What Is The Most Tax Friendly State

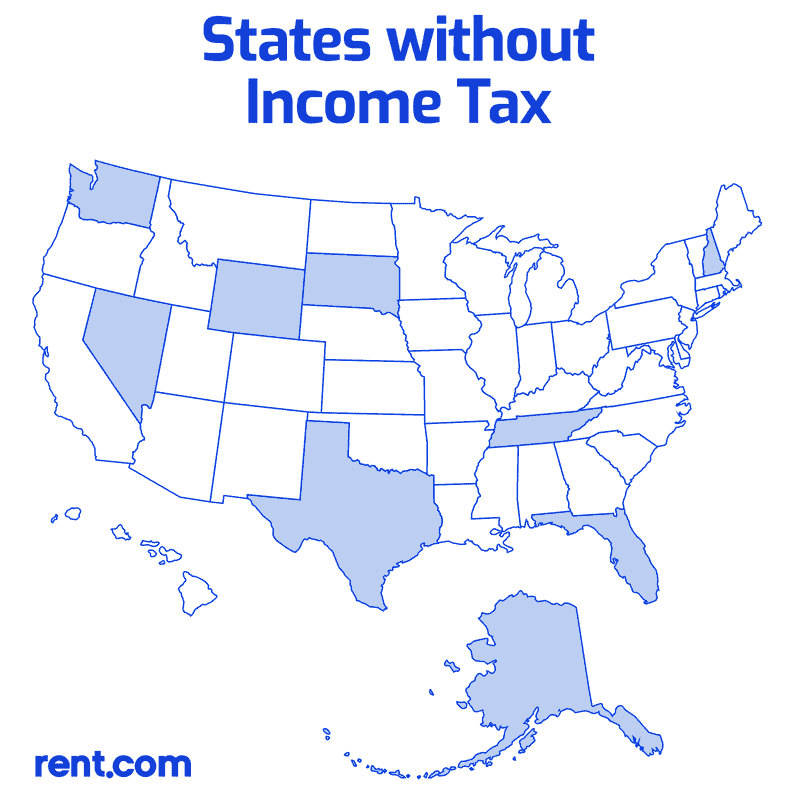

Everybody wants a lower tax bill. One way to accomplish that might be to live in a state with no income tax. As of 2021, our research has found that seven states Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyominglevy no state income tax. 1 New Hampshire doesnt tax earned wages.

Total Tax Burden: 684%

New Hampshire does not tax earned income but does tax dividends and interest. New Hampshires Senate passed legislation to phase out the investment income tax by 1% per year over five years, with full implementation by 2027. The state has no state sales tax but does levy excise taxes, including taxes on alcohol, and its average property tax rate of 1.86% of property values is the third highest in the country.

Even so, New Hampshires total tax burden is just 6.84%, according to WalletHub, ranking the state fifth in the nation. The state ranks fourth on the U.S. News & World Report list of Best States to Live In and 38th in the nation for affordability.

Although New Hampshire spent more on education than any other state on this list at $17,462 per pupil in 2019, its outlay was among the lowest in the northeastern region of the U.S. Additionally, in 2015 it earned a grade of D from the Education Law Center for its school funding distribution.

New Hampshire received a marginally better grade of C- for its infrastructure in 2017. At $9,589 per capita in 2014, its healthcare spending is the ninth highest in the nation.

Education In States With No Income Tax

South Dakota and Wyomingâtwo states that donât have an income taxâspent the least of all states on education, according to a 2021 Census Bureau analysis.

The lack of income tax revenue also impacts higher education. New Hampshire has some of the highest costs for in-state university tuition and provides the least funding for public colleges and universities.

Don’t Miss: How To Avoid Paying Taxes On Crypto

Combined Sales And Income Tax Leaders

The Tax Foundation interprets individual tax burden by what taxpayers actually spend in local and state taxes, rather than report these expenses from the state revenue perspective used by the Census Bureau. Its 2019 State and Local Tax Burden Rankings study reported that Americans paid an average rate of 9.9% in state and local taxes.

According to the foundation, the top five states with the highest state and local tax combinations are:

- California and Wisconsin 11.0%

The same states have ranked as the top three consistently since 2005, according to the foundation.

Although taxes may not be the first thing you consider when deciding where to live, knowing the tax situations of the locations you’re considering for a move could help you save in the long-run, especially when retiring.

Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted.File your own taxes with confidence using TurboTax. Just answer simple questions, and well guide you through filing your taxes with confidence.Whichever way you choose, get your maximum refund guaranteed.

Why Do States Charge A State Tax

Following the adoption of the U.S. Constitution, the federal government was granted the authority to impose taxes on its citizens. Each state also retained the right to impose what kind of tax it wanted, excluding any that are forbidden by the U.S. Constitution as well as its own state constitution. These states fund their governments through tax collection, fees, and licenses.

Also Check: Capital Gains Vs Income Tax

Texas Sales Tax Deadlines

Once a businesss sales tax application has been approved, it will receive a letter with instructions on how often it must file a sales tax return. Returns may be due monthly, quarterly, or yearly.

Monthly Filers: Due on the 20th of the following month.

| Period |

|---|

Annual Filers: Due on January 20 for the previous years taxes.

If a due date falls on a Saturday, Sunday, or legal holiday, the deadline is extended until the next business day.

Consider Sales Tax Software

You may have noticed the implication of having nexus for online sales for every state into which you could potentially deliver products or services. And then there are many localities with sales taxes. The way to deal with this almost unimaginable complexity is to get sales tax software.

Common software companies like Avalara and TaxJar automate the process of charging sales tax on your transactions, and they help you by tracking these taxes for each state and locality so you know how much and when to pay these taxes. They also follow rate changes, so you dont have to.

Don’t Miss: 401k Withdrawal Tax Calculator Fidelity

Which States Don’t Have Sales Tax

Even though there may be drawbacks, the five states that don’t have sales tax are Alaska, Delaware, Montana, New Hampshire and Oregon.

Still, while all of these states do not impose sales tax, some of them do permit localities to levy some sales tax. Additionally, many states with low sales tax have higher income taxes.

Where To Buy Physical Gold Or Silver

Buy gold or silver from a reputable precious metals dealer. A business that has been around for a long time, and therefore has an established reputation.

Some of you prefer your own local walk-in shop. Maybe youve established a relationship there, and all is good.

On the other hand, some of you dont have that luxury . Ive been in that situation a number of times depending on where I have lived.

So, I researched gold and silver dealers who also sell online. Ive used several over the years. Never had a problem. I was sure to only choose those who have been around for a long time!

Okay, full disclosure, the following gold and silver bullion dealer is one of our sponsors here. However, theyre highly reputable, a family business since 1974:

Oh, and theres no counterparty risk to physical gold or silver. None. Zero.

Before I go, I cant help but recall the following saying

Gold is the money of kings, silver is the money of gentlemen, barter is the money of peasants but debt is the money of slaves.

Read Also: Tax Deduction For Charitable Donations

Total Tax Burden: 510%

Alaska has no state income or sales tax. The total state and local tax burden on Alaskans, including income, property, sales, and excise taxes, is just 5.10% of personal income, the lowest of all 50 states.

All residents of Alaska receive an annual payment from the Alaska Permanent Fund Corp. made up of revenue and investment earnings from mineral lease rentals and royalties. The per citizen dividend payment for 2021 was $1,114.

The cost of living in Alaska is high, though, mostly due to the states remote location. Alaska also levies the second-highest beer tax of any state in the union at $1.07 per gallon, bested only by Tennessee. The state ranks 47 out of 50 in affordability and 45 out of 50 on the U.S. News & World Report list of Best States to Live In.

Alaska has one of the highest and fastest-rising healthcare costs of any state in the U.S. That said, at $11,064 per capita in 2014the most recent year the Centers for Medicare and Medicaid Services Office of the Actuary reported statisticsit also spent the most on healthcare, excluding the District of Columbia.

At $18,394 per pupil, it also spent the most on education of any state in the Western U.S. in 2019. In 2017, Alaskas infrastructure received a grade of C- from the American Society of Civil Engineers .

Montana And Oregon Advise Businesses To Comply With Applicable Online Sales Tax Laws

Tax departments in Montana and Oregon have advised resident businesses to comply with applicable economic nexus laws in other states.

Shortly after the Wayfair decision, the Montana Department of Revenue suggested online retailers in Big Sky Country seek competent legal advice on how to proceed with collecting and remitting sales tax for sales tax states.

Likewise, the Oregon Department of Revenue said, The Wayfair decision does affect Oregon businesses selling products online to buyers in a state that requires online retailers to collect sales tax. It recommended Oregon online retailers contact states where they have customers, or seek legal advice on how to proceed with collecting and remitting sales tax.

You May Like: Do 16 Year Olds Have To File Taxes

Is It Cheaper To Live In A State With No Sales Tax

Unfortunately, you can’t have it all.

While these states are exempt from sales tax for the most part , several of them make up for the savings in other ways.

Oregon, for example, has one of the higher income taxes in the country, coming in at around 9.9% – even taxing most retirement income .

Additionally, other states like Tennessee are thought of as some of the most tax efficient states in the country – because, while it does have a hefty sales tax , the Volunteer State has no income tax.

The bottom line is that, while states that do not impose sales tax may seem to save their residents extra cash, they likely make up for it in other ways – either in income or various other taxes for individuals, or higher prices of goods charged by businesses.

Texas Sales Tax By The Numbers:

Texas has ahigher-than-average sales tax, includingwhen local sales taxes from Texass 988 local tax jurisdictions are taken into account.

Rankings by Average State + Local Sales Tax:

Ranked 14th highest by combined state + local sales tax

Ranked 14th highest by per capita revenue from state + local sales taxes

Rankings by State Sales Tax Only:

Ranked 7th highest by state sales tax rate

Ranked 13th highest by per capita revenue from the statewide sales tax

Texas has a statewide sales tax rate of 6.25%, which has been in place since 1961.

Municipal governments in Texas are also allowed to collect a local-option sales tax that ranges from 0% to 2% across the state, with an average local tax of 1.69% .The maximum local tax rate allowed by Texas law is 2%.You can lookup Texas city and county sales tax rates here.

This page provides an overview of the sales tax rates and laws in Texas. If you are a business owner and need to learn more about things like getting a sales tax permit, filing a sales tax return, or making tax-exempt purchases for resale see the Texas Sales Tax Handbooks Table of Contents above.

Don’t Miss: What Is Real Estate Tax

Total Tax Burden: 819%

The Lone Star State loathes personal income taxes so much that it decided to forbid them in the states constitution. Still, because infrastructure and services must be paid for somehow, Texas relies on income from sales and excise taxes to foot the bill.

Sales tax can be as high as 8.25% in some jurisdictions. Property taxes are also higher than in most states, the net result of which is a total tax burden of 8.19% of personal income. Nevertheless, Texans overall tax bite is still one of the lowest in the U.S., with the state ranking 19th. Texas is average for affordability at 22nd in the nation, but it was ranked 31st by U.S. News & World Report on the Best States to Live In list.

Texas spent $9,827 per pupil on education in 2019, ranking it below average among the 17 Southern states, and it received a D grade for its school funding distribution in 2015. In 2021 the ASCE awarded it a grade of C for its infrastructure. Texas spent $6,998 per capita on healthcare in 2014, the seventh-lowest amount in the U.S.

One advantage of living in a no-tax state is that the $10,000 cap on state and local tax deductions imposed by the Tax Cuts and Jobs Act will likely not have as great an impact as it does on residents of high-tax states, such as California and New York.

Tax Deadlines And What To Know About Online Tax Software

Tax season is well underway as the IRS started accepting and processing tax returns on Jan. 24 for the 2022 tax season.

Taxes are traditionally due on April 15, but because April 15 falls on a holiday for Washington D.C., tax day this year is April 18, 2022. While most state deadlines are the same day, a few states have bumped their deadline back a few extra weeks. You can check your state’s filing deadline here.

The federal tax deadline is not far away meaning it’s time to start collecting your 2021 tax documents. And rather than mail your taxes to the IRS, you may consider signing up for an online tax service like H& R Block or TurboTax to ensure your taxes are securely filed.

It’s important to select the right tax platform based on your tax needs as each of them are designed for specific tax returns ranging from simple tax returns to complex returns.

Here are our favorite tax platforms:

- Best overall tax software: TurboTax

Recommended Reading: Work At Home Tax Credit

States Without Sales Tax 2022

Sales tax is a type of levy imposed by the government at the point of sale for goods or services. To simplify, when you make a purchase, the sales tax is added to the cost of your purchase. For example, if a state has a 5% sales tax and you purchase an item that costs ten dollars, you will pay $10.50 at the register.

The amount of sales tax varies from state to state. Some states 38 as of November 2018 also have local sales taxes. The highest average combined state and local tax rates are in Tennessee, Louisiana, Arkansas, and Washington, each of which has combined taxes of over 9%. At the state level, California has the highest tax rate at 7.25%. Four states fall only slightly behind with state sales tax rates of 7%. Those states are Tennessee, Indiana, Mississippi, and Rhode Island.

Forty-five states plus Washington, D.C., have statewide sales tax. The states that do not have state sales taxes are: Alaska, Delaware, Montana, New Hampshire, and Oregon. Even though Alaska does not have a state sales tax, localities can charge local sales taxes.

How Is Sales Tax Calculated On A Car Lease

You must pay sales tax when you lease a car. In most states, you pay sales tax on the monthly lease payment not the price of the car.

Sales tax for a leased vehicle is calculated based on the states tax percentage and the cost of the lease payments.

Imagine that your monthly lease payment is $500 and your states sales tax on a leased car is 6%. $500 X .06 = $30, which is what you must pay in sales tax each month. Therefore, your total monthly lease payment would be $500 + $30, or $530 with sales tax.

You May Like: Taxes Minimum Income To File

Is A Sales Tax Permit The Same As A Resale Certificate In Texas

No. These are two different documents. When a business has a sales permit, it is part of the states tax-collection process, in essence collecting the tax on the states behalf and remitting it to the Texas Comptroller.

A Resale Certificate is a document that allows a business owner to buy products from a wholesaler for the purposes of reselling to your customers. Purchasing inventory for resale does not require a business owner to pay a tax, as long as they have a resale certificate. The sales tax obligations will be paid by the customers purchasing the item from your store or business. Resale Certificates for Texas businesses can be obtained by completing Form 01-339 .

Sales Tax Is A Sneaky Tax

Stephen lives in California, which charges the highest sales tax in the nation: 7.25 percent. But even those states that tout no sales tax still find ways to get you. New Hampshire? Youll pay 9 percent on meals prepared in restaurants and on rental cars. Montana? If you go camping, youll pay a lodging and usage tax of up to 7 percent.

Sales taxes are different from income taxes in one big way: While most states and the federal government charge income taxes, the federal government is totally out of the sales tax game. What this means: State governments hew pretty closely to the standards set in federal income taxes. Theres less variety in the rules because its just easier to tweak rules that already exist.

Sales taxes, on the other hand, are the Wild West of taxes. Without any federal guidance, state sales taxes change on a dime, cost you many dollars, and require deep dives into mundane details to figure them all out. For example, Arizona has something called transaction privilege tax, Florida has a discretionary sales surtax, and Illinois has a retailers occupation tax.

Trust me, you dont want me explaining all those right now. In fact, I have a theory: States make these sales taxes confusing on purpose because its easier to hide just how much theyre taking from us. Its hard to lead a tax revolt if you dont understand the taxes in the first place.

Also Check: Pay Federal Estimated Tax Online

A Guide For States That Require Internet Sales Tax

Do you sell online? If so, youve probably tried to figure out how internet sales taxes on products or services you sell to customers outside your state work. Almost all states require larger online sellers to collect and pay sale taxes on internet sales.

But what does this mean for your business? Learn more about the current state of online sales tax laws and how a small business can navigate tax complexities.