewer service improvements.

You May Like: Sc State Tax Refund Status

Effective Property Tax Rate For Owner

New Jersey has the highest property taxes by state in the US. Still, the Garden State remains among the best places to flip houses in America. Its effective property tax rate is 2.49%, not much higher than the 2.27% in Illinois. New Hampshire rounds up the list of the top three states with the highest property tax. New Hampshires effective tax rate is 2.18%, and its the only other state with a property tax of over 2% besides Connecticut .

Hawaii meanwhile is at the other end of the spectrum in this category. With an effective property tax of only 0.28%, the state boasts the lowest property taxes by state. Alabama and Louisiana are the two other states with the lowest property taxes. Their effective rates for a median owner-occupied home are 0.41% and 0.51%, respectively.

Property Tax On Business Property

When someone says property tax, they usually refer to taxation on personal real estate. Still, business properties get taxed too. In the fiscal year 2020, the total state and local business property taxes generated $329.2 billion.

Each jurisdiction has individual commercial property taxes by state that affect the total business tax burden in that specific area. In Massachusetts, for example, businesses are taxed with $2.60 per $1,000 of tangible property. In Wyoming, companies pay 11.5% commercial property tax on industrial estates and 9.5% on commercial and other properties.

Minnesota is another example of how taxation on business properties can vary. In this state, the minimum commercial tax fee depends on the total value of the property, payroll, and sales of the business. Meaning, while there isnt a specific commercial property tax, properties still affect the overall tax burden companies face in Minnesota.

You May Like: Why Is Tax Day April 18

What States Have No Property Tax For Senior Citizens

There are a few states that dont have property taxes for seniors. These include Florida, Texas, and Arizona. There are also a few other states with no property tax after age 65, such as Colorado, Pennsylvania, and New Jersey. If youre a senior citizen looking to move to a state with no property tax, these are a few of your best options.

These States have No Property Tax for Seniors:

Citizens age 65 and above can receive a 50% tax exemption if their annual income is less than $29,000.

In Texas, most seniors over the age of 65 dont have to pay property taxes as there is an exemption on the first $160,000 of the home value.

Seniors over the age of 65 are eligible for a property tax exemption.

Among states with the least property tax from seniors, South Dakota is the most generous. To get tax exemption, seniors in South Dakota have to apply for state property tax relief programs. Citizens older than 70 years may also get a homestead exemption, which allows them to postpone paying property tax until the home is sold.

Seniors in Florida are eligible for significant property tax reductions and, under certain circumstances, they may get a 100% tax exemption.

Seniors of age 65 and above can claim tax exemption at a maximum home value of $120,000, and the number is likely to increase in the future.

Citizens over age 65 and non-military citizens can get a homestead exemption.

Seniors in Georgia can apply for a property tax deferral or tax exemption.

States With No Property Tax For Disabled Veterans

There are many different tax exemptions and programs available to disabled veterans, but one of the most important is the property tax exemption. This exemption can help disabled veterans save thousands of dollars each year on their property taxes.

Currently, there are 21 states that offer some form of property tax exemption for disabled veterans. These states are:

If you are a disabled veteran living in one of these states, be sure to check with your local county or city assessor to see if you qualify for the exemption.

Recommended Reading: New York State Tax Form

What State Has Highest Property Tax

New Jersey1. New Jersey. New Jersey holds the unenviable distinction of having the highest property taxes in America yet againits a title that the Garden State has gotten used to defending. The tax rate there is an astronomical 2.21%, the highest in the country, and its average home value is painfully high, as well.

What Other States Have Property Tax Rates Similar To Texas

The following states have similar average effective property tax rates to Texas. In these states, as in Texas, local governments levy property taxes rather than the state itself.

The effective property tax rates listed represent a homeowners average property tax in a given state. Since local government rates vary, your exact individual tax rate will depend on your specific location within your state.

Also Check: Is Credit Card Interest Tax Deductible

Property Tax Penalties Are Increasing Heres How Property Tax Lenders Can Help

Failing to pay your property taxes on time means facing stiff property tax penalties because the local government is so reliant on this revenue source. The absolute final date for property tax payments in Texas is 31 January every year unless you have qualified for property tax exemptions or deferrals. From 1 February, all unpaid property tax bills are considered delinquent, and penalties and interest begin accruing. Currently, these penalties can amount to around 43% of your current tax bill, making it even more challenging for people who are unable to pay on time.

This is a difficult situation to find yourself in, and the last thing you want is to be paying even more on your bill – fortunately, there is a solution to your property tax burden. If you are struggling to keep up with the high Texas property tax rates, lenders can offer you expert advice and services to deliver fast, effective tax relief. At American Finance & Investment Company, Inc, our compassionate and qualified team will settle your property bill quickly. We can help with an affordable property tax loan and a customized repayment plan to help you get back on your feet.

Interested in a property tax loan in Texas? Contact one of our qualified property tax lenders today.

How Do I Avoid Sales Tax If I Buy A Car Out Of State

To take advantage of no sales tax cars, you would have to purchase the vehicle in another state that doesnt charge a sales tax. Several different states dont charge sales tax on a used car. These states include Alaska, Montana, Delaware, Oregon, and New Hampshire.

Recommended Reading: How Does Income Tax Work