How Long Will My Tax Refund Take

The IRS sends over 9 out of 10 refunds to taxpayers in less than three weeks.

Unfortunately, a 21-day delivery of your tax refund isnt guaranteed. There are a number of factors including the choices you make when you file that could impact how long it takes for you to receive your tax refund.

Find out what other factors affect the timing of your refund in 15 minutes or less with our new video series.

You get to choose how you want to receive any refund the IRS owes you. Here are your options:

- Direct deposit into your bank account .

- Paper check sent through the mail.

- Debit card holding the value of the refund.

- Purchase up to $5,000 in U.S. Savings Bonds.

- Split your refund among up to three financial accounts in your name, including a traditional IRA, Roth IRA or SEP-IRA.

The delivery option you choose for your tax refund will affect how quickly you receive your funds. According to the IRS, the fastest way to receive your refund is to combine the direct deposit method with an electronically filed tax return.

Irs Tax Refund Deposit Dates 202: When Is The Irs Sending Refunds

Everything you need to know about when you’ll be paid your tax refund in 2022, including the dates when you can expect to have your money sent out

- Fourth Stimulus Check 2022.The criteria on how to receive a $1,400 payment

The Internal Revenue Service is already in the process of sending out tax refund payments in 2022 to citizens in the United States, who are keen to find out when their payment should land, with many expecting to receive a sizeable sum. Once your tax return has been filed and processed, the IRS will then determine if you are eligible for a tax refund, but it is worth noting that there can be some delays when it comes to receiving the money in your bank account.

The date that US citizens have to file their tax by in 2022 is quite noticeably sooner than in 2020 and 2021, as the closing date is Monday, April 18, 2022. Therefore, for anyone who is yet to file their taxes, you have just over two months left to do so.

Due to this, the federal and state income tax returns filing process should also be relatively regular, which will result in taxpayers most likely receiving refund payments within just two or three weeks of the aforementioned date.

Here, in this guide to tax refund dates in 2022, we outline all you need to know about the money you may be owed from the IRS and when you’ll see it.

Eitc/actc Tax Refunds Delayed Until Late February

Thats why, starting in the 2017 tax season, Congress gave the IRS more tools to question refunds. Specifically, Congress:

- Moved up the deadline for employers to send Forms W-2, which show taxpayers wages and the income tax withholding they paid, and Forms 1099 reporting payments made to independent contractors. The deadline is Jan. 31.

- Delayed refunds containing the earned income credit and/or the additional child tax credit . The IRS cant release these refunds before Feb. 15, but the IRS is saying to expect your refund by the first week of March.

Both new rules mean that, for the first time, the IRS will have the information and the time it needs to question more returns before issuing refunds. However, questioning and delaying refunds isnt a new concept for the IRS. In fact, several IRS compliance programs take or hold refunds for millions of taxpayers each year. Here are some of the reasons why your tax refund may be delayed:

Read Also: How Much Is Tax At Walmart

Are There Any Expected Tax Refund Delays

Yes, tax refund delays are common. The IRS is required by federal law to withhold tax refunds for taxpayers who claim Earned Income Tax Credits and Additional Child Tax Credit until at least Feb. 15, 2022. Keep in mind it can still take a week to receive your refund after the IRS releases it. So some people who file early may experience delays while awaiting their refunds. Refunds should be processed normally after this date.

Note: There may be delays for the 2021 tax year. The IRS continues to work through a backlog of tax returns , including those with errors and amended returns.

The IRS recommends filing your tax return electronically for faster processing and tax refund payments.

Also note that new identity theft protections and anti-fraud measures may hold up some refunds, as some federal tax returns may be held for further review.

Important Notice For Tax Time

Did you know that identity theft, especially around tax season, is running rampant? People’s credit information was stolen at Target, Home Depot, even The State of California. Now’s a great time to make sure that your credit is safe.

Credit Karma: Second, now is a great time to check your credit report and make sure that there are no issues. You should be checking your credit at least once per year, and tax time is a great time to do it. We recommend using because its free! Plus, has a lot of great tools to help you improve your credit if you need to, and they can help you monitor your credit over time.

Recommended Reading: How Much Will I Get Paid After Taxes

You May Face A Delay If You Claim These Tax Credits

There are a couple of issues that could cause delays, even if you do everything correctly.

The IRS notes that it can’t issue a refund that involves the Earned Income Tax Credit or the Child Tax Credit before mid-February. “The law provides this additional time to help the IRS stop fraudulent refunds from being issued,” the agency said this week.

That means if you file as soon as possible on January 24, you still might not receive a refund within the 21-day time frame if your tax return involves either of those tax credits. In fact, the IRS is informing those who claim these credits that they will most likely receive their refunds in early March, assuming they filed their returns on January 24 or close to that date.

The reason relates to a 2015 law that slows refunds for people who claim these credits, which was designed as a measure to combat fraudsters who rely on identity theft to grab taxpayer’s refunds.

With reporting by the Associated Press.

If You Choose Direct Deposit

Your tax refund will be sent to your bank the same day the IRS sends your tax refund. It will typically take 3-5 days for your bank to process, depending on your bank.

*Faster access compared to standard tax refund electronic deposit and subject to IRS submitting refund information to the bank before release date. IRS may not submit refund information early.

*Faster access compared to standard tax refund electronic deposit and subject to IRS submitting refund information to the bank before release date. IRS may not submit refund information early.

All timing is based on IRS estimates.

Recommended Reading: Taxes On 2 Million Dollars Income

My Spouse Has Passed Away And My Tax Refund Check Was Issued In Both Names How Can I Get This Corrected

Since a joint return was filed, the refund check must be issued jointly. When presenting the check for payment, you may want to include a copy of the death certificate to show you as surviving spouse. You may return the check to the Department and we will include “Surviving Spouse” and “Deceased” next to the respective names on the check. Should you need to return the check, please mail to: NC Department of Revenue, Attn: Customer Service, P O Box 1168, Raleigh NC 27602-1168.

Irs Continues Work On Inventory Of Tax Returns Original Tax Returns Filed In 2021 To Be Completed This Week

IR-2022-128, June 21, 2022

WASHINGTON Following intensive work during the past several months, the Internal Revenue Service announced today that processing on a key group of individual tax returns filed during 2021 will be completed by the end of this week.

Due to issues related to the pandemic and staffing limitations, the IRS began 2022 with a larger than usual inventory of paper tax returns and correspondence filed during 2021. The IRS took a number of steps to address this, and the agency is on track to complete processing of originally filed Form 1040 received in 2021 this week.

Business paper returns filed in 2021 will follow shortly after. The IRS continues to work on the few remaining 2021 individual tax returns that have processing issues or require additional information from the taxpayer.

As of June 10, the IRS had processed more than 4.5 million of the more than 4.7 million individual paper tax returns received in 2021. The IRS has also successfully processed the vast majority of tax returns filed this year: More than 143 million returns have been processed overall, with almost 98 million refunds worth more than $298 billion being issued.

IRS employees continue working hard to process these and other tax returns filed in the order received. The IRS continues to receive current and prior-year individual returns and related correspondence as people file extensions, amended returns and a variety of business tax returns.

Don’t Miss: Amended Tax Return Deadline 2020

How Much Is The Check

Your check may include amounts for one or both payments, and can include only payments that are at least $25.

The payment for the Empire State child credit is anywhere from 25% to 100% of the amount of the credit you received for 2021. The percentage depends on your income.

The payment for the earned income credit is 25% of the amount of the credit you received for 2021.

If you qualify to receive a check for:

- only one payment, your check is equal to that payment amount or

- both payments, add together your payment amounts to determine your check amount.

Remember, by law, we can issue payments only for amounts of $25 or more. If your payment based on one of the credits is less than $25, your check will not include a payment based on that credit. For example, if your payment based on the earned income credit would be $20, you would not receive this payment amount in your check.

How To Find The Current Status Of My Refund

The Wheres My Refund? tool lets you check the status of your refund through the IRS website or the IRS2Go mobile app. If you submit your tax return electronically, you can check the status of your refund within 24 hours. But if you mail your tax return, youll need to wait at least four weeks before you can receive any information about your tax refund. Keep in mind that usually, you can file your taxes in January.

In order to find out the status of your tax refund, youll need to provide your Social Security number , filing status and the exact dollar amount of your expected refund. If you accidentally enter the wrong SSN, it could trigger an IRS Error Code 9001. That may require further identity verification and delay your tax refund.

You May Like: Are Municipal Bonds Tax Free

When Are Taxes Due

For most years, the deadline to submit your tax return and pay your tax bill is April 15. However, taxes for 2021 were required to be filed by April 18, 2022, due to a legal holiday in Washington D.C. Residents of Massachusetts and Maine had until April 19, 2022.

For those that were unable to meet the tax filing deadline for the year, there was an option to file for a six-month extension. This would put your extension deadline to file your taxes at October 17, 2o22, but the sooner you file, the sooner you can receive your tax refund.

Experts Say Tax Returns Could Be Delayed

Although the IRS says most refunds will be sent within 21 days, experts warn that delays are likely, noting that the agency is still working through 2020 tax returns.

During the 2020 budget year, the IRS processed more than 240 million tax returns and issued roughly $736 billion in refunds, including $268 billion in federal stimulus payments, according to the latest IRS data. Over that period roughly 60 million people called or visited an IRS office.

Donald Williamson, an accounting and taxation professor at American University in Washington, said he expects “weeks and weeks” of IRS delays in 2022. “My advice in 2022 is file early, get started tomorrow and try to put your taxes together with a qualified professional.”

Compounding the challenge, tax preparers told CBS MoneyWatch that it remains hard to reach IRS personnel on the phone. The IRS answered only about 1 in 9 taxpayer calls during fiscal year 2021, Collins reported. “Many taxpayers are not getting answers to their questions and are frustrated,” she noted.

“Back in the old days, you’d wait 5-10 minutes and get an IRS agent on the phone,” said Christian Cyr, a CPA and president and chief investment officer at Cyr Financial. But now, he said, his CPAs wait hours to speak with an IRS employee, with no guarantee of ever reaching one.

1. File electronically

2. Get a refund via direct deposit

3. Don’t guesstimate

4. Save IRS letters about stimulus, CTC

Read Also: California Llc First Year Tax Exemption

How To Check The Status Of Your Tax Return

You should be able to check IRS tax refund status roughly 24 hours after you receive confirmation from the IRS that they have received your tax refund via e-File. You will need to wait at least four weeks if you mailed in your tax return.

The best way to check the status of your federal tax refund is to visit the Wheres My Refund page at the IRS website.

What you will need:

- Exact refund amount

You can also call the IRS at 1-800-829-1954 or 1-800-829-4477 or 1-800-829-1040 and inquire about your tax return status with an IRS customer service representative. Note that the IRS only updates tax return statuses once a day during the week, usually between midnight and 6 a.m. They do not update the status more than once a day, so checking throughout the day will not give you a different result.

Should I call the IRS to check my federal tax refund status?

The IRS has stated you should only call them if it has been:

- 21 days or more since you e-filed

- Six weeks or more since you mailed your return, or when

- Wheres My Refund tells you to contact the IRS

Checking Status Of Your Refund

Taxpayers can check the status of their refund at the IRS site “Where’s My Refund?”

People will need to know their Social Security number or their Individual Taxpayer Identification Number, their filing status and their exact refund amount.

The IRS says people can start checking the status of their refund within 24 hours after an electronically filed return is received by the agency, or four weeks after a taxpayer mails a paper return.

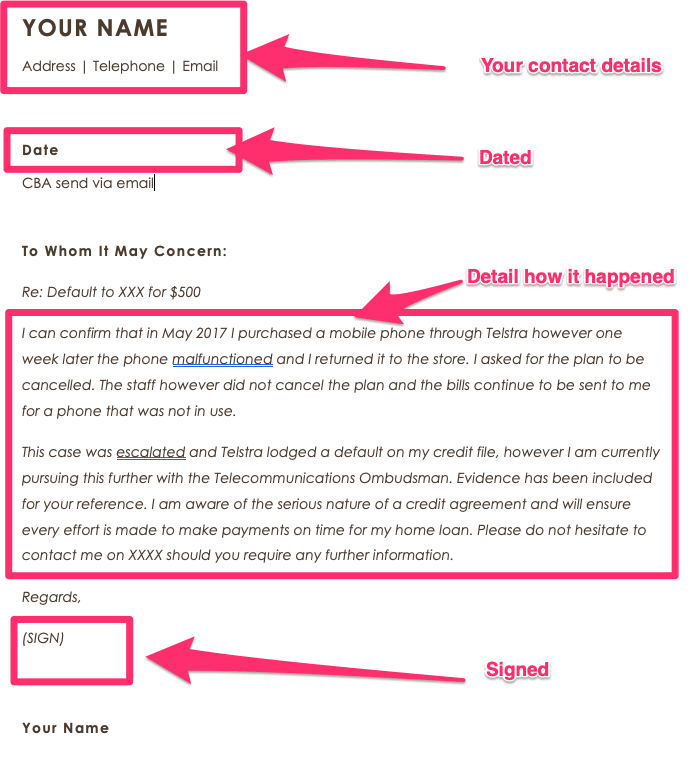

The tool will provide information about three phases of processing: Alerting the taxpayer when their return is received, when their refund is approved and when the refund is sent.

Don’t Miss: Free Irs Approved Tax Preparation Courses

How To Double Up On Tax Savings With The Savers Credit

About Ryan Guina

Ryan Guina is The Military Wallet’s founder. He is a writer, small business owner, and entrepreneur. He served over six years on active duty in the USAF and is a current member of the Illinois Air National Guard.

Ryan started The Military Wallet in 2007 after separating from active duty military service and has been writing about financial, small business, and military benefits topics since then. He also writes about personal finance and investing at Cash Money Life.

Ryan uses Personal Capital to track and manage his finances. Personal Capital is a free software program that allows him to track his net worth, balance his investment portfolio, track his income and expenses, and much more. You can open a free Personal Capital account here.

Featured In: Ryan’s writing has been featured in the following publications: Forbes, Military.com, US News & World Report, Yahoo Finance, Reserve & National Guard Magazine , Military Influencer Magazine, Cash Money Life, The Military Guide, USAA, Go Banking Rates, and many other publications.

Why Do I See A Tax Topic 151 Tax Topic 152 Or Irs Error Message

Although the Where’s My Refund tool typically shows a status of Received, Approved or Sent, there are a variety of other messages some users may see.

One of the most common is Tax Topic 152, indicating you’re likely getting a refund but it hasn’t been approved or sent yet. The notice simply links out to an informational topic page on the IRS FAQ website explaining the types and timing of tax refunds.

The delay could be an automated message for taxpayers claiming the child tax credit or earned income tax credit sent because of additional fraud protection steps.

Tax Topic 151 means your tax return is now under review by the IRS. The agency either needs to verify certain credits or dependents, or it has determined that your tax refund will be reduced to pay money that it believes you owe. You’ll need to wait about four weeks to receive a notice from the IRS explaining what you need to do to resolve the status.

There are other IRS refund codes that a small percentage of tax filers receive, indicating freezes, math errors on tax returns or undelivered checks. The College Investor offers a list of IRS refund reference codes and errors and their meaning.

Read Also: Where Is My California Tax Refund