Bottom Line On Tax Returns

An accurate income tax return estimator can keep you from banking on a refund thats bigger in your mind than the real refund that hits your bank account. It can also give you a heads-up if youre likely to owe money. Unless youre a tax accountant or someone who follows tax law changes closely, its easy to be surprised by changes in your refund from year to year. Use the tool ahead of time so you arent already spending money you may never see. You can also run the numbers through a tax refund calculator earlier in the year to see if you want or need to make any changes to the tax withholdings from your paycheck.

How To Check On Your State Tax Refund

Any state tax refund you have coming can come at a variety of times, depending on what state you filed in. Most of the time, state returns are processed faster than federal returns. Each state uses a slightly different system to let taxpayers check their tax refund status. In general though, there are two pieces of information that you will need in order to check on your refund.

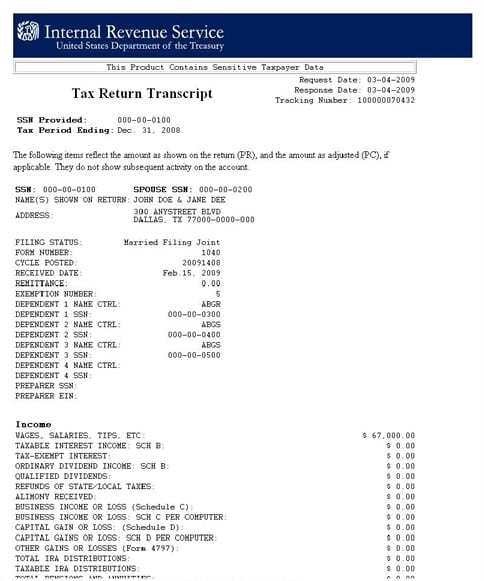

The first important information is your Social Security number . If you do not have a SSN, most states allow you to use a few different types of ID. One common type is an Individual Taxpayer Identification Number . If you file a joint return, use whichever ID number appears first on the return.

Almost all states will also require you to provide the amount of your refund. Most states ask you to round your return to the nearest whole number but some states, like Vermont, will ask for the exact amount of your refund.

These two things will be enough for you to check in some states. Other states may also require your date of birth, the year of the return, your filing status or your zip code. Below is a run down of how you can check your refund status in each state that collects an income tax.

Note that Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming have no state income tax. New Hampshire and Tennessee do not tax regular wages and income. Tennessee has phased out tax on income from dividends and investments and New Hampshire has proposed legislation to do the same.

Is There Tax Refund In The Philippines

There is no tax refund in the Philippines.

Your employer may withhold income taxes from your paycheck if you are an employee. If the total amount of income taxes due exceeds the amount withheld, an extra payment will be deducted from your paycheck. If you overstate the amount, your employer will compensate you for the difference. In the Philippines, the average tax rate is 15.6%, with a of 4.0%. As a result, the immediate additional income you receive will be taxed at this rate. Your employer will withhold income taxes from your paycheck if you are an employee.

You May Like: Tax Short Term Capital Gains

Wheres My State Tax Refund Idaho

Learn more about your tax return by visiting the Idaho State Tax Commissions Refund Info page. From there you can click on Wheres My Refund? to enter your information and see the status of your refund.

Taxpayers who e-file can expect their refunds in about seven to eight weeks after they receive a confirmation for filing their states return. Those who file a paper return can expect refunds to take 10 to 11 weeks.

If you receive a notice saying that more information is necessary to process your return, you will need to send the information before you can get a refund. Once the state receives that additional information, you can expect it to take six weeks to finish processing your refund.

Where Is My Amended Tax Return And When Will I Get My Refund Checking 2022 Payment Status And Direct Deposit

While the IRS promises to have regular season tax returns and associated refunds processed within 21 days for the vast majority of filers, it does take quite a bit longer for them to process amended tax returns and associated refund payments.

As discussed below, many tax payers have been waiting months or years to get their amended return processed due to IRS backlogs and capacity constraints.

Covered in this Article:

You May Like: How Long To Receive Tax Refund 2022

How To Calculate Your Tax Refund

Every year when you file your income taxes, three things can happen. You can learn that you owe the IRS money, that the IRS owes you money or that youre about even, having paid the right amount in taxes throughout the year. If the IRS owes you money it will come in the form of a tax refund. However, if you owe the IRS, youll have a bill to pay. SmartAsset’s tax return estimator can help you figure out how much money could be coming your way, or how much youre likely to owe.

Why would the IRS owe you a tax refund? There are several possible scenarios. You might have overpaid your estimated taxes or had too much withheld from your paycheck at work. You might also qualify for so many tax deductions and tax credits that you eliminate your tax liability and are eligible for a refund. A tax return calculator takes all this into account to show you whether you can expect a refund or not, and give you an estimate of how much to expect.

Looking For Information About Your Tax Refund

E-file and sign up for Direct Deposit to receive your refund faster, safer, and easier! You can check the status of your refund using IRS Wheres My Refund?

Not using e-file? You can still get all the benefits of Direct Deposit by getting your tax refund deposited into your account. Simply provide your banking information to the IRS at the time you are submitting your taxes.

Convenience, reliability and security. No more special trips to your institution to deposit your check a nice feature if you are busy, ill, away from home, located far from a branch or in a place where parking is hard to find. You no longer need to wait for your check to arrive in the mail. Your money will always be in your account on time. If you move without changing financial institutions, you will not have to wait for your check to catch up with you. You do not have to worry about lost, stolen or misplaced checks.

We issue most refunds in less than 21 calendar days.

Use the IRS2Go mobile app or the Wheres My Refund? tool. You can start checking on the status of your tax return within 24 hours after we have received your e-filed return or 4 weeks after you mail a paper return.

The Treasury Bureau of the Fiscal Service’s Kansas City Regional Financial Center will be disbursing all tax refund direct deposits on behalf of the IRS. Information in the ACH Batch Header Record can be used to identify an IRS tax refund, as follows:

Direct Deposit

Don’t Miss: Do 16 Year Olds Have To File Taxes

Find Out Which Payments You Received

To find the amounts of your Economic Impact Payments, check:

Your Online Account: Securely access your individual IRS account online to view the total of your first, second and third Economic Impact Payment amounts under the Economic Impact Payment Information section on the Tax Records page.

IRS EIP Notices: We mailed these notices to the address we have on file.

- Notice 1444: Shows the first Economic Impact Payment sent for tax year 2020

- Notice 1444-B: Shows the second Economic Impact Payment sent for tax year 2020

- Notice 1444-C: Shows the third Economic Impact Payment sent for tax year 2021

Letter 6475: Through March 2022, we’ll send this letter confirming the total amount of the third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need the total payment information from your online account or your letter to accurately calculate your Recovery Rebate Credit. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment.

How To Double Up On Tax Savings With The Savers Credit

About Ryan Guina

Ryan Guina is The Military Wallets founder. He is a writer, small business owner, and entrepreneur. He served over six years on active duty in the USAF and is a current member of the Illinois Air National Guard.

Ryan started The Military Wallet in 2007 after separating from active duty military service and has been writing about financial, small business, and military benefits topics since then. He also writes about personal finance and investing at Cash Money Life.

Ryan uses Personal Capital to track and manage his finances. Personal Capital is a free software program that allows him to track his net worth, balance his investment portfolio, track his income and expenses, and much more. You can open a free Personal Capital account here.

Featured In: Ryans writing has been featured in the following publications: Forbes, Military.com, US News & World Report, Yahoo Finance, Reserve & National Guard Magazine , Military Influencer Magazine, Cash Money Life, The Military Guide, USAA, Go Banking Rates, and many other publications.

You May Like: How To Check If Taxes Were Filed

How To Track Your Tax Refund

The IRS website offers a Wheres My Refund? tool that enables you to track your refund after youve filed your income tax return. You can also track your refund through the IRS2Go app with the same information. You will see one of the following statuses on the site:

Return received

Refund approved

To track your refund, youll need your Social Security number, your filing status, and the exact amount of your refund.

For filing status, youll have to choose from the following options:

-

Head of Household

-

Qualifying Widow

Providing all of these personal details helps protect your information and avoids anyone else accessing your tax return data. If youre wondering, Wheres my tax refund? this is how you find out the exact answer.

Typically, you can start tracking your return one day after you file if you submit your return electronically. But if you mail in a paper tax return, it takes about one month.

Irs Refund Schedule Chart

Here is a chart of when you can expect your tax refund for when the return was accepted . This is an estimate based on past years trends, but based on past information, does seem accurate for about 90% of taxpayers. Also, as always, you can use the link after the calendar to get your specific refund status.

When can you file your 2021 tax return? Anytime between January 24 and April 18, 2022.

Now, when to expect my tax refund based on when it’s accepted!

|

2022 IRS Tax Refund Calendar |

||

|---|---|---|

|

Date Accepted |

||

If, for some reason, you didnt receive your return in the time specified above, give or take a few days, you can always use the IRSs tool called Get Refund Status. Since the link requires personal information, here is the non-html version: https://sa2.www4.irs.gov/irfof/lang/en/irfofgetstatus.jsp.

Once you enter all your information, it will tell you what is going on with your refund. Remember, if you input the wrong SSN, it could cause an IRS Error Code 9001, and might make your return be held for Identity Verification.

Also, many people are concerned because they received a Reference Code when checking WMR. Here is a complete list of IRS Reference Codes. Just match up the code with the one in the list, and see what the problem could be. As always, if you are concerned, you can .

Read Also: Sales Tax And Use Texas

I Received A Validation Key Letter Will That Delay My Refund

In the best interest of all our taxpayers, the Colorado Department of Revenue implements measures to detect and prevent identity theft-related refund fraud. The Department has a “Validation Key” process where information will be requested to be entered on Revenue Online to validate their Colorado refund. Please be aware that if you do not respond to the validation key letter in a timely manner your refund will be delayed. Visit the Identity Verification web page for more information.

Wheres My Tax Refund Washington Dc

Check the status of your refund by visiting MyTax DC. From there, click on Wheres My Refund? on the right side of the page. Note that it may take some time for your status to appear. If you e-filed, you can expect to see a status within 14 business days of the DC Office of Tax and Revenue receiving your return. The status of a paper return is unlikely to appear in less than four weeks.

Like Alabama and some other states, D.C. will convert some direct deposit requests into paper check refunds. This is a security measure to ensure refunds are not deposited into the incorrect accounts.

Recommended Reading: What Will My Tax Return Be

How Can I Check To See If My Individual Income Tax Return Has Been Processed And When My Refund Will Be Issued

The department has responded to increasing occurrences of tax fraud by implementing enhanced security measures to protect Louisiana taxpayers. This means it will take additional time to process refunds. The expected refund processing time for returns filed electronically is up to 45 days. For paper returns, taxpayers should expect to wait as long as 14 weeks. If you selected direct deposit for your refund, the funds should be deposited within one week of processing.

Once you have filed, you can check the status of your refund using the following methods:

- Visit Wheres My Refund? at www.revenue.louisiana.gov/refund

Im Counting On My Refund For Something Important Can I Expect To Receive It In 21 Days

Many different factors can affect the timing of your refund after we receive your return. Even though we issue most refunds in less than 21 days, its possible your refund may take longer. Also, remember to take into consideration the time it takes for your financial institution to post the refund to your account or for you to receive it by mail.

Read Also: Federal Tax Credit Heat Pump

Factors That Can Affect Timing

Your tax refund may be delayed for several reasons, including if your return is incomplete, includes errors, was affected by fraud or identity theft, or requires further review.

There are also specific items that can hold up your refund. For example, tax returns that include Form 8379: Injured Spouse Allocation may take up to 14 weeks to process.

If you claim certain tax credits, the earliest you will receive your tax refund is the first week of March. Under the Protecting Americans from Tax Hikes Act, the IRS is prohibited from issuing refunds before mid-February for taxpayers who claim the EITC or the Additional Child Tax Credit .

Read Also: How To Do Taxes For Doordash

Wheres My State Tax Refund Kansas

If youre waiting for a tax refund from Kansas, simply visit the Income and Homestead Refund Status page. There you can check the status of income and homestead tax refunds. You can also check your refund status using an automated phone service.

Taxpayers who filed electronically can expect their refund to arrive in 10 to 14 business days. This is from the date when the state accepted your return. If you filed a paper return, you will receive your refund as a paper check. The state advises people that a paper refund could take 16 to 20 weeks to arrive.

Recommended Reading: Who Does Taxes For Free

Wheres My State Tax Refund Oregon

You can check on your state income tax refund by visiting the Oregon Department of Revenue and clicking on the Wheres My Refund? button. This will take you to an online form that requires your ID number and the amount of your refund.

This online system only allows you to see current year refunds. You cannot search for previous years tax returns or amended returns.

How To Get A Faster Tax Refund

Here are four things that can help keep your Wheres my refund worries under control.

Avoid filing your tax return on paper. Its a myth that your IRS refund status will be pending for a long time and that the IRS takes forever to issue a refund. In reality, you can avoid weeks of wondering wheres my refund? by avoiding paper. The IRS typically takes six to eight weeks to process paper returns. Instead, file electronically those returns are processed in about three weeks. State tax authorities also accept electronic tax returns, which means you may be able to get your state tax refund faster, too.

Get direct deposit. When you file your return, tell the IRS to deposit your refund directly into your bank account instead of sending a paper check. That cuts the time in waiting for the mail and having to check your IRS refund status. You even can have the IRS split your refund across your retirement, health savings, college savings or other accounts so that you dont fritter it away.

Dont let things go too long. If you havent received your tax refund after at least 21 days of filing online or six weeks of mailing your paper return, go to a local IRS office or call the federal agency . But that wont fast-track your refund, according to the IRS. Wheres my refund will undoubtedly be a concern, but the thing to worry about here is refund theft. It isnt corrected quickly, so you may be in for an even longer wait.

Recommended Reading: How Much Is Capital Gains Tax On Crypto