What Form Should I Use

Form 120

Corporations may use if the corporation:

- Has income from business activity that is taxable in more than one state

- Is a partner in:

- A multistate partnership: and/or

- A partnership that conducts no business in Arizona

Form 120A

Corporations may use if it files its return on a separate company basis and it is taxable entirely within Arizona.

- A corporation files on a separate company basis if:

- It is not part of a group of corporations comprising a unitary business and

- It is not a member of an affiliated group that elected to file an Arizona consolidated return.

Form 120ES

Corporations may use to make income tax liability payments by check or money order.

- Corporations expecting an Arizona income tax liability for the 2020 taxable year of $1,000 or more must make Arizona estimated income tax payments.

- Corporations making estimated tax payments for 2021 that expect a 2021 income tax liability of $500 or more must make Arizona estimated income tax payments using EFT.

Form 120X:

Corporations may use to amend corporate returns.

Principal Business Activity Codes

This list of principal business activities and their associated codes is designed to classify a business by the type of activity in which it is engaged to facilitate the administration of the California Revenue and Taxation Code. These principal business activity codes are based on the North American Industry Classification System.

Using the list of activities and codes below, determine from which activity the company derives the largest percentage of its “Total receipts.” Total receipts is defined as the sum of gross receipts or sales plus all other income . If the company purchases raw materials and supplies them to a subcontractor to produce the finished product, but retains title to the product, the company is considered a manufacturer and must use one of the manufacturing codes .

Once the principal business activity is determined, entries must be made on Form 100, Question F. For the business activity code, enter the six-digit code selected from the list below. On the next line enter a brief description of the companyâs business activity. Finally, enter a description of the principal product or service of the company on the next line.

Recomputation Of Estimated Tax

If, after paying any installment of estimated tax, the taxpayer determines that a new estimate is required, the payment amounts for the remaining installments may be increased or decreased, as the case may be. The amount required by the new estimate is computed by calculating the difference between the previous estimated tax amount and the new estimated tax amount and dividing that difference between the number of installments remaining to be paid.

Recommended Reading: How Long Does It Take For The Tax Refund

Business Tax Extension Deadlines

If you own a C corporation, employ household workers, or file business taxes as a sole proprietor, your business tax extension deadline is October 16, 2023.

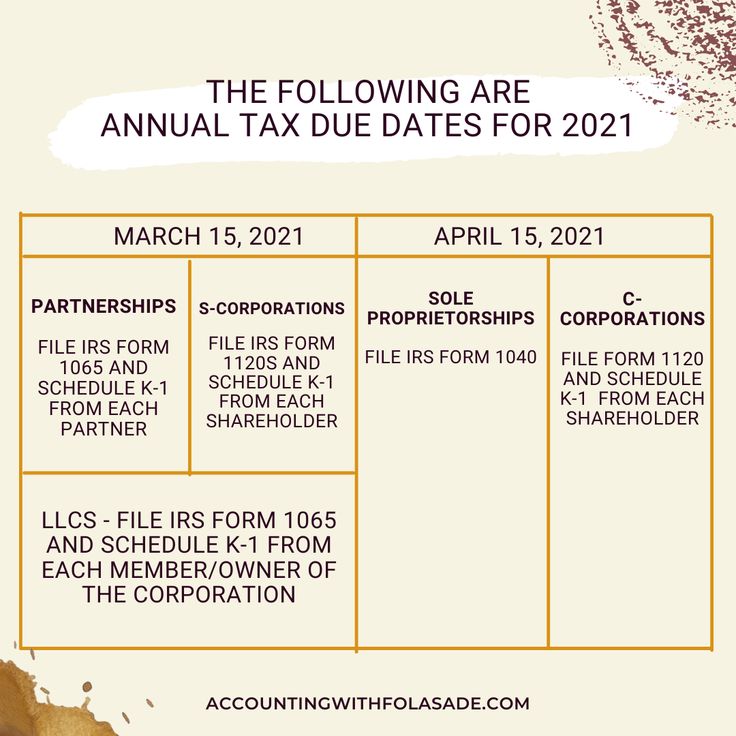

Your business taxes are due on this date if you filed for a tax-filing extension on or before this year’s original tax filing deadlines. This year, those deadlines are March 15, 2023 for S corporations and partnerships and April 18, 2023 for sole proprietorships, household employers, and C corporations. Filing for an extension gives you an extra six months to get your paperwork together and file.

Applying for a tax extension only extends the date you submit your tax paperwork. You must pay your estimated taxes on a quarterly basis or you will face a fine from the IRS.

Its fastest and easiest to apply for a tax-filing extension online, but again, the process differs depending on the type of business you own:

- Are you a sole proprietor planning to pay taxes online through the IRSs tax-payment system? If so, you can pay your estimated taxes by April 18 and simultaneously extend your filing deadline by clicking extension while using the IRSs tax-payment gateway.

- If youre a sole proprietor requesting a tax extension separately from paying your estimated taxes, youll need to fill out IRS Form 4868.

- If youre part of a partnership, S Corp, or C Corp, youll need to file IRS Form 7004 to request an extension.

How To Get The Quickest Return

Filing your return as soon as possible helps you get any refund you are eligible for faster. That said, there is more you can do to help your cause.

The fastest way to get your tax refund is to eFile and choose to receive your payment via direct deposit. You do have the option to split your deposit into up to three separate accounts.

After you file, you can use the Wheres My Refund tool to track progress.

Also Check: Irs Address To Mail Tax Returns

Filing An Amended Return

In order to amend the amounts reported for the computation of income or franchise taxes, you must file an amended Form CIFT-620. Louisiana Revised Statute 47:287.614 requires every taxpayer whose federal return is adjusted to furnish a statement disclosing the nature and amounts of such adjustments within 180 days after the adjustments have been made and accepted. This statement should accompany the amended return.

Quarterly Vs Annual Payments

Wondering if your business should pay taxes quarterly or annually? If your business has employees, youll need to file Form 941 every three months. You will also need to pay a quarterly tax if your business sells specified goods, like gasoline or alcohol, that require an excise sales tax.

If your business doesnt fall under those categories, figure on paying at the usual tax time. But if youre worried about having a large sum of cash on hand to make a lump-sum annual payment, consider paying quarterly instead. Additionally, freelancers are required to pay estimated quarterly taxes and to file an end-of year tax return.

All quarterly estimated tax payments for individuals, S corporations, and C corporations, should be made on the following schedule:

C Corporations will make their final estimated quarterly tax payment on December 15, 2023. Individuals and other types of corporations can wait until January 2024 to file their fourth quarterly payment for the 2023 tax year.

Don’t Miss: Long-term Hotel Stay Tax Exempt

When Are Taxes Due

For most taxpayers, the main income tax return deadline for 2020 tax returns is May 17, 2021 aka IRS Tax Day 2021. The deadline has been pushed from April 15 this year, but this does not change things for state taxes deadlines for those typically also fall on April 15, but you should check with your state to confirm.

The deadlines differ for individuals versus businesses, and it depends in part on whether you use a calendar year or a fiscal year. If youve already missed a deadline, file and pay your taxes as soon as possible to stop additional interest and penalties from accruing.

Schedule A Taxes Deducted

Enter the nature of the tax, the taxing authority, the total tax, and the amount of the tax that is not deductible for California purposes on Form 100, Side 4, Schedule A.

If the corporation is using the California computation method to compute the net income, enter the difference of column and column on Schedule F, line 17.

Also Check: New York State Tax Login

F Extension Of Time To File

If the corporation cannot file its California tax return by the 15th day of the 4th month after the close of the taxable year, it may file on or before the 15th day of the 11th month without filing a written request for an extension. Get FTB Notice 2019-07 for more information. There is no automatic extension period for business entities suspended on or after the original due date.

An automatic extension does not extend the time for payment of tax the full amount of tax must be paid by the original due date of Form 100. If there is an unpaid tax liability, complete form FTB 3539, Payment for Automatic Extension for Corporations and Exempt Organizations, included in this booklet, and send it with the payment by the original due date of the Form 100.

When the due date falls on a weekend or holiday, the deadline to file and pay without penalty is extended to the next business day.

Due to the federal Emancipation Day holiday observed on April 15, 2022, tax returns filed and payments mailed or submitted on April 18, 2022, will be considered timely.

If the corporation must pay its tax liability electronically, all payments must be remitted by Electronic Fund Transfer , EFW, Web Pay, or credit card to avoid the penalty. Do not send form FTB 3539.

When Are Business Taxes Due In 2023

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure.

If you’re a small-business owner who is planning on filing a business tax extension this April, your new tax-filing deadline will be October 16, 2023.

Only sole proprietors, household employers, and C corporations that requested a business tax extension by April 18, 2023 can file their taxes by October 16 without a fee. The tax extension filing deadline for S corporations and partnerships is on September 15, 2023.

Are you ready to file your small business’s taxes? Check out a list of the best tax software of the year for business owners. Each of the tax software options we review on the page, from Liberty Tax to TurboTax, can help you file your taxes on or before this year’s late tax-filing deadline.

And if you want to learn more about specific tax-filing deadlines, keep reading. We explain the IRS’s breakdown of different business types and list tax deadlines for the rest of the year.

The Employee Retention Tax Credit is a tax credit available to employers who successfully kept their workers employed during portions of the COVID-19 pandemic. Find out if you qualify for the tax credit and get started on your application to get up to $26,000 reimbursed per employee.

By signing up I agree to the Terms of Use and Privacy Policy.

Read Also: Federal Tax Extension Deadline 2022

Schedule F Computation Of Net Income

Note: Do not include IRC Section 965 and 951A amounts.

See General Information I, Net Income Computation, for information on net income computation methods.

Line 1a â Gross Receipts

âGross receiptsâ means the gross amounts realized on:

- The sale or exchange of property,

- The performance of services, or

- The use of property or capital in a transaction that produces business income, in which the income, gain, or loss is recognized under the IRC.

Amounts realized on the sale or exchange of property shall not be reduced by the cost of goods sold or the basis of property sold. For a complete definition of âgross receipts,â refer to R& TC Section 25120.

Line 4 â Total dividends

Enter the total amount of dividends received.

Line 13 â Salaries and wages

Gain from the exercise of California Qualified Stock Options issued and exercised on or after January 1, 1997, and before January 1, 2002, can be excluded from gross income if the individualâs earned income is $40,000 or less. The exclusion from gross income is subject to AMT and the corporation is not allowed a deduction for the compensation excluded from the employeeâs gross income. For more information, see R& TC Section 24602.

Line 17 â Taxes

If the corporation is using the California computation method to compute the net income, enter on line 17 the difference of column and column of Schedule A.

Line 27 â Other deductions

Line 28 â Specific deduction for organizations under R& TC Section 23701r or 23701t

A Franchise Or Income Tax

Corporation Franchise Tax

Entities subject to the corporation minimum franchise tax include all corporations that meet any of the following:

- Incorporated or organized in California.

- Qualified or registered to do business in California.

- Doing business in California, whether or not incorporated, organized, qualified, or registered under California law.

The minimum franchise tax must be paid by corporations incorporated in California or qualified or registered under California law whether the corporation is active, inactive, not doing business, or operates at a loss. See General Information C, Minimum Franchise Tax, for more information.

The measured franchise tax is imposed on corporations doing business in California and is measured by the income of the current taxable year for the privilege of doing business in that taxable year.

A taxpayer is âdoing businessâ if it actively engages in any transaction for the purpose of financial or pecuniary gain or profit in California or if any of the following conditions is satisfied:

In determining the amount of the taxpayerâs sales, property, and payroll for doing business purposes, include the taxpayerâs pro rata share of amounts from partnerships and S corporations.

For more information, see R& TC Section 23101 or go to ftb.ca.gov and search for doing business.

Corporation Income Tax

For purposes of the corporation income tax, the term âcorporationâ is not limited to incorporated entities but also includes the following:

Don’t Miss: How Long Do Tax Returns Take

When To File Your Corporation Income Tax Return

File your return no later than six months after the end of each tax year. The tax year of a corporation is its fiscal period.

When the corporation’s tax year ends on the last day of a month, file the return by the last day of the sixth month after the end of the tax year.

When the last day of the tax year is not the last day of a month, file the return by the same day of the sixth month after the end of the tax year.

X Limited Liability Companies

California law authorizes the formation of LLCs and recognizes out-of-state LLCs registered or doing business in California. The taxation of an LLC in California depends upon its classification as a corporation, partnership, or âdisregarded entityâ for federal tax purposes.

If an LLC elects to be taxed as a corporation for federal tax purposes, the LLC must file Form 100, Form 100-ES, form FTB 3539, and/or form FTB 3586 and enter the California corporation number, FEIN, and California SOS file number, if applicable, in the space provided. The FTB will assign an identification number to an LLC that files as a corporation, and notify the LLC with the identification number upon receipt of the first estimated tax payment, first tax payment, or the first tax return. The LLC will be subject to the applicable provisions of the Corporation Tax Law and should be considered a corporation for purpose of all instructions unless otherwise indicated.

If an LLC elects to be taxed as a partnership for federal tax purposes, it must file Form 568. LLCs taxed as partnerships determine their income, deductions, and credits under the Personal Income Tax Law and are subject to an annual tax as well as an annual fee based on total income.

Don’t Miss: How To Report Virtual Currency On Tax Return

Qualified Opportunity Zone Funds

California does not conform to the deferral and exclusion of capital gains reinvested or invested in qualified opportunity zone funds under IRC Sections 1400Z-1 and 1400Z-2. Enter the entire gain amount on line 1 or line 5, column .

If, for California purposes, gains from investment in qualified opportunity zone property had been included in income during previous taxable year, do not include the gain in the current year income.

Enter any unused capital loss carryover from 2020 Form 100, Side 6, Schedule D, line 11 on 2021 Form 100, Side 6, Schedule D, line 3.

For information regarding the application of the capital loss limitation and the capital loss carryover in a combined report, see Cal. Code Regs., tit. 18 section 25106.5-2 and FTB Pub. 1061.

Line 1 and Line 5

Report short-term or long-term capital gains from form FTB 3725 on Schedule D. Make sure to label on Schedule D, Part I, line 1 and/or Part II, line 5, under column Kind of property and description: âFTB 3725.â Enter the amount of short-term or long-term capital gains from form FTB 3725 on Schedule D, Part I, line 1, column and/or Part II, line 5, column . Attach a copy of form FTB 3725 to the Form 100.

Schedule D California Capital Gains Or Losses

California law does not conform to the federal reduced capital gains tax rates. California taxes capital gains at the same rate as other types of income. California does not allow a three-year carryback of capital losses.

Gross Income Exclusion for Bruceâs Beach â Effective September 30, 2021, California law allows an exclusion from gross income for the first time sale in the taxable year in which the land within Manhattan State Beach, known as âPeckâs Manhattan Beach Tract Block 5â and commonly referred to as âBruceâs Beachâ is sold, transferred, or encumbered. A recipientâs gross income does not include the following:

- Any sale, transfer, or encumbrance of Bruceâs Beach

- Any gain, income, or proceeds received that is directly derived from the sale, transfer, or encumbrance of Bruceâs Beach.

Capital Assets

California does not conform to the exclusion of a patent, invention, model or design , and a secret formula or process held by the taxpayer who created the property from the definition of capital asset under IRC Section 1221.

You May Like: H& r Block Online Tax