Why Do State Income Taxes Matter

State income taxes are an important part of a states overall budget that helps provide you and other residents as well as visitors with essential components of living. This could include things like road repair, infrastructure maintenance, educational systems, government services and more. In fact, individual income taxes are a major source of state government revenue, accounting for 37% of state tax collections, according to the Tax Foundation.

You can choose to live and work in a state with lower or no income taxes in order to reduce your tax obligation but remember there may be trade-offs. Before you decide to relocate for a job or to avoid state-level income taxes, research other cost-of-living factors in the state. This includes things like sales tax and property taxes .

Its also a good idea to crunch these numbers along with other cost-of-living considerations to learn how much buying power your income has in that state.

The Benefits Of Living In A State With No Income Tax Comes Down To Your Personal Finances

Whether you should move to a state with no income tax depends on your personal financial situation and your individual priorities. Families with college-aged students might not want to move to a state with no income tax if it means paying more tuition. Meanwhile, if the bulk of your household budget goes toward groceries and clothing items that are sales taxable you might not save much money in the long run. Statesinheritance taxes should also be taken into consideration, especially if youre nearing retirement and hoping to eventually pass down an asset while considering a move.

As the economy rebounds from the pandemic and remote work becomes increasingly more common, Americans might find that they can live and work in different places than they could before the outbreak. But if a state with no income tax has limited employment opportunities for your industry, you might want to hold off on relocating just so you can reduce much youre paying in taxes every year.

At the same time, higher-income earners might benefit from living in a state with no income tax. And if you dont own property, you might not feel a big difference in your tax burden.

You do see a trade-off when it comes to the major taxes that states levy, Loughead says. if youre a really high-income individual, youre probably going to think twice before living in a state with high income taxes, especially if theres a bordering state where you can reside in.

What Is The Income Tax Rate

The federal income tax is a progressive tax, which means that the more income you earn, the more you’re taxed. The tax rate is divided into brackets, and you pay taxes based on the brackets your income falls into. For example, the 2022 tax brackets are 10%, 12%, 22%, 24%, 32%, 35%, and 37%. If your taxable income is $45,000 in 2022 and you’re a single filer, you would pay 10% on your income up to $10,275, 12% on $10,275 to $41,775 in income, and 22% on your income over $41,775.

Don’t Miss: Tax Credits For Electric Vehicles

Why Do These States Have No Income Tax

As income tax is organised at the state level, it is as simple as states deciding that they do not want to impose it.

What this means is the state hikes taxes on products and other things people can buy to make up the shortfall. This can make these items more expensive and in some cases have unseen consequences. For example, Washington state has a tax of 49.4 cents per gallon on gasoline, one of the highest rates in the nation.

BREAKING: Florida Senate, on a 23-16 vote, just passed legislation ENDING Disneys tax privilege, self-governing power & special exemption status.

Tim Swain

Having no income tax comes with its problems. In 2015, Alaska saw one of its largest budget deficits in years. In 1980 the state had eliminated state income tax, as it was able to generate enough revenue through the extraction and commercialization of oil.

However, as many countries that depend on natural resources can attest, problems started when the price of oil began to fall. At the time of the crisis, the state saw a $4 billionbudget deficit with the Commissionaire of the Alaska Department of Revenue saying that for every $5 drop in oil prices, the state loses $120 million.

On the other side, the recent surge in oil price as a result of the war in Ukraine means Alaska can get a lot more money from the taxing of one commodity.

States With No Individual Income Tax

Nine U.S. states do not level a broad-based individual income tax. Some of these do tax certain forms of personal income:

Also Check: When Is Tax Returns Due

States With No Business Tax: Everything You Need To Know

There are states with no business tax. Seven states have no income tax, two others have very low income tax, and five have no sales tax.3 min read

There are states with no business tax. Seven states have no income tax, two others have very low income tax, and five have no sales tax. Several of the states treat only some items as tax-exempt, and there are two states that have neither income tax nor sales tax.

Total Tax Burden: 697%

This popular snowbird state features warm temperatures and a large population of retirees. Sales and excise taxes in Florida are above the national average, but the total tax burden is just 6.97%the sixth-lowest in the country.

Florida ranks 31st in affordability due to its higher-than-average housing costs. Still, Florida came in at 10 on the U.S. News & World Report Best States to Live In list.

In 2019, Florida was one of the lowest states in terms of school system spending, at $9,645 per pupil. In 2021 the ASCE gave Florida a C grade for its infrastructure. Six years earlier, Florida received the same grade from the Education Law Center for the fairness of its state school funding distribution. In 2014, its healthcare spending per capita was $8,076, $31 more than the national average.

Also Check: State Withholding Tax Table 2021

Are States With No Income Tax Outperforming The Other State

You need to ask if having no income taxes helps the state to do better than other states. Looking at the research, four of the top ten states with the most substantial economic projections are those states that do not have an income tax. That can be for a variety of different reasons.

No income tax states attract workers and businesses. People want to work in a place with fewer taxes, and it is beneficial to the bottom line of your company, and individuals enjoy the ability to work without paying more in taxes.

Texas, Washington, Nevada, and Florida are ranked in some of the fastest-growing states in the nation. As the economy grows within these states, there will be more incentive for other people to move there, allowing more income to come from sales tax and property tax.

Having no income taxes could come at a cost for these states. With less income tax, you will have less revenue to invest into education and infrastructure. South Dakota and Wyoming are at the bottom of the 50 states on spending on education. Parents care about their children’s future education, and it may be a better bet to have children in a state that has better-funded education.

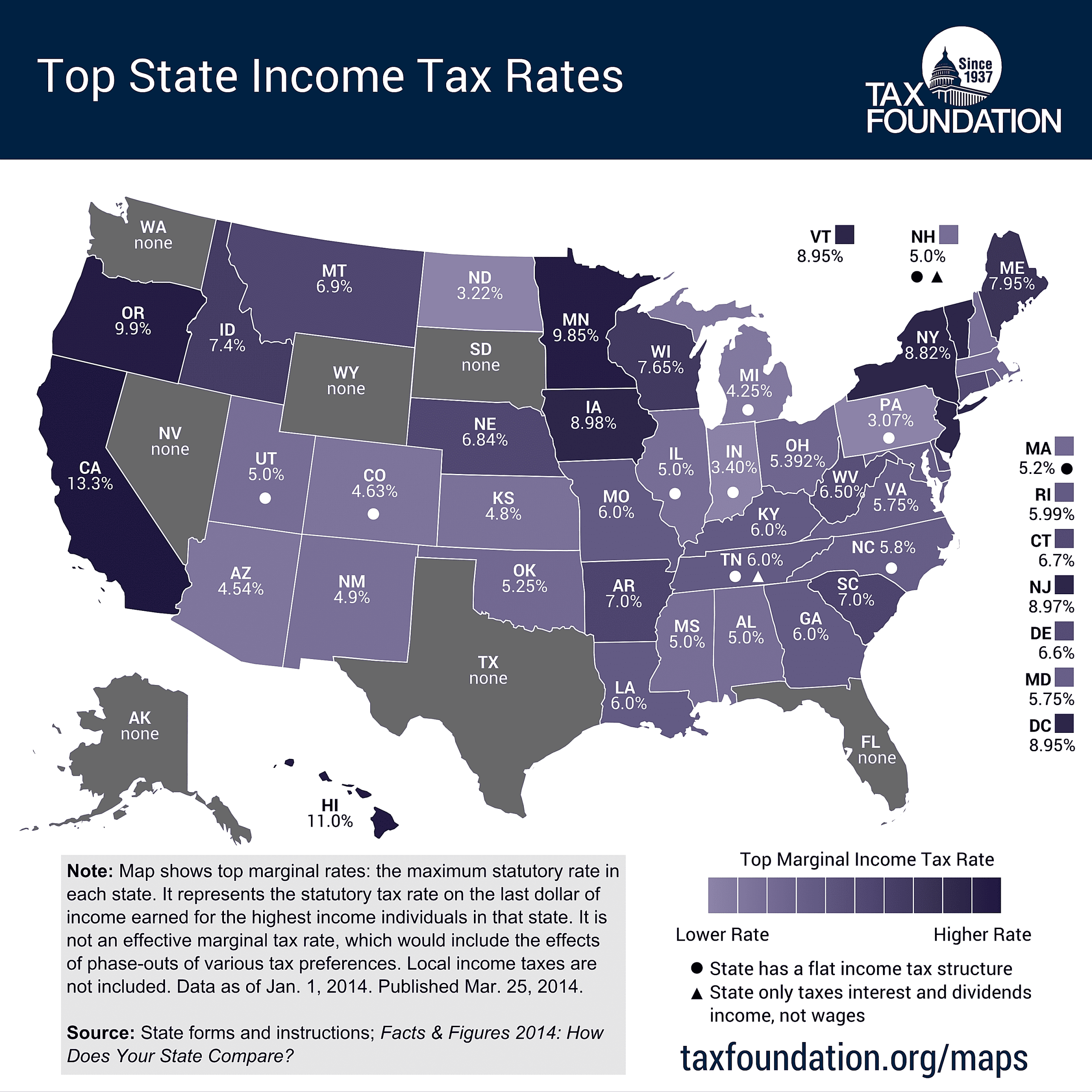

Us State Income Tax Rates

The general approach to US state income tax rates is done in three different ways.

- Residents and those working in a specific state either do not pay any income tax at all

- They pay a flat rate of income tax, including on interest and dividends, and this income tax rate does not change based on the level of earnings

- Or, the state you live in imposes a progressive tax. This means that people with higher taxable incomes pay higher state income tax rates, and those with lower incomes pay less tax.

Most people live and work in the same state for the entire year. This is your state of residence and determines the rate of income tax you pay. You may have a job that requires travel to other states, but this does not typically affect the rate of tax you pay on your income, it is the state you live in that determines this.

However, if you lived in one state for part of the year and moved to another state, you may owe state income tax to two different states at two different rates. Similarly, if you work in one state and own income-generating property in another state, you may be liable to pay income tax in more than one state, which may require more than one tax return.

Read Also: Filing Taxes With No Income

Which States Have No State Income Tax

8 Min Read | Jan 17, 2022

Raise your hand if you like paying taxes. Anyone? Anyone? Bueller? Bueller?

Even though most folks would rather get a root canal than pay their income taxes, thats never stopped the government from trying to get their hands on your hard-earned moneyand were not just talking about the federal government.

Most state governments are more than happy to tax your income on top of what you already owe Uncle Sam. What gives?!

However, there are a handful of states with no state income tax at allnine of them, to be exact. Lets take some time to learn more about them, shall we?

Taxes On Retirement Income

If you’re retired military, 34 states do not tax your military pension nine of these are the states without income taxes or ones that only tax dividends and interest. Income tax on traditional retirement is limited in 27 states, depending on your income.

Other states have partial or full exemptions for people who meet specific income requirements. For example, Kansas exempts Social Security income if your adjusted gross income from all sources is $75,000 or less.

Don’t Miss: Local County Tax Assessor Collector Office

Why Do States Charge A State Tax

Following the adoption of the U.S. Constitution, the federal government was granted the authority to impose taxes on its citizens. Each state also retained the right to impose what kind of tax it wanted, excluding any that are forbidden by the U.S. Constitution as well as its own state constitution. These states fund their governments through tax collection, fees, and licenses.

Is It Cheaper To Live In States With No Income Tax

Regardless of whether thereâs an income tax where you live, states still need resources to pay for things. If your state doesnât collect income taxes, you might pay more in sales tax, property tax or vehicle registration. The cost of living can also be a consideration.

Florida, for example, doesnât have an income tax. But its other state and local taxes rank 27th highest in the nation.

Alaska also has low taxes, but its remote location makes it an expensive place to live.

Recommended Reading: Look Up State Tax Id Number

Total Tax Burden: 834%

Washington hosts a young population, with only 15.9% of its residents over age 65, and many major employers, thanks to the lack of state-mandated corporate income tax . Residents do pay high sales and excise taxes, and gasoline is more expensive in Washington than in most other states. The state comes in at 26 out of 50, with a total tax burden of 8.34%.

Unusually higher-than-average living and housing costs hurt Washingtonians, putting the state at 44th in terms of affordability. For some residents that might not matter, however, because their state was ranked by U.S. News & World Report as the overall best state to live in once again for 2021.

Washington spent $7,913 per capita on healthcare in 2014, $132 below the national average. Conversely, at $14,223 per pupil, it spent more on education than most in 2019, though it received a C grade for its school funding distribution four years earlier. In 2019, Washington earned the same grade for its infrastructure from the ASCE.

Analysis Shows Population Growth In Lower Tax States

For many, the pandemic has altered their perceptions about where they want to live and where they can live. Millions of city-weary residents aching for more space have moved since the start of the pandemic.

Analysis of state tax burden rates and the change in population from 2020 to 2021, as estimated by the U.S. Census Bureau shows a negative correlation. The lower the state and local tax burden, the higher the population growth in 2021.

Four of the five states with an A grade in tax friendliness had population growth at or above the national average.

Of the states with an E grade, two out of three had population declines in 2021. Of the nine states with a D grade, only two New Hampshire and Vermont had population growth higher than the national average.

The included expert insights section on this page has advice on how to manage moving and taxes.

Read Also: State Of New Jersey Tax Refund

Florida Taxes A Quick Look

Major taxes collected in Florida include sales and use tax, intangible tax and corporate income taxes. Information regarding these and additional taxes can be located from the list below. There is no personal income tax in Florida.

- Florida Sales Tax: Florida sales tax rate is 6%.

- Florida State Tax: Florida does not have a state income tax.

- Florida Corporate Income Tax: Corporations that do business and earn income in Florida must file a corporate income tax return .

- Florida Property Tax: Florida Property Tax is based on market value as of January 1st that year.

Relative Versus Absolute Indexing

The State Business Tax Climate Index is designed as a relative index rather than an absolute or ideal index. In other words, each variable is ranked relative to the variables range in other states. The relative scoring scale is from 0 to 10, with zero meaning not worst possible but rather worst among the 50 states.

Many states tax rates are so close to each other that an absolute index would not provide enough information about the differences among the states tax systems, especially for pragmatic business owners who want to know which states have the best tax system in each region.

Comparing States without a Tax. One problem associated with a relative scale is that it is mathematically impossible to compare states with a given tax to states that do not have the tax. As a zero rate is the lowest possible rate and the most neutral base, since it creates the most favorable tax climate for economic growth, those states with a zero rate on individual income, corporate income, or sales gain an immense competitive advantage. Therefore, states without a given tax generally receive a 10, and the Index measures all the other states against each other.

Normalizing Final Scores. Another problem with using a relative scale within the components is that the average scores across the five components vary. This alters the value of not having a given tax across major indices. For example, the unadjusted average score of the corporate income tax component is

You May Like: Irs How To Pay Taxes

Ways To Recoup Revenue From Lost Tax Income

The local governments in these states have other ways to make up the revenue they aren’t making from income and sales tax. These other ways to adjust for lost revenue include higher property taxes and increasing either income tax or sales tax. Local governments might also charge more for other services they provide. Local jurisdictions are also able to set their own sales tax rates to recoup money from local shoppers.

What Are The Income Tax

Right now, the nine states that donât collect personal income taxes are Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming.

Alaska

Alaska doesnât have a state sales tax or income tax. Instead, it relies on property taxes for roughly 50% of its state and local tax revenue, according to a 2020 report by taxfoundation.org. Itâs also the state with the sixth-highest cost of living, according to a 2022 report by the Missouri Economic Research and Information Center , in part because of the high cost of goods and services, such as groceries and utilities.

Florida

Florida relies on property taxes and state taxes for much of its revenue, but the rates of those taxes is about average compared to the rest of the country. Despite being a popular retirement haven, Floridaâs cost of living is slightly above average, with groceries, housing and utilities representing the highest costs of living.

Nevada

Nevada has a state and local sales tax of 8.23%, the 13th-highest in the nation. High housing costs also contribute to its higher-than-average cost of living index, according to MERIC.

New Hampshire

Property taxes account for roughly 64% of New Hampshireâs state and local tax revenue, which makes sense considering it has the third-highest property tax rate in the country. Its cost-of-living index is also high, making it the 15th most expensive state to live in.

South Dakota

Tennessee

Texas

Washington

Wyoming

Don’t Miss: What Does It Mean To Write Off Taxes