Failure To Pay Sales Tax

If a merchant fails to pay sales tax when they should have, theyre likely to eventually receive an assessment letter, which requires that the merchant submit past-due sales tax returns and pay them. Penalties and interest for late filing often amount to 30% of the overdue tax.

If the state believes your intent was to defraud them , criminal penalties can apply as well.

Outsourcing Your Sales Tax Returns

Of course, in this day and age, you can always pay someone else to do it. With sales tax, you have two basic options: an automated service, or a live person.

What can be automated, and what cant be.

Automated Platforms

When it comes to automated platforms, the two most reliable and well-known are TaxJar and Avalara.

Protein Bars: Not As Tax Deductible As You Might Think

If there is only a trace of protein in the product, a protein bar is taxable in California. Bars are marketed as a high-nutritional source because they contain protein, which is added to increase the nutritional value. As a result, if you want to save money on your taxes this year, make sure to avoid protein bars with more than 10 grams of protein per serving. You can also find bars with just one or two grams of protein per bar.

You May Like: File State And Federal Taxes For Free

Which States Dont Have Sales Tax

As we know, sales taxes are governed at the state level as opposed to national, and it is logical that there are states which do not have sales tax. Every state handles the sales taxes of its territory, without abiding to the federal laws, and most of the states have sales taxes. But, fortunately, there are 5 amazing states which do not have sales tax at all.

However, keep in mind that each of these states have separate regulations for excise and sales taxes. Lets dive deep into this topic and try to cover each of these states separately.

States Without A Sales Tax

Sales taxes are actually “sales and use” taxes. If sales tax isn’t charged on a purchase, the buyer may be charged use tax, which is a tax on the use, storage, or consumption of an item. Sales tax is remitted by the seller, while use tax is remitted by the buyer.

Only five states don’t impose any sales tax: Alaska, Delaware, Montana, New Hampshire, and Oregon. Alaska is often added to this list, too however, the state’s rules are a bit complex.

Delaware doesn’t have a sales tax, but it does impose a gross receipts tax on businesses. Delaware’s gross receipts tax is a percentage of total receipts from goods sold and services rendered within the state, and it ranges from 0.0945% to 0.7468%, as of February 2022. It’s not technically charged to consumers, but its effect can nonetheless be felt in the sales prices of goods and services.

Read Also: How Much Foreign Income Is Tax Free In Usa

Total Tax Burden: 614%

With an estimated six people per square mile, Wyoming is the second least densely populated state, bested only by Alaska, which has roughly one human being for every square mile. Citizens pay no personal or corporate state income taxes, no retirement income taxes, and enjoy low sales tax rates. The total tax burdenincluding property, income, sales, and excise taxes as a percentage of personal incomeis 6.14%, ranking the state third lowest.

Like Alaska, Wyoming taxes natural resources, primarily oil, to make up for the lack of a personal income tax, according to reporting in the Cowboy State Daily. The state ranks an average 33rd in affordability and 35th on the U.S. News & World Report list of Best States to Live In.

In 2019, at $16,304 per pupil, Wyoming was one of the highest spenders on education in the western U.S., second only to Alaska. It also earned a grade of A for its school funding distribution in 2015, the best on this list.

Wyomings healthcare spending in 2014 was more moderate by comparison, at $8,320 per capita. Although Wyoming hasnt received an official letter grade for its infrastructure yet, the ASCE found that 6.9% of its bridges are structurally deficient and 99 of its dams have a high hazard potential.

States With Internet Sales Tax 2022

Internet sales tax is a tax on Internet-based services. For many years, states argued that they were losing money by not collecting sales tax on Internet sales. On June 21, 2018, the U.S. Supreme Court changed the rules for collecting sales tax by Internet-based retailers stating that individual states can require online sellers to collect state sales tax. Any individual who sells products online should be aware of the different laws in different states. The provisions set by the states are called Remote Seller Nexus and vary between states. There are four different types of Nexus according to the Sales Tax Institute: Click-Through Nexus, Affiliate Nexus, Marketplace Nexus, and Economic Nexus.

Also Check: Your Tax Return Is Still Being Processed 2022

Sales Tax: Then And Now

Modern retail sales tax is generally considered to date back to 1930, and is managed at a state level. Sales tax requires merchants pay sales tax of some kind in states where they have a presence, also known as nexus. The sales tax is collected from the consumer, by the merchant, who then sends the collected taxes to the state the tax was collected for.

Historically, states have recognized nexus in these situations:

- Home state nexus: your company is physically based in California, giving you nexus there.

- Employee nexus: your company is based in California, but you hire employees in Nevada. You now have sales tax nexus in both states, and must collect sales tax from buyers in both states.

- Inventory nexus: you store your inventory in a warehouse in a state that has inventory nexus, creating sales tax nexus.

With the increase in ecommerce, a new type of nexus is being recognized: that of remote sellers, referred to as economic nexus.

- Economic nexus: youre considered to have nexus in a state because you had a certain dollar amount of sales in that state, or have a certain number of sales transactions in that state.

Total Tax Burden: 834%

Washington hosts a young population, with only 15.9% of its residents over age 65, and many major employers, thanks to the lack of state-mandated corporate income tax . Residents do pay high sales and excise taxes, and gasoline is more expensive in Washington than in most other states. The state comes in at 26 out of 50, with a total tax burden of 8.34%.

Unusually higher-than-average living and housing costs hurt Washingtonians, putting the state at 44th in terms of affordability. For some residents that might not matter, however, because their state was ranked by U.S. News & World Report as the overall best state to live in once again for 2021.

Washington spent $7,913 per capita on healthcare in 2014, $132 below the national average. Conversely, at $14,223 per pupil, it spent more on education than most in 2019, though it received a C grade for its school funding distribution four years earlier. In 2019, Washington earned the same grade for its infrastructure from the ASCE.

You May Like: Can I Still File My 2017 Taxes Electronically In 2021

Online Orders Texas Purchasers And Sellers

A common question from Texans who purchase and sell things online is, “Do I owe Texas tax?” Texas purchasers and sellers may think they can save money by not paying tax when buying or selling on the internet, but those transactions are subject to Texas sales and use tax.

Online buyers must pay sales and use tax on taxable items delivered or brought into Texas.

Out-of-State Purchases Shipped or Delivered Into Texas

When a Texas purchaser buys a taxable item online from a seller that does not charge Texas sales tax, the purchaser owes use tax. Use tax is complementary to sales tax. Use tax is due on taxable items purchased online and shipped or delivered into Texas, and any shipping and handling charges are part of the sales price. The use tax due is based on the location where you first receive, store or use the item. You can verify the tax rate for a specific address using our Sales Tax Rate Locator.

If a seller does not collect Texas tax, you can report it directly to our office. If you do not have a sales tax permit, you can file a use tax return . If you have a sales tax permit, the use tax is reported under taxable purchases on your sales tax return. Remitting use tax protects in-state Texas retailers against unfair competition from out-of-state sellers that may not collect Texas tax.

If you purchased an item and brought it into Texas, then you must pay use tax. You can take a toward the Texas use tax owed if you paid sales tax to another state.

States With No Income Tax

The table below illustrates the differences among states with no income tax. The first two columns show the states total tax burden as a percentage of personal income followed by the rank that the state holds among all 50 states.

The third column shows the states affordability ranking, which combines both the cost of housing and cost of living, and the last column includes the states rank on the U.S. News& World Report Best States to Live In list.

These figures are as of the most recent reports: 2021 for overall tax burden, 2020 and 2019 for affordability, and 2021 for Best States to Live In.

| Comparison of States With No Income Tax | |

|---|---|

| No-Tax State | |

| 44 | 1 |

Also Check: What Percent Of Your Check Goes To Taxes

States With Low Sales Taxes

Among states that do have a sales tax, some are less significant than others. Thirteen states impose taxes of 5% of the purchase price or less, including five states where the tax is just 4%. The rest of the states all impose a sales tax that ranges from 5.5% to California’s 7.25%. As of 2022, they include:

New Mexico inches over the 5% line at 5.125%.

Creation Of Economic Nexus

This came about in June 2018, when the United States Supreme Court ruled in South Dakota v Wayfair that states can also require online sellers to collect sales tax based on the volume or value of transactions into a state, which create economic nexus.

One of the reasons behind the move to tax economic nexus is important in this case South Dakota does not impose income tax on its residents, which means it relies heavily on sales tax. As physical businesses lose more business to remote sellers, failure to tax these retailers results in a loss of tax revenue to the state.

In Wayfair vs.South Dakota, the state estimated that $50 million had been lost in sales tax revenue.

Recommended Reading: How To Calculate The Sales Tax

States With The Lowest Taxes And The Highest Taxes

OVERVIEW

Where you live can help or hinder your ability to make ends meet. A myriad of taxesproperty, license, state and local sales, property, inheritance, estate and excise taxes on gasolineeat away at your disposable income. Weighing the tax landscape against your financial picture lets you stretch your dollars. Here’s a roundup of the highest and lowest taxes by state.

“Location, location, location” is a focus that applies to more than just housing. Where you live can help or hinder your ability to make ends meet.

A myriad of taxes such as property, license, state and local sales, inheritance, estate, and excise taxes can eat away at your income. Often, the biggest tax ticket citizens face after paying the Internal Revenue Service is the one their state presents. As a result, identifying the states with the lowest taxes might be a smart financial move to make.

Currently, 41 states and the District of Columbia levy a personal income tax. Weighing the tax landscape against your financial picture could help you stretch your dollars further.

Types Of Internet Sales Tax

- Affiliate Nexus states an affiliated person of the retailer with a physical presence, or employees or agents in-state, has sufficient nexus in the state to require the retailer to collect and remit sales and use taxable retail sales of tangible personal property or services.

- Economic Nexus requires an out-of-state retailer to collect sales tax once the retailer meets a certain level of sales transactions or gross receipts activity within the state. The retailer does not need to have a physical presence in that state.

Additionally, Notice and Reporting Requirements require retailers to notify buyers that they must pay and report state use tax on purchases.

Don’t Miss: Morgan Stanley Tax Documents 2021

Collection Payment And Tax Returns

Sales taxes are collected by vendors in most states. Use taxes are self assessed by purchasers. Many states require individuals and businesses who regularly make sales to register with the state. All states imposing sales tax require that taxes collected be paid to the state at least annually. Most states have thresholds at which more frequent payment is required. Some states provide a discount to vendors upon payment of collected tax.

Sales taxes collected in some states are considered to be money owned by the state, and consider a vendor failing to remit the tax as in breach of its fiduciary duties. Sellers of taxable property must file tax returns with each jurisdiction in which they are required to collect sales tax. Most jurisdictions require that returns be filed monthly, though sellers with small amounts of tax due may be allowed to file less frequently.

Sales tax returns typically report all sales, taxable sales, sales by category of exemption, and the amount of tax due. Where multiple tax rates are imposed , these amounts are typically reported for each rate. Some states combine returns for state and local sales taxes, but many local jurisdictions require separate reporting. Some jurisdictions permit or require electronic filing of returns.

Purchasers of goods who have not paid sales tax in their own jurisdiction must file use tax returns to report taxable purchases. Many states permit such filing for individuals as part of individual income tax returns.

Do States With No Income Tax Outperform Other States

Four of the top 10 states with the strongest economic outlook do not charge an income tax, according to 2021 rankings from the American Legislative Exchange Council, a think tank focused on free markets and limited government.

Part of that might be because theyre attracting more workers. States that dont have an income tax gained a net inflow of 285,000 new residents leaving from the 41 states that did charge an income tax, according to 2018 figures from the IRS, the most recent for which data is available.

An analysis from the Tax Foundation using Commerce Department data shows that states without an income levy grew at twice the national rate over the past decade, while gross state product grew 56 percent faster in those locations over the same period.

They tend to be outshining some of their peers that do have income taxes, says Katherine Loughead, senior policy analyst at the Tax Foundation who focuses on state tax policy.

Others, however, point out that missing income tax revenue might come with a cost particularly when it comes to infrastructure and education spending. South Dakota and Wyoming, for example, spent the least on education of all states, according to a 2021 analysis from the Census Bureau.

Also Check: How Long To Get Tax Refund 2022

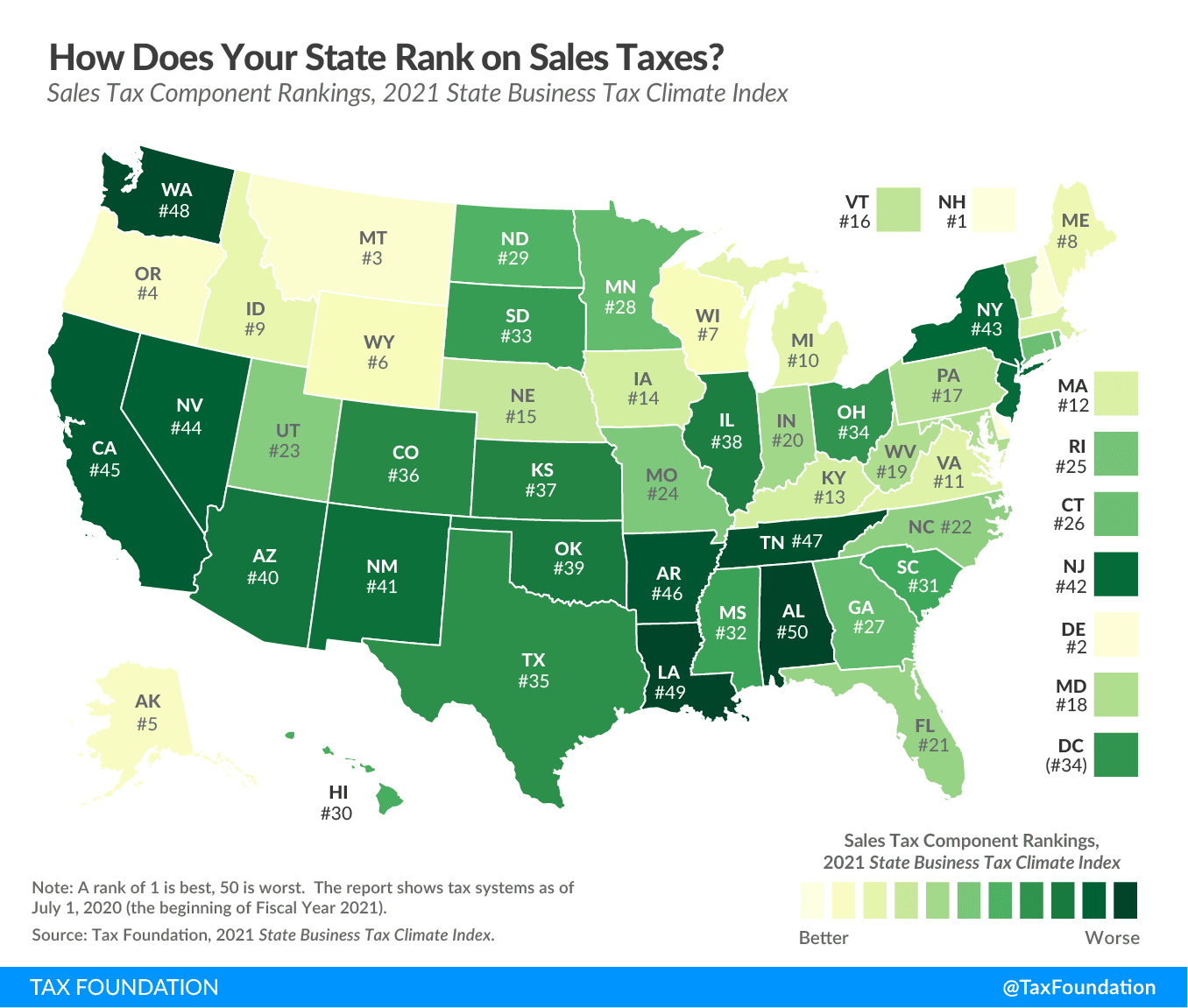

The Role Of Competition In Setting Sales Tax Rates

Avoidance of sales tax is most likely to occur in areas where there is a significant difference between jurisdictions rates. Research indicates that consumers can and do leave high-tax areas to make major purchases in low-tax areas, such as from cities to suburbs. For example, evidence suggests that Chicago-area consumers make major purchases in surrounding suburbs or online to avoid Chicagos 10.25 percent sales tax rate.

At the statewide level, businesses sometimes locate just outside the borders of high sales-tax areas to avoid being subjected to their rates. A stark example of this occurs in New England, where even though I-91 runs up the Vermont side of the Connecticut River, many more retail establishments choose to locate on the New Hampshire side to avoid sales taxes. One study shows that per capita sales in border counties in sales tax-free New Hampshire have tripled since the late 1950s, while per capita sales in border counties in Vermont have remained stagnant. Delaware actually uses its highway welcome sign to remind motorists that Delaware is the Home of Tax-Free Shopping.

State and local governments should be cautious about raising rates too high relative to their neighbors because doing so will yield less revenue than expected or, in extreme cases, revenue losses despite the higher tax rate.

How To Deal With Sales Tax As A Remote Seller

If you are doing business as an ecommerce seller, your first step is to determine whether you have nexus in any states. If your sales are still small, you may be able to do this yourself.

The basic steps are:

- Determine where you have sales tax nexus

- Register for the appropriate sales tax permit.

- Choose and implement a service or software to automate tax collection and calculation.

- Track due dates and file sales tax returns according to each states schedule.

Don’t Miss: How Do I Get My Tax Transcripts

What Is Sales Tax

Sales tax is a tax applied to the sale of goods or services – traditionally charged to the final user .

For example, companies rely on the government to define nexus – the physical presence of a company in a state – when determining taxes for online retailers. Some employees can constitute a nexus in a state if they work primarily out of that state – like Amazon for example. In New York state, recent laws called “Amazon laws” require companies to pay sales tax even if they aren’t based in a specific state.

However, other kinds of sales tax, like excise and value-added tax, add on to the consumer’s budget. Excise tax, sometimes colloquially coined “sin tax,” are taxes on products like cigarettes or alcohol.

Value-added tax essentially charges incremental tax for each level of production of an end good. However, in the U.S., conventional taxes are primarily used.

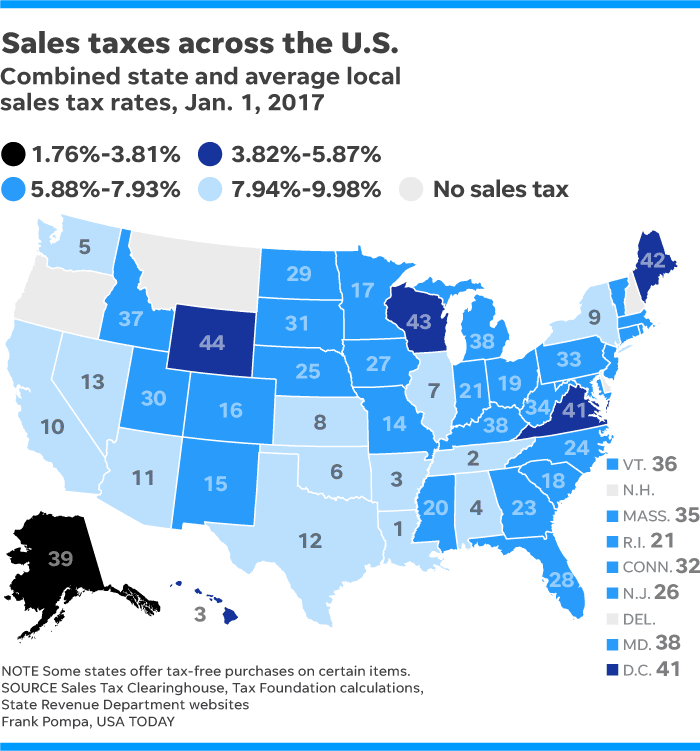

According to USA Today, Americans generally pay a sales tax of between 2.9% and 7.25% of the price of the good in most states.