Chancellor Delivers Plan For Stability Growth And Public Services

The Chancellor has today announced his Autumn Statement, aiming to restore stability to the economy, protect high-quality public services and build long-term prosperity for the United Kingdom.

- From:

- 17 November 2022

- Chancellor unveils a plan for stability, growth, and public services.

- Tackling inflation is top of the priority list to stop it eating into paycheques and savings, and disrupting business growth plans.

- To protect the most vulnerable the Chancellor unveiled £26 billion of support for the cost of living including continued energy support, as well as 10.1% rises in benefits and the State Pension and the largest ever cash increase in the National Living Wage.

- Necessary and fair tax changes will raise around £25 billion, including an increase in the Energy Profits Levy and a new tax on the extraordinary profits of electricity generators.

Jeremy Hunt outlined a targeted package of support for the most vulnerable, alongside measures to get debt and government borrowing down. The plan he set out is designed to fight inflation in the face of unprecedented global pressures brought about by the pandemic and the war in Ukraine.

The Chancellor of the Exchequer Jeremy Hunt said:

Working age benefits will rise by 10.1%, boosting the finances of millions of the poorest people in the UK, and the Triple Lock will be protected, meaning pensioners will also get a rise in the State Pension and the Pension Credit in line with inflation.

Further information

What Is The Business Tax Filing Deadline For 2022

The deadline for annual business tax filing depends on your business structure and the company’s tax year. For most corporations, annual tax returns need to be filed by the 15th day of the fourth month following the end of the company’s tax year. That would mean April 15th, if you company’s tax year ends on Dec. 31. Business organized as partnerships or S Corporations, have three months after the end of their tax year to file. Taxes for sole proprietors are due with their individual tax returns, typically, on April 15th. If any of these deadlines falls on a holiday or over a weekend, normally, taxes are due on the following business day.

What Happens To My Tax Deadlines If I Live In An Area Impacted By A Natural Disaster

If you need more time because you live in an area hit by a natural disaster, you might qualify for tax relief from the IRS. The IRS often postpones the tax filing deadline for taxpayers who live in or have a business within a federally declared disaster area.

For example, the IRS announced it would postpone tax filing and tax payment deadlines for taxpayers affected by the September 2020 California wildfires. Taxpayers in that area who extended their 2019 tax returns to October 15, 2020, now have until January 15, 2021, to file those returns.

Recommended Reading: Will Property Taxes Go Up In 2022

Corporations And Exempt Organizations

Use Corporation Estimated Tax to make your estimate payments. Visit Instructions for Form 100-ES for more information.

| Type | |

|---|---|

| 1st quarter estimated tax payment | 15th day of 4th month after the beginning of your tax year |

| 2nd quarter estimated tax payment | 15th day of 6th month after the beginning of your tax year |

| 3rd quarter estimated tax payment | 15th day of 9th month after the beginning of your tax year |

| 4th quarter estimated tax payment | 15th day of 12th month after the beginning of your tax year |

Advantages Of Early Filing

There are many advantages to filing your business taxes early and virtually no downside. Filing your business income tax return early eliminates the need to file for a tax extension. While reasons for requesting an extension vary by the enterprise, for many small businesses the need is driven by simply not getting tax documents gathered on time.

No business wants to make mistakes when filing its tax return. Rushing to meet the tax deadline makes it more likely that errors, perhaps costly ones, will occur. Getting started early means no hurrying and less likelihood of mistakes. Just make sure your bookkeeping is up-to-date and youâll be prepared to have your business taxes filed as soon as possible!

You May Like: What Form Do You Need To File Taxes

Real Estate Taxes Due Dec 5 2022

Prince William County real estate taxes for the second half of 2022 are due on Dec. 5, 2022. If you have not received a tax bill for your property and believe you should have, contact the Taxpayer Services Office at 703-792-6710 or .

The Taxpayer Services office hours are Monday through Friday, 8:00 a.m. â 5:00 p.m.

A late payment penalty of 10% will be assessed on the unpaid tax balance if taxes are not paid in full by Dec. 5, 2022. Interest at a rate of 10% per annum accrues monthly until the balance is paid in full.

Payments can be made by electronic check or credit card online at tax.pwcgov.org or by calling 1-888-272-9829, jurisdiction code is 1036 by mail to PO BOX 70519, Philadelphia, PA 19176-0519, and in person at the Ferlazzo , McCoart , and Sudley North Taxpayer Services offices Monday through Friday, 8:00 a.m. â 5:00 p.m.

If you receive a tax bill and escrow property taxes with your mortgage company, you should contact your mortgage company immediately.

Other Penalties & Fees

Penalties for fraud and failure to fileIn addition to the penalties above, Virginia law provides for civil and criminal penalties in cases involving fraud and failure to file. The civil penalty for filing a false or fraudulent return, or for failing or refusing to file a return with intent to evade the tax, is 100% of the correct tax. In addition, criminal penalties of imprisonment for up to one year or a fine of up to $2,500, or both, can apply in cases of fraud and failure to file.Returned payment feeIf your financial institution does not honor your payment to us, we may charge a fee of $35 . This fee is in addition to any other penalty or interest charged.

Read Also: Is Spousal Support Tax Deductible

Who Needs To Pay Estimated Tax

Sole proprietors, as well as partners and S corporation shareholders who expect to owe taxes of $1,000 or more at the time of their return, are required to pay estimated taxes. The requirements for corporations are slightly different as they need to make estimated tax payments if they believe theyll owe $500 or more in taxes.

In addition, if your tax was more than zero in the prior year, you might have to pay estimated tax for the current year. For more details on who must pay estimated tax, consult the worksheet found in Form 1040-ES, Estimated Tax for Individuals , or Form 1120-W, Estimated Tax for Corporations .

Business Tax Return Due Dates

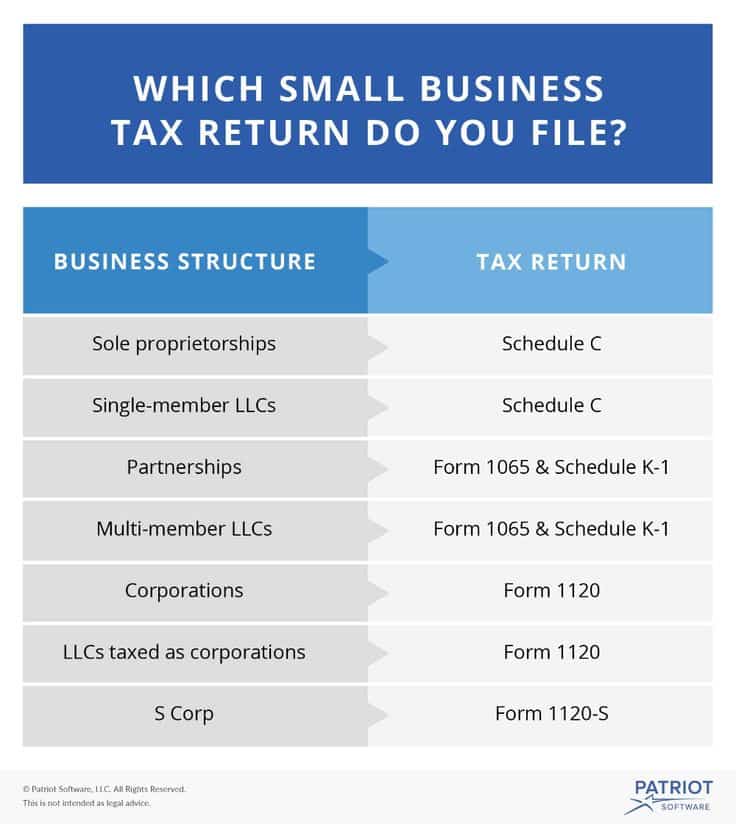

Here are the tax return due dates for small business taxes:

- Sole proprietorship and single-member LLC tax returns on Schedule C with the owner’s personal tax return: April 18, 2022

- Partnership tax returns on Form 1065: March 15, 2022

- Multiple-member LLC returns filing partnership returns on Form 1065:March 15, 2022

- S corporation returns on Form 1120 S: March 15, 2022

- All other corporations with fiscal years ending other than December 31: the 15th day of the fourth month after the end of the fiscal year.But for 2021 tax returns, the due date was April 18, 2022.

You May Like: Amended Tax Return Deadline 2020

Several Tax Deadlines Apply To Both Small Business Owners And Self

What you’ll learn:

Most individuals and small business owners know that there are certain tax-related filing deadlines every year. Many people, however, do not know what meeting those deadlines entails. The following answers to common tax questions provide an overview of the important dates and compliance deadlines for the 2022 tax year and key filing and reporting dates for the 2023 calendar year.

How To Get Organized For Next Year

With your 2021 tax returns under control, its never too early to start thinking about the 2022 business tax deadline and what you can do to make it as easy as possible.

Our number one piece of advice is to make sure you have a dedicated business account . And as a Shopify merchant, you already qualify for a free Shopify Balance account.

A Shopify Balance account allows you to manage your businesss money, and its connected to your Shopify store, so everything is in one ecosystem no need to struggle with multiple apps and accounts. Plus, you get faster access to the money youre making through your Shopify store and earn cashback.

You May Like: Calculate Pay Check After Taxes

Can You File Your Taxes After October 15

Sometimes, you are not prepared to file your business taxes on time and require an extension. You can file a tax extension by the time your payments are due. This way, you can potentially have more time to file your taxes officially.

For example, if your company’s tax return is due by March 15, you must file Form 7004 for a six-month extension by March 15.

What if you’re a business owner who reports their business activities on their personal tax returns? In that case, don’t file for a business extension with Form 7005. These taxpayers should instead request a personal extension with Form 4868 for both personal and business taxes. A Form 4868 should be filed by the original due date of your personal tax return on April 15.

Here’s a list of payment deadlines for extended business tax returns:

- Schedule C for sole proprietorship businesses is extension deadline is October 15, 2022. The same is true for single-member LLCs. This extension must be filed with the owner’s personal tax return

- Partnership and multiple-member LLC filing as partnership extension deadline is September 15, 2022.

- S-Corporation extension deadline is September 15, 2022.

- C-Corporation extension deadline is October 15, 2022.

How The Tax Works

Your gross revenue determines the amount of tax you pay. To calculate this amount, multiply your taxable gross revenue amount by the tax rate.

For example, if the retail sales tax rate is 0.00222 and the business has a taxable gross revenue amount of:

- $100,000, the business pays $222.

- $1,000,000, the business pays $2,220, and so forth.

Don’t Miss: How To Report Tax Fraud To The Irs

The Big List Of Small Business Tax Due Dates

This list of tax deadlines might look daunting, but keep in mind that you probably donât have to file every type of tax return listed here. Some are just for owners of pass-through businesses , and some are just for C corporations. In addition, some tax deadlines apply only to companies with employees.

Note that if any of these dates fall on a weekend or federal holiday, the due date shifts to the following business day.

Keep Up With Due Dates

Utilize the IRS Tax Calendar, an online resource that has options to add filing and payment dates into your calendars or be sent them through email. Make preparing, filing, and paying your taxes a routine part of your business activities and address any missteps or missed dates immediately.

About the Author

Tammy Farrell CPA CFE

Tammy Farrell is a Certified Public Accountant and Certified Fraud Examiner who enjoys researching the nuances of accounRead more

Recommended Reading: How To File Taxes Free

When Are Taxes Due

The due dates and intervals for payments are usually routine from year to year but they are affected by weekends and legally observed holidays. For example, Emancipation Day in the District of Columbia is April 16. When it falls on a Saturday, it is observed on April 15, which pushes the April 15 federal tax due date to April 18.

There are also exceptions for state-observed holidays and emergency orders. State holidays adjust the due dates only for specific states while emergency orders may extend the time for the whole country or specific areas that are affected by weather events or other emergencies that could cause postal delays. This allows residents more time to recover and collect their financial records.

What If I Owe More Than I Can Pay

This year, many people are dealing with financial troubles due to the pandemic, job loss, and other factors. If you’re one of them, you may not have the funds available to pay your tax bill by the deadline. But don’t put off filing just because you can’t afford to pay the amount due on the day you need to file your tax return. The IRS starts charging penalties and interest on the day the return is due, no matter when you file. You can minimize failure-to-file penalties by filing as soon as possible, paying as much as you can when you file, and setting up an installment plan for the balance.

You May Like: Tax On Pension Lump Sum

When Are Business Taxes Due For 2022

All businesses in the United States must report their business activities to the Internal Revenue Service . They do this by filing annual tax returns. The due dates of their annual returns depend on the type of business. Filing on time will keep you in the good books with the IRS and help you avoid penalties.

Plus, if you file early, you may even get a tax return!

However, tax states tend to shift around from year to year due to IRS procedures. Additionally, the COVID-19 pandemic made some things change for tax due dates in 2021. Staying on top of updates like this can be difficult. Thats why weve got it covered for you in 2022!

With this in mind, lets break down the business tax due dates for 2022 in detail. You can use these dates with your accounting software for even better results.

In this article, well cover:

What Are The Consequences Of Filing Late

What happens if you must file your tax return late or if you donât file taxes at all? You could end up with an additional bill from the IRS. The one thing you must not do is ignore your tax situation. Not filing your return on time generally means any taxes due were not paid, and that can lead to serious penalties.

The IRS will levy both a late filing penalty and a late payment penalty. How much you will have to pay depends on how late your filing and payment are and how much tax you owe.

Without filing for an extension, missing the tax deadline incurs a penalty. Forms 1120 and 1040 have a penalty of 5% of the unpaid tax for each month the return is late. Forms 1120-S and 1065 have a penalty of $210 per shareholder or partner per month late up to 12 months. That amount can add up very quickly. Failure to pay the amount of tax owed on time results in a penalty of 0.5% of the amount due for each month it is unpaid.

There is some good news for filers of Form 1120 or 1040. These penalties max out at 25% of the total tax owed. In a worst-case scenario, you max out at the 5% penalty for missing the tax deadline after five months. That âfailure to payâ penalty keeps going for quite some time if not resolved, with a total of 45 months, or close to four years.

What if your business is a new corporation and you didnât have any taxable income? You must still file a tax return. New partnerships do not need to file a separate return.

Don’t Miss: Why Is My Tax Refund So Low 2021

Is Your Business Eligible For A Refund

While tax refunds are common when filing personal income taxes, most businesses are not eligible for a tax refund. This is true of businesses structured as sole proprietorships, partnerships, S corporations, or limited liability corporations .

Thatâs because these entities are structured to pass income to the owners. The owners then report their portion of net taxable business income on their individual tax returns where it is then part of the tax computation. Small businesses structured this way do not pay taxes directly to the IRS, so the business per se cannot receive a refund. The owner might receive a refund based on their individual income tax return.

The exception is a business structured as a C corporation. Using IRS Form 1120, the U.S. Corporation Income Tax, a C corporation pays taxes directly to the IRS. If the C corporation pays more in estimated tax than is due on its final return, a refund may prove due.

The IRS treats an LLC either as a corporation, partnership, or as part of the ownerâs tax return. Much depends on the number of members of an LLC or the elections made by the LLC. A domestic LLC with two or more members is considered a partnership for federal income tax purposes unless it decides to be treated as a C corporation by filing Form 8832.

Learn more: The Complete Guide to LLC Taxes

How Can A Business Avoid Missing A Federal Or State Income Tax Filing Deadline

No business owner wants to miss federal or state income tax filing deadlines. However, it is not always easy to stay on top of those filing due dates while trying to manage day-to-day operations, finances, and everything else that goes into running a business.

There are several best practices you can implement to make sure your companyâs legal health remains strong.

Working with a qualified tax professional can provide added guidance and assurance as you navigate the tax filing obligations specific to you or your small business. A tax professional can also help you confirm that your Corporate Records are complete and that you are meeting your other business obligations.

Read Also: Is Hazard Insurance Tax Deductible