Property Tax Red States Vs Blue States

When analyzing the property tax rates by state, its noticeable that blue states have higher effective taxes on properties. Among the 10 states with the highest effective tax rate on median owner-occupied homes, seven are Democrat. The top four states with the highest property taxes are blue.

The situation is different when focusing on the states with the lowest property taxes. Here, six among the leading ten states are Republican. So, the conclusion is that red states tend to have looser taxation on personal properties.

According to the latest uninsured rates by states, Republican states also have more uninsured residents. Red states are also the most federally dependent states in America. So, having low property taxes doesnt necessarily place them in a better position than blue states.

Expert Insights: Moving And Taxes

Making the move to a different state is a big step, and from a tax perspective, it can get complicated. MoneyGeek interviewed several experts to elaborate on the unique tax issues that moving presents and what you may need to take into account if youre thinking about making a move across state lines. The views expressed are the opinions and insights of the individual contributors.

Senior Manager at Baker Newman Noyes

Recommended Reading: Do You Have To File Taxes With Doordash

Which States Have The Lowest Property Taxes

In 2019, taxpayers in Hawaii had the lowest property tax rates of anywhere in the country at just 0.31%. The next lowest states were Alabama at 0.37% and Louisiana and Wyoming, both at 0.51%.

Generally, the states with lower property tax rates tend to be those in the southern and western parts of the country. The biggest exception to this rule is Hawaii, which has the lowest property tax rate in the country. However, Hawaii also has the highest median home value in the country, so homeowners property tax bills in the Aloha State are likely higher than those in the other states listed.

Living in a state with lower property taxes has the clear benefit of reducing the burden of homeownership on taxpayers. This can be especially crucial for young or lower-income home buyers looking to break into the housing market for the first time.

Highest and Lowest Property Taxes by State

| Highest Property Tax Rate States: | Lowest Property Tax Rate States: |

|---|---|

| #1 New Jersey 2.13% |

Also Check: What Is The Small Business Tax Rate For 2021

Which States Do Not Have Property Tax In 2022

Unfortunately, there are no states without a property tax. Property taxes remain a significant contributor to overall state income. Tax funds are used to operate and maintain essential government services like law enforcement, infrastructure, education, transportation, parks, water and sewer service improvements.

States without property tax refer to those states that have the lowest ratio rate of property tax. In other words, the tax is so small that its almost negligible and doesnt affect the investment return much.

The Top 10 States With the Lowest Property Tax Based on State Median Home Value Are:

1- Hawaii

Property Tax Rate: 0.27%

According to a study by the Tax Foundation, Hawaii has the lowest average effective property tax rate at 0.27%. This is significantly lower than the national average of 1.19%.

The state also has relatively low property values, with the median home value being $551,800 compared to the national median home value of $184,700.

This combination of low property taxes and values may make Hawaii an attractive option for prospective homeowners.

2- Alabama

Property Tax Rate: 0.40%

The state of Alabama has some of the lowest property taxes in the United States, with an average effective rate of 0.40%. Some counties in Alabama even have a property tax rate of 0%, meaning residents do not have to pay any property taxes at all.

3- Louisiana

Property Tax Rate: 0.55%

4- Wyoming

Property Tax Rate: 0.58%

5- West Virginia

Property Tax Rate: 0.55%

7- Colorado

Total Tax Burden: 574%

Before 2016, Tennessee taxed income from investments, including most interest and dividends but not wages. Legislation passed in 2016 included a plan to lower taxes on unearned income by 1% per year until the tax was eliminated at the start of 2021. To make up for the shortfall, Tennessee levies high sales taxes and the highest beer tax of any state in the union at $1.29 per gallon.

With full implementation of the new legislation, Tennessee expects to attract retirees who depend heavily on investment income. The states total tax burden is 5.74%, the second-lowest in the nation. In the affordability category, Tennessee ranks 17th overall, and on the U.S. News& World Report Best States to Live In list, it ranks 29th.

In 2019, at $9,868 per pupil, Tennessee ranked just above Texas in terms of education spending in the southern U.S. It also did a better job of fairly distributing its school funding than the Lone Star State did, earning the Equality State a C in 2015.

At $7,372 per capita, Tennessee ranked 39th in terms of healthcare spending in 2014. The state hasnt received an official letter grade for its infrastructure yet, although the ASCE did note that 4.4% of its bridges are structurally deficient and 276 of its dams have a high hazard potential.

Don’t Miss: How Much Taxes Deducted From Paycheck Tn

Property Tax On Business Property

When someone says property tax, they usually refer to taxation on personal real estate. Still, business properties get taxed too. In the fiscal year 2020, the total state and local business property taxes generated $329.2 billion.

Each jurisdiction has individual commercial property taxes by state that affect the total business tax burden in that specific area. In Massachusetts, for example, businesses are taxed with $2.60 per $1,000 of tangible property. In Wyoming, companies pay 11.5% commercial property tax on industrial estates and 9.5% on commercial and other properties.

Minnesota is another example of how taxation on business properties can vary. In this state, the minimum commercial tax fee depends on the total value of the property, payroll, and sales of the business. Meaning, while there isnt a specific commercial property tax, properties still affect the overall tax burden companies face in Minnesota.

South Carolina And Delaware

Tied for the next slot on states with the lowest property tax rates are South Carolina and Delaware. Both of them have an effective state property tax rate of 0.56%. Delaware also has no sales tax and a higher income rate than South Carolina. However, South Carolina has cheaper homesby as much as $80,000 less on average!

Recommended Reading: Out Of State Sales Tax

Ways To Minimize Your Property Tax Burden

There is no way to avoid paying property taxes. However, there are a few things that you can do in order to minimize your property tax burden. These include:

Appeal Your Assessment: If you believe that your property has been assessed at a higher value than it should be, you can appeal the assessment. This could result in a lower property tax bill.

Look For Exemptions And Deductions: There are often exemptions and deductions available for certain types of properties or ownerships. For example, veterans and seniors may be eligible for property tax breaks.

Pay Your Taxes On Time: Property taxes are typically due once per year. If you pay them late, you may be subject to penalties and interest charges.

Stay Up To Date On Changes In The Law: Property tax laws are constantly changing. Keeping up with the latest changes can help you minimize your property tax burden.

States With The Lowest Average Effective Property Tax Rates In 2022

Property taxes are determined at a local level, not the state level, so different communities in a state can have different property tax costs. To get the bigger, statewide picture of each states property tax costs, we looked at its average effective property tax rate which is based on the average cost of owner-occupied residential property taxes paid across all communities.

Credit Karma found this data in the U.S. Census Bureaus 2020 American Community Survey.

Note that theres a tie for third and fifth place for states with the lowest average effective property tax rates.

| Rank | |

|---|---|

| South Carolina | 0.566% |

Hawaii is the real surprise on this list because it typically ranks as a pretty expensive state, especially in terms of the cost of property. In our study on the cheapest states to live in, Hawaii came in as the most expensive state for average Zillow home value, average rent and cost of living.

The state with the highest average effective property rate is New Jersey at 2.47%, followed by Illinois at 2.24% and Connecticut at 2.13%.

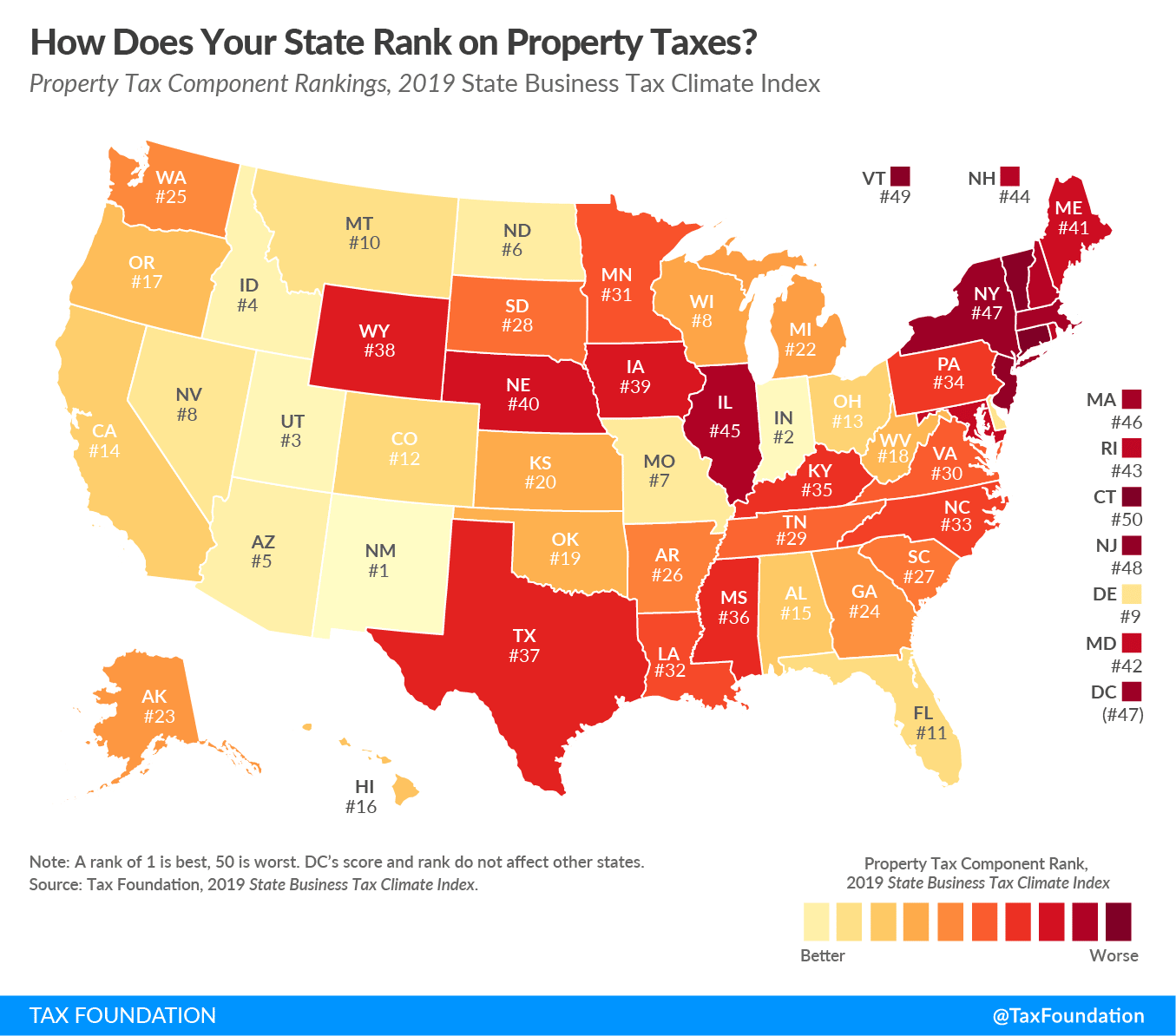

The map that follows shows the average effective property tax rate for each state, along with its rank. Theres a little cluster of higher average effective property tax rates in New England. Texas and Nebraska also make the list of top 10 most expensive states in terms of average property tax rates.

You May Like: State Tax Rate In Hawaii

Which States Dont Have Income Tax

There are a few states in the US that do not have an income tax. These states are:

There are also a couple of states that have no state tax on general income, but they do tax specific types of income like interest or dividends. These states are:

So if youre looking to move to a state with no income tax, you have a few options!

Are There Any States With No Property Taxes

All 50 states and the District of Columbia levy property taxes. However, some people may qualify for a property tax exemption. Some states offer homestead exemptions, while other types of exemptions exist for older homeowners, people with disabilities, military veterans, and homeowners who make certain renovations or install renewable energy systems .

Read Also: Selling House Capital Gain Tax

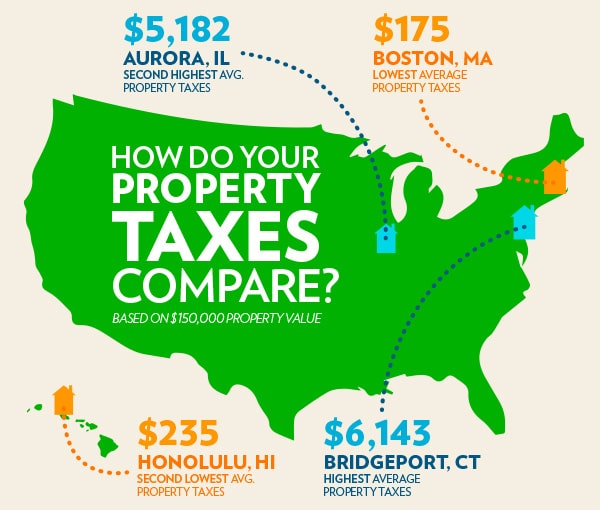

Where You’ll Pay The Most: States With High Property Taxes And High Home Prices

As one might expect, homeowners in states with a combination of high tax rates and above-average home prices have some of the most considerable property tax burdens in the U.S.

New Hampshire and Connecticut, for example, have property tax rates over two percent and median home prices higher than the rest of the country. The average homeowner in these states typically has an annual tax bill exceeding $5,000. Similarly, New York and Vermont residents pay some of the country’s highest real estate taxes, with rates around 1.7 to 1.9 percent.

Sales Tax Takers And Leavers

If youre a consumer, youll want to consider that all but four states Oregon, New Hampshire, Montana and Delaware rely on sales tax for revenue. Alaska only levies a paltry 1.76% sales tax rate.

Of these, Alaska also has no income tax, thanks to the severance tax it levies on oil and natural gas production. 37 states, including sales-tax-free Alaska and Montana, allow local municipalities to impose a sales tax, which can add up. Lake Providence, Louisiana has the dubious distinction of most expensive sales tax city in the country in 2021, with a combined state and city rate of 11.45%.

Factoring the combination of state and average local sales tax, the top five highest total sales tax states as ranked by the Tax Foundation for 2021 are:

- Tennessee 9.55%

Residents of these states pay the least in sales taxes overall:

You May Like: Tax Preparer License Requirements

Recommended Reading: When Is The Last Day To Turn In Taxes

States With The Lowest Personal Income Tax Rates

Only eight states have no personal income tax:

In addition, New Hampshire limits its tax to interest and dividend income, not income from wages.

Among the states that tax income, Pennsylvania’s 3.07% flat tax ranks the Keystone State as the 10th lowest in the nation for 2021.

Low personal income tax rates can be misleading a lack of available tax deductions, for example, can raise the effective rate you pay. The Retirement Living Information Center states that figuring your total tax burden, including sales and property taxes, can give you a more accurate reading on affordability, especially if you’re on a fixed income. However, these states with the lowest taxes on income can be a good place to start looking for a more affordable location.

TurboTax Tip: Personal income tax rates do not tell the whole state tax story. The states vary in their personal income tax floors, deductions, exemptions, credits, and definitions of taxable income. Sales and property taxes also affect the states affordability.

Effective Property Tax Rates By State

In the US, the median owner-occupied home value is $222,041, with an effective tax rate of 1.09%. Hence, the median property taxes paid for such homes are about $2,412.In the table below, we will go over each state and see how it compares to the American median figures. We will also analyze the states with the highest property taxes alongside the jurisdictions with the lowest property taxes in the US. Please note that in the next table, the focus is on personal property taxes by state.

You May Like: What Happens If Taxes Are Late

Read Also: Tax Credits For Electric Cars

Combined Sales And Income Tax Leaders

The Tax Foundation interprets individual tax burden by what taxpayers actually spend in local and state taxes, rather than report these expenses from the state revenue perspective used by the Census Bureau. Its 2019 State and Local Tax Burden Rankings study reported that Americans paid an average rate of 9.9% in state and local taxes.

According to the foundation, the top five states with the highest state and local tax combinations are:

- California and Wisconsin 11.0%

The same states have ranked as the top three consistently since 2005, according to the foundation.

Although taxes may not be the first thing you consider when deciding where to live, knowing the tax situations of the locations you’re considering for a move could help you save in the long-run, especially when retiring.

Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted.File your own taxes with confidence using TurboTax. Just answer simple questions, and well guide you through filing your taxes with confidence.Whichever way you choose, get your maximum refund guaranteed.

States With The Lowest Overall Tax Burden

Low tax rates

getty

Depending on your income in 2021, you may be feeling the pain of paying your taxes. Perhaps, you hurt when you look at your paychecks and see all the state and federal taxes being withheld. Some of you may feel a bit more pain based on the state where you live, how you earn your income, and whether you own a home. The overall tax burden can vary widely from state to state.

While seven states boast of not having an income tax, this doesn’t mean you get to live tax-free. Those states have to fund their budgets somehow. If you were wondering, the seven states without an income tax are Nevada, Washington, South Dakota, Texas, Florida, Wyoming, and Alaska. Keep reading to find the five states with the lowest overall tax burden for their residents.

Income taxes are just one part of the overall tax burden of living in a state. Your tax burden at the state level can vary widely depending on your financial circumstances. Your tax burden is the proportion of your total personal income required to cover your state and local taxes. The most common types of state and local taxes are personal income taxes, sales taxes, and of course, property taxes.

State tax burdens aren’t uniform across the country. For example, while Nevada and Washington have no state income tax, they have the second and third highest sales and excise taxes and rank No. 33 and 30, respectively, for overall tax burden.

Corbis via Getty Images

4. Wyoming

Getty Images

3. Delaware

Getty Images

Read Also: How To Get Previous Years Tax Returns

Property Tax As A Percentage Of State

New Hampshire, New Jersey, and Maine top several categories in our property tax ratings by state. They hold the 1st, 2nd, and 3rd position as states with the highest total property tax as a percentage of state-local revenue. Their percentages are 36.48, 28.69, and 26.8, respectively. Alabama holds the last place here as its total property tax collected represents only 6.93% of the state-local revenue.

What Are Property Taxes Used For

Now you may be thinking, if Im going to pay a lot of taxes as a property owner, I want to know where my tax dollars are going. Local governments predominantly use property tax dollars to fund public services. Although taxes can be expensive, you may find some reassurance knowing that your tax dollars are typically used to improve your local neighborhood, schools, parks, infrastructure, and amenities. These can help improve the attractiveness of your zip code, and thus help you bring in higher-paying tenants over time and improve your property value.

Here are some examples of where your property tax payments might go:

-

Building or improving public schools

-

Maintaining city parks and other green spaces

-

Help pay for museums, libraries, and other public amenities

-

Road construction and repair

-

Salaries and operational costs of emergency services

-

Local government services, administration, and infrastructure

Also Check: Irs Address To Mail Tax Returns

States That Have Lowest Property Tax Rates

Do you know what property tax is? The United States Department of the Treasury mentioned that each of the states in the country have different definitions of property that is taxable. Some states let towns or local counties to tax real estate, which includes buildings like land, homes, buildings, and so on. Some states also let municipalities to tax individual property .

Property taxes are a percentage of the value of your home that you pay every tax season. This percentage often funds public schools, public transportation, road construction, pensions and other local services.

Even though property tax rates vary from one county to another, you can find out the state with the cheapest total property taxes by checking the average property tax rate of each state.

Here, weve mentioned the 10 states in the country with the cheapest average property tax rates, with the ranking starting from the lowest to highest as reported on tax-rates.org.

Property taxes in the Northeast as well as Midwest can be higher. The ten states in the country with the highest average property tax rates include Vermont, Illinois, Michigan, Texas, New Jersey, Connecticut, Wisconsin, North Dakota, New Hampshire, and Nebraska.