State & Local Tax Breakdown

All effective tax rates shown below were calculated as a percentage of the mean third quintile U.S. income of $63,218 and based on the characteristics of the Median U.S. Household*.

|

State |

|---|

| 15.01% |

*Assumes Median U.S. Household has an income equal to $63,218 owns a home valued at $217,500 owns a car valued at $24,970 and spends annually an amount equal to the spending of a household earning the median U.S. income.

Sales Tax Isnt The Only Tax To Consider

While you may think you pay a lot of sales tax because of how often youâre charged it, of the list of taxes you will pay in your lifetime, sales tax actually doesnât amount to as much as you think. Even if you live in a state that has sales taxes, there are legal ways to sometimes avoid paying them, including sales tax holidays. In fact, you will likely pay more in loan interest than sales tax throughout your life.

But if you are considering what your tax burden may be in a new state, be sure to consider these larger tax bills:

Collection Payment And Tax Returns

Sales taxes are collected by vendors in most states. Use taxes are self assessed by purchasers. Many states require individuals and businesses who regularly make sales to register with the state. All states imposing sales tax require that taxes collected be paid to the state at least annually. Most states have thresholds at which more frequent payment is required. Some states provide a discount to vendors upon payment of collected tax.

Sales taxes collected in some states are considered to be money owned by the state, and consider a vendor failing to remit the tax as in breach of its fiduciary duties. Sellers of taxable property must file tax returns with each jurisdiction in which they are required to collect sales tax. Most jurisdictions require that returns be filed monthly, though sellers with small amounts of tax due may be allowed to file less frequently.

Sales tax returns typically report all sales, taxable sales, sales by category of exemption, and the amount of tax due. Where multiple tax rates are imposed , these amounts are typically reported for each rate. Some states combine returns for state and local sales taxes, but many local jurisdictions require separate reporting. Some jurisdictions permit or require electronic filing of returns.

Purchasers of goods who have not paid sales tax in their own jurisdiction must file use tax returns to report taxable purchases. Many states permit such filing for individuals as part of individual income tax returns.

Read Also: When Is The Last Day To Turn In Taxes

Wyoming Sales Tax: 4%

Residents of Wyoming and visitors to the state pay a 4% sales tax for most items purchased. Its the average cost of doing business in the state, but by the time some other local option sales taxes are added, you can end up paying up to 5.436%. The reason for the differences from one jurisdiction to another is that cities are allowed to vote in, additional taxes to help support their local economies. The highest combined sales tax in the state for 202 is 6%, which is still lower than in some states. Plan to pay the highest rates in Jackson, Casper, Sheridan, Laramie, Cheyenne, and 72 more cities in these areas.

Total Tax Burden: 737%

Like many states with no income tax, South Dakota rakes in revenue through other forms of taxation, including taxes on cigarettes and alcohol. The home of the Lakota Sioux and the Black Hills has one of the highest sales tax rates in the country and above-average property tax rates. South Dakotas position as home to several major companies in the credit card industry, in addition to higher property and sales tax rates, helps to keep the states residents free from income tax, according to reporting by The Atlantic.

South Dakotans pay just 7.37% of their personal income in taxes, according to WalletHub, ranking the state eighth in terms of the total tax burden. The state ranks 14th in affordability and 15th on the U.S. News& World Report Best States lists.

South Dakota spent $8,933 per capita on healthcare in 2014, the 14th highest in the nation. Although it spent more money on education, at $10,139 per pupil in 2019, it spent less than any other neighboring Midwestern state. Additionally, it received a grade of F for its school funding distribution.

South Dakota hasnt received an official letter grade from the ASCE, though much of its infrastructure is notably deteriorated, with 17% of bridges rated structurally deficient and 90 dams considered to have high hazard potential.

Also Check: New York State Tax Login

Lowest And Highest Sales Tax States

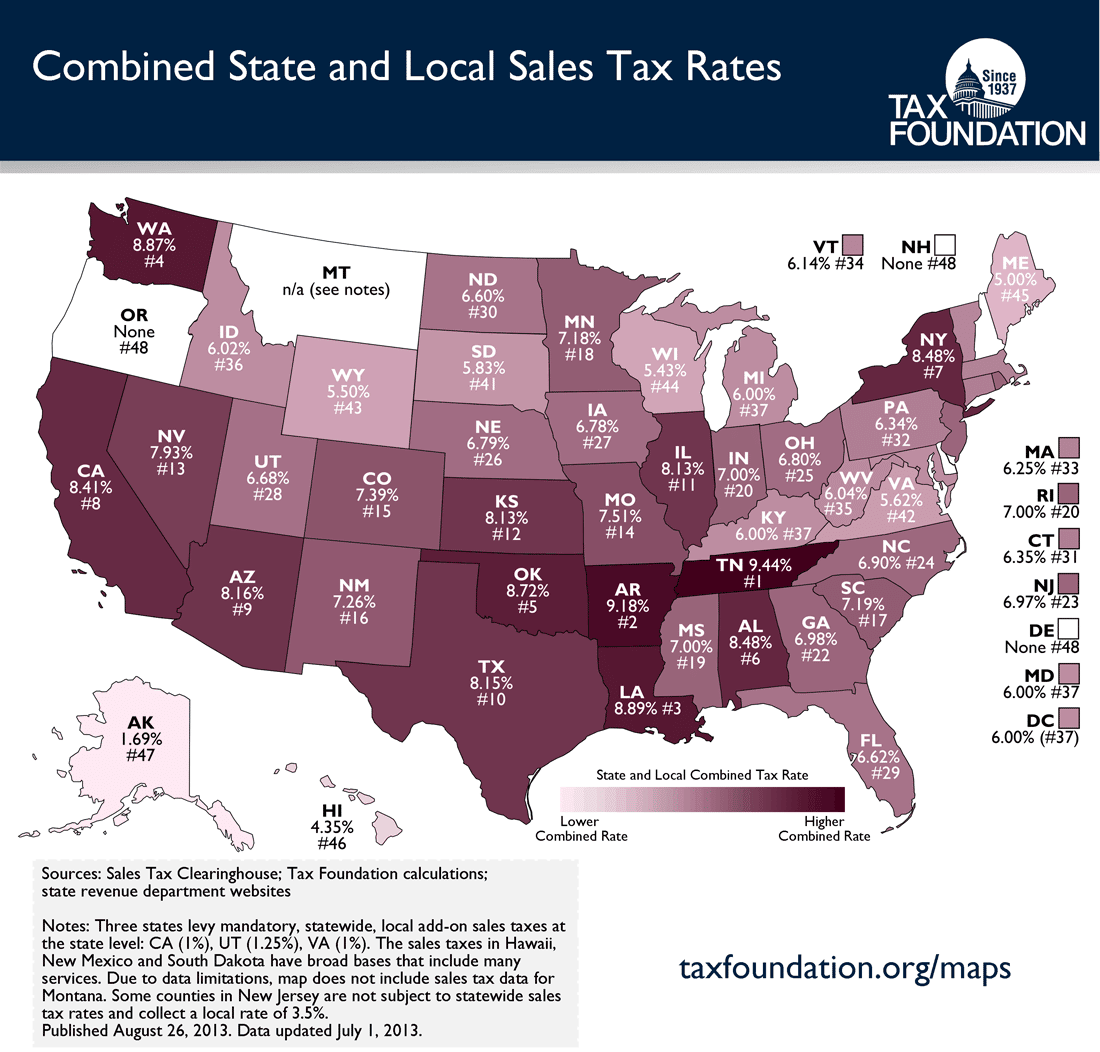

Four states Delaware, Montana, New Hampshire and Oregon have no statewide sales tax, or local sales taxes, either.

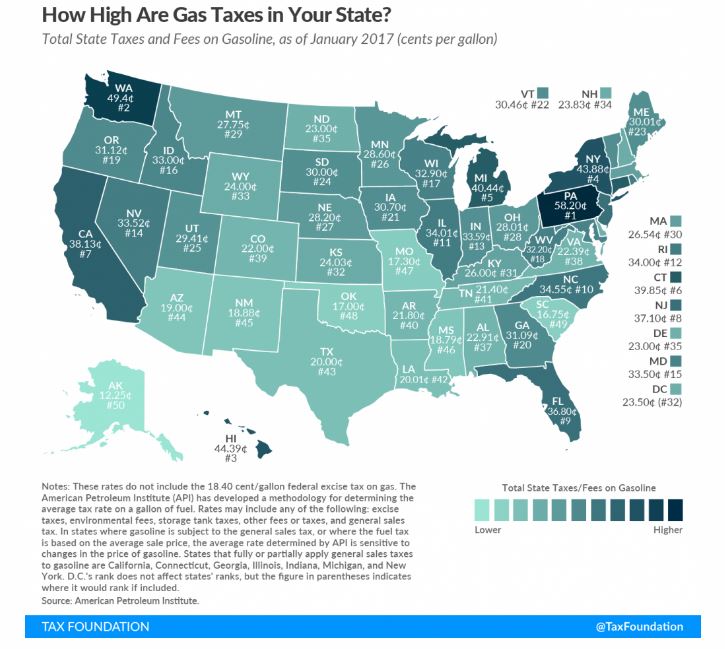

Alaska has no statewide sales tax, but it allows cities and towns to levy sales taxes. The Tax Foundation, an independent think tank, weights local sales taxes by population and adds them to statewide sales taxes. It calculates Alaskas sales tax at 1.76 percent, still well below the national average of 6.57 percent. The lowest state and local sales taxes after Alaskas are in Hawaii , Wyoming , Wisconsin and Maine .

On the other end of the spectrum is Louisiana, whose combined state and local sales tax weighs in at 9.55 percent. Tennessee, whose state sales tax is 9.547 percent, trails Louisiana by a fraction. Following Tennessee on the ranking of states with the highest sales taxes are Arkansas , Washington and Alabama .

States have to get revenue from somewhere, and sometimes states with low income taxes have high sales taxes. Tennessee has a very high sales tax but a very low income tax, says Janelle Fritts, policy analyst at the Tax Foundation. In fact, Tennessee doesnt tax wage income at all it just taxes dividends and capital gains. Washington and Texas, which dont have income taxes, also have above-average sales taxes.

Some states with low sales taxes, such as Alaska and Montana, get significant income from natural resource taxes.

How high are sales taxes in your state?

|

States |

Your email address is now confirmed.

Total Tax Burden: 823%

Nevada relies heavily on revenue from high sales taxes on everything from groceries to clothes, sin taxes on alcohol and gambling, and taxes on casinos and hotels. This results in a state-imposed total tax burden of 8.23% of personal income for Nevadans, the second-highest on this list. However, it still ranks a very respectable 22 out of 50 when compared with all states.

That said, the high costs of living and housing put Nevada near the bottom when it comes to affordability. The state ranks 37th on the U.S. News & World Report Best States to Live In list.

Nevadas spending on education in 2019 was $9,344 per pupil, the fourth-lowest in the western region of the U.S. One year earlier, in 2018, the ASCE gave Nevada a grade of C for its infrastructure.

In addition to receiving an F grade from the Education Law Center in 2015, Nevada was also the worst state overall in terms of the fairness of its state school funding distribution. Nevadas healthcare spending in 2014 was $6,714 per capita, the lowest on this list and the fourth-lowest nationally.

Recommended Reading: When Are Llc Taxes Due

How Does Your State Rank

As weve already mentioned, Alaskas combined tax rate is the countrys lowest at just 1.23%. Well break down each area in subsequent sections, but Alaska has no state income tax and no statewide sales tax, though some counties in the state do charge sales taxes. The states gas tax rate is the lowest in the country, and its property tax rate is near the middle of the pack.

On the flip side, Californias combined rate of 8.61% is the nations highest, putting the Golden State more than a percentage point ahead of Minnesota. California has the highest median income tax rate, the 10th-highest state sales tax rate and the fifth-highest gas tax rate.

Heres a look at how every state performed in our full ranking:

Among the states with the lowest combined tax rates, half are in the West, and Florida is the only Southern state among those with the 10 lowest overall rates. Two of the three most populous states have among the five highest rates in the nation.

North Carolina and South Carolina have almost identical rates , and four states have both one of the 10 highest tax rates and 10 highest rates of poverty, though, notably, the District of Columbia is the only one of the bunch with a very high income tax rate. That could indicate that the burden of state-level taxes in some places is being borne by people who can little afford it.

Total Tax Burden: 819%

The Lone Star State loathes personal income taxes so much that it decided to forbid them in the states constitution. Still, because infrastructure and services must be paid for somehow, Texas relies on income from sales and excise taxes to foot the bill.

Sales tax can be as high as 8.25% in some jurisdictions. Property taxes are also higher than in most states, the net result of which is a total tax burden of 8.19% of personal income. Nevertheless, Texans overall tax bite is still one of the lowest in the U.S., with the state ranking 19th. Texas is average for affordability at 22nd in the nation, but it was ranked 31st by U.S. News & World Report on the Best States to Live In list.

Texas spent $9,827 per pupil on education in 2019, ranking it below average among the 17 Southern states, and it received a D grade for its school funding distribution in 2015. In 2021 the ASCE awarded it a grade of C for its infrastructure. Texas spent $6,998 per capita on healthcare in 2014, the seventh-lowest amount in the U.S.

One advantage of living in a no-tax state is that the $10,000 cap on state and local tax deductions imposed by the Tax Cuts and Jobs Act will likely not have as great an impact as it does on residents of high-tax states, such as California and New York.

Also Check: Sales Tax And Use Texas

What You Need To Know About California Sales Tax

Governments, at all levels, may charge sales tax for goods and services. Retailers collect sales tax on their goods at the point of sale and then send their collections to the government. Currently, 45 states charge sales tax with some counties and cities charging their own taxes. No state has quite perfected the art of sales tax like California.

The California Department of Tax and Fee Administration , which administers tax and fee collection, shows that California cities charge a myriad of different sales tax rates. So what can you expect to pay and where does all that money go?

Need help creating a financial plan or managing your investments? A financial advisor can help. Find a trusted advisor today.

Take Advantage Of Tax

Retirement accounts like a 401 or IRA are great ways to defer taxes to a later date, while also growing your net worth. In 2022, you can contribute up to $20,500 in pre-tax income to your employer sponsored 401, and defer paying them until you’re ready to start withdrawing the money in retirement. If you’re employer doesn’t offer a 401, it’s easy to open an IRA through a financial company like like Wealthfront or Fidelity.

Additionally, if you have a high deductible health plan , you can contribute to a Health Savings Account if your employer offers one. If they don’t, you can contribute with post-tax money, and you will earn a tax write-off for your contribution.

You May Like: When Is An Estate Tax Return Required

What Is A Sales Tax

A sales tax is levied by the government on the sale of goods and services. When you purchase a good or service, the sales tax is the amount of money thats added when you pay at checkout.

The specific goods and services subject to sales tax vary by state. For instance, some states do not apply sales tax to food purchases. Check with your state government to determine which sales tax rates apply to you.

Retail businesses bear the responsibility of tracking and collecting this sales tax from shoppers, and paying it out to their state government on a recurring basis.

The Kind Of Tax Matters

State and local governments seeking to fund public services have historically relied on three broad types of taxes: personal income, property, and consumption . States also rely on a range of other tax and non-tax revenue sources such as corporate income taxes, estate and inheritance taxes, user fees, charges, and gambling revenues. A few states rely heavily on non-traditional tax sources, such as severance taxes on the extraction of natural resources, which are not included in this analysis.

FIGURE 6

As ITEPs analysis of the most and least regressive tax states shows, the relative fairness of state tax systems depends primarily on how heavily states rely on these different tax types. Each of these taxes has a distinct distributional impact, as the table on this page illustrates:

Also Check: Tax Id Numbers For Businesses

What Is Property Tax

Property taxes are taxes paid by property owners. The owners can be individuals or legal entities, such as corporations or other types of businesses. The amount of tax to be paid is assessed by the local government where the property is located. Well talk about how the tax is calculated in the next section.

Although property tax usually alludes to real estate, some states also assess property tax on other types of personal property, such as cars and boats. Property taxes are a key source of income for local governments. They are used to fund municipal projects such as schools, road improvements, parks and recreation, and public transportation.

Also Check: How Much Does H& r Block Charge For Doing Taxes

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Don’t Miss: Morgan Stanley Tax Documents 2021

State Sales Tax Rates

California has the highest state-level sales tax rate, at 7.25 percent. Four states tie for the second-highest statewide rate, at 7 percent: Indiana, Mississippi, Rhode Island, and Tennessee. The lowest non-zero state-level sales tax is in Colorado, which has a rate of 2.9 percent. Five states follow with 4 percent rates: Alabama, Georgia, Hawaii, New York, and Wyoming.

No state rates have changed since April 2019, when Utahs state-collected rate increased from 5.95 percent to 6.1 percent.

Delaware Sales Tax: 0%

The Tax Foundation confirms that Delaware is a state that does not charge a state sales tax, nor does it charge local sales taxes. When you purchase items in the grocery stores and department stores in this state, you can be certain that you will only pay the sticker price. Delaware is a pleasant state for shoppers because there is no need to try to calculate how much the tax will be on any given item.

Recommended Reading: Short Term Capital Gains Tax Rates 2021

Total Tax Burden: 684%

New Hampshire does not tax earned income but does tax dividends and interest. New Hampshires Senate passed legislation to phase out the investment income tax by 1% per year over five years, with full implementation by 2027. The state has no state sales tax but does levy excise taxes, including taxes on alcohol, and its average property tax rate of 1.86% of property values is the third highest in the country.

Even so, New Hampshires total tax burden is just 6.84%, according to WalletHub, ranking the state fifth in the nation. The state ranks fourth on the U.S. News & World Report list of Best States to Live In and 38th in the nation for affordability.

Although New Hampshire spent more on education than any other state on this list at $17,462 per pupil in 2019, its outlay was among the lowest in the northeastern region of the U.S. Additionally, in 2015 it earned a grade of D from the Education Law Center for its school funding distribution.

New Hampshire received a marginally better grade of C- for its infrastructure in 2017. At $9,589 per capita in 2014, its healthcare spending is the ninth highest in the nation.

States With No Income Tax

The table below illustrates the differences among states with no income tax. The first two columns show the states total tax burden as a percentage of personal income followed by the rank that the state holds among all 50 states.

The third column shows the states affordability ranking, which combines both the cost of housing and cost of living, and the last column includes the states rank on the U.S. News& World Report Best States to Live In list.

These figures are as of the most recent reports: 2021 for overall tax burden, 2020 and 2019 for affordability, and 2021 for Best States to Live In.

| Comparison of States With No Income Tax | |

|---|---|

| No-Tax State | |

| 44 | 1 |

Don’t Miss: Irs Extension To File Taxes